Professional Documents

Culture Documents

Mini Case

Mini Case

Uploaded by

Thùy DươngCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mini Case

Mini Case

Uploaded by

Thùy DươngCopyright:

Available Formats

Full name: Trần Phạm Thuỳ Dương

Student ID: 11218253

Class: Advanced Accounting 63

MINICASE 2

A = Produce new product

B = No produce new product

Sale:

Year 1 = 155,000 x 535 – 30,000 x 385 – 65,000 x (385 – 215)

Year 2 = 165,000 x 535 – 30,000 x 385 – 35,000 x (385 – 215)

Year 3 = 125,000 x 535

Year 4 = 95,000 x 535

Year 5 = 75,000 x 535

COGS = VC + FC

VC = New variable A – New variable B

Year 1 = 155,000 x 220 + 65,000 x 145 – 95,000 x 145

Year 2 = 165000 x 220 + 35,000 x 145 – 650,000 x 145

Year 3 = 125000 x 220

Year 4 = 95,000 x 220

Year 5 = 75,000 x 220

Because the equipment follows the seven– year MACRS

Depreciation = DEP

Year 1 = Cost of equity x 14.29%

Year 2 = Cost of equipment x 24.49%

Year 3 = Cost of equipment x 17.49%

Year 4 = Cost of equipment x 12.49%

Year 5 = Cost of equipment x 8.39%

Tax = EBT x 21%

CFFA = OPF – NWC

OPERATING CASH FLOW

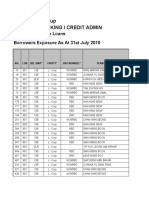

Year 1 Year 2 Year 3 Year 4 Year 5

Sale 60,325,000 70,775,000 66,875,000 50,825,000 40,125,000

COGS 36,150,000 38,350,000 33,900,000 27,300,000 22,900,000

DEP 6,216,150 10,653,150 7,608,150 5,433,150 3,884,550

EBIT 17,958,850 21,771,850 25,366,850 18,091,850 13,340,450

I 0 0 0 0 0

EBT 17,958,850 21,771,850 25,366,850 18,091,850 13,340,450

TAX 3,771,358.5 4,572,088.5 5,327,038.5 3,799,288.5 2,801,494.5

NI 14,187,491.5 17,199,761.5 20,039,811.5 14292561.5 10,538,955.5

DEP 6,216,150 10,653,150 7,608,150 5,433,150 3,884,550

OCF 20,403,641.5 27,852,911.5 27,647,961.5 19,725,711.5 14,423,505.5

NET CAPITAL SPENDING

BEG 0 7,239,000 8,493,000 8,025,000 6,099,000

END 7,239,000 8,493,000 8,025,000 6,099,000 0

NWC 7,239,000 1,254,000 –468,000 –1,926,000 –6,099,000

CFFA 13,164,641.5 26,598,911.5 28,115,961.5 21,651,711.5 20,522,505.5

Book value of equipment = 43,500.000 – 6,216,150 – 10,653,150 – 7,608,150 – 5,433,150 –

3,884,550 = $9,704,850

Tax on sale of equiment = (9,704.850 – 6,500,000) x 21% = $673,018.5

Cash flow on sale equipment = 673,018.5 + 6,500,000 = $7,173,018.5

THE CASH FLOW PROJECT

Year 0 –43,500,000

Year 1 13,164,641.5

Year 2 26,598,911.5

Year 3 28,115,961.5

Year 4 21,651,711.5

Year 5 20,522,505.5

1. What is the payback period of the project?

Year 0 = –$43,500,000

43,500,000 = 13,164,641.5 + 26,598,911.5 + 3,736,447

=> Payback period = 2 + 3,736,447/28,115,961.5 = 2.14 years

2. What is the profitability index of the project?

Profitability index = (13,164,641.5/(1 + 1.12) + 26,598,911.5/(1 + 1.12)2 + 28,115,961.5/(1

+ 1.12)3 + 21,651,711.5/(1 + 1.12)4 + 20,522,505.5/(1 + 1.12)5) /43,500,000

=> Profitability index = 1.801

3. What is the IRR of the project?

NPV = 0

IRR rate = x

NPV = 0 = –43,500,000 + (13,164,641.5/(1 + x) + 26,598,911.5/(1 + x)2 + 28,115,961.5/(1

+ x)3 + 21,651,711.5/(1 + x)4 + 20,522,505.5/(1 + x)5)

=> x = IRR = 38.95%

4. What is the NPV of the project?

NPV = –43,500,000 + (13,164,641.5/(1 + 1.12) + 26,598,911.5/(1 + 1.12)2 +

28,115,961.5/(1 + 1.12)3 + 21,651,711.5/(1 + 1.12)4 + 20,522,505.5/(1 + 1.12)5)

=> NPV = $34,876,095.49

You might also like

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- SaaS Financial Model Template by ChargebeeDocument15 pagesSaaS Financial Model Template by ChargebeeNikunj Borad0% (1)

- Fin 320 - Individual AssignmentDocument14 pagesFin 320 - Individual AssignmentAnis Umaira Mohd LutpiNo ratings yet

- Macrs Depreciation: New Smart Phone Calculation AnalysisDocument4 pagesMacrs Depreciation: New Smart Phone Calculation AnalysisErro Jaya Rosady100% (1)

- Memorandum of Agreement: Samson ConstructionDocument7 pagesMemorandum of Agreement: Samson ConstructionMimi KasukaNo ratings yet

- Mini CaseDocument3 pagesMini CaseThùy DươngNo ratings yet

- Finance Case StudyDocument4 pagesFinance Case StudyKelvin CharlesNo ratings yet

- Inputs: YR-1 YR-2 YR-3 YR-4 YR-5Document5 pagesInputs: YR-1 YR-2 YR-3 YR-4 YR-5omar hashmiNo ratings yet

- Assesmnet Task 1Document6 pagesAssesmnet Task 1Anonymous XYQ2ceuNo ratings yet

- Strategic Finance All Question-13Document1 pageStrategic Finance All Question-13TheNOOR129No ratings yet

- Chapter 3 Problems - Review in ClassDocument9 pagesChapter 3 Problems - Review in Classjimmy_chou1314No ratings yet

- M C R E ,: Inicase: Onch Epublic LectronicsDocument4 pagesM C R E ,: Inicase: Onch Epublic Lectronicsnara100% (3)

- Capital BudgetingDocument14 pagesCapital BudgetingbhaskkarNo ratings yet

- Analyzing Financial Statements ExerciseDocument4 pagesAnalyzing Financial Statements ExerciseVin MaoNo ratings yet

- Financial Plan (Ippizandayaw)Document6 pagesFinancial Plan (Ippizandayaw)Jayson IbaleNo ratings yet

- Draft 4.0Document15 pagesDraft 4.0Nizar AlamNo ratings yet

- NSDC Project ReportDocument53 pagesNSDC Project ReportAbirMukherjee67% (3)

- FM Solved Board Paper 2010 2Document7 pagesFM Solved Board Paper 2010 2Venugopal ShettyNo ratings yet

- UBS Capital BudgetingDocument19 pagesUBS Capital BudgetingRajas MahajanNo ratings yet

- Projected Income StatementDocument8 pagesProjected Income Statementdebate ddNo ratings yet

- Kamayo Travel and ToursDocument31 pagesKamayo Travel and ToursJay ArNo ratings yet

- Resume MK CHapter 10 - Cyrillus Ekana - 6032231237Document24 pagesResume MK CHapter 10 - Cyrillus Ekana - 6032231237Cyrillus EkanaNo ratings yet

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidNo ratings yet

- Annual Income StatementDocument2 pagesAnnual Income StatementAjhia ThymiaNo ratings yet

- Ie463 CHP5 (2010-2011)Document6 pagesIe463 CHP5 (2010-2011)Gözde ŞençimenNo ratings yet

- Bakiache CitiDocument8 pagesBakiache CitiMalevolent IncineratorNo ratings yet

- Final Cookies FsDocument8 pagesFinal Cookies FsDanah Jane GarciaNo ratings yet

- Business PlanDocument10 pagesBusiness PlanDanah Jane GarciaNo ratings yet

- Akansh Arora FM AssignmentDocument17 pagesAkansh Arora FM AssignmentAKANSH ARORANo ratings yet

- Chapter 6Document26 pagesChapter 6dshilkarNo ratings yet

- E. Sensitivities and ScenariosDocument3 pagesE. Sensitivities and ScenariosDadangNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- Cash Flow 17-12-16 UpdatedDocument6 pagesCash Flow 17-12-16 Updatednurulashikin93No ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- AnalysispdfDocument15 pagesAnalysispdfMalevolent IncineratorNo ratings yet

- Strategic Finance All Question-6Document1 pageStrategic Finance All Question-6TheNOOR129No ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Corporate Finance QuizDocument6 pagesCorporate Finance Quizarslan mumtazNo ratings yet

- ChapDocument61 pagesChapJahara GarciaNo ratings yet

- Financial Management - Homework 3 & 4Document2 pagesFinancial Management - Homework 3 & 4San HeeNo ratings yet

- LBO Valuation - Working File CV2Document5 pagesLBO Valuation - Working File CV2Ayushi GuptaNo ratings yet

- Financial Model TemplateDocument13 pagesFinancial Model Templatedina cholidin0% (1)

- Management Accounting: Page 1 of 6Document70 pagesManagement Accounting: Page 1 of 6Ahmed Raza MirNo ratings yet

- Final Assignment ValuationDocument5 pagesFinal Assignment ValuationSamin ChowdhuryNo ratings yet

- Projection of BalboaDocument7 pagesProjection of Balboapradip_kumarNo ratings yet

- J and J Medical ClinicDocument17 pagesJ and J Medical ClinicHarold Kent MendozaNo ratings yet

- Finance Mid Term Mba - 2B Presented To Wael AbdulkaderDocument4 pagesFinance Mid Term Mba - 2B Presented To Wael AbdulkaderMahmoud RedaNo ratings yet

- Selected Solutions - 17Document10 pagesSelected Solutions - 17moonisqNo ratings yet

- Assignment On: Principles of Accounting Course Code: ACC1101Document4 pagesAssignment On: Principles of Accounting Course Code: ACC1101Ruelliyas xxNo ratings yet

- Comparitive Profit and Loss Statement of Unitech Group For The Year Ended 2008Document4 pagesComparitive Profit and Loss Statement of Unitech Group For The Year Ended 2008mukulpharmNo ratings yet

- Balance Sheet: With The Assumption We Can Use All The Plants and EquipmentDocument4 pagesBalance Sheet: With The Assumption We Can Use All The Plants and EquipmentPriadarshini Subramanyam DM21B093No ratings yet

- FS Gas StationDocument25 pagesFS Gas StationKathlyn JambalosNo ratings yet

- Finec 2Document11 pagesFinec 2nurulnatasha sinclairaquariusNo ratings yet

- Financial Management Session 10Document20 pagesFinancial Management Session 10vaidehirajput03No ratings yet

- Jawaban Soal UAS 1Document5 pagesJawaban Soal UAS 1Muhammad SuryantoNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- ANNEXDocument4 pagesANNEXA Wahid KemalNo ratings yet

- Mine Investment AnalysisDocument6 pagesMine Investment AnalysisTriAnggaBayuPutra50% (2)

- ExcelDocument13 pagesExcelJazzd Sy GregorioNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Letter of Interest Model MINUTA DE LOI - END SELLERDocument3 pagesLetter of Interest Model MINUTA DE LOI - END SELLERSilvia FagáNo ratings yet

- The 10 Worst Corporate Accounting Scandals of All TimeDocument4 pagesThe 10 Worst Corporate Accounting Scandals of All TimeFarris Althaf PratamaNo ratings yet

- Hillary Clinton Saul Alinsky ThesisDocument5 pagesHillary Clinton Saul Alinsky Thesisprdezlief100% (1)

- SSRN Id923557 PDFDocument11 pagesSSRN Id923557 PDFMuhammad Ali HaiderNo ratings yet

- Accenture Strategy Transforming Banking BranchDocument8 pagesAccenture Strategy Transforming Banking BranchVishakha RathodNo ratings yet

- Warehouse InchargeDocument2 pagesWarehouse InchargeAmanullah AmarNo ratings yet

- Consistent Compounders: An Investment Strategy by Marcellus Investment ManagersDocument27 pagesConsistent Compounders: An Investment Strategy by Marcellus Investment ManagerslalitNo ratings yet

- Corporate Governance Disclosure Practices of Telecom Industry: Evidence From IndiaDocument14 pagesCorporate Governance Disclosure Practices of Telecom Industry: Evidence From IndiaIJAR JOURNAL100% (1)

- Pooja 2023 CVDocument6 pagesPooja 2023 CVVipinNo ratings yet

- KKE (Solar Energy - Solar - Basics)Document38 pagesKKE (Solar Energy - Solar - Basics)Iqbal Al FuadyNo ratings yet

- MATERI - HRA N OH Program SHED May 2023.Document23 pagesMATERI - HRA N OH Program SHED May 2023.muhammad sandriyanNo ratings yet

- US and Global MRC Slip Examples.Document49 pagesUS and Global MRC Slip Examples.Yudhisthar SinghNo ratings yet

- Internship JD (Full) 90 DaysDocument73 pagesInternship JD (Full) 90 Daysparika khannaNo ratings yet

- Health System Performance Assessment A Primer For Policy-MakersDocument39 pagesHealth System Performance Assessment A Primer For Policy-MakersΚΩΝΣΤΑΝΤΙΝΟΣ ΧΟΝΔΡΟΠΟΥΛΟΣNo ratings yet

- VlookupDocument608 pagesVlookupamiera norazmiNo ratings yet

- ServitisationDocument32 pagesServitisation256850100% (1)

- VAT Accounting Computation and Double EntryDocument31 pagesVAT Accounting Computation and Double EntryEdewo James JeremiahNo ratings yet

- Copy - Volume Spurt, Technical Analysis ScannerDocument2 pagesCopy - Volume Spurt, Technical Analysis ScannerVimalahar rajagopalNo ratings yet

- YFC Projects Private Limited (YPPL) : Rating RationaleDocument2 pagesYFC Projects Private Limited (YPPL) : Rating Rationalelalit rawatNo ratings yet

- G11 - Acctng1 - Problem JournalsDocument10 pagesG11 - Acctng1 - Problem JournalsKaye VillaflorNo ratings yet

- Assignment: Advanced Content and Social Tactics To Optimize SEODocument37 pagesAssignment: Advanced Content and Social Tactics To Optimize SEOB. M. Mekail Sarwar (192051056)No ratings yet

- AJC Case Analysis.Document4 pagesAJC Case Analysis.sunny rahulNo ratings yet

- Sub Order Labels E0c2d77c 9794 43cf Ad24 F7f6cb15a739Document60 pagesSub Order Labels E0c2d77c 9794 43cf Ad24 F7f6cb15a739Giri KanyakumariNo ratings yet

- 005 - 1965 - Law Relating To TaxationDocument15 pages005 - 1965 - Law Relating To TaxationSubhayan BoralNo ratings yet

- Cavalcanti PDFDocument18 pagesCavalcanti PDFThiago Leitao RibeiroNo ratings yet

- Gift 1Document5 pagesGift 1ashok9705030066100% (1)

- Employment Letter - Mohd Asri Bin SaharudinDocument7 pagesEmployment Letter - Mohd Asri Bin Saharudinbarumble247No ratings yet

- Sustainable Supply Chain Maturity ModelDocument11 pagesSustainable Supply Chain Maturity ModelbusinellicNo ratings yet