Professional Documents

Culture Documents

Market Outlook: Dealer's Diary

Market Outlook: Dealer's Diary

Uploaded by

Angel BrokingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook: Dealer's Diary

Market Outlook: Dealer's Diary

Uploaded by

Angel BrokingCopyright:

Available Formats

Market Outlook

India Research

November 21, 2011

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com Chg (%) (0.6) (0.6) (1.0) (1.9) 0.2 (1.0) (0.9) (1.2) (1.3) 0.0 (0.7) Chg (%) 0.2 (0.6) (1.1) (1.2) (1.7) (1.7) (1.9) (Pts) (90.2) (29.0) (59.5) (119.4) 11.4 (71.9) (89.0) (103.6) (137.7) 0.6 (39.7) (Pts) 25.4 (15.5) (60.2) (104.7) (326.2) (47.9) (46.5) (Close) 16,372 4,906 5,716 6,182 5,919 6,834 10,161 8,538 10,433 8,299 5,614 (Close) 11,796 2,573 5,363 8,375 18,491 2,730 2,417

Dealers Diary

Indian markets are expected to edge lower tracing weakness in Asian markets. The domestic indices declined on Friday for the third consecutive week as weakening trend in global markets on concerns over the euro zone debt crisis continued to spook investors. Global markets remained largely weak. European bourses closed lower on Friday on the prolonged sovereign debt crises. Concerns also brewed on growing rift between Germany and France over ECBs involvement on fixing the debt crises partially weigh on the markets. Major US indices closed on a mixed note following developments in the Euro-zone. On the domestic front, earnings season have ended on a mixed note. Nonetheless, markets are captured with negative sentiments owing to hardened business environment. In addition, Europes economic roller-coaster will remain as an overhang. Investors will also watch out for US home sales data which will partially indicate the health of US economy.

Markets Today

The trend deciding level for the day is 16,311/ 4,887 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 16,457 16,543 / 4,935 4,965 levels. However, if NIFTY trades below 16,311/ 4,887 levels for the first half-an-hour of trade then it may correct up to 16,225 16,079 / 4,875 4,809 levels.

Indices SENSEX NIFTY S2 16,079 4,809 S1 16,225 4,857 R1 16,457 4,935 R2 16,543 4,965

Indian ADRs Infosys Wipro ICICI Bank HDFC Bank

Chg (%) (0.6) 0.2 0.6 (0.0)

(Pts) (0.3) 0.0 0.2 (0.0)

(Close) $53.1 $9.5 $29.9 $27.9

News Analysis

Infra 2QFY2012 Result Review Three mega infra projects gets clearance

Refer detailed news analysis on the following page

Advances / Declines Advances Declines Unchanged

BSE 882 1,989 108

NSE 410 1,079 41

Net Inflows (November 17, 2011)

` cr FII MFs Purch 1,933 441 Sales 2,094 344 Net (161) 98 MTD 875 (474) YTD 1,390 4,662

Volumes (` cr) BSE NSE 2,378 10,735

FII Derivatives (November 18, 2011)

` cr Index Futures Stock Futures Purch 2,930 3,964 Sales 3,578 3,979 Net (648) (15) Open Interest 16,631 29,206

Gainers / Losers

Gainers Company Shree Renuka Sug Pantaloon Retl HPCL GVK Power Thermax Price (`) 35 198 297 11 450 chg (%) 9.2 8.4 6.3 5.8 4.8 Company Pipavav Defence Amtek Auto IVRCL LTD IFCI Suzlon Energy Losers Price (`) 56 95 32 23 24 chg (%) (20.0) (13.8) (11.8) (8.5) (7.0)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

Infra 2QFY2012 Result Review

Decent top-line growth + Lower EBITDAM/high interest cost = Bottom-line decline: Most infrastructure players (10 companies chosen for this analysis) witnessed decent yoy growth (average 17.3%) on the top-line front in 2QFY2012. We had mentioned in our 1QFY2012 note that sluggish performance on the execution front could be a worrying sign for C&EPC companies given the headwinds faced by the sector, but 2QFY2012s better-than-expected performance on the top-line front has been heartening. EBITDAM for the quarter broadly remained under pressure, owing to high commodity prices and inflationary pressures. Consistent hike in repo rates by the RBI (in order to contain inflation) accentuated the already high interest cost for companies in the sector. On the earnings front, high interest cost (owing to a high interest rate regime and increased debt levels) coupled with EBITDAM compression resulted in a decline in the bottom line for most companies under our coverage. Valuations continue to remain at abysmal levels; Lack of catalyst in sight + Persistent headwinds = Subdued performance to continue: Stock prices of infrastructure companies continued to take a beating on the bourses, bringing the stocks to very attractive levels on the valuation screen, even on subdued earnings estimates. However, lack of positive news flow from companies per se and persistent headwinds faced by the industry such as high interest rates, policy inaction, slower-than-anticipated revival in industrial capex led to underperformance of infrastructure stocks on the bourses. Therefore, given no visible signs of reversal of trends, we continue with our view that the performance of the sector will remain subdued. We prefer to remain selective: We believe that stock-specific approach would yield higher returns given the disparity among these companies and changing dynamics affecting them positively/negatively. Hence, in the current uncertain times, we remain positive on companies having 1) a comfortable leverage position (L&T and Sadbhav); 2) strong order book position (L&T and IVRCL); 3) undemanding valuations (IVRCL); 4) superior return ratios (L&T and Sadbhav); and 5) less dependence on capital markets for raising equity for funding projects (L&T and Sadbhav). Hence, we maintain L&T, IVRCL and Sadbhav as our top picks in the C&EPC space and recommend IRB in the development space after its recent fall, which has brought the stock to attractive levels.

Three mega infra projects gets clearance; L&Ts Hyderabad Metro one of them

The government has given regulatory clearances to three mega infrastructure projects involving an investment of `25,000cr. These are the first among a few projects the government has shortlisted to be put on a fast track. The projects cleared include Hinduja National Power Corporation Ltd. in Vishakhapatnam, L&T Metro Rail (Hyderabad) Ltd. and Simhapuri Expressways Ltd. (Andhra Pradesh). These projects had been held up because of regulatory bottlenecks. However, L&Ts metro project (about `16,000cr) is still facing some land acquisition issues, but these clearances would certainly help to expedite the project. The early clearance of the projects would lead to enhancement of order book for all the companies in the infrastructure space. The finance minister is reviewing the implementation of infrastructure projects valued >`100cr, which we believe is a step in the right direction.

November 21, 2011

Market Outlook | India Research

Economic and Political News

India-China bilateral trade may touch US$100bn by 2013 FDI see 77% yoy jump in 1HFY2012 Spices export up by 29% in values terms in 1HFY2012

Corporate News

Excise duty on diesel cars likely to be raised in the Budget RIL gets clean chit for capex till FY 2008 in KG-D6 Govt. nudges LIC to buy 10% stake in Kingfisher

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

November 21, 2011

Market Outlook | India Research

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

November 21, 2011

You might also like

- Why Moats Matter: The Morningstar Approach to Stock InvestingFrom EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingRating: 4 out of 5 stars4/5 (3)

- I Ching Acupuncture The Balance MethodDocument14 pagesI Ching Acupuncture The Balance MethodMaria Agustina Flores de Seguela100% (2)

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 17.11.11Document3 pagesMarket Outlook 17.11.11Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook 11th January 2012Document4 pagesMarket Outlook 11th January 2012Angel BrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingNo ratings yet

- Market Outlook 26th August 2011Document3 pagesMarket Outlook 26th August 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument5 pagesMarket Outlook: Dealer's DiaryVaibhav BhadangeNo ratings yet

- Market Outlook 6th September 2011Document4 pagesMarket Outlook 6th September 2011Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingNo ratings yet

- Market Outlook 20th September 2011Document4 pagesMarket Outlook 20th September 2011Angel BrokingNo ratings yet

- Market Outlook 28th September 2011Document3 pagesMarket Outlook 28th September 2011Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Market Outlook 26th September 2011Document3 pagesMarket Outlook 26th September 2011Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 4th August 2011Document4 pagesMarket Outlook 4th August 2011Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingNo ratings yet

- Market Outlook 19th August 2011Document3 pagesMarket Outlook 19th August 2011Angel BrokingNo ratings yet

- Market Outlook 18th August 2011Document3 pagesMarket Outlook 18th August 2011Angel BrokingNo ratings yet

- Market Outlook 4th October 2011Document3 pagesMarket Outlook 4th October 2011Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 23rd February 2012Document4 pagesMarket Outlook 23rd February 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingNo ratings yet

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- Market Outlook 12th January 2012Document4 pagesMarket Outlook 12th January 2012Angel BrokingNo ratings yet

- Market Outlook 30th March 2012Document3 pagesMarket Outlook 30th March 2012Angel BrokingNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Market Outlook 23rd September 2011Document4 pagesMarket Outlook 23rd September 2011Angel BrokingNo ratings yet

- Market Watch Daily 14.10Document1 pageMarket Watch Daily 14.10LBTodayNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook 22nd August 2011Document4 pagesMarket Outlook 22nd August 2011Angel BrokingNo ratings yet

- Market Outlook 5th October 2011Document4 pagesMarket Outlook 5th October 2011Angel BrokingNo ratings yet

- Market Outlook 13th September 2011Document4 pagesMarket Outlook 13th September 2011Angel BrokingNo ratings yet

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingNo ratings yet

- Market Outlook 2nd September 2011Document4 pagesMarket Outlook 2nd September 2011anon_8523690No ratings yet

- Market Outlook 6th January 2012Document4 pagesMarket Outlook 6th January 2012Angel BrokingNo ratings yet

- Research: Sintex Industries LimitedDocument4 pagesResearch: Sintex Industries LimitedMohd KaifNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 30th September 2011Document3 pagesMarket Outlook 30th September 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16860) / NIFTY (5104)Document4 pagesDaily Technical Report: Sensex (16860) / NIFTY (5104)Angel BrokingNo ratings yet

- Market Outlook 5th September 2011Document4 pagesMarket Outlook 5th September 2011Angel BrokingNo ratings yet

- Market Outlook 21st February 2012Document4 pagesMarket Outlook 21st February 2012Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingNo ratings yet

- (With Script) June 2021 Saturday WSF Teaching GuideDocument3 pages(With Script) June 2021 Saturday WSF Teaching GuideMichael T. BelloNo ratings yet

- CMRL.12.18 : Section A: New Business, Regulatory and Sales-Related RequirementsDocument2 pagesCMRL.12.18 : Section A: New Business, Regulatory and Sales-Related RequirementsJovelyn ArgeteNo ratings yet

- Shark ClassificationDocument44 pagesShark ClassificationSheeka TareyamaNo ratings yet

- Ca17 Activity 1Document2 pagesCa17 Activity 1Mark Kenneth CeballosNo ratings yet

- African Literature - WikipediaDocument1 pageAfrican Literature - Wikipediatem ijeNo ratings yet

- 2170908Document19 pages2170908bhavikNo ratings yet

- Covert Extinction TherapyDocument6 pagesCovert Extinction TherapyAnet Augustine AnetNo ratings yet

- Rodriguez Vs GellaDocument33 pagesRodriguez Vs GellaRozaiineNo ratings yet

- The Pisces Sagittarius SquareDocument3 pagesThe Pisces Sagittarius SquarejakilaNo ratings yet

- Main Slokas With MeaningDocument114 pagesMain Slokas With MeaningRD100% (1)

- Ancient IndiaDocument9 pagesAncient IndiaAchanger AcherNo ratings yet

- Duhamel's PrincipleDocument14 pagesDuhamel's Principlejoel24348584No ratings yet

- A Project Report On Financial Analysis at B D K LTD HubaliDocument104 pagesA Project Report On Financial Analysis at B D K LTD HubaliBabasab Patil (Karrisatte)100% (1)

- 1.1 Mechatronics Technology PRESENTATIONDocument46 pages1.1 Mechatronics Technology PRESENTATIONInnocent katengulaNo ratings yet

- The Tale of The Three BrothersDocument2 pagesThe Tale of The Three BrothersDéboraNo ratings yet

- International Business: Case Study-Report-3 18-02-2022Document5 pagesInternational Business: Case Study-Report-3 18-02-2022swapnil anandNo ratings yet

- Consolidated Company List December 2018Document478 pagesConsolidated Company List December 2018Rishabh GhaiNo ratings yet

- Elegoo Saturn 8K LCD Light Curable 3D Printer User ManualDocument20 pagesElegoo Saturn 8K LCD Light Curable 3D Printer User ManualStanNo ratings yet

- JK Civil Sevices Classification Control and AppealpdfDocument35 pagesJK Civil Sevices Classification Control and AppealpdfShuja Malik100% (1)

- First Certificate Booklet 2Document89 pagesFirst Certificate Booklet 2Alina TeranNo ratings yet

- Francisco Pagdanganan, Complainant, vs. Atty. Romeo C. Plata, Respondent.Document9 pagesFrancisco Pagdanganan, Complainant, vs. Atty. Romeo C. Plata, Respondent.ChristineNo ratings yet

- Latex ManualDocument160 pagesLatex Manualcd_levyNo ratings yet

- Nurse Managers' Responsive Coaching To Facilitate Staff Nurses' Clinical Skills Development in Public Tertiary HospitalDocument10 pagesNurse Managers' Responsive Coaching To Facilitate Staff Nurses' Clinical Skills Development in Public Tertiary Hospitalvan royeNo ratings yet

- PHD Thesis Library Science DownloadDocument8 pagesPHD Thesis Library Science Downloadyvrpugvcf100% (2)

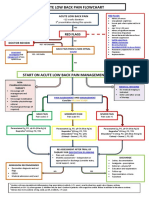

- Acute Low Back Pain Flowchart January 2017Document1 pageAcute Low Back Pain Flowchart January 20171234chocoNo ratings yet

- Tax Breaks in Puerto RicoDocument2 pagesTax Breaks in Puerto RicoLuis E. Meléndez CintrónNo ratings yet

- Transportation Engineering - I: Introduction To Bridge EngineeringDocument33 pagesTransportation Engineering - I: Introduction To Bridge Engineeringmit rami0% (1)

- West Indies Cricket BibliographyDocument20 pagesWest Indies Cricket BibliographyAminaNo ratings yet

- Aberca v. Ver, 1988 PDFDocument2 pagesAberca v. Ver, 1988 PDFLawiswisNo ratings yet