Professional Documents

Culture Documents

20200812145522BN001420913

20200812145522BN001420913

Uploaded by

De MatrixOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

20200812145522BN001420913

20200812145522BN001420913

Uploaded by

De MatrixCopyright:

Available Formats

daryl soedojo

2101705196

Chapter 31

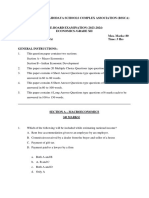

The following table shows government spending and tax revenue for a hypothetical

economy over a five-year period. All figures are in billions.

(a) In what years were there budget deficits and what were the amounts?

(b) In what year was there a budget surplus and what was the amount?

(c) What is the public debt in this economy over the five years?

(d) If the size of the economy (GDP) was $4000 billion, what would be the public debt as a

percentage of GDP?

Chapter 33

Using the balance sheet below and assuming a required reserve ratio of 20%, answer the

following: (a) What is the amount of excess reserves? (b) This bank can safely expand its

loans by what amount? (c) By expanding its loans by this amount in part (b), its checkable

deposits would expand to what amount (if all loans were made to checking account

customers)? (d) If checks clear against the bank equal to the amount loaned in (b), how

much would remain in reserves and in checkable deposits?

Answers

Chapter 31

a) In the 3rd, 4th, and 5th year there is budget deficit amounting $25 billion, $50 billion,

$75 billion.

b) In 1st year there is only budget surplus amounting $25 billion.

c) Over five years the total debt is $150 billion.

d) As a percentage of GDP the debt is 3.75% of the total GDP of $4000 billion.

Chapter 33

A) As a loan and securities value

= 70 000 + 50 000

= 120 000

So reserve to be maintained = 20% of 120 000 = $24 000

But actual reserve = 40 000

B) Bank can expand its loan by

= 70 000 + 16 000

= $86 000

C) By expanding this amount checkable deposite wont change

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Principles of Macroeconomics Final Exam Practice: Part One: Multiple Choices: Circle The Most Appropriate AnswerDocument8 pagesPrinciples of Macroeconomics Final Exam Practice: Part One: Multiple Choices: Circle The Most Appropriate AnswerKhalid Al Ali100% (2)

- Macroeconomics Canadian 8th Edition Sayre Test BankDocument40 pagesMacroeconomics Canadian 8th Edition Sayre Test Bankjerryholdengewmqtspaj100% (37)

- Final 2017Document9 pagesFinal 2017Ismail Zahid OzaslanNo ratings yet

- Economics Term Exam 1 2024-25Document3 pagesEconomics Term Exam 1 2024-25sarathsivadamNo ratings yet

- Practice Midterm 2Document10 pagesPractice Midterm 2bus242No ratings yet

- Review Questions For Test 2 Key 2012Document10 pagesReview Questions For Test 2 Key 2012Zeke MerchantNo ratings yet

- Macroeconomics Sectional 2Document5 pagesMacroeconomics Sectional 2Sashina GrantNo ratings yet

- ECO610 Final Term NotesDocument205 pagesECO610 Final Term Noteskhanrocks2222No ratings yet

- Spec 2008 - Unit 2 - Paper 1Document11 pagesSpec 2008 - Unit 2 - Paper 1capeeconomics83% (12)

- Chapters 8,11 & 12Document9 pagesChapters 8,11 & 12gg ggNo ratings yet

- Chapter 28 ReviewDocument9 pagesChapter 28 ReviewDavyieNo ratings yet

- International Trade 4Th Edition Feenstra Test Bank Full Chapter PDFDocument54 pagesInternational Trade 4Th Edition Feenstra Test Bank Full Chapter PDFRobinCummingsfikg100% (14)

- Economics PQDocument9 pagesEconomics PQash kathumNo ratings yet

- Cbse Class 12 Economics - PQDocument21 pagesCbse Class 12 Economics - PQMurtaza JamaliNo ratings yet

- ECO-12 CBSE Additional Practice Questions 2023-24Document20 pagesECO-12 CBSE Additional Practice Questions 2023-24Sadjaap SinghNo ratings yet

- Sample Paper 2Document19 pagesSample Paper 2balajayalakshmi96No ratings yet

- Mock Evaluation Term I (2021-2022) Class - Xii Subject-Economics (Code-030) Time: 90 Mins. + Reading Time: 20 Minutes MM-40 General InstructionsDocument8 pagesMock Evaluation Term I (2021-2022) Class - Xii Subject-Economics (Code-030) Time: 90 Mins. + Reading Time: 20 Minutes MM-40 General Instructionssourav krishnaNo ratings yet

- International Macroeconomics 4th Edition Feenstra Test BankDocument33 pagesInternational Macroeconomics 4th Edition Feenstra Test Bankchuseurusmnsn3100% (37)

- International Macroeconomics 4Th Edition Feenstra Test Bank Full Chapter PDFDocument54 pagesInternational Macroeconomics 4Th Edition Feenstra Test Bank Full Chapter PDFPatriciaSimonrdio100% (10)

- International Macroeconomics 4th Edition Feenstra Test BankDocument33 pagesInternational Macroeconomics 4th Edition Feenstra Test Bankjosephavilagfznrmoajw100% (35)

- AS and AS MCQ CUET - 8979858 - 2022 - 07 - 09 - 12 - 28Document7 pagesAS and AS MCQ CUET - 8979858 - 2022 - 07 - 09 - 12 - 28Harshit SainiNo ratings yet

- MAMS Sample Pre Board Term 1 2021-22Document16 pagesMAMS Sample Pre Board Term 1 2021-22Pooja BediNo ratings yet

- Concept Classes: Economics Paper - 3Document23 pagesConcept Classes: Economics Paper - 3Kunal SardanaNo ratings yet

- Practice Sample Paper-3Document13 pagesPractice Sample Paper-3RISHIKA KHURANANo ratings yet

- Sample Question Paper Eco XII - Sir S K AggarwalaDocument13 pagesSample Question Paper Eco XII - Sir S K AggarwalaKunwar PalNo ratings yet

- Tayabur Rahman - Final - AutumnDocument10 pagesTayabur Rahman - Final - AutumnTayabur RahmanNo ratings yet

- 12 Economics Pre Board 2 Set ADocument5 pages12 Economics Pre Board 2 Set Amcsworkshop777No ratings yet

- Govt BudgetDocument9 pagesGovt BudgetShreya PushkarnaNo ratings yet

- Sample Question Paper, 12 EconomicsDocument7 pagesSample Question Paper, 12 EconomicsSubhamita DasNo ratings yet

- Assignment GOVT BUDGETDocument11 pagesAssignment GOVT BUDGETPriyanshi RaiNo ratings yet

- Knox 2020 Economics Trials & SolutionsDocument55 pagesKnox 2020 Economics Trials & SolutionsAlecNo ratings yet

- ISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)Document15 pagesISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)hanaNo ratings yet

- Chapter 8 FincanceDocument4 pagesChapter 8 FincanceMINTDKS 0112100% (1)

- XII 90 MCQs For PracticeDocument12 pagesXII 90 MCQs For PracticeGirish SinghalNo ratings yet

- 65 Most Imp MCQ Eco Board 2024Document68 pages65 Most Imp MCQ Eco Board 2024devm48763No ratings yet

- Class 12 Sahodaya Pre Board QP Economics Set ADocument23 pagesClass 12 Sahodaya Pre Board QP Economics Set AAnshika GangwarNo ratings yet

- Chapter 2 Test Bank: Specialized AccountingDocument9 pagesChapter 2 Test Bank: Specialized AccountingMohammed Al-ghamdiNo ratings yet

- Macroeconomics 6th Edition Blanchard Test BankDocument10 pagesMacroeconomics 6th Edition Blanchard Test Bankroryhungzad6100% (32)

- Home Economics Mcqs PaperDocument27 pagesHome Economics Mcqs Paperlog manNo ratings yet

- Surprise Quiz IDocument5 pagesSurprise Quiz I23pgp011No ratings yet

- Selected Questions Chapter 23Document8 pagesSelected Questions Chapter 23Pranta SahaNo ratings yet

- Lesson 36 (Unit 8b) PracticeDocument4 pagesLesson 36 (Unit 8b) PracticeWilly WonkaNo ratings yet

- Coremacroeconomics 3rd Edition Chiang Test BankDocument50 pagesCoremacroeconomics 3rd Edition Chiang Test Banktwintervoodooaq2t9100% (35)

- Quiz Money and BankingDocument10 pagesQuiz Money and Bankingibrahim gendiiNo ratings yet

- CoreMacroeconomics 3rd Edition Chiang Test Bank instant download all chapterDocument73 pagesCoreMacroeconomics 3rd Edition Chiang Test Bank instant download all chapterpaopeklengt93100% (3)

- Income DeterminationDocument6 pagesIncome DeterminationHARI KRISHNANNo ratings yet

- (Download PDF) CoreMacroeconomics 3rd Edition Chiang Test Bank Full ChapterDocument83 pages(Download PDF) CoreMacroeconomics 3rd Edition Chiang Test Bank Full Chapteryazghiqadary100% (9)

- Macro Practice Test 4Document17 pagesMacro Practice Test 4ShankiegalNo ratings yet

- Tiền Tệ Ngân Hàng Cô TrâmDocument7 pagesTiền Tệ Ngân Hàng Cô Trâmhuy7n-35No ratings yet

- XII - Economics - MOCK PAPERDocument7 pagesXII - Economics - MOCK PAPERRiyanshi MauryaNo ratings yet

- BECO260 Final Examination Revision SheetDocument36 pagesBECO260 Final Examination Revision Sheetbill haddNo ratings yet

- HW2Document5 pagesHW2lolDevRNo ratings yet

- Multiple Choice QuestionsDocument6 pagesMultiple Choice QuestionsKago MakoNo ratings yet

- Economics Mcqs For Lecturer Test 2017Document27 pagesEconomics Mcqs For Lecturer Test 2017Ameer HaiderNo ratings yet

- 2020 - HSC Economics Trial - Sydney Grammar SchoolDocument73 pages2020 - HSC Economics Trial - Sydney Grammar Schoollg019 workNo ratings yet

- Term 1 Preboard 2021-22 Class XiiDocument12 pagesTerm 1 Preboard 2021-22 Class XiiAkshat GulatiNo ratings yet

- Quiz 547Document7 pagesQuiz 547Haris NoonNo ratings yet

- Chapter5 QuizDocument3 pagesChapter5 QuizJoey YUNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet