Professional Documents

Culture Documents

Risk Management

Risk Management

Uploaded by

aadarshshaw2345671890Copyright:

Available Formats

You might also like

- E Filing Project PDF To Word Format3Document17 pagesE Filing Project PDF To Word Format3shawpiyush328No ratings yet

- Problems and Prospects of E-Filing of Income Tax Returns: Naveen Kumar C, Dileep Kumar S DDocument10 pagesProblems and Prospects of E-Filing of Income Tax Returns: Naveen Kumar C, Dileep Kumar S DPriya mishraNo ratings yet

- Chapter - 10Document21 pagesChapter - 10Hritika GuptaNo ratings yet

- Sip ReportDocument40 pagesSip Reportavinashkumar.mba22No ratings yet

- Salman Beg Project Report On TaxDocument81 pagesSalman Beg Project Report On TaxAnonymous OqKK1jQi3No ratings yet

- Student Declaration: Mahnoor KHALID Registration No. 20-ARID-55, Hereby Declare That by Attempting TheDocument9 pagesStudent Declaration: Mahnoor KHALID Registration No. 20-ARID-55, Hereby Declare That by Attempting TheAjmal AftabNo ratings yet

- Dfm-Mbra Tax Efris Coursework Group OneDocument7 pagesDfm-Mbra Tax Efris Coursework Group OnemitchmubsNo ratings yet

- Internship Report On E-1Document113 pagesInternship Report On E-1YOGESH KUMARNo ratings yet

- Efilling ProjectDocument22 pagesEfilling ProjectTaiyab SiddiqueNo ratings yet

- DIGITAL SIGNATURE CERTIFICATE, E-Mudhra India, Digital Signature Emudhra DSC Kolkata India, MCA21 Digital Signature Certificate, Emudhra DSC LRA Kolkata, E-MudhraDocument5 pagesDIGITAL SIGNATURE CERTIFICATE, E-Mudhra India, Digital Signature Emudhra DSC Kolkata India, MCA21 Digital Signature Certificate, Emudhra DSC LRA Kolkata, E-Mudhraasmit569No ratings yet

- Step-By-step Guide To File Your Income Tax Return Online - Economic TimesDocument3 pagesStep-By-step Guide To File Your Income Tax Return Online - Economic TimesBiswa Prakash NayakNo ratings yet

- E-Filingofincome Taxreturns in India - Anoverview Suman GhoshDocument10 pagesE-Filingofincome Taxreturns in India - Anoverview Suman GhoshSuman GhoshNo ratings yet

- System InitiativesDocument10 pagesSystem InitiativesMj VarmaNo ratings yet

- Central Recruitment & Promotion Department, Corporate Centre, MumbaiDocument2 pagesCentral Recruitment & Promotion Department, Corporate Centre, MumbaiAnoop TyagiNo ratings yet

- How Toe FileDocument4 pagesHow Toe Fileirfanahmed.dba@gmail.comNo ratings yet

- Final Report RohiniDocument31 pagesFinal Report RohiniSagar BitlaNo ratings yet

- Mansi Mca21 Project ReportDocument13 pagesMansi Mca21 Project ReportrajibmukherjeekNo ratings yet

- TDS Defaults & Procedures Under Traces For Online Correction by Taxguru Consultancy & Online Publication LLPDocument98 pagesTDS Defaults & Procedures Under Traces For Online Correction by Taxguru Consultancy & Online Publication LLPAvantika SharmaNo ratings yet

- Synopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Document14 pagesSynopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Akhil SinghNo ratings yet

- The BLC ICB Financial Accounting ProgrammeDocument2 pagesThe BLC ICB Financial Accounting ProgrammeThe BLCollegeNo ratings yet

- Synopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Document13 pagesSynopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Akhil SinghNo ratings yet

- Income TaxDocument48 pagesIncome Tax044Lohar Veena GUNI VMPIMNo ratings yet

- Siaya Institute of TechnologyDocument10 pagesSiaya Institute of Technologywashingtone otieno oiroNo ratings yet

- "Effectiveness of Revenue Assurance and Fraud ManagementDocument69 pages"Effectiveness of Revenue Assurance and Fraud ManagementRashed Hossain Sonnet100% (1)

- Naas ProposalDocument6 pagesNaas ProposalzeusNo ratings yet

- Documentation of Insurance Compny Management SystemsDocument131 pagesDocumentation of Insurance Compny Management SystemsNand Kishore DubeyNo ratings yet

- A Study of E-Filling of Income Tax Return in IndiaDocument5 pagesA Study of E-Filling of Income Tax Return in IndiaVijay ChalwadiNo ratings yet

- Kaiynat 3rd Semester Project-1Document54 pagesKaiynat 3rd Semester Project-1amanrizvi3125No ratings yet

- E-Filing of Income Tax and GST-1Document67 pagesE-Filing of Income Tax and GST-1omkarshinde.7743No ratings yet

- Mba GST Project Report PDFDocument178 pagesMba GST Project Report PDFBhavesh KaleNo ratings yet

- Amit Internship ProjectDocument45 pagesAmit Internship Projectamitratha77No ratings yet

- Tooba DocumentDocument97 pagesTooba Documentjitendra kumarNo ratings yet

- ITR and E-Filing Project - CUDocument46 pagesITR and E-Filing Project - CUShaswata MalakarNo ratings yet

- IX2KHUgkuYQ6fFRs 0Document8 pagesIX2KHUgkuYQ6fFRs 0prebennaidoo15No ratings yet

- Nsic HRDocument2 pagesNsic HRSainaath RNo ratings yet

- Faceless Assessment GNDocument51 pagesFaceless Assessment GNP Mathavan RajkumarNo ratings yet

- Documentation of Tax Deduction at SourceDocument147 pagesDocumentation of Tax Deduction at SourceNand Kishore DubeyNo ratings yet

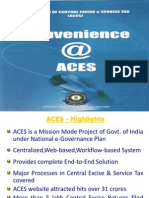

- Power Point Presentation On ACES For AssessesDocument45 pagesPower Point Presentation On ACES For Assessesharishnttf8346No ratings yet

- WiproDrive BCA BSC 2019Document3 pagesWiproDrive BCA BSC 2019MNNo ratings yet

- Sibani Internship ProjectDocument41 pagesSibani Internship Projectamitratha77No ratings yet

- Corporate Law 6th SemDocument12 pagesCorporate Law 6th SemJyoti GautamNo ratings yet

- FAQs On E-Filing of TARDocument6 pagesFAQs On E-Filing of TARhit2011No ratings yet

- NPS Guidbook PRAODocument48 pagesNPS Guidbook PRAONaga Sasi IlluriNo ratings yet

- Caef Aditya SonkarDocument41 pagesCaef Aditya Sonkarmessisingh1706No ratings yet

- Project Management Jan 2017Document4 pagesProject Management Jan 2017gannesh_05No ratings yet

- E FilingofvariousauditreportsunderIncomeTaxDocument47 pagesE FilingofvariousauditreportsunderIncomeTaxSajeevanKrishnanNo ratings yet

- BIR Ease of Doing BusinessDocument25 pagesBIR Ease of Doing BusinessCess MelendezNo ratings yet

- Income Tax and Tds Practiotioner CourseDocument8 pagesIncome Tax and Tds Practiotioner CourseSujata GugaleNo ratings yet

- 19 Kartik D KarkeraDocument73 pages19 Kartik D KarkeraAnkush SuryawanshiNo ratings yet

- Inviting Applications For Executive Assistant On Contractual BasisDocument1 pageInviting Applications For Executive Assistant On Contractual BasisRajesh PuniaNo ratings yet

- Unity University: Course: OOSAD, Project Report Title: Tax Management SystemDocument10 pagesUnity University: Course: OOSAD, Project Report Title: Tax Management SystemTsegazeab ZinabuNo ratings yet

- Data Management ServicesDocument21 pagesData Management ServicesKamal Kishor SankhlaNo ratings yet

- Registration Guidelines For TCS iON Remote InternshipsDocument6 pagesRegistration Guidelines For TCS iON Remote Internshipsatlantajohnson69No ratings yet

- E Filing ChapterDocument62 pagesE Filing Chapterhesheheshe123No ratings yet

- SWAPNIL PROJECT MBA Final Xerox 2121Document60 pagesSWAPNIL PROJECT MBA Final Xerox 2121sadhana karapeNo ratings yet

- E-Filing of Taxes - A Research PaperDocument8 pagesE-Filing of Taxes - A Research PaperRieke Savitri Agustin0% (1)

- 2024.4.6 - lhdnm_general-faqs_6apr2024Document10 pages2024.4.6 - lhdnm_general-faqs_6apr2024tiny cocomelonsNo ratings yet

- National Institute of Electronics and Information Technology, CalicutDocument9 pagesNational Institute of Electronics and Information Technology, CalicuthashimaNo ratings yet

- EIMS ERP Lite Proposal 5 Sq4xDocument6 pagesEIMS ERP Lite Proposal 5 Sq4xsameer.eccuratechNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- ARVINDDocument1 pageARVINDSourabh YadavNo ratings yet

- Ack Afcpy3063l 2021-22 163749600170721Document1 pageAck Afcpy3063l 2021-22 163749600170721Rakesh SinghNo ratings yet

- Itr Pankaj 2022-23Document1 pageItr Pankaj 2022-23gafoh81124No ratings yet

- Sehwag Internship ReportDocument30 pagesSehwag Internship ReportSEHWAG MATHAVANNo ratings yet

- Itr 2023 2024Document1 pageItr 2023 2024Deepak ThangamaniNo ratings yet

- PDFDocument7 pagesPDFprateekNo ratings yet

- Itr FormDocument10 pagesItr Formkunal kumarNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- Rohit ProjectDocument82 pagesRohit Projectsourav kumar dasNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- Form Itr Acknowledgement Ay 2023 24Document2 pagesForm Itr Acknowledgement Ay 2023 24Sakshi KaleNo ratings yet

- Acknowledgement AY 22-23Document1 pageAcknowledgement AY 22-23Nirav RavalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- Computerized Accounting ProjectDocument21 pagesComputerized Accounting ProjectEliza jNo ratings yet

- Project Report Sem IV - Tax Planning in IndiaDocument62 pagesProject Report Sem IV - Tax Planning in IndiaRahul SinghNo ratings yet

- Form PDF 763181760311022Document88 pagesForm PDF 763181760311022safiNo ratings yet

- Assessments and ReassessmentsDocument31 pagesAssessments and ReassessmentsRam PrasadNo ratings yet

- Nirmal SinghDocument69 pagesNirmal Singhi.sumitsuriNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- GST Suvidha Kendra Service List 2019Document26 pagesGST Suvidha Kendra Service List 2019Jayant Kumar SwainNo ratings yet

- 12th MarksheetDocument26 pages12th Marksheetnishanegi9375No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearKumari KhushbooNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Taxation ProjectDocument83 pagesTaxation ProjectManish JaiswalNo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument12 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedPrabhu VNo ratings yet

- Vikas Itr-V 2024-25Document1 pageVikas Itr-V 2024-25Neeraj SinghNo ratings yet

- MT GST Suvidha Kendra Service - 3april - 2023Document51 pagesMT GST Suvidha Kendra Service - 3april - 2023mayajainNo ratings yet

- Statement of FactsDocument2 pagesStatement of FactsNitin RautNo ratings yet

- Shakti Vahini Annual Audit Report 2018-2019Document14 pagesShakti Vahini Annual Audit Report 2018-2019ravikantsvNo ratings yet

- Tax Planning Strategies and Wealth Management Unit 2Document47 pagesTax Planning Strategies and Wealth Management Unit 2ANAM AFTAB 22GSOB2010404No ratings yet

Risk Management

Risk Management

Uploaded by

aadarshshaw2345671890Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management

Risk Management

Uploaded by

aadarshshaw2345671890Copyright:

Available Formats

lOMoARcPSD|42085796

Risk Management

Bachelors of Commerce (University of Calcutta)

Scan to open on Studocu

Studocu is not sponsored or endorsed by any college or university

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

TITLE OF THE PROJECT

RISK MANAGEMENT

(Submitted for the Degree of B.Com. Honours in Accounting & Finance under the

University of Calcutta )

SUBMITTED BY

NAME OF THE CANDIDATE : SAGAR GUPTA

SECTION : B.COM (HONOURS)

SUBJECT : Risk Management

CAS REGISTRATION NO : 144-1111-0698-20

ROLL NO : 201144-21-0153

COLLEGE ROLL NO : BH0253

SUPERVISED BY

NAME OF THE SUPERVISIOR : SUBHABHRATA DINDA

NAME OF THE COLLEGE : BANGABASI MORNING COLLEGE

MONTH & YEAR OF SUBMISSION MAY , 2023

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

SUPERVISOR’S CERTIFICATE

This is to certify that Mr. Sagar Gupta a student of B.com Honours

in Accounting & Finance of Bangabasi Morning College under

University of Calcutta has worked under my supervision and

guidance for the title Risk Management which he is submitting. His

Genuine and original work to the best of my knowledge.

Place : Kolkata Signature : __________________________

Date : 13.05.2023 Name : Subhabhrata Dinda

Name of College : Bangabasi Mornjng College

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

STUDENT DECLARATION

I hereby declare that this project Risk Management submitted

by me for the partial fulfillment of the degree B.COM Honours

in accounting and finance under University of Calcutta is my

original work and has not been submitted earlier under any

other University or institution for fulfillment the requirement

of other course of study.

I also declared that no chapter of this manuscript or part has

been incorporated in this report from any earlier work done by

other or by me.

However, extracts of any literature which has been used for

this report has been duly acknowledge providing details of

search literature in this reference.

Place : Kolkata Signature :

Date : 13.05.2023 Name : Sagar Gupta

Address : 40, Chinta Moni Dey Road Howrah-

711101

Name of College : Bangabasi Morning College

C.U. Reg. No. : 144-1111-0698-20

C.U. Roll No. : 201144-21-0153

College Roll No. : BH0253

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

INTRODUCTION

Filing income taxes doesn't need to be a challenging task. If you are

worried that filing taxes is about carrying hundreds of papers and

organising everything like students do before an exam, let us tell you

right away that income tax filing today is nothing like that. With India

embracing the digital world and the many conveniences it offers,

electronic filing (e-filing) makes it possible to file income tax returns

(ITRs) in a matter of few clicks. The best part is you can e-file your

taxes right from the comfort of your home or workstation in your

office. There are no long queues where time is wasted or human

interactions that complicate matters. Just register on the Income Tax

e-filing.

What is E-filing?

E-filing is the short form of electronic filing of income taxes. E-filing is

when you electronically file your income tax returns online for a

particular year. This means you no longer need to visit the nearest

Income Tax Department's office to file your returns physically.

Instead, you log onto the internet and do the job.

FEATURES

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

Features of E Filing 2.0

The following are some of the new features that are available in E Filing 2.0:

A one-stop solution: all interactions, uploads, or pending activities will be

shown on a single dashboard, and taxpayers will be responsible for any

necessary follow-up measures. Refunds that are processed more quickly

Integrated with the rapid processing of the income tax return 2.0(ITRs) to

ensure that taxpayers get their money as quickly as possible

Free ITR preparation is now attainable with the availability of a cost-free ITR

preparation programme that includes interactive questions. In addition, the

submission of ITRs 1 and 4 (both online and offline) and ITR 2 will be easier for

taxpayers due to this (offline). In the future, the facility that allows for

preparing ITRs 3, 5, 6, and 7 will also be made accessible.

After the TDS and SFT statements have been posted, pre-filled ITR forms will be

accessible. These pre-filled ITR forms will include salary income, interest

income, dividend income, and capital gains. The information taxpayers supply

to update their profiles and provide specific income data, including salary,

home property, business or profession, will subsequently be utilised to pre-fill

their ITRs. Taxpayers will have the ability to do this.

Contact centre: A brand-new call centre has been established to support

taxpayers and provide timely responses to questions.

For taxpayers, quick and precise results improve the user experience. Through

ongoing participation, raise taxpayer awareness, educate and encourage

voluntarily paying taxes.

Tutorials for users include in-depth Frequently Asked Questions (FAQs), user

manuals, videos, and chatbots or live agents.

New features: New features are made accessible for filing I-T forms, adding tax

experts, making comments to notifications under impersonal inspection, and

appealing decisions.

E-filing 2.0 permits tax payments made by RTGS/NEFT, credit card, UPI, and net

banking, expanding the range of payment alternatives previously available.

E Filing 2.0 Features

These new functionalities are included in E Filing 2.0:

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

One-stop-shop: For taxpayer follow-up actions, all interactions, uploads,

or pending actions will be shown on a single dashboard.

Refunds are issued to taxpayers more quickly because of the integrated

rapid processing of income tax returns (ITRs).

Free ITR preparation: Interactive questions are provided in a free ITR

preparation program. This will assist taxpayers in submitting ITRs 1, 4,

and ITR 2 (both online and offline) (offline). Later, a facility for ITRs 3, 5,

6, and 7 preparations will also be made available.

Pre-filled ITR forms: After the TDS and SFT statements have been

submitted, pre-filled ITRs containing salary income, interest, dividends,

and capital gains will be available. In addition, taxpayers can update their

profiles and enter information about their income sources, such as their

salaries, real estate holdings, and businesses or professions, which will

be used to pre-fill their ITRs.

New features: It is now possible to send comments to notices under

anonymous scrutiny or appeals, add tax professionals, file I-T forms, and

more.

More choices for paying taxes: E-filing 2.0 now allows payments via

RTGS/NEFT, credit card, UPI, and net banking.

A new call centre for taxpayer assistance will provide quick responses to

inquiries.

Detailed FAQs, user guides, videos, and chatbot/live agent are all

examples of useful tutorials.

ADVANTAGE

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

What are the advantages of e-filing?

SAVING OF TIME

The taxpayers do not need to visit a tax inspectorate. All information at almost any time of

day can be sent from a taxpayer office.

NO DUPLICATION

Submitting of tax returns and accounting documentation electronically does not require the

duplication in hard copy.

ERRORS AVOIDING

E-filing software greatly reduces the number of errors. The software allows checking tax and

accounting reporting automatically, processing data more accurately and reporting in

compliance with the standard.

GUARANTEED UPDATES

In case of change of tax or accounting reporting form, or the introduction of new reporting

forms, the taxpayer automatically gets an opportunity to update the list of forms before the

due date of e-filing.

PEACE OF MIND

When using e-filing the taxpayer has the opportunity to get from tax authority an official

statement (output printing on tax) confirming that the taxpayer is compliant. Such

information is also transmitted in secured form by tax authority through an authorized

operator.

PROMPT NOTIFICATION

The taxpayer has the opportunity to receive by e-mail publicly available information

on changes in tax laws, regulations, budgetary accounts, etc.

DELIVERY CONFIRMATION

When e-filing the taxpayer is guaranteed to obtain delivery confirmation, which has legal

validity in case of disputes.

CONFIDENTIALITY

E-filing software provides necessary level of information security and equipped with the

latest encryption software to protect privacy.

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

IMPROVING DATA PROCESSING

The reporting filed electronically gets through input check and enters in separate accounts.

Due to e-filing system there is increasing efficiency of data processing and excepting of

technical errors.

DISADVANTAGE

Disadvantages of e-Filing

Check out some of the reasons why you may opt not to e-File.

Limitations

Filing taxes electronically is not for everyone. Although convenient,

there are some limitations to e-Filing.

For individual tax returns, you cannot use the e-File application if:

You need to add statements or other attachments (e.g., PDF

attachments)

You are filing decedent returns

The “additional information” section on your form does not

contain enough space

You file before e-Filing begins (January 28) or after e-Filing ends

(October 20)

Visit the IRS website for additional details on limitations for e-Filing.

Data loss

E-Filing does have the advantages of safe storage and regular

backups. However, technology isn’t perfect.

The possibility of losing data is a risk you take with e-Filing. Consider

what would happen to your information if your system, computer, or

hard drive crashes. Could you replace your information? Will you

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

have the historical documents you need to prepare for upcoming tax

years?

1. PROJECT WORK ON REGISTRATION MY PAN

Step – 1

Click Link https://www.incometaxindiaefiling.gov.in/home

Click Register yourself

Select User Type as Individual and Press Continue

Fill the Registration form Individual – Enter Basic Details and Press Continue

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

10

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

Step – 2

Fill The Registration Form

Enter Password Details

Select Secret Question Form The Drop Down List

Fill The Contact Details

Fill The Address of Individual and Click Continue

11

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

Step – 3

Registration Verification

Enter E-mail OTP

Enter Mobile OTP

NOTE – OTP sent to Your E-mail and Mobile Number

Step – 4

Registration Successful

Open My Transaction ID and User ID

12

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

2. PROJET WORK ON 26AS FORM

INTRODUCTION

From 26AS is an annual tax statement issued by Income Tax department under Section

203AA and rule 31AB of Income Tax Act, 1961. It reflects the details of tax credit appearing

against the Permanent Account Number (PAN) of the taxpayer as per the database of the

Income-tax Department. It contains the details of :

1. Tax deducted at source.

2. Details of No/Low tax deduction claimed by the taxpayer.

3. Tax collected at source.

4. Tax deducted on sale of immovable property (For seller of property/ for buyer of

property).

5. Advance / Self-Assessment tax / Regular assessment tax deposited by Tax Payer

(PAN holder).

6. Refund paid by Income Tax Department to Tax Payer during the financial year.

7. AIR transactions.

8. Comprehensive view of TDS defaults to all TAN’s associated with a PAN.

IMPORTANCE OF 26AS

Form 26AS is act as a ready-reckoner to view tax credited relating to assesse’s

transactions during a specific financial year. It facilitates the assessing officer to

match the details declared in tax return by the assessee with Form 26AS. Hence, it is

imperative that both the documents are tallied. So, before filing ITR it is advisable to

the assessee to get the Form 26AS, cross check the data. At the time of e-filing return

all those fields (TDS, TCS, advance and self-assessment tax) will be appeared with

auto populated amount including consolidated details of deductors and collectors of

tax at sources. However, on the basis of the details of TDS provided by the deductor,

the Income-tax Department will update Form 26AS of the deductee.

But in reality, sometimes it ais found that deductor fails the TDS return in

time, makes mistakes when filing return when filing return or fails to provide

assessee’s details or deliver with incorrect PAN. It may also happen if assessee

evaluate and furnish incorrect amount of advance tax or self-assessment tax, banks

incorrectly furnish details of tax deposited by the assessee. Problems crop up when

the return is processed by Income tax department. Any discrepancy (between actual

TDS and TDS credited as per Form 26AS) could lead the tax authority to send a letter

of intimation u/s 143(1).This letter contains two columns. First one reflects income

declared by the assessee and another one shows income computed as per u/s 143(1)

by Income Tax department.

13

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

Step – 1

Click Link https://www.incomtaxindiaefiling.gov.in/home

Click on the log in here

Fill The Log In Details – [User ID Your PAN No.]

Enter Your User ID

Enter Password

Enter Captcha Code And Click on Log In Tab

14

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

Step – 2

Click On Profile Setting

Select My Profit

Click On Contact Details

Click On PAN Details

15

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

16

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

Step – 3

Click On My Account

Select View Form26AS (Tax Credit)

Click Confirm

Click Proceed

17

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

Step – 4

Click View Tax Credit (Form 26AS) to view your Form 26AS.

Put Assessment Year ( Current Year ) in the box

Put HTML in the view as box

Click View/Download {See The Next Page}

18

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

19

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

20

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

3. PROJECT WORK ON CHALLAN 280

21

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

lOMoARcPSD|42085796

THANK YOU

22

Downloaded by Adarsh Shaw (aadarshshaw2345671890@gmail.com)

You might also like

- E Filing Project PDF To Word Format3Document17 pagesE Filing Project PDF To Word Format3shawpiyush328No ratings yet

- Problems and Prospects of E-Filing of Income Tax Returns: Naveen Kumar C, Dileep Kumar S DDocument10 pagesProblems and Prospects of E-Filing of Income Tax Returns: Naveen Kumar C, Dileep Kumar S DPriya mishraNo ratings yet

- Chapter - 10Document21 pagesChapter - 10Hritika GuptaNo ratings yet

- Sip ReportDocument40 pagesSip Reportavinashkumar.mba22No ratings yet

- Salman Beg Project Report On TaxDocument81 pagesSalman Beg Project Report On TaxAnonymous OqKK1jQi3No ratings yet

- Student Declaration: Mahnoor KHALID Registration No. 20-ARID-55, Hereby Declare That by Attempting TheDocument9 pagesStudent Declaration: Mahnoor KHALID Registration No. 20-ARID-55, Hereby Declare That by Attempting TheAjmal AftabNo ratings yet

- Dfm-Mbra Tax Efris Coursework Group OneDocument7 pagesDfm-Mbra Tax Efris Coursework Group OnemitchmubsNo ratings yet

- Internship Report On E-1Document113 pagesInternship Report On E-1YOGESH KUMARNo ratings yet

- Efilling ProjectDocument22 pagesEfilling ProjectTaiyab SiddiqueNo ratings yet

- DIGITAL SIGNATURE CERTIFICATE, E-Mudhra India, Digital Signature Emudhra DSC Kolkata India, MCA21 Digital Signature Certificate, Emudhra DSC LRA Kolkata, E-MudhraDocument5 pagesDIGITAL SIGNATURE CERTIFICATE, E-Mudhra India, Digital Signature Emudhra DSC Kolkata India, MCA21 Digital Signature Certificate, Emudhra DSC LRA Kolkata, E-Mudhraasmit569No ratings yet

- Step-By-step Guide To File Your Income Tax Return Online - Economic TimesDocument3 pagesStep-By-step Guide To File Your Income Tax Return Online - Economic TimesBiswa Prakash NayakNo ratings yet

- E-Filingofincome Taxreturns in India - Anoverview Suman GhoshDocument10 pagesE-Filingofincome Taxreturns in India - Anoverview Suman GhoshSuman GhoshNo ratings yet

- System InitiativesDocument10 pagesSystem InitiativesMj VarmaNo ratings yet

- Central Recruitment & Promotion Department, Corporate Centre, MumbaiDocument2 pagesCentral Recruitment & Promotion Department, Corporate Centre, MumbaiAnoop TyagiNo ratings yet

- How Toe FileDocument4 pagesHow Toe Fileirfanahmed.dba@gmail.comNo ratings yet

- Final Report RohiniDocument31 pagesFinal Report RohiniSagar BitlaNo ratings yet

- Mansi Mca21 Project ReportDocument13 pagesMansi Mca21 Project ReportrajibmukherjeekNo ratings yet

- TDS Defaults & Procedures Under Traces For Online Correction by Taxguru Consultancy & Online Publication LLPDocument98 pagesTDS Defaults & Procedures Under Traces For Online Correction by Taxguru Consultancy & Online Publication LLPAvantika SharmaNo ratings yet

- Synopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Document14 pagesSynopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Akhil SinghNo ratings yet

- The BLC ICB Financial Accounting ProgrammeDocument2 pagesThe BLC ICB Financial Accounting ProgrammeThe BLCollegeNo ratings yet

- Synopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Document13 pagesSynopsis ON E-Banking Project: Bachelor of Computer Applications SESSION (2015-2016)Akhil SinghNo ratings yet

- Income TaxDocument48 pagesIncome Tax044Lohar Veena GUNI VMPIMNo ratings yet

- Siaya Institute of TechnologyDocument10 pagesSiaya Institute of Technologywashingtone otieno oiroNo ratings yet

- "Effectiveness of Revenue Assurance and Fraud ManagementDocument69 pages"Effectiveness of Revenue Assurance and Fraud ManagementRashed Hossain Sonnet100% (1)

- Naas ProposalDocument6 pagesNaas ProposalzeusNo ratings yet

- Documentation of Insurance Compny Management SystemsDocument131 pagesDocumentation of Insurance Compny Management SystemsNand Kishore DubeyNo ratings yet

- A Study of E-Filling of Income Tax Return in IndiaDocument5 pagesA Study of E-Filling of Income Tax Return in IndiaVijay ChalwadiNo ratings yet

- Kaiynat 3rd Semester Project-1Document54 pagesKaiynat 3rd Semester Project-1amanrizvi3125No ratings yet

- E-Filing of Income Tax and GST-1Document67 pagesE-Filing of Income Tax and GST-1omkarshinde.7743No ratings yet

- Mba GST Project Report PDFDocument178 pagesMba GST Project Report PDFBhavesh KaleNo ratings yet

- Amit Internship ProjectDocument45 pagesAmit Internship Projectamitratha77No ratings yet

- Tooba DocumentDocument97 pagesTooba Documentjitendra kumarNo ratings yet

- ITR and E-Filing Project - CUDocument46 pagesITR and E-Filing Project - CUShaswata MalakarNo ratings yet

- IX2KHUgkuYQ6fFRs 0Document8 pagesIX2KHUgkuYQ6fFRs 0prebennaidoo15No ratings yet

- Nsic HRDocument2 pagesNsic HRSainaath RNo ratings yet

- Faceless Assessment GNDocument51 pagesFaceless Assessment GNP Mathavan RajkumarNo ratings yet

- Documentation of Tax Deduction at SourceDocument147 pagesDocumentation of Tax Deduction at SourceNand Kishore DubeyNo ratings yet

- Power Point Presentation On ACES For AssessesDocument45 pagesPower Point Presentation On ACES For Assessesharishnttf8346No ratings yet

- WiproDrive BCA BSC 2019Document3 pagesWiproDrive BCA BSC 2019MNNo ratings yet

- Sibani Internship ProjectDocument41 pagesSibani Internship Projectamitratha77No ratings yet

- Corporate Law 6th SemDocument12 pagesCorporate Law 6th SemJyoti GautamNo ratings yet

- FAQs On E-Filing of TARDocument6 pagesFAQs On E-Filing of TARhit2011No ratings yet

- NPS Guidbook PRAODocument48 pagesNPS Guidbook PRAONaga Sasi IlluriNo ratings yet

- Caef Aditya SonkarDocument41 pagesCaef Aditya Sonkarmessisingh1706No ratings yet

- Project Management Jan 2017Document4 pagesProject Management Jan 2017gannesh_05No ratings yet

- E FilingofvariousauditreportsunderIncomeTaxDocument47 pagesE FilingofvariousauditreportsunderIncomeTaxSajeevanKrishnanNo ratings yet

- BIR Ease of Doing BusinessDocument25 pagesBIR Ease of Doing BusinessCess MelendezNo ratings yet

- Income Tax and Tds Practiotioner CourseDocument8 pagesIncome Tax and Tds Practiotioner CourseSujata GugaleNo ratings yet

- 19 Kartik D KarkeraDocument73 pages19 Kartik D KarkeraAnkush SuryawanshiNo ratings yet

- Inviting Applications For Executive Assistant On Contractual BasisDocument1 pageInviting Applications For Executive Assistant On Contractual BasisRajesh PuniaNo ratings yet

- Unity University: Course: OOSAD, Project Report Title: Tax Management SystemDocument10 pagesUnity University: Course: OOSAD, Project Report Title: Tax Management SystemTsegazeab ZinabuNo ratings yet

- Data Management ServicesDocument21 pagesData Management ServicesKamal Kishor SankhlaNo ratings yet

- Registration Guidelines For TCS iON Remote InternshipsDocument6 pagesRegistration Guidelines For TCS iON Remote Internshipsatlantajohnson69No ratings yet

- E Filing ChapterDocument62 pagesE Filing Chapterhesheheshe123No ratings yet

- SWAPNIL PROJECT MBA Final Xerox 2121Document60 pagesSWAPNIL PROJECT MBA Final Xerox 2121sadhana karapeNo ratings yet

- E-Filing of Taxes - A Research PaperDocument8 pagesE-Filing of Taxes - A Research PaperRieke Savitri Agustin0% (1)

- 2024.4.6 - lhdnm_general-faqs_6apr2024Document10 pages2024.4.6 - lhdnm_general-faqs_6apr2024tiny cocomelonsNo ratings yet

- National Institute of Electronics and Information Technology, CalicutDocument9 pagesNational Institute of Electronics and Information Technology, CalicuthashimaNo ratings yet

- EIMS ERP Lite Proposal 5 Sq4xDocument6 pagesEIMS ERP Lite Proposal 5 Sq4xsameer.eccuratechNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- ARVINDDocument1 pageARVINDSourabh YadavNo ratings yet

- Ack Afcpy3063l 2021-22 163749600170721Document1 pageAck Afcpy3063l 2021-22 163749600170721Rakesh SinghNo ratings yet

- Itr Pankaj 2022-23Document1 pageItr Pankaj 2022-23gafoh81124No ratings yet

- Sehwag Internship ReportDocument30 pagesSehwag Internship ReportSEHWAG MATHAVANNo ratings yet

- Itr 2023 2024Document1 pageItr 2023 2024Deepak ThangamaniNo ratings yet

- PDFDocument7 pagesPDFprateekNo ratings yet

- Itr FormDocument10 pagesItr Formkunal kumarNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- Rohit ProjectDocument82 pagesRohit Projectsourav kumar dasNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearvikas guptaNo ratings yet

- Form Itr Acknowledgement Ay 2023 24Document2 pagesForm Itr Acknowledgement Ay 2023 24Sakshi KaleNo ratings yet

- Acknowledgement AY 22-23Document1 pageAcknowledgement AY 22-23Nirav RavalNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- Computerized Accounting ProjectDocument21 pagesComputerized Accounting ProjectEliza jNo ratings yet

- Project Report Sem IV - Tax Planning in IndiaDocument62 pagesProject Report Sem IV - Tax Planning in IndiaRahul SinghNo ratings yet

- Form PDF 763181760311022Document88 pagesForm PDF 763181760311022safiNo ratings yet

- Assessments and ReassessmentsDocument31 pagesAssessments and ReassessmentsRam PrasadNo ratings yet

- Nirmal SinghDocument69 pagesNirmal Singhi.sumitsuriNo ratings yet

- 2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFDocument1 page2019 08 24 15 36 22 554 - 1566641182554 - XXXPR5688X - Itrv PDFShankar Rao AsipiNo ratings yet

- GST Suvidha Kendra Service List 2019Document26 pagesGST Suvidha Kendra Service List 2019Jayant Kumar SwainNo ratings yet

- 12th MarksheetDocument26 pages12th Marksheetnishanegi9375No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearKumari KhushbooNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Taxation ProjectDocument83 pagesTaxation ProjectManish JaiswalNo ratings yet

- TDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedDocument12 pagesTDS Rate Chart For FY 2021-22 - AY 2022-23 - UpdatedPrabhu VNo ratings yet

- Vikas Itr-V 2024-25Document1 pageVikas Itr-V 2024-25Neeraj SinghNo ratings yet

- MT GST Suvidha Kendra Service - 3april - 2023Document51 pagesMT GST Suvidha Kendra Service - 3april - 2023mayajainNo ratings yet

- Statement of FactsDocument2 pagesStatement of FactsNitin RautNo ratings yet

- Shakti Vahini Annual Audit Report 2018-2019Document14 pagesShakti Vahini Annual Audit Report 2018-2019ravikantsvNo ratings yet

- Tax Planning Strategies and Wealth Management Unit 2Document47 pagesTax Planning Strategies and Wealth Management Unit 2ANAM AFTAB 22GSOB2010404No ratings yet