Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsC13 - Cir-Vs.-Estate-Of-Benigno-P.-Toda-Jr.-Et.-Al

C13 - Cir-Vs.-Estate-Of-Benigno-P.-Toda-Jr.-Et.-Al

Uploaded by

Mae Ellen AvenCopyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You might also like

- Tax 0103-ExercisesDocument3 pagesTax 0103-ExercisesAlmaine PagayaoNo ratings yet

- 5 Case Digest Cir Vs Estate of TodaDocument2 pages5 Case Digest Cir Vs Estate of TodaChrissy Sabella0% (1)

- Cir v. Estate of Benigno Toda, JRDocument2 pagesCir v. Estate of Benigno Toda, JRJf Maneja100% (3)

- Doctrine:: Commissioner of Internal Revenue vs. The Estate of Benigno TodaDocument2 pagesDoctrine:: Commissioner of Internal Revenue vs. The Estate of Benigno TodaElla CanuelNo ratings yet

- Cases To Be Digest TAX 2 ATTY LIM No. 1 - 17 OnlyDocument131 pagesCases To Be Digest TAX 2 ATTY LIM No. 1 - 17 OnlyAngelo FulgencioNo ratings yet

- CIR v. Estate of Benigno Toda, JRDocument21 pagesCIR v. Estate of Benigno Toda, JRYale Brendan CatabayNo ratings yet

- CIR Vs Benigno TodaDocument10 pagesCIR Vs Benigno TodaAlvin CabreraNo ratings yet

- Part G 2F - CIR vs. Estate of Benigno Toda JRDocument2 pagesPart G 2F - CIR vs. Estate of Benigno Toda JRCyruz TuppalNo ratings yet

- CIR v. Estate of Toda, JR., G.R. No. 147188, September 14, 2004Document2 pagesCIR v. Estate of Toda, JR., G.R. No. 147188, September 14, 2004John Cyrus DangananNo ratings yet

- CIR Vs The Estate of TodaDocument3 pagesCIR Vs The Estate of TodaLDNo ratings yet

- 128 - TaxDocument2 pages128 - TaxBrent Christian Taeza TorresNo ratings yet

- CIR V Estate of Benigno Toda JRDocument9 pagesCIR V Estate of Benigno Toda JRParis LisonNo ratings yet

- CIR v. Estate of TodaDocument2 pagesCIR v. Estate of TodaJayzell Mae FloresNo ratings yet

- G.R. No. 147188 September 14, 2004 Commissioner of Internal Revenue Vs - The Estate of Benigno P. Toda, JR.Document2 pagesG.R. No. 147188 September 14, 2004 Commissioner of Internal Revenue Vs - The Estate of Benigno P. Toda, JR.micheleNo ratings yet

- Cir Vs Estate of TodaDocument3 pagesCir Vs Estate of TodaPia SottoNo ratings yet

- Recit Digest 1Document9 pagesRecit Digest 1Vincent NifasNo ratings yet

- 5-Commissioner of Internal Revenue vs. The Estate of Benigno P. Toda, Jr.Document15 pages5-Commissioner of Internal Revenue vs. The Estate of Benigno P. Toda, Jr.floravielcasternoboplazoNo ratings yet

- CIR v. TodaDocument8 pagesCIR v. TodaLovely ZyrenjcNo ratings yet

- CIR vs. THE ESTATE OF BENIGNO P. TODA, JR.Document9 pagesCIR vs. THE ESTATE OF BENIGNO P. TODA, JR.Rhett Vincent De La rosaNo ratings yet

- CIR v. Estate of Benigno Toda, 438 SCRA 290, 2004Document8 pagesCIR v. Estate of Benigno Toda, 438 SCRA 290, 2004JMae MagatNo ratings yet

- CIR vs. Estate of Benigno Toda, JR., SCRA 438 SCRA 291 (2004)Document3 pagesCIR vs. Estate of Benigno Toda, JR., SCRA 438 SCRA 291 (2004)I took her to my penthouse and i freaked itNo ratings yet

- Tax Cases Nos 1-5Document68 pagesTax Cases Nos 1-5Dimple VillaminNo ratings yet

- CIR Vs ESTATE OF BENIGNO TODADocument11 pagesCIR Vs ESTATE OF BENIGNO TODAMae Ellen AvenNo ratings yet

- Tax Evasion-Cir v. TodaDocument4 pagesTax Evasion-Cir v. TodaPax YabutNo ratings yet

- CIR v. The Estate of Benigno P. TodaDocument2 pagesCIR v. The Estate of Benigno P. TodaKyle DionisioNo ratings yet

- Cir VS Estate of TodaDocument3 pagesCir VS Estate of TodaGraziella AndayaNo ratings yet

- Commissioner of Internal Revenue v. Toda, Jr.Document1 pageCommissioner of Internal Revenue v. Toda, Jr.Mica ArceNo ratings yet

- Republic of The Philippines Manila: CIR v. Estate of Toda G.R. No. 147188Document8 pagesRepublic of The Philippines Manila: CIR v. Estate of Toda G.R. No. 147188Jopan SJNo ratings yet

- Week 4 DigestDocument37 pagesWeek 4 DigestJuls EspyNo ratings yet

- CIR v. Estate of Benigno Toda JR DIGESTDocument2 pagesCIR v. Estate of Benigno Toda JR DIGESTPia SottoNo ratings yet

- CIR, vs. THE ESTATE OF BENIGNO P. TODA, JR., G.R. No. 147188. September 14, 2004 FactsDocument1 pageCIR, vs. THE ESTATE OF BENIGNO P. TODA, JR., G.R. No. 147188. September 14, 2004 Factsian ballartaNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. The Estate of Benigno P. Toda, JR., Represented byDocument8 pagesCommissioner of Internal Revenue, Petitioner, vs. The Estate of Benigno P. Toda, JR., Represented byChrystelle Gail LiNo ratings yet

- Tax Digest CompilationDocument37 pagesTax Digest CompilationVerine SagunNo ratings yet

- CIR V Benigno TodaDocument2 pagesCIR V Benigno TodaAl PaglinawanNo ratings yet

- G.R. No. 147188: Tax Digest: CIR V. Estate of Benigno Toda Jr. (2004)Document2 pagesG.R. No. 147188: Tax Digest: CIR V. Estate of Benigno Toda Jr. (2004)BrenPeñarandaNo ratings yet

- CIR vs. TodaDocument8 pagesCIR vs. Todayasser lucmanNo ratings yet

- 06 CIR vs. Estate of TodDocument9 pages06 CIR vs. Estate of Todada mae santoniaNo ratings yet

- Commissioner of Internal Revenue vs. Estate of Benigno Toda (G.R. No. 147188, September 14, 2004)Document2 pagesCommissioner of Internal Revenue vs. Estate of Benigno Toda (G.R. No. 147188, September 14, 2004)Kent UgaldeNo ratings yet

- Tax Avoidance and Tax EvasionDocument2 pagesTax Avoidance and Tax EvasionLex DgtNo ratings yet

- CIR v. Estate of Benigno Toda - G.R. No. 147188Document9 pagesCIR v. Estate of Benigno Toda - G.R. No. 147188Ash SatoshiNo ratings yet

- Cir Vs Estate of Benigno TodaDocument2 pagesCir Vs Estate of Benigno TodaHarvey Leo RomanoNo ratings yet

- Taxma Iii D-HDocument29 pagesTaxma Iii D-HEarl TagraNo ratings yet

- Estate of Benigno Toda JRDocument2 pagesEstate of Benigno Toda JRMary AnneNo ratings yet

- CIR v. Benigno TodaDocument1 pageCIR v. Benigno TodaChou TakahiroNo ratings yet

- 17 - 120705-2004-Commissioner - of - Internal - Revenue - v. - Estate - Of20210505-12-1blkqymDocument11 pages17 - 120705-2004-Commissioner - of - Internal - Revenue - v. - Estate - Of20210505-12-1blkqymliliana corpuz floresNo ratings yet

- 28 CIR Vs TodaDocument17 pages28 CIR Vs TodaYaz CarlomanNo ratings yet

- Silkair Singapore V. CirDocument6 pagesSilkair Singapore V. CirConie NovelaNo ratings yet

- Tax1 Assigned CasesDocument5 pagesTax1 Assigned CasesflorencemanulatNo ratings yet

- 27th CaseDocument10 pages27th CaseBal Nikko Joville - RocamoraNo ratings yet

- CIR Vs Estate of TodaDocument1 pageCIR Vs Estate of Todaerica pejiNo ratings yet

- Purple Wings Tax DigestsDocument36 pagesPurple Wings Tax DigestsJf LarongNo ratings yet

- Taxation CasesDocument94 pagesTaxation CasesMichael jay sarmientoNo ratings yet

- Tax Doctrines (Pre Week 2019) P.2Document6 pagesTax Doctrines (Pre Week 2019) P.2Reina FabregasNo ratings yet

- Tax Doctrines (Pre Week 2019) P.1Document5 pagesTax Doctrines (Pre Week 2019) P.1Reina FabregasNo ratings yet

- Digested Cases in Taxation I, Part 1Document35 pagesDigested Cases in Taxation I, Part 1lonitsuaf89% (9)

- CIR vs. Estate of Benigno P. Toda, JRDocument13 pagesCIR vs. Estate of Benigno P. Toda, JRMrln VloriaNo ratings yet

- CIR Vs TodaDocument9 pagesCIR Vs TodaPrincess Kimberly Ubay-ubayNo ratings yet

- Landmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosDocument12 pagesLandmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosJudeRamosNo ratings yet

- Taxation DigestsDocument87 pagesTaxation DigestsMeng Goblas67% (3)

- ABAD Vs PHILCOMSAT - Fluor Daniel Phil vs. CIRDocument13 pagesABAD Vs PHILCOMSAT - Fluor Daniel Phil vs. CIRMae Ellen AvenNo ratings yet

- L8 - CIR-V-Maritime-Shipping-238-SCRA-42Document2 pagesL8 - CIR-V-Maritime-Shipping-238-SCRA-42Mae Ellen AvenNo ratings yet

- ABAD Vs PHILCOMSATDocument9 pagesABAD Vs PHILCOMSATMae Ellen AvenNo ratings yet

- DigestDocument2 pagesDigestMae Ellen AvenNo ratings yet

- Asia International AuctioneersDocument2 pagesAsia International AuctioneersMae Ellen AvenNo ratings yet

- Nursery Care Corporation VS AcevedoDocument2 pagesNursery Care Corporation VS AcevedoMae Ellen AvenNo ratings yet

- Planters-Product-Inc. VS Fertiphil Phil.Document6 pagesPlanters-Product-Inc. VS Fertiphil Phil.Mae Ellen AvenNo ratings yet

- TAX PlanningDocument56 pagesTAX PlanningSangram PandaNo ratings yet

- Analysis of Changes Introduced in The Lok Sabha-Approved Finance Bill 2023Document20 pagesAnalysis of Changes Introduced in The Lok Sabha-Approved Finance Bill 2023BuntyNo ratings yet

- 2009 Taxation Law ReviewerDocument203 pages2009 Taxation Law ReviewerDoctorGreyNo ratings yet

- Mock 4 KitDocument8 pagesMock 4 KitSabinaNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- NISM-Series V-A MFD CPE Material-Nov-2019Document202 pagesNISM-Series V-A MFD CPE Material-Nov-2019sushilalewa1No ratings yet

- Correction in Income Tax Volume 1Document12 pagesCorrection in Income Tax Volume 1CrcNo ratings yet

- CA Final Direct Tax Quick Revision of Assessment of Various 9DB7WBXYDocument16 pagesCA Final Direct Tax Quick Revision of Assessment of Various 9DB7WBXYRocka FellaNo ratings yet

- CPAR Income Tax of Corporations (Batch 93) - HandoutDocument41 pagesCPAR Income Tax of Corporations (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- 4TH Year SyllabusDocument54 pages4TH Year SyllabusABHYA SONINo ratings yet

- Taxation Law 1Document21 pagesTaxation Law 1Bill DanaoNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- 2008 Spring Audit State Developments 2Document285 pages2008 Spring Audit State Developments 2rashidsfNo ratings yet

- Chapter 3,4,5,6 (Income Tax)Document14 pagesChapter 3,4,5,6 (Income Tax)Txos Vaj50% (4)

- Residential Status & Scope of Total Income: Dr. Sarvagya ShuklaDocument72 pagesResidential Status & Scope of Total Income: Dr. Sarvagya ShuklaPrasad NaikNo ratings yet

- MCIT, IAET Handouts Oct 2019Document13 pagesMCIT, IAET Handouts Oct 2019Elsie GenovaNo ratings yet

- Tax4862 2023 TL 104 0 B PDFDocument126 pagesTax4862 2023 TL 104 0 B PDFLubabalo MapipaNo ratings yet

- Income TaxDocument254 pagesIncome TaxBabita DeviNo ratings yet

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaNo ratings yet

- Form 15CB - Filed FormDocument4 pagesForm 15CB - Filed FormBhagya RajoriaNo ratings yet

- Ethics ReviewerDocument22 pagesEthics ReviewerAbor ShawnNo ratings yet

- Incomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt ReviewDocument5 pagesIncomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt Reviewaarishak786No ratings yet

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocument25 pages7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiNo ratings yet

- Notes On Taxation LawDocument93 pagesNotes On Taxation Lawram patilNo ratings yet

- KPMG Bangladesh Investment Guide General 1601523967-Unlocked PDFDocument42 pagesKPMG Bangladesh Investment Guide General 1601523967-Unlocked PDFMuhammad Tahan AbdullahNo ratings yet

- LLB Business Law 2 LG6Document35 pagesLLB Business Law 2 LG6samaratian12No ratings yet

- Practical Financial Management 7th Edition Lasher Solution ManualDocument27 pagesPractical Financial Management 7th Edition Lasher Solution Manualharold100% (27)

- RA No 10752 The Right of Way ActDocument6 pagesRA No 10752 The Right of Way ActCarlemae SanquinaNo ratings yet

- Ho 4 - Pre-Week (Taxation Law)Document22 pagesHo 4 - Pre-Week (Taxation Law)J Velasco PeraltaNo ratings yet

C13 - Cir-Vs.-Estate-Of-Benigno-P.-Toda-Jr.-Et.-Al

C13 - Cir-Vs.-Estate-Of-Benigno-P.-Toda-Jr.-Et.-Al

Uploaded by

Mae Ellen Aven0 ratings0% found this document useful (0 votes)

2 views3 pagesOriginal Title

C13 - CIR-VS.-ESTATE-OF-BENIGNO-P.-TODA-JR.-ET.-AL (1)

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views3 pagesC13 - Cir-Vs.-Estate-Of-Benigno-P.-Toda-Jr.-Et.-Al

C13 - Cir-Vs.-Estate-Of-Benigno-P.-Toda-Jr.-Et.-Al

Uploaded by

Mae Ellen AvenCopyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

You are on page 1of 3

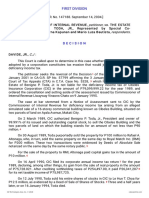

CIR VS. ESTATE OF BENIGNO P. TODA, et.al.

GR. No. 147188, Sept. 14,2004

TOPIC: TAX EVASION

Issues: Is this a case of tax evasion or tax avoidance?

Facts:

The court is called upon to determine in this case whether the tax planning scheme adopted by a

corporation constitutes tax evasion that would justify an assessment of deficiency income tax.

Petitioner (CIR) seeks the reversal of the Decision of the Court of Appeals of January 31 2001

affirming the January 3 2000 Decision of the Court of Tax Appeals which held that the respondent

Estate of Benigno P. Toda, Jr. is not liable for the deficiency income tax of Cibeles Insurance

Corporation (CIC)... a Notice of Assessment sent to CIC by the Commissioner of Internal Revenue

for deficiency income tax arising from an alleged simulated sale of a 16-storey commercial building

known as Cibeles Building at Ayala Avenue,... Makati City.

Toda purportedly sold the property for P100 million to Rafael A. Altonaga, who, in turn, sold the

same property on the same day to Royal Match Inc. (RMI) for P200 million. These two transactions

were done in the same day evidenced by Deeds of Absolute Sale notarized... on the same day by the

same notary public.

(BIR) sent an assessment notice and demand letter to the CIC for deficiency income tax for the year

1989 in the amount of P79,099,999.22.

New CIC asked for a reconsideration, asserting that the assessment should be directed against the old

CIC, and not against the new CIC, which is owned by an entirely different set of stockholders. The

Estate of Benigno P. Toda, Jr., represented by special co-administrators Lorna Kapunan and Mario

Luza Bautista, received a Notice of Assessment dated January 9 1995 from the Commissioner of

Internal Revenue for deficiency income... tax for the year 1989.

Commissioner dismissed the protest, stating that a fraudulent scheme was deliberately perpetuated by

the CIC wholly owned and controlled by Toda by covering up the additional gain of P100 million...

the Estate filed a petition for review with the CTA alleging that the Commissioner erred in holding

the Estate liable for income tax deficiency; the CTA held that the Commissioner failed to prove that

CIC committed fraud to deprive the government of the taxes due it. It ruled that even assuming that

a pre-conceived scheme was adopted by CIC, the same... constituted mere tax avoidance, and not tax

evasion.

Declared that the Estate is not liable for deficiency income tax of P79,099,999.22 and, accordingly,

cancelled and set aside the assessment issued by the Commissioner. A motion for reconsideration

was filed.

The CTA denied the motion for... reconsideration, prompting the Commissioner to file a petition for

review with the Court of Appeals.

Court of Appeals affirmed the decision of the CTA, reasoning that the CTA, being more

advantageously situated and having the necessary expertise in matters of taxation, is "better situated

to determine the correctness, propriety, and legality of the income tax assessments assailed by the

Toda

Commissioner filed the present petition.

Ruling:

It is significant to note that as early as May 4 1989, prior to the purported sale of the Cibeles property

by CIC to Altonaga on August 30 1989, CIC received P40 million from RMI. This would show that

the real buyer of the properties was RMI, and not the intermediary Altonaga.

The scheme resorted to by CIC in making it appear that there were two sales of the subject

properties, i.e., from CIC to Altonaga, and then from Altonaga to RMI cannot be considered a

legitimate tax planning. Such scheme is tainted with fraud.

Here, it is obvious that the objective of the sale to Altonaga was to reduce the amount of tax to be

paid especially that the transfer from him to RMI would then subject the income to only 5%

individual capital gains tax, and not the 35% corporate income tax. Altonaga's... sole purpose of

acquiring and transferring title of the subject properties on the same day was to create a tax shelter.

Altonaga never controlled the property and did not enjoy the normal benefits and burdens of

ownership. The sale to him was merely a tax ploy, a... sham, and without business purpose and

economic substance. Doubtless, the execution of the two sales was calculated to mislead the BIR

with the end in view of reducing the consequent income tax liability.

In a nutshell, the intermediary transaction, i.e., the sale to Altonaga, which was prompted more on

the mitigation of tax liabilities than for legitimate business purposes constitutes one of tax evasion.

To allow a taxpayer to deny tax liability on the ground that the sale was made through another and

distinct entity when it is proved that the latter was merely a conduit is to sanction a circumvention of

our tax laws. Hence, the sale to Altonaga should be disregarded for income... tax purposes. The two

sale transactions should be treated as a single direct sale by CIC to RMI.

CIC is therefore liable to pay a 35% corporate tax for its taxable net income in 1989. The 5%

individual capital gains tax provided for in Section 34 (h) of the NIRC of 1986 (now 6% under

Section 24 (D) (1) of the Tax Reform Act of 1997) is... inapplicable. Hence, the assessment for the

deficiency income tax issued by the BIR must be upheld.

in cases of (1) fraudulent returns; (2) false returns with intent to evade tax; and (3) failure to file a

return, the period within which to assess tax is ten years from discovery of the fraud, falsification or

omission, as the case may be.

we find that the income tax return filed by CIC for the year 1989 was false. It did not reflect the true

or actual amount gained from the sale of the Cibeles... property. Obviously, such was done with

intent to evade or reduce tax liability.

Has the period of... assessment prescribed?

No.

The prescriptive period to assess the correct taxes in case of false returns is ten years from the

discovery of the falsity. The false return was filed on April 15 1990, and the falsity thereof was

claimed to have been discovered only on March 8, 1991. The assessment for the 1989 deficiency

income tax of CIC was issued on January 9, 1995. Clearly, the issuance of the correct assessment for

deficiency income tax was well within the prescriptive period.

A corporation has a juridical personality distinct and separate from the persons owning or composing

it. Thus, the owners or stockholders of a corporation may not generally be made to answer for the

liabilities of a corporation and vice versa. There are, however, certain instances in which personal

liability may arise.

It is worth noting that when the late Toda sold his shares of stock to Le Hun T. Choa, he knowingly

and voluntarily held himself personally liable for all the tax liabilities of CIC and the buyer for the

years 1987, 1988, and 1989. Paragraph g of the Deed of Sale of Shares... of Stocks specifically

provides:

Cibeles has no liabilities or obligations, contingent or otherwise, for taxes, sums of money or

insurance claims other than those reported in its audited financial statement as of December 31, 1989

When the late Toda undertook and agreed "to hold the BUYER and Cibeles free from any all income

tax liabilities of Cibeles for the fiscal years 1987, 1988, and 1989," he thereby voluntarily held

himself personally liable therefor. Respondent estate cannot, therefore, deny... liability for CIC's

deficiency income tax for the year 1989 by invoking the separate corporate personality of CIC, since

its obligation arose from Toda's contractual undertaking, as contained in the Deed of Sale of Shares

of Stock.

the petition is hereby GRANTED. The decision of the Court of Appeals of January 31, 2001 in CA-

G.R. SP No. 57799 is REVERSED and SET ASIDE, ordering respondent Estate of Benigno P. Toda

Jr. to pay P79,099,999.22 as deficiency income tax of Cibeles Insurance Corporation for the year

1989,

Principles:

Tax avoidance is the tax saving device within the means sanctioned by law. This method should be

used by the taxpayer in good faith. Tax evasion, on the other hand, is a scheme used outside of those

lawful means and when availed of, it usually subjects the taxpayer to further or additional civil or

criminal liabilities.

Tax evasion connotes the integration of three factors with the intent to defraud the government: (1)

the end to be achieved, i.e., the payment of less than that known by the taxpayer to be legally due, or

the non-payment of tax when it is shown that a tax is due; (2) an accompanying state of mind which

is... described as being "evil," in "bad faith," "willfull,"or "deliberate and not accidental"; and (3) a

course of action or failure of action which is unlawful.

You might also like

- Tax 0103-ExercisesDocument3 pagesTax 0103-ExercisesAlmaine PagayaoNo ratings yet

- 5 Case Digest Cir Vs Estate of TodaDocument2 pages5 Case Digest Cir Vs Estate of TodaChrissy Sabella0% (1)

- Cir v. Estate of Benigno Toda, JRDocument2 pagesCir v. Estate of Benigno Toda, JRJf Maneja100% (3)

- Doctrine:: Commissioner of Internal Revenue vs. The Estate of Benigno TodaDocument2 pagesDoctrine:: Commissioner of Internal Revenue vs. The Estate of Benigno TodaElla CanuelNo ratings yet

- Cases To Be Digest TAX 2 ATTY LIM No. 1 - 17 OnlyDocument131 pagesCases To Be Digest TAX 2 ATTY LIM No. 1 - 17 OnlyAngelo FulgencioNo ratings yet

- CIR v. Estate of Benigno Toda, JRDocument21 pagesCIR v. Estate of Benigno Toda, JRYale Brendan CatabayNo ratings yet

- CIR Vs Benigno TodaDocument10 pagesCIR Vs Benigno TodaAlvin CabreraNo ratings yet

- Part G 2F - CIR vs. Estate of Benigno Toda JRDocument2 pagesPart G 2F - CIR vs. Estate of Benigno Toda JRCyruz TuppalNo ratings yet

- CIR v. Estate of Toda, JR., G.R. No. 147188, September 14, 2004Document2 pagesCIR v. Estate of Toda, JR., G.R. No. 147188, September 14, 2004John Cyrus DangananNo ratings yet

- CIR Vs The Estate of TodaDocument3 pagesCIR Vs The Estate of TodaLDNo ratings yet

- 128 - TaxDocument2 pages128 - TaxBrent Christian Taeza TorresNo ratings yet

- CIR V Estate of Benigno Toda JRDocument9 pagesCIR V Estate of Benigno Toda JRParis LisonNo ratings yet

- CIR v. Estate of TodaDocument2 pagesCIR v. Estate of TodaJayzell Mae FloresNo ratings yet

- G.R. No. 147188 September 14, 2004 Commissioner of Internal Revenue Vs - The Estate of Benigno P. Toda, JR.Document2 pagesG.R. No. 147188 September 14, 2004 Commissioner of Internal Revenue Vs - The Estate of Benigno P. Toda, JR.micheleNo ratings yet

- Cir Vs Estate of TodaDocument3 pagesCir Vs Estate of TodaPia SottoNo ratings yet

- Recit Digest 1Document9 pagesRecit Digest 1Vincent NifasNo ratings yet

- 5-Commissioner of Internal Revenue vs. The Estate of Benigno P. Toda, Jr.Document15 pages5-Commissioner of Internal Revenue vs. The Estate of Benigno P. Toda, Jr.floravielcasternoboplazoNo ratings yet

- CIR v. TodaDocument8 pagesCIR v. TodaLovely ZyrenjcNo ratings yet

- CIR vs. THE ESTATE OF BENIGNO P. TODA, JR.Document9 pagesCIR vs. THE ESTATE OF BENIGNO P. TODA, JR.Rhett Vincent De La rosaNo ratings yet

- CIR v. Estate of Benigno Toda, 438 SCRA 290, 2004Document8 pagesCIR v. Estate of Benigno Toda, 438 SCRA 290, 2004JMae MagatNo ratings yet

- CIR vs. Estate of Benigno Toda, JR., SCRA 438 SCRA 291 (2004)Document3 pagesCIR vs. Estate of Benigno Toda, JR., SCRA 438 SCRA 291 (2004)I took her to my penthouse and i freaked itNo ratings yet

- Tax Cases Nos 1-5Document68 pagesTax Cases Nos 1-5Dimple VillaminNo ratings yet

- CIR Vs ESTATE OF BENIGNO TODADocument11 pagesCIR Vs ESTATE OF BENIGNO TODAMae Ellen AvenNo ratings yet

- Tax Evasion-Cir v. TodaDocument4 pagesTax Evasion-Cir v. TodaPax YabutNo ratings yet

- CIR v. The Estate of Benigno P. TodaDocument2 pagesCIR v. The Estate of Benigno P. TodaKyle DionisioNo ratings yet

- Cir VS Estate of TodaDocument3 pagesCir VS Estate of TodaGraziella AndayaNo ratings yet

- Commissioner of Internal Revenue v. Toda, Jr.Document1 pageCommissioner of Internal Revenue v. Toda, Jr.Mica ArceNo ratings yet

- Republic of The Philippines Manila: CIR v. Estate of Toda G.R. No. 147188Document8 pagesRepublic of The Philippines Manila: CIR v. Estate of Toda G.R. No. 147188Jopan SJNo ratings yet

- Week 4 DigestDocument37 pagesWeek 4 DigestJuls EspyNo ratings yet

- CIR v. Estate of Benigno Toda JR DIGESTDocument2 pagesCIR v. Estate of Benigno Toda JR DIGESTPia SottoNo ratings yet

- CIR, vs. THE ESTATE OF BENIGNO P. TODA, JR., G.R. No. 147188. September 14, 2004 FactsDocument1 pageCIR, vs. THE ESTATE OF BENIGNO P. TODA, JR., G.R. No. 147188. September 14, 2004 Factsian ballartaNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. The Estate of Benigno P. Toda, JR., Represented byDocument8 pagesCommissioner of Internal Revenue, Petitioner, vs. The Estate of Benigno P. Toda, JR., Represented byChrystelle Gail LiNo ratings yet

- Tax Digest CompilationDocument37 pagesTax Digest CompilationVerine SagunNo ratings yet

- CIR V Benigno TodaDocument2 pagesCIR V Benigno TodaAl PaglinawanNo ratings yet

- G.R. No. 147188: Tax Digest: CIR V. Estate of Benigno Toda Jr. (2004)Document2 pagesG.R. No. 147188: Tax Digest: CIR V. Estate of Benigno Toda Jr. (2004)BrenPeñarandaNo ratings yet

- CIR vs. TodaDocument8 pagesCIR vs. Todayasser lucmanNo ratings yet

- 06 CIR vs. Estate of TodDocument9 pages06 CIR vs. Estate of Todada mae santoniaNo ratings yet

- Commissioner of Internal Revenue vs. Estate of Benigno Toda (G.R. No. 147188, September 14, 2004)Document2 pagesCommissioner of Internal Revenue vs. Estate of Benigno Toda (G.R. No. 147188, September 14, 2004)Kent UgaldeNo ratings yet

- Tax Avoidance and Tax EvasionDocument2 pagesTax Avoidance and Tax EvasionLex DgtNo ratings yet

- CIR v. Estate of Benigno Toda - G.R. No. 147188Document9 pagesCIR v. Estate of Benigno Toda - G.R. No. 147188Ash SatoshiNo ratings yet

- Cir Vs Estate of Benigno TodaDocument2 pagesCir Vs Estate of Benigno TodaHarvey Leo RomanoNo ratings yet

- Taxma Iii D-HDocument29 pagesTaxma Iii D-HEarl TagraNo ratings yet

- Estate of Benigno Toda JRDocument2 pagesEstate of Benigno Toda JRMary AnneNo ratings yet

- CIR v. Benigno TodaDocument1 pageCIR v. Benigno TodaChou TakahiroNo ratings yet

- 17 - 120705-2004-Commissioner - of - Internal - Revenue - v. - Estate - Of20210505-12-1blkqymDocument11 pages17 - 120705-2004-Commissioner - of - Internal - Revenue - v. - Estate - Of20210505-12-1blkqymliliana corpuz floresNo ratings yet

- 28 CIR Vs TodaDocument17 pages28 CIR Vs TodaYaz CarlomanNo ratings yet

- Silkair Singapore V. CirDocument6 pagesSilkair Singapore V. CirConie NovelaNo ratings yet

- Tax1 Assigned CasesDocument5 pagesTax1 Assigned CasesflorencemanulatNo ratings yet

- 27th CaseDocument10 pages27th CaseBal Nikko Joville - RocamoraNo ratings yet

- CIR Vs Estate of TodaDocument1 pageCIR Vs Estate of Todaerica pejiNo ratings yet

- Purple Wings Tax DigestsDocument36 pagesPurple Wings Tax DigestsJf LarongNo ratings yet

- Taxation CasesDocument94 pagesTaxation CasesMichael jay sarmientoNo ratings yet

- Tax Doctrines (Pre Week 2019) P.2Document6 pagesTax Doctrines (Pre Week 2019) P.2Reina FabregasNo ratings yet

- Tax Doctrines (Pre Week 2019) P.1Document5 pagesTax Doctrines (Pre Week 2019) P.1Reina FabregasNo ratings yet

- Digested Cases in Taxation I, Part 1Document35 pagesDigested Cases in Taxation I, Part 1lonitsuaf89% (9)

- CIR vs. Estate of Benigno P. Toda, JRDocument13 pagesCIR vs. Estate of Benigno P. Toda, JRMrln VloriaNo ratings yet

- CIR Vs TodaDocument9 pagesCIR Vs TodaPrincess Kimberly Ubay-ubayNo ratings yet

- Landmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosDocument12 pagesLandmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosJudeRamosNo ratings yet

- Taxation DigestsDocument87 pagesTaxation DigestsMeng Goblas67% (3)

- ABAD Vs PHILCOMSAT - Fluor Daniel Phil vs. CIRDocument13 pagesABAD Vs PHILCOMSAT - Fluor Daniel Phil vs. CIRMae Ellen AvenNo ratings yet

- L8 - CIR-V-Maritime-Shipping-238-SCRA-42Document2 pagesL8 - CIR-V-Maritime-Shipping-238-SCRA-42Mae Ellen AvenNo ratings yet

- ABAD Vs PHILCOMSATDocument9 pagesABAD Vs PHILCOMSATMae Ellen AvenNo ratings yet

- DigestDocument2 pagesDigestMae Ellen AvenNo ratings yet

- Asia International AuctioneersDocument2 pagesAsia International AuctioneersMae Ellen AvenNo ratings yet

- Nursery Care Corporation VS AcevedoDocument2 pagesNursery Care Corporation VS AcevedoMae Ellen AvenNo ratings yet

- Planters-Product-Inc. VS Fertiphil Phil.Document6 pagesPlanters-Product-Inc. VS Fertiphil Phil.Mae Ellen AvenNo ratings yet

- TAX PlanningDocument56 pagesTAX PlanningSangram PandaNo ratings yet

- Analysis of Changes Introduced in The Lok Sabha-Approved Finance Bill 2023Document20 pagesAnalysis of Changes Introduced in The Lok Sabha-Approved Finance Bill 2023BuntyNo ratings yet

- 2009 Taxation Law ReviewerDocument203 pages2009 Taxation Law ReviewerDoctorGreyNo ratings yet

- Mock 4 KitDocument8 pagesMock 4 KitSabinaNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- NISM-Series V-A MFD CPE Material-Nov-2019Document202 pagesNISM-Series V-A MFD CPE Material-Nov-2019sushilalewa1No ratings yet

- Correction in Income Tax Volume 1Document12 pagesCorrection in Income Tax Volume 1CrcNo ratings yet

- CA Final Direct Tax Quick Revision of Assessment of Various 9DB7WBXYDocument16 pagesCA Final Direct Tax Quick Revision of Assessment of Various 9DB7WBXYRocka FellaNo ratings yet

- CPAR Income Tax of Corporations (Batch 93) - HandoutDocument41 pagesCPAR Income Tax of Corporations (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- 4TH Year SyllabusDocument54 pages4TH Year SyllabusABHYA SONINo ratings yet

- Taxation Law 1Document21 pagesTaxation Law 1Bill DanaoNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- 2008 Spring Audit State Developments 2Document285 pages2008 Spring Audit State Developments 2rashidsfNo ratings yet

- Chapter 3,4,5,6 (Income Tax)Document14 pagesChapter 3,4,5,6 (Income Tax)Txos Vaj50% (4)

- Residential Status & Scope of Total Income: Dr. Sarvagya ShuklaDocument72 pagesResidential Status & Scope of Total Income: Dr. Sarvagya ShuklaPrasad NaikNo ratings yet

- MCIT, IAET Handouts Oct 2019Document13 pagesMCIT, IAET Handouts Oct 2019Elsie GenovaNo ratings yet

- Tax4862 2023 TL 104 0 B PDFDocument126 pagesTax4862 2023 TL 104 0 B PDFLubabalo MapipaNo ratings yet

- Income TaxDocument254 pagesIncome TaxBabita DeviNo ratings yet

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaNo ratings yet

- Form 15CB - Filed FormDocument4 pagesForm 15CB - Filed FormBhagya RajoriaNo ratings yet

- Ethics ReviewerDocument22 pagesEthics ReviewerAbor ShawnNo ratings yet

- Incomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt ReviewDocument5 pagesIncomes Chargeable To Tax Under The Head "Profits and Gains of Business or Profession" (Section 28) - Attempt Reviewaarishak786No ratings yet

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkDocument25 pages7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiNo ratings yet

- Notes On Taxation LawDocument93 pagesNotes On Taxation Lawram patilNo ratings yet

- KPMG Bangladesh Investment Guide General 1601523967-Unlocked PDFDocument42 pagesKPMG Bangladesh Investment Guide General 1601523967-Unlocked PDFMuhammad Tahan AbdullahNo ratings yet

- LLB Business Law 2 LG6Document35 pagesLLB Business Law 2 LG6samaratian12No ratings yet

- Practical Financial Management 7th Edition Lasher Solution ManualDocument27 pagesPractical Financial Management 7th Edition Lasher Solution Manualharold100% (27)

- RA No 10752 The Right of Way ActDocument6 pagesRA No 10752 The Right of Way ActCarlemae SanquinaNo ratings yet

- Ho 4 - Pre-Week (Taxation Law)Document22 pagesHo 4 - Pre-Week (Taxation Law)J Velasco PeraltaNo ratings yet