Professional Documents

Culture Documents

Internship 2

Internship 2

Uploaded by

Karthik GbhatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internship 2

Internship 2

Uploaded by

Karthik GbhatCopyright:

Available Formats

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

EXECUTIVE SUMMARY

The Internship report has been undertaken in The Mysore Co-Operative Bank Ltd, Mysore

for a period of 4 weeks. The study includes the primary data collected from the Manager &

other staff members and secondary data is collected from annual reports of The Mysore Co-

operative Bank Ltd.

The bank is running on its own share capital and funds without taking any help or financial

assistance from Government. The Mysore cooperative bank on the co-operative principle of

“Each for all and all for each” allowed general public to become its members, irrespective of

caste or creed. Any person living in Mysore city can become a member of this bank .This

bank has been classified as “A” grade bank in Mysore city, the Reserve Bank of India

considered this bank as Grade I bank.

From this internship we can get a comprehensive understanding of banking operations,

financial products, and customer service. It covers risk management, financial analysis, and

technological advancements. Emphasis is placed on collaboration, ethics, and regulatory

compliance. Insights into market trends and develop essential professional skills required for

career in finance.

Though much smaller as compared to scheduled commercial banks, co-operative banks

constitute an important segment of the Indian banking system. They have extensive branch

network and reach out to people in remote areas. They have traditionally played an important

role in creating banking habits among the lower and middle-income groups and in

strengthening the rural credit delivery system.

A wider distribution and access of financial services helps both consumers and producers to

raise their welfare and productivity. Such access is especially powerful for the poor as it

provides them opportunities to build savings, make investments, avail credit, and more

important, insure themselves against income shocks and emergencies.

The bank has started with 36 members with a share capital of Rs.578/- has now reached

30,607 members, with a share capital of Rs. 532.09 Lakhs, having mobilized a deposit of Rs.

9,297.97 Lakhs and advanced to the tune of Rs.6,110.05 Lakhs and earned a net profit of

Rs.89.84 Lakhs as on 31.3.2017. This is one of the prominent co-operative banks in Mysore

city.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 1

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

INDUSTRY PROFILE

The Indian banking industry plays a crucial role in the country’s economy and is considered

one of the most robust and well-regulated banking systems in the world. With a history

spanning over two centuries, the banking sector in India has witnessed significant growth and

transformation. The Reserve Bank of India (RBI) is the central regulatory authority

responsible for overseeing and supervising the banking sector in India. It formulates policies,

issues guidelines, and regulates the functioning of banks to maintain stability and promote

financial inclusion.

The banking sector in India has witnessed significant transformation driven by economic

liberalization, technological advancements, and regulatory reforms. The entry of private and

foreign banks, coupled with the adoption of technology, has revolutionized banking

operations. Initiatives like financial inclusion programs have expanded the sector's reach.

Banks have evolved into universal institutions offering a broad spectrum of financial

services. This transformation has not only enhanced operational efficiency but also propelled

the sector's worth, making it a crucial pillar of India's economic growth and development.

The market size of cooperative banks in India can be assessed based on various factors such

as the total deposits held by these banks, their loan portfolio, and the number of branches and

customers served. The Reserve Bank of India (RBI) regulates cooperative banks in India and

periodically publishes data on their performance, including their financial indicators and

outreach.

In recent years, the Indian government has emphasized financial inclusion and the expansion

of banking services to underserved areas, which has further underscored the importance of

cooperative banks. These banks often cater to the needs of farmers, small businesses, and

individuals in rural and remote regions, contributing significantly to the country's overall

banking sector. The consolidated assets of the co-operative banking sector at end-March 2022

were ₹21.6 lakh crore. There are 31 cooperative banks in India, each of which is controlled

by a government firm to provide services to its employees. These cooperative banks are

furthermore managed by the Reserve Bank of India and were subject to the Banking Laws

Act of 1955 and the Banking Regulation Act of 1949.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 2

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

COMPANY PROFILE

Figure

1. The Mysore Co-operative Bank

The Mysore Co-operative Bank Limited was established in the year 1906 on account of the

interest and encouragement by the great visionary His Highness Rajarshi Nalvadi

Krishnaraja Wadiyar. Late Nanjundaraje Urs was the first President of this Institution. In the

beginning years the institution has served the Society as a food provision store under the

banner" SWADESHI STORES", which was converted into a Bank after the enforcement of

Banking Regulation in 1966. Ever since its incorporation the Bank has been serving all

sections of the people of Mysore by enrolling them as its members and Depositors. The Bank

has celebrated its Silver Jubilee in 1931, Golden Jubilee in 1956, Diamond Jubilee in 1967

and Platinum Jubilee in 1976.

The Centenary year of celebrations were held in a grand manner in 2006. The operations of

the main office and the branch of the bank are fully computerized. The keen Inspection

Committee of Reserve Bank of India has appreciated the maintenance of books and accounts

of the bank. The Audit Department has considered the bank as 'A' Grade Bank till this

date .This bank is the first bank registered under co-operative institutions in Mysore. It has

obtained License from Reserve bank of India to continue the banking business and its

deposits are insured with Deposit Insurance and Credit Guarantee Corporation(DICGC).

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 3

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

1. Year Of Establishment 1906

2. Type Of Company Banking

3. Nature Of Business Lending and deposits

4. Address Gandhi Square , Lashkar

Mohalla, Mysuru

5. State Karnataka

6. Pin code 570001

7. Branches 1

8. Phone Number 0821 252 1631

9. IFSC code IBKL01092MY

10. Services Loans, deposits ,banking.

Table 1 Details of the Mysore co-operative bank

BACKGROUND AND HISTORY

In the year 1966 when the co-operative Banking act came into effect the name “Swadeshi

Stores” was changed as “THE MYSORE CO-OPERATIVE BANK Ltd., with the aim to

provide banking facility to its members. The bank is running on its own share capital and

funds without taking any help or financial assistance from Government. The Mysore

cooperative bank on the co-operative principle of “Each for all and all for each” allowed

general public to become its members, irrespective of caste or creed. Any person living in

Mysore city can become a member of this bank .

This bank has been classified as “A” grade bank in Mysore city, the Reserve Bank of India

considered this bank as Grade I bank. This bank has celebrated Silver Jubilee in the year

1933, Golden Jubilee in the year 1956, Platinum Jubilee in the year 1976 and after

completing 100 years in 2006 celebrated centenary celebration in a befitting manner. The

bank started to function in a small rented building but now has its own buildings at Gandhi

Square as Head Office and a branch at New Sayyaji Rao road, Mysore. Both head office and

branch offices are fully computerized.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 4

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

In addition to the banking facility provided to its members it is rendering social service to its

members and public. Such as the bank has created a fund to provide one day meal in a year to

the patients of Bharath Cancer Hospital at Mysore. The bank so far conducted nine free eye

camps and conducted eye testing and eye operations to its member’s. This bank is the first

bank registered under co-operative institutions in Mysore. It has obtained License from

Reserve bank of India to continue the banking business and its deposits are insured with

Deposit Insurance and Credit Guarantee Corporation (DICGC).

The bank has started with 36 members with a share capital of Rs.578/- has now reached

30,607 members, with a share capital of Rs. 532.09 Lakhs, having mobilized a deposit of Rs.

9,297.97 Lakhs and advanced to the tune of Rs.6,110.05 Lakhs and earned a net profit of

Rs.89.84 Lakhs as on 31.3.2017. This is one of the prominent co-operative banks in Mysore

city.

NATURE OF BUSINESS

The Mysore Co-operative Bank provides its members with financial assistance, mostly in the

form of short-term loans, loans for constructing and housing, loans for buying cars, and

assistance for the less fortunate sections of society. Since 1906, The Mysore Co-operative

Bank has operated a branch in Mysore. In order to motivate people to save more money,

Mysore Co-operative Bank is committed to providing basic banking services, such as

opening several types of bank accounts, including bank savings accounts, a bank account, a

bank term deposit account, and many more. The bank also provides loans and advances on

gold jewellery and bonds through enticing programs.

VISION, MISSION, POLICY

VISION STATEMENT

The Mysore Co-operative bank is dedicated to the overall growth of the bank by providing

the required credit facility to the client. It also promises to serve the general public by

developing improved banking services and improving credit dispersion better than any other

banking channel.

• Increase shareholder value by maximizing profits per share over time.

• A place where people care about one other on a personal level and work together

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 5

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

to achieve common goals .

MISSION STATEMENT

Aiming to maintain the Bank's reputation as the dominant wealth management corporation,

with standards set and considerable worldwide significance, and to play a leadership role in

developing and broadening wealth management industries while retaining focus on its growth

finance rule.

POLICY STATEMENT

Co-operative banks typically operate under regulations set forth by the government or

regulatory bodies in the country where they are located. These regulations govern various

aspects of banking operations, including lending practices, capital requirements, governance

structures, and customer protection measures. Here's an overview of some common banking

policies for cooperative banks.

Governance and Management: Cooperative banks are typically required to have a transparent

governance structure with clearly defined roles and responsibilities for board members,

management, and staff. Regulatory authorities often set standards for the qualifications and

experience required for key management positions.

Prudential Regulations: Prudential regulations are designed to ensure the safety and

soundness of cooperative banks by establishing minimum capital requirements, liquidity

standards, and risk management practices. These regulations help prevent excessive risk-

taking and protect depositors' funds.

Lending Policies: Cooperative banks are usually required to follow prudent lending practices

to minimize credit risk. This may include conducting thorough credit assessments,

establishing loan-to-value ratios, and setting limits on exposure to specific borrowers or

sectors.

Asset Quality: Regulatory authorities typically require cooperative banks to maintain a

certain level of asset quality by regularly assessing the quality of their loan portfolio and

making provisions for potential loan losses. Non-performing assets (NPAs) are closely

monitored, and banks may be required to take corrective actions to address any deterioration

in asset quality.

Compliance and Reporting: Cooperative banks must comply with all applicable laws,

regulations, and guidelines issued by regulatory authorities. They are typically required to

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 6

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

submit periodic reports on their financial condition, operations, and compliance with

regulatory requirements.

WORK FLOW MODEL

Figure 2.1 Workflow in a Co-operative bank

The Banking workflow chart outlines the steps involved in providing banking services to

customers. The first step is when a customer requests service, which may involve opening a

new account or performing a transaction on an existing account. If the customer is opening a

new account, the next step is to gather the necessary information and documentation to open

the account. This may include verifying the customer's identity, collecting their personal

information, and determining the type of account that best meets their needs.

Once the account has been opened, the next step is to perform any requested transactions on

the account. This may include deposits, withdrawals, transfers, or other banking services.

Throughout the process, it is important to provide the customer with a receipt for any

transactions performed. This can help ensure that the customer has a record of the transaction

and can be used for future reference or disputes.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 7

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

Figure 2.2 Customer Service Process

The process begins with the customer requesting service, which could be through a variety of

channels such as phone, email, or online chat. The customer's information is collected, which

could include their name, contact information, and details about the issue they are

experiencing. This information is used to create a ticket, which is logged in a system to track

the progress of the issue.

The ticket is then assigned to the appropriate team based on the nature of the issue. For

example, a technical issue might be assigned to the IT team, while a billing issue might be

assigned to the finance team. The team works to resolve the issue, which could involve

troubleshooting, research, or other actions. If the issue has been resolved, the team confirms

the resolution with the customer. This could be done through a follow-up call, email, or other

communication. The customer confirms that the issue has been resolved to their satisfaction,

and the ticket is closed in the system.

Overall, this process ensures that customer issues are handled efficiently and effectively, with

clear communication and tracking throughout the process to ensure that the issue is resolved

to the customer's satisfaction. By following this process, organizations can improve their

customer service quality and customer satisfaction.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 8

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

SERVICE PROFILE

The bank has started with 36 members with a share capital of Rs.578/- has now reached

30,607 members, with a share capital of Rs. 532.09 Lakhs, having mobilized a deposit of Rs.

9,297.97 Lakhs and advanced to the tune of Rs.6,110.05 Lakhs and earned a net profit of

Rs.89.84 Lakhs as on 31.3.2017. This is one of the prominent co-operative banks in Mysore

city.

Savings Account:

Easy Account Opening Procedure: Mysore Cooperative Bank offers a straightforward process

for opening savings accounts, making it convenient for customers to start saving.

Facility of Computerized Passbook: Customers can easily track their transactions and account

balance through a computerized passbook provided by the bank.

Free Cheque Books: Account holders are provided with complimentary cheque books,

facilitating easy transactions and payments.

Free Ru-Pay Debit cum ATM Cards: Customers can access their funds conveniently through

Ru-Pay debit cards, which can be used for both online and offline transactions as well as for

ATM withdrawals.

Nomination Facility Available: The bank allows customers to nominate individuals who will

receive the funds in the event of the account holder's demise.

Minimum Balance of Rs. 1000: Account holders are required to maintain a minimum balance

of Rs. 1000 in their savings account.

Current Account:

Available to Various Entities: The current account is open to individuals, proprietorship

firms, partnership firms, companies, Hindu Undivided Families (HUFs), trusts, and other

entities.

Free Ru-Pay Debit-cum-ATM Card: Individual account holders are provided with a Ru-Pay

debit card for convenient access to funds and transactions.

Easy Account Opening Procedure: Similar to savings accounts, the current account can be

opened with a straightforward process, ensuring convenience for customers.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 9

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

Loans

The cooperatives pool their surplus funds, which are then used as collateral to obtain loans

from a bank. This loan amount is used to further lend to the members of the cooperative.

When the members repay the loan to the cooperative, the cumulative amount is repaid to the

bank

Housing Loan:

Wide Eligibility: Housing loans are available to a broad range of entities including

individuals, proprietorship firms, partnership firms, companies, HUFs, co-operative societies,

and associations.

Free Debit-cum-ATM Card: Individual account holders availing housing loans are provided

with Ru-Pay debit cards.

Easy Account Opening Procedure: The bank offers a hassle-free process for opening accounts

for customers applying for housing loans.

Loan Against Property:

Loan for Business Needs: Customers can avail loans against marketable property to meet

their business requirements.

Attractive Interest Rates: The bank offers competitive interest rates for loans against

property.

Easy Repayment Schedule: Flexible repayment schedules are provided to borrowers, making

it easier for them to repay the loan.

Interest Applied on Daily Reducing Balance: Interest is calculated on a daily reducing

balance basis, potentially reducing the overall interest burden on the borrower.

SL.NO DETAILS INTEREST RATE

1. From 25lakhs to 50lakhs 12%

2. From 15 lakhs to 13.50%

24.99lakhs

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 10

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

3. From 15 lakhs 14.50%

Gold Loans:

Loan Against Gold Ornaments: Customers can obtain loans by pledging their gold ornaments

to meet their business needs.

Attractive Interest Rates: The bank offers competitive interest rates for gold loans @ 9% .

Easy Process and Repayment: The process for obtaining a gold loan is simple, and repayment

options are convenient for borrowers.

Interest Applied on Daily Reducing Balance: Similar to loan against property, interest for

gold loans is applied on a daily reducing balance basis .

Fixed Deposit

Sl. No. Duration of Days Interest

1. 31days to 90days 4.00%

2. 91days to 180days 4.50%

3. 181days to 270days 5.50%

4. 271days to 365days 7.50%

5. Above 1year 6.50%

Note: Senior Citizens above 60 years will be paid 0.50% higher interest.

Table 2.1 Interest rates on fixed deposits

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 11

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

OWNERSHIP PATTERN

The bank has owned funds of Rs. 1660.71 lakhs which consists of 34005 members as of the

current financial year 2022-2023.

Key Personals

NAME DESIGNATION

P Rajeshwari President

H Harish Kumar Vice - President

K Harshith Gowda Chief Executive Officer

K Umashankar Director

S Sommanna Director

P Savitha Director

S Aravind Director

J Yogesh Director

M Y Ramesh Gowda Professional Director

Table 2.2 list of Directors in the Bank

ACHIEVEMENTS AND REWARDS

The bank has been classified as “A” grade bank in Mysore city, the Reserve Bank of India

considered this bank as Grade I bank.

This bank has celebrated Silver Jubilee in the year 1933, Golden Jubilee in the year 1956,

Platinum Jubilee in the year 1976 and after completing 100 years in 2006 celebrated

centenary celebration in a befitting manner. On account of Centenary Celebrations on

24.12.2006 it was decided to honor one hundred Senior members and ten members who have

borrowed and regular in repayment.

The bank is encouraging for the education of the children of members with low income

bearing the tuition and examination fees. Children of the members who secure distinction in

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 12

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

public examinations, participate and win prizes in State and National Level sports events are

honored by the bank.10,000

The bank is providing Rs.10000 in the event of death of any member for the cremation and

ritual rites within 6 months-to the Nominee/ authorized persons of the members. This kind of

service is appreciated by everyone. A provision for meeting a day's food expenses of Bharath

Cancer Hospital of Mysore has been made.

A Health check-up Camp was organized to examine the health of the members where eye,

hears, throat, blood pressure, sugar and other tests were conducted for both male and female

members .

List of Being First :

• The First Registered Co-operative Institution in the entire Mysore City.

• The First Co-operative Bank in Mysore.

• The First Cooperative Bank to get permission for banking from the Reserve Bank of India.

• The First Cooperative Bank celebrating Centenary year in the entire state of Karnataka.

• The First Co-operative Bank in Mysore City to have more than twenty-five thousand

members from all sections of the Society.

• The First Cooperative Bank having the practice of helping the families of the deceased

members at the time of need.

FUTURE GROWTH AND PROSPECTS

Opening of 4 new branches in Mysore is a strategic move for Mysore Cooperative Bank to

expand its physical presence and accessibility to customers in key areas of the city. This

expansion allows the bank to reach a broader customer base and serve the growing population

in that locality.

Adopting new banking technology is crucial for the modernization and efficiency of Mysore

Cooperative Bank's operations. By integrating the latest technological advancements, such as

online banking platforms, mobile banking apps, and digital payment solutions, the bank can

enhance its service offerings, improve customer experience, and streamline internal

processes.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 13

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

MCKINSEY’s 7S FRAMEWORK

McKinsey 7s model was developed in 1980s by McKinsey consultants Tom Peters, Robert

Waterman and Julien Philips with a help from Richard Pascale and Anthony G. Athos. Since

the introduction, the model has been widely used by academics and practitioners and remains

one of the most popular strategic planning tools.

The model highlights that there exists a domino effect when any one element is transformed

to restore effective balance. The central placement of shared values emphasizes that a strong

change culture impacts all the other elements to drive change. The 7 elements identified in

the McKinsey 7s model can be categorized as being hard or soft in nature. Hard elements

include strategy, structure, and systems. The soft elements of the McKinsey 7s model, in turn,

include shared values, staff, skills, and strategy.

1.Strategy:

The strategic direction and the overall business strategy for the co-operative bank are clearly

defined and communicated to all the employees and stakeholders. This helps the organization

manage performance, guide actions, and devise different tactics that are aligned with the

business strategy.

An important aspect of the strategy at Mysore co-operative bank is that it takes into constant

consideration the changing consumer trends and demands, as well as the evolving consumer

market patterns and consumption behavior. This is an important part of the strategic direction

as it allows the company to remain competitive and relevant to its target consumer groups, as

well as allows the company to identify demand gaps in the consumer market.

2.Structure:

The bank has a flatter organizational hierarchy that is supported by learning and progressive

organizations. With lesser managerial levels in between and more access to the senior

management and leadership, the employees feel more secure and confident and also have

higher access to information. It has a developed and intricate system for ensuring

communication between employees, and different managerial levels.

3.System:

The system of monitoring the performance of the employees is continual and ongoing done

through observation and informal discussions. Feedback to employees and overall department

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 14

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

heads is informally given regularly as and when is required. Formal evaluation of

performance is also conducted semiannually or quarterly, depending on the need and the

urgency of the projects and assigned tasks. This is a formal process that is undertaken by

supervisors and managers to ensure the identification of performance lags, and suggestive

means of improvement.

4. Shared values:

Creativity ,honesty ,transparency ,accountability ,trust, quality and heritage to foster a

creative and supportive organizational structure that will allow employees to perform

optimally, and enhance their motivation and organizational commitment. “Each for all and all

for each” is one of the principles they follow in the bank.

5. Style:

The co-operative bank is following participative leadership style, which will engage and

involve its employees in decision-making processes and managerial decisions. This also

allows the leadership to regularly interact with the employees and different managerial

groups to identify any potential conflicts for resolution, as well as for feedback regarding

strategic tactics and operations.

6.Staff:

There are around 50 employees in the organization and all the job roles and positions are

designed to facilitate the achievement of objectives and clearing of examinations prescribed

time to time .Based on the nature of the need, the human resource department arranges for

recruitments which may be permanent or contractual in nature, as well as arranges training

sessions if need be for the current workforce.

7.Skills:

Problem solving and analytical skills are required by the employees of the bank and they

should be able to perform the quickest basic calculations, multiplications, ratios, and

fractions. The human resource is one of the core competitive advantages of the bank and

skills of employees are developed specifically for job roles and requirements .

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 15

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

PORTER’S FIVE FORCE MODEL

Porter's five forces are used to identify and analyze an industry's competitive forces. The five

forces are competition, the threat of new entrants to the industry, supplier bargaining power,

customer bargaining power, and the ability of customers to find substitutes for the sector's

products.

The model guides businesses in determining the intensity of competition and potential

profitability within their market, helping them better understand where power lies in their

sector. Porter's model was meant to critique "perfectly competitive" business models, unlike

real-world markets where competitors aren't just rivals and firms in specific industries tend to

rise and fall together.

1.Bargaining Power of Buyers:

High bargaining power of customers on account of banks renders uniform services to the

clients. Now a day's almost all banks would like to provide requisite information very easily

by way to Internet, Mobile banking to the clients. If the bargaining power of customers is

high, they influence the profitability of the market by imposing their requirements in terms of

price, service, quality, clients is crucial because a firm should avoid to be in a situation of

dependence. The level of concentration of customers gives them more or less power.

2. Bargaining power of Supplier:

Low bargaining power of suppliers on account of RBI regulatory benchmarks. Banks have to

meet numerous regulatory standards created by RBI .The bargaining power of suppliers is

very important in a market. Powerful suppliers can impose their conditions in terms of price,

quality and quantity. On the other hand, if there are a lot of suppliers their influence is

weaker. One has to analyze the number of realized orders, the cost of changing the supplier,

the presence of raw materials.

3. Competitive Rivalry:

High competition of account of number of prominent public , private, foreign along with

cooperative banks. The competition between firms determines the attractiveness of a sector.

Banks are struggling to maintain their power. The competition changes based on sector

development, diversity and the existence of barriers to enter. In addition to this is an

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 16

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

analysis of the number of competitors, products, brands, strengths and weaknesses, strategies,

market shares.

4. Threat of New Entrants:

Low threat of new entrants on account of banking regulations. Before setting up of a new

bank, it is essential to take the consent of Reserve Bank of India .It is in a company's interest

to create barriers to prevent its competitors to enter to market. They are either new

companies, or companies which intend to diversify. These barriers can be legal and the

arrival of new entrants also depends on the size of the market (economy of scale) The

reputation of a company already installed, the cost of entry, access to raw materials, technical

standards, cultural barriers.

5.Threats of Substitutes Products:

High level threat from substitutes like NBFC's, Mutual funds, Government securities and T-

bills. The substitute products can be considered as an alternative compared to supply on the

market. These products are due to changes in the state of technology or to the innovation. The

companies see their products be replaced by different products. These products often have a

better price/quality report and come from sectors with higher profits. These substitute

products can be dangerous and the company should anticipate to cope with this threat.

SWOT ANALYSIS

SWOT analysis is used in Co-operative banks to evaluate their internal strengths and

weaknesses, as well as external opportunities and threats, enabling them to leverage their

strengths, address weaknesses, capitalize on opportunities, and mitigate potential threats for

the success and growth of the bank.

SWOT analysis is an acronym for (Strength, Weakness, Opportunities, and Threats) and is a

structured planning method that evaluates those four elements of an organization, project or

business venture.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 17

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

Strengths:

1. Large client base: The Mysore Cooperative Bank boasts a substantial customer base,

indicating trust and reliability among the local populace.

2. Variety of new products and programs: The bank's diverse product range indicates

adaptability and innovation, catering to various financial needs of customers.

3. Short-term low-interest loan: Offering low-interest loans for businesses and small

enterprises enhances the bank's appeal and supports local economic development.

4. Skilled human resources: Having dedicated and skilled employees ensures efficient service

delivery and fosters customer satisfaction.

5. Friendly environment: A welcoming atmosphere in the bank contributes to positive

customer experiences and promotes customer loyalty.

6. Good reputation and reliability: A solid reputation signifies trustworthiness, which is

essential in the banking sector, leading to customer retention and attracting new clients.

7. Popularity among the people of Mysore: Being favored by the local community

strengthens the bank's position and fosters community engagement.

Weaknesses:

1. Limited area of operation: Restriction to a specific geographic area limits potential growth

opportunities and diversification.

2. Non-performing assets: Having a high proportion of non-performing assets can strain the

bank's financial health and hinder profitability.

3. Less adoption of new technologies: Lagging behind in technology adoption may result in

inefficiencies and hamper competitiveness in the digital age.

4. Few ATM booths: Insufficient ATM infrastructure may inconvenience customers and limit

accessibility to banking services.

5. Language barriers: Language barriers can hinder effective communication with diverse

customer segments and may require additional resources for translation services.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 18

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

Opportunities:

1. Credit demand: Anticipating credit needs presents an opportunity to expand loan offerings

and attract new customers, stimulating business growth.

2. Technological advancement: Investing in technology can streamline operations, improve

customer experience, and enhance competitiveness in the market.

3. High household savings: The presence of high household savings indicates potential

opportunities for deposit mobilization and investment products.

4.Prime commercial area: Being located in a prime commercial area presents opportunities

for increased foot traffic and business partnerships.

5. Offering various loan types: Diversifying loan products can cater to different customer

segments and increase revenue streams.

Challenges:

1. Competition: Intense competition from other banks and financial institutions requires

strategic differentiation to maintain market share.

2. Government policy changes: Changes in government policies can impact regulatory

compliance and business operations, necessitating adaptability.

3. NBFCs, capital markets, and mutual funds: Competing with non-banking financial

institutions and capital markets requires innovative strategies to retain customers and attract

investments.

4. Inflation and recession: Economic fluctuations such as inflation and recession can affect

loan performance and financial stability.

5. High preliminary cost of new technologies: Initial investment costs for implementing new

technologies may strain financial resources and require careful budgeting and plan.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 19

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

ANALYSIS OF FINANCIAL STATEMENTS

PROFIT AND LOSS STATEMEMT

A profit and loss (P&L) statement, also known as an income statement, is a financial

statement that summarizes the revenues, costs, expenses, and profits/losses of a company

during a specified period. These records provide information about a company’s ability to

generate revenues, manage costs, and make profit

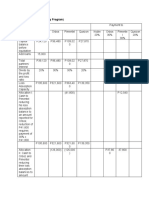

Tabel 4.1 Profit and loss statement for five years from 2022-2018

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 20

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

BALANCE SHEET

A balance sheet is a financial statement that reports a company's assets, liabilities, and

shareholder equity. The balance sheet is one of the three core financial statements that are

used to evaluate a business.

Table4.2 Balance sheet for 5 years from 2022-2018

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 21

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

RATIO ANALYSIS

Ratio analysis is a financial analysis technique used to evaluate performance, profitability,

and financial health of a company by examining the relationships between different financial

variables. There are four categories of ratio analysis namely profitability, liquidity, solvency,

and valuation.

NET PROFIT MARGIN

Net profit margin, or simply net margin, measures how much net income or profit is

generated as a percentage of revenue. It is the ratio of net profits to revenues for a company

or business segment.

FORMULA : Net Profit Margin = Net Profit ⁄ Total Revenue x 100

YEAR NET PROFIT TOTAL REVENUE PERCENTAGE

2018 13400553 123388266 10.86%

2019 10655423 120754138 8.82%

2020 10271776 130634552 7.82%

2021 20063063 140217206 14.30%

2022 32451026 157156709 20.64%

Table 5.1 Net profit for five years

Figu

NET PROFIT

re 5.2

180000000 25.00%

160000000

140000000 20.00%

120000000

15.00%

100000000

80000000

10.00%

60000000

40000000 5.00%

20000000

0 0.00%

2018 2019 2020 2021 2022

NET PROFIT TOTAL REVENUE PERCENTAGE

Composition of net profit in total revenue for five years

INTERPRETATION:

From the above ratio we can say that the company has been experiencing growth in both

revenue and profitability over the specified period, with fluctuations in the net profit ratio

indicating varying levels of operational efficiency and profitability from one year to year.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 22

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

ASSET TURNOVER RATIO

The asset turnover ratio measures how effectively a company uses its assets to generate

revenues or sales. The ratio compares the dollar amount of sales or revenues to the company's

total assets to measure the efficiency of the company's operations. To calculate the ratio,

divide net sales or revenues by average total assets.

FORMULA Asset Turnover Ratio = Net Sales / Total Assets

YEAR SALES TOTAL ASSETS ATR

2018 123388266 1139630607 0.108

2019 120754138 1133141124 0.106

2020 130634552 1299973926 0.1

2021 140217206 1447202608 0.096

2022 157156709 1520388761 0.103

Table5.2 Sales and total assets for five years

0.11 ASSET TURNOVER RATIO

0.108

0.108

0.106

0.106

0.104 0.103

PERCENTAGE

0.102

0.1

0.1

0.098

0.096

0.096

0.094

0.092

0.09

2018 2019 2020 2021 2022

YEARS

Figure 5.2 Asset turnover ratio for five years

INTERPRETATION

The data includes sales and total assets from 2018 to 2022, alongside the asset turnover ratio

for each year. Fluctuations in the ratio reflect changes in the company's efficiency in using

assets to generate revenue, with higher ratios indicating better utilization and lower ratios

suggesting decreased efficiency.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 23

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

DEBT EQUITY RATIO

Debt to Equity ratio is a financial and a liquidity ratio that indicates how much debt and

equity a company uses. It shows the capital structure of the company and is calculated by

dividing the company's debts by shareholders' equity.

FORMULA Debt Equity Ratio = Total Debt / Total Equity

YEAR TOTAL DEBT TOTAL EQUITY PERCENTAGE

2018 97,90,06,216.23 16,72,14,249.60 5.85%

2019 96,01,32,124.11 17,51,56,234.75 548.31%

2020 1,14,76,36,416.89 18,40,98,155.05 6.23%

2021 1,14,52,56,444.72 20,90,91,484.32 5.48%

2022 1,29,12,09,830.43 23,42,17,430.69 5.51%

Table 5.3. Debt equity ratios for Five years

DEBT EQUITY RATIO

1,400,000,000.00

1,200,000,000.00

1,000,000,000.00

800,000,000.00

TOTAL

600,000,000.00

400,000,000.00

200,000,000.00

0.00

2018 2019 2020 2021 2022

YEARS

TOTAL DEBT TOTAL EQUITY

Linear (TOTAL EQUITY)

Figure5.3 Composition of debt and equity for five years

INTERPRETATION

Total Debt and Total Equity have shown an upward trend, indicating growth and investment.

The Debt Equity ratio remained stable around 5.5 from 2020 to 2022, suggesting a balanced

capital structure. However, the sharp increase in the ratio to 548.31 in 2019 raises concerns

about high financial risk due to excessive debt compared to equity. The company seems to

have improved its debt management in recent years.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 24

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

INTEREST COVERAGE RATIO

The Interest Coverage Ratio (ICR) is a financial ratio that is used to determine how well a

company can pay the interest on its outstanding debts. The ICR is commonly used by lenders,

creditors, and investors to determine the riskiness of lending capital to a company.

FORMULA Interest Coverage Ratio = Net Profit / Interest on Deposits

YEAR NET PROFIT INTEREST ON DEPOSITS RATIO

2018 13400553 7,60,31,896.29 0.162

2019 10655423 7,27,21,121.67 0.1464

2020 10271776 7,15,48,152.00 0.1439

2021 20063063 7,41,45,805.63 0.27

2022 32451026 7,07,23,806.90 0.458

Table5.4 Net profit and interest on deposits for five years

INTEREST COVERAGE RATIO

0.5

0.45

0.4

0.35

0.3

RATIO

0.25

0.2

0.15

0.1

0.05

0

2018 2019 2020 2021 2022

YEARS

Figure 5.4 Interest Coverage ratio for five years

INTERPRETATION

The Interest Coverage Ratio, which reflects the company's ability to handle its interest

obligations, has been fluctuating but remained relatively low. A lower ratio implies that the

company's operating profits are not sufficient to cover its interest expenses adequately.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 25

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

LOAN TO VALUE RATIO

LTV ratio is a metric to compare a loan amount to the value of the asset purchased with the

loan. This ratio is a lending risk assessment ratio that financial institutions and other lenders

examine before approving a mortgage .

FORMULA

Loan-to-Value Ratio = (Total Loans and Advances / Value of Assets) * 100

YEAR LOANS AND ADVANCES VALUE OF ASSETS RATIO

2018 39,33,52,450.30 1,13,96,30,607 34.49%

2019 41,25,72,841.30 41,25,72,841.30 36.39%

2020 73,35,31,835.30 1,29,99,73,926 56.43%

2021 74,58,86,827.30 1,44,72,02,608 51.52%

2022 84,09,18,552.39 1,52,03,88,761 55.35%

Table 5.5 Total amount of loans and assets for five years

LOAN TO VALUE RATIO

56.43% 55.35%

55.00% 51.52%

45.00%

36.39%

PERCENTAGE

34.49%

35.00%

25.00%

15.00%

5.00%

2018 2019 2020 2021 2022

RATIO 34.49% 36.39% 56.43% 51.52% 55.35%

YEARS

Figure 5.5 loan to value ratio for five years

INTERPRETATION

The LTV ratio was at its lowest, indicating conservative lending practices. Overall, the

company appears to have maintained a balanced approach in providing loans while ensuring

the value of assets supports its lending activities.

LEARNING EXPERIENCE

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 26

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

On the first day of the internship a brief introduction about the organization was given by the

General Manager. I started my internship under the guidance of Sri Harshith Gowda Sir,

who is the CEO and the General Manager at Mysore co-operative Bank Ltd . I was given an

opportunity to refer to the organization records. Wherein I got to know about the

documentation procedures involved in that work and gained a fair idea and the functions of

the bank. I came to know the various activities that the bank is involved with the

departments .

I learnt about the various types of services provided by the bank and their way of handling

customers. Account opening and closing procedures along with lending of different kinds of

loans especially the home loan and gold loan were taught to me . Various aspects relating to

book keeping ,maintaining registers of employees everyday attendance,

deposits ,withdrawals and knowing about the interest rates .

Information related to closure of accounts on maturity and process of reinvestment were also

been taught .I could see a lot of customers during the morning hours and the workload was

hectic due to this reason. All the counters were operating simultaneously at that time. I gained

understanding of financial reports and day-to-day operations.

The good quality service that the bank provided impressed me a lot. The customers have a

very good impression on the bank and have been the customers since long time . The working

hours are helpful to the customers. I am very impressed with the decorum of the bank. The

bank staff also helped me by providing the details and information of the bank for

completing the project.

The internship taken up in the bank has given me a very comprehensive image of the work of

the bank and I have gained complete knowledge of the working of bank. The bank I choose

has completed 100 years and it is a successful bank even today. The service is their motto. It

is one of the popular banks in the heart of the Mysuru city. I am proud to have taken up the

project in such a bank .I am thankful to the bank authorities to have given me an opportunity

to learn all the information listed above.

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 27

INTERNSHIP AT THE MYSORE CO-OPERATIVE BANK LTD

BIBLIOGRAPHY

https://themycobank.com/

https://www.dicgc.org.in/

DEPARTMENT OF BUSINESS ADMINISTRATION ,VVCE, 28

You might also like

- The 10 Magic Words To Immediately Remove Any DebtDocument8 pagesThe 10 Magic Words To Immediately Remove Any DebtSim Cooke100% (14)

- Taking Sides - Clashing Views On Economic Issues - Issue 2.4Document4 pagesTaking Sides - Clashing Views On Economic Issues - Issue 2.4Shawn Rutherford0% (1)

- Carrefour S, ADocument14 pagesCarrefour S, Aketut_widya67% (3)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Punjab State Cooperative Bank 1 (Repaired)Document60 pagesPunjab State Cooperative Bank 1 (Repaired)DeepikaSaini75% (4)

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Income Tax Malaysia General and Specific DeductionsDocument10 pagesIncome Tax Malaysia General and Specific DeductionsNeha Pamini83% (6)

- Latihan Budget 2014 - 2015Document48 pagesLatihan Budget 2014 - 2015Elizabeth DeeNo ratings yet

- Bank of Maharashtra ProjectDocument39 pagesBank of Maharashtra Projectchakshyutgupta76% (21)

- Coopart Bank Second Plag FinalDocument84 pagesCoopart Bank Second Plag FinalNamrathaNo ratings yet

- Part A: Internship Experience: Chapter OneDocument2 pagesPart A: Internship Experience: Chapter OneMD.JASHIM HASAN RIPONNo ratings yet

- Darshan Black Book 180917 FinalDocument91 pagesDarshan Black Book 180917 Finaladitya desaiNo ratings yet

- Banking Industry in India Central Bank of India CCDocument57 pagesBanking Industry in India Central Bank of India CCAmit PasiNo ratings yet

- Sachin ReportDocument44 pagesSachin ReportMilap NaiduNo ratings yet

- A Study On Attrition Rate in Standard Chartered BankDocument55 pagesA Study On Attrition Rate in Standard Chartered BankAjay RohillaNo ratings yet

- A Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Document70 pagesA Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Umang Vora0% (1)

- About Privet Banking Sector in IndiaDocument11 pagesAbout Privet Banking Sector in IndiaRakesh MalusareNo ratings yet

- Project Report - The Saraswat Co-Op Bank LTD - by Pahal SatvilkarDocument6 pagesProject Report - The Saraswat Co-Op Bank LTD - by Pahal SatvilkarPRALHADNo ratings yet

- Term Paper: SUBMITTED TO: Prabhjot KaurDocument23 pagesTerm Paper: SUBMITTED TO: Prabhjot KauramritabarunNo ratings yet

- Introduction of The StudyDocument51 pagesIntroduction of The Studyravikiran1955No ratings yet

- 1.industry Profile: 1. Primary FunctionDocument70 pages1.industry Profile: 1. Primary FunctionBhavanams Rao0% (1)

- Profile of SBIDocument15 pagesProfile of SBIkarthikrishnaNo ratings yet

- Comparitive Analysis of Public Sector and Private Sectors Banks PDFDocument67 pagesComparitive Analysis of Public Sector and Private Sectors Banks PDFAnonymous y3E7ia100% (1)

- Desk Report - Pragati - HRD2017111Document73 pagesDesk Report - Pragati - HRD2017111Pragati AgrawalNo ratings yet

- Wa0008.Document34 pagesWa0008.Krishnan 18No ratings yet

- G H Raisoni Institute of Engineering & Technology, NagpurDocument34 pagesG H Raisoni Institute of Engineering & Technology, NagpurPratik JainNo ratings yet

- State Bank of IndiaDocument14 pagesState Bank of IndiaMahadevan KrishnamurthyNo ratings yet

- MIE Project Report Sec B Group 6Document11 pagesMIE Project Report Sec B Group 6ashwin saiNo ratings yet

- Industry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankDocument66 pagesIndustry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankGoutham BindigaNo ratings yet

- Summer ProjectDocument68 pagesSummer Projectgauravgupta18290No ratings yet

- The BirthDocument51 pagesThe BirthSantosh BarikNo ratings yet

- SarvoDocument33 pagesSarvoDisha GandhiNo ratings yet

- About Corporation Bank IndiaDocument4 pagesAbout Corporation Bank IndiaPriyanka SawantNo ratings yet

- Punjab State Cooperative BankDocument58 pagesPunjab State Cooperative BankRavneet Singh75% (4)

- DCB Bank - SipDocument59 pagesDCB Bank - SipRiya AgrawalNo ratings yet

- 0 - A Study On Competency Mapping in Ujjivan Small Finance BankDocument8 pages0 - A Study On Competency Mapping in Ujjivan Small Finance BankPRANUNo ratings yet

- Chapter 1Document12 pagesChapter 1tikeshNo ratings yet

- Sakshi MHRD SEM-4Document80 pagesSakshi MHRD SEM-4nikitamoradiya24No ratings yet

- Project Proposal SBI MicrofinanceDocument7 pagesProject Proposal SBI MicrofinanceKiran Chopra100% (1)

- AcknowlegdementDocument29 pagesAcknowlegdementYamini MehtaNo ratings yet

- Industry NameDocument32 pagesIndustry NameBavadharani MNo ratings yet

- Profile State Bank of MysoreDocument5 pagesProfile State Bank of MysoreNagnath B HalgondeNo ratings yet

- Upendra Ananth Pai T. M. A. Pai Vaman Srinivas Kudva Government of India Manipal Canara BankDocument5 pagesUpendra Ananth Pai T. M. A. Pai Vaman Srinivas Kudva Government of India Manipal Canara BankrahulNo ratings yet

- Ramya Canara Bank Project Final ReportDocument106 pagesRamya Canara Bank Project Final ReportShiva Kumar Mahadevappa79% (14)

- Co OperativeDocument220 pagesCo OperativeMeenukutty MeenuNo ratings yet

- Introduction of Banking System in IndiaDocument41 pagesIntroduction of Banking System in IndiaAnushree AnuNo ratings yet

- SBI SHRM Project - MihirDocument26 pagesSBI SHRM Project - MihirAmul KapoorNo ratings yet

- Chapter 1 Profile of Sbi and Its Customer SatisfactionDocument13 pagesChapter 1 Profile of Sbi and Its Customer SatisfactionNirav PatelNo ratings yet

- Cooperative Banking Is Retail and Commercial BankingDocument8 pagesCooperative Banking Is Retail and Commercial Bankingbabu kumavatNo ratings yet

- Canara Bank - Vishal NihalaniDocument15 pagesCanara Bank - Vishal NihalanivishnihalaniNo ratings yet

- Shivam STPDocument80 pagesShivam STPshraddha chauhanNo ratings yet

- Types of Loan Offered by SBIDocument88 pagesTypes of Loan Offered by SBIShilpa Nikam67% (3)

- SBM Final-Ok1Document69 pagesSBM Final-Ok1Subramanya DgNo ratings yet

- Banking & Financial Services-Unit 1 PDFDocument49 pagesBanking & Financial Services-Unit 1 PDFImran KhanNo ratings yet

- The Growth of Merchant Banking in IndiaDocument7 pagesThe Growth of Merchant Banking in IndiamgajenNo ratings yet

- Indian Banking System (UNIT-1)Document27 pagesIndian Banking System (UNIT-1)ranakritika1820No ratings yet

- Contemporary Issue Report ON: "A Critical Case Study of Icici Bank Before and After Merger of Bank of RajasthanDocument68 pagesContemporary Issue Report ON: "A Critical Case Study of Icici Bank Before and After Merger of Bank of RajasthanParesh DuaNo ratings yet

- A Research Project On Credit Risk and Liquidity RiskDocument86 pagesA Research Project On Credit Risk and Liquidity RiskEkam JotNo ratings yet

- History of Indian Banking IndustryDocument10 pagesHistory of Indian Banking IndustryDrasti DesaiNo ratings yet

- Banking IndustryDocument26 pagesBanking IndustrySaahil BcNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- Mc070200390 Presentation Askari Bank Ltd.Document45 pagesMc070200390 Presentation Askari Bank Ltd.Imran Mehmood100% (1)

- 2 - Project Structure and Financing Sources For Wind FarmsDocument28 pages2 - Project Structure and Financing Sources For Wind Farmsviethoa_uehNo ratings yet

- Accounts Receivable System For TPITDocument6 pagesAccounts Receivable System For TPITFokso FutekoNo ratings yet

- Cae05-Chapter 3 Notes Receivable and PayableDocument8 pagesCae05-Chapter 3 Notes Receivable and PayableSteffany RoqueNo ratings yet

- Provident FormDocument2 pagesProvident FormRyahNeil Bohol MoralesNo ratings yet

- State Bank of India ProjectDocument64 pagesState Bank of India ProjectEsha JaiswalNo ratings yet

- Our Educational Institutions Controlled by IlluminatiDocument4 pagesOur Educational Institutions Controlled by IlluminatiArnulfo Yu LanibaNo ratings yet

- Negotiable Debt InstrumentsDocument7 pagesNegotiable Debt InstrumentsVickens Moscova El100% (2)

- Financial Institution and Market Chapter 6Document23 pagesFinancial Institution and Market Chapter 6Jonathan 24No ratings yet

- Literature Review On Debt Recovery TechniquesDocument7 pagesLiterature Review On Debt Recovery Techniquesc5pgcqzv100% (1)

- Borutski Divorce PapersDocument16 pagesBorutski Divorce PapersTheCanadianPressNo ratings yet

- Current Liab Trade and Other PayablesDocument6 pagesCurrent Liab Trade and Other PayablesRamainne Chalsea RonquilloNo ratings yet

- A Study On Portfolio Management of Individual Investors in MumbaiDocument77 pagesA Study On Portfolio Management of Individual Investors in MumbaiTechno GuysNo ratings yet

- SEED INUDSTRY SWOT AnalysisDocument107 pagesSEED INUDSTRY SWOT AnalysisABIN JOHNNo ratings yet

- Resizing Provisions PDFDocument4 pagesResizing Provisions PDFadonisghlNo ratings yet

- Project Report Mandap DecorationDocument17 pagesProject Report Mandap Decorationkushal chopda100% (1)

- Senate Finds Massive Fraud Washington Mutual Special Delivery For Wamu VictimsDocument666 pagesSenate Finds Massive Fraud Washington Mutual Special Delivery For Wamu Victimsthomasfamily98_68860No ratings yet

- Capital Structure Analysis of "Bajaj Auto LTD Thesis001Document55 pagesCapital Structure Analysis of "Bajaj Auto LTD Thesis001Arjun SinghNo ratings yet

- Corporate GuaranteeDocument3 pagesCorporate GuaranteeJigo DacuaNo ratings yet

- Problem 7-1 (Cash Priority Program)Document7 pagesProblem 7-1 (Cash Priority Program)AmethystNo ratings yet

- Audit Final To PrintDocument6 pagesAudit Final To PrintKHathy AsoiralNo ratings yet

- Actionable ClaimDocument8 pagesActionable ClaimAdv NesamudheenNo ratings yet

- FIN 3331 Managerial Finance: Time Value of MoneyDocument23 pagesFIN 3331 Managerial Finance: Time Value of MoneyHa NguyenNo ratings yet

- Article 9519Document10 pagesArticle 9519sheena -No ratings yet

- Case Law Listings PDFDocument287 pagesCase Law Listings PDFLopez SupremioNo ratings yet