Professional Documents

Culture Documents

MITC

MITC

Uploaded by

Pratik RajgorCopyright:

Available Formats

You might also like

- Simulation 2Document11 pagesSimulation 2api-256421103No ratings yet

- Natural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Document5 pagesNatural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Andre IsmaelNo ratings yet

- MisUse of MonteCarlo Simulation in NPV Analysis-DavisDocument5 pagesMisUse of MonteCarlo Simulation in NPV Analysis-Davisminerito2211No ratings yet

- ZerodhaTD 23Document1 pageZerodhaTD 23hr.zerodhabbsrNo ratings yet

- Most Important Terms and ConditionsDocument1 pageMost Important Terms and Conditionsfarhanali1921No ratings yet

- Annexure ADocument1 pageAnnexure AKushal KhagtaNo ratings yet

- INSP60147Document3 pagesINSP60147rala.mitrajiNo ratings yet

- EQUITY Do's and Don'TsDocument2 pagesEQUITY Do's and Don'TsmkjailaniNo ratings yet

- Dos and Donts Disaster ManagementDocument1 pageDos and Donts Disaster ManagementMahitha ReddyNo ratings yet

- Gmail - Funds - Securities BalanceDocument2 pagesGmail - Funds - Securities Balancesujeetkumar90608No ratings yet

- Mandatory & VoluntaryDocument29 pagesMandatory & VoluntaryAnkit GujarNo ratings yet

- Notice Board2Document3 pagesNotice Board2bhushan khoriNo ratings yet

- Dear InvestorDocument3 pagesDear InvestorAdvocate ChandraNo ratings yet

- Gmail - Funds - Securities BalanceDocument2 pagesGmail - Funds - Securities BalanceKumar SunilNo ratings yet

- Terms and Conditions Eu PhoneDocument14 pagesTerms and Conditions Eu Phonelittle blingNo ratings yet

- Annexure-4 Guidance Note - Do'S and Don'Ts For The Clients Do'sDocument3 pagesAnnexure-4 Guidance Note - Do'S and Don'Ts For The Clients Do'smohanNo ratings yet

- Jupiter FaqDocument3 pagesJupiter FaqJagjit SinghNo ratings yet

- Topics For Nukkad NatakDocument3 pagesTopics For Nukkad NatakMahesh BabuNo ratings yet

- Consent/ Authorization To Avail Margin Trading FundingDocument11 pagesConsent/ Authorization To Avail Margin Trading FundingGemini PatelNo ratings yet

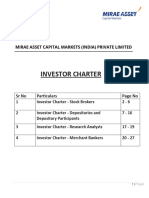

- Investor CharterDocument27 pagesInvestor CharterDhrumil PatelNo ratings yet

- Investor Charter - Stock Brokers: Page 1 of 5Document5 pagesInvestor Charter - Stock Brokers: Page 1 of 5Pranav SNo ratings yet

- Analysis of Demat-AccountDocument77 pagesAnalysis of Demat-AccountNagireddy KalluriNo ratings yet

- FAQs On Mutual Fund Service System (MFSS) For InvestorsrDocument7 pagesFAQs On Mutual Fund Service System (MFSS) For InvestorsrRajeshkanna PNo ratings yet

- Procedure Dor Demat Acc Opening BY THE HUSTLERSDocument8 pagesProcedure Dor Demat Acc Opening BY THE HUSTLERSSankhadeep DebdasNo ratings yet

- Investor Charter - Stock Brokers: Annexure-ADocument19 pagesInvestor Charter - Stock Brokers: Annexure-AchanduNo ratings yet

- Demat Simplified: A Guide To Dealing in Dematerialised SecuritiesDocument2 pagesDemat Simplified: A Guide To Dealing in Dematerialised SecuritiesBalraj PadmashaliNo ratings yet

- FAQ DematDocument10 pagesFAQ DematPrashant SharmaNo ratings yet

- Annexure 9Document2 pagesAnnexure 9vijay aroraNo ratings yet

- DematdownloadDocument8 pagesDematdownloadankit_47369No ratings yet

- Over-The-Counter Exchange of India - OTCEIDocument7 pagesOver-The-Counter Exchange of India - OTCEISunil KumarNo ratings yet

- FAQ Main CategoriesDocument5 pagesFAQ Main CategoriesRoxy ThomasNo ratings yet

- Punjab National Bank Vision & Mission StatementDocument34 pagesPunjab National Bank Vision & Mission StatementdhruvinNo ratings yet

- MOST IMPORTANT TERMS AND CONDITIONS MITC 43151b71bcDocument2 pagesMOST IMPORTANT TERMS AND CONDITIONS MITC 43151b71bcphd.gkgNo ratings yet

- Overview of Demat AccountDocument12 pagesOverview of Demat AccountNagireddy KalluriNo ratings yet

- Mutual Fund Service System Facility (MFSS) Client Registration FormDocument4 pagesMutual Fund Service System Facility (MFSS) Client Registration FormbasabNo ratings yet

- Investor Guide: A Y N T K (Vol: II)Document15 pagesInvestor Guide: A Y N T K (Vol: II)Jaleel AhmadNo ratings yet

- Dematerialisation Is The Process of Converting The Physical Form of Shares Into Electronic FormDocument15 pagesDematerialisation Is The Process of Converting The Physical Form of Shares Into Electronic FormNitin KanojiaNo ratings yet

- Do and DontDocument5 pagesDo and Dontromola613No ratings yet

- Ecs Nach Si Mandate FormDocument2 pagesEcs Nach Si Mandate FormSachinNo ratings yet

- BluFX RULES AND REGULATIONSDocument6 pagesBluFX RULES AND REGULATIONSQueen FideNo ratings yet

- I Depository SystemDocument17 pagesI Depository Systemjasleen1No ratings yet

- SBP CircularDocument4 pagesSBP CircularShair Haider MalikNo ratings yet

- Risk Disclosure and Warnings NoticeDocument11 pagesRisk Disclosure and Warnings NoticeJavier SaldaNo ratings yet

- Mutual Fund Service System (MFSS) For Investors: Frequently Asked QuestionDocument7 pagesMutual Fund Service System (MFSS) For Investors: Frequently Asked QuestionAJAY KUMAR TALATHOTANo ratings yet

- FAQ-Dematerialisation: Bank DepositoryDocument9 pagesFAQ-Dematerialisation: Bank DepositoryRitika SharmaNo ratings yet

- Individual Application Form - Online Trading: ApplicantDocument2 pagesIndividual Application Form - Online Trading: Applicantgalan68261No ratings yet

- OTCEIDocument8 pagesOTCEIbhavna_v21100% (1)

- Policies and Procedures Governing TradingDocument6 pagesPolicies and Procedures Governing Tradingamit79768No ratings yet

- Gmail - Funds - Securities BalanceDocument1 pageGmail - Funds - Securities BalanceKumar SunilNo ratings yet

- How To Buy SharesDocument3 pagesHow To Buy ShareslakshyainvestNo ratings yet

- Invest-Terms ENDocument46 pagesInvest-Terms ENmathew holeyNo ratings yet

- Demat Account: Efforts byDocument21 pagesDemat Account: Efforts byPrabhakar DashNo ratings yet

- CH 2 Remaining NotesDocument5 pagesCH 2 Remaining NotesBeniwal NidhiNo ratings yet

- Key Fact Statement-Neobiz: Mashreqbank PSC Is Regulated by The Central Bank of The United Arab EmiratesDocument4 pagesKey Fact Statement-Neobiz: Mashreqbank PSC Is Regulated by The Central Bank of The United Arab Emiratesresources erpNo ratings yet

- Project On Demat OperationsDocument57 pagesProject On Demat Operationsvijee_877No ratings yet

- Lecture 04Document19 pagesLecture 04Syed NayemNo ratings yet

- Systematic Investment Plan (Sip)Document2 pagesSystematic Investment Plan (Sip)GujuNo ratings yet

- Client AgreementDocument26 pagesClient AgreementRayhan Mubarak'sNo ratings yet

- Central Depository Systems (PVT) Limited: Particulars of Depositor/s (I.e Applicant/s) BranchDocument4 pagesCentral Depository Systems (PVT) Limited: Particulars of Depositor/s (I.e Applicant/s) Branchsandu sihinaNo ratings yet

- 1 Yr Fixed Rate DepositDocument2 pages1 Yr Fixed Rate DepositEnifeni OlawaleNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Conch Venture Letter of IntentDocument2 pagesConch Venture Letter of IntentMhel LaurelNo ratings yet

- Pricing and Its StrategiesDocument29 pagesPricing and Its StrategiessidNo ratings yet

- WBCSD CTI v3.0 Report - Metrics For Business by BusinessDocument90 pagesWBCSD CTI v3.0 Report - Metrics For Business by BusinessComunicarSe-ArchivoNo ratings yet

- Final Examination Ge3 The Contemporary WorldDocument4 pagesFinal Examination Ge3 The Contemporary WorldRamon III ObligadoNo ratings yet

- GECONTWO Act4EnrileDocument2 pagesGECONTWO Act4EnrileJuevyllee EnrileNo ratings yet

- Gri 102 General Disclosures 2016Document44 pagesGri 102 General Disclosures 2016Pablo MalgesiniNo ratings yet

- Credit Rating Process NewDocument13 pagesCredit Rating Process NewArbaz PashaNo ratings yet

- Topic 6 Notes Imperfect Markets 2023Document15 pagesTopic 6 Notes Imperfect Markets 2023cyonela5No ratings yet

- Dividend Policy - Problems For Class DiscussionDocument5 pagesDividend Policy - Problems For Class Discussionchandel08No ratings yet

- Hiring PolicyDocument3 pagesHiring PolicyEhtesham ShoukatNo ratings yet

- Article ReviewDocument2 pagesArticle ReviewRameNo ratings yet

- Documentary Analysis For "Magtanim Ay Di Biro" by Kara DavidDocument1 pageDocumentary Analysis For "Magtanim Ay Di Biro" by Kara DavidEishley Gwen Espiritu CabatbatNo ratings yet

- Quiz 1 FMDocument3 pagesQuiz 1 FMwaqar HaiderNo ratings yet

- Export Import Policy of India (Group No.1)Document30 pagesExport Import Policy of India (Group No.1)Pranav ChandraNo ratings yet

- The Following Students Were Present For The Group Discussion and Contributed To The Assignment Per The RACI ChartDocument11 pagesThe Following Students Were Present For The Group Discussion and Contributed To The Assignment Per The RACI ChartHarpreet singhNo ratings yet

- Accounting 1 (Abm)Document7 pagesAccounting 1 (Abm)ALLIYAH JONES PAIRATNo ratings yet

- Annamalai University MBA Assignment Solution 2019Document98 pagesAnnamalai University MBA Assignment Solution 2019palaniappannNo ratings yet

- PM External Report L4M8 July 2019Document1 pagePM External Report L4M8 July 2019Shane SookrajNo ratings yet

- Arnold - Econ13e - ch02 Production Possibilities Frontier FrameworkDocument34 pagesArnold - Econ13e - ch02 Production Possibilities Frontier FrameworkMartinChooNo ratings yet

- Livestock LRRD 2014 SR - Ismat - Alam PDFDocument27 pagesLivestock LRRD 2014 SR - Ismat - Alam PDFPranoy ChakrabortyNo ratings yet

- Chapter # 16 - Marketing GloballyDocument23 pagesChapter # 16 - Marketing GloballyAnonymous gf3tINCNo ratings yet

- Green BuildingDocument79 pagesGreen BuildingSURJIT DUTTANo ratings yet

- Business Economics Curriculum PDFDocument67 pagesBusiness Economics Curriculum PDFTushar KanodiaNo ratings yet

- DLL - BRM - Ecommerce AnalyticsDocument4 pagesDLL - BRM - Ecommerce AnalyticsamanNo ratings yet

- Sources of Finance - CreditDocument12 pagesSources of Finance - CreditSanta PinkaNo ratings yet

- Objectives:: Tourism Industry in BangladeshDocument39 pagesObjectives:: Tourism Industry in BangladeshAshiqur RahmanNo ratings yet

- Recycling Saves The EcosystemDocument3 pagesRecycling Saves The EcosystemAbdulrahman AlhammadiNo ratings yet

- HuskyDocument10 pagesHuskypreetimurali100% (1)

MITC

MITC

Uploaded by

Pratik RajgorCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MITC

MITC

Uploaded by

Pratik RajgorCopyright:

Available Formats

MOST IMPORTANT TERMS AND CONDITIONS (MITC)

(For non-custodial settled trading accounts)

To,

Moneylicious Securities Private Limited

302, Western Edge I, 3 rd Floor,

Off Western Express Highway,

Borivali (East), Mumbai – 400 066.

Maharashtra, India.

1. Your trading account has a “Unique Client Code” (UCC), different from your demat account number. Do not allow

anyone (including your own stock broker, their representatives and dealers) to trade in your trading account on their

own without taking specific instruction from you for your trades. Do not share your internet/ mobile trading login

credentials with anyone else.

2. You are required to place collaterals as margins with the stock broker before you trade. The collateral can either be

in the form of funds transfer into specified stock broker bank accounts or margin pledge of securities from your demat

account. The bank accounts are listed on the stock broker website. Please do not transfer funds into any other

account. The stock broker is not permitted to accept any cash from you.

3. The stock broker’s Risk Management Policy provides details about how the trading limits will be given to you, and the

tariff sheet provides the charges that the stock broker will levy on you.

4. All securities purchased by you will be transferred to your demat account within one working day of the payout. In

case of securities purchased but not fully paid by you, the transfer of the same may be subject to limited period pledge

i.e. seven trading days after the pay-out (CUSPA pledge) created in favor of the stock broker. You can view your

demat account balances directly at the website of the Depositories after creating a login.

5. The stock broker is obligated to deposit all funds received from you with any of the Clearing Corporations duly

allocated in your name. The stock broker is further mandated to return excess funds as per applicable norms to you

at the time of quarterly/ monthly settlement. You can view the amounts allocated to you directly at the website of the

Clearing Corporation(s).

6. You will get a contract note from the stock broker within 24 hours of the trade.

7. You may give a one-time Demat Debit and Pledge Instruction (DDPI) authority to your stock broker for limited access

to your demat account, including transferring securities, which are sold in your account for pay-in.

8. The stock broker is expected to know your financial status and monitor your accounts accordingly. Do share all

financial information (e.g. income, networth, etc.) with the stock broker as and when requested for. Kindly also keep

your email Id and mobile phone details with the stock broker always updated.

9. In case of disputes with the stock broker, you can raise a grievance on the dedicated investor grievance ID of the

stock broker. You can also approach the stock exchanges and/or SEBI directly.

10. Any assured/guaranteed/fixed returns schemes or any other schemes of similar nature are prohibited by law. You will

not have any protection/recourse from SEBI/stock exchanges for participation in such schemes.

NAME OF THE ACCOUNT HOLDER SIGNATURE OF THE ACCOUNT HOLDER

UCC Code

DP BO ID

Place

Date DD / MM / YYYY

23

You might also like

- Simulation 2Document11 pagesSimulation 2api-256421103No ratings yet

- Natural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Document5 pagesNatural Trading, LLC - Leeloo Proprietary Letter and Contract Natural Trading, LLC Montana 59072Andre IsmaelNo ratings yet

- MisUse of MonteCarlo Simulation in NPV Analysis-DavisDocument5 pagesMisUse of MonteCarlo Simulation in NPV Analysis-Davisminerito2211No ratings yet

- ZerodhaTD 23Document1 pageZerodhaTD 23hr.zerodhabbsrNo ratings yet

- Most Important Terms and ConditionsDocument1 pageMost Important Terms and Conditionsfarhanali1921No ratings yet

- Annexure ADocument1 pageAnnexure AKushal KhagtaNo ratings yet

- INSP60147Document3 pagesINSP60147rala.mitrajiNo ratings yet

- EQUITY Do's and Don'TsDocument2 pagesEQUITY Do's and Don'TsmkjailaniNo ratings yet

- Dos and Donts Disaster ManagementDocument1 pageDos and Donts Disaster ManagementMahitha ReddyNo ratings yet

- Gmail - Funds - Securities BalanceDocument2 pagesGmail - Funds - Securities Balancesujeetkumar90608No ratings yet

- Mandatory & VoluntaryDocument29 pagesMandatory & VoluntaryAnkit GujarNo ratings yet

- Notice Board2Document3 pagesNotice Board2bhushan khoriNo ratings yet

- Dear InvestorDocument3 pagesDear InvestorAdvocate ChandraNo ratings yet

- Gmail - Funds - Securities BalanceDocument2 pagesGmail - Funds - Securities BalanceKumar SunilNo ratings yet

- Terms and Conditions Eu PhoneDocument14 pagesTerms and Conditions Eu Phonelittle blingNo ratings yet

- Annexure-4 Guidance Note - Do'S and Don'Ts For The Clients Do'sDocument3 pagesAnnexure-4 Guidance Note - Do'S and Don'Ts For The Clients Do'smohanNo ratings yet

- Jupiter FaqDocument3 pagesJupiter FaqJagjit SinghNo ratings yet

- Topics For Nukkad NatakDocument3 pagesTopics For Nukkad NatakMahesh BabuNo ratings yet

- Consent/ Authorization To Avail Margin Trading FundingDocument11 pagesConsent/ Authorization To Avail Margin Trading FundingGemini PatelNo ratings yet

- Investor CharterDocument27 pagesInvestor CharterDhrumil PatelNo ratings yet

- Investor Charter - Stock Brokers: Page 1 of 5Document5 pagesInvestor Charter - Stock Brokers: Page 1 of 5Pranav SNo ratings yet

- Analysis of Demat-AccountDocument77 pagesAnalysis of Demat-AccountNagireddy KalluriNo ratings yet

- FAQs On Mutual Fund Service System (MFSS) For InvestorsrDocument7 pagesFAQs On Mutual Fund Service System (MFSS) For InvestorsrRajeshkanna PNo ratings yet

- Procedure Dor Demat Acc Opening BY THE HUSTLERSDocument8 pagesProcedure Dor Demat Acc Opening BY THE HUSTLERSSankhadeep DebdasNo ratings yet

- Investor Charter - Stock Brokers: Annexure-ADocument19 pagesInvestor Charter - Stock Brokers: Annexure-AchanduNo ratings yet

- Demat Simplified: A Guide To Dealing in Dematerialised SecuritiesDocument2 pagesDemat Simplified: A Guide To Dealing in Dematerialised SecuritiesBalraj PadmashaliNo ratings yet

- FAQ DematDocument10 pagesFAQ DematPrashant SharmaNo ratings yet

- Annexure 9Document2 pagesAnnexure 9vijay aroraNo ratings yet

- DematdownloadDocument8 pagesDematdownloadankit_47369No ratings yet

- Over-The-Counter Exchange of India - OTCEIDocument7 pagesOver-The-Counter Exchange of India - OTCEISunil KumarNo ratings yet

- FAQ Main CategoriesDocument5 pagesFAQ Main CategoriesRoxy ThomasNo ratings yet

- Punjab National Bank Vision & Mission StatementDocument34 pagesPunjab National Bank Vision & Mission StatementdhruvinNo ratings yet

- MOST IMPORTANT TERMS AND CONDITIONS MITC 43151b71bcDocument2 pagesMOST IMPORTANT TERMS AND CONDITIONS MITC 43151b71bcphd.gkgNo ratings yet

- Overview of Demat AccountDocument12 pagesOverview of Demat AccountNagireddy KalluriNo ratings yet

- Mutual Fund Service System Facility (MFSS) Client Registration FormDocument4 pagesMutual Fund Service System Facility (MFSS) Client Registration FormbasabNo ratings yet

- Investor Guide: A Y N T K (Vol: II)Document15 pagesInvestor Guide: A Y N T K (Vol: II)Jaleel AhmadNo ratings yet

- Dematerialisation Is The Process of Converting The Physical Form of Shares Into Electronic FormDocument15 pagesDematerialisation Is The Process of Converting The Physical Form of Shares Into Electronic FormNitin KanojiaNo ratings yet

- Do and DontDocument5 pagesDo and Dontromola613No ratings yet

- Ecs Nach Si Mandate FormDocument2 pagesEcs Nach Si Mandate FormSachinNo ratings yet

- BluFX RULES AND REGULATIONSDocument6 pagesBluFX RULES AND REGULATIONSQueen FideNo ratings yet

- I Depository SystemDocument17 pagesI Depository Systemjasleen1No ratings yet

- SBP CircularDocument4 pagesSBP CircularShair Haider MalikNo ratings yet

- Risk Disclosure and Warnings NoticeDocument11 pagesRisk Disclosure and Warnings NoticeJavier SaldaNo ratings yet

- Mutual Fund Service System (MFSS) For Investors: Frequently Asked QuestionDocument7 pagesMutual Fund Service System (MFSS) For Investors: Frequently Asked QuestionAJAY KUMAR TALATHOTANo ratings yet

- FAQ-Dematerialisation: Bank DepositoryDocument9 pagesFAQ-Dematerialisation: Bank DepositoryRitika SharmaNo ratings yet

- Individual Application Form - Online Trading: ApplicantDocument2 pagesIndividual Application Form - Online Trading: Applicantgalan68261No ratings yet

- OTCEIDocument8 pagesOTCEIbhavna_v21100% (1)

- Policies and Procedures Governing TradingDocument6 pagesPolicies and Procedures Governing Tradingamit79768No ratings yet

- Gmail - Funds - Securities BalanceDocument1 pageGmail - Funds - Securities BalanceKumar SunilNo ratings yet

- How To Buy SharesDocument3 pagesHow To Buy ShareslakshyainvestNo ratings yet

- Invest-Terms ENDocument46 pagesInvest-Terms ENmathew holeyNo ratings yet

- Demat Account: Efforts byDocument21 pagesDemat Account: Efforts byPrabhakar DashNo ratings yet

- CH 2 Remaining NotesDocument5 pagesCH 2 Remaining NotesBeniwal NidhiNo ratings yet

- Key Fact Statement-Neobiz: Mashreqbank PSC Is Regulated by The Central Bank of The United Arab EmiratesDocument4 pagesKey Fact Statement-Neobiz: Mashreqbank PSC Is Regulated by The Central Bank of The United Arab Emiratesresources erpNo ratings yet

- Project On Demat OperationsDocument57 pagesProject On Demat Operationsvijee_877No ratings yet

- Lecture 04Document19 pagesLecture 04Syed NayemNo ratings yet

- Systematic Investment Plan (Sip)Document2 pagesSystematic Investment Plan (Sip)GujuNo ratings yet

- Client AgreementDocument26 pagesClient AgreementRayhan Mubarak'sNo ratings yet

- Central Depository Systems (PVT) Limited: Particulars of Depositor/s (I.e Applicant/s) BranchDocument4 pagesCentral Depository Systems (PVT) Limited: Particulars of Depositor/s (I.e Applicant/s) Branchsandu sihinaNo ratings yet

- 1 Yr Fixed Rate DepositDocument2 pages1 Yr Fixed Rate DepositEnifeni OlawaleNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Conch Venture Letter of IntentDocument2 pagesConch Venture Letter of IntentMhel LaurelNo ratings yet

- Pricing and Its StrategiesDocument29 pagesPricing and Its StrategiessidNo ratings yet

- WBCSD CTI v3.0 Report - Metrics For Business by BusinessDocument90 pagesWBCSD CTI v3.0 Report - Metrics For Business by BusinessComunicarSe-ArchivoNo ratings yet

- Final Examination Ge3 The Contemporary WorldDocument4 pagesFinal Examination Ge3 The Contemporary WorldRamon III ObligadoNo ratings yet

- GECONTWO Act4EnrileDocument2 pagesGECONTWO Act4EnrileJuevyllee EnrileNo ratings yet

- Gri 102 General Disclosures 2016Document44 pagesGri 102 General Disclosures 2016Pablo MalgesiniNo ratings yet

- Credit Rating Process NewDocument13 pagesCredit Rating Process NewArbaz PashaNo ratings yet

- Topic 6 Notes Imperfect Markets 2023Document15 pagesTopic 6 Notes Imperfect Markets 2023cyonela5No ratings yet

- Dividend Policy - Problems For Class DiscussionDocument5 pagesDividend Policy - Problems For Class Discussionchandel08No ratings yet

- Hiring PolicyDocument3 pagesHiring PolicyEhtesham ShoukatNo ratings yet

- Article ReviewDocument2 pagesArticle ReviewRameNo ratings yet

- Documentary Analysis For "Magtanim Ay Di Biro" by Kara DavidDocument1 pageDocumentary Analysis For "Magtanim Ay Di Biro" by Kara DavidEishley Gwen Espiritu CabatbatNo ratings yet

- Quiz 1 FMDocument3 pagesQuiz 1 FMwaqar HaiderNo ratings yet

- Export Import Policy of India (Group No.1)Document30 pagesExport Import Policy of India (Group No.1)Pranav ChandraNo ratings yet

- The Following Students Were Present For The Group Discussion and Contributed To The Assignment Per The RACI ChartDocument11 pagesThe Following Students Were Present For The Group Discussion and Contributed To The Assignment Per The RACI ChartHarpreet singhNo ratings yet

- Accounting 1 (Abm)Document7 pagesAccounting 1 (Abm)ALLIYAH JONES PAIRATNo ratings yet

- Annamalai University MBA Assignment Solution 2019Document98 pagesAnnamalai University MBA Assignment Solution 2019palaniappannNo ratings yet

- PM External Report L4M8 July 2019Document1 pagePM External Report L4M8 July 2019Shane SookrajNo ratings yet

- Arnold - Econ13e - ch02 Production Possibilities Frontier FrameworkDocument34 pagesArnold - Econ13e - ch02 Production Possibilities Frontier FrameworkMartinChooNo ratings yet

- Livestock LRRD 2014 SR - Ismat - Alam PDFDocument27 pagesLivestock LRRD 2014 SR - Ismat - Alam PDFPranoy ChakrabortyNo ratings yet

- Chapter # 16 - Marketing GloballyDocument23 pagesChapter # 16 - Marketing GloballyAnonymous gf3tINCNo ratings yet

- Green BuildingDocument79 pagesGreen BuildingSURJIT DUTTANo ratings yet

- Business Economics Curriculum PDFDocument67 pagesBusiness Economics Curriculum PDFTushar KanodiaNo ratings yet

- DLL - BRM - Ecommerce AnalyticsDocument4 pagesDLL - BRM - Ecommerce AnalyticsamanNo ratings yet

- Sources of Finance - CreditDocument12 pagesSources of Finance - CreditSanta PinkaNo ratings yet

- Objectives:: Tourism Industry in BangladeshDocument39 pagesObjectives:: Tourism Industry in BangladeshAshiqur RahmanNo ratings yet

- Recycling Saves The EcosystemDocument3 pagesRecycling Saves The EcosystemAbdulrahman AlhammadiNo ratings yet

- HuskyDocument10 pagesHuskypreetimurali100% (1)