Professional Documents

Culture Documents

Igacc0903 ST C

Igacc0903 ST C

Uploaded by

Marcel JonathanCopyright:

Available Formats

You might also like

- Quiz 3 - 1193 - IEECONO - EB INDUSTRIAL ENGINEERING ECONOMY PDFDocument18 pagesQuiz 3 - 1193 - IEECONO - EB INDUSTRIAL ENGINEERING ECONOMY PDFkiks fernsNo ratings yet

- Business Plan Tote Bag CompanyDocument64 pagesBusiness Plan Tote Bag CompanyMuhamad RiskiNo ratings yet

- PFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial StatementsDocument71 pagesPFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial Statementscalista sNo ratings yet

- Uae Contractors' Association Members List: Company Name Tel. No. Fax. No. P.O.Box Emirate WebsiteDocument15 pagesUae Contractors' Association Members List: Company Name Tel. No. Fax. No. P.O.Box Emirate Websitehamza100% (2)

- Paf 3023 - Adjusting Entries Exercise SkemaDocument6 pagesPaf 3023 - Adjusting Entries Exercise SkemaLIM LEE THONGNo ratings yet

- Economics 3342 (Due On Feb 18, 10am) : 1 The Ricardian Model (15pts)Document3 pagesEconomics 3342 (Due On Feb 18, 10am) : 1 The Ricardian Model (15pts)mattNo ratings yet

- Supply Chain Chap-4Document10 pagesSupply Chain Chap-4SuMit SoMai THapaNo ratings yet

- Igacc0903 MT CDocument8 pagesIgacc0903 MT CMarcel JonathanNo ratings yet

- Igacc0901 ST CDocument6 pagesIgacc0901 ST CMarcel JonathanNo ratings yet

- Chapter 03 SMDocument67 pagesChapter 03 SMAthena LauNo ratings yet

- Igacc0907 ST CDocument8 pagesIgacc0907 ST CMarcel JonathanNo ratings yet

- Igacc0901 MT CDocument5 pagesIgacc0901 MT CMarcel JonathanNo ratings yet

- Student NameDocument16 pagesStudent NameishwarsumeetNo ratings yet

- Acc.1 - HW Ch. 1+2+3 - 31-10-2023Document6 pagesAcc.1 - HW Ch. 1+2+3 - 31-10-2023samerghaith0No ratings yet

- BTE343MT 1 Winter 2010.solutionDocument16 pagesBTE343MT 1 Winter 2010.solutionishwarsumeetNo ratings yet

- Igacc0903 Ab CDocument43 pagesIgacc0903 Ab CMarcel JonathanNo ratings yet

- Adjusting Accounts and Preparing Financial StatementsDocument54 pagesAdjusting Accounts and Preparing Financial StatementsAmna TahirNo ratings yet

- Cost Management Accounting DEC 2023Document4 pagesCost Management Accounting DEC 2023Aash RedmiNo ratings yet

- Mock Midterm 1 Solution UPDATED SEPT 28Document15 pagesMock Midterm 1 Solution UPDATED SEPT 28Venkat ChamarthiNo ratings yet

- 7110 s04 QP 2Document12 pages7110 s04 QP 2mstudy123456No ratings yet

- © The Institute of Chartered Accountants of India: ST ST STDocument14 pages© The Institute of Chartered Accountants of India: ST ST STRITZ BROWNNo ratings yet

- Ce 8328: Construction Management: Assignment 02Document9 pagesCe 8328: Construction Management: Assignment 02Chiranjaya HulangamuwaNo ratings yet

- Strategic Case For IT InvestmentDocument64 pagesStrategic Case For IT Investmentjackson fooNo ratings yet

- 7110 s18 QP 23Document24 pages7110 s18 QP 23Shahzaib ShahbazNo ratings yet

- 157 28395 EY111 2013 4 2 1 Chap003Document74 pages157 28395 EY111 2013 4 2 1 Chap003JasonNo ratings yet

- Adjusting Accounts and Preparing Financial Statements: QuestionsDocument74 pagesAdjusting Accounts and Preparing Financial Statements: QuestionsChaituNo ratings yet

- ch03 Part6Document6 pagesch03 Part6Sergio HoffmanNo ratings yet

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- Final Exam F2021 PDFDocument4 pagesFinal Exam F2021 PDFbilelNo ratings yet

- FABMDocument2 pagesFABMTinNo ratings yet

- Accounting PrinciplesDocument7 pagesAccounting PrinciplesNitin ArasappanNo ratings yet

- MN-M001 Online 24 Hour Exam - January 2024 FINAL - 240115 - 093952Document5 pagesMN-M001 Online 24 Hour Exam - January 2024 FINAL - 240115 - 093952szj00247No ratings yet

- Ch04Prob4 14A-Exe1Document4 pagesCh04Prob4 14A-Exe1kanika019No ratings yet

- Mid I ACT 411Document3 pagesMid I ACT 411hosnearanazninNo ratings yet

- FAB Assignment 2020-2021 - UpdatedDocument7 pagesFAB Assignment 2020-2021 - UpdatedMuhammad Hamza AminNo ratings yet

- Strategic Case For IT InvestmentDocument64 pagesStrategic Case For IT Investmentjackson fooNo ratings yet

- Management Question PaperDocument6 pagesManagement Question PaperSechaba ChejanaNo ratings yet

- Paper12 Solution RevisedDocument17 pagesPaper12 Solution Revised15Nabil ImtiazNo ratings yet

- Godavari Electricals LTD., Wanted To Set Up Its New Plant For Manufacturing of Heaters. The Management ofDocument32 pagesGodavari Electricals LTD., Wanted To Set Up Its New Plant For Manufacturing of Heaters. The Management ofckamdarNo ratings yet

- Grade 9 Edexcel AccountingDocument11 pagesGrade 9 Edexcel Accountingnirosha pereraNo ratings yet

- Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment PaymentDocument3 pagesGet Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment PaymentManishNo ratings yet

- Igcse Accounting Control Accounts - Questions AnswersDocument24 pagesIgcse Accounting Control Accounts - Questions AnswersOmar WaheedNo ratings yet

- f2 MGMT Accounting August 2017Document20 pagesf2 MGMT Accounting August 2017MSHANA ALLYNo ratings yet

- ACCA F3 Control Accounts and Incomplete Records Questions2Document6 pagesACCA F3 Control Accounts and Incomplete Records Questions2Amos OkechNo ratings yet

- Fundamental Accounting Principles 22Nd Edition Wild Solutions Manual Full Chapter PDFDocument60 pagesFundamental Accounting Principles 22Nd Edition Wild Solutions Manual Full Chapter PDFTaraThomasdwbz100% (15)

- ACC 304 Week 3 Homework - Chapter 10Document8 pagesACC 304 Week 3 Homework - Chapter 10Leree0% (1)

- ACC101 2023 02 AssignmentDocument6 pagesACC101 2023 02 AssignmentNicoleneNo ratings yet

- 2023 Specimen Paper 4Document10 pages2023 Specimen Paper 4l PLAY GAMESNo ratings yet

- DCAT-Sem II 2013 Question PapersDocument4 pagesDCAT-Sem II 2013 Question Paperssubhash dalviNo ratings yet

- Test Acc406 - Dec 2018 QQDocument8 pagesTest Acc406 - Dec 2018 QQtakoyaki papadomNo ratings yet

- A GCE Accounting 2505 June 2007 Question Paper +ansDocument17 pagesA GCE Accounting 2505 June 2007 Question Paper +ansNaziya BocusNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Igacc0902 ST CDocument8 pagesIgacc0902 ST CMarcel JonathanNo ratings yet

- Test-6 CMA Inter gr-1 Financial Statement of Profit OrganisationDocument14 pagesTest-6 CMA Inter gr-1 Financial Statement of Profit Organisationadityatiwari122006No ratings yet

- 102.COA PL I Solution CMA Special Examination 2021novemberDocument7 pages102.COA PL I Solution CMA Special Examination 2021novemberSky WalkerNo ratings yet

- VCE Accounting - VCAA Unit 3 2012 Suggested SolutionsDocument13 pagesVCE Accounting - VCAA Unit 3 2012 Suggested SolutionsConnect EducationNo ratings yet

- 6e Brewer CH09 B EOCDocument10 pages6e Brewer CH09 B EOCJonathan Altamirano BurgosNo ratings yet

- Igacc0907 Ab CDocument34 pagesIgacc0907 Ab CMarcel JonathanNo ratings yet

- 17mba22 FM T2 KeyDocument7 pages17mba22 FM T2 KeySwathi ShanmuganathanNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- QuickBooks Online for Beginners: A Quick Reference and Step-by-Step Guide to Mastering QuickBooks Online for Small Business Owners from Beginners to ExpertFrom EverandQuickBooks Online for Beginners: A Quick Reference and Step-by-Step Guide to Mastering QuickBooks Online for Small Business Owners from Beginners to ExpertNo ratings yet

- CNY Event IdeasDocument2 pagesCNY Event IdeasMarcel JonathanNo ratings yet

- Quiz 3 Sevilla Grade 10Document5 pagesQuiz 3 Sevilla Grade 10Marcel JonathanNo ratings yet

- Lecture 1 Introduction To Macroeconomics, GDP and Economic GrowthDocument73 pagesLecture 1 Introduction To Macroeconomics, GDP and Economic GrowthMarcel JonathanNo ratings yet

- References ListDocument1 pageReferences ListMarcel JonathanNo ratings yet

- Basic Pythagoras TheoremDocument4 pagesBasic Pythagoras TheoremMarcel JonathanNo ratings yet

- Circular Motion Part 2Document6 pagesCircular Motion Part 2Marcel JonathanNo ratings yet

- Project Brief - Biometrio Earth - FinalDocument3 pagesProject Brief - Biometrio Earth - FinalMarcel JonathanNo ratings yet

- Double Entry Bookkeeping Part A HWDocument2 pagesDouble Entry Bookkeeping Part A HWMarcel JonathanNo ratings yet

- Grade 8 Module Test RevisionDocument4 pagesGrade 8 Module Test RevisionMarcel JonathanNo ratings yet

- Statistics For Business and Economics,: 11E Anderson/Sweeney/WilliamsDocument39 pagesStatistics For Business and Economics,: 11E Anderson/Sweeney/WilliamsMarcel JonathanNo ratings yet

- Setting Up and Solving QuadraticsDocument6 pagesSetting Up and Solving QuadraticsMarcel JonathanNo ratings yet

- Eb Lecturer Guide 1.2Document100 pagesEb Lecturer Guide 1.2Marcel JonathanNo ratings yet

- Lectorial Slides 6bDocument25 pagesLectorial Slides 6bMarcel JonathanNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/31Marcel JonathanNo ratings yet

- Journal & Double EntryDocument2 pagesJournal & Double EntryMarcel JonathanNo ratings yet

- Lectorial Slides 5b NEWDocument23 pagesLectorial Slides 5b NEWMarcel JonathanNo ratings yet

- Lectorial Slides 6aDocument30 pagesLectorial Slides 6aMarcel JonathanNo ratings yet

- Ingles ConsumismoDocument3 pagesIngles ConsumismoSónia RibeiroNo ratings yet

- ELHF Jun'18 Investor CommuniquéDocument6 pagesELHF Jun'18 Investor CommuniquéHarsh GandhiNo ratings yet

- Test Bank For International Financial Management 14th Edition Jeff MaduraDocument25 pagesTest Bank For International Financial Management 14th Edition Jeff Madurak60.2113340007No ratings yet

- PDF 20230505 224013 0000 PDFDocument1 pagePDF 20230505 224013 0000 PDFAmir SofuanNo ratings yet

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- Marketing To The Bottom of The Pyramid: CASE 3-3Document2 pagesMarketing To The Bottom of The Pyramid: CASE 3-3Nazmul Hasan NahidNo ratings yet

- Advanced Corporate Finance Case 1Document2 pagesAdvanced Corporate Finance Case 1Adrien PortemontNo ratings yet

- 2003 IndexDocument47 pages2003 Indexboni nugrohoNo ratings yet

- Yeshi Habte Final Thesis On Factors Affecting of Time and Cost OverrunDocument83 pagesYeshi Habte Final Thesis On Factors Affecting of Time and Cost OverrunYishak KibruNo ratings yet

- Customer Satisfaction Indexing For Banking Services and Skills of The Service Providers in The State of AssamDocument10 pagesCustomer Satisfaction Indexing For Banking Services and Skills of The Service Providers in The State of AssamSudhanshu VermaNo ratings yet

- Investment Calculator - SmartAssetDocument1 pageInvestment Calculator - SmartAssetSulemanNo ratings yet

- Rural Marketing: Introduction, Concept and Definitions: These AreDocument3 pagesRural Marketing: Introduction, Concept and Definitions: These AregunjanNo ratings yet

- Is Forex HalalDocument14 pagesIs Forex HalalHamid GhorzangNo ratings yet

- IC-38 Question Bank - 1Document48 pagesIC-38 Question Bank - 1anshul2503No ratings yet

- Monopolistically CompetitiveDocument26 pagesMonopolistically Competitivebeth el100% (1)

- Lecture 15 - Summing Up of Part-1 (Policy) & Introduction To Housing PlanningDocument17 pagesLecture 15 - Summing Up of Part-1 (Policy) & Introduction To Housing PlanningRadhika KhandelwalNo ratings yet

- Far210 - July2020 SS Q5Document2 pagesFar210 - July2020 SS Q5imn njwaaaNo ratings yet

- BALANCE SHEET 2020-2021 OF Hindustan Unilever .: Akhil Manoj Panikar Sybms B Roll No:-6163 Management AccountingDocument4 pagesBALANCE SHEET 2020-2021 OF Hindustan Unilever .: Akhil Manoj Panikar Sybms B Roll No:-6163 Management AccountingAkhil ManojNo ratings yet

- G.O.Ms - No.59 - House Building AdvanceDocument3 pagesG.O.Ms - No.59 - House Building AdvanceMahendar Erram100% (1)

- 12th CBSE 2021-22 BatchDocument253 pages12th CBSE 2021-22 BatchPriyanshu GehlotNo ratings yet

- Allied Bank Ltd. Financial Statements AnalysisDocument22 pagesAllied Bank Ltd. Financial Statements Analysisbilal_jutttt100% (1)

- Appendix A Table A. 1. List of Voluntary Disclosure ItemsDocument3 pagesAppendix A Table A. 1. List of Voluntary Disclosure ItemsyuliaNo ratings yet

- AUTO - 0ar Aop 2014 PDFDocument276 pagesAUTO - 0ar Aop 2014 PDFAndro BonerezNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument128 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceamer.ms2711No ratings yet

- 2023 - NQS - April 27 - FinalDocument5 pages2023 - NQS - April 27 - FinalPaolo Angelo GutierrezNo ratings yet

- Doing Business in Tanzania, Questions and AnswersDocument26 pagesDoing Business in Tanzania, Questions and Answersimran hameerNo ratings yet

Igacc0903 ST C

Igacc0903 ST C

Uploaded by

Marcel JonathanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Igacc0903 ST C

Igacc0903 ST C

Uploaded by

Marcel JonathanCopyright:

Available Formats

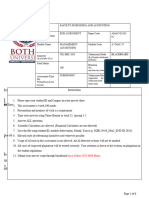

IGCSE ACCOUNTING 903 – SECTION TESTS

Name: Date: Passing Score: Score:

24

30 80% 30 %

Section 1 Test

1. Explain what a Trial Balance is. [2 marks each = 4 marks]

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

2. What is the purpose of a trial balance?

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

IGACC0903 ST C Page 1 of 7 © EDUSEEDS 2023

IGCSE ACCOUNTING 903 – SECTION TESTS

3. Draw up a sample Trial Balance using your examples in the space provided below:

[10 marks]

Trial Balance as at

Ledger Balance Debit Credit

IGACC0903 ST C Page 2 of 7 © EDUSEEDS 2023

IGCSE ACCOUNTING 903 – SECTION TESTS

4. From the following information, draw up a Trial Balance in the books of Samson

[16 marks]

as at 31 March 2017

Ledger Balance $ Ledger Balance $

Capital 500,000 Sales 195,400

Purchases 40,000 Creditors 5,000

Cash in Hand 7,000 Rent 2,000

Cash at Bank 8,500 Furniture 16,000

Electricity exp 4,800 Bank Loan 10,000

Stationery 500 Opening Stock 1,800

Office Equipment 25,400 Commission Received 3,600

Debtors 8,000

Machinery 600,000

IGACC0903 ST C Page 3 of 7 © EDUSEEDS 2023

IGCSE ACCOUNTING 903 – SECTION TESTS

IGACC0903 ST C Page 4 of 7 © EDUSEEDS 2023

IGCSE ACCOUNTING 903 – SECTION TESTS

Name: Date: Passing Score: Score:

24

30 80% 30 %

Section 2 Test

1. Explain these terms: [2 marks each = 4 marks]

a. Capital Expenditure

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

b. Revenue Expenditure

_________________________________________________________________________________

_________________________________________________________________________________

_________________________________________________________________________________

2. Refer to the details below and state whether they are Capital or Revenue

Expenditure. [1 mark each = 10 marks]

Capital or Revenue

Purchase of machinery for use in the

business

Carriage paid to bring the machinery to

the construction site

Purchase of stock of soft drinks for the

vending machine

Payment for heating expenses

IGACC0903 ST C Page 5 of 7 © EDUSEEDS 2023

IGCSE ACCOUNTING 903 – SECTION TESTS

Salaries paid by contractor to his

workmen for the erection of an office in

the builder’s stockyard

Purchase of additional stock

Bought a new computer

Paid office rent

Paid office workers salary

Painted whole office

3. Refer to the details below and state whether they are Capital or Revenue Receipt.

[1 mark each = 10 marks]

Capital or Revenue

Sale of unused machinery belonging to

the business.

Received commission from third party

Sale of inventory in cash

Sale of inventory to James, a debtor

A long-term bank loan to be used for

expanding the business

Paid a creditor early and received a

discount

Sublet part of office premises and

receive monthly rent

Owner of the business banks in money

into the company bank account

Sold a vehicle that was wrongly bought

for external use.

IGACC0903 ST C Page 6 of 7 © EDUSEEDS 2023

IGCSE ACCOUNTING 903 – SECTION TESTS

Sold a painting that was part of office

fixtures and received cash

4. Explain the matching concept. [3 marks each = 6 marks]

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

5. Marcus runs a business selling car spare parts. For the year ended 31 December 2017,

his total cash sales are $35000 and his total credit sales are $65000. From this

amount, he managed to collect $40000 from his outstanding creditors. What are his

total sales for the year ended 31 December 2017? Give a reason for your answer.

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

IGACC0903 ST C Page 7 of 7 © EDUSEEDS 2023

You might also like

- Quiz 3 - 1193 - IEECONO - EB INDUSTRIAL ENGINEERING ECONOMY PDFDocument18 pagesQuiz 3 - 1193 - IEECONO - EB INDUSTRIAL ENGINEERING ECONOMY PDFkiks fernsNo ratings yet

- Business Plan Tote Bag CompanyDocument64 pagesBusiness Plan Tote Bag CompanyMuhamad RiskiNo ratings yet

- PFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial StatementsDocument71 pagesPFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial Statementscalista sNo ratings yet

- Uae Contractors' Association Members List: Company Name Tel. No. Fax. No. P.O.Box Emirate WebsiteDocument15 pagesUae Contractors' Association Members List: Company Name Tel. No. Fax. No. P.O.Box Emirate Websitehamza100% (2)

- Paf 3023 - Adjusting Entries Exercise SkemaDocument6 pagesPaf 3023 - Adjusting Entries Exercise SkemaLIM LEE THONGNo ratings yet

- Economics 3342 (Due On Feb 18, 10am) : 1 The Ricardian Model (15pts)Document3 pagesEconomics 3342 (Due On Feb 18, 10am) : 1 The Ricardian Model (15pts)mattNo ratings yet

- Supply Chain Chap-4Document10 pagesSupply Chain Chap-4SuMit SoMai THapaNo ratings yet

- Igacc0903 MT CDocument8 pagesIgacc0903 MT CMarcel JonathanNo ratings yet

- Igacc0901 ST CDocument6 pagesIgacc0901 ST CMarcel JonathanNo ratings yet

- Chapter 03 SMDocument67 pagesChapter 03 SMAthena LauNo ratings yet

- Igacc0907 ST CDocument8 pagesIgacc0907 ST CMarcel JonathanNo ratings yet

- Igacc0901 MT CDocument5 pagesIgacc0901 MT CMarcel JonathanNo ratings yet

- Student NameDocument16 pagesStudent NameishwarsumeetNo ratings yet

- Acc.1 - HW Ch. 1+2+3 - 31-10-2023Document6 pagesAcc.1 - HW Ch. 1+2+3 - 31-10-2023samerghaith0No ratings yet

- BTE343MT 1 Winter 2010.solutionDocument16 pagesBTE343MT 1 Winter 2010.solutionishwarsumeetNo ratings yet

- Igacc0903 Ab CDocument43 pagesIgacc0903 Ab CMarcel JonathanNo ratings yet

- Adjusting Accounts and Preparing Financial StatementsDocument54 pagesAdjusting Accounts and Preparing Financial StatementsAmna TahirNo ratings yet

- Cost Management Accounting DEC 2023Document4 pagesCost Management Accounting DEC 2023Aash RedmiNo ratings yet

- Mock Midterm 1 Solution UPDATED SEPT 28Document15 pagesMock Midterm 1 Solution UPDATED SEPT 28Venkat ChamarthiNo ratings yet

- 7110 s04 QP 2Document12 pages7110 s04 QP 2mstudy123456No ratings yet

- © The Institute of Chartered Accountants of India: ST ST STDocument14 pages© The Institute of Chartered Accountants of India: ST ST STRITZ BROWNNo ratings yet

- Ce 8328: Construction Management: Assignment 02Document9 pagesCe 8328: Construction Management: Assignment 02Chiranjaya HulangamuwaNo ratings yet

- Strategic Case For IT InvestmentDocument64 pagesStrategic Case For IT Investmentjackson fooNo ratings yet

- 7110 s18 QP 23Document24 pages7110 s18 QP 23Shahzaib ShahbazNo ratings yet

- 157 28395 EY111 2013 4 2 1 Chap003Document74 pages157 28395 EY111 2013 4 2 1 Chap003JasonNo ratings yet

- Adjusting Accounts and Preparing Financial Statements: QuestionsDocument74 pagesAdjusting Accounts and Preparing Financial Statements: QuestionsChaituNo ratings yet

- ch03 Part6Document6 pagesch03 Part6Sergio HoffmanNo ratings yet

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- Final Exam F2021 PDFDocument4 pagesFinal Exam F2021 PDFbilelNo ratings yet

- FABMDocument2 pagesFABMTinNo ratings yet

- Accounting PrinciplesDocument7 pagesAccounting PrinciplesNitin ArasappanNo ratings yet

- MN-M001 Online 24 Hour Exam - January 2024 FINAL - 240115 - 093952Document5 pagesMN-M001 Online 24 Hour Exam - January 2024 FINAL - 240115 - 093952szj00247No ratings yet

- Ch04Prob4 14A-Exe1Document4 pagesCh04Prob4 14A-Exe1kanika019No ratings yet

- Mid I ACT 411Document3 pagesMid I ACT 411hosnearanazninNo ratings yet

- FAB Assignment 2020-2021 - UpdatedDocument7 pagesFAB Assignment 2020-2021 - UpdatedMuhammad Hamza AminNo ratings yet

- Strategic Case For IT InvestmentDocument64 pagesStrategic Case For IT Investmentjackson fooNo ratings yet

- Management Question PaperDocument6 pagesManagement Question PaperSechaba ChejanaNo ratings yet

- Paper12 Solution RevisedDocument17 pagesPaper12 Solution Revised15Nabil ImtiazNo ratings yet

- Godavari Electricals LTD., Wanted To Set Up Its New Plant For Manufacturing of Heaters. The Management ofDocument32 pagesGodavari Electricals LTD., Wanted To Set Up Its New Plant For Manufacturing of Heaters. The Management ofckamdarNo ratings yet

- Grade 9 Edexcel AccountingDocument11 pagesGrade 9 Edexcel Accountingnirosha pereraNo ratings yet

- Get Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment PaymentDocument3 pagesGet Fully Solved Assignment 100% Trusted Website Bcoz We Use Installment PaymentManishNo ratings yet

- Igcse Accounting Control Accounts - Questions AnswersDocument24 pagesIgcse Accounting Control Accounts - Questions AnswersOmar WaheedNo ratings yet

- f2 MGMT Accounting August 2017Document20 pagesf2 MGMT Accounting August 2017MSHANA ALLYNo ratings yet

- ACCA F3 Control Accounts and Incomplete Records Questions2Document6 pagesACCA F3 Control Accounts and Incomplete Records Questions2Amos OkechNo ratings yet

- Fundamental Accounting Principles 22Nd Edition Wild Solutions Manual Full Chapter PDFDocument60 pagesFundamental Accounting Principles 22Nd Edition Wild Solutions Manual Full Chapter PDFTaraThomasdwbz100% (15)

- ACC 304 Week 3 Homework - Chapter 10Document8 pagesACC 304 Week 3 Homework - Chapter 10Leree0% (1)

- ACC101 2023 02 AssignmentDocument6 pagesACC101 2023 02 AssignmentNicoleneNo ratings yet

- 2023 Specimen Paper 4Document10 pages2023 Specimen Paper 4l PLAY GAMESNo ratings yet

- DCAT-Sem II 2013 Question PapersDocument4 pagesDCAT-Sem II 2013 Question Paperssubhash dalviNo ratings yet

- Test Acc406 - Dec 2018 QQDocument8 pagesTest Acc406 - Dec 2018 QQtakoyaki papadomNo ratings yet

- A GCE Accounting 2505 June 2007 Question Paper +ansDocument17 pagesA GCE Accounting 2505 June 2007 Question Paper +ansNaziya BocusNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Igacc0902 ST CDocument8 pagesIgacc0902 ST CMarcel JonathanNo ratings yet

- Test-6 CMA Inter gr-1 Financial Statement of Profit OrganisationDocument14 pagesTest-6 CMA Inter gr-1 Financial Statement of Profit Organisationadityatiwari122006No ratings yet

- 102.COA PL I Solution CMA Special Examination 2021novemberDocument7 pages102.COA PL I Solution CMA Special Examination 2021novemberSky WalkerNo ratings yet

- VCE Accounting - VCAA Unit 3 2012 Suggested SolutionsDocument13 pagesVCE Accounting - VCAA Unit 3 2012 Suggested SolutionsConnect EducationNo ratings yet

- 6e Brewer CH09 B EOCDocument10 pages6e Brewer CH09 B EOCJonathan Altamirano BurgosNo ratings yet

- Igacc0907 Ab CDocument34 pagesIgacc0907 Ab CMarcel JonathanNo ratings yet

- 17mba22 FM T2 KeyDocument7 pages17mba22 FM T2 KeySwathi ShanmuganathanNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- QuickBooks Online for Beginners: A Quick Reference and Step-by-Step Guide to Mastering QuickBooks Online for Small Business Owners from Beginners to ExpertFrom EverandQuickBooks Online for Beginners: A Quick Reference and Step-by-Step Guide to Mastering QuickBooks Online for Small Business Owners from Beginners to ExpertNo ratings yet

- CNY Event IdeasDocument2 pagesCNY Event IdeasMarcel JonathanNo ratings yet

- Quiz 3 Sevilla Grade 10Document5 pagesQuiz 3 Sevilla Grade 10Marcel JonathanNo ratings yet

- Lecture 1 Introduction To Macroeconomics, GDP and Economic GrowthDocument73 pagesLecture 1 Introduction To Macroeconomics, GDP and Economic GrowthMarcel JonathanNo ratings yet

- References ListDocument1 pageReferences ListMarcel JonathanNo ratings yet

- Basic Pythagoras TheoremDocument4 pagesBasic Pythagoras TheoremMarcel JonathanNo ratings yet

- Circular Motion Part 2Document6 pagesCircular Motion Part 2Marcel JonathanNo ratings yet

- Project Brief - Biometrio Earth - FinalDocument3 pagesProject Brief - Biometrio Earth - FinalMarcel JonathanNo ratings yet

- Double Entry Bookkeeping Part A HWDocument2 pagesDouble Entry Bookkeeping Part A HWMarcel JonathanNo ratings yet

- Grade 8 Module Test RevisionDocument4 pagesGrade 8 Module Test RevisionMarcel JonathanNo ratings yet

- Statistics For Business and Economics,: 11E Anderson/Sweeney/WilliamsDocument39 pagesStatistics For Business and Economics,: 11E Anderson/Sweeney/WilliamsMarcel JonathanNo ratings yet

- Setting Up and Solving QuadraticsDocument6 pagesSetting Up and Solving QuadraticsMarcel JonathanNo ratings yet

- Eb Lecturer Guide 1.2Document100 pagesEb Lecturer Guide 1.2Marcel JonathanNo ratings yet

- Lectorial Slides 6bDocument25 pagesLectorial Slides 6bMarcel JonathanNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/31Marcel JonathanNo ratings yet

- Journal & Double EntryDocument2 pagesJournal & Double EntryMarcel JonathanNo ratings yet

- Lectorial Slides 5b NEWDocument23 pagesLectorial Slides 5b NEWMarcel JonathanNo ratings yet

- Lectorial Slides 6aDocument30 pagesLectorial Slides 6aMarcel JonathanNo ratings yet

- Ingles ConsumismoDocument3 pagesIngles ConsumismoSónia RibeiroNo ratings yet

- ELHF Jun'18 Investor CommuniquéDocument6 pagesELHF Jun'18 Investor CommuniquéHarsh GandhiNo ratings yet

- Test Bank For International Financial Management 14th Edition Jeff MaduraDocument25 pagesTest Bank For International Financial Management 14th Edition Jeff Madurak60.2113340007No ratings yet

- PDF 20230505 224013 0000 PDFDocument1 pagePDF 20230505 224013 0000 PDFAmir SofuanNo ratings yet

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- Marketing To The Bottom of The Pyramid: CASE 3-3Document2 pagesMarketing To The Bottom of The Pyramid: CASE 3-3Nazmul Hasan NahidNo ratings yet

- Advanced Corporate Finance Case 1Document2 pagesAdvanced Corporate Finance Case 1Adrien PortemontNo ratings yet

- 2003 IndexDocument47 pages2003 Indexboni nugrohoNo ratings yet

- Yeshi Habte Final Thesis On Factors Affecting of Time and Cost OverrunDocument83 pagesYeshi Habte Final Thesis On Factors Affecting of Time and Cost OverrunYishak KibruNo ratings yet

- Customer Satisfaction Indexing For Banking Services and Skills of The Service Providers in The State of AssamDocument10 pagesCustomer Satisfaction Indexing For Banking Services and Skills of The Service Providers in The State of AssamSudhanshu VermaNo ratings yet

- Investment Calculator - SmartAssetDocument1 pageInvestment Calculator - SmartAssetSulemanNo ratings yet

- Rural Marketing: Introduction, Concept and Definitions: These AreDocument3 pagesRural Marketing: Introduction, Concept and Definitions: These AregunjanNo ratings yet

- Is Forex HalalDocument14 pagesIs Forex HalalHamid GhorzangNo ratings yet

- IC-38 Question Bank - 1Document48 pagesIC-38 Question Bank - 1anshul2503No ratings yet

- Monopolistically CompetitiveDocument26 pagesMonopolistically Competitivebeth el100% (1)

- Lecture 15 - Summing Up of Part-1 (Policy) & Introduction To Housing PlanningDocument17 pagesLecture 15 - Summing Up of Part-1 (Policy) & Introduction To Housing PlanningRadhika KhandelwalNo ratings yet

- Far210 - July2020 SS Q5Document2 pagesFar210 - July2020 SS Q5imn njwaaaNo ratings yet

- BALANCE SHEET 2020-2021 OF Hindustan Unilever .: Akhil Manoj Panikar Sybms B Roll No:-6163 Management AccountingDocument4 pagesBALANCE SHEET 2020-2021 OF Hindustan Unilever .: Akhil Manoj Panikar Sybms B Roll No:-6163 Management AccountingAkhil ManojNo ratings yet

- G.O.Ms - No.59 - House Building AdvanceDocument3 pagesG.O.Ms - No.59 - House Building AdvanceMahendar Erram100% (1)

- 12th CBSE 2021-22 BatchDocument253 pages12th CBSE 2021-22 BatchPriyanshu GehlotNo ratings yet

- Allied Bank Ltd. Financial Statements AnalysisDocument22 pagesAllied Bank Ltd. Financial Statements Analysisbilal_jutttt100% (1)

- Appendix A Table A. 1. List of Voluntary Disclosure ItemsDocument3 pagesAppendix A Table A. 1. List of Voluntary Disclosure ItemsyuliaNo ratings yet

- AUTO - 0ar Aop 2014 PDFDocument276 pagesAUTO - 0ar Aop 2014 PDFAndro BonerezNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument128 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceamer.ms2711No ratings yet

- 2023 - NQS - April 27 - FinalDocument5 pages2023 - NQS - April 27 - FinalPaolo Angelo GutierrezNo ratings yet

- Doing Business in Tanzania, Questions and AnswersDocument26 pagesDoing Business in Tanzania, Questions and Answersimran hameerNo ratings yet