Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 views2023214232203622SRO178

2023214232203622SRO178

Uploaded by

Muhammad EhsanFBR SRO on Federal excise duty

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 201961121607202CIGARETTEENOTIFICATION--11.06.2019Document1 page201961121607202CIGARETTEENOTIFICATION--11.06.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- 2019112716112814206SRO1461OF2019DATED27.11.2019Document1 page2019112716112814206SRO1461OF2019DATED27.11.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- 202352155571455sro 515 of 2023Document1 page202352155571455sro 515 of 2023Muhammad EhsanNo ratings yet

- SRO774 2023-Amendment SRO 645 2018-24-05-2018Document1 pageSRO774 2023-Amendment SRO 645 2018-24-05-2018owaisharifNo ratings yet

- 202311614112317194cgo03 2023Document1 page202311614112317194cgo03 2023Farhan MalikNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- Government of Pakistan Revenue Division Federal Board of RevenueDocument1 pageGovernment of Pakistan Revenue Division Federal Board of RevenuehardajhbfNo ratings yet

- Ce18 2023Document1 pageCe18 2023Aravind GovindarajaluNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- (I) 20123Document80 pages(I) 20123Muddassir AliNo ratings yet

- Open Cell - 5% - 9 ConditionDocument1 pageOpen Cell - 5% - 9 Conditionbe21513dNo ratings yet

- Notification (Sales Tax) S.R.O. 283 (I) /2010. in Exercise of The Powers Conferred by Sections 30 andDocument1 pageNotification (Sales Tax) S.R.O. 283 (I) /2010. in Exercise of The Powers Conferred by Sections 30 andayazkhan7979No ratings yet

- Notificatiion (Sales Tax)Document1 pageNotificatiion (Sales Tax)Shoaib UsmanNo ratings yet

- Notification No.7/2013-Central Excise: Vide G.S.R No.471 (E), DatedDocument2 pagesNotification No.7/2013-Central Excise: Vide G.S.R No.471 (E), Datedpatelpratik1972No ratings yet

- 20221111413947880SRO44-2022Document1 page20221111413947880SRO44-2022Chaudhary Mehtab Shaukat AdvNo ratings yet

- CST 24 2024Document2 pagesCST 24 2024Darshan BambNo ratings yet

- Noti Rate Utgst 4 2017Document2 pagesNoti Rate Utgst 4 2017sridharanNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- 20196291962542408694of2019dated29 06 2019Document1 page20196291962542408694of2019dated29 06 2019bilalsiddiqi1048No ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- Customs Notification 44 - 2023Document1 pageCustoms Notification 44 - 2023Raja SinghNo ratings yet

- 2019629196324639696OF2019DATED29.06.2019Document1 page2019629196324639696OF2019DATED29.06.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- 10 2018 Notification Dated 02 Feb 2018Document2 pages10 2018 Notification Dated 02 Feb 2018vinodNo ratings yet

- NotificationDocument1 pageNotificationNewsinc 24No ratings yet

- 2007 Sro 880Document3 pages2007 Sro 880Waqas ShaheenNo ratings yet

- Act No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NDocument2 pagesAct No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NERSKINE LONEYNo ratings yet

- SRO - ST - Increase in Retailer's ScopeDocument1 pageSRO - ST - Increase in Retailer's ScopeMuhammad Khalid Hafeez RaoNo ratings yet

- Ce 0713Document1 pageCe 0713yagayNo ratings yet

- 2023121216125942252SRO1525Document1 page2023121216125942252SRO1525BILWANI CONo ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- Circular 2 2023Document1 pageCircular 2 2023NESL WebsiteNo ratings yet

- csnt67 2013Document1 pagecsnt67 2013stephin k jNo ratings yet

- Appendix II Obc FormatDocument2 pagesAppendix II Obc FormatAnbazhagan AnnaduraiNo ratings yet

- (To Be Published in Part Ii, Section 3, Sub-Section (I) of The Gazette of India, Extraordinary)Document1 page(To Be Published in Part Ii, Section 3, Sub-Section (I) of The Gazette of India, Extraordinary)Arul Kumar RajendranNo ratings yet

- NotificationDocument1 pageNotificationsanjeev1910No ratings yet

- Permen Keu 191PMK0102022 2022 enDocument4 pagesPermen Keu 191PMK0102022 2022 enAndina RahmaniarNo ratings yet

- 20218416889385SRO982OF2021DATED04.08.2021--RESCISSIONOFSRO992OF2019,DATED04.09.2019Document1 page20218416889385SRO982OF2021DATED04.08.2021--RESCISSIONOFSRO992OF2019,DATED04.09.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- Notification 14Document11 pagesNotification 14Amol MoreNo ratings yet

- PUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY PART II SECTION 3 SUB-SECTION (I) DATED 1Document2 pagesPUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY PART II SECTION 3 SUB-SECTION (I) DATED 1TechnicalNo ratings yet

- OBC ReservationDocument2 pagesOBC ReservationBasanti KI DhannoNo ratings yet

- OBC ReservationDocument2 pagesOBC ReservationpranavNo ratings yet

- GST CT 28 2023 5Document1 pageGST CT 28 2023 5cadeepaksingh4No ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- This Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994Document1 pageThis Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994T Ankamma RaoNo ratings yet

- csnt69 2013Document2 pagescsnt69 2013stephin k jNo ratings yet

- 20228302185617813SRO1637OF2022DATED30.08.2022--EXEMPTIONFROMFEDONGOODSASCERTIFIEDBYNDMAANDPDMAFORFLOODAFFECTEESDocument1 page20228302185617813SRO1637OF2022DATED30.08.2022--EXEMPTIONFROMFEDONGOODSASCERTIFIEDBYNDMAANDPDMAFORFLOODAFFECTEESChaudhary Mehtab Shaukat AdvNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- DA DBM NTA Joint Memorandum Circular No 2020 001Document9 pagesDA DBM NTA Joint Memorandum Circular No 2020 001Eva C. Domingo-ManibogNo ratings yet

- 02.02 (Full Day)Document252 pages02.02 (Full Day)Saurabh JhaNo ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- csnt22 2019Document1 pagecsnt22 2019jayendraNo ratings yet

- 2201 Ir Ii 20238182023 - 34404 - PMDocument2 pages2201 Ir Ii 20238182023 - 34404 - PMshaheer salehNo ratings yet

- Customs Notification 33-2022Document2 pagesCustoms Notification 33-2022Raja SinghNo ratings yet

- csnt16 2022Document2 pagescsnt16 2022accountsNo ratings yet

2023214232203622SRO178

2023214232203622SRO178

Uploaded by

Muhammad Ehsan0 ratings0% found this document useful (0 votes)

2 views1 pageFBR SRO on Federal excise duty

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFBR SRO on Federal excise duty

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views1 page2023214232203622SRO178

2023214232203622SRO178

Uploaded by

Muhammad EhsanFBR SRO on Federal excise duty

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

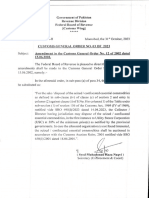

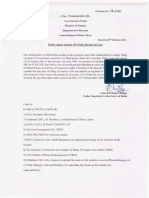

Government of Pakistan

Federal Board of Revenue

(Revenue Division)

*****

Islamabad, 14th February, 2023.

Notification

(Federal Excise)

S.R.O. 178(1)/2023.— In exercise of the powers conferred by clause (b) of

sub-section (3) of section 3 of the Federal Excise Act, 2005, the Federal Board of

Revenue is pleased to direct that the excise duty shall be levied and collected on

fixed basis at the rates specified in column (4) of the Table below on the goods

specified in column (2) of the said Table falling under Pakistan Customs Tariff

heading specified in column (3) thereof, namely:—

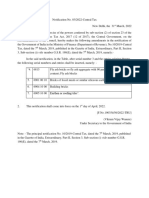

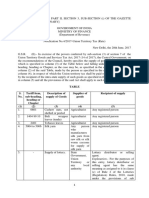

TABLE

S.No. Description of Goods Heading/ Rate of duty

sub-heading

Number

(1) (2) (3) (4)

Locally produced cigarettes if 24.02 Rupees sixteen thousand

their on-pack printed retail five hundred per thousand

price exceeds nine thousand cigarettes

rupeeEH per thousand

cigarettes.

Locally produced cigarettes if 24.02 Rupees five thousand and

their on-pack printed retail fifty per thousand

price does not exceed nine cigarettes

thousand rupees per thousand

cigarettes.

No. 5/3-STB/20231

41 I (3/0/7.1 2

(A tar Abbas) /

Secretary (ST&FE-Budget)

You might also like

- 201961121607202CIGARETTEENOTIFICATION--11.06.2019Document1 page201961121607202CIGARETTEENOTIFICATION--11.06.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- 2019112716112814206SRO1461OF2019DATED27.11.2019Document1 page2019112716112814206SRO1461OF2019DATED27.11.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- 202352155571455sro 515 of 2023Document1 page202352155571455sro 515 of 2023Muhammad EhsanNo ratings yet

- SRO774 2023-Amendment SRO 645 2018-24-05-2018Document1 pageSRO774 2023-Amendment SRO 645 2018-24-05-2018owaisharifNo ratings yet

- 202311614112317194cgo03 2023Document1 page202311614112317194cgo03 2023Farhan MalikNo ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- Government of Pakistan Revenue Division Federal Board of RevenueDocument1 pageGovernment of Pakistan Revenue Division Federal Board of RevenuehardajhbfNo ratings yet

- Ce18 2023Document1 pageCe18 2023Aravind GovindarajaluNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- (I) 20123Document80 pages(I) 20123Muddassir AliNo ratings yet

- Open Cell - 5% - 9 ConditionDocument1 pageOpen Cell - 5% - 9 Conditionbe21513dNo ratings yet

- Notification (Sales Tax) S.R.O. 283 (I) /2010. in Exercise of The Powers Conferred by Sections 30 andDocument1 pageNotification (Sales Tax) S.R.O. 283 (I) /2010. in Exercise of The Powers Conferred by Sections 30 andayazkhan7979No ratings yet

- Notificatiion (Sales Tax)Document1 pageNotificatiion (Sales Tax)Shoaib UsmanNo ratings yet

- Notification No.7/2013-Central Excise: Vide G.S.R No.471 (E), DatedDocument2 pagesNotification No.7/2013-Central Excise: Vide G.S.R No.471 (E), Datedpatelpratik1972No ratings yet

- 20221111413947880SRO44-2022Document1 page20221111413947880SRO44-2022Chaudhary Mehtab Shaukat AdvNo ratings yet

- CST 24 2024Document2 pagesCST 24 2024Darshan BambNo ratings yet

- Noti Rate Utgst 4 2017Document2 pagesNoti Rate Utgst 4 2017sridharanNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- 20196291962542408694of2019dated29 06 2019Document1 page20196291962542408694of2019dated29 06 2019bilalsiddiqi1048No ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- Customs Notification 44 - 2023Document1 pageCustoms Notification 44 - 2023Raja SinghNo ratings yet

- 2019629196324639696OF2019DATED29.06.2019Document1 page2019629196324639696OF2019DATED29.06.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- 10 2018 Notification Dated 02 Feb 2018Document2 pages10 2018 Notification Dated 02 Feb 2018vinodNo ratings yet

- NotificationDocument1 pageNotificationNewsinc 24No ratings yet

- 2007 Sro 880Document3 pages2007 Sro 880Waqas ShaheenNo ratings yet

- Act No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NDocument2 pagesAct No. 1 of 2023: Legal Supplement Part A To The "Trinidad and Tobago Gazette", Vol. 62, NERSKINE LONEYNo ratings yet

- SRO - ST - Increase in Retailer's ScopeDocument1 pageSRO - ST - Increase in Retailer's ScopeMuhammad Khalid Hafeez RaoNo ratings yet

- Ce 0713Document1 pageCe 0713yagayNo ratings yet

- 2023121216125942252SRO1525Document1 page2023121216125942252SRO1525BILWANI CONo ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- Circular 2 2023Document1 pageCircular 2 2023NESL WebsiteNo ratings yet

- csnt67 2013Document1 pagecsnt67 2013stephin k jNo ratings yet

- Appendix II Obc FormatDocument2 pagesAppendix II Obc FormatAnbazhagan AnnaduraiNo ratings yet

- (To Be Published in Part Ii, Section 3, Sub-Section (I) of The Gazette of India, Extraordinary)Document1 page(To Be Published in Part Ii, Section 3, Sub-Section (I) of The Gazette of India, Extraordinary)Arul Kumar RajendranNo ratings yet

- NotificationDocument1 pageNotificationsanjeev1910No ratings yet

- Permen Keu 191PMK0102022 2022 enDocument4 pagesPermen Keu 191PMK0102022 2022 enAndina RahmaniarNo ratings yet

- 20218416889385SRO982OF2021DATED04.08.2021--RESCISSIONOFSRO992OF2019,DATED04.09.2019Document1 page20218416889385SRO982OF2021DATED04.08.2021--RESCISSIONOFSRO992OF2019,DATED04.09.2019Chaudhary Mehtab Shaukat AdvNo ratings yet

- Notification 14Document11 pagesNotification 14Amol MoreNo ratings yet

- PUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY PART II SECTION 3 SUB-SECTION (I) DATED 1Document2 pagesPUBLISHED IN THE GAZETTE OF INDIA EXTRAORDINARY PART II SECTION 3 SUB-SECTION (I) DATED 1TechnicalNo ratings yet

- OBC ReservationDocument2 pagesOBC ReservationBasanti KI DhannoNo ratings yet

- OBC ReservationDocument2 pagesOBC ReservationpranavNo ratings yet

- GST CT 28 2023 5Document1 pageGST CT 28 2023 5cadeepaksingh4No ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- This Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994Document1 pageThis Notification Amends Notification No 62/94-Customs (NT), Dated The 21st November, 1994T Ankamma RaoNo ratings yet

- csnt69 2013Document2 pagescsnt69 2013stephin k jNo ratings yet

- 20228302185617813SRO1637OF2022DATED30.08.2022--EXEMPTIONFROMFEDONGOODSASCERTIFIEDBYNDMAANDPDMAFORFLOODAFFECTEESDocument1 page20228302185617813SRO1637OF2022DATED30.08.2022--EXEMPTIONFROMFEDONGOODSASCERTIFIEDBYNDMAANDPDMAFORFLOODAFFECTEESChaudhary Mehtab Shaukat AdvNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- DA DBM NTA Joint Memorandum Circular No 2020 001Document9 pagesDA DBM NTA Joint Memorandum Circular No 2020 001Eva C. Domingo-ManibogNo ratings yet

- 02.02 (Full Day)Document252 pages02.02 (Full Day)Saurabh JhaNo ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- csnt22 2019Document1 pagecsnt22 2019jayendraNo ratings yet

- 2201 Ir Ii 20238182023 - 34404 - PMDocument2 pages2201 Ir Ii 20238182023 - 34404 - PMshaheer salehNo ratings yet

- Customs Notification 33-2022Document2 pagesCustoms Notification 33-2022Raja SinghNo ratings yet

- csnt16 2022Document2 pagescsnt16 2022accountsNo ratings yet