Professional Documents

Culture Documents

Memo For Activity 3

Memo For Activity 3

Uploaded by

mishomabunda20Copyright:

Available Formats

You might also like

- F7 (FR) Workbook (Mix)Document6 pagesF7 (FR) Workbook (Mix)Aye Myat ThawtarNo ratings yet

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- Motivation Letter ASPDocument2 pagesMotivation Letter ASPJuan David Rincon DuranNo ratings yet

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- Engineering Management Case 6-7Document1 pageEngineering Management Case 6-7maryNo ratings yet

- Macro and Micro Level HRPDocument17 pagesMacro and Micro Level HRPGurpreet Kaur33% (3)

- Eacc1614 Test 2 Memo 2021 AdjDocument10 pagesEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- 15 Sole Trader - 2020Document34 pages15 Sole Trader - 2020Philile NkwanyanaNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- FAC1601-oct2014 Suggested Sol eDocument7 pagesFAC1601-oct2014 Suggested Sol ePhelane FNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Exam 5 May 2011, Answers Exam 5 May 2011, AnswersDocument10 pagesExam 5 May 2011, Answers Exam 5 May 2011, AnswerscandiceNo ratings yet

- Tutorial 12Document15 pagesTutorial 12lkaixin 02No ratings yet

- Identify Elements of Corporate Report and Explain The Purpose of Each ElementDocument6 pagesIdentify Elements of Corporate Report and Explain The Purpose of Each ElementwsndichaonaNo ratings yet

- AFS SolutionsDocument19 pagesAFS SolutionsRolivhuwaNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Accounting PracticeDocument24 pagesAccounting PracticeLloydNo ratings yet

- Prorata ExerciceDocument3 pagesProrata ExerciceNjakanarivo Christian RajaonaNo ratings yet

- 2247 Chapter 11Document3 pages2247 Chapter 11fp4jcjnsr4No ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Empire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMDocument3 pagesEmpire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMJasmin JimmyNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 3 SolutionDocument9 pagesFAC 2602 - 2023 - S1 - Assessment 3 SolutionlennoxhaniNo ratings yet

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Grade 10 Provincial Case Study MG 2023Document3 pagesGrade 10 Provincial Case Study MG 2023kwazy dlaminiNo ratings yet

- Ans Jan 2018 Far410Document8 pagesAns Jan 2018 Far4102022478048No ratings yet

- Cash Flow Statement Template in ExcelDocument5 pagesCash Flow Statement Template in ExcelOyewale OyelayoNo ratings yet

- 11 ACC CH 6.11 To 6.16 MemosDocument19 pages11 ACC CH 6.11 To 6.16 Memosora mashaNo ratings yet

- Marking Guidelines - Grade 12 Accounting MODULE 3 Companies Financial ReportingDocument52 pagesMarking Guidelines - Grade 12 Accounting MODULE 3 Companies Financial Reportingbuhle02mngomezuluNo ratings yet

- Task 3.11 MemoDocument4 pagesTask 3.11 MemoNomfundo ShabalalaNo ratings yet

- Additional Case K17409 - Ias 7Document2 pagesAdditional Case K17409 - Ias 7Vy DangNo ratings yet

- KZN 2020 June P1 Memo 2Document7 pagesKZN 2020 June P1 Memo 2shandren19No ratings yet

- Zimsec - Nov - 2016 - Ms 3Document9 pagesZimsec - Nov - 2016 - Ms 3Wesley KisiNo ratings yet

- Statement of CF - Dallas LTD - Intermediate Level ExerciseDocument4 pagesStatement of CF - Dallas LTD - Intermediate Level ExerciseNhư QuỳnhNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Final Account - Sole Trader - Practice QuestionDocument3 pagesFinal Account - Sole Trader - Practice QuestionMUSTHARI KHANNo ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- Recycle PLC - QuestionDocument3 pagesRecycle PLC - Questiontom willetsNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- Assign AcctDocument12 pagesAssign AcctNaeemullah baig100% (1)

- Companies Practice 1Document10 pagesCompanies Practice 1Dayaan ANo ratings yet

- 2002 DecemberDocument7 pages2002 DecemberSherif AwadNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Hapsburg SDocument3 pagesHapsburg SMunir Muhammad Shafi, ACA, ACCANo ratings yet

- 1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramDocument3 pages1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramLê Minh TríNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- Income Taxes - Moments LTD Rupert LTD MemoDocument5 pagesIncome Taxes - Moments LTD Rupert LTD Memoandiswa zuluNo ratings yet

- Hercule Monthly AC-JUNE.2013Document20 pagesHercule Monthly AC-JUNE.2013Kyaw Htin WinNo ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- FAC1602 Exam PackDocument25 pagesFAC1602 Exam PackNthabeza De Ntha MogaleNo ratings yet

- Group 5Document8 pagesGroup 5Doreen OngNo ratings yet

- Topic 6 Test ISBS 3E4Document5 pagesTopic 6 Test ISBS 3E4LynnHanNo ratings yet

- Task 3 AccDocument4 pagesTask 3 Accbbang bbyNo ratings yet

- Kunci Jawaban Pt. Himada JayaDocument78 pagesKunci Jawaban Pt. Himada JayaFitri TroneNo ratings yet

- Sample Questions For Publication-Mbaf 601-Oct-2022Document3 pagesSample Questions For Publication-Mbaf 601-Oct-2022Laud ListowellNo ratings yet

- Gr10 Acc (English) June 2016 Question PaperDocument9 pagesGr10 Acc (English) June 2016 Question Papermishomabunda20No ratings yet

- 12 ACC Production Cost - Statement LessonDocument11 pages12 ACC Production Cost - Statement Lessonmishomabunda20No ratings yet

- Paper1 QuestionsDocument42 pagesPaper1 Questionsmishomabunda20No ratings yet

- Pship Fs WW Act 3 DoneDocument91 pagesPship Fs WW Act 3 Donemishomabunda20No ratings yet

- Accounting Grade 10 Revision Memo Term 1 - 2023Document26 pagesAccounting Grade 10 Revision Memo Term 1 - 2023mishomabunda20No ratings yet

- Accounting Work 11 12 May 2020 1Document8 pagesAccounting Work 11 12 May 2020 1mishomabunda20No ratings yet

- Acc GR 10 p1 (A) 2018 Eng Memo Exemplar-4 2Document8 pagesAcc GR 10 p1 (A) 2018 Eng Memo Exemplar-4 2mishomabunda20No ratings yet

- Exponents and SurdsDocument1 pageExponents and Surdsmishomabunda20No ratings yet

- Acc GR 10 P2 (A) Exemplar Nov18 Eng QP.Document12 pagesAcc GR 10 P2 (A) Exemplar Nov18 Eng QP.mishomabunda20No ratings yet

- Apple Inc. Strategic Management Implementation 978-3-659-92891-8Document57 pagesApple Inc. Strategic Management Implementation 978-3-659-92891-8Sobhi Braidy100% (2)

- Ecn 138 Summer 2021-2022Document11 pagesEcn 138 Summer 2021-2022Denise RoqueNo ratings yet

- Problem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Document2 pagesProblem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Rizky Wahyu FebriyantoNo ratings yet

- Q8 IM05 FinalDocument35 pagesQ8 IM05 FinalJb MacarocoNo ratings yet

- CH 10Document18 pagesCH 10SARA َNo ratings yet

- FIN441 Assignment 2Document4 pagesFIN441 Assignment 2MahiraNo ratings yet

- Post Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditDocument5 pagesPost Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditPaolo IcangNo ratings yet

- Tybmm RatioDocument4 pagesTybmm RatioSeema PatilNo ratings yet

- Fiber@HomeDocument28 pagesFiber@HomeNayem HossainNo ratings yet

- Written Work 1Document35 pagesWritten Work 1ABM ST.MATTHEW Misa john carlo100% (1)

- PSC Reopening and Recovery Back To Work Checklist (Final - April 20, 2020)Document6 pagesPSC Reopening and Recovery Back To Work Checklist (Final - April 20, 2020)WWMT100% (1)

- Meckson Ndali Resume-1Document1 pageMeckson Ndali Resume-1Rodric PeterNo ratings yet

- Practical Accounting 1 Mockboard 2014Document8 pagesPractical Accounting 1 Mockboard 2014Jonathan Tumamao Fernandez100% (1)

- Introduction To Economic TheoryDocument11 pagesIntroduction To Economic TheoryEyhla Mae GalopeNo ratings yet

- Titman CH 16 - Dividend PolicyDocument55 pagesTitman CH 16 - Dividend PolicyIKA RAHMAWATINo ratings yet

- Overview and Conclusions: BIS Papers No 71 - The Finances of Central Banks 3Document2 pagesOverview and Conclusions: BIS Papers No 71 - The Finances of Central Banks 3ManavNo ratings yet

- UNICEF Youth Review InvestmentDocument94 pagesUNICEF Youth Review InvestmentamadpocrcNo ratings yet

- Bank Op Manager JDDocument4 pagesBank Op Manager JDgopal royNo ratings yet

- Case StudyDocument17 pagesCase StudyMukesh AgrawalNo ratings yet

- Wazir Report - Surviving The Rise of Sustainability LegislationsDocument20 pagesWazir Report - Surviving The Rise of Sustainability Legislationsvarunvaid6636100% (1)

- Class 10 Project on Sustainable Development 2Document21 pagesClass 10 Project on Sustainable Development 2sonupurve169No ratings yet

- There's A Confluence Template For ThatDocument6 pagesThere's A Confluence Template For Thatmaurits toliuNo ratings yet

- BA 5025 Logistics Management Notes and SCMDocument96 pagesBA 5025 Logistics Management Notes and SCMganga sweetyNo ratings yet

- Asean SCP Framework FinalDocument28 pagesAsean SCP Framework FinalSyed MubashirNo ratings yet

- Mba WebsterDocument4 pagesMba WebsterDavid BlakeNo ratings yet

- Job and Batch CostingDocument3 pagesJob and Batch CostingbhngbjNo ratings yet

- Linking Compentency To Performance and PayDocument3 pagesLinking Compentency To Performance and PayKarthickNo ratings yet

Memo For Activity 3

Memo For Activity 3

Uploaded by

mishomabunda20Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Memo For Activity 3

Memo For Activity 3

Uploaded by

mishomabunda20Copyright:

Available Formats

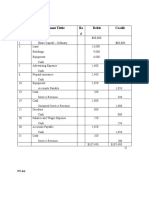

MEMO FOR ACTIVITY 3

L LAILA AND Z ZANELE

LAZEN TRADERS

INCOME STATEMENT FOR THE YEAR ENDED 28 FEBRUARY 2015

Note R

Sales (1 875 800 – 15 500) 1 860 300

Cost of sales (685 000) (685 000)

Gross profit 1 175 300

Other operating income 111 038

Rent income (118 400 – 17 600) 100 800

Discount received 3 600 6 600

Profit on sale of assets (18 000 + 14 000 – 30 000) 2 000

Bad debts recovered 1 500

Provision for bad debts adjustment 138

Gross operating income 1 286 338

Operating expenses (448 308)

Stationery (8 500 – 500) 8 000

Packing material (9 603) 9 603

Salaries and wages (188 400 + 10 000) 198 400

Bad debts (4 500 + 400) 4 900

Discount allowed (3 200) 3 200

Insurance (80 400 – 13 200) 67 200

Water and electricity (42 600 + 1 400) 44 000

Sundry expenses (21 300) 21 300

Trading stock deficit (126 500 – 121 000) 5 500

Depreciation (50 000 + 30 000) 80 000

Repairs to building 4 000

Pension fund contributions 1 125

Medical Aid contributions 980

UIF contributions 100

Operating profit (loss) 838 030

Interest income 1 7 500

Profit (loss) before interest expense 845 530

Interest expense 2 (45 000)

800 530

Net profit (loss) for the year

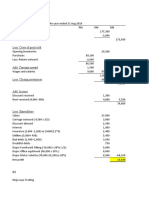

L LAILA AND Z ZANELE

LAZEN TRADERS

BALANCE SHEET AT 28 FEBRUARY 2015

Note R

ASSETS

NON-CURRENT ASSETS 1 898 000

Fixed / Tangible assets 3 1 798 000

Financial assets – Fixed Deposit 100 000 100 000

CURRENT ASSETS 292 535

Inventories 4 121 500

Trade & other receivables 5 71 038

Cash & cash equivalents 6 99 997

TOTAL ASSETS 2 190 535

EQUITY & LIABILITIES

OWNER’S EQUITY 1 859 530

Capital 7 1 500 000

Current accounts 8 359 530

NON-CURRENT LIABILITIES 60 000

Loan from GP Bank 180 000 – 120 000 60 000

Loan from

CURRENT LIABILITIES 271 005

Trade & other payables 8 151 005

Bank overdraft

Current portion of loan (NB could be placed in Note 8) 120 000

TOTAL EQUITY & LIABILITIES 2 190 535

3 FIXED/TANGIBLE ASSETS Land & Vehicles Equipment Total

buildings

Carrying value beginning of year 1 300 000 500 000 94 000 1 894 000

Cost 1 300 000 680 000 150 000 2 130 000

Accumulated depreciation (180 000) (56 000) (236 000)

Movement

Additions

Disposals at carrying value *(16 000) (16 000)

Depreciation (50 000) (30 000) (80 000)

Carrying value at end of year 1 300 000 450 000 48 000 1 798 000

Cost 1 300 000 680 000 **120 000 2 100 000

Accumulated depreciation (230 000) ***(72 000) (302 000)

*R30 000 – R14 000 ** R150 000 – R30 000 = R120 000

= R16 000 *** R56 000 + R30 000 – R14 000

= R72 000

4 INVENTORIES

Trading stock 126 500 – 5 500 121 000

Consumable stores on hand 500 500

121 500

5 TRADE & OTHER RECEIVABLES

Trade debtors 56 000 – 400 55 600

Provision for bad debts 1 800 – 138 (1 662)

Net trade debtors 53 938

Expenses prepaid 13 200

Income accrued (receivable) 3 900 3 900

Deposit for water and electricity

71 038

6 CASH & CASH EQUIVALENTS

Fixed deposit (maturing within 12 months)

Savings account

Bank 80 497 + 1 500 + 18 000 99 997

Cash float

Petty Cash

99 997

7 CAPITAL ACCOUNTS L LAILA Z ZANELE Total

Balance at beginning of year 900 000 600 000 1 500 000

Contributions of capital during the year

Withdrawal of capital during the year

Balance at end of year 900 000 600 000 1 500 000

8 CURRENT ACCOUNTS L LAILA Z ZANELE Total

Net profit as per Income Statement 431 318 369 212 800 530

Partners’ salaries 240 000 240 000 480 000

Interest on capital 90 000 60 000 150 000

Partners’ bonuses 5 000 5 000 10 000

Primary distribution of profit 335 000 305 000 640 000

Final distribution of profit 96 318 64 212 160 530

Drawings for the year (288 000) (272 500) (560 500)

Undrawn profits for the year 143 318 96 712 240 030

Balance at beginning of year 125 000 (5 500) 119 500

Balance at end of year 268 318 91 212 359 530

9 TRADE & OTHER PAYABLES

Trade creditors 119 800 119 800.

Expenses accrued (payable) 1 400

Income received in advance (deferred) 17 600

Creditors for salaries 10 000 – 1 800 – 750 – 980 – 100 6 370

Pension Fund 7,5% X R10 000 = 750 + 1 125 1 875

Medical Fund 980 + 980 1 960

South African Revenue Services(PAYE) 18% X R10 000 1 800

UIF 1% X R10 000 = 100 + 100 200

151 005

.

You might also like

- F7 (FR) Workbook (Mix)Document6 pagesF7 (FR) Workbook (Mix)Aye Myat ThawtarNo ratings yet

- Bharat Chemical CaseDocument5 pagesBharat Chemical CaseambitiousfirkinNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- Motivation Letter ASPDocument2 pagesMotivation Letter ASPJuan David Rincon DuranNo ratings yet

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- Engineering Management Case 6-7Document1 pageEngineering Management Case 6-7maryNo ratings yet

- Macro and Micro Level HRPDocument17 pagesMacro and Micro Level HRPGurpreet Kaur33% (3)

- Eacc1614 Test 2 Memo 2021 AdjDocument10 pagesEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- 15 Sole Trader - 2020Document34 pages15 Sole Trader - 2020Philile NkwanyanaNo ratings yet

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaNo ratings yet

- FAC1601-oct2014 Suggested Sol eDocument7 pagesFAC1601-oct2014 Suggested Sol ePhelane FNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- Exam 5 May 2011, Answers Exam 5 May 2011, AnswersDocument10 pagesExam 5 May 2011, Answers Exam 5 May 2011, AnswerscandiceNo ratings yet

- Tutorial 12Document15 pagesTutorial 12lkaixin 02No ratings yet

- Identify Elements of Corporate Report and Explain The Purpose of Each ElementDocument6 pagesIdentify Elements of Corporate Report and Explain The Purpose of Each ElementwsndichaonaNo ratings yet

- AFS SolutionsDocument19 pagesAFS SolutionsRolivhuwaNo ratings yet

- OCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesOCTOBER 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Accounting PracticeDocument24 pagesAccounting PracticeLloydNo ratings yet

- Prorata ExerciceDocument3 pagesProrata ExerciceNjakanarivo Christian RajaonaNo ratings yet

- 2247 Chapter 11Document3 pages2247 Chapter 11fp4jcjnsr4No ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Empire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMDocument3 pagesEmpire Enterprise Statament of Account For Profit and Loss As at 31 December 2015 RM RM RMJasmin JimmyNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 3 SolutionDocument9 pagesFAC 2602 - 2023 - S1 - Assessment 3 SolutionlennoxhaniNo ratings yet

- Statement of Financial Position With Supporting NotesDocument4 pagesStatement of Financial Position With Supporting NotesKennethEdizaNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- Grade 10 Provincial Case Study MG 2023Document3 pagesGrade 10 Provincial Case Study MG 2023kwazy dlaminiNo ratings yet

- Ans Jan 2018 Far410Document8 pagesAns Jan 2018 Far4102022478048No ratings yet

- Cash Flow Statement Template in ExcelDocument5 pagesCash Flow Statement Template in ExcelOyewale OyelayoNo ratings yet

- 11 ACC CH 6.11 To 6.16 MemosDocument19 pages11 ACC CH 6.11 To 6.16 Memosora mashaNo ratings yet

- Marking Guidelines - Grade 12 Accounting MODULE 3 Companies Financial ReportingDocument52 pagesMarking Guidelines - Grade 12 Accounting MODULE 3 Companies Financial Reportingbuhle02mngomezuluNo ratings yet

- Task 3.11 MemoDocument4 pagesTask 3.11 MemoNomfundo ShabalalaNo ratings yet

- Additional Case K17409 - Ias 7Document2 pagesAdditional Case K17409 - Ias 7Vy DangNo ratings yet

- KZN 2020 June P1 Memo 2Document7 pagesKZN 2020 June P1 Memo 2shandren19No ratings yet

- Zimsec - Nov - 2016 - Ms 3Document9 pagesZimsec - Nov - 2016 - Ms 3Wesley KisiNo ratings yet

- Statement of CF - Dallas LTD - Intermediate Level ExerciseDocument4 pagesStatement of CF - Dallas LTD - Intermediate Level ExerciseNhư QuỳnhNo ratings yet

- Example Problems W Solutions in SFP & SCFDocument7 pagesExample Problems W Solutions in SFP & SCFQueen Valle100% (1)

- Final Account - Sole Trader - Practice QuestionDocument3 pagesFinal Account - Sole Trader - Practice QuestionMUSTHARI KHANNo ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- Recycle PLC - QuestionDocument3 pagesRecycle PLC - Questiontom willetsNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- Assign AcctDocument12 pagesAssign AcctNaeemullah baig100% (1)

- Companies Practice 1Document10 pagesCompanies Practice 1Dayaan ANo ratings yet

- 2002 DecemberDocument7 pages2002 DecemberSherif AwadNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Hapsburg SDocument3 pagesHapsburg SMunir Muhammad Shafi, ACA, ACCANo ratings yet

- 1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramDocument3 pages1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramLê Minh TríNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- Income Taxes - Moments LTD Rupert LTD MemoDocument5 pagesIncome Taxes - Moments LTD Rupert LTD Memoandiswa zuluNo ratings yet

- Hercule Monthly AC-JUNE.2013Document20 pagesHercule Monthly AC-JUNE.2013Kyaw Htin WinNo ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- FAC1602 Exam PackDocument25 pagesFAC1602 Exam PackNthabeza De Ntha MogaleNo ratings yet

- Group 5Document8 pagesGroup 5Doreen OngNo ratings yet

- Topic 6 Test ISBS 3E4Document5 pagesTopic 6 Test ISBS 3E4LynnHanNo ratings yet

- Task 3 AccDocument4 pagesTask 3 Accbbang bbyNo ratings yet

- Kunci Jawaban Pt. Himada JayaDocument78 pagesKunci Jawaban Pt. Himada JayaFitri TroneNo ratings yet

- Sample Questions For Publication-Mbaf 601-Oct-2022Document3 pagesSample Questions For Publication-Mbaf 601-Oct-2022Laud ListowellNo ratings yet

- Gr10 Acc (English) June 2016 Question PaperDocument9 pagesGr10 Acc (English) June 2016 Question Papermishomabunda20No ratings yet

- 12 ACC Production Cost - Statement LessonDocument11 pages12 ACC Production Cost - Statement Lessonmishomabunda20No ratings yet

- Paper1 QuestionsDocument42 pagesPaper1 Questionsmishomabunda20No ratings yet

- Pship Fs WW Act 3 DoneDocument91 pagesPship Fs WW Act 3 Donemishomabunda20No ratings yet

- Accounting Grade 10 Revision Memo Term 1 - 2023Document26 pagesAccounting Grade 10 Revision Memo Term 1 - 2023mishomabunda20No ratings yet

- Accounting Work 11 12 May 2020 1Document8 pagesAccounting Work 11 12 May 2020 1mishomabunda20No ratings yet

- Acc GR 10 p1 (A) 2018 Eng Memo Exemplar-4 2Document8 pagesAcc GR 10 p1 (A) 2018 Eng Memo Exemplar-4 2mishomabunda20No ratings yet

- Exponents and SurdsDocument1 pageExponents and Surdsmishomabunda20No ratings yet

- Acc GR 10 P2 (A) Exemplar Nov18 Eng QP.Document12 pagesAcc GR 10 P2 (A) Exemplar Nov18 Eng QP.mishomabunda20No ratings yet

- Apple Inc. Strategic Management Implementation 978-3-659-92891-8Document57 pagesApple Inc. Strategic Management Implementation 978-3-659-92891-8Sobhi Braidy100% (2)

- Ecn 138 Summer 2021-2022Document11 pagesEcn 138 Summer 2021-2022Denise RoqueNo ratings yet

- Problem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Document2 pagesProblem 2-24: © The Mcgraw-Hill Companies, Inc., 2010. All Rights Reserved. Solutions Manual, Chapter 2 51Rizky Wahyu FebriyantoNo ratings yet

- Q8 IM05 FinalDocument35 pagesQ8 IM05 FinalJb MacarocoNo ratings yet

- CH 10Document18 pagesCH 10SARA َNo ratings yet

- FIN441 Assignment 2Document4 pagesFIN441 Assignment 2MahiraNo ratings yet

- Post Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditDocument5 pagesPost Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditPaolo IcangNo ratings yet

- Tybmm RatioDocument4 pagesTybmm RatioSeema PatilNo ratings yet

- Fiber@HomeDocument28 pagesFiber@HomeNayem HossainNo ratings yet

- Written Work 1Document35 pagesWritten Work 1ABM ST.MATTHEW Misa john carlo100% (1)

- PSC Reopening and Recovery Back To Work Checklist (Final - April 20, 2020)Document6 pagesPSC Reopening and Recovery Back To Work Checklist (Final - April 20, 2020)WWMT100% (1)

- Meckson Ndali Resume-1Document1 pageMeckson Ndali Resume-1Rodric PeterNo ratings yet

- Practical Accounting 1 Mockboard 2014Document8 pagesPractical Accounting 1 Mockboard 2014Jonathan Tumamao Fernandez100% (1)

- Introduction To Economic TheoryDocument11 pagesIntroduction To Economic TheoryEyhla Mae GalopeNo ratings yet

- Titman CH 16 - Dividend PolicyDocument55 pagesTitman CH 16 - Dividend PolicyIKA RAHMAWATINo ratings yet

- Overview and Conclusions: BIS Papers No 71 - The Finances of Central Banks 3Document2 pagesOverview and Conclusions: BIS Papers No 71 - The Finances of Central Banks 3ManavNo ratings yet

- UNICEF Youth Review InvestmentDocument94 pagesUNICEF Youth Review InvestmentamadpocrcNo ratings yet

- Bank Op Manager JDDocument4 pagesBank Op Manager JDgopal royNo ratings yet

- Case StudyDocument17 pagesCase StudyMukesh AgrawalNo ratings yet

- Wazir Report - Surviving The Rise of Sustainability LegislationsDocument20 pagesWazir Report - Surviving The Rise of Sustainability Legislationsvarunvaid6636100% (1)

- Class 10 Project on Sustainable Development 2Document21 pagesClass 10 Project on Sustainable Development 2sonupurve169No ratings yet

- There's A Confluence Template For ThatDocument6 pagesThere's A Confluence Template For Thatmaurits toliuNo ratings yet

- BA 5025 Logistics Management Notes and SCMDocument96 pagesBA 5025 Logistics Management Notes and SCMganga sweetyNo ratings yet

- Asean SCP Framework FinalDocument28 pagesAsean SCP Framework FinalSyed MubashirNo ratings yet

- Mba WebsterDocument4 pagesMba WebsterDavid BlakeNo ratings yet

- Job and Batch CostingDocument3 pagesJob and Batch CostingbhngbjNo ratings yet

- Linking Compentency To Performance and PayDocument3 pagesLinking Compentency To Performance and PayKarthickNo ratings yet