Professional Documents

Culture Documents

Adv Acc Cluster Revision 1

Adv Acc Cluster Revision 1

Uploaded by

NIKHIL MITTALCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv Acc Cluster Revision 1

Adv Acc Cluster Revision 1

Uploaded by

NIKHIL MITTALCopyright:

Available Formats

ADVANCE ACCOUNTS

CLUSTER REVISION

PART – 1

Contents

1. Liquidation of Companies

2. Banking Companies

3. Non-Banking Finance Companies

4. AS 19 - Leases

5. AS 20 – Earnings per Share

6. AS 22 – Accounting for Taxes on Income

7. AS 24 – Discontinuing Operations

CA RAHUL GARG

(TRG)

GOLD MEDALIST

ALL INDIA RANKHOLDER in CA CS CMA

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

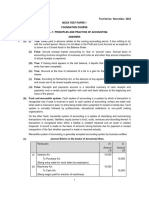

Question 1

X Ltd. went into voluntary liquidation on 31st Dec, 2010 when their Balance Sheet read as

follows:

Liabilities ₹

Issued and Subscribed Capital :

5,000 10% Cumulative Preference Shares of ₹ 100 each, fully paid 5,00,000

2,500 Equity Shares of ₹ 100 each, ₹ 75 paid 1,87,500

7,500 Equity Shares of ₹ 100 each, ₹ 60 paid 4,50,000

15% Debentures secured by a floating charge 2,50,000

Interest outstanding on Debentures 37,500

Creditors 3,18,750

Total 17,43,750

Assets

Land & Building 2,50,000

Machinery & Plant 6,25,000

Patents 1,00,000

Stock 1,37,500

Trade Receivables 2,75,000

Cash at Bank 75,000

Profit & Loss Account 2,81,250

Total 17,43,750

Preference dividends were in arrears for 2 years and the creditors included Preferential Creditors

of ₹ 38,000.

The assets realized as follows :

Land and Building ₹ 3,00,000; Machinery and Plant ₹ 5,00,000; Patents ₹ 75,000; Stock ₹

1,50,000; Trade receivables ₹ 2,00,000.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

The expenses of liquidation amounted to ₹ 27,250. The liquidator is entitled to a commission of

3% on assets realized except cash.

Assuming the final payments including those on debentures is made on 30th June, 2011 show the

Liquidator’s Statement of Account.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

Question 2

The following is an extract from Trial Balance of overseas Bank as at 31st March, 2014.

₹ ₹

Bills discounted 12,64,000

Rebate on bills discounted not due on March 31st, 2013 22,160

Discount received 1,05,708

An analysis of the bills discounted is as follows :

Amount Due Date 2014 Rate of Discount (%)

(i) 1,40,000 June 5 14

(ii) 4,36,000 June 12 14

(iii) 2,82,000 June 25 14

(iv) 4,06,000 July 6 16

Calculate Rebate on Bills Discounted as on 31-3-2014 and show necessary journal entries.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

Question 3

From the following information, calculate the amount of Provisions and Contingencies and prepare

Profit and Loss Account of Zed Bank Ltd. for the year ended 31.3.2011.

(₹ in ‘000)

Interest and Discount (Includes interest accrued on investments) 8,860

Other Income 220

Interest expended 2,720

Operating expenses 2,830

Interest accrued on Investments 10

Additional Information :

a. Rebate on bills discounted to be provided for 30

b. Classification of Advances :

Standard assets 4,000

Sub-standard assets 2,240

Doubtful assets − (fully unsecured) 390

Doubtful assets – covered fully by security

Less than 1 year 100

More than 1 year, but less than 3 years 600

More than 3 years 600

Loss Assets 376

c. Provide 35% of the profit towards provision for taxation.

d. Transfer 25% of the profit to Statutory Reserve.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

Question 4

Lokraj Financiers Ltd. is an NBFC providing Hire Purchase Solutions for acquiring consumer

durables. The following information is extracted from its books for the year ended 31st March,

2017:

Asset Funded Interest Overdue but recognized in Profit & loss A/c Net Book Value of

Period Overdue Interest Amount Assets outstanding

(₹ in crore) (₹ in crore)

Washing Machines Upto 12 months 450.00 20,550.00

Air Conditioners For 24 months 25.25 675.00

Music systems For 30 months 15.25 225.00

Refrigerators For 21 months 60.15 1,050.00

Air purifiers Upto 12 months 18.25 980.00

LCD Televisions For 45 months 420.00 21,200.00

You are required to calculate the amount of additional provision to be made.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

Question 5

Jet Carriers Ltd. has initiated a lease for four years in respect of a vehicle costing ₹ 20,00,000

with expected useful life of 5 years. The asset would revert to the company under the lease

agreement.

The other information available in respect of lease agreement is :

a. The unguaranteed residual value of the equipment after the expiry of the lease term is

estimated at ₹ 2,50,000.

b. The implicit rate of interest is 10%.

c. The annual payments have been determined in such a way that the present value of the lease

payment plus the residual value is equal to the cost of asset.

Ascertain in the hand of Jet Carriers Ltd.

a. The annual lease payment.

b. The unearned finance income.

c. The segregation of finance income.

PV Residual value for 4 years @ 10% is 0.683. (b) PV Factor for 4 years @ 10% is 3.16987.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

Question 6

Net profit for the year 2012 ₹ 11,00,000

Net profit for the year 2013 ₹ 15,00,000

No. of shares outstanding prior to rights issue 5,00,000 shares

Rights issue price ₹ 15

Last date to exercise rights 1st April, 2013

Rights issue is one new share for each five outstanding. Fair value of one equity share immediately

prior to exercise of rights on 1st April 2013 was ₹ 21.

Compute Basic Earnings Per Share.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

Question 7

Ultra Ltd. has provided the following information.

Depreciation as per accounting records = ₹ 4,00,000

Depreciation as per tax records = ₹ 10,00,000

Unamortised preliminary expenses as per tax record = ₹ 30,000

There is adequate evidence of future profit sufficiency.

How much deferred tax asset/liability should be recognised as transition adjustment when the tax

rate is 50%?

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

CA Rahul Garg Gold Medalist All India Rankholder in CA, CS, CMA (incl. Rank 1)

Copyright of these notes is with RSA. Buy Regular & Fast Track Lectures @ www.carahulgarg.com

Question 8

What is the meaning of Discontinuing Operation as per AS 24?

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

ANSWER – 8

A discontinuing operation is a component of an enterprise:

a. That the enterprise, pursuant to a single plan, is:

▪ Disposing of substantially in its entirety, such as by selling the component in a

single transaction or by demerger or spin-off of ownership of the component to

the enterprise's shareholders or

▪ Disposing of piecemeal, such as by selling off the component's assets and

settling its liabilities individually or

▪ Terminating through abandonment and

b. That represents a separate major line of business or geographical area of

operations.

c. That can be distinguished operationally and for financial reporting purposes.

Telegram @ t.me/carahulgargrsa, Follow Instagram @https://www.instagram.com/rahulgarg_thefighter

Subscribe YouTube channel https://www.youtube.com/channel/UC0pn4J1gb2q4e98T-BX-Sng

Cost, FM, Accounts, Advanced Account Lectures available at www.carahulgarg.com, (R.S.A.)

You might also like

- Trading Mastery School 2 - Laurens BensdorpDocument38 pagesTrading Mastery School 2 - Laurens Bensdorphenryjove33No ratings yet

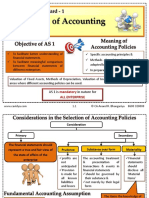

- Screenshot 2023-04-12 at 5.34.59 PMDocument24 pagesScreenshot 2023-04-12 at 5.34.59 PMManthan JainNo ratings yet

- Notes Holding CompanyDocument4 pagesNotes Holding CompanySaurav NasaNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Accounts Test 100 Marks PDFDocument9 pagesAccounts Test 100 Marks PDFAruna RajappaNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Please Review These Questions Before You Enter For Your Test and Final Examination Thank You AC405DDocument13 pagesPlease Review These Questions Before You Enter For Your Test and Final Examination Thank You AC405DELIZABETHNo ratings yet

- Red. of Deb Imp QsDocument10 pagesRed. of Deb Imp Qshero36407No ratings yet

- Ch.3 Liquidation of Companies (June 2023)Document14 pagesCh.3 Liquidation of Companies (June 2023)prakharvaidya5No ratings yet

- Advanced Accounting Test 4 CH 4 Unscheduled Nov 2023 Test PaperDocument8 pagesAdvanced Accounting Test 4 CH 4 Unscheduled Nov 2023 Test Paperdiyaj003No ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Suggested Answer CAP II Dec 2011Document98 pagesSuggested Answer CAP II Dec 2011Sankalpa NeupaneNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- Advanced Partnership: Important Questions (Must Do Before Exam)Document21 pagesAdvanced Partnership: Important Questions (Must Do Before Exam)D SoniNo ratings yet

- Bca 304 Financial Statement AnalysisDocument5 pagesBca 304 Financial Statement Analysiskennymugo39No ratings yet

- 12th HSC Accounts Sample PaperDocument5 pages12th HSC Accounts Sample Papervaibhavnakashe44No ratings yet

- By: Vinit Mishra Sir: Ca IntermediateDocument128 pagesBy: Vinit Mishra Sir: Ca IntermediategimNo ratings yet

- Hba 2401 Advanced Financial Reporting Cat March 2024Document5 pagesHba 2401 Advanced Financial Reporting Cat March 2024PhilipNo ratings yet

- Ccac 1.3 Electronic Accounting Final Exam of GSTDocument7 pagesCcac 1.3 Electronic Accounting Final Exam of GSTkishenmanocha485No ratings yet

- (WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7Document4 pages(WWW - Entrance-Exam - Net) - DOEACC B Level Course-Accounting and Financial Management Sample Paper 7ishupandit620No ratings yet

- Corporate Accounting Imp QuestionsDocument10 pagesCorporate Accounting Imp QuestionsbalachandranharipriyaNo ratings yet

- ACCT1002 - Introduction To Financial Accounting Assignment # 2 Page - 1Document21 pagesACCT1002 - Introduction To Financial Accounting Assignment # 2 Page - 1MingxNo ratings yet

- r7 Mba Financial Accounting and Analysis Set1Document3 pagesr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNo ratings yet

- Test 2 QPDocument8 pagesTest 2 QPDharmateja ChakriNo ratings yet

- Ty Sorn-T: (Time:Z%) Iours)Document4 pagesTy Sorn-T: (Time:Z%) Iours)shahisonal02No ratings yet

- RTP Dec 18 AnsDocument36 pagesRTP Dec 18 AnsbinuNo ratings yet

- June 2016Document27 pagesJune 2016subham8555No ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- Assignment On Session - 1: General Ledger's Name Group Op. Bal. Dr. / CRDocument18 pagesAssignment On Session - 1: General Ledger's Name Group Op. Bal. Dr. / CRcyber kci100% (1)

- Advanced Financial Accounting: Question Paper 2014Document3 pagesAdvanced Financial Accounting: Question Paper 2014irfanNo ratings yet

- PC66 Trial Balance & Financial StatementsDocument1 pagePC66 Trial Balance & Financial StatementsVansh SethiNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- RAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteDocument5 pagesRAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteRishikesh KalantriNo ratings yet

- Banking Company QuestionDocument11 pagesBanking Company QuestionOmkar VichareNo ratings yet

- Funds and Flow StatementDocument14 pagesFunds and Flow Statement75 SHWETA PATILNo ratings yet

- 5th Sem Accounts Previous Year PapersDocument25 pages5th Sem Accounts Previous Year PapersViratNo ratings yet

- Accounting Standard Notes by Anand R. BhangariyaDocument96 pagesAccounting Standard Notes by Anand R. BhangariyaSanjana SharmaNo ratings yet

- Disclosure of Accounting PoliciesDocument7 pagesDisclosure of Accounting PoliciesvenumadhavanNo ratings yet

- 6a MTP Oct 2020Document13 pages6a MTP Oct 2020Bijay AgrawalNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- AFM-Assignment-2021: Trial Balance As On 31 March 2015Document1 pageAFM-Assignment-2021: Trial Balance As On 31 March 2015SILLA SAIKUMARNo ratings yet

- FAR 1 Mock 4 - FinalDocument4 pagesFAR 1 Mock 4 - Finalahsanalipalipoto17No ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- Assignment Subsequent To Date of AcquisitionDocument5 pagesAssignment Subsequent To Date of AcquisitionTrelle DiazNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- 6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed AssetsDocument5 pages6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed Assetsvaibhav_kapoor_6No ratings yet

- Question ADV GMDocument11 pagesQuestion ADV GMDharmateja ChakriNo ratings yet

- Accounts Must Do Questions by Vinit Mishra SirDocument137 pagesAccounts Must Do Questions by Vinit Mishra SirCan I Get 1000 SubscribersNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- RatioDocument24 pagesRatioSadika KhanNo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- RatioanalysisanswersDocument5 pagesRatioanalysisanswersAnu PriyaNo ratings yet

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- AmalgamationDocument15 pagesAmalgamationTejasree SaiNo ratings yet

- Ccac 1.3Document7 pagesCcac 1.3kishenmanocha485No ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Financial Statement Analysis Probs On Funds Flow Analysis PDFDocument15 pagesFinancial Statement Analysis Probs On Funds Flow Analysis PDFSAITEJA ANUGULANo ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- 31.10.2023 - EYP Pernod Ricard Vs DiageoDocument27 pages31.10.2023 - EYP Pernod Ricard Vs Diageoneptune flagNo ratings yet

- Chapter 6 Business Level Strategy and Industry EnvironmentDocument14 pagesChapter 6 Business Level Strategy and Industry EnvironmentMai PhươngNo ratings yet

- Business Model CanvasDocument1 pageBusiness Model CanvasblirrinctNo ratings yet

- Gist of Adani Group's Rebuttal To Hindenburg ReportDocument6 pagesGist of Adani Group's Rebuttal To Hindenburg ReportRafay AnwarNo ratings yet

- Flyer Produktu Bersicht Eigenkapitalfinanzierungen - De.enDocument2 pagesFlyer Produktu Bersicht Eigenkapitalfinanzierungen - De.enOmar SalahNo ratings yet

- Gohida Industrial PLC One YearDocument20 pagesGohida Industrial PLC One YearAbel GetachewNo ratings yet

- Topic 3 - Islamic Banking NowDocument2 pagesTopic 3 - Islamic Banking NowAndinii PirliNo ratings yet

- Unit 6 - DiversificationDocument31 pagesUnit 6 - DiversificationSasha MacNo ratings yet

- Introduction To Macro Economics Class 12 Notes CBSE Macro Economics Chapter 1 PDF 1Document4 pagesIntroduction To Macro Economics Class 12 Notes CBSE Macro Economics Chapter 1 PDF 1g26091993No ratings yet

- Trần Thị Thu Nguyệt-Pa3-Hwchapter17Document2 pagesTrần Thị Thu Nguyệt-Pa3-Hwchapter17Nguyet Tran Thi ThuNo ratings yet

- Managerial DecisionsDocument85 pagesManagerial DecisionsVy NguyenNo ratings yet

- 3973461-Fundamentals of Marketing MixDocument9 pages3973461-Fundamentals of Marketing MixmakenziejanesmithNo ratings yet

- Lec 14Document9 pagesLec 14Ryan GroffNo ratings yet

- Accounting Training Manual and Solutions DBE PDFDocument239 pagesAccounting Training Manual and Solutions DBE PDFGift SphesihleeNo ratings yet

- Manufacturing Update - January 2024Document29 pagesManufacturing Update - January 2024Kevin ParkerNo ratings yet

- Citizen Charter April 2023Document25 pagesCitizen Charter April 2023Parody CentralNo ratings yet

- Igx 2024 AgendaDocument10 pagesIgx 2024 AgendaopzoutenNo ratings yet

- Roland Berger Belgian Banks DisruptionDocument20 pagesRoland Berger Belgian Banks DisruptionHaidir AuliaNo ratings yet

- CASE STUDY 1 - MidtermsDocument2 pagesCASE STUDY 1 - MidtermsArbie DecimioNo ratings yet

- Chapter 1. The Nature of CreditDocument14 pagesChapter 1. The Nature of CreditcalliemozartNo ratings yet

- CSME SummaryDocument100 pagesCSME SummarySunday David KayodeNo ratings yet

- Finman QuizDocument65 pagesFinman QuizChrista LenzNo ratings yet

- European M&A Monitor September 2023Document19 pagesEuropean M&A Monitor September 2023kovacsmathieu87No ratings yet

- Cases&Exercises - Chapter 4Document3 pagesCases&Exercises - Chapter 4Barbara AraujoNo ratings yet

- Monica Jangid - D23 - Summer Internship Final ReportDocument77 pagesMonica Jangid - D23 - Summer Internship Final ReportcoolujjwaljainNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- MTP 14 28 Answers 1701406110Document11 pagesMTP 14 28 Answers 1701406110aim.cristiano1210No ratings yet

- Stock Broking: Dr. Kamaljeet Kaur Assistant ProfessorDocument18 pagesStock Broking: Dr. Kamaljeet Kaur Assistant ProfessorSimran SainiNo ratings yet

- Demat & Trading AOF Individuals Updated FATCA & PPDIDocument12 pagesDemat & Trading AOF Individuals Updated FATCA & PPDIds462387No ratings yet