Professional Documents

Culture Documents

Allowable Expenses-Delivery Services Companies

Allowable Expenses-Delivery Services Companies

Uploaded by

Sirbulescu Teodora0 ratings0% found this document useful (0 votes)

2 views1 pageTax allowable expenses

Original Title

Allowable expenses-Delivery services companies (2)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax allowable expenses

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageAllowable Expenses-Delivery Services Companies

Allowable Expenses-Delivery Services Companies

Uploaded by

Sirbulescu TeodoraTax allowable expenses

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

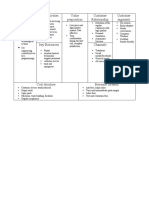

Van and travel expenses vehicle insurance

repairs and servicing

washing or cleaning your vehicle

fuel

parking

hire charges

vehicle licence fees (costs of your annual road tax and your MOT test)

breakdown cover

train, bus, air and taxi fares

daily meals (groceries, restaurant, take away) up to £15

hotel rooms and meals on overnight business trips

You cannot claim non-business driving or travel costs

fines and penalties

travel between home and work

Office Supplies Stationery and any printing costs

computer software

phone bills linked to work

Staff costs employees’ salaries

bonuses, pensions, and the costs towards National Insurance

Marketing and advertising costs along with website hosting and maintenance

subscriptions

Training courses These must be explicitly related to your operations

Clothing Uniforms (with the company logo) or protective wear only

You might also like

- The Offical DVSA Guide to Driving Goods Vehicles: DVSA Safe Driving for Life SeriesFrom EverandThe Offical DVSA Guide to Driving Goods Vehicles: DVSA Safe Driving for Life SeriesRating: 5 out of 5 stars5/5 (1)

- Tag Life Science Corporation: Purok Uno, Minante II, Cauayan City, IsabelaDocument3 pagesTag Life Science Corporation: Purok Uno, Minante II, Cauayan City, IsabelaBrandon Jorjs HolgadoNo ratings yet

- Allowable and Disallowable Expenses PDFDocument1 pageAllowable and Disallowable Expenses PDFAnna MwitaNo ratings yet

- Variable Costs: Break-Even Analysis Notes and DescriptionsDocument1 pageVariable Costs: Break-Even Analysis Notes and DescriptionsNahom AsamenewNo ratings yet

- Vikram Thermo FinancialsDocument15 pagesVikram Thermo FinancialsUmang ChoudharyNo ratings yet

- Tax Checklist For NursesDocument1 pageTax Checklist For NursesSasperilla SummerNo ratings yet

- Business Startup Costs TemplateDocument10 pagesBusiness Startup Costs TemplatePatrick OppongNo ratings yet

- Elements of Cost and Its Impact of PricingDocument12 pagesElements of Cost and Its Impact of PricingAnu PriyaNo ratings yet

- Microsoft Candidate Travel PolicyDocument3 pagesMicrosoft Candidate Travel PolicymegkhNo ratings yet

- Small Business Expenses - Tax CategoriesDocument1 pageSmall Business Expenses - Tax CategoriesAKINYEMI ADISA KAMORUNo ratings yet

- Business Startup Costs TemplateDocument12 pagesBusiness Startup Costs TemplatezappyzaNo ratings yet

- Assets 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33Document9 pagesAssets 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33arts.amita09No ratings yet

- Carwash Case TemplteDocument6 pagesCarwash Case Templtesonaxiv697No ratings yet

- Components of Airline Fare CalculationDocument10 pagesComponents of Airline Fare CalculationaraNo ratings yet

- Cost Concepts and ClassificationDocument8 pagesCost Concepts and ClassificationJericho PagsuguironNo ratings yet

- Accounting 2Document5 pagesAccounting 2jessicaong2403No ratings yet

- Chart of Account 2Document46 pagesChart of Account 2mohamed kotbNo ratings yet

- List of Expense AccountsDocument6 pagesList of Expense AccountsAarajita ParinNo ratings yet

- Calculating The Cost Per HireDocument2 pagesCalculating The Cost Per HireAytanNo ratings yet

- Canadian College Of: Business, Science & TechnologyDocument1 pageCanadian College Of: Business, Science & TechnologyAdel LatifNo ratings yet

- Restaurant Startup Cost WorkoutDocument9 pagesRestaurant Startup Cost WorkoutNatarajanThirunavukkarasuNo ratings yet

- Chart of Accounts-Andruk Realty TeamDocument4 pagesChart of Accounts-Andruk Realty TeamnikolaNo ratings yet

- Abott StatementsDocument211 pagesAbott StatementsAhzam KazmiNo ratings yet

- Session 8 E-Bus Total Costs of Ownership Analysis - Batch 6Document13 pagesSession 8 E-Bus Total Costs of Ownership Analysis - Batch 6sachi dongarwarNo ratings yet

- Carro 1Document4 pagesCarro 1JosePedroTrocadoMoreiraNo ratings yet

- Vaučer Za RentakarDocument4 pagesVaučer Za Rentakarjlc.milutinovicNo ratings yet

- Six Sigma KpiDocument17 pagesSix Sigma KpiJohn Cabrera Placente100% (2)

- Book 4Document4 pagesBook 4Eduardo RodríguezNo ratings yet

- Physical Evidence and The Servicescape (Chapter 11) : - Dwayne D. GremlerDocument12 pagesPhysical Evidence and The Servicescape (Chapter 11) : - Dwayne D. GremlerAmmar AshrafNo ratings yet

- Financial Plan TemplateDocument5 pagesFinancial Plan TemplateDiego GreccoNo ratings yet

- Types of OverheadsDocument12 pagesTypes of Overheadsashishmission202080% (5)

- Services CapeDocument11 pagesServices CapeHeavy Gunner100% (3)

- OverHead ClassificationDocument17 pagesOverHead ClassificationKookie12No ratings yet

- Module 1 - Basics of CostingDocument40 pagesModule 1 - Basics of Costingmaheshbendigeri5945No ratings yet

- Cost Sheet PreparationDocument12 pagesCost Sheet PreparationAmisha SinghNo ratings yet

- Cost Accounting Sem 4Document13 pagesCost Accounting Sem 4Narendra WadhwaNo ratings yet

- Total Cost of Ownership (TCO) Calculator: Direct CostsDocument3 pagesTotal Cost of Ownership (TCO) Calculator: Direct CostsSree NivasNo ratings yet

- Entrap WorkDocument2 pagesEntrap WorkAdrian DunkleyNo ratings yet

- UntitledDocument16 pagesUntitledMaria Nena LoretoNo ratings yet

- Vehicle Operating CostDocument8 pagesVehicle Operating Costsroy.subhojitNo ratings yet

- Leading and Lagging Fleet IndicatorsDocument3 pagesLeading and Lagging Fleet Indicatorsjadwa consultingNo ratings yet

- Topic 2 Nature of ServicesDocument16 pagesTopic 2 Nature of ServicesOM DINANo ratings yet

- Gross MarginsDocument2 pagesGross Marginsbaileysmith8752No ratings yet

- Elements of Costs AND Classification of Expenditure: Asst. Prof. Joseph George Konnully, MJCETDocument14 pagesElements of Costs AND Classification of Expenditure: Asst. Prof. Joseph George Konnully, MJCETJoseph George KonnullyNo ratings yet

- I Standing Charges (Or) Fixed ChargesDocument2 pagesI Standing Charges (Or) Fixed ChargesVasu GuptaNo ratings yet

- Business Startup Costs TemplateDocument10 pagesBusiness Startup Costs TemplateAtiyah AliasNo ratings yet

- Business Startup Costs TemplateDocument10 pagesBusiness Startup Costs TemplateRandoNo ratings yet

- Business Startup Costs TemplateDocument10 pagesBusiness Startup Costs TemplateMohammad Abd Alrahim ShaarNo ratings yet

- Business Startup Costs TemplateDocument10 pagesBusiness Startup Costs Templateminhtutran1983No ratings yet

- Hotel Jargon BusterDocument5 pagesHotel Jargon BusterNovia CareraNo ratings yet

- Financial FeasibilityDocument2 pagesFinancial FeasibilityFire burnNo ratings yet

- Ma Project FMCG-: Marico, Itc, Colgate, Unilever, Yili, PepsicoDocument12 pagesMa Project FMCG-: Marico, Itc, Colgate, Unilever, Yili, PepsicoJasneet BaidNo ratings yet

- Cost and Supply Analysis - Unit 1Document12 pagesCost and Supply Analysis - Unit 1PethurajNo ratings yet

- Company Name Company Location Company Started Product Dealt With ParametersDocument20 pagesCompany Name Company Location Company Started Product Dealt With ParametersnidhisanjeetNo ratings yet

- Business Model Canva of CatarmanDocument2 pagesBusiness Model Canva of CatarmanRisavina Dorothy CondorNo ratings yet

- Re-Evaluating The Total Cost of Truck Fleet OwnershipDocument8 pagesRe-Evaluating The Total Cost of Truck Fleet OwnershipfellipeNo ratings yet

- Tour Costing Work SheetsDocument3 pagesTour Costing Work SheetsAnna Allyssa Dela RosaNo ratings yet

- Sesi 2 - Konsep BiayaDocument14 pagesSesi 2 - Konsep BiayaanindhabackupNo ratings yet

- Untitled DocumentDocument3 pagesUntitled DocumentalexanderjensenalexNo ratings yet