Professional Documents

Culture Documents

Annexure B - BSID Collect TCS Us 206 (1H) & 206CCA

Annexure B - BSID Collect TCS Us 206 (1H) & 206CCA

Uploaded by

sabale xerox0 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

Annexure B - BSID Collect TCS us 206(1H) & 206CCA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageAnnexure B - BSID Collect TCS Us 206 (1H) & 206CCA

Annexure B - BSID Collect TCS Us 206 (1H) & 206CCA

Uploaded by

sabale xeroxCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

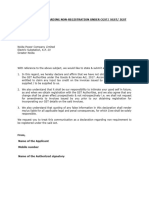

Annexure B

To, Date:11.03.2024

Bridgestone India Private Limited

Plot A43, Phase II, MIDC Chakan, Village Sawardari,

Taluka Khed, Dist Pune, Maharashtra - 410501

Subject : Declaration with respect to my/ our filing of income tax

returns

Previous Year (PY) : 2021-22

Assessment Year (AY) : 2023-24

Permanent Account Number (PAN) : AAKPD5397F

Declaration under section 206CCA of the Income-tax Act, 1961

1. Filing of return of income:

This is to declare that I/ we have filed Income tax returns for following PYs relevant to respective AYs as on the

date of providing the said declaration:

PY 2019-20 (AY 2020-21)

PY 2018-19 (AY 2019-20)

2. Threshold limit for tax deducted at source (‘TDS’) and tax collected at source (‘TCS’):

This is to declare that the aggregate of TDS and TCS in my/ our case for each of the above mentioned PYs is

equal to or in excess of/less than* INR 50,000/-.

I/ we hereby certify that the declaration made above is true and correct. If there is any change in the above

information, I/we would promptly inform Bridgestone India Pvt Ltd. Further, I/we would also submit any

documents required/needed to support the above declaration, if and when required.

In the event that the above declaration is found to be false or incorrect, due to which the Company is held liable

for any consequences under the Act, then, I/we would indemnify the Company towards any loss/ damage

incurred in this regard.

Yours sincerely,

MAHENDRA TYRES

Page 1 of 1

You might also like

- 15CADocument2 pages15CAavinash14 neereNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- Declaration FormatsDocument5 pagesDeclaration Formatskirubkanchan96No ratings yet

- AHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024Document4 pagesAHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024hadassaha VNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- Resident Individual Shareholders Valid PanDocument4 pagesResident Individual Shareholders Valid Panharikrishnan176No ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- Notice Under Clause (B) of Section 148A of The Income-Tax Act, 1961Document4 pagesNotice Under Clause (B) of Section 148A of The Income-Tax Act, 1961infoNo ratings yet

- Individual Tax Return 2023 - Xiwan Song - EncryptedDocument8 pagesIndividual Tax Return 2023 - Xiwan Song - EncryptedWinnie SongNo ratings yet

- TDS Intimation To ShareholdersDocument7 pagesTDS Intimation To Shareholdersnamratapandey244No ratings yet

- Gmail - Tata Steel Limited - Communication On Tax Deduction at Source On Dividend PayoutDocument7 pagesGmail - Tata Steel Limited - Communication On Tax Deduction at Source On Dividend PayoutDheeraj UppiNo ratings yet

- GST DeclarationksjdhwjnnDocument1 pageGST Declarationksjdhwjnnphoenix.hb.krNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Show Cause Sairuchi DMC Dated 13.03.2024Document1 pageShow Cause Sairuchi DMC Dated 13.03.2024basecandlesNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- 4 - DeclarationDocument1 page4 - DeclarationSonu YadavNo ratings yet

- Sodexo Rectification - 154 IT ActDocument2 pagesSodexo Rectification - 154 IT ActGaurav AgarwalNo ratings yet

- Amendment in Section 43B of Income Tax Act Related To MSMEDocument4 pagesAmendment in Section 43B of Income Tax Act Related To MSMEcszohebsayaniNo ratings yet

- Dividend IntimationDocument21 pagesDividend IntimationRutuja SNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- Digitally Signed by SANIN Panicker Date: 2024.05.07 19:11:07 +05'30'Document7 pagesDigitally Signed by SANIN Panicker Date: 2024.05.07 19:11:07 +05'30'Prakash KumarNo ratings yet

- Interim-Dividen-2021-22 - TDS-on-dividend-CommunicationDocument4 pagesInterim-Dividen-2021-22 - TDS-on-dividend-CommunicationNimesh PatelNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnganeshzenaNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- B2B To B2C CertificateDocument1 pageB2B To B2C Certificatebhaseen photostateNo ratings yet

- Mr. Rajendra Jain File Scanned.Document36 pagesMr. Rajendra Jain File Scanned.tharundigistudiotmkNo ratings yet

- Union GST Audit ReplyDocument2 pagesUnion GST Audit ReplybirmaniNo ratings yet

- b0d9c Reply To 16 4 NoticeDocument7 pagesb0d9c Reply To 16 4 NoticeahemadriandcoNo ratings yet

- Aayush JainDocument3 pagesAayush Jaindingle2No ratings yet

- NSP20 K 17 May 21Document1 pageNSP20 K 17 May 21harishNo ratings yet

- Sainathan Hemant Kaushik 2023 T1 - ClientDocument32 pagesSainathan Hemant Kaushik 2023 T1 - ClientJoe SainathanNo ratings yet

- 2023 Itr SushmithakuppusamiDocument18 pages2023 Itr SushmithakuppusamidennisNo ratings yet

- CRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Document2 pagesCRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Salman ArshadNo ratings yet

- Proposal Letter 148A (A) Shree Siddhivinayak Oil Foods - AY202021Document8 pagesProposal Letter 148A (A) Shree Siddhivinayak Oil Foods - AY202021basecandlesNo ratings yet

- IT Declaration Form April 2023 To March 2024.Document3 pagesIT Declaration Form April 2023 To March 2024.partha.uneesolutionsNo ratings yet

- ITR FormDocument3 pagesITR Formguneet sandhuNo ratings yet

- Final: Form GST DRC - 03Document3 pagesFinal: Form GST DRC - 03manoj kumar singodiyaNo ratings yet

- 856 Proposal FormDocument6 pages856 Proposal FormDhiman NaskarNo ratings yet

- (Template) Application For Merchant Cooperation - HCPH OPG and QR (As of March 2023) - Filled-Out FormDocument6 pages(Template) Application For Merchant Cooperation - HCPH OPG and QR (As of March 2023) - Filled-Out FormGabrielNo ratings yet

- Iffco-Tokio General Insurance Co. LTD.: Benefits Sum InsuredDocument1 pageIffco-Tokio General Insurance Co. LTD.: Benefits Sum Insuredma.shehlaintNo ratings yet

- Demand NoticeDocument1 pageDemand NoticeManuNo ratings yet

- SFL Controlling Person FormDocument2 pagesSFL Controlling Person FormSyed SaqlainNo ratings yet

- Galt500: Registered No. Hse - 49 / 2016Document3 pagesGalt500: Registered No. Hse - 49 / 2016satishNo ratings yet

- Annex UreDocument2 pagesAnnex UreKunal RajkhowaNo ratings yet

- TdsDocument1 pageTdskaranNo ratings yet

- Asst Order Priya Arya AY 2022-23Document8 pagesAsst Order Priya Arya AY 2022-23basecandlesNo ratings yet

- GST and It Ppt. GRP.6Document32 pagesGST and It Ppt. GRP.6BANANI DASNo ratings yet

- Applicable Tax Deduction at Source Tds 2023Document4 pagesApplicable Tax Deduction at Source Tds 2023Hemangi PrabhuNo ratings yet

- APAPM1230P - Demand Notice Us 156 - 1056620148 (1) - 27092023Document2 pagesAPAPM1230P - Demand Notice Us 156 - 1056620148 (1) - 27092023harshilmittapalli947.comNo ratings yet

- New Self Certification FormDocument3 pagesNew Self Certification Formtimstark004No ratings yet

- Declaration For Rekyc Non IndividualsDocument2 pagesDeclaration For Rekyc Non IndividualsPartha SundarNo ratings yet

- Annexure BDocument3 pagesAnnexure Bshowmytv12No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- Declaration To Be Obtained From Vendors For 206AB - RevisedDocument1 pageDeclaration To Be Obtained From Vendors For 206AB - RevisedPraveen RanaNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet