Professional Documents

Culture Documents

Income Tax Calculation Form 2019-20

Income Tax Calculation Form 2019-20

Uploaded by

rajputrana51666Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculation Form 2019-20

Income Tax Calculation Form 2019-20

Uploaded by

rajputrana51666Copyright:

Available Formats

Central University of Haryana

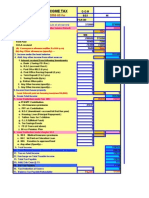

INCOME TAX CALCULATION FORM for Financial Year 2019-20

EMP NO: NAME: F. NAME

RESIDENTIAL ADDRESS:

OWN/RENTED/UNIV. ACCO. RENT: Rs. (YLY) PAN: SEX: Male/Female

DATE OF BIRTH: / / ASSESSMENT YEAR: 2020-21 E C R /PAGE: MOBILE NO.

STATUS: INDIVIDUAL EMAIL-ID @

A) i) Salary (as per Salary Statement including LTC, Remu. and arrears)

1. ii) Pension ………….

iii) House Rent Allowance ………….

………….

PERQUISITES:-

i) 10% of the cost of Articles as provided by the University. ………….

ii) Difference of 7.5% of the Salary and the rent charged where

Accommodation is provided by the University. ………….

iii) Other Perquisites ………….

Note: Copy of the Salary Statement should be attached as proof.

B) Deduct H.R.A. in case of rented house u/s 10 (13A) as per following

Formula:-

a) Actual House Rent received ….……….

b) Rent paid in excess of 1/10th of the Salary (B.P.+D.A.) ………….

c) 40% of the Salary. ……..……

Least of the above is exempted)

C) Gross Salary (A-B)

Note: If House Rent paid exceeds Rs 1.00 lac p.a., HRA deduction will be allowed only if copy

of PAN Card of landlord is attached.

Name of Landlord :

PAN No. of Landlord

(INCOME CHARGEABLE UNDER THE HEAD “SALARY”)

2. Annual Value/Higher of Actual Rent Received …………………

Less: Taxes actually paid to local authority ………………..

Annual Value of property ………………..

Less: Deductions claimed u/s 24

Interest paid on borrowed capital ………………. (-)

( Interest paid on borrowed capital is allowed upto Max. of Rs. 30,000.00 on

Loan before 1.4.1999 OR Rs. 2,00,000.00 after 1.4.1999 ) Photocopy of

completion/ occupied certificate from competent authority be attached.)

Deduction of Interest on Housing Loan will be allowed only if certified PAN of Bank/

Institution is attached.

Name of Bank/Institution :

PAN No. of Bank/Institution

INCOME CHARGEABLE UNDER THE HEAD “INCOME FROM HOUSE PROPERTY”

3. Income from other Sources:-

Remuneration Income other than CUH …………

i) Bank Interest from Saving A/c …………

ii) Other Interest on FDR etc. …………

iii) Other Income …………

(It is the personal responsibility of the concerned individual to include …………

all the income other then Salary in the current Financial Year)

INCOME CHARGEABLE UNDER THE HEAD “INCOME FROM OTHER SOURCES”

4.

Gross Total Income (1+2+3) C/F Amount

5. Deductions u/s Ch. VI-A

a) Savings u/s 80 C B/F Amount

i) P.F. : ………….

ii) A.P.F. : …………..

iii) L.I.C. : …………..

iv) P.P.F. : …………..

v) Repayment of HBL : …………..

vi) New Purchase of NSC’s : ………….

vii) Accrued Interest on Old NSC’s : ………….

viii) MEP/UTI : ………….

ix) Tuition Fee (For two children) : ………….

x) 80 CCC : ………….

xi) PLI

xii) FDR (5 Year) : ………….

xiii) Others : …………..

Total (i to xiii) limited to Rs. 1,50,000/- :

b) Saving u/s 80 CCG (50% of Investment in

RGESS , Max. up to Rs. 25,000/- and subject

to G.T.I.<Rs. 10 Lac) :

c) 80 D d) 80 DD e) 80 E

f) 80 U g) 80 GG h) 80TTA

i) 80CCD(1)B

Total of a to i :

6. Taxable Income (4-5)

7.

Calculation of Income Tax Normal For

Rate of Senior

Tax Citizen

Basic Exemption=====>>>>>>> Rs. 2,50,000 Rs. 3,00,000

S. Slab Rates Bifurcation % of Income Income

No of Income Tax Tax Tax

1. Up to Basic 0%

Exemption 2.5 lacs

2. Above Basic 5%

Exemption to Rs. 5

Lacs

3. Above Rs. 5 20 %

Lacs to Rs. 10

Lacs

4. Above Rs. 10 30 %

Lacs

Total

8. Income Tax Payable :

Less :- Rebate U/s 87A Rs. 2500/- or tax amount whichever is less

(if Taxable income less than Rs. 350000/-) :

Total Income Tax Payable :

Add:- 4 % (Education Cess + Higher Edu. Cess) :

9. Tax Deducted at source a) Already deducted

b) To be deducted

Place: Mahendergarh

Date:

Signature of Employee

You might also like

- Statement 2024 1Document1 pageStatement 2024 1xfzm99mr8rNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Practice Final PB PartialDocument25 pagesPractice Final PB PartialBenedict BoacNo ratings yet

- Income Tax Calculation Form 2019-20Document2 pagesIncome Tax Calculation Form 2019-20Ishwar MittalNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- INCOME TAX 2015-16. Annexure - IDocument5 pagesINCOME TAX 2015-16. Annexure - IPhani PitchikaNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Q.P. Voc-I Direct TaxDocument4 pagesQ.P. Voc-I Direct TaxNitin DhawleNo ratings yet

- TaxationDocument3 pagesTaxationIshika PansariNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Document10 pagesReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGNo ratings yet

- Income Tax Calculation Statement For The Year 2001-2002Document1 pageIncome Tax Calculation Statement For The Year 2001-2002elango128No ratings yet

- Paper7 Set1 SolutionDocument17 pagesPaper7 Set1 Solutionwhitedevil69696No ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- Tax Laws: NoteDocument8 pagesTax Laws: NotePadmambigai Chandra SekaranNo ratings yet

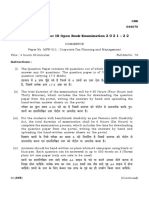

- MBA (RI) Semester III Open Book Examination 2 0 2 1 - 2 2: Total No. of Printed Pages: 4)Document4 pagesMBA (RI) Semester III Open Book Examination 2 0 2 1 - 2 2: Total No. of Printed Pages: 4)Rohit KumarNo ratings yet

- Form 20231218064720293198Document2 pagesForm 20231218064720293198siddharthbackupfilesNo ratings yet

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNo ratings yet

- Paper7 SolutionDocument16 pagesPaper7 SolutionJeyanthiNo ratings yet

- KL Taxtaion I May June 2012Document2 pagesKL Taxtaion I May June 2012asdfghjkl007No ratings yet

- Ibps - Cwe - Clerks - VDocument2 pagesIbps - Cwe - Clerks - VJeganNo ratings yet

- Tax 2 AnsDocument12 pagesTax 2 AnsCollege CollegeNo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Assignment - Com Tax Sys ChinaDocument10 pagesAssignment - Com Tax Sys ChinaTanvir SiddiqueNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- Bcoc 136Document2 pagesBcoc 136Suraj JaiswalNo ratings yet

- Tybms Sem5 DT Nov19Document5 pagesTybms Sem5 DT Nov19omsantoshbhosale01No ratings yet

- Income Tax Procedure and Practice II Year Tax Specilization 20 FinalDocument37 pagesIncome Tax Procedure and Practice II Year Tax Specilization 20 FinalDivya DubeyNo ratings yet

- (April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Form 16Document4 pagesForm 16harit sharmaNo ratings yet

- Paper7 Set2 AnsDocument21 pagesPaper7 Set2 Ansmonukroy1234No ratings yet

- Fringe Benefits AnswersDocument5 pagesFringe Benefits AnswersJonnah Grace SimpalNo ratings yet

- OSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05Document5 pagesOSMS/M-20 Taxation Laws IMS-601: Roll No. .......................... Total Pages: 05mehaik patwa , 20No ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Nov DecIII V Sem 2020Document8 pagesNov DecIII V Sem 2020dweeps75No ratings yet

- Sem - 4 - Jadavpur University Questions PaperDocument13 pagesSem - 4 - Jadavpur University Questions Papernishashams94No ratings yet

- Basics (DT) Revision P Ques Jan 23Document10 pagesBasics (DT) Revision P Ques Jan 23Grave diggerNo ratings yet

- Document From Rajan®Document5 pagesDocument From Rajan®Anit LuckyNo ratings yet

- DocumentsRequirementGuidelines FinalDocument13 pagesDocumentsRequirementGuidelines Finalsumit4up6rNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- BCom Income Tax Procedure and PracticeDocument61 pagesBCom Income Tax Procedure and PracticeUjjwal Kandhawe100% (1)

- 18u3cm06 CC06Document8 pages18u3cm06 CC06Manoj MJNo ratings yet

- Direct Tax Summary Notes For IPCC JKQK1AK0Document24 pagesDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaNo ratings yet

- PA - 17 UPA 308 Income TaxDocument28 pagesPA - 17 UPA 308 Income TaxKASHISH CHOUDHARYNo ratings yet

- Paper 7 CmaDocument16 pagesPaper 7 CmaRama KrishnaNo ratings yet

- Paper 7Document23 pagesPaper 7Nipun AroraNo ratings yet

- 15.deductions From Gross Total IncomeDocument5 pages15.deductions From Gross Total IncomeDEV BHARGAVANo ratings yet

- Summary of SalaryDocument6 pagesSummary of SalaryRahul GhosaleNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- TANJOT BankDocument1 pageTANJOT Banknaresh08smailboxNo ratings yet

- Islamic FinanceDocument5 pagesIslamic FinanceAbdul Wahid KhanNo ratings yet

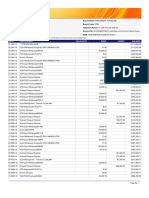

- Account Statement From 1 Sep 2023 To 31 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 1 Sep 2023 To 31 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceprnali.vflNo ratings yet

- 5010XXXXXX4611 Cd4da797 16apr2023 TO 15may2023 194143040Document4 pages5010XXXXXX4611 Cd4da797 16apr2023 TO 15may2023 194143040hemant61088No ratings yet

- State Bank M 6Document4 pagesState Bank M 6Pritam GoswamiNo ratings yet

- Philippine National BankDocument8 pagesPhilippine National BankrellysolryNo ratings yet

- Form 16 BDocument1 pageForm 16 BSurendra Kumar BaaniyaNo ratings yet

- Nego CasesDocument5 pagesNego CasesDESSA JOY PARAGASNo ratings yet

- Jehan Zeb Jamaldini:: Please Read Carefully Important Information/ Notification Printed at The End of StatementDocument4 pagesJehan Zeb Jamaldini:: Please Read Carefully Important Information/ Notification Printed at The End of StatementBijjar Baloch100% (1)

- RFM Notes-Commercial and SMEDocument8 pagesRFM Notes-Commercial and SMEmuneebmateen01No ratings yet

- MCA Discussion Paper On Amendments To The IBC2016Document22 pagesMCA Discussion Paper On Amendments To The IBC2016Zalak ModyNo ratings yet

- Amex EstatementDocument2 pagesAmex Estatementjohn vikNo ratings yet

- 10.3 PensionsDocument6 pages10.3 PensionsFausto SosaNo ratings yet

- DL3CCP5359 FASTag Statement 1709708968558Document2 pagesDL3CCP5359 FASTag Statement 1709708968558sunilsharmachef007No ratings yet

- TRRRDocument9 pagesTRRRskhushbusahniNo ratings yet

- Activity #4 Corporate LiquidationDocument3 pagesActivity #4 Corporate LiquidationddddddaaaaeeeeNo ratings yet

- Chase CreditDocument2 pagesChase CreditMichael DixonNo ratings yet

- Tebe BriDocument2 pagesTebe BriRisal SandiNo ratings yet

- VQR Question Bank - 1Document2 pagesVQR Question Bank - 1sairam97969No ratings yet

- Chap 1-2 Form 3Document11 pagesChap 1-2 Form 3changxinjie5No ratings yet

- MayaCredit SoA 2023JUL 4Document3 pagesMayaCredit SoA 2023JUL 4Bourne AprilNo ratings yet

- Simple Interest 1Document88 pagesSimple Interest 1Sean Ray Silva DelgadoNo ratings yet

- Personal Loan Application Form For WebsiteDocument1 pagePersonal Loan Application Form For Websitealicante.rodel0iNo ratings yet

- e-StatementBRImo 409101006079507 Sep2023 20230924 041813Document2 pagese-StatementBRImo 409101006079507 Sep2023 20230924 041813latuo tuoNo ratings yet

- Case Study With Questions Based On Human Life Value Insurance CoverDocument10 pagesCase Study With Questions Based On Human Life Value Insurance CoverKshitijNo ratings yet

- SelfDocument4 pagesSelfdiane angobNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- Bankucrpty Amd InsolvencyDocument13 pagesBankucrpty Amd InsolvencyHarshdeep groverNo ratings yet

- Accounting Eqn TestDocument3 pagesAccounting Eqn TestRaghav BangaNo ratings yet