Professional Documents

Culture Documents

1099 BPSeal

1099 BPSeal

Uploaded by

ahmed adlyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1099 BPSeal

1099 BPSeal

Uploaded by

ahmed adlyCopyright:

Available Formats

Schedule D (Form 1040), or Pub. 550 for details.

Instructions for Recipient Box 1f. Shows the amount of accrued market discount. For details on market discount, see the

Brokers and barter exchanges must report proceeds from (and in some cases, basis for) Schedule D (Form 1040) instructions, the Instructions for Form 8949, and Pub. 550.

transactions to you and the IRS on Form 1099-B. Reporting also is required when your broker If box 5 is checked, box 1f may be blank.

knows or has reason to know that a corporation in which you own stock has had a reportable Box 1g. Shows the amount of nondeductible loss in a wash sale transaction. For details on wash

change in control or capital structure. You may be required to recognize gain from the receipt of sales, see the Schedule D (Form 1040) instructions, the Instructions for Form 8949,

cash, stock, or other property that was exchanged for the corporation’s stock. If your broker and Pub. 550. If box 5 is checked, box 1g may be blank.

reported this type of transaction to you, the corporation is identified in box 1a.

Box 2. The short-term and long-term boxes pertain to short-term gain or loss and long-term gain

Recipient's taxpayer id number (TIN). For your protection, this form may show only the or loss. If the Ordinary box is checked, your security may be subject to special rules. For

last four digits of your TIN (social security number (SSN), individual taxpayer identification example, gain on a contingent payment debt instrument subject to the noncontingent bond

number (ITIN), adoption taxpayer identification number (ATIN), or employer identification method is generally treated as ordinary interest income rather than as capital gain. See the

number (EIN)). However, the issuer has reported your complete TIN to the IRS. Instructions for Form 8949, Pub. 550, or Pub. 1212 for more details on whether there are any

Account number. May show an account or other unique number the payer assigned to special rules or adjustments that might apply to your security. If box 5 is checked, box 2 may be

distinguish your account. blank.

CUSIP number. Shows the CUSIP (Committee on Uniform Security Identification Procedures) Box 3.If checked, proceeds are from a transaction involving collectibles or from a Qualified

number or other applicable identifying number. Opportunity Fund (QOF).

FATCA filing requirement. If the FATCA filing requirement box is checked, the payer is Box 4. Shows backup withholding. Generally, a payer must backup withhold if you did not furnish

reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement. You may your TIN to the payer. See Form W-9 for information on backup withholding. Include this amount

also have a filing requirement. See the Instructions for Form 8938. on your income tax return as tax withheld.

Applicable check box on Form 8949. Indicates where to report this transaction on Form Box 5. If checked, the securities sold were noncovered securities and boxes 1b, 1e, 1f, 1g, and 2

8949 and Schedule D (Form 1040), and which check box is applicable. See the may be blank. Generally, a noncovered security means (a) stock purchased before 2011, (b) stock

instructions for your Schedule D (Form 1040) and/or Form 8949. in most mutual funds purchased before 2012, (c) stock purchased in or transferred to a dividend

Box 1a. Shows a brief description of the item or service for which amounts are being reported. reinvestment plan before 2012, (d) debt acquired before 2014, (e) options granted or acquired

For regulated futures contracts and forward contracts, "RFC" or other appropriate description before 2014, and (f) securities futures contracts executed before 2014.

may be shown. For Section 1256 option contracts, "Section 1256 option" or other appropriate Box 6. If the exercise of a noncompensatory option resulted in a sale of a security, a checked

description may be shown. For a corporation that had a reportable change in control or capital "net proceeds" box indicates whether the amount in box 1d was adjusted for option premium.

structure, this box may show the class of stock as C (common), P (preferred), or O (other). Box 7. If checked, you cannot take a loss on your tax return based on gross proceeds from a

Box 1b. This box may be blank if box 5 is checked or if the securities sold were acquired on a reportable change in control or capital structure reported in box 1d. See the Form 8949 and

variety of dates. For short sales, the date shown is the date you acquired the security delivered Schedule D (Form 1040) instructions. The broker should advise you of any losses

to close the short sale. on a separate statement.

Box 1c. Shows the trade date of the sale or exchange. For short sales, the date shown is the Regulated Futures Contracts, Foreign Currency Contracts, and Section 1256 Option

date the security was delivered to close the short sale. For aggregate reporting in boxes 8 Contracts (Boxes 8 Through 11):

through 11, no entry will be present. Box 8. Shows the profit or (loss) realized on regulated futures, foreign currency, or Section 1256

Box 1d. Shows the cash proceeds, reduced by any commissions or transfer taxes related to the option contracts closed during 2023.

sale, for transactions involving stocks, debt, commodities, forward contracts, non-Section 1256 Box 9. Shows any year-end adjustment to the profit or (loss) shown in box 8 due to open

option contracts, or securities futures contracts. May show the proceeds from the disposition contracts on December 31, 2022.

of your interest(s) in a widely held fixed investment trust. May also show the aggregate amount Box 10. Shows the unrealized profit or (loss) on open contracts held in your account on

of cash and the fair market value of any stock or other property received in a reportable change December 31, 2023. These are considered closed out as of that date. This will become an

in control or capital structure arising from the corporate transfer of property to a foreign adjustment reported as unrealized profit or (loss) on open contracts -- 12/31/2023 in 2024.

corporation. Losses on forward contracts or non-Section 1256 option contracts are shown Box 11. Boxes 8, 9, and 10 are all used to figure the aggregate profit or (loss) on regulated

in parentheses. This box does not include proceeds from regulated futures contracts or Section futures, foreign currency, or Section 1256 option contracts for the year. Include this amount on

1256 option contracts. Report this amount on Form 8949 or Schedule D (Form 1040) your 2023 Form 6781.

(whichever applies) as explained in the Instructions for Schedule D (Form 1040). Box 12. If checked, the basis in box 1e has been reported to the IRS and either the short-term or

Box 1e. Shows the cost or other basis of securities sold. If the securities were acquired through the long-term gain or loss box in box 2 will be checked. If box 12 is checked on Form(s) 1099-B

the exercise of a non-compensatory option granted or acquired on or after January 1, 2014, the and NO adjustment is required, see the instructions for your Schedule D (Form 1040)

basis has been adjusted to reflect your option premium. If the securities were acquired through as you may be able to report your transaction directly on Schedule D (Form 1040).

the exercise of a non-compensatory option granted or acquired before January 1, 2014, your If the "Ordinary" box in box 2 is checked, an adjustment may be required.

broker is permitted, but not required, to adjust the basis to reflect your option premium. If the Box 13. Shows the cash you received, the fair market value of any property or services you

securities were acquired through the exercise of a compensatory option, the basis has not been received, and the fair market value of any trade credits or scrip credited to your account by a

adjusted to include any amount related to the option that was reported to you on a Form W-2. barter exchange. See Pub. 525.

If box 5 is checked, box 1e may be blank. See the Instructions for Form 8949, Instructions for Boxes 14–16. Show state(s)/local income tax information.

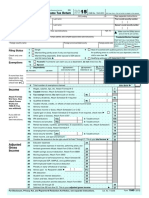

, CORRECTED (if checked)

PAYER'S name, street address, city, state, ZIP code, and telephone number Applicable check box on Form 8949 OMB No. 1545-0715 Proceeds From

A Broker and

INTEGRATED DATA MANAGEMENT SYSTEMS, INC

ACCOUNT ABILITY COMPLIANCE SOFTWARE

SHORT-TERM <:23 Barter Exchange

REPORTED TO IRS Form 1099-B Transactions

555 BROADHOLLOW ROAD SUITE 273

1a Description of property (Example 100 sh. XYZ Co.)

MELVILLE NY 11747-5001

225000 OF 345000 SHARE ABC XYZ

1b Date acquired 1c Date sold or disposed

631-249-7744/SALES DEPT 03/14/2017 05/18/2021 Copy B

PAYER'S TIN RECIPIENT'S TIN 1d Proceeds 1e Cost or other basis For Recipient

$ 472525.00 $ 132588.00

13-3249958 XXX-XX-0023 1f Accrued market discount 1g Wash sale loss disallowed This is important tax

information and is

$ $ being furnished to

RECIPIENT'S name, street address, city, state, and ZIP code 2 Short-term gain or loss , 3 If checked, proceeds from: the Internal Revenue

Long-term gain or loss + Collectibles + Service. If you are

required to file a

Ordinary + QOF , return, a negligence

4 Federal income tax withheld 5 If checked, noncovered penalty or other

security sanction may be

JOHN DOE $ +

imposed on you if

33 EAST 17 STREET UNIT 2101 6 Reported to IRS: 7 If checked, loss is not allowed

this income is

based on amount in 1d

NEW YORK NY 10003-2005 Gross proceeds + taxable and the IRS

Net proceeds , , determines that it

has not been

8 Profit or (loss) realized in 9 Unrealized profit or (loss) on

reported.

Account number (see instructions) 2023 on closed contracts open contracts - 12/31/2022

D8923484923448 $ ( 2336.28) $

CUSIP number FATCA filing 10 Unrealized profit or (loss) on 11 Aggregate profit or (loss)

requirement open contracts - 12/31/2023 on contracts

F449538294323 +

14 State 15 State identification no. 16 State tax withheld $ $

NY 13-3249958 $ 69780.00 12 If checked, basis reported 13 Bartering

to IRS

NJ 129255681001 $ 35.00 , $

Form 1099-B (Keep for your records) Department of the Treasury - Internal Revenue Service

INTEGRATED DATA MANAGEMENT SYSTEMS, INC

ACCOUNT ABILITY COMPLIANCE SOFTWARE

555 BROADHOLLOW ROAD SUITE 273

MELVILLE NY 11747-5001

FIRST-CLASS MAIL JOHN DOE

Important Tax Document Enclosed 33 EAST 17 STREET UNIT 2101

NEW YORK NY 10003-2005

ID # 1

You might also like

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (1)

- I 1099 MecDocument12 pagesI 1099 MecZaheer N 21No ratings yet

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- Your Ultimate Guide To 1099sDocument9 pagesYour Ultimate Guide To 1099sKierra Dunbar100% (3)

- 1099-b Whfit FormDocument6 pages1099-b Whfit FormYarod EL100% (5)

- Instructions For Form 1099-B: Future DevelopmentsDocument12 pagesInstructions For Form 1099-B: Future DevelopmentsScott Homuth100% (1)

- Form 1099ADocument6 pagesForm 1099ABenne JamesNo ratings yet

- Chapter-3Document20 pagesChapter-3rajes wariNo ratings yet

- PDF W2Document1 pagePDF W2John LittlefairNo ratings yet

- Cash 1099Document5 pagesCash 1099b.black.sploitNo ratings yet

- Cash 1099Document6 pagesCash 1099Shub OutNo ratings yet

- Cash 1099Document4 pagesCash 1099Trish HitNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- Instructions For Form 1099-B: Future DevelopmentsDocument12 pagesInstructions For Form 1099-B: Future DevelopmentsJeff LouisNo ratings yet

- Interest and Ordinary DividendsDocument2 pagesInterest and Ordinary DividendsSarah KuldipNo ratings yet

- Instructions For Form 8949: Future DevelopmentsDocument12 pagesInstructions For Form 8949: Future DevelopmentsJacen Bonds0% (1)

- 1099-Div 2021 3350349Document1 page1099-Div 2021 3350349Adam Clifton0% (1)

- Ldentification: Request For andDocument1 pageLdentification: Request For andclaraNo ratings yet

- F 1099 ADocument6 pagesF 1099 AWb Warnabrother Hatchet50% (2)

- Form 1040 Schedule BDocument1 pageForm 1040 Schedule BGwo GwppyNo ratings yet

- Interest and Ordinary DividendsDocument2 pagesInterest and Ordinary DividendsDunkMe100% (1)

- US Internal Revenue Service: F1040as1 - 2003Document2 pagesUS Internal Revenue Service: F1040as1 - 2003IRSNo ratings yet

- FF.,T (LT: Ldentification CertificationDocument1 pageFF.,T (LT: Ldentification CertificationÉzsaiás JiménezNo ratings yet

- I 1099 IntDocument8 pagesI 1099 IntAnthony MNo ratings yet

- Part III-Investment Interest Expense Deduction: Form 4952 (2009)Document1 pagePart III-Investment Interest Expense Deduction: Form 4952 (2009)Afzal ImamNo ratings yet

- US Internal Revenue Service: I1099intDocument5 pagesUS Internal Revenue Service: I1099intIRSNo ratings yet

- Form 1040A or 1040Document2 pagesForm 1040A or 1040Vita Volunteers WebmasterNo ratings yet

- I1099msc PDFDocument13 pagesI1099msc PDFAdam SNo ratings yet

- I1099msc PDFDocument13 pagesI1099msc PDFAdam SNo ratings yet

- Partner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceDocument10 pagesPartner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceIRSNo ratings yet

- 8 IRS Form W9Document6 pages8 IRS Form W9jherringarciaNo ratings yet

- US Internal Revenue Service: I1099int - 2002Document5 pagesUS Internal Revenue Service: I1099int - 2002IRSNo ratings yet

- Img 0001 PDFDocument9 pagesImg 0001 PDFAnonymous mzkNojivNo ratings yet

- US Internal Revenue Service: I1065bsk - 2001Document10 pagesUS Internal Revenue Service: I1065bsk - 2001IRSNo ratings yet

- TimeClock Plus LLC LOCKBOX W-9 2023 (6) 1Document1 pageTimeClock Plus LLC LOCKBOX W-9 2023 (6) 1rofira9450No ratings yet

- Form - 1040 - Schedule BDocument2 pagesForm - 1040 - Schedule BEl-Sayed FarhanNo ratings yet

- Instructions For Forms 1099-INT and 1099-OID: (Rev. January 2022)Document8 pagesInstructions For Forms 1099-INT and 1099-OID: (Rev. January 2022)AbhishekNo ratings yet

- W - 9 Request For Taxpayer Identification Number and CertificationDocument1 pageW - 9 Request For Taxpayer Identification Number and Certificationxgnw8bc6tdNo ratings yet

- W9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFDocument1 pageW9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFAnonymous 6ZE5pGNo ratings yet

- Interest and Ordinary DividendsDocument1 pageInterest and Ordinary DividendsBetty Ann LegerNo ratings yet

- US Internal Revenue Service: I1099div - 2002Document2 pagesUS Internal Revenue Service: I1099div - 2002IRSNo ratings yet

- 8938 InstructionsDocument13 pages8938 Instructionssrinivas NNo ratings yet

- US Internal Revenue Service: I1065bsk - 2002Document10 pagesUS Internal Revenue Service: I1065bsk - 2002IRSNo ratings yet

- Partner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceDocument10 pagesPartner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceIRSNo ratings yet

- US Internal Revenue Service: I1099div 07Document3 pagesUS Internal Revenue Service: I1099div 07IRSNo ratings yet

- US Internal Revenue Service: I1099r 06Document15 pagesUS Internal Revenue Service: I1099r 06IRSNo ratings yet

- US Internal Revenue Service: I1065bsk - 2005Document10 pagesUS Internal Revenue Service: I1065bsk - 2005IRSNo ratings yet

- US Internal Revenue Service: I5500sp - 2003Document1 pageUS Internal Revenue Service: I5500sp - 2003IRSNo ratings yet

- US Internal Revenue Service: I1065sk1 - 2002Document11 pagesUS Internal Revenue Service: I1065sk1 - 2002IRSNo ratings yet

- US Internal Revenue Service: I1065bskDocument11 pagesUS Internal Revenue Service: I1065bskIRSNo ratings yet

- US Internal Revenue Service: I1040sf - 2004Document6 pagesUS Internal Revenue Service: I1040sf - 2004IRSNo ratings yet

- US Internal Revenue Service: I1099int 07Document5 pagesUS Internal Revenue Service: I1099int 07IRSNo ratings yet

- F 1040 SBDocument2 pagesF 1040 SBapi-252942620No ratings yet

- f1099msc 2019Document8 pagesf1099msc 2019pyatetsky100% (1)

- 2020 1099-INT WellsFargoDocument2 pages2020 1099-INT WellsFargosayma kandaf0% (1)

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099kmufti7No ratings yet

- US Internal Revenue Service: I1099msc - 2003Document7 pagesUS Internal Revenue Service: I1099msc - 2003IRSNo ratings yet

- Instructions For Form 1099-MISC: Future Developments Specific InstructionsDocument11 pagesInstructions For Form 1099-MISC: Future Developments Specific InstructionsVenkatapavan SinagamNo ratings yet

- Partner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceDocument10 pagesPartner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceIRSNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsDocument6 pagesAttention:: Not File Copy A Downloaded From This Website. The Official Printed Version of This IRS Form IsBenne James50% (2)

- US Internal Revenue Service: I1065sk1Document13 pagesUS Internal Revenue Service: I1065sk1IRS100% (1)

- Partner's Instructions For Schedule K-1 (Form 1065)Document15 pagesPartner's Instructions For Schedule K-1 (Form 1065)Mario LaflammeNo ratings yet

- US Internal Revenue Service: I1040sd - 1999Document7 pagesUS Internal Revenue Service: I1040sd - 1999IRSNo ratings yet

- Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesFrom EverandWealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment PropertiesNo ratings yet

- National Taxpayer Advocate Annual Report To Congress 2018 Volume 1Document664 pagesNational Taxpayer Advocate Annual Report To Congress 2018 Volume 1Brian BergquistNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- Ray and Maria Gomez Have Been Married For 3 Years PDFDocument1 pageRay and Maria Gomez Have Been Married For 3 Years PDFTaimour HassanNo ratings yet

- 2018 Federal Desk CardDocument2 pages2018 Federal Desk Cardblancarosa03No ratings yet

- Alarming U.S. Tax Rules ArticleDocument9 pagesAlarming U.S. Tax Rules Articlee1chin0No ratings yet

- MGPTaxReturn 2019Document49 pagesMGPTaxReturn 2019KGW NewsNo ratings yet

- Mortgage Tax StatementDocument1 pageMortgage Tax StatementAriz10No ratings yet

- I 1040 ScaDocument15 pagesI 1040 Scaapi-173610472No ratings yet

- Shrout Superseding IndictmentDocument12 pagesShrout Superseding IndictmentColin Miner100% (1)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354No ratings yet

- 1 What Is A Revocation of ElectionDocument7 pages1 What Is A Revocation of ElectionmykandooNo ratings yet

- Au Pair Handbook InterexchangeDocument38 pagesAu Pair Handbook InterexchangeAngie Yineth Laguna Barragan100% (1)

- NullDocument7 pagesNullsarahmahay5609No ratings yet

- Fee ScheduleDocument39 pagesFee Scheduleapi-1271864110% (1)

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- Old Master FileDocument15 pagesOld Master FileTanbir. Nahid.No ratings yet

- Instructions For Form 1040-NRDocument48 pagesInstructions For Form 1040-NRAlan Mateo Escobar AgudeloNo ratings yet

- Publication 523, Selling Your Home (2021)Document22 pagesPublication 523, Selling Your Home (2021)Dianna VenezianoNo ratings yet

- Individual Tax Returns - IRS 2009Document200 pagesIndividual Tax Returns - IRS 2009Steve EldridgeNo ratings yet

- 2022 Turbo Tax ReturnDocument14 pages2022 Turbo Tax ReturndsutetyrNo ratings yet

- Marshall IndictmentDocument10 pagesMarshall IndictmentMegan Strickland SacryNo ratings yet

- United States v. Damian Jackson, Et Al, Complaint 2012Document25 pagesUnited States v. Damian Jackson, Et Al, Complaint 2012Beverly TranNo ratings yet

- Federal Judge States in Court That He Gets His Orders From EnglandDocument11 pagesFederal Judge States in Court That He Gets His Orders From EnglandRob DoelenNo ratings yet

- IRS Publication 4012 Volunteer Resource GuideDocument164 pagesIRS Publication 4012 Volunteer Resource GuideCenter for Economic ProgressNo ratings yet

- Are You A Slave?Document9 pagesAre You A Slave?E1iasNo ratings yet