Professional Documents

Culture Documents

Chapter 2 Concept Map

Chapter 2 Concept Map

Uploaded by

Ashly Janelian Villamor (Aj)Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 Concept Map

Chapter 2 Concept Map

Uploaded by

Ashly Janelian Villamor (Aj)Copyright:

Available Formats

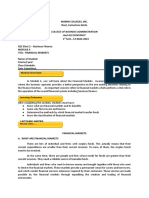

ADVANTAGES OF CREDIT ECONOMY FOUNDATIONS OF CREDIT

BASIS OF CREDIT

1. It generates additional funding

1. Capacity 2. Capital 3. Character 2. It presents opportunity 1. Assistance

4. Collateral 5. Condition 3. It can increase government spending 2. Confidence

6. Currency 7. Confidence 4. It benefits the economy 3. Stability of money

5. It postpones financial outlay

DISADVANTAGES OF

SOURCES OF CREDIT ECONOMY

CREDIT 1. Credit may lead to

CREDIT SYSTEMS: inflation

INDIVIDUAL MONEY LENDERS

STORES

PAWNSHOPS

COMMERCIAL BANKS

2. It can lead to wastage

FUNDAMENTALS,

INVESTMENT BANKS

DEVELOPMENT BANKS of resources

SAVINGS BANKS

RURAL BANKS 3. Unlike cash, it has

EMPLOYEES’ COOPERATIVES OR

pervasive effect

SOURCES & BASES

SINKING FUNDS

CREDIT UNIONS

INSURANCE COMPANIES 4. It can burden next

SOCIAL SECURITY SYSTEM

GOVERNMENT SERVICE INSURANCE

SYSTEM

generation

HOME DEVELOPMENT MUTUAL 5. It can reduce spending

FUND/PAG-IBIG FUND

CLASSIFICATION OF CREDIT CARD

ACCORDING TO CLASSIFICATION OF ADVANTAGES OF

CREDIT CARD

DISADVANTAGES OF

CREDIT CARD

MATURITY

CATEGORY USER

Consumer Credit

Long-term Credit CREDIT CARD Ease of purchase Blowing your budget

Medium-term Credit RELEASE OF THE LOAN SECURITY

PURPOSE Protection of purchases High interest rates and

Short-term Credit 1.Lump sum Secured Credit

1. Agricultural Credit

MANNER OF PAYMENT 2.Installment Unsecured Credit Character Loan

Building a credit line increased debt

2. Industrial Credit Emergencies

Lump sum HOW THE CREDIT IS GRANTED Credit card fraud

3. Commercial Credit

Installment Direct Credit Credit card benefits, points &

4. Real Estate Credit

Discount Loan bonuses

5. Export Credit

You might also like

- Sources of FinanceDocument14 pagesSources of FinanceSatyasnu SutradharNo ratings yet

- Classification and Sources of CreditDocument8 pagesClassification and Sources of Creditgeofrey gepitulan100% (1)

- Non-Agency Mbs PrimerDocument50 pagesNon-Agency Mbs Primerab3rd100% (1)

- Automatic Knife Opening Acknowledgement FormDocument1 pageAutomatic Knife Opening Acknowledgement FormJNRifleworksNo ratings yet

- (Digest) Ganzon v. AndoDocument3 pages(Digest) Ganzon v. AndoJechel TanNo ratings yet

- Private Capital: Myths and RealityDocument15 pagesPrivate Capital: Myths and RealityJose M AlayetoNo ratings yet

- "Credit Appraisal System For Sme Sector": by - Rishav SarkarDocument13 pages"Credit Appraisal System For Sme Sector": by - Rishav Sarkaraparajitha lalasaNo ratings yet

- 01 Konsep Dasar Manajemen KeuanganDocument35 pages01 Konsep Dasar Manajemen Keuangandulli fitriantoNo ratings yet

- Slide - Financing & Venture Capital 2023Document6 pagesSlide - Financing & Venture Capital 2023NrhudadiniNo ratings yet

- Money & Banking PresentationDocument14 pagesMoney & Banking PresentationMuaaz NaeemNo ratings yet

- Credit Risk and Security Documentation For Agri OfficersDocument192 pagesCredit Risk and Security Documentation For Agri OfficersAdnan Adil HussainNo ratings yet

- Chapter 2 - CreditDocument18 pagesChapter 2 - CreditĐỉnh Kout NamNo ratings yet

- Thiruma Valavan A: 10 September 2022Document69 pagesThiruma Valavan A: 10 September 2022Ramesh ReddyNo ratings yet

- E.bs 3rd-Unit 14 BankingDocument52 pagesE.bs 3rd-Unit 14 BankingQuỳnh HunnieNo ratings yet

- Day 1 IPCC M2 - Basic Credit SkillsDocument217 pagesDay 1 IPCC M2 - Basic Credit Skillsaisyahsaad62No ratings yet

- Participation in The Market: A Portion ofDocument5 pagesParticipation in The Market: A Portion ofRonah Abigail BejocNo ratings yet

- LAS BF Q3 Week 5 IGLDocument2 pagesLAS BF Q3 Week 5 IGLdaisymae.buenaventuraNo ratings yet

- Investment DistributionDocument7 pagesInvestment DistributionJessica LanozaNo ratings yet

- Mint 12oct2020 PDFDocument16 pagesMint 12oct2020 PDFchintan desaiNo ratings yet

- Ch.4 Redemption of DebenturesDocument14 pagesCh.4 Redemption of DebenturesNidhi LathNo ratings yet

- Cac Prelim ReviewerDocument3 pagesCac Prelim ReviewerAnna Lyssa BatasNo ratings yet

- Ammetlife - Ceilli (Eng) - Mas 2014Document159 pagesAmmetlife - Ceilli (Eng) - Mas 2014Suthakar SubramaniamNo ratings yet

- Fixed Income Analysis 5Th Edition Cfa Institute Full ChapterDocument67 pagesFixed Income Analysis 5Th Edition Cfa Institute Full Chapterbrandon.mckeel726100% (16)

- Oliver Wyman 2012 State of The Financial Services Industry ReportDocument28 pagesOliver Wyman 2012 State of The Financial Services Industry ReportsidharthNo ratings yet

- CH 4 Introduction To Asset Backed SecuritiesDocument42 pagesCH 4 Introduction To Asset Backed SecuritiesDivya YennamNo ratings yet

- GoalDocument2 pagesGoalVarun JainNo ratings yet

- Fundamentals of Credit We School 05 - 09-2022Document52 pagesFundamentals of Credit We School 05 - 09-2022Sanika SankheNo ratings yet

- SecuritizationDocument34 pagesSecuritizationsanil mehtaNo ratings yet

- 15 - Econ 190.2 - Global Financial CrisisDocument15 pages15 - Econ 190.2 - Global Financial CrisisbrowndeskwhitewallNo ratings yet

- Financial Institutions and ServicesDocument17 pagesFinancial Institutions and Servicesanand.av8rNo ratings yet

- Retail Loans: Thiruma Valavan ADocument57 pagesRetail Loans: Thiruma Valavan Amithilesh tabhaneNo ratings yet

- Banking Ope Art IonsDocument26 pagesBanking Ope Art IonsPurti TiwariNo ratings yet

- Banking Ope Art IonsDocument26 pagesBanking Ope Art IonsChinmay KhetanNo ratings yet

- Sme Finance For Nise: Sbicrm Gurugram PresentationDocument66 pagesSme Finance For Nise: Sbicrm Gurugram PresentationShadifNo ratings yet

- Debt Product Suite - Upto 1 Yr - March 2023Document17 pagesDebt Product Suite - Upto 1 Yr - March 2023DeepakNo ratings yet

- Aglietta (2008)Document4 pagesAglietta (2008)Lucas BalestraNo ratings yet

- GEC Elect 2 Module 4Document10 pagesGEC Elect 2 Module 4Aira Mae Quinones OrendainNo ratings yet

- General Banking LawDocument62 pagesGeneral Banking LawwhatrichNo ratings yet

- Business Finance ReviewerDocument17 pagesBusiness Finance ReviewerkassyvsNo ratings yet

- Concept of Securitisation of Standard Asset, Anti-Money Laundering & CibilDocument32 pagesConcept of Securitisation of Standard Asset, Anti-Money Laundering & CibilGurpreet kaurNo ratings yet

- Bba Elective 3-Unit 1Document22 pagesBba Elective 3-Unit 1Pridhvi Raj ReddyNo ratings yet

- Banking Frauds in IndiaDocument12 pagesBanking Frauds in IndiaxyzNo ratings yet

- 1 INVEST101 Group 4 Bond FundamentalsDocument36 pages1 INVEST101 Group 4 Bond Fundamentalsbubblensuds.phNo ratings yet

- Ra 8791 Gen Bank Law of 2000Document60 pagesRa 8791 Gen Bank Law of 2000Joseph MangahasNo ratings yet

- Chapter Two The Financial System2 - Eco551Document25 pagesChapter Two The Financial System2 - Eco551Hafiz akbarNo ratings yet

- PDF 20230915 183638 0000Document28 pagesPDF 20230915 183638 0000niks.kat25No ratings yet

- Transferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoDocument15 pagesTransferring Funds From Lenders To Borrowers: By: Myla Jenn L. ConstantinoIvy RosalesNo ratings yet

- Securitisation of Micro Credit ReceivablesDocument4 pagesSecuritisation of Micro Credit ReceivablesNidhi BothraNo ratings yet

- Formation EDHEC 2021 Market Risk v1Document67 pagesFormation EDHEC 2021 Market Risk v1林木田No ratings yet

- Shopping For The Right Bank AccountDocument2 pagesShopping For The Right Bank AccountSam ONiNo ratings yet

- Stableton Alternative Lending (USD) Strategy - Factsheet (EN) - 2021-11Document8 pagesStableton Alternative Lending (USD) Strategy - Factsheet (EN) - 2021-11David CartellaNo ratings yet

- Loan From Commercial BankDocument7 pagesLoan From Commercial Bankfsvzfzw7kcNo ratings yet

- Final Project 786Document52 pagesFinal Project 786Pranav ViraNo ratings yet

- AB Financial Awareness Capsule For RRB SO Officer Scale 2 PDFDocument95 pagesAB Financial Awareness Capsule For RRB SO Officer Scale 2 PDFsanat samanta100% (2)

- 08 Bank Guarantee & Letter of CreditDocument59 pages08 Bank Guarantee & Letter of CreditishujyotianandNo ratings yet

- 13 8B-3 Special Attachment Transcript FS Conventional BanksDocument2 pages13 8B-3 Special Attachment Transcript FS Conventional BanksAneke PowaNo ratings yet

- General Banking LawDocument62 pagesGeneral Banking LawKristine FayeNo ratings yet

- Risk ManagementDocument15 pagesRisk Managementvaibhav surekaNo ratings yet

- Factors Influencing The Choice of Marketable Securities - Chapter 18Document23 pagesFactors Influencing The Choice of Marketable Securities - Chapter 18Zairah Lyn SaysonNo ratings yet

- An Introduction To Private Credit 1692229676Document9 pagesAn Introduction To Private Credit 1692229676aurorameiNo ratings yet

- CWJ Banking AwarenessDocument201 pagesCWJ Banking AwarenessManileeNo ratings yet

- The Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaFrom EverandThe Design of Micro Credit Contracts and Micro Enterprise Finance in UgandaNo ratings yet

- TheFundamentalsofAccounting 10004358Document445 pagesTheFundamentalsofAccounting 10004358Ashly Janelian Villamor (Aj)No ratings yet

- Sts Historical AntecedentsDocument33 pagesSts Historical AntecedentsAshly Janelian Villamor (Aj)No ratings yet

- 1Document1 page1Ashly Janelian Villamor (Aj)No ratings yet

- Downloadfile JPGDocument1 pageDownloadfile JPGAshly Janelian Villamor (Aj)No ratings yet

- STI Holdings SEC Form 17 A For The Fiscal Year Ended June 30 2022 PSEDocument145 pagesSTI Holdings SEC Form 17 A For The Fiscal Year Ended June 30 2022 PSEAshly Janelian Villamor (Aj)No ratings yet

- 4 PshealthDocument1 page4 PshealthAshly Janelian Villamor (Aj)No ratings yet

- Acctg. 111 Course Guide - Fundamentals of Accounting 1Document12 pagesAcctg. 111 Course Guide - Fundamentals of Accounting 1Ashly Janelian Villamor (Aj)No ratings yet

- Entrep Act1Document1 pageEntrep Act1Ashly Janelian Villamor (Aj)No ratings yet

- Ebcl Part 1Document72 pagesEbcl Part 1Aman GuttaNo ratings yet

- Assignment No.9Document6 pagesAssignment No.9Kim NgânNo ratings yet

- Deed of SaleDocument2 pagesDeed of SaleSu SanNo ratings yet

- Telus Bill JanDocument4 pagesTelus Bill JanDee LammNo ratings yet

- SITXHRM002 Roster Staff Student Guide V1.1 1 .Docx 1 PDFDocument91 pagesSITXHRM002 Roster Staff Student Guide V1.1 1 .Docx 1 PDFNicolas EscobarNo ratings yet

- Letter Writing-Placing An OrderDocument12 pagesLetter Writing-Placing An OrderArudra NarangNo ratings yet

- Andrew Gardner BrownDocument22 pagesAndrew Gardner BrownAna Carolina ZappaNo ratings yet

- WEB Application Security: Cse-ADocument12 pagesWEB Application Security: Cse-ASantoshi AlekhyaNo ratings yet

- PLB Phe Bphe enDocument28 pagesPLB Phe Bphe enCY LeeNo ratings yet

- Innovative Approach in Fertiliser Production at GSFC SikkaDocument8 pagesInnovative Approach in Fertiliser Production at GSFC SikkaPinak VadherNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Receiving User GuideDocument76 pagesReceiving User GuideKamal MeshramNo ratings yet

- Prohibition Regarding WagesDocument18 pagesProhibition Regarding WagesJM BanaNo ratings yet

- IDBI Bank: This Article Has Multiple Issues. Please HelpDocument15 pagesIDBI Bank: This Article Has Multiple Issues. Please HelpmayurivinothNo ratings yet

- FIN301 - Financial ManagementDocument8 pagesFIN301 - Financial ManagementSHANILA AHMED KHANNo ratings yet

- Distribution Management SimDocument93 pagesDistribution Management Simlorvina2yna2ramirezNo ratings yet

- KLM Hazop Rev 3 PDFDocument3 pagesKLM Hazop Rev 3 PDFWisam HusseinNo ratings yet

- Theint Thazin Win (MBF - 66)Document57 pagesTheint Thazin Win (MBF - 66)htethtethlaingNo ratings yet

- Esenbok City Estate EpeDocument3 pagesEsenbok City Estate EpeClifford PaNo ratings yet

- Proposed CEMEA 2022 2Document226 pagesProposed CEMEA 2022 2Jayme-Lea VanderschootNo ratings yet

- NWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapDocument10 pagesNWC PM Manual - Road Map NWC PM Manual - Road Map NWC PM Manual - Road MapEng hassan hussienNo ratings yet

- Lectura Duarte-Vidal Et Al. 2021Document31 pagesLectura Duarte-Vidal Et Al. 2021Daniel Vargas ToroNo ratings yet

- Gemini Air CargoDocument34 pagesGemini Air CargoMichael PietrobonoNo ratings yet

- Scaffolding - Pre-Start Risk Assessment Checklist V1.3 (NOT YET DISTRIBUTED)Document1 pageScaffolding - Pre-Start Risk Assessment Checklist V1.3 (NOT YET DISTRIBUTED)Aidan PitsisNo ratings yet

- Standard Chartered BankDocument31 pagesStandard Chartered BankAl Imran100% (3)

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDPradeepNo ratings yet

- Tech Mahindra LTD: by Apanshula Mishra Vijetta ThakurDocument13 pagesTech Mahindra LTD: by Apanshula Mishra Vijetta ThakurApanshula Anantabh MishraNo ratings yet

- Assignment Banking Law, Shubham Singh Kirar IX Sem, BBALLBDocument7 pagesAssignment Banking Law, Shubham Singh Kirar IX Sem, BBALLBShubham Singh KirarNo ratings yet