Professional Documents

Culture Documents

Assignment

Assignment

Uploaded by

coolco270Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment

Assignment

Uploaded by

coolco270Copyright:

Available Formats

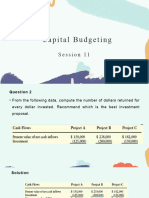

Let's assume that SAP Corporation, a leader in the business

applications software industry, is interested in developing a new

application package for inventory management and shipping

control. It is trying to decide which project to select from a set of

three potential alternatives.

Alternative 1

Year 0 1 2 3 4 5 6 7 8

Benefits 0 70000 75000 70000 75000 80000 85000 90000 95000

Costs 300000 5000 5000 5500 5500 7000 7000 7000 8000

Alternative 2

Year 0 1 2 3 4 5 6 7 8

Benefits 0 50000 60000 70000 80000 85000 90000 95000 100000

Costs 260000 5000 5500 6000 6500 7000 7500 8000 8500

Alternative 3

Year 0 1 2 3 4 5 6 7 8

Benefits 0 55000 60000 75000 80000 85000 90000 95000 100000

Costs 270000 5000 5500 6000 6500 7000 7500 8000 9000

Based on past commercial experiences, the company feels that the

most important selection criteria for its choice are: net present

value, payback period, return on investment, and internal rate

of return. Each criterion is ranked according to its relative

importance. Our choice of projects will thus reflect our desire to

maximize the impact of certain criteria on our decision. We assign

a specific weight to each of our four criteria:

Criterion Weight

Net present value 35%

Payback period 35%

Return on investment 10%

Internal rate of return 20%

In addition to developing the decision criteria, we create

evaluative descriptors that reflect how well the project

alternatives correspond to our key selection criteria. We evaluate

each criterion (which is scored high, medium, or low) according to

the following Table:

Score

Criterion

low medium high

Net present value 1 2 3

Payback period 3 2 1

Return on investment 1 2 3

Internal rate of return 1 2 3

1. For each alternative, calculate the net present value, the

payback period, the return on investment, and the internal rate of

return using a discount rate of 12 percent.

2. Which project alternative is the best? Why?

You might also like

- MBA 7001 Accounting For Decision Makers AssignmentDocument8 pagesMBA 7001 Accounting For Decision Makers AssignmentSupun25% (4)

- PM Assignment 2Document4 pagesPM Assignment 2Juan Quiroz67% (3)

- Project Selection Exercise: ScenarioDocument6 pagesProject Selection Exercise: ScenarioMiguel VienesNo ratings yet

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- Impact Evaluation of Development Interventions: A Practical GuideFrom EverandImpact Evaluation of Development Interventions: A Practical GuideNo ratings yet

- Sew Invisible Zippers Like A ProDocument4 pagesSew Invisible Zippers Like A ProEster Cellucci86% (7)

- Project Selection and Portfolio Management: Chapter ThreeDocument23 pagesProject Selection and Portfolio Management: Chapter Threetan lee huiNo ratings yet

- Xaviers Institute of Business Management StudiesDocument2 pagesXaviers Institute of Business Management StudiesJay KrishnaNo ratings yet

- PMBOK 2-1 Alternatives Analysis-2Document5 pagesPMBOK 2-1 Alternatives Analysis-2esalamanca1No ratings yet

- ABPL90030: Project Evaluation Worksheet 2 - EUAC Model For Project EvaluationDocument1 pageABPL90030: Project Evaluation Worksheet 2 - EUAC Model For Project EvaluationMohamed MamdouhNo ratings yet

- NPV Irr CaseDocument22 pagesNPV Irr Casealim shaikhNo ratings yet

- Strategic Case For IT InvestmentDocument64 pagesStrategic Case For IT Investmentjackson fooNo ratings yet

- Corporate Finance LOS 36Document26 pagesCorporate Finance LOS 36RamNo ratings yet

- A Project Has Initial Investment of Rs.40,000/-.It ProvidesDocument3 pagesA Project Has Initial Investment of Rs.40,000/-.It ProvidesAkshay KumarNo ratings yet

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- 1 Hour Sigma LeanDocument74 pages1 Hour Sigma LeanGunawan tNo ratings yet

- Business and Invesment Pitch Deck-TemplateDocument29 pagesBusiness and Invesment Pitch Deck-TemplateGhost JosefNo ratings yet

- Lecture 07 EEDocument14 pagesLecture 07 EEMuhammad SalmanNo ratings yet

- Strategic Cost ManagementDocument9 pagesStrategic Cost Managementdivyakashyapbharat1No ratings yet

- Finance Management-Week 8Document12 pagesFinance Management-Week 8arwa_mukadam03No ratings yet

- Advanced Cons Methd Lecture Capacity and QualityDocument46 pagesAdvanced Cons Methd Lecture Capacity and QualityadaneNo ratings yet

- Business Decision Making Payback Period and Net Present Value EvaluationDocument6 pagesBusiness Decision Making Payback Period and Net Present Value Evaluationnawal zaheerNo ratings yet

- Healthcare FinnaceDocument4 pagesHealthcare Finnacemobinil1No ratings yet

- FM For CA Intermediate 6-11-20Document45 pagesFM For CA Intermediate 6-11-20Lakshay Singh BhandariNo ratings yet

- Weekly Summary2.1Document12 pagesWeekly Summary2.1Ambrish (gYpr.in)No ratings yet

- WEEK 8: Lecture 8: ROR Multiple Alternatives: October 26-30, 2020Document29 pagesWEEK 8: Lecture 8: ROR Multiple Alternatives: October 26-30, 2020Aziezah PalintaNo ratings yet

- Tutorial 1 - Project Management - Fairuza Fasya RDocument1 pageTutorial 1 - Project Management - Fairuza Fasya RFairuza Fasya RahadistyNo ratings yet

- Report Master. Bau 874 Age 0 SA 500000Document4 pagesReport Master. Bau 874 Age 0 SA 500000bojji28No ratings yet

- Module 5 NotesDocument5 pagesModule 5 NotesVHIMBER GALLUTANNo ratings yet

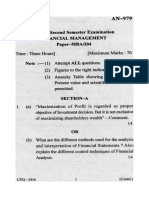

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- August 2022 R: Page 1 of 7Document6 pagesAugust 2022 R: Page 1 of 7Salai SivagnanamNo ratings yet

- Project Planning and Capital BudgetingDocument16 pagesProject Planning and Capital BudgetingtoabhishekpalNo ratings yet

- TYIT - SPM - L8 Project Evaluation2Document21 pagesTYIT - SPM - L8 Project Evaluation2sanilNo ratings yet

- Exercise 1 and 1B Version 2Document10 pagesExercise 1 and 1B Version 2Salman Sajid0% (1)

- CHAPTER 9 - Investment AppraisalDocument37 pagesCHAPTER 9 - Investment AppraisalnaurahimanNo ratings yet

- Illustration On Projects AppraisalDocument6 pagesIllustration On Projects AppraisalAsmerom MosinehNo ratings yet

- Case 12Document2 pagesCase 12HealthyYOUNo ratings yet

- MS-4 Dec 2007Document4 pagesMS-4 Dec 2007Saket DubeyNo ratings yet

- Economy OK.2022 MS.CDocument4 pagesEconomy OK.2022 MS.Cabdullah 3mar abou reashaNo ratings yet

- Financial Management Session 14Document24 pagesFinancial Management Session 14Shivangi MohpalNo ratings yet

- CH 10Document76 pagesCH 10Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Managerial EconomicsDocument20 pagesManagerial EconomicsAbhishek ModakNo ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- FM-Cap. Budgeting LeverageDocument31 pagesFM-Cap. Budgeting Leverageshagun.2224mba1003No ratings yet

- 3 - Capital BudgetingDocument29 pages3 - Capital BudgetingMohit MaheshwariNo ratings yet

- Final Exam 2017Document10 pagesFinal Exam 2017Ahtisham KhawajaNo ratings yet

- Topic 3: Project SelectionDocument31 pagesTopic 3: Project Selectionayushi kNo ratings yet

- 6TH Sem Previous Year Question PaperDocument42 pages6TH Sem Previous Year Question Paperguptaonly01No ratings yet

- Ty SPM L7Document15 pagesTy SPM L7sanilNo ratings yet

- Capital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Document8 pagesCapital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Imtiaz AhmedNo ratings yet

- Airtel IcreateDocument6 pagesAirtel IcreateAl Ameen Sherfuddeen100% (1)

- BMM3023 - Engineering Management & Safety - Project ReportDocument11 pagesBMM3023 - Engineering Management & Safety - Project Reportsiven rajNo ratings yet

- Chapter 2. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 2. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- ModifiedDocument20 pagesModifiedsarvesh_kumarNo ratings yet

- Cisb 243/cisb3433 - Is Project Management - Midterm ExaminationDocument5 pagesCisb 243/cisb3433 - Is Project Management - Midterm ExaminationNalesh AnanshaNo ratings yet

- Accounting For Managerial DecisionsDocument6 pagesAccounting For Managerial DecisionsKrutika ManeNo ratings yet

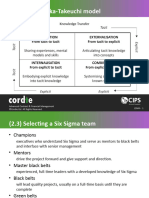

- L5M4 Additional SlidesDocument7 pagesL5M4 Additional SlidesTlotlo RamotlhabiNo ratings yet

- Financial Management Tutorial 2 AnswersDocument6 pagesFinancial Management Tutorial 2 AnswersDelfPDF100% (2)

- Chapter 5. An Introduction Investment Appraisal TechniquesDocument10 pagesChapter 5. An Introduction Investment Appraisal TechniquesHastings KapalaNo ratings yet

- Present Worth Analysis: Engineering Economy With AccountingDocument21 pagesPresent Worth Analysis: Engineering Economy With AccountingCamilo Dela Cruz Jr.No ratings yet

- Applied Economics ReportDocument16 pagesApplied Economics ReportJoyce Ann Agdippa Barcelona100% (1)

- Growth of Tea IndustryDocument18 pagesGrowth of Tea IndustryYasi NabamNo ratings yet

- Country of Origin, Construction, Approvals & Fire PerformanceDocument3 pagesCountry of Origin, Construction, Approvals & Fire PerformanceAnand sNo ratings yet

- Usa Policy y GlobalizationDocument11 pagesUsa Policy y GlobalizationmayuNo ratings yet

- Financial Markets (Chapter 1)Document1 pageFinancial Markets (Chapter 1)Kyla DayawonNo ratings yet

- UntitledDocument86 pagesUntitledMuhammed KamrulNo ratings yet

- Services Marketing 7th Edition Zeithaml Test BankDocument24 pagesServices Marketing 7th Edition Zeithaml Test BankElizabethHoodpzbxNo ratings yet

- Module 7 Market StructureDocument82 pagesModule 7 Market StructurenirmalrinturaviNo ratings yet

- SATISH CHAND - AgraDocument3 pagesSATISH CHAND - AgraGideon DassNo ratings yet

- Depreciation Concepts - ACTIVITYDocument13 pagesDepreciation Concepts - ACTIVITYsab x bts100% (1)

- James-Stein Estimator - IntroductionDocument4 pagesJames-Stein Estimator - IntroductionKai WangNo ratings yet

- Purchase Order Lines - 637912271505859618Document47 pagesPurchase Order Lines - 637912271505859618Anoop PurohitNo ratings yet

- Catalogue ReadyBenderDocument20 pagesCatalogue ReadyBenderEngineerNo ratings yet

- Bhubaneswar InternetDocument1 pageBhubaneswar InternetAmit DashNo ratings yet

- TOCICO-Baptista, Humberto Modern TOC Distribution (Workshop) v1Document54 pagesTOCICO-Baptista, Humberto Modern TOC Distribution (Workshop) v1telegenicsNo ratings yet

- Processing ID:: 5-Material Return Voucher (MRV) ReportDocument1 pageProcessing ID:: 5-Material Return Voucher (MRV) ReportSyedahsan IlyasNo ratings yet

- Paper 1 (Answer All Questions) : Saraswati Vidya NiketanDocument3 pagesPaper 1 (Answer All Questions) : Saraswati Vidya Niketanyuvita prasadNo ratings yet

- DIY Hand Plane - WoodArchivistDocument10 pagesDIY Hand Plane - WoodArchivistEricsNo ratings yet

- CP Seismic Bracing Catalog sb2014Document28 pagesCP Seismic Bracing Catalog sb2014dthunes1No ratings yet

- Extrusion Method of Tube With Spiral InnerDocument3 pagesExtrusion Method of Tube With Spiral InnerTHE SEZARNo ratings yet

- Geodren PEITDocument1 pageGeodren PEITMikolajBojarskiNo ratings yet

- ASEAN TMview, Free Online Trademark Search Service Federating The 10 ASEAN IP OfficesDocument2 pagesASEAN TMview, Free Online Trademark Search Service Federating The 10 ASEAN IP OfficesLemuel PetronioNo ratings yet

- Michigan DNR Summer Parcel AuctionDocument81 pagesMichigan DNR Summer Parcel AuctionWXYZ-TV Channel 7 Detroit33% (3)

- Bodie Essentials of Investments 12e Chapter 09 PPT AccessibleDocument33 pagesBodie Essentials of Investments 12e Chapter 09 PPT AccessibleEdna DelantarNo ratings yet

- Mehak Fatima QRM ExamDocument4 pagesMehak Fatima QRM ExamMEHAK FATIMANo ratings yet

- Volume+1,+no +3+hal+39-59Document21 pagesVolume+1,+no +3+hal+39-59Syafrie Fadhil WirayudhaNo ratings yet

- LH - Room Allotment Policy 2024-25Document4 pagesLH - Room Allotment Policy 2024-25raghavkejriwal199No ratings yet

- LESSON 3 Capital BudgetingDocument10 pagesLESSON 3 Capital BudgetingNoel Salazar JrNo ratings yet

- Roof Slab PlanDocument10 pagesRoof Slab PlanghansaNo ratings yet