Professional Documents

Culture Documents

Nouveauté Loi Des Finances 2023 E

Nouveauté Loi Des Finances 2023 E

Uploaded by

Minyam Jenny0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

Nouveauté loi des finances 2023 E

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesNouveauté Loi Des Finances 2023 E

Nouveauté Loi Des Finances 2023 E

Uploaded by

Minyam JennyCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

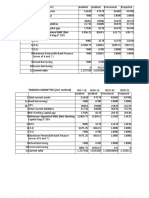

News of the 2023 finance law in Cameroon

Taxes, Rates and Before From January 1,2023

déclarations

Computer fee on 0.45% of the CIF value 1% of CIF value

imports

Submission no later than March 15 of transfer pricing

documentation to the Customs Department, including:

- The statement of the participations of the

associated company,

Declaration of This declaration did not - The description of the activities of the associated

transfer pricing exist at customs, just for company and the Cameroonian company,

policy to customs taxes. - A general description of transfer pricing

- A summary statement of transactions made with

related companies (nature, amount, territory of tax

residence, beneficial owners of payments, method

of determining the transfer prices applied)

- Statement of loans or borrowings

- Statement of non-monetary transactions

The rate for companies Reduction of the rate for companies whose turnover is less

Company tax with a turnover of less than 3 billion to 27.5%

than 3 billion was 30.8%

The withholding tax was Companies that import must deduct from their sales a

due on sales to prepayment to be paid back to taxes.

wholesalers and semi- This prepayment is due if and only if the customer buys to

Prepayment on sale wholesalers by resell.

companies that import This prepayment must be present on the invoice given to

the customer.

The rate is 2%, 5% or 10% depending on the tax status of

the client

Automotive stamp 150,000 FCFA per year 200,000 FCFA per year and per machine

duty and per machine

At the same time as the filing of the financial statements on

March 15, a declaration of the beneficial owner must be

made with the filing of supporting documents providing the

following information:

- Birth name and usual name

- First names and pseudonyms

Declaration of the No obligation - Nationality

beneficial owner - Date and place of birth

- Place of residence

- Home Address

- Method of control exercised by the beneficial

owner

- Date on which the person became the beneficial

owner.

To this obligation is added an obligation to keep a register

to be kept for 5 years.

Fine in the event of non-declaration and record keeping:

5,000,000 FCFA, fine of 100,000 FCFA per day of delay if

formal notice to declare received.

Fine for failure to update: 1,000,000 FCFA

You might also like

- Taxes On Commercial LeaseDocument8 pagesTaxes On Commercial Leasebelbel08100% (1)

- Lumbera NotesDocument7 pagesLumbera NotesElizabeth LotillaNo ratings yet

- Certificate Under Section 603: Council Chambers Telephone: Email: All Correspondence To: The Chief Executive OfficerDocument1 pageCertificate Under Section 603: Council Chambers Telephone: Email: All Correspondence To: The Chief Executive OfficerNir AlonNo ratings yet

- Authoritative Guide On Real Estate Transfer TaxesDocument37 pagesAuthoritative Guide On Real Estate Transfer TaxesJames ReyesNo ratings yet

- Profession Tax For ProfessionalsDocument3 pagesProfession Tax For ProfessionalsSanket MistryNo ratings yet

- Business and Transfer TaxationDocument5 pagesBusiness and Transfer TaxationElizabeth OlaNo ratings yet

- Tax ReviewerDocument10 pagesTax ReviewerClaire ZafraNo ratings yet

- Afghanistan Tax Card FinalDocument17 pagesAfghanistan Tax Card FinalSalman XrNo ratings yet

- 20 Panasonic Communications vs. CIRDocument10 pages20 Panasonic Communications vs. CIRJohn BernalNo ratings yet

- Consumption Is The Usage or Utilization of Goods or Services by PurchaseDocument7 pagesConsumption Is The Usage or Utilization of Goods or Services by PurchaseNicole ReintegradoNo ratings yet

- Income, Tax Treatment and Mode of Filing 2020Document2 pagesIncome, Tax Treatment and Mode of Filing 2020francis dungcaNo ratings yet

- BUSTAXADocument9 pagesBUSTAXATitania ErzaNo ratings yet

- October 12,: Vat Zero-Rated Sale of Service (Labor Aspect)Document6 pagesOctober 12,: Vat Zero-Rated Sale of Service (Labor Aspect)LaBron JamesNo ratings yet

- LGC NotesDocument12 pagesLGC NotesIsaac Joshua AganonNo ratings yet

- Quick Sell Repossessed Properties FNB: WWW - Quicksell.co - ZaDocument9 pagesQuick Sell Repossessed Properties FNB: WWW - Quicksell.co - ZaChristian MakandeNo ratings yet

- Module 5Document21 pagesModule 5Krisly Erica DALISAYNo ratings yet

- Business Tax SummaryDocument10 pagesBusiness Tax SummaryJohn Raymond MarzanNo ratings yet

- 2301 Turnover Tax Declaration FormDocument3 pages2301 Turnover Tax Declaration FormMaddahayota College100% (1)

- Module 5Document19 pagesModule 5Jisung ParkNo ratings yet

- Other Percentage TaxesDocument9 pagesOther Percentage TaxesLeonard CañamoNo ratings yet

- Supplier Registration Information Form v6 2018-03Document9 pagesSupplier Registration Information Form v6 2018-03Blue Dots DeeaNo ratings yet

- Authority To Sell: Signature Over Printed Name of Landowner/Representative)Document1 pageAuthority To Sell: Signature Over Printed Name of Landowner/Representative)NBP CashierNo ratings yet

- Transfer of Shares - Taxguru - inDocument4 pagesTransfer of Shares - Taxguru - inRamesh MandavaNo ratings yet

- J. Bersamin TaxDocument14 pagesJ. Bersamin TaxJessica JungNo ratings yet

- Business TaxationDocument33 pagesBusiness Taxationrose querubinNo ratings yet

- KRA Taxpayers HandbookDocument6 pagesKRA Taxpayers HandbookSteadynet TechnologiesNo ratings yet

- Withholding Tax On RentalDocument2 pagesWithholding Tax On Rentalsabir.mail28576No ratings yet

- Kinds of Shifting: Escape From Taxation A. Tax ShiftingDocument2 pagesKinds of Shifting: Escape From Taxation A. Tax ShiftingLAW10101No ratings yet

- Module 1 - VAT ExemptionsDocument15 pagesModule 1 - VAT ExemptionsCrazy DaveNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- BIR - Remittance of CWT (Form 1606) Discussion 1Document92 pagesBIR - Remittance of CWT (Form 1606) Discussion 1Roy RitagaNo ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- Real Estate TaxesDocument5 pagesReal Estate TaxesJorgeNo ratings yet

- Finals in Taxation Law ReviewDocument15 pagesFinals in Taxation Law ReviewSij Da realNo ratings yet

- Estate Planning Tools Tax Charges Before The Train Law Tax Charges After The Train LawDocument5 pagesEstate Planning Tools Tax Charges Before The Train Law Tax Charges After The Train LawAmiel SaquisameNo ratings yet

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Document39 pagesNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonNo ratings yet

- Guidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnDocument1 pageGuidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnRieland CuevasNo ratings yet

- Post Registration Returns Filing and Payments LeafletDocument2 pagesPost Registration Returns Filing and Payments LeafletArthur ShimotweNo ratings yet

- Taxation PDFDocument55 pagesTaxation PDFHumphrey OdchigueNo ratings yet

- Taxation Reviewer - Percentage TaxDocument3 pagesTaxation Reviewer - Percentage TaxDaphne BarceNo ratings yet

- Paseo Realty and Development Corp. Vs - Court of Appealsg.R. No. 119286 October 13, 2004FACTSDocument8 pagesPaseo Realty and Development Corp. Vs - Court of Appealsg.R. No. 119286 October 13, 2004FACTSShynnMiñozaNo ratings yet

- Presentation 3 Real Property Gains TaxDocument29 pagesPresentation 3 Real Property Gains TaxAimi AzemiNo ratings yet

- Percentage Taxes NotesDocument4 pagesPercentage Taxes NotesWearIt Co.No ratings yet

- Highlights-FinanceAct2022-23 TANVEER LAW ASSOCIATESDocument45 pagesHighlights-FinanceAct2022-23 TANVEER LAW ASSOCIATESAhmed RazaNo ratings yet

- GST Overview Rachana 1Document31 pagesGST Overview Rachana 1Path A Way AheadNo ratings yet

- FAQ Property Tax 10 02 2017Document7 pagesFAQ Property Tax 10 02 2017Diya PandeNo ratings yet

- Taxation IIDocument3 pagesTaxation IIAnonymous BNrz1arNo ratings yet

- TRAIN (Changes) ???? Pages 2, 3, 5, 7Document4 pagesTRAIN (Changes) ???? Pages 2, 3, 5, 7blackmail1No ratings yet

- Kjaefncl (Complete)Document42 pagesKjaefncl (Complete)Kenzo RodisNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Contex Corporation vs. CIR Persons LiableDocument16 pagesContex Corporation vs. CIR Persons LiableEvan NervezaNo ratings yet

- KPMG - Newsletter Loi de Finances 2024 (English Version)Document6 pagesKPMG - Newsletter Loi de Finances 2024 (English Version)boukhlefNo ratings yet

- 68 Filipinas Synthetic Vs CADocument9 pages68 Filipinas Synthetic Vs CAPam ChuaNo ratings yet

- Coral Bay Nickel Vs CIRDocument5 pagesCoral Bay Nickel Vs CIRCJ CasedaNo ratings yet

- I. Estate Tax Liability: Effective January 1, 1998 Up To December 31, 2017 (RA No. 8424)Document8 pagesI. Estate Tax Liability: Effective January 1, 1998 Up To December 31, 2017 (RA No. 8424)utaknghenyoNo ratings yet

- BIR RulingDocument3 pagesBIR RulingyakyakxxNo ratings yet

- TAXATION 2 Chapter 8 Percentage Tax PDFDocument4 pagesTAXATION 2 Chapter 8 Percentage Tax PDFKim Cristian MaañoNo ratings yet

- RMC No. 4-2021 Revised - v2Document5 pagesRMC No. 4-2021 Revised - v2jesieNo ratings yet

- W14 Module 12withholding TaxesDocument7 pagesW14 Module 12withholding Taxescamille ducutNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- The Lemon LawDocument24 pagesThe Lemon Lawshiela shielaNo ratings yet

- Steps For Successful Career Planning: ANSWER: There Are Many Things That I Would Enjoy Doing The Most, But The TopDocument9 pagesSteps For Successful Career Planning: ANSWER: There Are Many Things That I Would Enjoy Doing The Most, But The TopGian Paula MonghitNo ratings yet

- 1.c.JMMARKETS Trading Plan Free PDFDocument7 pages1.c.JMMARKETS Trading Plan Free PDFalanorules001No ratings yet

- MPBF Other MethodsDocument10 pagesMPBF Other Methodskaren sunilNo ratings yet

- Terms of Business: Define The FollowingDocument3 pagesTerms of Business: Define The FollowingBetyou WannaNo ratings yet

- MSDocument36 pagesMSJason WangNo ratings yet

- Hilco Management Agreement PropCo ExecutedDocument31 pagesHilco Management Agreement PropCo ExecutedMeetzy OfficielNo ratings yet

- Balus V BalusDocument2 pagesBalus V BalusybunNo ratings yet

- Test Bank For Contemporary Logistics 11 e 11th Edition 0132953463Document4 pagesTest Bank For Contemporary Logistics 11 e 11th Edition 0132953463Joel Slama100% (40)

- Tax Circular Dated 27.2.18Document4 pagesTax Circular Dated 27.2.18Mahendra SharmaNo ratings yet

- Proposed CEMEA 2022 2Document226 pagesProposed CEMEA 2022 2Jayme-Lea VanderschootNo ratings yet

- Nasir Ahmad Recommendtion LetterDocument2 pagesNasir Ahmad Recommendtion LetterAhmadshah NejatiNo ratings yet

- A Friedman Doctrine-The Social Responsibility of Business Is To Increase Its ProfitsDocument7 pagesA Friedman Doctrine-The Social Responsibility of Business Is To Increase Its ProfitsVarun S UNo ratings yet

- Assignment Banking Law, Shubham Singh Kirar IX Sem, BBALLBDocument7 pagesAssignment Banking Law, Shubham Singh Kirar IX Sem, BBALLBShubham Singh KirarNo ratings yet

- Tech Mahindra LTD: by Apanshula Mishra Vijetta ThakurDocument13 pagesTech Mahindra LTD: by Apanshula Mishra Vijetta ThakurApanshula Anantabh MishraNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce: Instructions: 1) 2) 3) 4) 5)Document8 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce: Instructions: 1) 2) 3) 4) 5)Kartik GurmuleNo ratings yet

- METHODOLOGY EE-Hanger Support InstallationDocument4 pagesMETHODOLOGY EE-Hanger Support Installationjerrick raulNo ratings yet

- (DSPACE) CodersTrust - Kaisary Jahan - 111 171 146Document32 pages(DSPACE) CodersTrust - Kaisary Jahan - 111 171 146Selim KhanNo ratings yet

- Effects of Social Media On The Younger GenerationDocument1 pageEffects of Social Media On The Younger Generationhimanshu vermaNo ratings yet

- Full Download Test Bank For Economics Principles and Policy 14th Edition William J Baumol Alan S Blinder John L Solow PDF Full ChapterDocument36 pagesFull Download Test Bank For Economics Principles and Policy 14th Edition William J Baumol Alan S Blinder John L Solow PDF Full Chapterinkleunsevensymdy100% (15)

- FP Lec 3Document42 pagesFP Lec 3engbabaNo ratings yet

- Summer Internship Report On Verka Milk Plant JalandharDocument45 pagesSummer Internship Report On Verka Milk Plant Jalandharsahilsahil92986No ratings yet

- The Inox Group Is A WellDocument7 pagesThe Inox Group Is A WellPriyanshu SharmaNo ratings yet

- Assignment 1 - Project ManagementDocument5 pagesAssignment 1 - Project ManagementSaumya SinghNo ratings yet

- Catilo, CarmelaDocument6 pagesCatilo, CarmelaFLEICH ANNE PASCUANo ratings yet

- Mi 15122023Document30 pagesMi 15122023bdt131No ratings yet

- Management PrerogativeDocument13 pagesManagement PrerogativeGracey Paulino100% (2)

- Accounting For Inventory - 1Document4 pagesAccounting For Inventory - 1ZAKAYO NJONYNo ratings yet