Professional Documents

Culture Documents

Cis Sship

Cis Sship

Uploaded by

dhinesh subramaniamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cis Sship

Cis Sship

Uploaded by

dhinesh subramaniamCopyright:

Available Formats

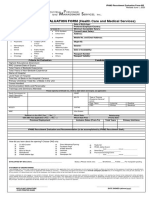

United India Insurance Company Limited

Corporate Identity Number: U93090TN1938GOI000108

Registered Office: 24 Whites Road, Chennai – 600014

IRDAI REG NO.545

SAMAVESHI SURAKSHA HEALTH INSURANCE POLICY

CUSTOMER INFORMATION SHEET (CIS)

Guide to the CIS

This document provides key information about your Samaveshi Suraksha Health Insurance Policy. You are also advised to go through your

policy document.

(Description is illustrative and not exhaustive )

POLICY

S.

TITLE DESCRIPTION CLAUSE

No.

NUMBER

Name of

1 Insurance Samaveshi Suraksha Health Insurance Policy -

Policy

Policy {}

2 -

Number

Type of

3 Insurance Indemnity Based & Benefit Based -

Policy

Sum

Insured Individual Sum Insured Basis

Basis

4 -

Sum

{}

Insured

Base Covers

1. In-patient Hospitalisation Expenses - Expenses of

III.A.1

Hospitalisation for a minimum period of 24 consecutive hours

only shall be admissible. However, the time limit shall not apply

Policy in respect of Day Care Treatment

Coverage 2. All Day Care Procedures III.A.1.

1.c

5 (What 3. Pre and Post–Hospitalisation Expenses - Covers expenses

the Policy III.A.2

incurred in the 30 days prior to hospitalisation and in the 60

Covers?)

days post hospitalisation.

4. Emergency Road Ambulance Cover - Covers expenses

incurred on transportation of the Insured Person by Road III.A.4

Ambulance to a Hospital for treatment in an Emergency upto

Rs. 2,000/hospitalisation

1|P a g e

Samaveshi Suraksha Health Insurance Policy – Customer Information Sheet

UIN: UIIHLIP23214V012223

United India Insurance Company Limited

Corporate Identity Number: U93090TN1938GOI000108

Registered Office: 24 Whites Road, Chennai – 600014

IRDAI REG NO.545

5. Modern Treatment Methods & Advancement in Technology III.A.3

- Covers expenses for advanced medical procedures such as

Robotic Surgeries, Oral Chemotherapy, Deep Brain Stimulation

Bronchial Thermoplasty, Stereotactic Radio Surgeries, etc

6. Lump Sum Benefit for persons with HIV/AIDS - 100% of

III.A.5

Sum insured or the balance sum insured available under the

policy, whichever is lower, as lump sum amount to the insured,

in case the CD4 count of the patient goes below 150 during the

policy period.

Optional Cover III.B.1

Waiver of Co-Payment

The following is a partial list. Please refer to Policy Wordings

for the complete list of exclusions.

1. Admission primarily for investigation & evaluation (Code – IV.B.1

Excl04)

Exclusion 2. Admission primarily for rest cure, rehabilitation, and respite IV.B.2

s care (Code – Excl05)

6 (What the 3. Expenses related to the surgical treatment of obesity that do

hospital IV.B.3

doesn’t not fulfil certain conditions (Code – Excl06)

cover)

4. Change-of-Gender treatments (Code – Code07) IV.B.4

5. Expenses for cosmetic or plastic surgery (Code – Excl08) IV.B.5

6. Expenses related to any treatment necessitated due to IV.B.6

participation in hazardous or adventure sports (Code – Excl09)

1. Pre-Existing diseases will be covered after a waiting period of IV.A.1

forty-eight (48) months of continuous coverage

2. Expenses related to the treatment of any illness within 30 days IV.A.3

Waiting from the first policy commencement date shall be excluded

7

Period

except claims arising due to an accident.

3. Specified surgeries/treatments/diseases are covered after IV.A.

specific waiting period 24 months Table A

2|P a g e

Samaveshi Suraksha Health Insurance Policy – Customer Information Sheet

UIN: UIIHLIP23214V012223

United India Insurance Company Limited

Corporate Identity Number: U93090TN1938GOI000108

Registered Office: 24 Whites Road, Chennai – 600014

IRDAI REG NO.545

4. Specified surgeries/treatments/diseases are covered after IV.A.

Table B

specific waiting period 48 months

Financial The policy will pay only u to the limits specified

8 Limits of hereunder for the following diseases/procedures:

Coverage

i. Room Rent, Boarding, nursing expenses all -

inclusive as provided by the Hospital/Nursing

Sub-Limits Home up to 1% of the sum insured subject to

maximum of Rs. 5000/ - per day. III.A.1

ii. Intensive Care Unit (ICU) charges/Intensive

Cardiac Care Unit (ICCU) charges all -inclusive as

provided by the Hospital/Nursing Home up to 2%

of the sum insured subject to a maximum of Rs.

10,000/- per day.

iii. Cataract Surgery – 10% of Sum Insured (Max.

40,000/- per eye) III.A.1.

2.a

Co-pay

Every admissible claim under the policy (except claims

for Emergency Road Ambulance and Lump Sum Benefit V.B.2

for HIV) shall be subject to a Co -payment of 20% on

the admissible claim amount and conditions of the

Policy.

Deductible NA

Any Other

Limit NA

Turn Around Time (TAT) for claims settlement:

i. TAT for Pre-Auth of cashless facility - 2 hours

ii. TAT for cashless final bill authorization - 3 hours

Network Hospitals details

Claims V.B.12

9 https://uiic.co.in/en/tpa -ppn-network-hospitals

Procedure

Helpline number

https://uiic.co.in/en/tpa -ppn-network-hospitals

Excluded Providers:

https://uiic.co.in/sites/default/files/Excluded_Providers_List.pdf

Claim form: https://uiic.co.in/en/claims/claim -forms

Policy Please contact your Policy issuing office, details of which are

10 -

Servicing mentioned in your Policy Schedule.

3|P a g e

Samaveshi Suraksha Health Insurance Policy – Customer Information Sheet

UIN: UIIHLIP23214V012223

United India Insurance Company Limited

Corporate Identity Number: U93090TN1938GOI000108

Registered Office: 24 Whites Road, Chennai – 600014

IRDAI REG NO.545

In case of any grievance, you may contact UIIC through:

a. Website: www.uiic.co.in

b. Toll Free Number: 1800 425 333 33

11 Grievance/ c. E-Mail: customercare@uiic.co.in

Complaint You may also approach the grievance cell at any of our branches

with details of the grievance.

V.A.14

Alternatively, you may lodge a complaint at the IRDAI Integrated

Grievance Management System (https://igms.irda.gov.in/) OR

approach the Office of the Insurance Ombudsman in your

respective Area/Region. Details of Insurance Ombudsman offices

have been provided as Annexure – 3 in the Policy Wordings.

Free Look cancellation:

You are allowed a period of 15 days from date of receipt of the

policy document to review its terms and conditions and to return

12 Things to V.A.7

remember the policy if not acceptable to you. This is not applicable on

renewals.

If the Insured has not made any claim during the free look period,

the Insured shall be entitled to:

i. A refund of the premium paid less any expenses incurred

by the Company on medical examination of the insured

persons and the stamp duty charges or

ii. Where the risk has already commenced and the option of

return of the policy is exercised by the insured person, a

deduction towards the proportionate risk premium for period

of cover or

iii. Where only a part of the insurance coverage has

commenced, such proportionate premium commensurate

with the risk covered during such period

Policy renewal:

Except on grounds of fraud, moral hazard or V.A.15

misrepresentation or non -cooperation, renewal of your

policy shall not be denied, provided the policy is not

withdrawn.

4|P a g e

Samaveshi Suraksha Health Insurance Policy – Customer Information Sheet

UIN: UIIHLIP23214V012223

United India Insurance Company Limited

Corporate Identity Number: U93090TN1938GOI000108

Registered Office: 24 Whites Road, Chennai – 600014

IRDAI REG NO.545

Migration V.A.8

Insured Person has the option to migrate the policy to other health

insurance products/plans offered by UIIC by applying at least 30

days before the policy renewal date.

Portability V.A.12

Insured Person has the option to port the entire policy to an

individual health insurance product offered by another Insurer by

applying at least 45 days before policy renewal date. Portability is

subject to underwriting.

Change of Sum Insured: V.B.1

Sum Insured can be changed (increased/decreased) only at the

time of renewal or at any times subject to underwriting by the

Company. For increase

in S.I, the waiting period if any shall start afresh only for the

enhanced portion of the sum insured.

Moratorium Period:

After completion of eight continuous years under the policy no look

back to be applied. This period of eight years is called as

moratorium period. The moratorium would be applicable for the V.A.9

sum insured of the first policy and subsequently completion of eight

continuous years would be applicable from date of enhancement

of sum insured only on the enhancement limits.

After the expiry of Moratorium Period no health insurance policy

shall be contestable except for proven fraud and permanent

exclusions specified in the policy contract.

13

1. Disclosure of Information: Policyholder is required to disclose V.A.5

all material information such as, but not limited to, pre-existing

diseases/conditions, medical history, etc. as sought in the

Y our Proposal form and other connected documents.

O b l ig at i o ns

Non-disclosure, misrepresentation or misdescription of such

information may result in claim not being paid and shall make

the policy void and all premium paid thereon shall be forfeited

to UIIC.

5|P a g e

Samaveshi Suraksha Health Insurance Policy – Customer Information Sheet

UIN: UIIHLIP23214V012223

United India Insurance Company Limited

Corporate Identity Number: U93090TN1938GOI000108

Registered Office: 24 Whites Road, Chennai – 600014

IRDAI REG NO.545

Nomination: Policyholder is required at the inception of the policy

to make a nomination for the purpose of payment of claims under V.A.11

the policy in the event of death of the Policyholder.

Declaration by the Policy Holder

I have read the above and confirm having noted the details.

Place:

Date: Signature of Policy Holder

Legal Disclaimer Note: The information must be read in conjunction with the policy document. In case of any conflict between

the CIS and the policy document, the terms and conditions mentioned in the policy shall prevail.

6|P a g e

Samaveshi Suraksha Health Insurance Policy – Customer Information Sheet

UIN: UIIHLIP23214V012223

You might also like

- Books and LinksDocument3 pagesBooks and LinksLuís RochaNo ratings yet

- Cis YhipDocument7 pagesCis Yhipdhinesh subramaniamNo ratings yet

- CIS YuvaanDocument7 pagesCIS Yuvaandhinesh subramaniamNo ratings yet

- Cis IhipDocument7 pagesCis Ihipdhinesh subramaniamNo ratings yet

- Cis IhipDocument5 pagesCis Ihipdhinesh subramaniamNo ratings yet

- Cis FMPDocument7 pagesCis FMPdhinesh subramaniamNo ratings yet

- Cis StumpDocument8 pagesCis Stumpdhinesh subramaniamNo ratings yet

- Individual Health Insurance Policy CISDocument3 pagesIndividual Health Insurance Policy CISGIJONo ratings yet

- Super Top-Up Medicare Policy: United India Insurance Company LimitedDocument5 pagesSuper Top-Up Medicare Policy: United India Insurance Company LimitedGIJONo ratings yet

- Smart Super Health Assure - Customer Information SheetDocument12 pagesSmart Super Health Assure - Customer Information SheetNiket RaikangorNo ratings yet

- Base Covers: Coverages in Force For The Insured Persons Shall BeDocument13 pagesBase Covers: Coverages in Force For The Insured Persons Shall Beroydonn1983No ratings yet

- Easy Health: Customer Information Sheet - Standard PlanDocument19 pagesEasy Health: Customer Information Sheet - Standard PlanAvi MaherishiNo ratings yet

- Cis DocumentDocument21 pagesCis Documentyoga.crossfit.kickboxingNo ratings yet

- Care Advantage Policy Usage GuideDocument4 pagesCare Advantage Policy Usage Guidew4fcpmhtqdNo ratings yet

- Cis DocumentDocument23 pagesCis Documentatadu1No ratings yet

- Easy-Health Policy-Wording Standard PDFDocument21 pagesEasy-Health Policy-Wording Standard PDFdeepak_singla227No ratings yet

- Arogya Sanjeevani Policy CIS - 2Document3 pagesArogya Sanjeevani Policy CIS - 2PrasanthNo ratings yet

- Health Wallet Combined PW Cis HegiDocument32 pagesHealth Wallet Combined PW Cis Hegihiteshmohakar15No ratings yet

- SBI General Insurance Company Limited: (Description Is Illustrative and Not Exhaustive)Document45 pagesSBI General Insurance Company Limited: (Description Is Illustrative and Not Exhaustive)adnaanrashid7No ratings yet

- Senior Citizen Policy WordingsDocument6 pagesSenior Citizen Policy WordingsBINAY KUMAR YADAVNo ratings yet

- Title Description: UIN: RHLHLIP19097V011819Document45 pagesTitle Description: UIN: RHLHLIP19097V011819Touch MidasNo ratings yet

- Customer Information Sheet: Title Description Refer To Policy Clause Number Product Name Tata Aig Medicare Plus Top-UpDocument4 pagesCustomer Information Sheet: Title Description Refer To Policy Clause Number Product Name Tata Aig Medicare Plus Top-UpSankyBoy06No ratings yet

- Combined-Pw or c2phDocument16 pagesCombined-Pw or c2phalokkhuntia82No ratings yet

- The Health Insurance SpecialistDocument8 pagesThe Health Insurance SpecialistsaranyaNo ratings yet

- Notes and ImportantDocument19 pagesNotes and ImportantRajat BansalNo ratings yet

- TATA AIG Medicare Premier Customer Information Sheet 2e2c10e8d0Document17 pagesTATA AIG Medicare Premier Customer Information Sheet 2e2c10e8d0harshitha0196No ratings yet

- PolicyUsageGuide UPTO 40 LAKHS PDFDocument3 pagesPolicyUsageGuide UPTO 40 LAKHS PDFpizza nmorevikNo ratings yet

- Arogya Sanjeevani A5 Size PW HehiDocument26 pagesArogya Sanjeevani A5 Size PW Hehihiteshmohakar15No ratings yet

- Apollo Munich InsuranceDocument16 pagesApollo Munich InsuranceapalNo ratings yet

- Tata AIG Medi Care Plus E8a0cf5358Document16 pagesTata AIG Medi Care Plus E8a0cf5358Sameer DesaiNo ratings yet

- Customer Information Sheet: Ican EssentialDocument22 pagesCustomer Information Sheet: Ican EssentialDkkkkNo ratings yet

- Equicover Health Cis PWDocument27 pagesEquicover Health Cis PWLogeshParthasarathyNo ratings yet

- Customer Information Sheet: UIN: IRDA/NL-HLT/AMHI/P-H/V.II/1/14-15Document19 pagesCustomer Information Sheet: UIN: IRDA/NL-HLT/AMHI/P-H/V.II/1/14-15vinitNo ratings yet

- The Oriental Insurance Company LimitedDocument33 pagesThe Oriental Insurance Company LimitedSharma AmanNo ratings yet

- Axis Policy WordingsDocument18 pagesAxis Policy WordingsSatyanarayana NandulaNo ratings yet

- Optima-Restore PW PDFDocument16 pagesOptima-Restore PW PDFJava CoderNo ratings yet

- Policy Arogya Sanjeevani Policy V 1 Final 0204 WebDocument10 pagesPolicy Arogya Sanjeevani Policy V 1 Final 0204 WebHiiNo ratings yet

- Customer Information Sheet: HDFC ERGO General Insurance Company LimitedDocument29 pagesCustomer Information Sheet: HDFC ERGO General Insurance Company LimitedvigneshNo ratings yet

- Benefits Manual FC Tier 1Document46 pagesBenefits Manual FC Tier 1Devesh BharathanNo ratings yet

- SHealth Shield 360 Retail - Policy Schedule & Policy Wordings - AMEX - Copy - PdfsDocument41 pagesSHealth Shield 360 Retail - Policy Schedule & Policy Wordings - AMEX - Copy - PdfsMonish JayasuriyanNo ratings yet

- NICHLIP21113 V032021 IDocument16 pagesNICHLIP21113 V032021 ISURYA SNo ratings yet

- Super Surplus Insurance PolicyDocument10 pagesSuper Surplus Insurance PolicyJTO PATHIRAPPALLYNo ratings yet

- Star Cardiac Care Insurance PolicyDocument12 pagesStar Cardiac Care Insurance Policyakashpalkar54No ratings yet

- Tata Aig Medicare Premier: Policy WordingsDocument16 pagesTata Aig Medicare Premier: Policy WordingsSiddhartha PorwalNo ratings yet

- Navi Policy SummaryDocument47 pagesNavi Policy SummarysandeepfoxNo ratings yet

- Customer Information Sheet NEW INDIA ASHA KIRAN POLICY 18.12Document15 pagesCustomer Information Sheet NEW INDIA ASHA KIRAN POLICY 18.12bipinchauhan87No ratings yet

- IRDAI - Optional Items Excluded - July 2016Document92 pagesIRDAI - Optional Items Excluded - July 2016Jerome GelfandNo ratings yet

- The Health Insurance SpecialistDocument8 pagesThe Health Insurance SpecialistYogesh KhemaniNo ratings yet

- Myoptima Secure - Cis PWWDocument29 pagesMyoptima Secure - Cis PWWMythili BalakrishnanNo ratings yet

- Insurance Research.Document19 pagesInsurance Research.Partha BatabyalNo ratings yet

- Health Insurance HandbookDocument10 pagesHealth Insurance HandbookDipsonNo ratings yet

- Individual Health Insurance Policy ProspectusDocument16 pagesIndividual Health Insurance Policy ProspectusPrasanthNo ratings yet

- Tata Aig MedicareDocument16 pagesTata Aig MedicareRahul DarakNo ratings yet

- CIS-Arogya Sanjeevani - ITGIDocument2 pagesCIS-Arogya Sanjeevani - ITGIvikrantNo ratings yet

- RELHLIP21521V032021Document29 pagesRELHLIP21521V032021Shubrojyoti ChowdhuryNo ratings yet

- HDFC ERGO General Insurance Company Limited: Customer Information Sheet Optima Restore PolicyDocument28 pagesHDFC ERGO General Insurance Company Limited: Customer Information Sheet Optima Restore PolicyShivendra ChandNo ratings yet

- Myhealth Suraksha Hospital Cash Add On PWDocument24 pagesMyhealth Suraksha Hospital Cash Add On PWvigneshNo ratings yet

- (Description Is Illustrative and Not Exhaustive) : Customer Information SheetDocument29 pages(Description Is Illustrative and Not Exhaustive) : Customer Information SheetUtkarsh ShahNo ratings yet

- Lifeline 2.0 Policy WordingDocument33 pagesLifeline 2.0 Policy WordingVijay Singh RathourNo ratings yet

- All India CPIO and FAA LIST - FinalDocument5 pagesAll India CPIO and FAA LIST - Finaldhinesh subramaniamNo ratings yet

- Section 4 (1) (B) (I) - The Particulars of Its Organization, Functions and DutiesDocument3 pagesSection 4 (1) (B) (I) - The Particulars of Its Organization, Functions and Dutiesdhinesh subramaniamNo ratings yet

- M1Document1 pageM1dhinesh subramaniamNo ratings yet

- MDocument2 pagesMdhinesh subramaniamNo ratings yet

- MP 3Document2 pagesMP 3dhinesh subramaniamNo ratings yet

- Lung ConditionsDocument5 pagesLung ConditionsRaunakNo ratings yet

- DR Narendra Kumar PRDocument2 pagesDR Narendra Kumar PRSini RaizadaNo ratings yet

- Cosmetic Surgery An Interdisciplinary ApproachDocument1,004 pagesCosmetic Surgery An Interdisciplinary ApproachDaniel FilizzolaNo ratings yet

- IPAMS Healthcare and Medical Services Evaluation FormDocument2 pagesIPAMS Healthcare and Medical Services Evaluation FormManases VelasquezNo ratings yet

- PIN1290 Stellate Ganglion BlockDocument3 pagesPIN1290 Stellate Ganglion BlockBob AdleNo ratings yet

- Classification of Deep EndometriosisDocument11 pagesClassification of Deep EndometriosisAgung SentosaNo ratings yet

- Daftar Buku Perpustakaan: Tanggal Judul Buku Pengarang Kode Buku Keterangan (Edisi, Tahun, Penerbit)Document21 pagesDaftar Buku Perpustakaan: Tanggal Judul Buku Pengarang Kode Buku Keterangan (Edisi, Tahun, Penerbit)SuyotoAhmadNo ratings yet

- A Simplified Scoring System For The Post-Operative Recovery RoomDocument4 pagesA Simplified Scoring System For The Post-Operative Recovery RoomlemootpNo ratings yet

- Chest Wall Reconstruction in Poland SyndromeDocument5 pagesChest Wall Reconstruction in Poland Syndromeahmed bouzouidaNo ratings yet

- E000675 FullDocument37 pagesE000675 Fullmartina silalahiNo ratings yet

- Intrathecal FluoresceinDocument7 pagesIntrathecal FluoresceinArvin AhujaNo ratings yet

- Internship Logbook For Applied Computer ScienceDocument30 pagesInternship Logbook For Applied Computer ScienceJESEE GITAUNo ratings yet

- It Is All About Peri-Implant Tissue HealthDocument4 pagesIt Is All About Peri-Implant Tissue Healthkaue francoNo ratings yet

- Thesis Topics in Maxillofacial SurgeryDocument8 pagesThesis Topics in Maxillofacial Surgerysarahgriegoalbuquerque100% (3)

- Certificate For Person With Disability: Government of Andhra PradeshDocument1 pageCertificate For Person With Disability: Government of Andhra PradeshkalavaguntasachivalayamNo ratings yet

- Open Book FractureDocument7 pagesOpen Book FractureFebrian Parlangga MuisNo ratings yet

- Intramedullary Nail Extraction Surgical TechniqueDocument16 pagesIntramedullary Nail Extraction Surgical TechniqueJimson FulgarNo ratings yet

- STS Skin GraftingDocument5 pagesSTS Skin GraftingSmithjohanNo ratings yet

- Treatment Process For Esm Through Echs: Reqd)Document1 pageTreatment Process For Esm Through Echs: Reqd)Sasi KumarNo ratings yet

- 2 Air Way SuctionDocument41 pages2 Air Way SuctionAhmad KayanNo ratings yet

- Periodontal Considerations in Restorative and Implant TherapyDocument10 pagesPeriodontal Considerations in Restorative and Implant TherapyAntonny VasquezNo ratings yet

- Tracheo-Oesophageal FistulaDocument23 pagesTracheo-Oesophageal FistulaAhmad KhanNo ratings yet

- Triumph of Surgery-NotesDocument2 pagesTriumph of Surgery-NotesAntonitaNo ratings yet

- FCMFOS (SA) Final Past Papers - 2018 1st Semester 19-4-2018Document2 pagesFCMFOS (SA) Final Past Papers - 2018 1st Semester 19-4-2018Isak Isak IsakNo ratings yet

- Normal Anatomy of AnorectumDocument7 pagesNormal Anatomy of AnorectumGillarhymesNo ratings yet

- MC-55-097-001 r2 DRE ASG 300 UG-EDocument60 pagesMC-55-097-001 r2 DRE ASG 300 UG-EGSD Qualimed SJDMNo ratings yet

- Surgical Management of Significant Maxillary Anterior Vertical Ridge Defects - Urban2016Document10 pagesSurgical Management of Significant Maxillary Anterior Vertical Ridge Defects - Urban2016Claudio GuzmanNo ratings yet

- 212 - Holy Cross Hospital - DRGDocument3 pages212 - Holy Cross Hospital - DRGswarnaNo ratings yet

- Pinnaplasty: A Step by Step Guide: December 2012Document7 pagesPinnaplasty: A Step by Step Guide: December 2012Cristina MihetiuNo ratings yet