Professional Documents

Culture Documents

03 Activity Intacc

03 Activity Intacc

Uploaded by

jerwinsan12010 ratings0% found this document useful (0 votes)

3 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views1 page03 Activity Intacc

03 Activity Intacc

Uploaded by

jerwinsan1201Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Maglangit, Kerby B.

Bsais 401

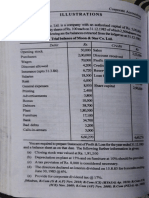

On January 1,2019, BIG Corp. issued bonds with a par value of P800,000 at 97 (which is net of

issue costs), due in 20 years. Eight (8) years after the issuance date, the entire issue is called at

101 and is cancelled. The company uses the straight-line method in amortization.

Using the given information, answer the following items:

1.What is the carrying amount of the bonds redeemed? Face

Value P800,000 Unamortized discount

{P800,000 x (1-97)} = 24,000 x 12/20 (14,400) Carrying amount of the bonds

P785,600

2.What is the total loss on redemption?

Reacquisition price (P800,000 at 101)

P808,000

Less: Carrying amount of the bonds 785,600

Loss on reacquisition P 22,400

3.Prepare the entry record the reacquisition and cancellation of bonds.

Bonds Payable P800,000

Loss on reacquisition (redemption of bond) 22,400 Bonds payable

discount P 14,400 Cash

808,000

You might also like

- Ch. 3 HW ExplanationDocument7 pagesCh. 3 HW ExplanationJalaj GuptaNo ratings yet

- Chapter 8-SHEDocument77 pagesChapter 8-SHEVip Bigbang100% (1)

- HahahahaDocument3 pagesHahahahaTyrelle Dela Cruz100% (1)

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- Partnership Liquidation: Debit CreditDocument7 pagesPartnership Liquidation: Debit CreditWenjun0% (1)

- Answers - Module 2Document4 pagesAnswers - Module 2bhettyna noayNo ratings yet

- An Aidcbse Xiiweb7 12pdfDocument92 pagesAn Aidcbse Xiiweb7 12pdfImran mohammedNo ratings yet

- Ia 2Document23 pagesIa 2Gelo OwssNo ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- Change in PSR 12th Commerce Accountancy AnswersheetDocument11 pagesChange in PSR 12th Commerce Accountancy Answersheetsinghharshu3222No ratings yet

- AFAR Preweek Lecture (B42)Document34 pagesAFAR Preweek Lecture (B42)Ciarie Mae Salgado100% (2)

- AFAR.01 Partnership AccountingDocument13 pagesAFAR.01 Partnership AccountingCristine Joy BenitezNo ratings yet

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- Preparing Financial Statements: (UK Stream)Document15 pagesPreparing Financial Statements: (UK Stream)LincolnYNo ratings yet

- RTP June 2018 AnsDocument29 pagesRTP June 2018 AnsbinuNo ratings yet

- Sec 03 - A2Document8 pagesSec 03 - A2MahmozNo ratings yet

- FINANCIALREPORTINGand Analysis ExamDocument7 pagesFINANCIALREPORTINGand Analysis ExamKizito KizitoNo ratings yet

- Lagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFDocument3 pagesLagrimas, Sarah Nicole S. - Provisions, Contingencies & Other Liabilities PDFSarah Nicole S. LagrimasNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- Intermediate Accounting CH 8 Vol 1 2012 AnswersDocument6 pagesIntermediate Accounting CH 8 Vol 1 2012 AnswersPrincessAngelaDeLeon100% (5)

- Session 1c Accounting For AssetsDocument20 pagesSession 1c Accounting For AssetsFeku RamNo ratings yet

- Intermediate Accounting 2 Quiz #3Document4 pagesIntermediate Accounting 2 Quiz #3Claire Magbunag AntidoNo ratings yet

- MS Xii Accountancy Set 1Document10 pagesMS Xii Accountancy Set 1arikoff07No ratings yet

- Quiz 2 Receivables - Solution GuideDocument8 pagesQuiz 2 Receivables - Solution GuideMaricar PinedaNo ratings yet

- Cost and Equity MethodDocument11 pagesCost and Equity MethoddmangiginNo ratings yet

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- AC11 Ch5Document79 pagesAC11 Ch5anon_467190796100% (1)

- FARDocument222 pagesFARAireNo ratings yet

- 2009 S3 Ase2007Document15 pages2009 S3 Ase2007May CcmNo ratings yet

- 94 - CPAR Final Preaboard AFAR - BookletDocument14 pages94 - CPAR Final Preaboard AFAR - Booklettheresabalagata03No ratings yet

- Government Grant ActivitiesDocument5 pagesGovernment Grant Activitiesjoong wanNo ratings yet

- Fra 300 January - June 2016 Mid - Semester Exams - Marking SchemeDocument6 pagesFra 300 January - June 2016 Mid - Semester Exams - Marking SchemeTissie MkumbadzalaNo ratings yet

- Partnership Q1 To Q3 SolutionsDocument8 pagesPartnership Q1 To Q3 SolutionsJAYARAJALAKSHMI IlangoNo ratings yet

- Pre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingDocument13 pagesPre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingRobert CastilloNo ratings yet

- AFAR-01A (Supplemental Material To Partnership Accounting)Document2 pagesAFAR-01A (Supplemental Material To Partnership Accounting)Maricris AlilinNo ratings yet

- Batch 17 1st Preboard (P1)Document13 pagesBatch 17 1st Preboard (P1)Jericho Pedragosa100% (1)

- Warranty Liability Empleo Robles SolManDocument2 pagesWarranty Liability Empleo Robles SolManJohanna Raissa CapadaNo ratings yet

- Accounting Mid Term RevisionDocument4 pagesAccounting Mid Term Revisionkareem abozeedNo ratings yet

- Accounting Mid Term RevisionDocument4 pagesAccounting Mid Term Revisionkareem abozeedNo ratings yet

- Assignment#2Document5 pagesAssignment#2Kristine Esplana ToraldeNo ratings yet

- ASSIGNMENT#2Document5 pagesASSIGNMENT#2Kristine Esplana ToraldeNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- ACC 206 Test 2 2023Document9 pagesACC 206 Test 2 2023tawanaishe shoniwaNo ratings yet

- 2accountancy-Ms (4) - 230329 - 173510Document11 pages2accountancy-Ms (4) - 230329 - 173510jiya.mehra.2306No ratings yet

- Adobe Scan 01-Nov-2022Document5 pagesAdobe Scan 01-Nov-2022Suthersan SoundarrajNo ratings yet

- Magic Dominique Julius Julius TotalDocument4 pagesMagic Dominique Julius Julius TotalPaupauNo ratings yet

- Interim Assessment 2 With Answer KeysDocument4 pagesInterim Assessment 2 With Answer KeyscaraaatbongNo ratings yet

- (CBCS) (Repeaters) Commerce Paper - 3.5: Accounting For Specialised InstitutionsDocument4 pages(CBCS) (Repeaters) Commerce Paper - 3.5: Accounting For Specialised InstitutionsSanaullah M SultanpurNo ratings yet

- AFAR Summary Lecture (10 May 2021)Document30 pagesAFAR Summary Lecture (10 May 2021)Joanna MalubayNo ratings yet

- Advanced Financial Accounting and Reporting: Ash - . - . - . - . - . - . - . - . P48, OOO Ccounts Receivable - 92,000Document54 pagesAdvanced Financial Accounting and Reporting: Ash - . - . - . - . - . - . - . - . P48, OOO Ccounts Receivable - 92,000Pricia AbellaNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- Private Wealth: Wealth Management In PracticeFrom EverandPrivate Wealth: Wealth Management In PracticeRating: 3 out of 5 stars3/5 (1)