Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsCompany Info - Print Financials

Company Info - Print Financials

Uploaded by

uffhbb99a study on pl

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Shinola Case Study Questions - Seminar 8 BrandingDocument4 pagesShinola Case Study Questions - Seminar 8 Brandingsilvia100% (1)

- Wildcat Capital InvestorsDocument18 pagesWildcat Capital Investorsokta hutahaeanNo ratings yet

- 1 MW - Solar Power Financial ModelDocument15 pages1 MW - Solar Power Financial Modelannu priyaNo ratings yet

- Financial Management:: Understanding Financial Statements, Taxes, and Cash FlowsDocument102 pagesFinancial Management:: Understanding Financial Statements, Taxes, and Cash FlowsArgem Jay PorioNo ratings yet

- Dividend Payout Ration On EPS CalculationDocument2 pagesDividend Payout Ration On EPS CalculationvanishaNo ratings yet

- RatiosDocument2 pagesRatiosPRATHAMNo ratings yet

- TCS Ratio AnalysisDocument2 pagesTCS Ratio AnalysisLogesh SureshNo ratings yet

- JaypeeDocument2 pagesJaypeeKintali VinodNo ratings yet

- Housing Ratio PDFDocument2 pagesHousing Ratio PDFAbdul Khaliq ChoudharyNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsUday KumarNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- Nestle ST RatioDocument2 pagesNestle ST Rationeha.talele22.stNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- Bosch 5confrDocument2 pagesBosch 5confrSsNo ratings yet

- Financial Ratio Latest 5 YrsDocument2 pagesFinancial Ratio Latest 5 YrsAryan BagdekarNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosTejaswiniNo ratings yet

- Moneycontrol PDFDocument6 pagesMoneycontrol PDFMANIVISHVARJOON BOOMINATHANNo ratings yet

- Hul ST RatioDocument2 pagesHul ST Rationeha.talele22.stNo ratings yet

- Larsen & Toubro InfotechDocument2 pagesLarsen & Toubro InfotechPriyaPrasadNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Airan RatioDocument2 pagesAiran RatiomilanNo ratings yet

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFgaurav khuleNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsHarsh PuseNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- RatiosDocument2 pagesRatiosAbhay Kumar SinghNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosranjansolanki13No ratings yet

- Sbi Ratios PDFDocument2 pagesSbi Ratios PDFutkarsh varshneyNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Comparison - Ratios - Tyre - DistributionDocument15 pagesComparison - Ratios - Tyre - DistributionParehjuiNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Ratio Analysis of Bata IndiaDocument2 pagesRatio Analysis of Bata IndiaSanket BhondageNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Bajaj Finserv: Previous YearsDocument2 pagesBajaj Finserv: Previous Yearsrohansparten01No ratings yet

- Ratios of BajajDocument2 pagesRatios of BajajSunil KumarNo ratings yet

- Financial RatioDocument16 pagesFinancial RatioSantanu ModiNo ratings yet

- Marico RatiosDocument2 pagesMarico RatiosAbhay Kumar SinghNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Finacial Ratio Mar 21Document9 pagesFinacial Ratio Mar 21VishNo ratings yet

- Industry Analysis RatioDocument79 pagesIndustry Analysis Ratiopratz1996No ratings yet

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Cipla Financial RatiosDocument2 pagesCipla Financial RatiosNEHA LALNo ratings yet

- Backend - Bajaj Auto - Dupont & Z ScoreDocument17 pagesBackend - Bajaj Auto - Dupont & Z ScoreYuvraj BholaNo ratings yet

- Icici 1Document2 pagesIcici 1AishwaryaSushantNo ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda MotorsMehul ShuklaNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Rdy Mad e Pmegp 10 LacsDocument13 pagesRdy Mad e Pmegp 10 LacssyedNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- 1 - Laporan Tahunan 2022 11Document1 page1 - Laporan Tahunan 2022 11Lowongan PekerjaanNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Principles of Microeconomics: Twelfth Edition, Global EditionDocument35 pagesPrinciples of Microeconomics: Twelfth Edition, Global EditionmmNo ratings yet

- Cyber Media Deck 2021Document36 pagesCyber Media Deck 2021Mohit GaurNo ratings yet

- Economics Assignment1Document67 pagesEconomics Assignment1tamam hajiNo ratings yet

- Finance ProjectDocument80 pagesFinance ProjectDinoop Devaraj0% (1)

- Structure of Commercial Banking in IndiaDocument56 pagesStructure of Commercial Banking in IndiaSamridhi Goad86% (7)

- ABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Document45 pagesABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Willie Montes Poblacion Jr.No ratings yet

- To View KFC Associate Members - Kenya Flower CouncilDocument4 pagesTo View KFC Associate Members - Kenya Flower CouncilLily Li100% (1)

- MakeMyTrip SEOUL NEWDocument3 pagesMakeMyTrip SEOUL NEWbindu mathaiNo ratings yet

- Packaging Trends 2024 Ebook2Document19 pagesPackaging Trends 2024 Ebook2Hoosain AbbassNo ratings yet

- 2 Geofilesuperpowers PDFDocument4 pages2 Geofilesuperpowers PDFAakanksha SrivastavaNo ratings yet

- BL OneDocument1 pageBL OneLizbeth VieyraaNo ratings yet

- Economic Turbulence in GreeceDocument9 pagesEconomic Turbulence in GreeceSatish BindumadhavanNo ratings yet

- ABCD of GST Second AdditionDocument142 pagesABCD of GST Second AdditionAvnish KumarNo ratings yet

- Accounting Assignment (Question Number 1)Document4 pagesAccounting Assignment (Question Number 1)wasifNo ratings yet

- Fa2 BPP Kit 2019Document209 pagesFa2 BPP Kit 2019Zubair RafiqueNo ratings yet

- Newsletter July 2022 PDFDocument13 pagesNewsletter July 2022 PDFDwaipayan MojumderNo ratings yet

- Home Work Intermediate2 Week 11Document2 pagesHome Work Intermediate2 Week 11NABILA SARINo ratings yet

- Supply Chain Management 1Document26 pagesSupply Chain Management 1taraka krishna kishoreNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Nama 10 GDPDocument3 pagesNama 10 GDPAracelli TitoNo ratings yet

- International and Local EntrepreneursDocument2 pagesInternational and Local Entrepreneurskent.alvarez2005No ratings yet

- Marketing PrinciplesDocument2 pagesMarketing Principleskeltoum mekidNo ratings yet

- Tiffany Goldstein ReceiptDocument19 pagesTiffany Goldstein ReceiptAllan AbadNo ratings yet

- FAQs - MO India Excellence Fund - AIF Mid To MegaDocument4 pagesFAQs - MO India Excellence Fund - AIF Mid To MegaSandyNo ratings yet

- 5 Bar Reversal Pattern: Buy SetupDocument1 page5 Bar Reversal Pattern: Buy Setupalistair7682No ratings yet

- TT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarDocument5 pagesTT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarNGỌC ĐIỆP TRẦNNo ratings yet

Company Info - Print Financials

Company Info - Print Financials

Uploaded by

uffhbb990 ratings0% found this document useful (0 votes)

1 views2 pagesa study on pl

Original Title

Moneycontrol.com __ Company Info __ Print Financials (3)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenta study on pl

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views2 pagesCompany Info - Print Financials

Company Info - Print Financials

Uploaded by

uffhbb99a study on pl

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

This data can be easily copy pasted into a Microsoft Excel sheet PRINT

Coal India Previous Years »

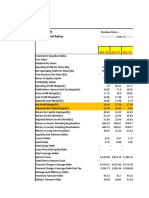

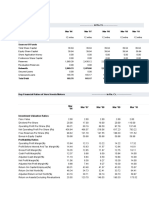

Key Financial Ratios ------------------- in Rs. Cr. -------------------

Mar '24 Mar '23 Mar '22 Mar '21 Mar '20

Investment Valuation Ratios

Face Value 10.00 10.00 10.00 10.00 10.00

Dividend Per Share 20.50 24.25 17.00 16.00 12.00

Operating Profit Per Share (Rs) 1.23 0.95 0.72 0.04 -0.34

Net Operating Profit Per Share (Rs) 2.46 3.17 1.84 1.04 1.37

Free Reserves Per Share (Rs) -- -- -- -- --

Bonus in Equity Capital -- -- -- -- --

Profitability Ratios

Operating Profit Margin(%) 49.79 30.03 39.18 3.40 -24.54

Profit Before Interest And Tax Margin(%) 4.22 3.28 3.50 0.02 -2.10

Gross Profit Margin(%) 46.93 27.82 37.34 0.33 -30.97

Cash Profit Margin(%) 93.83 89.95 92.99 92.14 91.32

Adjusted Cash Margin(%) 93.83 89.95 92.99 92.14 91.32

Net Profit Margin(%) 1,039.76 758.89 989.60 1,193.29 1,334.76

Adjusted Net Profit Margin(%) 93.57 89.69 92.82 91.83 90.89

Return On Capital Employed(%) 92.60 90.13 69.43 45.81 67.23

Return On Net Worth(%) 91.00 88.60 68.47 45.60 67.09

Adjusted Return on Net Worth(%) 91.00 88.60 68.47 45.60 67.09

Return on Assets Excluding Revaluations 28.11 27.11 26.54 27.18 27.28

Return on Assets Including Revaluations 28.11 27.11 26.54 27.18 27.28

Return on Long Term Funds(%) 92.60 90.13 69.43 45.81 67.23

Liquidity And Solvency Ratios

Current Ratio 1.35 1.33 1.36 1.52 1.71

Quick Ratio 1.34 1.33 1.36 1.52 1.71

Debt Equity Ratio -- -- -- -- --

Long Term Debt Equity Ratio -- -- -- -- --

Debt Coverage Ratios

Interest Cover 7,903.52 7,862.20 7,572.23 4,827.40 2,149.15

Total Debt to Owners Fund -- 0.00 -- -- --

Financial Charges Coverage Ratio 7,924.87 7,884.57 7,586.11 4,843.40 2,159.49

Financial Charges Coverage Ratio Post

7,789.26 7,732.90 7,482.60 4,822.09 2,155.99

Tax

Management Efficiency Ratios

Inventory Turnover Ratio 40.27 94.92 86.01 640.25 56.42

Debtors Turnover Ratio 849.51 657.84 157.76 64.15 205.64

Investments Turnover Ratio 0.09 0.12 0.07 0.04 0.05

Fixed Assets Turnover Ratio 1.97 3.22 2.00 1.33 2.01

Total Assets Turnover Ratio 0.09 0.12 0.07 0.04 0.05

Asset Turnover Ratio 0.09 0.12 0.07 0.04 0.05

Average Raw Material Holding -- -- -- -- --

Average Finished Goods Held -- -- -- -- --

Number of Days In Working Capital -1,243.48 -1,020.58 -1,745.32 -3,121.77 -1,939.35

Profit & Loss Account Ratios

Material Cost Composition 0.27 24.33 0.10 0.34 0.60

Imported Composition of Raw Materials

-- -- -- -- --

Consumed

Selling Distribution Cost Composition -- 0.30 0.59 0.37 0.82

Expenses as Composition of Total Sales -- 0.48 -- -- --

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit -- 96.79 96.27 100.82 65.55

Dividend Payout Ratio Cash Profit -- 96.51 96.10 100.49 65.24

Earning Retention Ratio 100.00 3.21 3.73 -0.82 34.45

Cash Earning Retention Ratio 100.00 3.49 3.90 -0.49 34.76

AdjustedCash Flow Times -- 0.00 -- -- --

Source : Dion Global Solutions Limited

You might also like

- Shinola Case Study Questions - Seminar 8 BrandingDocument4 pagesShinola Case Study Questions - Seminar 8 Brandingsilvia100% (1)

- Wildcat Capital InvestorsDocument18 pagesWildcat Capital Investorsokta hutahaeanNo ratings yet

- 1 MW - Solar Power Financial ModelDocument15 pages1 MW - Solar Power Financial Modelannu priyaNo ratings yet

- Financial Management:: Understanding Financial Statements, Taxes, and Cash FlowsDocument102 pagesFinancial Management:: Understanding Financial Statements, Taxes, and Cash FlowsArgem Jay PorioNo ratings yet

- Dividend Payout Ration On EPS CalculationDocument2 pagesDividend Payout Ration On EPS CalculationvanishaNo ratings yet

- RatiosDocument2 pagesRatiosPRATHAMNo ratings yet

- TCS Ratio AnalysisDocument2 pagesTCS Ratio AnalysisLogesh SureshNo ratings yet

- JaypeeDocument2 pagesJaypeeKintali VinodNo ratings yet

- Housing Ratio PDFDocument2 pagesHousing Ratio PDFAbdul Khaliq ChoudharyNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsUday KumarNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- Nestle ST RatioDocument2 pagesNestle ST Rationeha.talele22.stNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- Bosch 5confrDocument2 pagesBosch 5confrSsNo ratings yet

- Financial Ratio Latest 5 YrsDocument2 pagesFinancial Ratio Latest 5 YrsAryan BagdekarNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosTejaswiniNo ratings yet

- Moneycontrol PDFDocument6 pagesMoneycontrol PDFMANIVISHVARJOON BOOMINATHANNo ratings yet

- Hul ST RatioDocument2 pagesHul ST Rationeha.talele22.stNo ratings yet

- Larsen & Toubro InfotechDocument2 pagesLarsen & Toubro InfotechPriyaPrasadNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Airan RatioDocument2 pagesAiran RatiomilanNo ratings yet

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFgaurav khuleNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsHarsh PuseNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- RatiosDocument2 pagesRatiosAbhay Kumar SinghNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosranjansolanki13No ratings yet

- Sbi Ratios PDFDocument2 pagesSbi Ratios PDFutkarsh varshneyNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Comparison - Ratios - Tyre - DistributionDocument15 pagesComparison - Ratios - Tyre - DistributionParehjuiNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Ratio Analysis of Bata IndiaDocument2 pagesRatio Analysis of Bata IndiaSanket BhondageNo ratings yet

- Financial Ratios of Hero Honda MotorsDocument6 pagesFinancial Ratios of Hero Honda MotorsParag MaheshwariNo ratings yet

- Bajaj Finserv: Previous YearsDocument2 pagesBajaj Finserv: Previous Yearsrohansparten01No ratings yet

- Ratios of BajajDocument2 pagesRatios of BajajSunil KumarNo ratings yet

- Financial RatioDocument16 pagesFinancial RatioSantanu ModiNo ratings yet

- Marico RatiosDocument2 pagesMarico RatiosAbhay Kumar SinghNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Finacial Ratio Mar 21Document9 pagesFinacial Ratio Mar 21VishNo ratings yet

- Industry Analysis RatioDocument79 pagesIndustry Analysis Ratiopratz1996No ratings yet

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Financial Ratios of NHPCDocument2 pagesFinancial Ratios of NHPCsathish kumarNo ratings yet

- Reliance GuriDocument2 pagesReliance GurigurasisNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Cipla Financial RatiosDocument2 pagesCipla Financial RatiosNEHA LALNo ratings yet

- Backend - Bajaj Auto - Dupont & Z ScoreDocument17 pagesBackend - Bajaj Auto - Dupont & Z ScoreYuvraj BholaNo ratings yet

- Icici 1Document2 pagesIcici 1AishwaryaSushantNo ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda MotorsMehul ShuklaNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Rdy Mad e Pmegp 10 LacsDocument13 pagesRdy Mad e Pmegp 10 LacssyedNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- 1 - Laporan Tahunan 2022 11Document1 page1 - Laporan Tahunan 2022 11Lowongan PekerjaanNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Principles of Microeconomics: Twelfth Edition, Global EditionDocument35 pagesPrinciples of Microeconomics: Twelfth Edition, Global EditionmmNo ratings yet

- Cyber Media Deck 2021Document36 pagesCyber Media Deck 2021Mohit GaurNo ratings yet

- Economics Assignment1Document67 pagesEconomics Assignment1tamam hajiNo ratings yet

- Finance ProjectDocument80 pagesFinance ProjectDinoop Devaraj0% (1)

- Structure of Commercial Banking in IndiaDocument56 pagesStructure of Commercial Banking in IndiaSamridhi Goad86% (7)

- ABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Document45 pagesABMFABM2 q2 Mod2 FundOfAcctng Taxation-Corrected2Willie Montes Poblacion Jr.No ratings yet

- To View KFC Associate Members - Kenya Flower CouncilDocument4 pagesTo View KFC Associate Members - Kenya Flower CouncilLily Li100% (1)

- MakeMyTrip SEOUL NEWDocument3 pagesMakeMyTrip SEOUL NEWbindu mathaiNo ratings yet

- Packaging Trends 2024 Ebook2Document19 pagesPackaging Trends 2024 Ebook2Hoosain AbbassNo ratings yet

- 2 Geofilesuperpowers PDFDocument4 pages2 Geofilesuperpowers PDFAakanksha SrivastavaNo ratings yet

- BL OneDocument1 pageBL OneLizbeth VieyraaNo ratings yet

- Economic Turbulence in GreeceDocument9 pagesEconomic Turbulence in GreeceSatish BindumadhavanNo ratings yet

- ABCD of GST Second AdditionDocument142 pagesABCD of GST Second AdditionAvnish KumarNo ratings yet

- Accounting Assignment (Question Number 1)Document4 pagesAccounting Assignment (Question Number 1)wasifNo ratings yet

- Fa2 BPP Kit 2019Document209 pagesFa2 BPP Kit 2019Zubair RafiqueNo ratings yet

- Newsletter July 2022 PDFDocument13 pagesNewsletter July 2022 PDFDwaipayan MojumderNo ratings yet

- Home Work Intermediate2 Week 11Document2 pagesHome Work Intermediate2 Week 11NABILA SARINo ratings yet

- Supply Chain Management 1Document26 pagesSupply Chain Management 1taraka krishna kishoreNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Nama 10 GDPDocument3 pagesNama 10 GDPAracelli TitoNo ratings yet

- International and Local EntrepreneursDocument2 pagesInternational and Local Entrepreneurskent.alvarez2005No ratings yet

- Marketing PrinciplesDocument2 pagesMarketing Principleskeltoum mekidNo ratings yet

- Tiffany Goldstein ReceiptDocument19 pagesTiffany Goldstein ReceiptAllan AbadNo ratings yet

- FAQs - MO India Excellence Fund - AIF Mid To MegaDocument4 pagesFAQs - MO India Excellence Fund - AIF Mid To MegaSandyNo ratings yet

- 5 Bar Reversal Pattern: Buy SetupDocument1 page5 Bar Reversal Pattern: Buy Setupalistair7682No ratings yet

- TT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarDocument5 pagesTT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarNGỌC ĐIỆP TRẦNNo ratings yet