Professional Documents

Culture Documents

Acc102 Final Exam 1

Acc102 Final Exam 1

Uploaded by

fanchasticommsCopyright:

Available Formats

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Practice Questions Final Exam-Financial ManagementDocument8 pagesPractice Questions Final Exam-Financial ManagementNilotpal Chakma100% (9)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- 10 Merger Model Case Study Jos A Bank Mens WearhouseDocument6 pages10 Merger Model Case Study Jos A Bank Mens WearhouseTayyaba YounasNo ratings yet

- Intermediate Accounting 1 Review MaterialsDocument24 pagesIntermediate Accounting 1 Review MaterialsGIRLNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- MasTec Corporate Presentation 051021Document38 pagesMasTec Corporate Presentation 051021girish_patkiNo ratings yet

- Cfas - Quiz QuestionsDocument3 pagesCfas - Quiz QuestionsNavdeep KaurNo ratings yet

- ADVACC3 Set B 150 CopiesDocument7 pagesADVACC3 Set B 150 CopiesPearl Mae De VeasNo ratings yet

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Advacc 3 Question Set A 150 CopiesDocument6 pagesAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasNo ratings yet

- Comprehensive Accounting Review 2333Document3 pagesComprehensive Accounting Review 2333linkin soyNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 1Document8 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 1JordanNo ratings yet

- Accounting CoreDocument10 pagesAccounting CoreGioNo ratings yet

- Kalinga State University College of Business, Entrepreneurship & Accountancy Test QuestionsDocument12 pagesKalinga State University College of Business, Entrepreneurship & Accountancy Test QuestionsJaymee Andomang Os-agNo ratings yet

- Review 105 - Day 22 TOADocument6 pagesReview 105 - Day 22 TOAAbriel BumatayNo ratings yet

- FARDocument7 pagesFARRosemarie MoinaNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- Financial Accountinng 3Document10 pagesFinancial Accountinng 3Nami2mititNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryROMAR A. PIGANo ratings yet

- FAR - First Preboard ExaminationsDocument13 pagesFAR - First Preboard ExaminationsMonique PendijitoNo ratings yet

- AdU Compre Exam - IntAcc 1Document5 pagesAdU Compre Exam - IntAcc 1Angel Madelene BernardoNo ratings yet

- Theories Conceptual Framework and Accouting Standards Answer KeyDocument7 pagesTheories Conceptual Framework and Accouting Standards Answer KeyEl AgricheNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- PRTC Olympiad Reg 12Document14 pagesPRTC Olympiad Reg 12Vincent Larrie MoldezNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- Mock Cpa Board Exams Rfjpia R 12 WDocument17 pagesMock Cpa Board Exams Rfjpia R 12 Wlongix100% (2)

- ReSA B42 FAR First PB Exam Questions Answers Solutions-1Document25 pagesReSA B42 FAR First PB Exam Questions Answers Solutions-1Heart EspineliNo ratings yet

- Fifth Departmental QuizDocument9 pagesFifth Departmental QuizMica R.No ratings yet

- Midterms WITHOUT ANSWERSDocument21 pagesMidterms WITHOUT ANSWERScasio3627No ratings yet

- Preliminary Examination in Financial ManagementDocument6 pagesPreliminary Examination in Financial ManagementJken OrtizNo ratings yet

- Lesson 003 Users of Accounting InformationsDocument4 pagesLesson 003 Users of Accounting InformationsYnnoJhom harthartNo ratings yet

- 1st PreMid WITHOUT ANSWERSDocument19 pages1st PreMid WITHOUT ANSWERScasio3627No ratings yet

- SM08 4thExamReview-TheoryDocument7 pagesSM08 4thExamReview-TheoryHilarie JeanNo ratings yet

- 40 Financial Statements TheoryDocument9 pages40 Financial Statements TheoryPrincesNo ratings yet

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- All Subjects - CCDocument11 pagesAll Subjects - CCMJ YaconNo ratings yet

- A. Business CombinationDocument30 pagesA. Business CombinationJason SheeshNo ratings yet

- PS - BasicDocument4 pagesPS - BasicErwin Dave M. DahaoNo ratings yet

- AP - General ReviewDocument15 pagesAP - General ReviewVhiejhaan16100% (1)

- Quiz Questions: Student Centre Chapter 2: Review of AccountingDocument4 pagesQuiz Questions: Student Centre Chapter 2: Review of AccountingSandyNo ratings yet

- All Subj Board Exam Picpa Ee PDF FreeDocument9 pagesAll Subj Board Exam Picpa Ee PDF FreeannyeongchinguNo ratings yet

- Rizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyDocument14 pagesRizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyHatdogNo ratings yet

- Finals Exam - IaDocument8 pagesFinals Exam - IaJennifer Rasonabe100% (1)

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- Toa 2022 Q1 PDFDocument6 pagesToa 2022 Q1 PDFNiña Yna Franchesca PantallaNo ratings yet

- F Acadl 01Document12 pagesF Acadl 01Illion IllionNo ratings yet

- BAC 214 Final Examination With QuestionsDocument13 pagesBAC 214 Final Examination With Questionsjanus lopezNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- Nfjpia Nmbe Afar 2017 AnsDocument10 pagesNfjpia Nmbe Afar 2017 AnshyosungloverNo ratings yet

- Multiple Choice Questions For Chapter 01Document14 pagesMultiple Choice Questions For Chapter 01Phương Anh HàNo ratings yet

- Theory of Accounts (No Ak)Document10 pagesTheory of Accounts (No Ak)Irish Joy AlaskaNo ratings yet

- Acctg Integ 3b Prelim ExamDocument6 pagesAcctg Integ 3b Prelim ExamKathrine Gayle BautistaNo ratings yet

- ACC106 P2 Q2 Set A KDocument2 pagesACC106 P2 Q2 Set A KShane QuintoNo ratings yet

- Multiple-Choice Questions For Chapter 01Document15 pagesMultiple-Choice Questions For Chapter 01Minh Châu VũNo ratings yet

- Auditing Theories and Problems Quiz WEEK 1Document19 pagesAuditing Theories and Problems Quiz WEEK 1Sarah GNo ratings yet

- Chap 1 BuscomDocument6 pagesChap 1 BuscomNathalie GetinoNo ratings yet

- DocxDocument7 pagesDocxPearl Jade YecyecNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionFrom EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNo ratings yet

- (Solved) Based On The Results of Using The Hanging-Drop Method in Figure 2... Course HeroDocument1 page(Solved) Based On The Results of Using The Hanging-Drop Method in Figure 2... Course HerofanchasticommsNo ratings yet

- Maliga 04 Task Performance 1 ARGDocument3 pagesMaliga 04 Task Performance 1 ARGfanchasticommsNo ratings yet

- Chap 56Document15 pagesChap 56fanchasticommsNo ratings yet

- 6428f18a787d8 Problem 20 Castor Arenas and LaurenteDocument4 pages6428f18a787d8 Problem 20 Castor Arenas and LaurentefanchasticommsNo ratings yet

- Physics 1Document8 pagesPhysics 1fanchasticommsNo ratings yet

- FINAL EXAMINATION GartDocument4 pagesFINAL EXAMINATION GartfanchasticommsNo ratings yet

- Exam 2017 Questions and AnswersDocument22 pagesExam 2017 Questions and AnswersfanchasticommsNo ratings yet

- Endo Perio Revalida 2Document19 pagesEndo Perio Revalida 2fanchasticommsNo ratings yet

- Module 5 and Module 6Document3 pagesModule 5 and Module 6fanchasticommsNo ratings yet

- Alorica FinalDocument7 pagesAlorica FinalfanchasticommsNo ratings yet

- FC Notes Part 1Document86 pagesFC Notes Part 1fanchasticommsNo ratings yet

- Week 4 Science 9Document45 pagesWeek 4 Science 9fanchasticommsNo ratings yet

- Examination For Physics 101 in Preparation For Exit ExamDocument28 pagesExamination For Physics 101 in Preparation For Exit ExamfanchasticommsNo ratings yet

- AnswerDocument1 pageAnswerfanchasticommsNo ratings yet

- Corporate Management JurisprudenceDocument37 pagesCorporate Management Jurisprudencegilberthufana446877No ratings yet

- SAP MM Interview Questions......Document3 pagesSAP MM Interview Questions......AnoopBinuNo ratings yet

- 05 Chapter 2Document123 pages05 Chapter 2Masy121No ratings yet

- Blackbook Project On Mutual FundsDocument88 pagesBlackbook Project On Mutual FundsPooja Adhikari100% (2)

- Multiple Choice Questions: Pamantasan NG Cabuyao MTEDocument13 pagesMultiple Choice Questions: Pamantasan NG Cabuyao MTEMaybelle BernalNo ratings yet

- Thesis Arjun Gope PDFDocument225 pagesThesis Arjun Gope PDFJayesh PatelNo ratings yet

- Gce Departmental Accounting - Com PDFDocument5 pagesGce Departmental Accounting - Com PDFShakun ThapaNo ratings yet

- 1 Why Did Mso S Stock Price Decline Due To MarthaDocument1 page1 Why Did Mso S Stock Price Decline Due To MarthaAmit PandeyNo ratings yet

- Swayam Academy - Dow TheoryDocument2 pagesSwayam Academy - Dow TheoryvineetkrsinghNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- P1-43 Comprehensive Business Combination ProblemDocument3 pagesP1-43 Comprehensive Business Combination ProblemkathNo ratings yet

- Assignment 4 AnswersDocument2 pagesAssignment 4 Answerssainath reddy100% (1)

- Project Report On Buy Back of Shares FinalDocument18 pagesProject Report On Buy Back of Shares FinalDivyaModaniNo ratings yet

- Master Directions ODIDocument43 pagesMaster Directions ODImailnevadaNo ratings yet

- (Pistolese) Using Technical Analysis A Step-By-Step Guide To Understanding and Applying Stock Market Charting TechniquesDocument344 pages(Pistolese) Using Technical Analysis A Step-By-Step Guide To Understanding and Applying Stock Market Charting Techniquespmondal909No ratings yet

- Project On RaymondDocument36 pagesProject On Raymonddinesh beharaNo ratings yet

- The Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFDocument5 pagesThe Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFEraNo ratings yet

- Financial Performance of Ceramics Industry of BangladeshDocument127 pagesFinancial Performance of Ceramics Industry of BangladeshGazi Shahbaz MohammadNo ratings yet

- Notes To The Financial StatementsDocument9 pagesNotes To The Financial StatementsANDREA NATALIA PINZON CHAVARRIONo ratings yet

- Financial Analysis of EBLDocument49 pagesFinancial Analysis of EBLAbu TaherNo ratings yet

- Linear Whitepaper v1.1 A Cross-Chain Compatible, Decentralized Delta-One Asset Protocol With Unlimited LiquidityDocument12 pagesLinear Whitepaper v1.1 A Cross-Chain Compatible, Decentralized Delta-One Asset Protocol With Unlimited LiquidityJuanNo ratings yet

- Richard L Voorhees Financial Disclosure Report For 2010Document8 pagesRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Function of Financial MarketsDocument7 pagesFunction of Financial MarketsNuzhat TasnumNo ratings yet

- BOOK00 Review Capital MarketsDocument5 pagesBOOK00 Review Capital MarketsGenirose CalambroNo ratings yet

- 31 DECAMBER FromDocument8 pages31 DECAMBER FromMd Rajikul IslamNo ratings yet

- Rangkuman Chapter 9 Cost of CapitalDocument4 pagesRangkuman Chapter 9 Cost of CapitalDwi Slamet RiyadiNo ratings yet

- Greenlight Letter Q4Document5 pagesGreenlight Letter Q4ZerohedgeNo ratings yet

Acc102 Final Exam 1

Acc102 Final Exam 1

Uploaded by

fanchasticommsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc102 Final Exam 1

Acc102 Final Exam 1

Uploaded by

fanchasticommsCopyright:

Available Formats

Republic of the Philippines

BATANGAS STATE UNIVERSITY

The National Engineering University

Pablo Borbon Campus

Rizal Avenue Ext., Batangas City, Batangas, Philippines 4200

Tel Nos.: (+63 43) 980-0385; 980-0387; 980-0392 to 94; 425-7158 to 62 loc. 1124

E-mail Address: cabeihm.pb@g.batstate-u.edu.ph | Website Address: http://www.batstate-u.edu.ph

College of Accountancy, Business, Economics and

International Hospitality Management

FINAL EXAMINATION

ACC102 - Financial Accounting & Reporting 2

Second Sem. AY2021-2022

Name: ________________________________ Score: ______________________________

SR Code: ______________________________ Class Schedule: ______________________

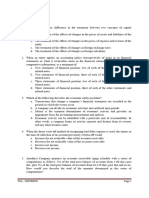

I. MULTIPLE CHOICE: CHOOSE THE LETTER OF THE CORRECT ANSWER (30pts)

1. A corporation acquires juridical personality

a. upon filing of the articles of incorporation.

b. upon filing of the by-laws.

c. upon the issuance of the certificate of incorporation.

d. within 30 days from the receipt of the notice of issuance of the certificate of incorporation.

2. A delinquent stockholder is not entitled to the following rights, except the right

a. to be voted.

b. to dividends.

c. to vote or be represented in the meetings of the stockholders.

d. He is not entitled to all the rights of a stockholder.

3. What is the order of payment of liabilities of a dissolved general partnership using the code number

representing each liability?

I. Those owing to partners other than for capital or profits.

II. Those owing to creditors other than partners.

III. Those owing to partners in respect of profits.

IV. Those owing to partners in respect of capital.

a. I, II, III, IV

b. II, I, IV, III

c. II, I, III, IV

d. I, II, IV, III

4. What is the order of payment of liabilities of a dissolved general partnership using the code number

representing each liability?

I. Those owing to general partners other than for capital or for profits.

II. Those owing to creditors including limited partners, except those to limited partners on

account of their contributions and general partners.

III. Those owing to limited partners by way of their share in the profits and other compensation

by way of income.

IV. Those owing to limited partners in respect to their capital contributions.

V. Those owing to general partners in respect of capital.

VI. Those owing to general partners in respect of profits.

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

a. I, II, III, IV, V, VI

b. II, III, IV, I, V, VI

c. I, II, III, IV, VI, V

d. II, III, IV, I, VI, V

5. Statement I: A substantial loss on realization may yield for a partner a capital deficiency but this will

not affect the partner’s interest in the partnership.

Statement II: In cases where the partnership assets are insufficient to settle all outside liabilities, the

partners should make additional cash contributions in the partnership.

a. Both statements are correct.

b. Both statements are incorrect.

c. Only statement I is correct.

d. Only statement II is correct.

6. Statement I: Liquidity of a business is important because it looks at the ability of the business in

meeting its financial obligations over long term.

Statement II: Vertical analysis is commonly called as trend analysis.

a. Both statements are correct.

b. Both statements are incorrect.

c. Only statement I is correct.

d. Only statement II is correct.

7. The formula for Return on Assets is

a. Net Income/Total Assets

b. Gross Income/Total Assets

c. Total Assets/Net Income

d. Total Assets/Gross Income

8. Statement I: Under access control, all cash expenses should be authorized by responsible managers.

Statement II: External auditors are responsible for a firm’s internal control.

a. Both statements are correct.

b. Both statements are incorrect.

c. Only statement I is correct.

d. Only statement II is correct.

9. The cash account is involved in which cycle?

a. Revenue and collection.

b. Acquisition and expenditure.

c. Production and conversion.

d. All of the given choices.

10. The articles of incorporation differ from the by-laws in that the articles of incorporation are

a. the rules of action adopted by a corporation for its internal government.

b. adopted before or after incorporation.

c. a condition precedent in the acquisition by a corporation of a juridical personality.

d. approved by the stockholders if adopted after incorporation.

11. The following may be the consideration of the shares of stock of a corporation, except:

a. actual cash paid to the corporation.

b. previously incurred indebtedness of the corporation.

c. amounts transferred from unrestricted retained earnings.

d. services to be performed by a lawyer on the proposed increase in capital stock of the

corporation.

12. Stock dividends differ from cash dividends in that stock dividends

a. do not increase legal capital.

b. require the approval of both the board of directors and the stockholders.

c. involve disbursements of corporate funds.

d. once received by the stockholders, are beyond the reach of corporate creditors.

13. A stock that is issued without consideration or below par value or the issued price is known as

a. watered stock.

b. delinquent stock.

c. redeemable stock.

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

d. preferred stock.

14. Which of the following control procedures would most likely assure that access to shipping, billing,

inventory control, and accounting records is restricted to personnel authorized by management?

a. Segregate the responsibilities for authorization, execution, and recording, and prenumber and

control the custody of documents.

b. Establish the cash receipts function in a centralized location and require a daily reconciliation

of cash receipts records with deposit slips.

c. Establish policy and procedures manuals, organization charts, and supporting documentation.

d. Periodically substantiate and evaluate the recorded account balances.

15. Which of the following internal control procedures most likely would deter lapping of collections

from customers?

a. Independent internal verification of dates of entry in the cash receipts journal with dates of

daily cash summaries.

b. Authorization of write-offs of uncollectible accounts by a supervisor who is independent of

credit approval.

c. Segregation of duties between receiving cash and posting collections to the accounts receivable

ledger.

d. Supervisor’s comparison of the daily cash summary with the sum of the cash receipts journal

entries.

16. Collection of the company which are deposited already in the bank but not yet reflected in the bank

statement because it did not catch up with the cut-off period during the month and will be reported only in

the bank statement of the following month.

a. Outstanding Checks

b. Deposit in Transit

c. Notes Receivable Collected

d. Debit Memos

17. The formula for fixed asset turnover ratio is

a. Sales/Fixed Assets

b. Net Income/Fixed Assets

c. Fixed Assets/Sales

d. Fixed Assets/Net Income

18. ______________________ is also known as working capital ratio.

a. Asset turnover ratio

b. Receivable turnover ratio

c. Quick ratio

d. Current ratio

19. ______________________ is also known as acid-test ratio.

a. Asset turnover ratio

b. Receivable turnover ratio

c. Quick ratio

d. Current ratio

20. This method shows who among the partners have priority in the distribution of cash. Every time cash

is available for distribution to the partners, this is prepared.

a. Schedule of Safe Payments

b. Cash Priority Program

c. Statement of Liquidation

d. None of the above

21. When the current ratio is 2:1, an equal increase in current assets and current liabilities would result in

a. no change in current ratio.

b. increase in current ratio.

c. decrease in current ratio.

d. current ratio will double.

22. The statement of financial position of the partnership of A, B and C shows the following information:

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

Cash 22,400

Other assets 212,000

Total assets 234,400

Liabilities 38,400

A, capital (50%) 76,000

B, capital (25%) 64,000

C, capital (25%) 56,000

Total liabilities and

equity 234,400

The partners realized ₱56,000 from the first installment sale of non-cash assets with total carrying

amount of ₱120,000. How much did B receive from the partial liquidation?

a. ₱25,000

b. ₱24,000

c. ₱16,000

d. ₱0

23. The statement of financial position of the partnership of A, B and C shows the following information:

Cash 40,000

Other assets 720,000

Total assets 760,000

Liabilities 300,000

B, loan 64,000

C, loan 20,000

A, capital (50%) 250,000

B, capital (30%) 86,000

C, capital (20%) 40,000

Total liabilities and

equity 760,000

The non-cash assets are sold for ₱320,000. Partner C is the only solvent partner. In the settlement of the

partners’ claims, how much additional contribution is required of Partner C?

a. ₱50,000

b. ₱30,000

c. ₱20,000

d. ₱0

24. The entry to record the issuance of ordinary shares for fully paid share subscriptions is

a. a memorandum entry.

b. Dr. Common Stock Subscribed; Cr. Common Stock; Cr. Additional Paid-In Capital

c. Dr. Subscribed Share Capital; Cr. Subscriptions Receivable

d. Dr. Subscribed Share Capital; Cr. Share Capital

25. The issuance of shares of preferred stock to shareholders

a. increases preferred stock outstanding.

b. has no effect on preferred stock outstanding.

c. increases preferred stock authorized.

d. decreases preferred stock authorized.

26. In 2020, Newt Corp. acquired 6,000 shares of its own ₱1 par value ordinary share at ₱18 per share. In

2021, Newt issued 3,000 of these shares at ₱25 per share. Newt uses the cost method to account for its

treasury stock transactions. What accounts and amounts should Newt credit in 2021 to record the issuance

of the 3,000 shares?

a. Treasury Shares ₱54,000; Retained Earnings ₱21,000

b. Treasury Shares ₱54,000; Share Premium ₱21,000

c. Share Premium ₱72,000; Ordinary Shares ₱3,000

d. Share Premium ₱51,000; Retained Earnings ₱21,000; Ordinary Shares ₱3,000

27. On December 1, 2021, Line Corp. received a donation of 2,000 shares of its ₱5 par value ordinary

shares from a shareholder. On that date, the stock’s market value was ₱35 per share. The stock was

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

originally issued for ₱25 per share. By what amount would this donation cause total stockholders’ equity

to decrease?

a. ₱70,000

b. ₱50,000

c. ₱20,000

d. ₱0

28. The charter of a corporation (articles of incorporation) provides for the issuance of 100,000 shares of

common stock. Assume that 60,000 shares were originally issued and 5,000 were subsequently

reacquired. What is the number of shares outstanding?

a. 95,000

b. 100,000

c. 55,000

d. 60,000

29. The unadjusted balance in cash book is because of the result of which error?

a. Omission of bank charges

b. Unrepresented checks

c. Outstanding checks

d. Deposit in transit

30. ABC Company had sales of ₱10 million; operating income of ₱3 million; after tax income of ₱1

million; assets of ₱8 million; stockholder’s equity of ₱5 million; and a total debt of ₱3 million. What is

ABC’s return on equity?

a. 10.0%

b. 20.0%

c. 37.5%

d. 60.0%

II. FINAL ANSWER: PROVIDE THE FINAL ANSWER (2 pts each; 40 pts)

1. Ray Corp. declared a 5% stock (share) dividend on its 10,000 issued and outstanding shares of ₱2 par

value common stock, which had a fair value of ₱5 per share before the stock dividend was declared. This

stock dividend was distributed 60 days after the declaration date. By what amount did Ray’s current

liabilities increase as a result of the stock dividend declaration?

For numbers 2 and 3:

Nest Co. issued 100,000 shares of common stock (i.e., ordinary shares). Of these, 5,000 were held as

treasury stock at December 31, 2021. During 2022, transactions involving Nest's common stock were as

follows:

• May 3 - 1,000 shares of treasury stock were sold.

• August 6 - 10,000 shares of previously unissued stock were sold.

• November 18 - a 2-for-1 stock split took effect.

2. Laws in Nest's state of incorporation protect treasury stock from dilution. At December 31, 2022, how

many shares of Nest's common stock were issued?

3. Laws in Nest's state of incorporation protect treasury stock from dilution. At December 31, 2022, how

many shares of Nest's common stock were issued?

4. At December 31, 2020 and 2021, Carr Corp. had outstanding 4,000 shares of ₱100 par value 6%

cumulative preferred stock and 20,000 shares of ₱10 par value common stock (i.e., ordinary shares). At

December 31, 2020, dividends in arrears on the preferred stock were ₱12,000. Cash dividends declared in

2021 totaled ₱44,000. Of the ₱44,000, what amount were payable to preferred shares?

5. Using the same given in the preceding number, what amount were payable to common shares?

6. Arp Corp.’s outstanding capital stock at December 15, 2021, consisted of the following:

• 30,000, 5% cumulative preference shares, par value ₱10 per share, fully participating as to

dividends. No dividends were in arrears.

• 200,000 ordinary shares, par value ₱1 per share.

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

On December 15, 2021, Arp declared dividends of ₱100,000. What was the amount of dividends payable

to Arp’s ordinary stockholders?

7. The equity section of the statement of financial position of the partnership of A, B and C shows the

following information:

A, capital (40%) 64,000

B, capital (40%) 104,000

C, capital (20%) 76,800

Total liabilities and equity 244,800

Non-cash assets are sold in installment. Cash distributions are made to the partners as cash becomes

available. In the second sale of non-cash assets, the partners received the same amount of cash in the

distribution. In the third sale of non-cash assets, the amount of cash available for distribution is ₱100,000.

The carrying amount of the remaining non-cash assets is ₱260,000. Under the cash priority program, how

much cash is distributed to B in the third installment payment?

For numbers 8-9.

The partners of ABC Co. decided to liquidate their partnership. ABC Co’s statement of financial position

is shown below:

Cash 40,000Accounts Payable 100,000

Accounts Receivable 200,000Payable to A 50,000

Inventory 300,000A, Capital (50%) 600,000

Equipment – Net 800,000B, Capital (40%) 420,000

C, Capital (10%) 170,000

Total Assets 1,340,000 Total Liab. & Equity 1,340,000

Information on the conversion of non-cash assets is as follows:

a. 80% of the accounts receivable was collected for only ₱60,000.

b. 90% of the inventory was sold for ₱40,000.

c. Equipment with the carrying amount of ₱600,000 was sold for ₱220,000.

d. Actual liquidation expenses of ₱2,000 were paid.

e. Estimated future liquidation expenses totaled ₱3,000.

f. ₱10,000 cash was retained in the business for potential unrecorded liabilities and anticipated

expenses.

8. Determine the amount of cash distributed to Partner A from the partial realization of partnership assets.

9. Determine the amount of cash distributed to Partner C from the partial realization of partnership assets.

10. Partners A, B and C decided to liquidate their partnership. A summary of the partnership’s statement

of financial position is shown below:

Cash 50,000 Accounts Payable 100,000

Non-Cash Assets 1,200,000 Payable to A 50,000

A, Capital (40%) 400,000

B, Capital (40%) 450,000

C, Capital (20%) 250,000

Total Assets 1,250,000 Total Liab. & Equity 1,250,000

Three-fourths of the non-cash assets were sold for ₱920,000 The partnership paid ₱5,000 transaction

costs on the sale. How much cash did C receive from the settlement of the partner’s interests?

11. Partners A, B and C decided to liquidate their partnership. A summary of the partnership’s statement

of financial position is shown below:

ASSETS LIABILITIES EQUITY

Cash Non-Cash A (20%) B (30%) C (50%)

20,000 480,000 30,000 100,000 170,000 200,000

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

One-third of the non-cash assets were sold for ₱70,000. The partnership paid ₱8,000 liquidation

expenses. Partner C is insolvent. How much cash did A receive from the settlement of partners’ interests?

For numbers 12-14.

Partners A, B and C decided to liquidate their partnership. A summary of the partnership’s statement of

financial position is shown below:

Cash 50,000 Accounts Payable 100,000

Non-Cash Assets 1,200,000 Payable to A 50,000

A, Capital (50%) 540,000

B, Capital (30%) 360,000

C, Capital (20%) 200,000

Total Assets 1,250,000 Total Liab. & Equity 1,250,000

12 - 13. If a cash priority program is prepared, which partner is paid first and how much is the total

payments to that partner before all partners will share on the available cash based on their profit or loss

ratios? (12 partner; 13 amount)

14. Three-fourths of the non-cash assets were sold for ₱920,000. The partnership paid ₱5,000 transaction

costs on the sale. How much cash did A receive from the settlement of the partners’ interests under the

cash priority program?

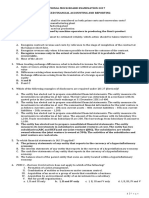

For numbers 15 – 17.

Bank statement information:

1. Bank loan is credited by the bank, 100,000.

2. NSF check was returned, 5,000.

3. The two debit memos are both bank service charges.

4. Check 11021 is a bank error.

15. How much is the deposit in transit at the end of the month?

16. How much is outstanding checks at the end of the month?

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

17. How much is the adjusted book balance?

For numbers 18 – 19.

You and I won an accounting quiz bee in college and have invested the money in ABC Co. You acquired

1,000 preference shares, while I acquired 1,000 ordinary shares. Today, ABC Co. declared cash dividends

of ₱12 million. ABC Co.’s equity structure before the dividend declaration is as follows:

10% Preference Share Capital, ₱200 par 1,000,000

Ordinary Share Capital, ₱1 par 2,000,000

Retained Earnings 15,000,000

Total Shareholders’ Equity 18,000,000

18. If preference shares are cumulative and nonparticipating (dividends in arrears are five years, including

the current year), how much dividends (gross of tax) will I receive from my investment?

19. If preference shares are cumulative and participating (dividends in arrears are five years, including the

current year), how much dividends (gross of tax) will you receive you’re your investment?

20. ABC Co. has a total debt of ₱420,000 and shareholders’ equity of ₱700,000. ABC Co. is seeking

capital to fund an expansion. It is planning to issue an additional ₱300,000 in common stock, and is

negotiating with a bank to borrow additional funds. The bank is requiring a debt-to-equity rate of 0.75.

What is the maximum additional amount ABC Co. will be able to borrow?

- END OF EXAMINATION -

Prepared by:

KIMBERLY CAMILLE MENDOZA

ACC 102 Instructor

Checked & Verified by:

ASST. PROF. MA. CONCEPCION MANALO CPA, MBA

Department Chair-AMA

Approved by:

DR. BENDALYN M. LANDICHO

Dean-CABEIHM

This study source was downloaded by 100000885748714 from CourseHero.com on 05-11-2024 02:23:10 GMT -05:00

Leading Innovations, Transforming Lives

https://www.coursehero.com/file/152310424/ACC102-FINAL-EXAM-1docx/

Powered by TCPDF (www.tcpdf.org)

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Practice Questions Final Exam-Financial ManagementDocument8 pagesPractice Questions Final Exam-Financial ManagementNilotpal Chakma100% (9)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- 10 Merger Model Case Study Jos A Bank Mens WearhouseDocument6 pages10 Merger Model Case Study Jos A Bank Mens WearhouseTayyaba YounasNo ratings yet

- Intermediate Accounting 1 Review MaterialsDocument24 pagesIntermediate Accounting 1 Review MaterialsGIRLNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- MasTec Corporate Presentation 051021Document38 pagesMasTec Corporate Presentation 051021girish_patkiNo ratings yet

- Cfas - Quiz QuestionsDocument3 pagesCfas - Quiz QuestionsNavdeep KaurNo ratings yet

- ADVACC3 Set B 150 CopiesDocument7 pagesADVACC3 Set B 150 CopiesPearl Mae De VeasNo ratings yet

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Advacc 3 Question Set A 150 CopiesDocument6 pagesAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasNo ratings yet

- Comprehensive Accounting Review 2333Document3 pagesComprehensive Accounting Review 2333linkin soyNo ratings yet

- 2022 Sem 1 ACC10007 Practice MCQs - Topic 1Document8 pages2022 Sem 1 ACC10007 Practice MCQs - Topic 1JordanNo ratings yet

- Accounting CoreDocument10 pagesAccounting CoreGioNo ratings yet

- Kalinga State University College of Business, Entrepreneurship & Accountancy Test QuestionsDocument12 pagesKalinga State University College of Business, Entrepreneurship & Accountancy Test QuestionsJaymee Andomang Os-agNo ratings yet

- Review 105 - Day 22 TOADocument6 pagesReview 105 - Day 22 TOAAbriel BumatayNo ratings yet

- FARDocument7 pagesFARRosemarie MoinaNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- Financial Accountinng 3Document10 pagesFinancial Accountinng 3Nami2mititNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryROMAR A. PIGANo ratings yet

- FAR - First Preboard ExaminationsDocument13 pagesFAR - First Preboard ExaminationsMonique PendijitoNo ratings yet

- AdU Compre Exam - IntAcc 1Document5 pagesAdU Compre Exam - IntAcc 1Angel Madelene BernardoNo ratings yet

- Theories Conceptual Framework and Accouting Standards Answer KeyDocument7 pagesTheories Conceptual Framework and Accouting Standards Answer KeyEl AgricheNo ratings yet

- Select The Best Answer From The Choices Given.: TheoryDocument14 pagesSelect The Best Answer From The Choices Given.: TheoryROMAR A. PIGANo ratings yet

- PRTC Olympiad Reg 12Document14 pagesPRTC Olympiad Reg 12Vincent Larrie MoldezNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- Mock Cpa Board Exams Rfjpia R 12 WDocument17 pagesMock Cpa Board Exams Rfjpia R 12 Wlongix100% (2)

- ReSA B42 FAR First PB Exam Questions Answers Solutions-1Document25 pagesReSA B42 FAR First PB Exam Questions Answers Solutions-1Heart EspineliNo ratings yet

- Fifth Departmental QuizDocument9 pagesFifth Departmental QuizMica R.No ratings yet

- Midterms WITHOUT ANSWERSDocument21 pagesMidterms WITHOUT ANSWERScasio3627No ratings yet

- Preliminary Examination in Financial ManagementDocument6 pagesPreliminary Examination in Financial ManagementJken OrtizNo ratings yet

- Lesson 003 Users of Accounting InformationsDocument4 pagesLesson 003 Users of Accounting InformationsYnnoJhom harthartNo ratings yet

- 1st PreMid WITHOUT ANSWERSDocument19 pages1st PreMid WITHOUT ANSWERScasio3627No ratings yet

- SM08 4thExamReview-TheoryDocument7 pagesSM08 4thExamReview-TheoryHilarie JeanNo ratings yet

- 40 Financial Statements TheoryDocument9 pages40 Financial Statements TheoryPrincesNo ratings yet

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- All Subjects - CCDocument11 pagesAll Subjects - CCMJ YaconNo ratings yet

- A. Business CombinationDocument30 pagesA. Business CombinationJason SheeshNo ratings yet

- PS - BasicDocument4 pagesPS - BasicErwin Dave M. DahaoNo ratings yet

- AP - General ReviewDocument15 pagesAP - General ReviewVhiejhaan16100% (1)

- Quiz Questions: Student Centre Chapter 2: Review of AccountingDocument4 pagesQuiz Questions: Student Centre Chapter 2: Review of AccountingSandyNo ratings yet

- All Subj Board Exam Picpa Ee PDF FreeDocument9 pagesAll Subj Board Exam Picpa Ee PDF FreeannyeongchinguNo ratings yet

- Rizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyDocument14 pagesRizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyHatdogNo ratings yet

- Finals Exam - IaDocument8 pagesFinals Exam - IaJennifer Rasonabe100% (1)

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- Toa 2022 Q1 PDFDocument6 pagesToa 2022 Q1 PDFNiña Yna Franchesca PantallaNo ratings yet

- F Acadl 01Document12 pagesF Acadl 01Illion IllionNo ratings yet

- BAC 214 Final Examination With QuestionsDocument13 pagesBAC 214 Final Examination With Questionsjanus lopezNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- Nfjpia Nmbe Afar 2017 AnsDocument10 pagesNfjpia Nmbe Afar 2017 AnshyosungloverNo ratings yet

- Multiple Choice Questions For Chapter 01Document14 pagesMultiple Choice Questions For Chapter 01Phương Anh HàNo ratings yet

- Theory of Accounts (No Ak)Document10 pagesTheory of Accounts (No Ak)Irish Joy AlaskaNo ratings yet

- Acctg Integ 3b Prelim ExamDocument6 pagesAcctg Integ 3b Prelim ExamKathrine Gayle BautistaNo ratings yet

- ACC106 P2 Q2 Set A KDocument2 pagesACC106 P2 Q2 Set A KShane QuintoNo ratings yet

- Multiple-Choice Questions For Chapter 01Document15 pagesMultiple-Choice Questions For Chapter 01Minh Châu VũNo ratings yet

- Auditing Theories and Problems Quiz WEEK 1Document19 pagesAuditing Theories and Problems Quiz WEEK 1Sarah GNo ratings yet

- Chap 1 BuscomDocument6 pagesChap 1 BuscomNathalie GetinoNo ratings yet

- DocxDocument7 pagesDocxPearl Jade YecyecNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionFrom EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNo ratings yet

- (Solved) Based On The Results of Using The Hanging-Drop Method in Figure 2... Course HeroDocument1 page(Solved) Based On The Results of Using The Hanging-Drop Method in Figure 2... Course HerofanchasticommsNo ratings yet

- Maliga 04 Task Performance 1 ARGDocument3 pagesMaliga 04 Task Performance 1 ARGfanchasticommsNo ratings yet

- Chap 56Document15 pagesChap 56fanchasticommsNo ratings yet

- 6428f18a787d8 Problem 20 Castor Arenas and LaurenteDocument4 pages6428f18a787d8 Problem 20 Castor Arenas and LaurentefanchasticommsNo ratings yet

- Physics 1Document8 pagesPhysics 1fanchasticommsNo ratings yet

- FINAL EXAMINATION GartDocument4 pagesFINAL EXAMINATION GartfanchasticommsNo ratings yet

- Exam 2017 Questions and AnswersDocument22 pagesExam 2017 Questions and AnswersfanchasticommsNo ratings yet

- Endo Perio Revalida 2Document19 pagesEndo Perio Revalida 2fanchasticommsNo ratings yet

- Module 5 and Module 6Document3 pagesModule 5 and Module 6fanchasticommsNo ratings yet

- Alorica FinalDocument7 pagesAlorica FinalfanchasticommsNo ratings yet

- FC Notes Part 1Document86 pagesFC Notes Part 1fanchasticommsNo ratings yet

- Week 4 Science 9Document45 pagesWeek 4 Science 9fanchasticommsNo ratings yet

- Examination For Physics 101 in Preparation For Exit ExamDocument28 pagesExamination For Physics 101 in Preparation For Exit ExamfanchasticommsNo ratings yet

- AnswerDocument1 pageAnswerfanchasticommsNo ratings yet

- Corporate Management JurisprudenceDocument37 pagesCorporate Management Jurisprudencegilberthufana446877No ratings yet

- SAP MM Interview Questions......Document3 pagesSAP MM Interview Questions......AnoopBinuNo ratings yet

- 05 Chapter 2Document123 pages05 Chapter 2Masy121No ratings yet

- Blackbook Project On Mutual FundsDocument88 pagesBlackbook Project On Mutual FundsPooja Adhikari100% (2)

- Multiple Choice Questions: Pamantasan NG Cabuyao MTEDocument13 pagesMultiple Choice Questions: Pamantasan NG Cabuyao MTEMaybelle BernalNo ratings yet

- Thesis Arjun Gope PDFDocument225 pagesThesis Arjun Gope PDFJayesh PatelNo ratings yet

- Gce Departmental Accounting - Com PDFDocument5 pagesGce Departmental Accounting - Com PDFShakun ThapaNo ratings yet

- 1 Why Did Mso S Stock Price Decline Due To MarthaDocument1 page1 Why Did Mso S Stock Price Decline Due To MarthaAmit PandeyNo ratings yet

- Swayam Academy - Dow TheoryDocument2 pagesSwayam Academy - Dow TheoryvineetkrsinghNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- P1-43 Comprehensive Business Combination ProblemDocument3 pagesP1-43 Comprehensive Business Combination ProblemkathNo ratings yet

- Assignment 4 AnswersDocument2 pagesAssignment 4 Answerssainath reddy100% (1)

- Project Report On Buy Back of Shares FinalDocument18 pagesProject Report On Buy Back of Shares FinalDivyaModaniNo ratings yet

- Master Directions ODIDocument43 pagesMaster Directions ODImailnevadaNo ratings yet

- (Pistolese) Using Technical Analysis A Step-By-Step Guide To Understanding and Applying Stock Market Charting TechniquesDocument344 pages(Pistolese) Using Technical Analysis A Step-By-Step Guide To Understanding and Applying Stock Market Charting Techniquespmondal909No ratings yet

- Project On RaymondDocument36 pagesProject On Raymonddinesh beharaNo ratings yet

- The Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFDocument5 pagesThe Effect of Asset Structure and Firm Size On Firm Value With Capitalstructure As Intervening Variable 2167 0234 1000298 PDFEraNo ratings yet

- Financial Performance of Ceramics Industry of BangladeshDocument127 pagesFinancial Performance of Ceramics Industry of BangladeshGazi Shahbaz MohammadNo ratings yet

- Notes To The Financial StatementsDocument9 pagesNotes To The Financial StatementsANDREA NATALIA PINZON CHAVARRIONo ratings yet

- Financial Analysis of EBLDocument49 pagesFinancial Analysis of EBLAbu TaherNo ratings yet

- Linear Whitepaper v1.1 A Cross-Chain Compatible, Decentralized Delta-One Asset Protocol With Unlimited LiquidityDocument12 pagesLinear Whitepaper v1.1 A Cross-Chain Compatible, Decentralized Delta-One Asset Protocol With Unlimited LiquidityJuanNo ratings yet

- Richard L Voorhees Financial Disclosure Report For 2010Document8 pagesRichard L Voorhees Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Function of Financial MarketsDocument7 pagesFunction of Financial MarketsNuzhat TasnumNo ratings yet

- BOOK00 Review Capital MarketsDocument5 pagesBOOK00 Review Capital MarketsGenirose CalambroNo ratings yet

- 31 DECAMBER FromDocument8 pages31 DECAMBER FromMd Rajikul IslamNo ratings yet

- Rangkuman Chapter 9 Cost of CapitalDocument4 pagesRangkuman Chapter 9 Cost of CapitalDwi Slamet RiyadiNo ratings yet

- Greenlight Letter Q4Document5 pagesGreenlight Letter Q4ZerohedgeNo ratings yet