Professional Documents

Culture Documents

Depreciation Example

Depreciation Example

Uploaded by

Madiha JavedCopyright:

Available Formats

You might also like

- PSA - Financial Accounting (Question Bank)Document276 pagesPSA - Financial Accounting (Question Bank)Anowar Al Farabi100% (3)

- Amm 3550 - Data Analysis Project Adidas VsDocument8 pagesAmm 3550 - Data Analysis Project Adidas Vsapi-272953906No ratings yet

- Chapter 11Document45 pagesChapter 11LBL_Lowkee100% (3)

- Assets: Director's Letter & Auditor's Notes Flag Major Points Attributed To RiskDocument7 pagesAssets: Director's Letter & Auditor's Notes Flag Major Points Attributed To RiskCH NAIRNo ratings yet

- AssignmentDocument3 pagesAssignmentLEON JOAQUIN VALDEZNo ratings yet

- Book 1Document2 pagesBook 1Ánh MaiNo ratings yet

- Sacco Statistics 2023-FinDocument3 pagesSacco Statistics 2023-FinbmwenjaNo ratings yet

- Sacco Statistics 2023-FinDocument4 pagesSacco Statistics 2023-FinbmwenjaNo ratings yet

- Annual Report 2075 76 EnglishDocument200 pagesAnnual Report 2075 76 Englishram krishnaNo ratings yet

- SD Weekly September 2020Document10 pagesSD Weekly September 2020hendri rudiansyahNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueIkhlas SadiminNo ratings yet

- Money in Dotn/Grant Fees Other 638,335: Essi Ledger-February, 2016Document3 pagesMoney in Dotn/Grant Fees Other 638,335: Essi Ledger-February, 2016rico vanNo ratings yet

- Annual Report 2021 22 OracleDocument200 pagesAnnual Report 2021 22 Oracleraki090No ratings yet

- Study Id28566 Soap and Bath Product Consumption in The United Kingdom Kantar Media TgiDocument50 pagesStudy Id28566 Soap and Bath Product Consumption in The United Kingdom Kantar Media Tginusrat sadiaNo ratings yet

- LA 2 Construction Contracts PDFDocument3 pagesLA 2 Construction Contracts PDFliliNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- JTM Quick Facts 2019 - 15august2019Document2 pagesJTM Quick Facts 2019 - 15august2019Ezran FarquharNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- (W3) ANS-Tutorial PPE Initial RecognitionDocument3 pages(W3) ANS-Tutorial PPE Initial RecognitionMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Annual Report 2018 19 24Document89 pagesAnnual Report 2018 19 24ompatelNo ratings yet

- Wipro SFM - CIA1.1 2Document12 pagesWipro SFM - CIA1.1 2Saloni Jain 1820343No ratings yet

- Premium Income - Individaul Life: Year Rs. in MillionDocument3 pagesPremium Income - Individaul Life: Year Rs. in MillionLucifer RegeneratedNo ratings yet

- County Work SessionDocument13 pagesCounty Work SessionBen SchachtmanNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- 011 September 2022Document21 pages011 September 2022John Louie LagunaNo ratings yet

- Construction ContractsDocument5 pagesConstruction ContractsDJ ULRICHNo ratings yet

- Long Term Construction ContractsDocument5 pagesLong Term Construction ContractsDJ ULRICHNo ratings yet

- Spicy Malunggay CookiesDocument19 pagesSpicy Malunggay CookiesChristine Margoux SiriosNo ratings yet

- College Savings CalculatorDocument1 pageCollege Savings CalculatorsrinaldyNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueKipli SNo ratings yet

- Operating Profit: A. Founded in 1892, Calcutta B. C. Chairman/Head-Nusli Wadia D. Managing Director - Varun BerryDocument5 pagesOperating Profit: A. Founded in 1892, Calcutta B. C. Chairman/Head-Nusli Wadia D. Managing Director - Varun BerryVIDHI AGARAIYANo ratings yet

- Tugas Pertemuan 11Document4 pagesTugas Pertemuan 11Hana NadhifaNo ratings yet

- Health Service Delivery Analysis, Hospital & Health Workforce MasterplanDocument13 pagesHealth Service Delivery Analysis, Hospital & Health Workforce MasterplanADB Health Sector GroupNo ratings yet

- New Microsoft Excel WorksheetDocument7 pagesNew Microsoft Excel WorksheetHossain MinhazNo ratings yet

- Rakib Explanation of Funds FormationDocument1 pageRakib Explanation of Funds FormationMd Razwanul Islam RupomNo ratings yet

- Intercompany Sale of Merchandise - AdditionalDocument4 pagesIntercompany Sale of Merchandise - AdditionalJaimell LimNo ratings yet

- Sample MaDocument15 pagesSample MaSineenart SolotNo ratings yet

- No Description Amount Contingency-10% Days From To April May June July August Duration MonthsDocument2 pagesNo Description Amount Contingency-10% Days From To April May June July August Duration MonthsKushan Mayuranga RuphasingheNo ratings yet

- Lembar Jawab Laporan KeuanganDocument10 pagesLembar Jawab Laporan Keuanganricoananta10No ratings yet

- Kekurangan Okt 2016 S/D Februari 2017: September OktoberDocument4 pagesKekurangan Okt 2016 S/D Februari 2017: September OktoberPuskesmas MasbagikNo ratings yet

- Ahmad Fahmi 1707621056 Uas AplikomDocument13 pagesAhmad Fahmi 1707621056 Uas AplikomAhmad FahmiNo ratings yet

- JTM Quick Facts 2019 - 10october2019Document2 pagesJTM Quick Facts 2019 - 10october2019Ezran FarquharNo ratings yet

- Loss CarryforwardDocument1 pageLoss Carryforwardryanclarke628No ratings yet

- CelastroFinanceModel-4.1Document17 pagesCelastroFinanceModel-4.1Seemant SengarNo ratings yet

- Economic Cost and Profit of BeximcoDocument15 pagesEconomic Cost and Profit of BeximcoMamun RashidNo ratings yet

- DataDocument16 pagesDataعثمان سلیمNo ratings yet

- Coffee Report and Outlook April 2023 - ICODocument39 pagesCoffee Report and Outlook April 2023 - ICOsyifa amaliaNo ratings yet

- Solution - Handout - Cash and Cash Equivalents - Inclusions and ExclusionsDocument5 pagesSolution - Handout - Cash and Cash Equivalents - Inclusions and ExclusionsMaricon BerjaNo ratings yet

- L18.12 UTS 1718 v3Document11 pagesL18.12 UTS 1718 v3AnggiNo ratings yet

- Bafacr4X Non-Financial Liabilities: Problem 4.1Document7 pagesBafacr4X Non-Financial Liabilities: Problem 4.1Aga Mathew MayugaNo ratings yet

- Tan Vernon Jay Homework 6Document9 pagesTan Vernon Jay Homework 6ASHANTI JANE EREDIANONo ratings yet

- PDFDocument8 pagesPDFtbnc5nbdqwNo ratings yet

- PERSIJADocument10 pagesPERSIJAricoananta10No ratings yet

- 2017 Fall Solution: Sales BudgetDocument3 pages2017 Fall Solution: Sales BudgetRaam Tha BossNo ratings yet

- Latihan PPEDocument3 pagesLatihan PPEkin primasNo ratings yet

- EKO2 Marsya As - 12ipa3 - 16Document7 pagesEKO2 Marsya As - 12ipa3 - 16Marsya AlyssaNo ratings yet

- Calculo Wacc - AlicorpDocument14 pagesCalculo Wacc - Alicorpludwing espinar pinedoNo ratings yet

- China Oil Crackdown ImpactDocument5 pagesChina Oil Crackdown ImpactBeatriz RosenburgNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- IB Merger ModelDocument12 pagesIB Merger Modelkirihara95100% (1)

- Sap-C Ts4fi 2021Document38 pagesSap-C Ts4fi 2021xuewupsyNo ratings yet

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanNo ratings yet

- Reconstitution of A Partnership Firm - Admission of A PartnerDocument65 pagesReconstitution of A Partnership Firm - Admission of A PartnerPathan KausarNo ratings yet

- Valuations Remvest - ScenarioDocument6 pagesValuations Remvest - ScenarioMoses Nhlanhla MasekoNo ratings yet

- Ais205 June 23Document7 pagesAis205 June 23ediza adha0% (1)

- DocxDocument33 pagesDocxGray Javier0% (1)

- Corporate Finance 3rd Edition Graham Test BankDocument18 pagesCorporate Finance 3rd Edition Graham Test BankRoderick RonidelNo ratings yet

- BaiduDocument29 pagesBaiduidradjatNo ratings yet

- Question Paper Financial Accounting (MB131) : January 2005Document32 pagesQuestion Paper Financial Accounting (MB131) : January 2005Ujwalsagar SagarNo ratings yet

- Exercise For IAS 16 PPEDocument2 pagesExercise For IAS 16 PPENguyễn PhươngNo ratings yet

- Accountancy SQP PDFDocument21 pagesAccountancy SQP PDFSuyash YaduNo ratings yet

- SOLUTION FAR560 - JUN 2016 RevisedDocument9 pagesSOLUTION FAR560 - JUN 2016 RevisedNurul Farahdatul Ashikin RamlanNo ratings yet

- Financial Accounting GlossaryDocument5 pagesFinancial Accounting GlossaryDheeraj SunthaNo ratings yet

- Analysis of Financial StatementDocument23 pagesAnalysis of Financial StatementMohammad Tariq AnsariNo ratings yet

- Group Assignment 2 - Fall 2021 - BlankDocument13 pagesGroup Assignment 2 - Fall 2021 - Blankhalelz69No ratings yet

- ABM103 Final PT En2C - GABILISH CHIPSDocument3 pagesABM103 Final PT En2C - GABILISH CHIPSmae annNo ratings yet

- UntitledDocument9 pagesUntitledPriya NairNo ratings yet

- Daftar Istilah Akuntansi Dalam Bahasa InggrisDocument6 pagesDaftar Istilah Akuntansi Dalam Bahasa InggrisSteven Sher50% (2)

- Cash Flow Estimation MbaDocument27 pagesCash Flow Estimation MbaViolets n' DaisiesNo ratings yet

- 3 Statement Model TemplateDocument16 pages3 Statement Model TemplateDamn SonNo ratings yet

- Financial Services: Topic: Tax Aspects of LeasingDocument10 pagesFinancial Services: Topic: Tax Aspects of LeasingSri NilayaNo ratings yet

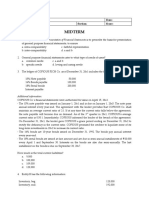

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Fixed Asset Policy AdvDocument23 pagesFixed Asset Policy Advkamran1983No ratings yet

- CA Inter Taxation Suggested Answer May 2022Document30 pagesCA Inter Taxation Suggested Answer May 2022ileshrathod0No ratings yet

- Prac1: Multiple ChoiceDocument9 pagesPrac1: Multiple ChoiceROMAR A. PIGANo ratings yet

- Chap3 - Benefits, Costs, and DecisionsDocument10 pagesChap3 - Benefits, Costs, and DecisionsAnthony DyNo ratings yet

Depreciation Example

Depreciation Example

Uploaded by

Madiha JavedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Example

Depreciation Example

Uploaded by

Madiha JavedCopyright:

Available Formats

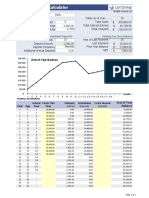

Cost of Equipment 40,000 1-Jan-15 Standard Method

Transportation - Dep = (Cost-SV) / Life

Instalation -

Estimated Useful Life 6 Year Depreciation

Salvage 4,000 2015 6,000

2016 6,000

Capitalized Amount 40,000 2017 6,000

2018 6,000

2019 6,000

2020 6,000

Assume that:

After ONE year (i.e. in 2016), the estimate of salvage vaue was revised to: 6,000

After TWO years (i.e. in 2017), remaining life of the equipment was increased by: 2

St. Line Depreciation Beg. Book Value - Salvage Beg BV

Remaining Life 2015 40,000

2016 34,000

2017 28,400

2018 24,667

2019 20,933

2020 17,200

2021 13,467

2022 9,733

St. Line Dep = (Beg. Book Value - Salvage)

ost-SV) / Life Remaining Life

Acc. Dep Year Beg BV Salvage Rem. Life Dep Acc. Dep

6,000 2015 40,000 4,000 6 6,000 6,000

12,000 2016 34,000 4,000 5 6,000 6,000

18,000 2017 28,000 4,000 3 8,000 8,000

24,000 2018 20,000 2,000 2 9,000 9,000

30,000 2019 11,000 2,000 1 9,000 9,000

36,000 2020 2,000 2,000 0

years

Salvage Rem. Life Dep Acc. Dep End BV

4,000 6 6,000 6,000 34,000

6,000 5 5,600 11,600 28,400

6,000 6 3,733 15,333 24,667

6,000 5 3,733 19,067 20,933

6,000 4 3,733 22,800 17,200

6,000 3 3,733 26,533 13,467

6,000 2 3,733 30,267 9,733

6,000 1 3,733 34,000 6,000

End BV

34,000

28,000

20,000

11,000

2,000

You might also like

- PSA - Financial Accounting (Question Bank)Document276 pagesPSA - Financial Accounting (Question Bank)Anowar Al Farabi100% (3)

- Amm 3550 - Data Analysis Project Adidas VsDocument8 pagesAmm 3550 - Data Analysis Project Adidas Vsapi-272953906No ratings yet

- Chapter 11Document45 pagesChapter 11LBL_Lowkee100% (3)

- Assets: Director's Letter & Auditor's Notes Flag Major Points Attributed To RiskDocument7 pagesAssets: Director's Letter & Auditor's Notes Flag Major Points Attributed To RiskCH NAIRNo ratings yet

- AssignmentDocument3 pagesAssignmentLEON JOAQUIN VALDEZNo ratings yet

- Book 1Document2 pagesBook 1Ánh MaiNo ratings yet

- Sacco Statistics 2023-FinDocument3 pagesSacco Statistics 2023-FinbmwenjaNo ratings yet

- Sacco Statistics 2023-FinDocument4 pagesSacco Statistics 2023-FinbmwenjaNo ratings yet

- Annual Report 2075 76 EnglishDocument200 pagesAnnual Report 2075 76 Englishram krishnaNo ratings yet

- SD Weekly September 2020Document10 pagesSD Weekly September 2020hendri rudiansyahNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueIkhlas SadiminNo ratings yet

- Money in Dotn/Grant Fees Other 638,335: Essi Ledger-February, 2016Document3 pagesMoney in Dotn/Grant Fees Other 638,335: Essi Ledger-February, 2016rico vanNo ratings yet

- Annual Report 2021 22 OracleDocument200 pagesAnnual Report 2021 22 Oracleraki090No ratings yet

- Study Id28566 Soap and Bath Product Consumption in The United Kingdom Kantar Media TgiDocument50 pagesStudy Id28566 Soap and Bath Product Consumption in The United Kingdom Kantar Media Tginusrat sadiaNo ratings yet

- LA 2 Construction Contracts PDFDocument3 pagesLA 2 Construction Contracts PDFliliNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- JTM Quick Facts 2019 - 15august2019Document2 pagesJTM Quick Facts 2019 - 15august2019Ezran FarquharNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- (W3) ANS-Tutorial PPE Initial RecognitionDocument3 pages(W3) ANS-Tutorial PPE Initial RecognitionMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Annual Report 2018 19 24Document89 pagesAnnual Report 2018 19 24ompatelNo ratings yet

- Wipro SFM - CIA1.1 2Document12 pagesWipro SFM - CIA1.1 2Saloni Jain 1820343No ratings yet

- Premium Income - Individaul Life: Year Rs. in MillionDocument3 pagesPremium Income - Individaul Life: Year Rs. in MillionLucifer RegeneratedNo ratings yet

- County Work SessionDocument13 pagesCounty Work SessionBen SchachtmanNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- 011 September 2022Document21 pages011 September 2022John Louie LagunaNo ratings yet

- Construction ContractsDocument5 pagesConstruction ContractsDJ ULRICHNo ratings yet

- Long Term Construction ContractsDocument5 pagesLong Term Construction ContractsDJ ULRICHNo ratings yet

- Spicy Malunggay CookiesDocument19 pagesSpicy Malunggay CookiesChristine Margoux SiriosNo ratings yet

- College Savings CalculatorDocument1 pageCollege Savings CalculatorsrinaldyNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueKipli SNo ratings yet

- Operating Profit: A. Founded in 1892, Calcutta B. C. Chairman/Head-Nusli Wadia D. Managing Director - Varun BerryDocument5 pagesOperating Profit: A. Founded in 1892, Calcutta B. C. Chairman/Head-Nusli Wadia D. Managing Director - Varun BerryVIDHI AGARAIYANo ratings yet

- Tugas Pertemuan 11Document4 pagesTugas Pertemuan 11Hana NadhifaNo ratings yet

- Health Service Delivery Analysis, Hospital & Health Workforce MasterplanDocument13 pagesHealth Service Delivery Analysis, Hospital & Health Workforce MasterplanADB Health Sector GroupNo ratings yet

- New Microsoft Excel WorksheetDocument7 pagesNew Microsoft Excel WorksheetHossain MinhazNo ratings yet

- Rakib Explanation of Funds FormationDocument1 pageRakib Explanation of Funds FormationMd Razwanul Islam RupomNo ratings yet

- Intercompany Sale of Merchandise - AdditionalDocument4 pagesIntercompany Sale of Merchandise - AdditionalJaimell LimNo ratings yet

- Sample MaDocument15 pagesSample MaSineenart SolotNo ratings yet

- No Description Amount Contingency-10% Days From To April May June July August Duration MonthsDocument2 pagesNo Description Amount Contingency-10% Days From To April May June July August Duration MonthsKushan Mayuranga RuphasingheNo ratings yet

- Lembar Jawab Laporan KeuanganDocument10 pagesLembar Jawab Laporan Keuanganricoananta10No ratings yet

- Kekurangan Okt 2016 S/D Februari 2017: September OktoberDocument4 pagesKekurangan Okt 2016 S/D Februari 2017: September OktoberPuskesmas MasbagikNo ratings yet

- Ahmad Fahmi 1707621056 Uas AplikomDocument13 pagesAhmad Fahmi 1707621056 Uas AplikomAhmad FahmiNo ratings yet

- JTM Quick Facts 2019 - 10october2019Document2 pagesJTM Quick Facts 2019 - 10october2019Ezran FarquharNo ratings yet

- Loss CarryforwardDocument1 pageLoss Carryforwardryanclarke628No ratings yet

- CelastroFinanceModel-4.1Document17 pagesCelastroFinanceModel-4.1Seemant SengarNo ratings yet

- Economic Cost and Profit of BeximcoDocument15 pagesEconomic Cost and Profit of BeximcoMamun RashidNo ratings yet

- DataDocument16 pagesDataعثمان سلیمNo ratings yet

- Coffee Report and Outlook April 2023 - ICODocument39 pagesCoffee Report and Outlook April 2023 - ICOsyifa amaliaNo ratings yet

- Solution - Handout - Cash and Cash Equivalents - Inclusions and ExclusionsDocument5 pagesSolution - Handout - Cash and Cash Equivalents - Inclusions and ExclusionsMaricon BerjaNo ratings yet

- L18.12 UTS 1718 v3Document11 pagesL18.12 UTS 1718 v3AnggiNo ratings yet

- Bafacr4X Non-Financial Liabilities: Problem 4.1Document7 pagesBafacr4X Non-Financial Liabilities: Problem 4.1Aga Mathew MayugaNo ratings yet

- Tan Vernon Jay Homework 6Document9 pagesTan Vernon Jay Homework 6ASHANTI JANE EREDIANONo ratings yet

- PDFDocument8 pagesPDFtbnc5nbdqwNo ratings yet

- PERSIJADocument10 pagesPERSIJAricoananta10No ratings yet

- 2017 Fall Solution: Sales BudgetDocument3 pages2017 Fall Solution: Sales BudgetRaam Tha BossNo ratings yet

- Latihan PPEDocument3 pagesLatihan PPEkin primasNo ratings yet

- EKO2 Marsya As - 12ipa3 - 16Document7 pagesEKO2 Marsya As - 12ipa3 - 16Marsya AlyssaNo ratings yet

- Calculo Wacc - AlicorpDocument14 pagesCalculo Wacc - Alicorpludwing espinar pinedoNo ratings yet

- China Oil Crackdown ImpactDocument5 pagesChina Oil Crackdown ImpactBeatriz RosenburgNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- IB Merger ModelDocument12 pagesIB Merger Modelkirihara95100% (1)

- Sap-C Ts4fi 2021Document38 pagesSap-C Ts4fi 2021xuewupsyNo ratings yet

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanNo ratings yet

- Reconstitution of A Partnership Firm - Admission of A PartnerDocument65 pagesReconstitution of A Partnership Firm - Admission of A PartnerPathan KausarNo ratings yet

- Valuations Remvest - ScenarioDocument6 pagesValuations Remvest - ScenarioMoses Nhlanhla MasekoNo ratings yet

- Ais205 June 23Document7 pagesAis205 June 23ediza adha0% (1)

- DocxDocument33 pagesDocxGray Javier0% (1)

- Corporate Finance 3rd Edition Graham Test BankDocument18 pagesCorporate Finance 3rd Edition Graham Test BankRoderick RonidelNo ratings yet

- BaiduDocument29 pagesBaiduidradjatNo ratings yet

- Question Paper Financial Accounting (MB131) : January 2005Document32 pagesQuestion Paper Financial Accounting (MB131) : January 2005Ujwalsagar SagarNo ratings yet

- Exercise For IAS 16 PPEDocument2 pagesExercise For IAS 16 PPENguyễn PhươngNo ratings yet

- Accountancy SQP PDFDocument21 pagesAccountancy SQP PDFSuyash YaduNo ratings yet

- SOLUTION FAR560 - JUN 2016 RevisedDocument9 pagesSOLUTION FAR560 - JUN 2016 RevisedNurul Farahdatul Ashikin RamlanNo ratings yet

- Financial Accounting GlossaryDocument5 pagesFinancial Accounting GlossaryDheeraj SunthaNo ratings yet

- Analysis of Financial StatementDocument23 pagesAnalysis of Financial StatementMohammad Tariq AnsariNo ratings yet

- Group Assignment 2 - Fall 2021 - BlankDocument13 pagesGroup Assignment 2 - Fall 2021 - Blankhalelz69No ratings yet

- ABM103 Final PT En2C - GABILISH CHIPSDocument3 pagesABM103 Final PT En2C - GABILISH CHIPSmae annNo ratings yet

- UntitledDocument9 pagesUntitledPriya NairNo ratings yet

- Daftar Istilah Akuntansi Dalam Bahasa InggrisDocument6 pagesDaftar Istilah Akuntansi Dalam Bahasa InggrisSteven Sher50% (2)

- Cash Flow Estimation MbaDocument27 pagesCash Flow Estimation MbaViolets n' DaisiesNo ratings yet

- 3 Statement Model TemplateDocument16 pages3 Statement Model TemplateDamn SonNo ratings yet

- Financial Services: Topic: Tax Aspects of LeasingDocument10 pagesFinancial Services: Topic: Tax Aspects of LeasingSri NilayaNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Fixed Asset Policy AdvDocument23 pagesFixed Asset Policy Advkamran1983No ratings yet

- CA Inter Taxation Suggested Answer May 2022Document30 pagesCA Inter Taxation Suggested Answer May 2022ileshrathod0No ratings yet

- Prac1: Multiple ChoiceDocument9 pagesPrac1: Multiple ChoiceROMAR A. PIGANo ratings yet

- Chap3 - Benefits, Costs, and DecisionsDocument10 pagesChap3 - Benefits, Costs, and DecisionsAnthony DyNo ratings yet