Professional Documents

Culture Documents

Return For Credit Payments To Issuers of Qualified Bonds: Information On Entity That Is To Receive Payment

Return For Credit Payments To Issuers of Qualified Bonds: Information On Entity That Is To Receive Payment

Uploaded by

iqbalpecintateajussCopyright:

Available Formats

You might also like

- Isaac Spoon FALL 8w2 South Delaware Coors Case AnalysisDocument12 pagesIsaac Spoon FALL 8w2 South Delaware Coors Case AnalysisIsaac SpoonNo ratings yet

- Improving Customer Service in SunpharmaDocument5 pagesImproving Customer Service in SunpharmaIIMnotes100% (7)

- 2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingDocument17 pages2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingPeter Kitchen100% (2)

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- Amended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesDocument4 pagesAmended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesMoose112No ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- United States Additional Estate Tax Return: General InformationDocument4 pagesUnited States Additional Estate Tax Return: General Informationdouglas jonesNo ratings yet

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13Ahmad GaberNo ratings yet

- F1040nre 2012 PDFDocument2 pagesF1040nre 2012 PDFJohanna AriasNo ratings yet

- f1040seDocument2 pagesf1040seikechi.mikeNo ratings yet

- f1120s AccessibleDocument5 pagesf1120s AccessiblebhanuprakashbadriNo ratings yet

- 2551Document2 pages2551Mariluz BeltranNo ratings yet

- 1120S Case StudyDocument5 pages1120S Case StudyHimani SachdevNo ratings yet

- FORM 501 (Ver 1.3.0) (See Rule 60 (1) ) Application For Refund Under Section 51 of The Maharashtra Value Added Tax Act, 2002Document9 pagesFORM 501 (Ver 1.3.0) (See Rule 60 (1) ) Application For Refund Under Section 51 of The Maharashtra Value Added Tax Act, 2002nitinnawarNo ratings yet

- U.S. Corporation Income Tax Return: Type OR PrintDocument6 pagesU.S. Corporation Income Tax Return: Type OR PrintWEBTREE TECHNOLOGYNo ratings yet

- f1040x PDFDocument2 pagesf1040x PDFAlexNo ratings yet

- Form 3520-A (Rev. December 2023)Document5 pagesForm 3520-A (Rev. December 2023)Jeff LouisNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarNo ratings yet

- Pag para FirmarDocument1 pagePag para FirmarGaela SalvatierraNo ratings yet

- F1040se DFTDocument3 pagesF1040se DFTjyoti06ranjanNo ratings yet

- U.S. Return of Partnership Income: Sign HereDocument6 pagesU.S. Return of Partnership Income: Sign HerelordbippyNo ratings yet

- US Internal Revenue Service: f2220 - 1999Document4 pagesUS Internal Revenue Service: f2220 - 1999IRSNo ratings yet

- US Internal Revenue Service: f4970 - 2000Document2 pagesUS Internal Revenue Service: f4970 - 2000IRSNo ratings yet

- Finalized Schedule EDocument2 pagesFinalized Schedule EMira HuNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changesgolcha_edu532No ratings yet

- U.S. Income Tax Return For Cooperative AssociationsDocument5 pagesU.S. Income Tax Return For Cooperative AssociationsbhanuprakashbadriNo ratings yet

- US Internal Revenue Service: f8860 - 2003Document2 pagesUS Internal Revenue Service: f8860 - 2003IRSNo ratings yet

- U.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Document5 pagesU.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Benny BerniceNo ratings yet

- US Internal Revenue Service: f2220 - 1996Document4 pagesUS Internal Revenue Service: f2220 - 1996IRSNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax Returnmarxvera158No ratings yet

- 2010 Blank IRS Form 1065Document5 pages2010 Blank IRS Form 1065Nick PechaNo ratings yet

- US Internal Revenue Service: f2220 - 1992Document2 pagesUS Internal Revenue Service: f2220 - 1992IRSNo ratings yet

- 1065 Case StudyDocument5 pages1065 Case StudyHimani SachdevNo ratings yet

- US Internal Revenue Service: f2220 - 1995Document4 pagesUS Internal Revenue Service: f2220 - 1995IRSNo ratings yet

- Sales of Business PropertyDocument2 pagesSales of Business Propertyhiamang27No ratings yet

- Underpayment of Estimated Tax by Corporations: Required Annual PaymentDocument4 pagesUnderpayment of Estimated Tax by Corporations: Required Annual Paymentkushaal subramonyNo ratings yet

- 2021 Form 1040-NRDocument2 pages2021 Form 1040-NRvalentynad74No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- Income Tax On Dollar To InrDocument1 pageIncome Tax On Dollar To InrApki mautNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Navek SmithsNo ratings yet

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocument2 pagesUnited States Estate (And Generation-Skipping Transfer) Tax Returndouglas jonesNo ratings yet

- U.S. Income Tax Return For Certain Political Organizations: Sign HereDocument6 pagesU.S. Income Tax Return For Certain Political Organizations: Sign HereManikanta Sai KumarNo ratings yet

- File PDFDocument18 pagesFile PDFAmanda CoffeyNo ratings yet

- U.S. Return of Partnership Income: Sign HereDocument5 pagesU.S. Return of Partnership Income: Sign HereMarie CaragNo ratings yet

- Form 7200 (2021) - PDF Reader ProDocument1 pageForm 7200 (2021) - PDF Reader Proahmed.hany817818No ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- Form 4A - GCT Returns PDFDocument2 pagesForm 4A - GCT Returns PDFNicquainCTNo ratings yet

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Document2 pagesExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldNo ratings yet

- Tax Form Template 21 Page1 0001Document1 pageTax Form Template 21 Page1 0001ayesha mihiraniNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesEri TakataNo ratings yet

- US Internal Revenue Service: f8390 - 1991Document4 pagesUS Internal Revenue Service: f8390 - 1991IRSNo ratings yet

- Casualties and TheftsDocument4 pagesCasualties and TheftsDr Camille Belle And Jade LinkNo ratings yet

- Tax DocumentDocument2 pagesTax Documentlynnmarie0905No ratings yet

- Like-Kind Exchanges: (And Section 1043 Conflict-Of-Interest Sales)Document2 pagesLike-Kind Exchanges: (And Section 1043 Conflict-Of-Interest Sales)Abdullah TheNo ratings yet

- Generation-Skipping Transfer Tax Return For Distributions: General InformationDocument1 pageGeneration-Skipping Transfer Tax Return For Distributions: General Informationdouglas jonesNo ratings yet

- US Internal Revenue Service: f2220 - 1994Document4 pagesUS Internal Revenue Service: f2220 - 1994IRSNo ratings yet

- Return of Organization Exempt From Income Tax: Open To Public InspectionDocument12 pagesReturn of Organization Exempt From Income Tax: Open To Public InspectionsakkioNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- Form 13A (Request For Availability of Name)Document2 pagesForm 13A (Request For Availability of Name)Zaim Adli100% (1)

- Lecture 3 - AMADocument11 pagesLecture 3 - AMALưu Hồng Hạnh 4KT-20ACNNo ratings yet

- Timothy - Chap 10Document44 pagesTimothy - Chap 10Chaeyeon JungNo ratings yet

- XD 500Document56 pagesXD 500rovelo3405475No ratings yet

- Order ReceiptDocument2 pagesOrder ReceiptYogesh PatilNo ratings yet

- Devil's Pulpit Site, Scotland July 2021Document4 pagesDevil's Pulpit Site, Scotland July 2021GraemeNichollsNo ratings yet

- UntitledDocument4 pagesUntitledRudra PrakashNo ratings yet

- HR Leaders Asia PH Post Event Report 2022Document19 pagesHR Leaders Asia PH Post Event Report 2022Robin PunoNo ratings yet

- Hotstar Media KitDocument46 pagesHotstar Media KitIvory EducationNo ratings yet

- Thesis Presentation ClothesDocument8 pagesThesis Presentation Clotheselizabethkennedyspringfield100% (2)

- Indirect Tax Revision Notes-CS Exe June 23 Lyst3130Document56 pagesIndirect Tax Revision Notes-CS Exe June 23 Lyst3130tskpestsolutions.chennaiNo ratings yet

- FMCG - Sector ReportDocument10 pagesFMCG - Sector ReportRajendra BhoirNo ratings yet

- Fabm ReviewerDocument18 pagesFabm ReviewerDrahneel MarasiganNo ratings yet

- 3M: Rethinking Innovation: Joe Tidd, John Bessant, Keith PavittDocument5 pages3M: Rethinking Innovation: Joe Tidd, John Bessant, Keith PavittArbresh RaveniNo ratings yet

- Ten Peak OutfittersDocument25 pagesTen Peak Outfittersapi-666443860No ratings yet

- Case Study101Document3 pagesCase Study101King Abner GubatanNo ratings yet

- Unit 16 Product LaunchDocument5 pagesUnit 16 Product LaunchSyrill CayetanoNo ratings yet

- National Coffee Bill 2018Document46 pagesNational Coffee Bill 2018The Independent MagazineNo ratings yet

- Assumptions:: Simple LBO Model - Key Drivers and Rules of ThumbDocument2 pagesAssumptions:: Simple LBO Model - Key Drivers and Rules of Thumbw_fibNo ratings yet

- Container Lifting Plan For Container at MPCL Warehouse NewDocument5 pagesContainer Lifting Plan For Container at MPCL Warehouse Newlike saddamNo ratings yet

- Company Certifications Fire Classifications Product ApprovalsDocument4 pagesCompany Certifications Fire Classifications Product ApprovalsHussein BeqaiNo ratings yet

- An Analysis of Financial Performance Analysis of NRBC Bank LimitedDocument37 pagesAn Analysis of Financial Performance Analysis of NRBC Bank LimitedHarunur RashidNo ratings yet

- RMIT BP251 - Teach-out-Plan IN 2024Document2 pagesRMIT BP251 - Teach-out-Plan IN 2024s3927319No ratings yet

- Brand Awareness of The LACOSTE CHALLENGE PerfumeDocument7 pagesBrand Awareness of The LACOSTE CHALLENGE PerfumeHabib LashariNo ratings yet

- Social Studies Form 4Document4 pagesSocial Studies Form 4Isabella RamsinghNo ratings yet

- Breakeven AnalysisDocument2 pagesBreakeven Analysisabrar mahir SahilNo ratings yet

- Technical IssueDocument1 pageTechnical IssueMohammed Qaid AlathwaryNo ratings yet

- Tem C1 PDFDocument6 pagesTem C1 PDFmae KuanNo ratings yet

Return For Credit Payments To Issuers of Qualified Bonds: Information On Entity That Is To Receive Payment

Return For Credit Payments To Issuers of Qualified Bonds: Information On Entity That Is To Receive Payment

Uploaded by

iqbalpecintateajussOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Return For Credit Payments To Issuers of Qualified Bonds: Information On Entity That Is To Receive Payment

Return For Credit Payments To Issuers of Qualified Bonds: Information On Entity That Is To Receive Payment

Uploaded by

iqbalpecintateajussCopyright:

Available Formats

Verify & Print Form

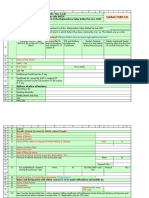

Form 8038-CP Return for Credit Payments

(Rev. January 2022)

Department of the Treasury

to Issuers of Qualified Bonds OMB No. 1545-0047

Internal Revenue Service ▶ Go to www.irs.gov/Form8038CP for instructions and the latest information.

Part I Information on Entity That Is To Receive Payment Check if Amended Return (see instructions) ▶

1 Name of entity that is to receive payment of the credit 2 Employer identification number (EIN)

3 Number and street (or P.O. box no. if mail is not delivered to street address) Room/suite

4 City, town, or post office; state; and ZIP code

5 Name and title of designated contact person whom the IRS may contact for more information 6 Telephone number of contact person shown on line 5

Part II Reporting Authority

7 Issuer’s name (if same as line 1, enter “SAME” and skip lines 8, 9, 11, 15, and 16) 8 EIN

9 Number and street (or P.O. box no. if mail is not delivered to street address) Room/suite 10 Report number (see instructions)

11 City, town, or post office; state; and ZIP code 12 Date of issue (MM/DD/YYYY)

13 Name of issue 14 CUSIP number (see instructions)

15 Name and title of officer or other person whom the IRS may contact for more information 16 Telephone number of contact person shown on line 15

17a Check applicable box (see instructions) ▶ Variable rate bond Fixed rate bond b Enter the issue price ▶ 17b

c Enter code number for type of bonds (see instructions) . . . . . . . . . . . .

Part III Payment of Credit (For specified tax credit bonds with multiple maturities, see instructions.)

18 Interest payment date to which this payment of credit relates (MM/DD/YYYY)

19a Interest payable to bondholders on the interest payment date. See instructions . . . . . . . . . . 19a

b For specified tax credit bonds only, enter the applicable credit rate determined under sec. 54A(b)(3) . %

c For specified tax credit bonds only, complete Schedule A and enter amount from Schedule A, line 3 . . . 19c

20 Amount of credit allowed for the interest payment date (complete only line 20a, 20b, 20c, 20d, 20e, or 20f)

a Build America bonds. Multiply line 19a by 35% (0.35) . . . . . . . . . . . . . . . . . 20a

b Recovery zone economic development bonds. Multiply line 19a by 45% (0.45) . . . . . . . . . . 20b

c New clean renewable energy bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . 20c

d Qualified energy conservation bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . 20d

e Qualified zone academy bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . . . 20e

f Qualified school construction bonds, enter the smaller of lines 19a or 19c . . . . . . . . . . . 20f

21 Adjustment to previous credit payments (complete line 21a OR line 21b only):

a Net increase to previous payments . . . . . . . . . . . . . . . . . . . . . . 21a

b Net decrease to previous payments . . . . . . . . . . . . . . . . . . . . . . 21b

c Enter explanation code for lines 21a or 21b (see instructions) . . . . . . . . . .

22 Amount of credit payment requested. Combine either line 20a, 20b, 20c, 20d, 20e, or 20f with line 21a or line 21b . 22

23a Has there been a change to the debt service schedule most recently filed with the IRS? . . . . . . . . . . Yes No

b If “Yes,” enter the explanation code and attach the revised debt service schedule (see instructions)

24a Have you paid or will you pay all the interest from line 19a on or before the date from line 18? See instructions . . . Yes No

b If “No,” enter the explanation code (see instructions) . . . . . . . . . . . . .

25 Is this return submitted for the final interest payment date for the bonds? . . . . . . . . . . . . . . Yes No

26 Enter direct deposit information below:

Direct

a Routing number ▶ b Type: Checking Savings

Deposit

c Account number

Under penalties of perjury, I declare that I have examined this return, and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and complete. I further declare that I authorize the IRS to send the requested refundable credit payment to the entity

Signature identified in Part I, and I consent to the disclosure of the issuer’s return information, as necessary to process the refundable credit payment, to the

and designated contact person(s) listed above in Parts I and II, as applicable.

Consent

▲

▶

Signature of issuer Date Type or print name and title

Print/Type preparer’s name Preparer’s signature Date Check if PTIN

Paid self-employed

Preparer

Firm’s name Firm’s EIN

Use Only

▶ ▶

Firm’s address ▶ Phone no.

For Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 52810E Form 8038-CP (Rev. 1-2022)

You might also like

- Isaac Spoon FALL 8w2 South Delaware Coors Case AnalysisDocument12 pagesIsaac Spoon FALL 8w2 South Delaware Coors Case AnalysisIsaac SpoonNo ratings yet

- Improving Customer Service in SunpharmaDocument5 pagesImproving Customer Service in SunpharmaIIMnotes100% (7)

- 2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingDocument17 pages2020 Proteus Offshore, LLC Form 1065 Partnerships Tax Return - FilingPeter Kitchen100% (2)

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- Amended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesDocument4 pagesAmended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesMoose112No ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- United States Additional Estate Tax Return: General InformationDocument4 pagesUnited States Additional Estate Tax Return: General Informationdouglas jonesNo ratings yet

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13Ahmad GaberNo ratings yet

- F1040nre 2012 PDFDocument2 pagesF1040nre 2012 PDFJohanna AriasNo ratings yet

- f1040seDocument2 pagesf1040seikechi.mikeNo ratings yet

- f1120s AccessibleDocument5 pagesf1120s AccessiblebhanuprakashbadriNo ratings yet

- 2551Document2 pages2551Mariluz BeltranNo ratings yet

- 1120S Case StudyDocument5 pages1120S Case StudyHimani SachdevNo ratings yet

- FORM 501 (Ver 1.3.0) (See Rule 60 (1) ) Application For Refund Under Section 51 of The Maharashtra Value Added Tax Act, 2002Document9 pagesFORM 501 (Ver 1.3.0) (See Rule 60 (1) ) Application For Refund Under Section 51 of The Maharashtra Value Added Tax Act, 2002nitinnawarNo ratings yet

- U.S. Corporation Income Tax Return: Type OR PrintDocument6 pagesU.S. Corporation Income Tax Return: Type OR PrintWEBTREE TECHNOLOGYNo ratings yet

- f1040x PDFDocument2 pagesf1040x PDFAlexNo ratings yet

- Form 3520-A (Rev. December 2023)Document5 pagesForm 3520-A (Rev. December 2023)Jeff LouisNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarNo ratings yet

- Pag para FirmarDocument1 pagePag para FirmarGaela SalvatierraNo ratings yet

- F1040se DFTDocument3 pagesF1040se DFTjyoti06ranjanNo ratings yet

- U.S. Return of Partnership Income: Sign HereDocument6 pagesU.S. Return of Partnership Income: Sign HerelordbippyNo ratings yet

- US Internal Revenue Service: f2220 - 1999Document4 pagesUS Internal Revenue Service: f2220 - 1999IRSNo ratings yet

- US Internal Revenue Service: f4970 - 2000Document2 pagesUS Internal Revenue Service: f4970 - 2000IRSNo ratings yet

- Finalized Schedule EDocument2 pagesFinalized Schedule EMira HuNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changesgolcha_edu532No ratings yet

- U.S. Income Tax Return For Cooperative AssociationsDocument5 pagesU.S. Income Tax Return For Cooperative AssociationsbhanuprakashbadriNo ratings yet

- US Internal Revenue Service: f8860 - 2003Document2 pagesUS Internal Revenue Service: f8860 - 2003IRSNo ratings yet

- U.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Document5 pagesU.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Benny BerniceNo ratings yet

- US Internal Revenue Service: f2220 - 1996Document4 pagesUS Internal Revenue Service: f2220 - 1996IRSNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax Returnmarxvera158No ratings yet

- 2010 Blank IRS Form 1065Document5 pages2010 Blank IRS Form 1065Nick PechaNo ratings yet

- US Internal Revenue Service: f2220 - 1992Document2 pagesUS Internal Revenue Service: f2220 - 1992IRSNo ratings yet

- 1065 Case StudyDocument5 pages1065 Case StudyHimani SachdevNo ratings yet

- US Internal Revenue Service: f2220 - 1995Document4 pagesUS Internal Revenue Service: f2220 - 1995IRSNo ratings yet

- Sales of Business PropertyDocument2 pagesSales of Business Propertyhiamang27No ratings yet

- Underpayment of Estimated Tax by Corporations: Required Annual PaymentDocument4 pagesUnderpayment of Estimated Tax by Corporations: Required Annual Paymentkushaal subramonyNo ratings yet

- 2021 Form 1040-NRDocument2 pages2021 Form 1040-NRvalentynad74No ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Kiran JituriNo ratings yet

- Income Tax On Dollar To InrDocument1 pageIncome Tax On Dollar To InrApki mautNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Navek SmithsNo ratings yet

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocument2 pagesUnited States Estate (And Generation-Skipping Transfer) Tax Returndouglas jonesNo ratings yet

- U.S. Income Tax Return For Certain Political Organizations: Sign HereDocument6 pagesU.S. Income Tax Return For Certain Political Organizations: Sign HereManikanta Sai KumarNo ratings yet

- File PDFDocument18 pagesFile PDFAmanda CoffeyNo ratings yet

- U.S. Return of Partnership Income: Sign HereDocument5 pagesU.S. Return of Partnership Income: Sign HereMarie CaragNo ratings yet

- Form 7200 (2021) - PDF Reader ProDocument1 pageForm 7200 (2021) - PDF Reader Proahmed.hany817818No ratings yet

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- Form 4A - GCT Returns PDFDocument2 pagesForm 4A - GCT Returns PDFNicquainCTNo ratings yet

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Document2 pagesExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldNo ratings yet

- Tax Form Template 21 Page1 0001Document1 pageTax Form Template 21 Page1 0001ayesha mihiraniNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesEri TakataNo ratings yet

- US Internal Revenue Service: f8390 - 1991Document4 pagesUS Internal Revenue Service: f8390 - 1991IRSNo ratings yet

- Casualties and TheftsDocument4 pagesCasualties and TheftsDr Camille Belle And Jade LinkNo ratings yet

- Tax DocumentDocument2 pagesTax Documentlynnmarie0905No ratings yet

- Like-Kind Exchanges: (And Section 1043 Conflict-Of-Interest Sales)Document2 pagesLike-Kind Exchanges: (And Section 1043 Conflict-Of-Interest Sales)Abdullah TheNo ratings yet

- Generation-Skipping Transfer Tax Return For Distributions: General InformationDocument1 pageGeneration-Skipping Transfer Tax Return For Distributions: General Informationdouglas jonesNo ratings yet

- US Internal Revenue Service: f2220 - 1994Document4 pagesUS Internal Revenue Service: f2220 - 1994IRSNo ratings yet

- Return of Organization Exempt From Income Tax: Open To Public InspectionDocument12 pagesReturn of Organization Exempt From Income Tax: Open To Public InspectionsakkioNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- Form 13A (Request For Availability of Name)Document2 pagesForm 13A (Request For Availability of Name)Zaim Adli100% (1)

- Lecture 3 - AMADocument11 pagesLecture 3 - AMALưu Hồng Hạnh 4KT-20ACNNo ratings yet

- Timothy - Chap 10Document44 pagesTimothy - Chap 10Chaeyeon JungNo ratings yet

- XD 500Document56 pagesXD 500rovelo3405475No ratings yet

- Order ReceiptDocument2 pagesOrder ReceiptYogesh PatilNo ratings yet

- Devil's Pulpit Site, Scotland July 2021Document4 pagesDevil's Pulpit Site, Scotland July 2021GraemeNichollsNo ratings yet

- UntitledDocument4 pagesUntitledRudra PrakashNo ratings yet

- HR Leaders Asia PH Post Event Report 2022Document19 pagesHR Leaders Asia PH Post Event Report 2022Robin PunoNo ratings yet

- Hotstar Media KitDocument46 pagesHotstar Media KitIvory EducationNo ratings yet

- Thesis Presentation ClothesDocument8 pagesThesis Presentation Clotheselizabethkennedyspringfield100% (2)

- Indirect Tax Revision Notes-CS Exe June 23 Lyst3130Document56 pagesIndirect Tax Revision Notes-CS Exe June 23 Lyst3130tskpestsolutions.chennaiNo ratings yet

- FMCG - Sector ReportDocument10 pagesFMCG - Sector ReportRajendra BhoirNo ratings yet

- Fabm ReviewerDocument18 pagesFabm ReviewerDrahneel MarasiganNo ratings yet

- 3M: Rethinking Innovation: Joe Tidd, John Bessant, Keith PavittDocument5 pages3M: Rethinking Innovation: Joe Tidd, John Bessant, Keith PavittArbresh RaveniNo ratings yet

- Ten Peak OutfittersDocument25 pagesTen Peak Outfittersapi-666443860No ratings yet

- Case Study101Document3 pagesCase Study101King Abner GubatanNo ratings yet

- Unit 16 Product LaunchDocument5 pagesUnit 16 Product LaunchSyrill CayetanoNo ratings yet

- National Coffee Bill 2018Document46 pagesNational Coffee Bill 2018The Independent MagazineNo ratings yet

- Assumptions:: Simple LBO Model - Key Drivers and Rules of ThumbDocument2 pagesAssumptions:: Simple LBO Model - Key Drivers and Rules of Thumbw_fibNo ratings yet

- Container Lifting Plan For Container at MPCL Warehouse NewDocument5 pagesContainer Lifting Plan For Container at MPCL Warehouse Newlike saddamNo ratings yet

- Company Certifications Fire Classifications Product ApprovalsDocument4 pagesCompany Certifications Fire Classifications Product ApprovalsHussein BeqaiNo ratings yet

- An Analysis of Financial Performance Analysis of NRBC Bank LimitedDocument37 pagesAn Analysis of Financial Performance Analysis of NRBC Bank LimitedHarunur RashidNo ratings yet

- RMIT BP251 - Teach-out-Plan IN 2024Document2 pagesRMIT BP251 - Teach-out-Plan IN 2024s3927319No ratings yet

- Brand Awareness of The LACOSTE CHALLENGE PerfumeDocument7 pagesBrand Awareness of The LACOSTE CHALLENGE PerfumeHabib LashariNo ratings yet

- Social Studies Form 4Document4 pagesSocial Studies Form 4Isabella RamsinghNo ratings yet

- Breakeven AnalysisDocument2 pagesBreakeven Analysisabrar mahir SahilNo ratings yet

- Technical IssueDocument1 pageTechnical IssueMohammed Qaid AlathwaryNo ratings yet

- Tem C1 PDFDocument6 pagesTem C1 PDFmae KuanNo ratings yet