Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsProblem Set 3

Problem Set 3

Uploaded by

Ehtsham Ul HaqCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Homework 1 Please Answer The Following QuestionsDocument7 pagesHomework 1 Please Answer The Following QuestionsAhmed Danaf100% (1)

- PQ 3Document3 pagesPQ 3tony345No ratings yet

- Econ 302 - Intermediate Macroeconomic Analysis Assignment 2018Document13 pagesEcon 302 - Intermediate Macroeconomic Analysis Assignment 2018PatriqKaruriKimboNo ratings yet

- Solutions To Tutorial 5Document2 pagesSolutions To Tutorial 5Yuki TanNo ratings yet

- Chapter 18 - Revision Questions Answers-1Document6 pagesChapter 18 - Revision Questions Answers-1Christiaan DiedericksNo ratings yet

- 14.02 Principles of Macroeconomics Fall 2005 Quiz 1 SolutionsDocument9 pages14.02 Principles of Macroeconomics Fall 2005 Quiz 1 SolutionsNguyen Thi Thu HaNo ratings yet

- PS01Document4 pagesPS01Manooch GholmoradiNo ratings yet

- Inter. Macro AssignmentDocument2 pagesInter. Macro Assignmentmuyi kunleNo ratings yet

- Chapter 9Document18 pagesChapter 9Karen ReasonNo ratings yet

- Class 5. The IS-LM Model and Aggregate Demand: Macroeconomics I. Antonio Zabalza. University of Valencia 1Document26 pagesClass 5. The IS-LM Model and Aggregate Demand: Macroeconomics I. Antonio Zabalza. University of Valencia 1Zenni Cr100% (1)

- Ecu-07412 Tutorial Qns 2Document3 pagesEcu-07412 Tutorial Qns 2Omari MaugaNo ratings yet

- Assignment 1 Sec 222 2020Document3 pagesAssignment 1 Sec 222 2020Haggai Simbaya100% (1)

- Exercise in Income DeterminationDocument2 pagesExercise in Income DeterminationcyccNo ratings yet

- Econ Workings ReeditedDocument8 pagesEcon Workings ReeditedPatriqKaruriKimboNo ratings yet

- − π > 0, > π. −π < 0, since we stated that actual inflation isDocument3 pages− π > 0, > π. −π < 0, since we stated that actual inflation isMd. ShohagNo ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicsEdith KuaNo ratings yet

- Goods Market MultiplierDocument22 pagesGoods Market MultiplierYograj PandeyaNo ratings yet

- Econ 302 - Intermediate Macroeconomic AnalysisDocument3 pagesEcon 302 - Intermediate Macroeconomic AnalysisMangani IsaacNo ratings yet

- Addis Ababa University College of Business and Economics Department of Economics Macroeconomics I (Econ 2031) WorksheetDocument4 pagesAddis Ababa University College of Business and Economics Department of Economics Macroeconomics I (Econ 2031) WorksheetProveedor Iptv España100% (3)

- Macro-Economic Equilibrium: Meaning and Concepts Goods Market, Determination of Equilibrium Level of Income inDocument26 pagesMacro-Economic Equilibrium: Meaning and Concepts Goods Market, Determination of Equilibrium Level of Income inYograj PandeyaNo ratings yet

- Simple Keynesian Model and Its ApplicationDocument1 pageSimple Keynesian Model and Its ApplicationRikNo ratings yet

- Ficha de Trabalho III.1Document5 pagesFicha de Trabalho III.1yayaayoi27No ratings yet

- Macroeconomics 20181220 180426275Document4 pagesMacroeconomics 20181220 180426275Honelign ZenebeNo ratings yet

- Practice Questions For Mid Term 2Document3 pagesPractice Questions For Mid Term 2md1sabeel1ansariNo ratings yet

- ECON208 Main 20-21Document5 pagesECON208 Main 20-21dariusNo ratings yet

- Tutorial 1 - MacroDocument3 pagesTutorial 1 - MacroJiahui XiongNo ratings yet

- Topic 3Document10 pagesTopic 3Benard BettNo ratings yet

- In-Class Assignment Mathematical Model of AD NameDocument1 pageIn-Class Assignment Mathematical Model of AD NameAj JohnsonNo ratings yet

- Income DeterminationDocument22 pagesIncome Determinationkevin djousse tsopwa100% (1)

- Extra Practicals - ECO4F 1Document21 pagesExtra Practicals - ECO4F 1degikoh540No ratings yet

- Open Economic BalanceDocument35 pagesOpen Economic BalanceNamira Sofwatul Farokhi100% (1)

- Homework Assignment 3 Answer: Econ 512 Yili Chien Intermediate Economics Spring 2006Document7 pagesHomework Assignment 3 Answer: Econ 512 Yili Chien Intermediate Economics Spring 2006Asif KhanNo ratings yet

- National Income Determination in Four Sector EconomyDocument32 pagesNational Income Determination in Four Sector Economyutsav100% (1)

- The Copperbelt University Directorate of Distance Education and Open Learning Bec 220: Intermediate Macroeconomic Theory Assignment TwoDocument2 pagesThe Copperbelt University Directorate of Distance Education and Open Learning Bec 220: Intermediate Macroeconomic Theory Assignment Twoshibu joyNo ratings yet

- National Income Determination: (Three Sector Model)Document12 pagesNational Income Determination: (Three Sector Model)Yash KumarNo ratings yet

- Macro NoteDocument12 pagesMacro NotelawNo ratings yet

- 04 Econ 208 Week 4 Tutorial ProblemsDocument1 page04 Econ 208 Week 4 Tutorial ProblemsdariusNo ratings yet

- Answerstohomework 5 Summer 2013Document21 pagesAnswerstohomework 5 Summer 2013GoodnessNo ratings yet

- Chapter 11Document12 pagesChapter 11Ergi CanollariNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of National IncomeDocument2 pagesAP Macroeconomics Assignment: Apply Concepts of National IncomeSixPennyUnicornNo ratings yet

- ISLM QuesDocument6 pagesISLM Quesrexon2232No ratings yet

- P T D Δ M P G X D T is real tax revenue, M is money supply, X is transfers. From this structureDocument7 pagesP T D Δ M P G X D T is real tax revenue, M is money supply, X is transfers. From this structureGökhan DüzüNo ratings yet

- ECON 2123 Problem Set 1 SolutionDocument6 pagesECON 2123 Problem Set 1 SolutionNgsNo ratings yet

- Homework 1 Summer 2018Document4 pagesHomework 1 Summer 2018Amirhosein AbediniNo ratings yet

- Keynesian Macroeconomics: Aggregate Demand and The Multiplier EffectDocument11 pagesKeynesian Macroeconomics: Aggregate Demand and The Multiplier EffectintizarbukhariNo ratings yet

- ExercisesDocument2 pagesExercisesStanley Renz Obaña Dela CruzNo ratings yet

- The Keynesian ModelDocument13 pagesThe Keynesian ModelNick GrzebienikNo ratings yet

- Macro Tutorial SetDocument3 pagesMacro Tutorial SetFlavious AcquahNo ratings yet

- Qns Sec 222Document8 pagesQns Sec 222Haggai SimbayaNo ratings yet

- Hum 277Document4 pagesHum 277Mir Noushad HussainNo ratings yet

- Business HomeworkDocument2 pagesBusiness HomeworkClaudia Sanchez0% (1)

- Ps 4Document2 pagesPs 4Ankit KumarNo ratings yet

- Midterm ESPS 2021 1Document3 pagesMidterm ESPS 2021 1toaa ahmedNo ratings yet

- EC201 Tutorial Exercise 3 SolutionDocument6 pagesEC201 Tutorial Exercise 3 SolutionPriyaDarshani100% (1)

- Macor TUTORIAL 3 Eng.Document3 pagesMacor TUTORIAL 3 Eng.tomshave28No ratings yet

- Economic MacroDocument4 pagesEconomic Macrom habiburrahman55No ratings yet

- Economics Notes Unit 6Document5 pagesEconomics Notes Unit 6Hritwik GhoshNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Basic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyFrom EverandBasic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyNo ratings yet

- Quiz 2 Micro Economics Summer 2022Document1 pageQuiz 2 Micro Economics Summer 2022Ehtsham Ul HaqNo ratings yet

- Ehtsham ul Haq, (PUblic Sector Economics)Document1 pageEhtsham ul Haq, (PUblic Sector Economics)Ehtsham Ul HaqNo ratings yet

- Paper Setting Rules: Course/ContentsDocument1 pagePaper Setting Rules: Course/ContentsEhtsham Ul HaqNo ratings yet

- (Old Paper) Islamic Economics,Document1 page(Old Paper) Islamic Economics,Ehtsham Ul HaqNo ratings yet

- Paper Formate Part-IIDocument1 pagePaper Formate Part-IIEhtsham Ul HaqNo ratings yet

- ECN316 Lec1 - Introduction - HODocument19 pagesECN316 Lec1 - Introduction - HOEhtsham Ul HaqNo ratings yet

- Chapter 4 Brain Drain Global Lives BookDocument322 pagesChapter 4 Brain Drain Global Lives BookEhtsham Ul HaqNo ratings yet

- MSC 2 PresenatationDocument2 pagesMSC 2 PresenatationEhtsham Ul HaqNo ratings yet

- The Greek Brain DrainDocument23 pagesThe Greek Brain DrainEhtsham Ul HaqNo ratings yet

- Medical Brain Drain How Why WhereDocument16 pagesMedical Brain Drain How Why WhereEhtsham Ul HaqNo ratings yet

- Mirpur University of Science and TechnologyDocument11 pagesMirpur University of Science and TechnologyEhtsham Ul HaqNo ratings yet

- Human Brain Drain and Its Impact On EducDocument22 pagesHuman Brain Drain and Its Impact On EducEhtsham Ul HaqNo ratings yet

- EconomicsDocument1 pageEconomicsEhtsham Ul HaqNo ratings yet

- PresentationDocument9 pagesPresentationEhtsham Ul HaqNo ratings yet

Problem Set 3

Problem Set 3

Uploaded by

Ehtsham Ul Haq0 ratings0% found this document useful (0 votes)

1 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageProblem Set 3

Problem Set 3

Uploaded by

Ehtsham Ul HaqCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

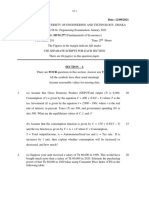

Problem Set-3 Dr Arshad Ali Bhatti

ECN-316 Office C-026, IIIE

Spring, 2017

To be handed in on May 10, 2017

Q-1: Assume that an economy is characterized by the following equations:

Y= C + I + G

Y(GDP) = 6000

C = 600 + 0.6 (Y – T)

I = 2000 – 100r

T = 500

G = 500,

where r is the real rate of interest in percent, T is tax and G is a government

spending.

a. What are the equilibrium values of C, I, and r ?

b. What are the values of private saving, public saving, and national saving?

If government spending rises to 1000, what are the new equilibrium?

c. values of C, I, r, private saving, public saving, and national saving?

Q-2: Suppose the government decides to reduce spending and (lump-sum) income taxes

by the same amount. Use the long-run classical model of the economy to

graphically illustrate the impact of the equal reductions in spending and taxes. State

in words what happens to the real interest rate, national saving, investment,

consumption, and output.

Q-3: Consider a small open economy described by the following equations:

Y = C + I + G + NX,

Y = 5,000,

G = 1000, T = 1000,

C = 250 + 0.75(Y – T)

I = 1000 - 50r,

NX = 500 - 500 ε ,

r = r* = 5,

where ε is the real exchange rate and r* is the world interest rate.

a. In this economy, solve for national saving, investment, the trade balance, and the

equilibrium exchange rate.

b. Suppose now that G rises to 1,250. Solve for national saving, investment, the trade

balance, and the equilibrium exchange rate. Explain what you find.

c. Now suppose that the world interest rate rises from 5 to 10 percent. (G is again

1000). Solve for national saving, investment, the trade balance, and the equilibrium

exchange rate. Explain what you find.

You might also like

- Homework 1 Please Answer The Following QuestionsDocument7 pagesHomework 1 Please Answer The Following QuestionsAhmed Danaf100% (1)

- PQ 3Document3 pagesPQ 3tony345No ratings yet

- Econ 302 - Intermediate Macroeconomic Analysis Assignment 2018Document13 pagesEcon 302 - Intermediate Macroeconomic Analysis Assignment 2018PatriqKaruriKimboNo ratings yet

- Solutions To Tutorial 5Document2 pagesSolutions To Tutorial 5Yuki TanNo ratings yet

- Chapter 18 - Revision Questions Answers-1Document6 pagesChapter 18 - Revision Questions Answers-1Christiaan DiedericksNo ratings yet

- 14.02 Principles of Macroeconomics Fall 2005 Quiz 1 SolutionsDocument9 pages14.02 Principles of Macroeconomics Fall 2005 Quiz 1 SolutionsNguyen Thi Thu HaNo ratings yet

- PS01Document4 pagesPS01Manooch GholmoradiNo ratings yet

- Inter. Macro AssignmentDocument2 pagesInter. Macro Assignmentmuyi kunleNo ratings yet

- Chapter 9Document18 pagesChapter 9Karen ReasonNo ratings yet

- Class 5. The IS-LM Model and Aggregate Demand: Macroeconomics I. Antonio Zabalza. University of Valencia 1Document26 pagesClass 5. The IS-LM Model and Aggregate Demand: Macroeconomics I. Antonio Zabalza. University of Valencia 1Zenni Cr100% (1)

- Ecu-07412 Tutorial Qns 2Document3 pagesEcu-07412 Tutorial Qns 2Omari MaugaNo ratings yet

- Assignment 1 Sec 222 2020Document3 pagesAssignment 1 Sec 222 2020Haggai Simbaya100% (1)

- Exercise in Income DeterminationDocument2 pagesExercise in Income DeterminationcyccNo ratings yet

- Econ Workings ReeditedDocument8 pagesEcon Workings ReeditedPatriqKaruriKimboNo ratings yet

- − π > 0, > π. −π < 0, since we stated that actual inflation isDocument3 pages− π > 0, > π. −π < 0, since we stated that actual inflation isMd. ShohagNo ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicsEdith KuaNo ratings yet

- Goods Market MultiplierDocument22 pagesGoods Market MultiplierYograj PandeyaNo ratings yet

- Econ 302 - Intermediate Macroeconomic AnalysisDocument3 pagesEcon 302 - Intermediate Macroeconomic AnalysisMangani IsaacNo ratings yet

- Addis Ababa University College of Business and Economics Department of Economics Macroeconomics I (Econ 2031) WorksheetDocument4 pagesAddis Ababa University College of Business and Economics Department of Economics Macroeconomics I (Econ 2031) WorksheetProveedor Iptv España100% (3)

- Macro-Economic Equilibrium: Meaning and Concepts Goods Market, Determination of Equilibrium Level of Income inDocument26 pagesMacro-Economic Equilibrium: Meaning and Concepts Goods Market, Determination of Equilibrium Level of Income inYograj PandeyaNo ratings yet

- Simple Keynesian Model and Its ApplicationDocument1 pageSimple Keynesian Model and Its ApplicationRikNo ratings yet

- Ficha de Trabalho III.1Document5 pagesFicha de Trabalho III.1yayaayoi27No ratings yet

- Macroeconomics 20181220 180426275Document4 pagesMacroeconomics 20181220 180426275Honelign ZenebeNo ratings yet

- Practice Questions For Mid Term 2Document3 pagesPractice Questions For Mid Term 2md1sabeel1ansariNo ratings yet

- ECON208 Main 20-21Document5 pagesECON208 Main 20-21dariusNo ratings yet

- Tutorial 1 - MacroDocument3 pagesTutorial 1 - MacroJiahui XiongNo ratings yet

- Topic 3Document10 pagesTopic 3Benard BettNo ratings yet

- In-Class Assignment Mathematical Model of AD NameDocument1 pageIn-Class Assignment Mathematical Model of AD NameAj JohnsonNo ratings yet

- Income DeterminationDocument22 pagesIncome Determinationkevin djousse tsopwa100% (1)

- Extra Practicals - ECO4F 1Document21 pagesExtra Practicals - ECO4F 1degikoh540No ratings yet

- Open Economic BalanceDocument35 pagesOpen Economic BalanceNamira Sofwatul Farokhi100% (1)

- Homework Assignment 3 Answer: Econ 512 Yili Chien Intermediate Economics Spring 2006Document7 pagesHomework Assignment 3 Answer: Econ 512 Yili Chien Intermediate Economics Spring 2006Asif KhanNo ratings yet

- National Income Determination in Four Sector EconomyDocument32 pagesNational Income Determination in Four Sector Economyutsav100% (1)

- The Copperbelt University Directorate of Distance Education and Open Learning Bec 220: Intermediate Macroeconomic Theory Assignment TwoDocument2 pagesThe Copperbelt University Directorate of Distance Education and Open Learning Bec 220: Intermediate Macroeconomic Theory Assignment Twoshibu joyNo ratings yet

- National Income Determination: (Three Sector Model)Document12 pagesNational Income Determination: (Three Sector Model)Yash KumarNo ratings yet

- Macro NoteDocument12 pagesMacro NotelawNo ratings yet

- 04 Econ 208 Week 4 Tutorial ProblemsDocument1 page04 Econ 208 Week 4 Tutorial ProblemsdariusNo ratings yet

- Answerstohomework 5 Summer 2013Document21 pagesAnswerstohomework 5 Summer 2013GoodnessNo ratings yet

- Chapter 11Document12 pagesChapter 11Ergi CanollariNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of National IncomeDocument2 pagesAP Macroeconomics Assignment: Apply Concepts of National IncomeSixPennyUnicornNo ratings yet

- ISLM QuesDocument6 pagesISLM Quesrexon2232No ratings yet

- P T D Δ M P G X D T is real tax revenue, M is money supply, X is transfers. From this structureDocument7 pagesP T D Δ M P G X D T is real tax revenue, M is money supply, X is transfers. From this structureGökhan DüzüNo ratings yet

- ECON 2123 Problem Set 1 SolutionDocument6 pagesECON 2123 Problem Set 1 SolutionNgsNo ratings yet

- Homework 1 Summer 2018Document4 pagesHomework 1 Summer 2018Amirhosein AbediniNo ratings yet

- Keynesian Macroeconomics: Aggregate Demand and The Multiplier EffectDocument11 pagesKeynesian Macroeconomics: Aggregate Demand and The Multiplier EffectintizarbukhariNo ratings yet

- ExercisesDocument2 pagesExercisesStanley Renz Obaña Dela CruzNo ratings yet

- The Keynesian ModelDocument13 pagesThe Keynesian ModelNick GrzebienikNo ratings yet

- Macro Tutorial SetDocument3 pagesMacro Tutorial SetFlavious AcquahNo ratings yet

- Qns Sec 222Document8 pagesQns Sec 222Haggai SimbayaNo ratings yet

- Hum 277Document4 pagesHum 277Mir Noushad HussainNo ratings yet

- Business HomeworkDocument2 pagesBusiness HomeworkClaudia Sanchez0% (1)

- Ps 4Document2 pagesPs 4Ankit KumarNo ratings yet

- Midterm ESPS 2021 1Document3 pagesMidterm ESPS 2021 1toaa ahmedNo ratings yet

- EC201 Tutorial Exercise 3 SolutionDocument6 pagesEC201 Tutorial Exercise 3 SolutionPriyaDarshani100% (1)

- Macor TUTORIAL 3 Eng.Document3 pagesMacor TUTORIAL 3 Eng.tomshave28No ratings yet

- Economic MacroDocument4 pagesEconomic Macrom habiburrahman55No ratings yet

- Economics Notes Unit 6Document5 pagesEconomics Notes Unit 6Hritwik GhoshNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Basic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyFrom EverandBasic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyNo ratings yet

- Quiz 2 Micro Economics Summer 2022Document1 pageQuiz 2 Micro Economics Summer 2022Ehtsham Ul HaqNo ratings yet

- Ehtsham ul Haq, (PUblic Sector Economics)Document1 pageEhtsham ul Haq, (PUblic Sector Economics)Ehtsham Ul HaqNo ratings yet

- Paper Setting Rules: Course/ContentsDocument1 pagePaper Setting Rules: Course/ContentsEhtsham Ul HaqNo ratings yet

- (Old Paper) Islamic Economics,Document1 page(Old Paper) Islamic Economics,Ehtsham Ul HaqNo ratings yet

- Paper Formate Part-IIDocument1 pagePaper Formate Part-IIEhtsham Ul HaqNo ratings yet

- ECN316 Lec1 - Introduction - HODocument19 pagesECN316 Lec1 - Introduction - HOEhtsham Ul HaqNo ratings yet

- Chapter 4 Brain Drain Global Lives BookDocument322 pagesChapter 4 Brain Drain Global Lives BookEhtsham Ul HaqNo ratings yet

- MSC 2 PresenatationDocument2 pagesMSC 2 PresenatationEhtsham Ul HaqNo ratings yet

- The Greek Brain DrainDocument23 pagesThe Greek Brain DrainEhtsham Ul HaqNo ratings yet

- Medical Brain Drain How Why WhereDocument16 pagesMedical Brain Drain How Why WhereEhtsham Ul HaqNo ratings yet

- Mirpur University of Science and TechnologyDocument11 pagesMirpur University of Science and TechnologyEhtsham Ul HaqNo ratings yet

- Human Brain Drain and Its Impact On EducDocument22 pagesHuman Brain Drain and Its Impact On EducEhtsham Ul HaqNo ratings yet

- EconomicsDocument1 pageEconomicsEhtsham Ul HaqNo ratings yet

- PresentationDocument9 pagesPresentationEhtsham Ul HaqNo ratings yet