Professional Documents

Culture Documents

Finance Assignment - Sugar Company

Finance Assignment - Sugar Company

Uploaded by

Hassan KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Assignment - Sugar Company

Finance Assignment - Sugar Company

Uploaded by

Hassan KhanCopyright:

Available Formats

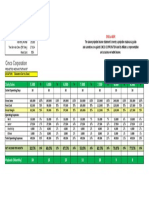

Name Hassan Khan

Roll No. 25040066

Section 1

EMBA25

Discount rate 15%

Year

0 1 2 3 4 5 6

Sales - status quo 5 000 000 5 000 000 5 000 000 5 000 000 5 000 000

Sales - new facility 6 000 000 7 500 000 10 000 000 10 000 000 10 000 000

Incremental Sales 1 000 000 2 500 000 5 000 000 5 000 000 5 000 000

Variable Costs - new facility 59.50 58.50 58.00 58.00 58.00

Variable costs - status quo 60 60 60 60 60

Units sold - status quo 50 000 50 000 50 000 50 000 50 000

Units sold - new facility 60 000 75 000 100 000 100 000 100 000

Marketing - status quo 87 500 87 500 87 500 87 500 87 500

Marketing - new facility 287 500 287 000 253 000 253 000 253 000

ACRS rate 20% 32% 19% 12% 11% 6%

Year

0 1 2 3 4 5 6

Sales 1 000 000 2 500 000 5 000 000 5 000 000 5 000 000

CGS 595 000 1 462 500 2 900 000 2 900 000 2 900 000

Savings of existing production 25 000 75 000 100 000 100 000 100 000

Marketing 200 000 199 500 165 500 165 500 165 500

Leasing costs 225 000 225 000 225 000 225 000 225 000

Others 250 000 250 000 250 000 250 000 250 000

Depreciation 260 000 416 000 247 000 156 000 143 000 78 000

Operating Income 0 505 000 22 000 1 312 500 1 403 500 1 416 500 78 000

Less: tax at 40% 202 000 8 800 525 000 561 400 566 600 31 200

Add: depreciation 260 000 416 000 247 000 156 000 143 000 78 000

Operating Cashflow after tax 0 43 000 429 200 1 034 500 998 100 992 900 31 200

Outlay 1 300 000

Salvage proceeds 500 000

Tax on sale 200 000

Working Capital 305 000 315 000 301 000 921 000

Cashflows 1 300 000 348 000 114 200 733 500 998 100 2 213 900 31 200

NPV 650 886

IRR 25.25%

Questions 1

Leasing costs of $325,000 p.a. must be allocated in part to the existing production as well, so not all for the new syrup production.

Alternatively, the leasing costs saved from the move should be a positive flow in the NPV calculation.

Questions 2

Cashflows are relevant rather than accounting flows as investment appraisal requires discounting the after-tax cashflows.

Accounting flows are relevant for profit, not for NPV calculations. Financial appraisal relies on the timing and amount of cashflows.

Questions 3

It is better to focus on incremental cashflows rather than the straight comparison between the one with the alternative and without.

This would provide a snapshot of how the proposal impacts on the value creation,

which would not be the case when side by side the @with” and “without” figures are given.

Questions 4

No, the payback criterion is not suitable as it does not relate to the totality of the relevant cashflows and merely seeks to find out when the initial investment will be recouped.

NPV is the best criterion which should be used for capital budgeting decisions as it shows the value creation in absolute terms due to the project proposal.

Questions 5

Generally, projects have to be supported in the initial years from other finance sources and that sets up as the discount rate.

Here, WACC is used if the project has the same business risk as the existing projects.

You might also like

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample BreakevenOver Mango50% (2)

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Financial Model Forecasting - Case StudyDocument15 pagesFinancial Model Forecasting - Case Study唐鹏飞No ratings yet

- Analysis of Project Cash FlowsDocument16 pagesAnalysis of Project Cash FlowsTanmaye KapurNo ratings yet

- Chapter 16 ProblemsDocument4 pagesChapter 16 ProblemsDaood AbdullahNo ratings yet

- Decision Tree To Evaluate Capacity AlternativesDocument2 pagesDecision Tree To Evaluate Capacity AlternativesShashank TewariNo ratings yet

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- p11 29Document5 pagesp11 29Saeful AzizNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- Seatwork 4 - Decentralized OperationsDocument3 pagesSeatwork 4 - Decentralized OperationsJessaLyza CordovaNo ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Cash Plant Size 1 Plant Size 2 Plant Size 3Document7 pagesCash Plant Size 1 Plant Size 2 Plant Size 3Angelica Jane AradoNo ratings yet

- Assignment Capital BudgetingDocument29 pagesAssignment Capital BudgetingYasha Sahu0% (1)

- Base Case Analysis Best CaseDocument6 pagesBase Case Analysis Best CaseMaphee CastellNo ratings yet

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- Flujos de Expansi N. Simulador. 2019 Unidad 1Document6 pagesFlujos de Expansi N. Simulador. 2019 Unidad 1yoki cortezNo ratings yet

- Entrepreneur JSDCHHCBCDocument3 pagesEntrepreneur JSDCHHCBCshayan.53260No ratings yet

- Solution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadDocument7 pagesSolution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadStephenWolfpdiz100% (51)

- Time 1Document3 pagesTime 1pancrasNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- Chapter 8 Solutions Berk and DemerzoDocument9 pagesChapter 8 Solutions Berk and DemerzoKishan TCNo ratings yet

- SIP AmrutleelaDocument14 pagesSIP AmrutleelapremNo ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample Breakevenphuri.siaNo ratings yet

- CH 3 Problem SolutionsDocument9 pagesCH 3 Problem SolutionsFrancisco PradoNo ratings yet

- Merak Fiscal Model Library: Cambodia PSC (1996)Document2 pagesMerak Fiscal Model Library: Cambodia PSC (1996)Libya TripoliNo ratings yet

- Competitive Markets: Glorioso, Dianne LDocument20 pagesCompetitive Markets: Glorioso, Dianne LDianne GloriosoNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- JN23PGC026Document6 pagesJN23PGC026ragarwal22No ratings yet

- A&f - Group Assignment - Assignment 2Document8 pagesA&f - Group Assignment - Assignment 2lavaniaNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- A6-A7. Ikon Paints Valuation WorkingsDocument3 pagesA6-A7. Ikon Paints Valuation Workingsmohantyrishita2000No ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Allied Sugar Company!!: Financial SummaryDocument2 pagesAllied Sugar Company!!: Financial SummaryFawad Ejaz BhattíNo ratings yet

- Target Market Every Month 3,600.00 Average Sales Per Customer 25.00Document4 pagesTarget Market Every Month 3,600.00 Average Sales Per Customer 25.00Mark Harold RaspadoNo ratings yet

- 3StatementModelTemplate Full Version1Document16 pages3StatementModelTemplate Full Version1Dawit TilahunNo ratings yet

- Phuket Beach Hotel - 2022Document10 pagesPhuket Beach Hotel - 2022Gavani Durga SaiNo ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- Cup Pa ManiaDocument2 pagesCup Pa ManiadeepaksikriNo ratings yet

- Module 3 CVP AnswersDocument18 pagesModule 3 CVP AnswersSophia DayaoNo ratings yet

- Ind Assignment ScenarioDocument6 pagesInd Assignment Scenariogaurav.jain.25nNo ratings yet

- Practice Q (Capital Budgeting)Document12 pagesPractice Q (Capital Budgeting)Divyam GargNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsDocument1 pageCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal67% (3)

- 2016 FR PDFDocument6 pages2016 FR PDFSomeone 4780No ratings yet

- Task-1 Master Budget With Profit ProjectionsDocument5 pagesTask-1 Master Budget With Profit ProjectionsbabluanandNo ratings yet

- ArezzoDocument46 pagesArezzoandre.torresNo ratings yet

- Quiz BusFinHVRJULIANA VILLANUEVA ABM201-1Document10 pagesQuiz BusFinHVRJULIANA VILLANUEVA ABM201-1Juliana Angela VillanuevaNo ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- NPV ExcelDocument7 pagesNPV Excelkhanfaiz4144No ratings yet

- Budgeting SolutionsDocument9 pagesBudgeting SolutionsPavan Kalyan KolaNo ratings yet

- Esmeralda Springs SurpriseDocument8 pagesEsmeralda Springs Surpriseflorinmen1No ratings yet

- Solution Manual - Capital Budgeting Part 2Document21 pagesSolution Manual - Capital Budgeting Part 2Lab Dema-alaNo ratings yet

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocument1 pageMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNo ratings yet

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- 12 Month Rolling Cash Flow Forecast - CompleteDocument5 pages12 Month Rolling Cash Flow Forecast - CompleteBishoy SamirNo ratings yet

- Practice - Problem Set - Week 4 SolutionsDocument3 pagesPractice - Problem Set - Week 4 SolutionsShravan DeshmukhNo ratings yet

- Chapter Five Format and ExampleDocument8 pagesChapter Five Format and Examplechris mutungaNo ratings yet

- Managerial Economics Applications Strategies and Tactics 14Th Edition Mcguigan Solutions Manual Full Chapter PDFDocument30 pagesManagerial Economics Applications Strategies and Tactics 14Th Edition Mcguigan Solutions Manual Full Chapter PDFJenniferPerrykisd100% (15)

- Market Map - 2023: Travel & Leisure Fintech Transportation & Logistics GamingDocument5 pagesMarket Map - 2023: Travel & Leisure Fintech Transportation & Logistics GamingHassan KhanNo ratings yet

- Spirit 1Document1 pageSpirit 1Hassan KhanNo ratings yet

- Chap11 - PPT - Decisions MakingDocument29 pagesChap11 - PPT - Decisions MakingHassan KhanNo ratings yet

- Agri Project - Final Report - SarmadDocument6 pagesAgri Project - Final Report - SarmadHassan KhanNo ratings yet

- Equity FramingDocument1 pageEquity FramingHassan KhanNo ratings yet

- New Doc 2019-11-29 09.37.24Document14 pagesNew Doc 2019-11-29 09.37.24Hassan KhanNo ratings yet

- PIA SolvedDocument7 pagesPIA SolvedHassan KhanNo ratings yet

- General Pump CompanyDocument1 pageGeneral Pump CompanyHassan KhanNo ratings yet

- 12.1. Vanourek 2013 Collaborative AlignmentDocument6 pages12.1. Vanourek 2013 Collaborative AlignmentHassan KhanNo ratings yet

- Agri Project - Muhammad AhmadDocument6 pagesAgri Project - Muhammad AhmadHassan KhanNo ratings yet

- Pakistan Census 2023 Summary by FCG Including Top 10 Cities - 20-Oct-2023 - WADocument13 pagesPakistan Census 2023 Summary by FCG Including Top 10 Cities - 20-Oct-2023 - WAHassan KhanNo ratings yet

- Newzeland (Muhammad Usman)Document9 pagesNewzeland (Muhammad Usman)Hassan KhanNo ratings yet

- Australia-Mango Exoport - Ghulam MustafaDocument8 pagesAustralia-Mango Exoport - Ghulam MustafaHassan KhanNo ratings yet

- DR SadiaDocument5 pagesDR SadiaHassan KhanNo ratings yet

- Business Plan Final - Ayesha SameenDocument5 pagesBusiness Plan Final - Ayesha SameenHassan KhanNo ratings yet

- Report - Mujahid ShababDocument5 pagesReport - Mujahid ShababHassan KhanNo ratings yet

- Rice Export To Turkey - Adnan MushtaqDocument9 pagesRice Export To Turkey - Adnan MushtaqHassan KhanNo ratings yet

- Social Responsibility of BusinessDocument11 pagesSocial Responsibility of BusinessDr-Faheem SiddiquiNo ratings yet

- 2012 CombinedDocument195 pages2012 CombinedTamal Kishore AcharyaNo ratings yet

- Contract Farming in IndiaDocument39 pagesContract Farming in IndiaaksjsimrNo ratings yet

- Material Costing and ControlDocument54 pagesMaterial Costing and ControlFADIASATTNo ratings yet

- Financial ManagementDocument34 pagesFinancial ManagementNidhi GuptaNo ratings yet

- NCP 29Document18 pagesNCP 29aksNo ratings yet

- SBR - Hedge AccountingDocument13 pagesSBR - Hedge AccountingMyo Naing100% (1)

- Public Private PartnershipDocument9 pagesPublic Private PartnershipAyoola17No ratings yet

- Vocabulaire Anglais EntrepriseDocument3 pagesVocabulaire Anglais EntrepriseradoniainaNo ratings yet

- Indian Technology Startup Funding Report 2017Document141 pagesIndian Technology Startup Funding Report 2017Dhir100% (1)

- The Persimmon Studios in Mabolo, Cebu City, PhilippinesDocument34 pagesThe Persimmon Studios in Mabolo, Cebu City, PhilippinesClifford EnocNo ratings yet

- Mid Term IFM 2023Document2 pagesMid Term IFM 2023thutrangonedNo ratings yet

- GDP VS GNPDocument5 pagesGDP VS GNPankitNo ratings yet

- Public Private Partnership in IndiaDocument11 pagesPublic Private Partnership in IndiaDeepak SharmaNo ratings yet

- International Market Entry StrategiesDocument5 pagesInternational Market Entry StrategiessureshexecutiveNo ratings yet

- Gmo 7 Year Asset Class Forecast (1q2017)Document1 pageGmo 7 Year Asset Class Forecast (1q2017)superinvestorbulletiNo ratings yet

- ICM - Mutual Fund Distributors (Study and Reference Guide-January 2013)Document150 pagesICM - Mutual Fund Distributors (Study and Reference Guide-January 2013)Umar Sarfraz KhanNo ratings yet

- DLFDocument28 pagesDLFKashish ThakurNo ratings yet

- With The Filipino-Foreign Ownership Requirements Prescribed in The Constitution And/or Existing Laws by Corporations Engaged in Nationalized and Partly Nationalized Activities."Document4 pagesWith The Filipino-Foreign Ownership Requirements Prescribed in The Constitution And/or Existing Laws by Corporations Engaged in Nationalized and Partly Nationalized Activities."nikkofernandezNo ratings yet

- F5 Mock 1 Dec 2012Document7 pagesF5 Mock 1 Dec 2012Rakib Hossain100% (1)

- JLL India - India's Green FootprintDocument9 pagesJLL India - India's Green FootprintVulcanmindNo ratings yet

- Fall 2012 Air University Comparative Management Student Projects Prof Manzoor Iqbal Awan Japan Russia Pakistan India Samsung Sony KFC McDonald P&G Unilever 1 January 2013Document295 pagesFall 2012 Air University Comparative Management Student Projects Prof Manzoor Iqbal Awan Japan Russia Pakistan India Samsung Sony KFC McDonald P&G Unilever 1 January 2013Manzoor AwanNo ratings yet

- Chapter 3Document36 pagesChapter 3Urgessa FiromsaNo ratings yet

- Revenue Recognition HandbookDocument1,081 pagesRevenue Recognition HandbookTurley Muller100% (2)

- How To Build Your Own BRKDocument13 pagesHow To Build Your Own BRKmilandeepNo ratings yet

- CASE STUDY-British AirwaysDocument6 pagesCASE STUDY-British AirwaysOlusegun Olasunkanmi PatNo ratings yet

- Online Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Document4 pagesOnline Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Teri BuhlNo ratings yet

- Cryptoasssets ExplainedDocument11 pagesCryptoasssets ExplainedjeNo ratings yet