Professional Documents

Culture Documents

Demo

Demo

Uploaded by

palashkhurpiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Demo

Demo

Uploaded by

palashkhurpiaCopyright:

Available Formats

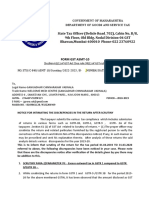

BHUPESH KHURPIA & ASSOCIATES

ADVOCATES & TAX CONSULTANTS

Office: S1, Purshottam Eastend

Plot No. R-28, Zone-II, Mob: 9826222464, 9039891749

MP Nagar, Bhopal -462016 E-mail: khurpia.associates@gmail.com

To 26.03.2024

XXXXXXXXXXX,

XXXXXXXXXXX,

[Place], 123456

Ref: Show Cause Notice having reference no. XXXXXXXXXX dated XXth

December 2023.

Subject: Reply to the show cause notice in the matter of M/s. XXXXXXXXXXX

for the F.Y. 2018-19

Sir,

At the outset we would humbly like to submit that Mr. XXXXXXXXXXX is

performing business in the name of M/s XXXXXXXXXXX (GSTIN:

XXXXXXXXXXX) (hereinafter referred to as the Noticee). M/s XXXXXXXXXXX,

is a sole proprietorship concern carrying on the business of selling computers and

computer parts. I Adv. Palash Khurpia duly authorized by Mr. XXXXXXXXXXX,

hereby on behalf of the Noticee submit the following:

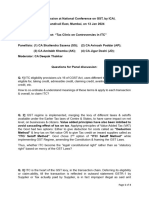

1. The Hon’ble Authority has pointed out that the Noticee has not discharged the

tax liability under RCM amounting to Rs. 560.00 (Rs.280.00 under the head

CGST and Rs. 280.00 under the head SGST). In this matter, we would like to

submit that the Noticee admits this tax liability and has paid the amount by way

of DRC-03 having ARN AD230224014106U.

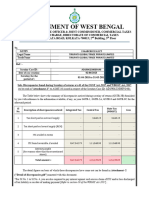

2. The Hon’ble Authority has pointed out that the difference of ITC claimed and

getting reflected in GSTR-2A as per Table 8D of GSTR-9 amounts to Rs.

5,32,065.00 (IGST Rs. 74,24,953.78, CGST Rs. 6,37,280.00 and SGST Rs.

6,37,280.00). However, as per our precise calculation, the difference in ITC

claimed in GSTR-3B and ITC as per GSTR-2A is tabulated below:

Particulars Total ITC

B2B (2A)

Less: Credit Note (2A)

Add: Debit Note (2A)

Net ITC as per GSTR-2A

ITC Claimed in GSTR-3B

Diff.

We have identified the invoices of which ITC is not getting reflected in GSTR-

2A the list of these invoices is attached as Annexure-A

Further we have also obtained certificates form the respective suppliers in line

with the Circular No. 183/15/2022-GST issued by the CBIC on 27 th December

2022. Thus, we request the Hon’ble Authority to kindly drop the proceedings

on this issue.

3. The Hon’ble Authority has provided a list of invoices which according to them

is ineligible. In this matter, we would like to bring to the notice of the Hon’ble

Authority that we have provided the sample copy of invoices of all the

suppliers mentioned in the show cause notice and all these transactions are of a

business nature and are not restricted for availing ITC under section 17(5).

Thus, we request the Hon’ble Authority to kindly drop the proceedings on this

issue.

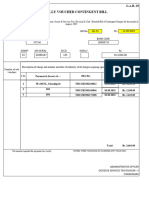

4. The Hon’ble Authority has pointed out that the noticee has issued the Credit

Notes worth 34,58,457.63 wherein the GST amounts to Rs. 2,21,924.47 under

the head CGST, Rs. 2,21,924.47 under the head SGST and Rs. 1,88,446.97

under the head IGST. These Credit Notes have already been adjusted before

claiming the ITC under the respective head and the same can be seen from the

calculation table of the difference in ITC claimed and ITC as per GSTR-2A as

provided in para 2 of this reply.

Thus, we request the Hon’ble Authority to kindly drop the proceedings in the said

matter.

We also request the Hon’ble Authority to kindly provide us an opportunity of a

personal hearing before the matter is decided.

Thanking You.

For M/s Perfect World Computers

Place: Bhopal

Date: 27.03.2024

Mr. Palash Khurpia

(Advocate)

You might also like

- Cyber Security SEMINARDocument13 pagesCyber Security SEMINARpiyush dhamgaye100% (2)

- DRC 01 ReplyDocument5 pagesDRC 01 Replyrameshbara.rksNo ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- B2B To B2C CertificateDocument1 pageB2B To B2C Certificatebhaseen photostateNo ratings yet

- Page 1 of 4Document4 pagesPage 1 of 4Sunil ShahNo ratings yet

- Mamatha Traders Adjuducation Order Us 73 - CompressedDocument31 pagesMamatha Traders Adjuducation Order Us 73 - Compressedurmilachoudhary1999No ratings yet

- 3a Notices Ysk Amar SubDocument1,066 pages3a Notices Ysk Amar SubKrishna ReddyNo ratings yet

- CGST 16 (2) (C)Document31 pagesCGST 16 (2) (C)noorensaba01No ratings yet

- BMOUTCOME27102023Document26 pagesBMOUTCOME27102023akshay kausaleNo ratings yet

- Sri Chowdeshwari Rice TradersDocument2 pagesSri Chowdeshwari Rice Tradershemanth1234No ratings yet

- Tax Collector Correspondence3362544Document5 pagesTax Collector Correspondence3362544hamza awanNo ratings yet

- NITYA - Indirect Tax Bulletin: January 2022 - Week 1Document9 pagesNITYA - Indirect Tax Bulletin: January 2022 - Week 1swastik groverNo ratings yet

- Draft Reply For DRC 01Document5 pagesDraft Reply For DRC 01Rahul GoelNo ratings yet

- Format of Draft Reply On DRC-01Document3 pagesFormat of Draft Reply On DRC-01Awanish SrivastavaNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDocument2 pagesTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNo ratings yet

- AAR - ITC On Capital Goods in Case of Taxable + Exepmt SupplyDocument3 pagesAAR - ITC On Capital Goods in Case of Taxable + Exepmt SupplyJigar MakwanaNo ratings yet

- Commissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Document16 pagesCommissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017j0d3No ratings yet

- Mismatch of Itc ReplayDocument2 pagesMismatch of Itc ReplayHardev SinghNo ratings yet

- J 2020 SCC OnLine Tri 598 2021 87 GSTR 170 2021 52 G Rameshananda Gmailcom 20231212 121104 1 27Document27 pagesJ 2020 SCC OnLine Tri 598 2021 87 GSTR 170 2021 52 G Rameshananda Gmailcom 20231212 121104 1 27r.preethimanasaug22No ratings yet

- Response To SCNDocument2 pagesResponse To SCNshikshadhariwal1No ratings yet

- 03 WP GST - Ipsum - v2Document47 pages03 WP GST - Ipsum - v2noorensaba01100% (1)

- BMOUTCOMEDocument17 pagesBMOUTCOMEakshay kausaleNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Input Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtDocument9 pagesInput Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtdeepakasopaNo ratings yet

- YASH TOBACCO BorsadDocument1 pageYASH TOBACCO BorsadLut cartNo ratings yet

- Relief For ITC Claimed For Unmatched Invoices in GSTR 2A For FYs 2017-18Document3 pagesRelief For ITC Claimed For Unmatched Invoices in GSTR 2A For FYs 2017-18sanket lunkadNo ratings yet

- Tolia AppealDocument7 pagesTolia Appealmau8684No ratings yet

- Digitally Proceedings of P Hanumantharao & Sons 2018-19 S-73Document31 pagesDigitally Proceedings of P Hanumantharao & Sons 2018-19 S-73CTOAUDIT1 BLYNo ratings yet

- GST Law Communique Dec 2023 1704557082Document5 pagesGST Law Communique Dec 2023 1704557082nirmalseervi.mkdNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- Contigent Bill OE 54 - Dated 11.09.2023Document5 pagesContigent Bill OE 54 - Dated 11.09.2023jaideep sainiNo ratings yet

- Letter Template-1Document21 pagesLetter Template-1QwertyNo ratings yet

- Proposal Letter 148A (A) Shree Siddhivinayak Oil Foods - AY202021Document8 pagesProposal Letter 148A (A) Shree Siddhivinayak Oil Foods - AY202021basecandlesNo ratings yet

- Aa240123134087p SCN03022023Document1 pageAa240123134087p SCN03022023ANISH SHAIKHNo ratings yet

- ITC Cannot Be Denied Solely Due To GSTR 2A & 3B Discrepancies - Kerala HC - Taxguru - inDocument2 pagesITC Cannot Be Denied Solely Due To GSTR 2A & 3B Discrepancies - Kerala HC - Taxguru - inRiya Shankar SharmaNo ratings yet

- Amendment Booklet NOV 21 - by CA Yachaa Mutha BhuratDocument46 pagesAmendment Booklet NOV 21 - by CA Yachaa Mutha BhuratSuraj BijlaniNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- Form GST ASMT 11 - Clyde BergemannDocument5 pagesForm GST ASMT 11 - Clyde BergemannektaNo ratings yet

- Sodexo Rectification - 154 IT ActDocument2 pagesSodexo Rectification - 154 IT ActGaurav AgarwalNo ratings yet

- Application For Condonation of Delay in Filing of Form VII & VIII ToDocument2 pagesApplication For Condonation of Delay in Filing of Form VII & VIII Tokrishna gattaniNo ratings yet

- Ref: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Document4 pagesRef: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Nikhil JainNo ratings yet

- Raj - Typed LettersDocument4 pagesRaj - Typed LettersAnmol JhaNo ratings yet

- Drc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Document1 pageDrc-01a 10bpopk6312p1zo Chandu Kumar Chaudhary 2019-20Rahul KumarNo ratings yet

- Voltas LimitedDocument16 pagesVoltas LimitedvedaNo ratings yet

- Questions On Computation of Net GST PayableDocument24 pagesQuestions On Computation of Net GST PayablesneakyblackskullNo ratings yet

- Screenshot 2024-04-24 at 8.41.17 AMDocument21 pagesScreenshot 2024-04-24 at 8.41.17 AMnagegowdu.nNo ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Show Cause NoticeDocument8 pagesShow Cause NoticeinfoNo ratings yet

- Independence Day Edition: Adv. (CA) Ranjan MehtaDocument10 pagesIndependence Day Edition: Adv. (CA) Ranjan MehtaCA Ranjan MehtaNo ratings yet

- GST Circular-Restriction in Availment of ITC-Rule 36Document3 pagesGST Circular-Restriction in Availment of ITC-Rule 36Tejas RajkotiaNo ratings yet

- Shree Krishna EnterprisesDocument3 pagesShree Krishna EnterprisesVinay JainNo ratings yet

- Detailed Statement of ClarificationDocument1 pageDetailed Statement of ClarificationDivyanshu TejwaniNo ratings yet

- ITO Vs Shree Keshorai Patan Sahakari Sugar Mill ITAT JaipurDocument16 pagesITO Vs Shree Keshorai Patan Sahakari Sugar Mill ITAT JaipurMohan ChoudharyNo ratings yet

- Durga Raman Patnaik Vs Addl Comm GSTDocument70 pagesDurga Raman Patnaik Vs Addl Comm GSTHardev SinghNo ratings yet

- CIT v. MKJ Enterprises Ltd.-Cal HCDocument2 pagesCIT v. MKJ Enterprises Ltd.-Cal HCSaksham ShrivastavNo ratings yet

- Shree Karthik Papers Ltdvs Deputy Commissionerof Income TDocument4 pagesShree Karthik Papers Ltdvs Deputy Commissionerof Income TKaran GannaNo ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Jose Juan Rodriguez Garcia, A044 581 069 (BIA May 6, 2015)Document3 pagesJose Juan Rodriguez Garcia, A044 581 069 (BIA May 6, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Peripheral Nerve Injuries - Medical ApplicationsDocument103 pagesPeripheral Nerve Injuries - Medical ApplicationsJune Epe100% (1)

- 2 Check Memo 2023-25Document5 pages2 Check Memo 2023-25varma typingNo ratings yet

- Air Force News Jan-Dec 1919Document1,176 pagesAir Force News Jan-Dec 1919CAP History LibraryNo ratings yet

- Stephan Van GalenDocument6 pagesStephan Van GalenmayunadiNo ratings yet

- Sixth Amendment HistoryDocument6 pagesSixth Amendment Historyapi-108537159No ratings yet

- Lana Vianney L. Caseda Gr. 3 - GraceDocument4 pagesLana Vianney L. Caseda Gr. 3 - GracejoyNo ratings yet

- Prayer in HinduismDocument2 pagesPrayer in HinduismSudhakar V.Rao MDNo ratings yet

- Preliminaries of Registration Lecture 4 UDocument25 pagesPreliminaries of Registration Lecture 4 UJudge and Jury.No ratings yet

- Raymond Bronowicz v. County of Allegheny, 3rd Cir. (2015)Document23 pagesRaymond Bronowicz v. County of Allegheny, 3rd Cir. (2015)Scribd Government DocsNo ratings yet

- J. Habermas Between Facts and NormsDocument6 pagesJ. Habermas Between Facts and NormsAntonio Mosquera AguilarNo ratings yet

- The Influence of Sir James Stephen On The Law of Evidence : FeaturesDocument22 pagesThe Influence of Sir James Stephen On The Law of Evidence : FeaturesKARTHIKEYAN MNo ratings yet

- Affidavit of Allodial Secured Land Property Repossession Written StatementDocument6 pagesAffidavit of Allodial Secured Land Property Repossession Written StatementAlahdeen Moroc BeyNo ratings yet

- Deed of Absolute Sale - CalzadoDocument2 pagesDeed of Absolute Sale - CalzadoAlfred AglipayNo ratings yet

- Pimentel - Welch Vs City of LADocument16 pagesPimentel - Welch Vs City of LASouthern California Public RadioNo ratings yet

- UntitledDocument380 pagesUntitlednellycNo ratings yet

- Statement Letter For Local Company StatusDocument1 pageStatement Letter For Local Company StatusFarNo ratings yet

- GSIS vs. CA DigestDocument1 pageGSIS vs. CA DigestCaitlin Kintanar100% (1)

- Borromeo v. Family Care Hospital, G.R. No. 191018, January 25, 2016Document22 pagesBorromeo v. Family Care Hospital, G.R. No. 191018, January 25, 2016Agent BlueNo ratings yet

- Dissolution of Hindu MarriageDocument13 pagesDissolution of Hindu MarriageKumar MangalamNo ratings yet

- 025 - 1988 - Labour Law-I Labour Management RelationsDocument16 pages025 - 1988 - Labour Law-I Labour Management RelationsFadzwan LibertusNo ratings yet

- Suite Burlesque: G.P.Telemann 1. OuvertureDocument21 pagesSuite Burlesque: G.P.Telemann 1. OuvertureSaxoNo ratings yet

- The Term Metohija Is A Matter of Identity: KossevDocument7 pagesThe Term Metohija Is A Matter of Identity: Kossevvojkan73No ratings yet

- Pe G11 Sem2 Q1 ExamDocument6 pagesPe G11 Sem2 Q1 ExamShelvie Morata (Bebeng)No ratings yet

- Sentence CompletionDocument5 pagesSentence CompletionApoorvaNo ratings yet

- Who-Wants-To-Be-A-Millionaire FCEDocument33 pagesWho-Wants-To-Be-A-Millionaire FCEmacNo ratings yet

- 21.rizal in Hong Kong - Report - Motol PDFDocument14 pages21.rizal in Hong Kong - Report - Motol PDFRochelle Anne Lope MotolNo ratings yet

- Script For Interdisciplinary: Hidden FiguresDocument2 pagesScript For Interdisciplinary: Hidden FiguresEmilie VigliottaNo ratings yet

- Regional Trial CourtDocument3 pagesRegional Trial CourtAnnNo ratings yet