Professional Documents

Culture Documents

Insurance 2024

Insurance 2024

Uploaded by

raosahabsahab690 ratings0% found this document useful (0 votes)

3 views2 pagesOk

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesInsurance 2024

Insurance 2024

Uploaded by

raosahabsahab69Ok

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

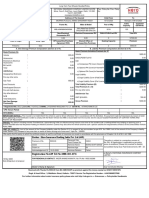

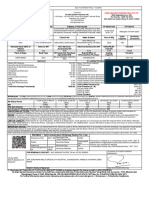

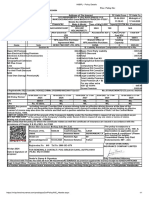

Stand-Alone Motor Damage Cover for Two Wheeler

Policy No. Issued at

HERO/1711198 SBI General Insurance Company Limited HERO INSURANCE BROKING INDIA PVT LTD.

Second Floor, Raj Complex, Old Pahargaon,Dollygunj IRDA Registration No.: 649

Prev. Policy No. Port Blair, Nicobar, Andaman and Nicobar Islands, 744103 Toll-Free No.: 1800 102 4376

231291006530790 Tel:1800-102-1111,1800-22-1111 264, Okhla Ind. Estate, Phase-III, Delhi-110020

0000

Insured Business/Professi Address of The Insured OD Valid From OD Valid To

on

Mr GAURAV YADAV Businessman S/O-ROHTASH VPO-KHARKHARI(131) Gurgaon HARYANA 18-12-2023 Midnight of 17-12-2024

122503 12:00:00 AM

GSTIN

Vehicle Regn No. Engine No. Chassis No. Make & Model Year of Mfg Cubic Capacity No.(Customer)

HR-26-EL-8669 HA11ERL9J08550 MBLHAC041L9J59825 Hero MotoCorp HF DLX KICK 2020 100

START BS6

Declared Value (IDV) of Side Car IDV Non-Electrical Accessories Electrical Accessories IDV CNG/LPG/Bi-Fuel Total IDV

Vehicle IDV IDV

34965.00 NA 0.00 0.00 0 34965.00

Place of Regn. Body Type HP/Lease/Hire-Purchase Branch Office of Seating Capacity Premium

Agreement With HP/Lease/Hire-Purchase

GURGAON Solo ,, --- 2 590.00

OWN DAMAGE (Section A)

Basic OD Premium : 527.00

Non-Electrical-Fitting Premium : 0.00

Electronic & Electrical Accessories : 0.00

Bi-Fuel Kit : 0.00

Geographical Extension : 0.00

Depreciation Allowance : 157.00

Less :

Handicapped Discount : 0.00

ForAnti-Theft Discount : 0.00

NCB (35 %) : 184.00

Total Own Damage Premium(A) : 500.00

SGST @9.00 : 45.00

CGST @9.00 : 45.00

Gross OD Premium : 590.00

IRDAI'sRegnNo.:144||LicenceNo.:144||CINNo.:U66000MH2009PLC190546||PANNo.:AAMCS8857L||HSN/SAC:997134 || 4. GSTIN No. : 06AAMCS8857L1ZG ||UIN No.-

IRDAN144RP0002V01201920||IRDAN144RP0002V01201920/A0008V01202021

Stand-Alone Motor Damage Cover for Two Wheeler -

Certificate & Policy No. Policy Type Insurance Company Name TP Cover Start Date TP Cover End Date

Bundled Auto Secure - Two Wheeler

2312910065307900000 Policy (1 Year Term for Own Damage HDFC ERGO General Insurance Company Limited 08/11/2020 07/11/2025

& 5 Years for Third Party)

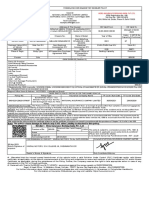

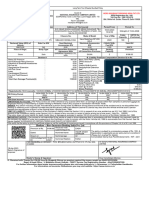

LIMITATIONS AS TO USE:--The Policy covers use of the vehicle for any purpose other than: a) Hire Or Reward b) Carriage of goods (other than samples or personal luggage) c)

Organized Racing d) Pace Making e) Speed Testing f) Reliability Trials g) Any purpose in connection with Motor Trade.

DRIVER: Any person including insured: Provided that a persondriving holds an effective driving licence at the time of the accident and is notdisqualified from Holding or obtaining

such a licence.Provided also that the person holding an effective Learner's Licence may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the

Central Motor Vehicle Rules,1989.

IMPORTANT NOTICE:-- The insured is not indemified if the vehicle is used or driven otherwise than in accordance with this Schedule. Any payment made by thecompany by reason

of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act,1988 is recoverable from the insured. See the clause headed'AVOIDANCE OF CERTAIN

TERMS AND RIGHTS OF RECOVERY'

I/We certify that the policy to which the certificate relates as well the certificate of insurance are issued in accordance with the provisions of Chapter X & XI of M.V. Act 1988

Broker : Hero Insurance Broking India Pvt. Ltd

Premium of Rs. 590.00 Received Vide e-

mode Ref No.

Dated Consolidted Stamp Duty Paid Endorsements:

Drawn on

Acknowledgement Dt 01-12-2023

on Behalf of SBI General Insurance Company

Limited

18-Dec-2023

Date &Signature of proposer FOR RENEWALS CONTACT: HIBIPL Ph. No- Ph.No- 1800-1024376

Dealer's Stamp &Signature Duly Constituted Attorney

# : Warranted that the insured named herein/owner of the vehicle holds a valid Pollution Under Control (PUC) Certificate and/or valid fitness certificate, as applicable, on

the date of commencement of the Policy and undertakes to renew and maintain a valid and effective PUC and/or fitness Certificate, as applicable, during the subsistence

of the Policy. Further, the Company reserves the right to take appropriate action in case of any discrepancy in the PUC or fitness certificate.

# : Received with Thanks Rs 590.00 from Mr GAURAV YADAV as premium against the money receipt no 020000001711198

Regd. & Head Office : SBI General Insurance, 101,'Natraj', Junction of Andheri-Kurla Road &Western Express Highway, Andheri East, Mumbai, 400069 Consolidated

stamp duty paid to state exchequer

For further information about motor insurance policy please also visit http://irda.gov.in >> Grievances >> Policyholder Handbooks

AVOIDANCE OF CERTAIN TERMS AND RIGHT TO RECOVERY

Nothing in this Policy or and endorsement hereon shall affect the right of any person indemnified by this policy or any other person to recover an amount under or by virtue of the

Provisions of the Motor Vehicles Act.

But the Insured shall repay to the Company all sums paid by the Company which Company would not have been liable to pay but for the said provisions..

IMPORTANT:--IN THE EVENT OF TRANSFER OFOWNERSHIP, INSURANCE IS NOT AUTOMATICALLY TRANSFERRED IN THE NAME OF TRANSFEREE UNLESS

APPLICATION IS MADE WITHIN FOURTEEN DAYS THERE OF SEEKING TRANSFER OF INSURANCE .

GRIEVANCE CLAUSE:-- For resolution of any query or grievance Insured may contact the respective branch office of the Company or may call at 1800-102-1111,1800-22-1111 or

may write an email at customer.care@sbigeneral.in. In case the insured is not satisfied with the response of the office, insured may email to Grievance Officer at

customer.care@sbigeneral.in In the event of unsatisfactory response from the Grievance Officer, he/she may, subject to vested jurisdiction, approach the Insurance Ombudsman for

the redressal of grievance. Details of the offices of the Insurance Ombudsman are available at IRDAI website www.irdai.gov.in or on company website www.sbigeneral.in

SCHEDULE OF DEPRECIATION FOR ARRIVING AT IDV

AGE OF THE VEHICLE RATE OF DEPRECIATION FOR FIXING IDV

Not Exceeding 6 months 5%

Exceeding 6 months but not exceeding 1 year 15%

Exceeding 1 year but not exceeding 2 years 20%

Exceeding 2 year but not exceeding 3 years 30%

Exceeding 3 year but not exceeding 4 years 40%

Exceeding 4 year but not exceeding 5 years 50%

Depreciation of Parts for Partial Loss Claims

a. Rate of depreciation for all rubber/nylon/plastic parts, tyres and tubes, batteries and air bags 50%

Not Exceeding 6 months 5%

Exceeding 6 months but not exceeding 1 year 15%

Exceeding 1 year but not exceeding 2 years 20%

Exceeding 2 year but not exceeding 3 years 30%

Exceeding 3 year but not exceeding 4 years 40%

Exceeding 4 year but not exceeding 5 years 50%

e. Rate of Depreciation for Painting:- In the case of painting, the depreciation rate of 50% shall be applied only on the material cost of total painting charges. In case of a

consolidated bill for painting charges, the material component shall be considered as 25% of the total painting charges for the purpose of applying the depreciation

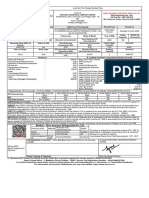

DO'S FOR THE INSURED

1. In the event of accident to the vehicle, please Inform in writing to the authorised Hero MotoCorp dealer &/ or Insurance Company's office immediately.

2. Please complete and sign the claim form.

3. Documents like claim form, original driving licence, original registration certificates, copy of policy, police report (In case of the theft/third party loss) and Satisfaction Voucher be

submitted to the authorised Hero MotoCorp Dealer. .

4. If the vehicle is to be repaired at a workshop other thanHero MotoCorpauthorized workshop, please intimate to the nearest office of SBI General Insurance Company Limited

along with copy of policy for appointment of surveyor to assess the loss.

DONT'S FOR THE INSURED

1.In case of Third Party Loss/ extensive Damage to own vehicle inform the police for obtaining proper F.I.R. and do not admit any liability or enter in to any compromise without

written consent of the Insurance Company.

2. Do not proceed with the repairs or replacement job unless approved by the Insurer/authorized surveyor.

On renewal,the benefits provided under the policy and/or terms and conditions of the policy including premium rate may be subject to change.

The insured is entitled for a No Claim Bonus (NCB) on the own damage section of the policy, if no claim is made or pending in each completed year of risk* , as per the following

table provided the policy is renewed with us on long term basis:

Scan the QR code to renew your policy in future

You might also like

- Week 8: Ecotourism in The PhilippinesDocument35 pagesWeek 8: Ecotourism in The Philippinesbea krysleen tulio90% (10)

- Registration No:649 Tel No:1800-102-4376: Broker: Hero Insurance Broking India Pvt. LTDDocument2 pagesRegistration No:649 Tel No:1800-102-4376: Broker: Hero Insurance Broking India Pvt. LTDObaid Shafi67% (3)

- NTPCDocument158 pagesNTPCAnand GuptaNo ratings yet

- Insurance 2023Document2 pagesInsurance 2023raosahabsahab69No ratings yet

- HDFC ERGO General Insurance Company Limited 2nd Floor, Potluri Castle, Dwarakanagar, VSP, 16, Vishakapatnam - 530 016Document2 pagesHDFC ERGO General Insurance Company Limited 2nd Floor, Potluri Castle, Dwarakanagar, VSP, 16, Vishakapatnam - 530 016Siva rajNo ratings yet

- Issued At: BrokerDocument2 pagesIssued At: BrokerrajeshbhansaliNo ratings yet

- Vasi 2Document1 pageVasi 2mobileshop001msNo ratings yet

- Vjay InsuDocument1 pageVjay InsuRajveer AutoNo ratings yet

- JayeshbhaiDocument1 pageJayeshbhaiaarshfinconopsNo ratings yet

- Vishal Bhaiya Broker - Policy DetailsDocument2 pagesVishal Bhaiya Broker - Policy Detailsastha shuklaNo ratings yet

- BrokerDocument1 pageBrokerWilson ThomasNo ratings yet

- Mangala InsDocument2 pagesMangala InsManish R ShankarNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

- Insurance UnitedDocument1 pageInsurance UnitedRajveer AutoNo ratings yet

- Vehicle Policy 22-23Document2 pagesVehicle Policy 22-23Sahana SatishNo ratings yet

- Bajrang Singh PDFDocument1 pageBajrang Singh PDFRny buriaNo ratings yet

- Ramndeep InsDocument2 pagesRamndeep InsheroelectricbnlNo ratings yet

- Achyut Kumar GoudaDocument1 pageAchyut Kumar GoudaAakash MotorsNo ratings yet

- Vikash KumarDocument1 pageVikash KumarRny buriaNo ratings yet

- Broker - Policy DetailsRADocument1 pageBroker - Policy DetailsRARupendra sainiNo ratings yet

- Broker - Policy DetailsDocument1 pageBroker - Policy DetailsRupendra sainiNo ratings yet

- Yatin PDFDocument2 pagesYatin PDFMONU100% (1)

- Broker - Policy DetailsDocument2 pagesBroker - Policy DetailsVenkatesh EESHANNo ratings yet

- Broker - Policy DetailsRADHA BAIDocument1 pageBroker - Policy DetailsRADHA BAIBrijesh EnterprisesNo ratings yet

- Doc-20230604-Wa0004 230625 211038Document4 pagesDoc-20230604-Wa0004 230625 211038Manu DevangNo ratings yet

- Broker - Policy DetailsBIKKYDocument1 pageBroker - Policy DetailsBIKKYBrijesh EnterprisesNo ratings yet

- Broker - Policy DetailsDocument2 pagesBroker - Policy DetailsheroelectricbnlNo ratings yet

- Registration No:649 Tel No:1800-102-4376: Broker: Hero Insurance Broking India Pvt. LTDDocument2 pagesRegistration No:649 Tel No:1800-102-4376: Broker: Hero Insurance Broking India Pvt. LTDAbhitab ChoudharyNo ratings yet

- Broker - Policy DetailsCDocument1 pageBroker - Policy DetailsCRupendra sainiNo ratings yet

- Broker - Policy DetailsRANIDocument1 pageBroker - Policy DetailsRANIBrijesh EnterprisesNo ratings yet

- Reliance Two Wheeler Package Policy - Schedule: Policy Number: 240322223120007234 Proposal/Covernote No: R19092232360Document6 pagesReliance Two Wheeler Package Policy - Schedule: Policy Number: 240322223120007234 Proposal/Covernote No: R19092232360santosh kumarNo ratings yet

- Broker - Policy Details PDFDocument2 pagesBroker - Policy Details PDFAnonymous y68YEvNo ratings yet

- Broker - Policy DetailsBHARPI BAIDocument1 pageBroker - Policy DetailsBHARPI BAIBrijesh EnterprisesNo ratings yet

- Two Wheeler-Comprehensive Insurance: Certificate of Insurance Cum ScheduleDocument1 pageTwo Wheeler-Comprehensive Insurance: Certificate of Insurance Cum SchedulePrabu ArNo ratings yet

- Pre Print HeaderDocument1 pagePre Print HeaderAnonymous gqXYebllkNo ratings yet

- Selim MiaDocument1 pageSelim Miaadhikari.sagar2013No ratings yet

- AbhijeetDocument1 pageAbhijeetafnan8873108850No ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument2 pagesBroker:: Hero Insurance Broking India Pvt. LTDPalliwal MotorsNo ratings yet

- Broker - Policy DetailsBHAGVATDocument1 pageBroker - Policy DetailsBHAGVATBrijesh EnterprisesNo ratings yet

- BRR 2 PDFDocument1 pageBRR 2 PDFsureshNo ratings yet

- HIBIPL - Policy DetailsDocument1 pageHIBIPL - Policy DetailsBrijesh EnterprisesNo ratings yet

- Broker - Policy DetailsDocument1 pageBroker - Policy DetailsBrijesh EnterprisesNo ratings yet

- W Hero Scooty InsuranceDocument3 pagesW Hero Scooty InsuranceVivek Kümär RNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument2 pagesBroker:: Hero Insurance Broking India Pvt. LTDRohit ChauhanNo ratings yet

- PolicyDocument7 pagesPolicymanoj pandaNo ratings yet

- Mahesh Tanwar Khanbe PolicyDocument2 pagesMahesh Tanwar Khanbe PolicyNOOB FIRENo ratings yet

- KotakbillDocument1 pageKotakbillamanNo ratings yet

- Bike PolicyDocument2 pagesBike PolicyJagjeet SinghNo ratings yet

- HIBIPL - Policy DetailsDocument1 pageHIBIPL - Policy DetailsBrijesh EnterprisesNo ratings yet

- Bike Insurance PDFDocument1 pageBike Insurance PDFVaishnavi HallikarNo ratings yet

- Wb40au7913 PolicyDocument1 pageWb40au7913 Policyzaid AhmedNo ratings yet

- Calc of Verna With NildepDocument1 pageCalc of Verna With Nildepniren4u1567No ratings yet

- Sharada B: Digit Two-Wheeler Stand-Alone Own Damage PolicyDocument14 pagesSharada B: Digit Two-Wheeler Stand-Alone Own Damage PolicyUday BNo ratings yet

- PolicySoftCopy 104667249Document1 pagePolicySoftCopy 104667249Masum PatthakNo ratings yet

- 3005 53561895 01 000Document1 page3005 53561895 01 000santoshganjure@bluebottle.comNo ratings yet

- N Sure PolicyDocument2 pagesN Sure Policymadhav100% (2)

- PolicySofyCopy 87175987Document1 pagePolicySofyCopy 87175987Grace Touch Interior and DesignsNo ratings yet

- ACFrOgAuks-FLUGTRVAbwbanKl352rAnl OVgwUKeboMzikY2OFuTpxZhpaxi4eT Hah6cknePQVmYPx CqnVY4D-4K8XOXkv3bCfDL4XlMzaxGdhtjGAes4RKisznkDocument1 pageACFrOgAuks-FLUGTRVAbwbanKl352rAnl OVgwUKeboMzikY2OFuTpxZhpaxi4eT Hah6cknePQVmYPx CqnVY4D-4K8XOXkv3bCfDL4XlMzaxGdhtjGAes4RKisznkganapathy rNo ratings yet

- Policy ScheduleDocument2 pagesPolicy Schedulepou pouNo ratings yet

- NumpyDocument6 pagesNumpyraosahabsahab69No ratings yet

- 11 IpDocument1 page11 Ipraosahabsahab69No ratings yet

- Database ConnectivityDocument6 pagesDatabase Connectivityraosahabsahab69No ratings yet

- PracticeDocument2 pagesPracticeraosahabsahab69No ratings yet

- OopsDocument3 pagesOopsraosahabsahab69No ratings yet

- ForDocument6 pagesForraosahabsahab69No ratings yet

- FunDocument4 pagesFunraosahabsahab69No ratings yet

- AssignmentDocument8 pagesAssignmentraosahabsahab69No ratings yet

- DefDocument5 pagesDefraosahabsahab69No ratings yet

- NB C/N Ellipse EGI Parts Number SC Description QTY Status Parts Status Wo Wo Aging Ir Date IR IR AuthorizedDocument12 pagesNB C/N Ellipse EGI Parts Number SC Description QTY Status Parts Status Wo Wo Aging Ir Date IR IR AuthorizedReza SyailendraNo ratings yet

- Data Center Topology GuideDocument6 pagesData Center Topology GuideMauro De GrandeNo ratings yet

- EHB322E Digital Electronic Circuits Midterm Ii: 1) Consider A Boolean Function 8k 24kDocument3 pagesEHB322E Digital Electronic Circuits Midterm Ii: 1) Consider A Boolean Function 8k 24kfurkan çelikNo ratings yet

- Maths Crossword Puzzle 1c8bb 61632ad7Document1 pageMaths Crossword Puzzle 1c8bb 61632ad7Yash VermaNo ratings yet

- BS BuzzDocument8 pagesBS BuzzBS Central, Inc. "The Buzz"No ratings yet

- First of All Praise and Gratitude To The Presence of Allah SWTDocument2 pagesFirst of All Praise and Gratitude To The Presence of Allah SWTMuhammad Firmal KusyandiNo ratings yet

- Replenishment Overview V14toV16Document76 pagesReplenishment Overview V14toV16Apoorv SrivastavaNo ratings yet

- INFLATIONDocument24 pagesINFLATIONLovely Bordaje dela FuenteNo ratings yet

- Impaction: BY T.Subba Raju Iind Year Post GraduateDocument63 pagesImpaction: BY T.Subba Raju Iind Year Post GraduateJoseph Parasa100% (1)

- Man of Sorrows PDFDocument4 pagesMan of Sorrows PDFjoao.beckNo ratings yet

- Kuensel IssuesDocument12 pagesKuensel IssuesDeepen SharmaNo ratings yet

- 1.the SuperiorDocument10 pages1.the SuperiorIdrissa ContehNo ratings yet

- Rom, Eprom, & Eeprom Technology: Figure 9-1. Read Only Memory SchematicDocument14 pagesRom, Eprom, & Eeprom Technology: Figure 9-1. Read Only Memory SchematicVu LeNo ratings yet

- Wastewater Characteristics: Table 7.1.5 Table 7.1.6Document4 pagesWastewater Characteristics: Table 7.1.5 Table 7.1.6Amin EnviroNo ratings yet

- Roquette-SDS - GB-TACKIDEX B056 - DEXTRINE-000000200390-EN MsdsDocument6 pagesRoquette-SDS - GB-TACKIDEX B056 - DEXTRINE-000000200390-EN MsdsSorin LazarNo ratings yet

- Fault Level CalculationDocument1 pageFault Level Calculationpb21No ratings yet

- First Long Test in SPS 7Document3 pagesFirst Long Test in SPS 7Dennmark IgutNo ratings yet

- Advisory No. 061 S. 2021 International Research Conference On Higher Education Irche 2021Document23 pagesAdvisory No. 061 S. 2021 International Research Conference On Higher Education Irche 2021John Mark Go PayawalNo ratings yet

- Chem 27.1 Experiment 5 Oxidation Reduction Titration IodimetryDocument3 pagesChem 27.1 Experiment 5 Oxidation Reduction Titration IodimetryNathaniel John JumalonNo ratings yet

- Experiment 1 Solubility of Organic CompoundsDocument5 pagesExperiment 1 Solubility of Organic CompoundsKirstin Blaire MagdadaroNo ratings yet

- Segovia vs. The Climate Change Commission 819 SCRA 543, G.R. No. 211010 March 7, 2017.Document41 pagesSegovia vs. The Climate Change Commission 819 SCRA 543, G.R. No. 211010 March 7, 2017.VKNo ratings yet

- Infectious Mononucleosis in Adults and Adolescents - UpToDateDocument26 pagesInfectious Mononucleosis in Adults and Adolescents - UpToDateEduardo Romero StéfaniNo ratings yet

- NITIN Rdbms AssignmentDocument131 pagesNITIN Rdbms Assignmentnitinsingaur.bizNo ratings yet

- Summary of Eric HobsbawmDocument4 pagesSummary of Eric HobsbawmDCNo ratings yet

- KGVK BrouchureDocument4 pagesKGVK Brouchuregurjit20No ratings yet

- Towards A Critical RegionalismDocument7 pagesTowards A Critical RegionalismDanielNo ratings yet

- Kiwi Automation Company Aurora Shows Off Its Palletizing RobotDocument3 pagesKiwi Automation Company Aurora Shows Off Its Palletizing RobotPrimanedyNo ratings yet

- Heat Pump TrainerDocument6 pagesHeat Pump TrainerAfzaal FiazNo ratings yet