Professional Documents

Culture Documents

Deduction From Wages

Deduction From Wages

Uploaded by

evawambs0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

Deduction from wages

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageDeduction From Wages

Deduction From Wages

Uploaded by

evawambsCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

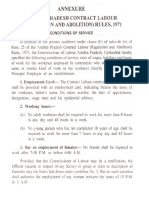

Deduction from wages. 6.

(1) Notwithstanding subsection (1) of section 4, an emploer may deduct from

the wages of his employee - (a) any amount due from the employee as a contribution to any provident

fund or superannuation scheme or any other scheme approved by the Labour Commissioner to which

the employee has agreed to contribute; (b) a reasonable amount for any damage done to, or loss of , any

property lawfully in the possession or custody of the employer occasioned by the wilful default of the

employee; (c) an amount not exceeding one day's wages in respect of each working day for the whole of

which the employee, without leave or other lawful cause, absents himself Employment Act, Cap 226

www.kenyalaw.org from the premises of the employer or other place proper and appointed for the

performance of his work; (d) an amount equal to the amount of any shortage of money arising through

the negligence or dishonesty of the employee whose contract of service provides specifically for his

being entrusted with the receipt, custody and payment of money; (e) any amount paid to the employee

in error as wages in excess of the amount of wages due to him; (f) any amount the deduction of which is

authorized by any written law for the time being in force; (g) any amount in which the employer has no

beneficial interest, whether direct or indirect, and which the employee has requested the employer in

writing to deduct from his wages; (h) an amount due and payable by the employee under and in

accordance with the terms of an agreement in writing, by way of repayment or part repayment of a loan

of money made to him by the employer, not exceeding fifty per cent of the wages payable to that

employee after the deduction of all such other amounts as may be due from him under this section; (i)

such other amounts as the Minister may prescribe. (2) No deduction shall be made by an employer from

the wages payable to an employee as an advance of wages in consideration of, or as a reward for, the

provision of employment for that employee, or for retaining the employee in employment. (3) Without

prejudice to any right of recovery of any debt due, and notwithstanding the provisions of any other

written law, the total amount of all deductions which, under the provisions of subsection (1), may be

made by an employer from the wages of his employee at any one time shall not exceed one-half of such

wages or such additional or other amount as may be prescribed by the Minister either generally or in

relation to any specified employer or employee or class of employers or employees or any trade or

industry. Leave with full pay. 7. (1) Every employee shall be entitled - (a) after every twelve consecutive

months of service with his employer to not less than twenty-one working days of leave with full pay; (b)

where employment is terminated after the completion of two or more consecutive months of service

during any twelve months' leave-earning period, to not less than one and three-quarter days of leave

with full pay, in respect of each completed month of service in that period, to be taken consecutively. (2)

A woman employee shall be entitled to two months maternity leave with full pay: Provided that a

woman who has taken two months maternity leave shall forfeit her Employment Act, Cap 226

www.kenyalaw.org annual leave in that year. (3) After two consecutive months of service with his

employer an employee shall be entitled to sick leave of not less than seven days with full pay, and

thereafter to seek leave of seven days with half pay, in each period of twelve consecutive months of

service, subject to production by the employee of a certificate of incapacity to work signed by a duly

qualified medical practitioner or a person acting on the practitioner's behalf in charge of a dispensary or

medical aid centre. (4) The leave referred to in subsection (1) shall be additional to all public holidays,

weekly rest days and any sick leave, whether fixed by law or agreement, in respect of which an employee

is not required to work. (5) For the purposes of this section "full pay" includes wages and salary at the

basic rate excluding any deductions from wages made by virtue of section 6.

You might also like

- Deferred Compensation OutlineDocument45 pagesDeferred Compensation OutlineEli ColmeneroNo ratings yet

- Kahn Probs and AnswersDocument96 pagesKahn Probs and AnswersAdam DicksonNo ratings yet

- Bangladesh Labour ActDocument12 pagesBangladesh Labour ActA karim50% (2)

- Wage Law Third ClassDocument4 pagesWage Law Third ClassKumaar utsavNo ratings yet

- Fourth ScheduleDocument8 pagesFourth Schedulegourav bhuddiNo ratings yet

- Q1.Define Wages As Per The Payment of Wages Act. Answer-: But Does Not IncludeDocument6 pagesQ1.Define Wages As Per The Payment of Wages Act. Answer-: But Does Not IncludeKhushi DbNo ratings yet

- Israel Wage Protection LawDocument12 pagesIsrael Wage Protection LawShohamnnf100% (1)

- Form V: Abstract of The Payment of Wages Act, 1936Document4 pagesForm V: Abstract of The Payment of Wages Act, 1936jovioNo ratings yet

- The Payment of Gratuity Act, 1972: Prof. Priyanka NagoriDocument21 pagesThe Payment of Gratuity Act, 1972: Prof. Priyanka Nagorishilpatiwari1989No ratings yet

- Abstract Under Minimum Wages ActDocument6 pagesAbstract Under Minimum Wages ActRAMESHWARNo ratings yet

- The First Schedule Part B Recognised Provident Funds (See Section 2 (52) )Document5 pagesThe First Schedule Part B Recognised Provident Funds (See Section 2 (52) )Zahir UddinNo ratings yet

- Recognized PFDocument8 pagesRecognized PFYousaf GillaniNo ratings yet

- Form - I - (See Rule 22) Abstracts of The Minimum Wages Act 1948, and The Rules Made ThereunderDocument6 pagesForm - I - (See Rule 22) Abstracts of The Minimum Wages Act 1948, and The Rules Made ThereunderNethaji MettNo ratings yet

- PAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheDocument4 pagesPAYMENT OF GRATUITY. - (1) Gratuity Shall Be Payable To An Employee On TheVenkata Rao NaiduNo ratings yet

- Abstract of Minimum WagesDocument6 pagesAbstract of Minimum WagesAkhil JamesNo ratings yet

- Describe The Scope of Payment of Gratuity Act 1972Document3 pagesDescribe The Scope of Payment of Gratuity Act 1972Jaspreet SinghNo ratings yet

- Abstract of The Minimum Wages Act, 1948Document4 pagesAbstract of The Minimum Wages Act, 1948Shabir TrambooNo ratings yet

- Abstract of Minimum Wages ActDocument7 pagesAbstract of Minimum Wages ActManikanta SatishNo ratings yet

- Reading Material - Payment of Gratuity ActDocument4 pagesReading Material - Payment of Gratuity ActKaushik BoseNo ratings yet

- Part II Gratuity Act 1972Document9 pagesPart II Gratuity Act 1972Kanishk ChaddhaNo ratings yet

- Form V - Abstract of Payment of Wages Act, 1936 and Rules - Taxguru - inDocument5 pagesForm V - Abstract of Payment of Wages Act, 1936 and Rules - Taxguru - iner_amit_hrNo ratings yet

- Abstract of The Payment of Wages ActDocument3 pagesAbstract of The Payment of Wages ActBiswajit Behera100% (1)

- Termination & Lay-Off Benefits in MalaysiaDocument6 pagesTermination & Lay-Off Benefits in MalaysiaSanchit GargNo ratings yet

- Employment Act Chapter 91 Part III - 23 - Payment On Termination by EmployeeDocument5 pagesEmployment Act Chapter 91 Part III - 23 - Payment On Termination by EmployeeTaylor W. HickemNo ratings yet

- The Fourth ScheduleDocument9 pagesThe Fourth Schedulezubin galaNo ratings yet

- Bill3316 2Document7 pagesBill3316 2Samuel JeebanNo ratings yet

- Contract Labour Act GistDocument4 pagesContract Labour Act Gistvikas2519No ratings yet

- WcactDocument5 pagesWcactRajendra KumarNo ratings yet

- Abstract On Min Wages Act PDFDocument4 pagesAbstract On Min Wages Act PDFppppnnnnpppNo ratings yet

- "Salary", "Perquisite" and "Profits in Lieu of Salary" Defined. 17Document5 pages"Salary", "Perquisite" and "Profits in Lieu of Salary" Defined. 17vineet_agrawal_ca2574No ratings yet

- FORM IXA Abstract of The Minimum Wages Act, 1948Document7 pagesFORM IXA Abstract of The Minimum Wages Act, 1948Avinash Kumar PandeyNo ratings yet

- Form U - Abstract of Payment of Gratuity Act, 1972 - Taxguru - inDocument6 pagesForm U - Abstract of Payment of Gratuity Act, 1972 - Taxguru - iner_amit_hrNo ratings yet

- Gratuity Act 1972Document17 pagesGratuity Act 1972princep4545No ratings yet

- The Sixth ScheduleDocument15 pagesThe Sixth Schedulejunaid khanNo ratings yet

- 04 The Payment of Gratuity ActDocument22 pages04 The Payment of Gratuity ActDharani KumarNo ratings yet

- Eobi Loan RegDocument6 pagesEobi Loan RegEOBI FEDERATION100% (1)

- Topic Six - Work Injury Benefits Act 2007Document8 pagesTopic Six - Work Injury Benefits Act 2007Scolanne WagicheruNo ratings yet

- Liquidation of Companies PDFDocument8 pagesLiquidation of Companies PDFTippanna GodiNo ratings yet

- 1st Schedule (Part ABC)Document8 pages1st Schedule (Part ABC)Tareq ChowdhuryNo ratings yet

- Payment of Wages Act, 1936: Regular PayDocument5 pagesPayment of Wages Act, 1936: Regular PayKavipriyaNo ratings yet

- AP Contract Labour Rules 1971Document6 pagesAP Contract Labour Rules 1971siddhantkhetawatNo ratings yet

- 1 1 Employees PF ActDocument9 pages1 1 Employees PF ActSudha SatishNo ratings yet

- PaymentofgratuityactDocument19 pagesPaymentofgratuityactMona Sharma DudhaleNo ratings yet

- Annual Leave With WagesDocument12 pagesAnnual Leave With WagesPrachi DeoupadhyeNo ratings yet

- Employees Deposit Linked Insurance Scheme, EDLIS Scheme, 1976Document6 pagesEmployees Deposit Linked Insurance Scheme, EDLIS Scheme, 1976paragranjitNo ratings yet

- Abstract of Labour LawsDocument4 pagesAbstract of Labour LawsVishwesh KoundilyaNo ratings yet

- Long Service Leave Act 1955 NSWDocument27 pagesLong Service Leave Act 1955 NSWcheekychops12No ratings yet

- Payment of Gratuity ActDocument22 pagesPayment of Gratuity Acta.ravi100% (1)

- Abstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesDocument3 pagesAbstract of The Karnataka PAYMENT of WAGES ACT 1963 & RulesShabir Tramboo100% (1)

- Abstract of Payment of Gratuity Act & Rules, 1972, Form UDocument4 pagesAbstract of Payment of Gratuity Act & Rules, 1972, Form UPankaj Mehra100% (2)

- Eligibility For Bonus: Thirty Working DaysDocument17 pagesEligibility For Bonus: Thirty Working DaysAli AsgarNo ratings yet

- Prateek-Workman Compensation Act, 1923Document14 pagesPrateek-Workman Compensation Act, 1923Prateek GeraNo ratings yet

- The Payment of Gratuity Act, 1972Document30 pagesThe Payment of Gratuity Act, 1972Saket DokaniaNo ratings yet

- Section - 36Document5 pagesSection - 36adipawar2824No ratings yet

- Unit 2 - Income From SalaryDocument14 pagesUnit 2 - Income From SalaryRakhi DhamijaNo ratings yet

- LEAVEDocument7 pagesLEAVEVijaykumar PandeyNo ratings yet

- The Child LabourDocument6 pagesThe Child LabourJithin KrishnanNo ratings yet

- ESIC Act, RulesDocument50 pagesESIC Act, RulesmanishsoniesicinNo ratings yet

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

- Smart Saver Final Write UpDocument11 pagesSmart Saver Final Write UpJOREM PATRICK ELUNGATNo ratings yet

- Accounting II - Assignment 1Document5 pagesAccounting II - Assignment 1Hawultu AsresieNo ratings yet

- Math 11 ABM Business Math Q2 Week 3Document18 pagesMath 11 ABM Business Math Q2 Week 3Flordilyn DichonNo ratings yet

- Candidate PackDocument38 pagesCandidate PackOvidiu RotariuNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsPrince kumarNo ratings yet

- 3-Pit ExercisesDocument5 pages3-Pit ExercisesNguyen Hoang Tram AnhNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Shs Genmath q2 w4 Studentsversion v1Document10 pagesShs Genmath q2 w4 Studentsversion v1Hanna Zaina AlveroNo ratings yet

- 01 Problem SetDocument4 pages01 Problem Setorela123123No ratings yet

- MAHARASHTRA-CIVIL-SERVICES-LEAVE-RULES 1981 EnglishDocument48 pagesMAHARASHTRA-CIVIL-SERVICES-LEAVE-RULES 1981 EnglishNilesh BhoyarNo ratings yet

- Real Time Information User GuideDocument44 pagesReal Time Information User GuideDinkan TalesNo ratings yet

- Taxation of Banks Financial InstittutionsDocument7 pagesTaxation of Banks Financial InstittutionsTriila manillaNo ratings yet

- Judy Njambi Ndichu Mba 2017Document93 pagesJudy Njambi Ndichu Mba 2017neha singhNo ratings yet

- Glossary Accounting1Document125 pagesGlossary Accounting1salshaNo ratings yet

- (Company Name/Logo Here) : Sales Incentive Compensation Plan DocumentDocument9 pages(Company Name/Logo Here) : Sales Incentive Compensation Plan DocumentashokNo ratings yet

- FOMB - Statement - POADocument3 pagesFOMB - Statement - POAFran Javier SolerNo ratings yet

- DOL RDWSU 2020 Form 5500Document205 pagesDOL RDWSU 2020 Form 5500seanredmondNo ratings yet

- C.S.A (Customer Service Associate) : For TheDocument9 pagesC.S.A (Customer Service Associate) : For Theanmol singhNo ratings yet

- Taxation ProjectDocument15 pagesTaxation ProjectTanya SinglaNo ratings yet

- ANZ KS Annual ReportDocument9 pagesANZ KS Annual ReportAlan LuckstedtNo ratings yet

- IAS12 TaxationDocument4 pagesIAS12 TaxationLasborn DubeNo ratings yet

- FSB Pensions Enquiry FormDocument5 pagesFSB Pensions Enquiry FormFin24100% (3)

- PaySlip PDFDocument1 pagePaySlip PDFVamshi GoudNo ratings yet

- Annuity Tool QADocument2 pagesAnnuity Tool QAGaurav BansalNo ratings yet

- IASBABA PRELIMS 2024 T10 (Upscmaterial - Online)Document84 pagesIASBABA PRELIMS 2024 T10 (Upscmaterial - Online)ABHIDEV J KNo ratings yet

- Quickbooks Guide - Chart of AccountsDocument13 pagesQuickbooks Guide - Chart of Accountsjr7mondo7edoNo ratings yet

- TL105 2022 Slides 4 Per PGDocument60 pagesTL105 2022 Slides 4 Per PGBryan SinqaduNo ratings yet