Professional Documents

Culture Documents

3, Inventory Valuation

3, Inventory Valuation

Uploaded by

clairecstrattonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3, Inventory Valuation

3, Inventory Valuation

Uploaded by

clairecstrattonCopyright:

Available Formats

Class 3:

Inventory Valuation

ACCT 4200 | University of Iowa | Professor Quinto 1 / 20

Variable and Absorption Costing

Variable costing: A method of inventory costing in which all variable

manufacturing costs (direct and indirect) are included as product costs; all fixed

manufacturing costs are excluded from product costs and are instead treated as

costs of the period in which they are incurred

Absorption costing: A method of inventory costing in which all variable

manufacturing costs and all fixed manufacturing costs are included as product

costs; that is, inventory “absorbs” all manufacturing costs

The main difference between Variable Costing and Absorption

Costing is the accounting for fixed manufacturing overhead

ACCT 4200 | University of Iowa | Professor Quinto 2 / 19

Why Do We Need to Allocate Fixed

Manufacturing Overhead (FMOH)?

➢ Required by GAAP (and IFRS)

o Absorption Costing aka Full Costing

aka Gross Margin Format

➢ Allocation of FMOH to

individual units of each product

is required to determine the The matching

Financial Accounting

value of inventory principle states

that all expenses

o Matching principle ⇒ A product’s value must be matched

should be the sum of the costs of Direct to the revenues

Materials, Direct Labor, and the they help to

Manufacturing Overhead that it uses up generate

ACCT 4200 | University of Iowa | Professor Quinto 3 / 20

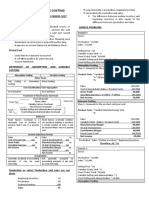

Absorption Costing: Example

Item Amount Income Statement

Sales

Opening inventory 0

Less: Cost of goods sold

Units made 20,000

Gross margin

Units sold 17,000 Less: SG&A expenses

Selling price per unit $690 Net income (loss)

Variable materials cost per unit $295

Variable labor cost per unit $75

Variable SG&A expenses per unit sold $24 Cost of goods sold SG&A expenses

Total FMOH $2,800,000 DM Variable SG&A

Total fixed SG&A expenses $2,520,000 DL

Fixed SG&A

FMOH

SG&A expenses

Note: Costs are allocated based on number of units Cost of goods sold

ACCT 4200 | University of Iowa | Professor Quinto 4 / 20

Absorption Costing: Example

Item Amount Balance Sheet

Inventory

Opening inventory 0

Units made 20,000

Units sold 17,000 Inventory

DM per unit

Selling price per unit $690

DL per unit

Variable materials cost per unit $295

FMOH per unit

Variable labor cost per unit $75

Inventoriable cost per unit

Variable SG&A expenses per unit sold $24

x Units in ending inventory

Total FMOH $2,800,000

Inventory cost

Total fixed SG&A expenses $2,520,000

Note: Costs are allocated based on number of units

ACCT 4200 | University of Iowa | Professor Quinto 5 / 20

Absorption Costing: Example

Units produced FMOH

Units in FMOH allocated

Inventory, to Inventory,

3,000 , 15% $420,000 , 15%

Units in FMOH allocated

COGS, to COGS,

17,000 , 85% $2,380,000 , 85%

ACCT 4200 | University of Iowa | Professor Quinto 6 / 20

Internal Reporting of FMOH

➢ For internal reporting purposes, a firm might use a different

method

➢ For example, a firm might immediately expense FMOH, rather

than allocating it to individual units

aka Direct Costing

o This method is known as Variable Costing

aka Contribution Margin Format

• Not permitted under GAAP

o Recognizes the non-controllability of FMOH in the short term

o May be useful from a decision-making perspective (at least in the short run)

ACCT 4200 | University of Iowa | Professor Quinto 7 / 20

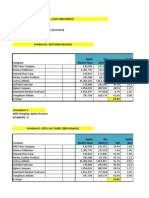

Variable Costing: Example

Item Amount Income Statement

Sales

Opening inventory 0

Less: Variable costs

Units made 20,000

Contribution margin

Units sold 17,000 Less: Fixed costs

Selling price per unit $690 Net income (loss)

Variable materials cost per unit $295

Variable labor cost per unit $75

Variable SG&A expenses per unit sold $24 Variable costs Fixed costs

Total FMOH $2,800,000 DM Fixed MOH

Total fixed SG&A expenses $2,520,000 DL Fixed SG&A

Variable SG&A Fixed costs

Note: Costs are allocated based on number of units

Drives the difference in net

Variable costs

income under Absorption

Costing vs. Variable Costing

ACCT 4200 | University of Iowa | Professor Quinto 8 / 20

Variable Costing: Example

Item Amount Balance Sheet

Inventory

Opening inventory 0

Units made 20,000

Units sold 17,000 Inventory

DM per unit

Selling price per unit $690

DL per unit

Variable materials cost per unit $295

Inventoriable cost per unit

Variable labor cost per unit $75

x Units in ending inventory

Variable SG&A expenses per unit sold $24

Inventory cost

Total FMOH $2,800,000

Total fixed SG&A expenses $2,520,000

Note: Costs are allocated based on number of units

ACCT 4200 | University of Iowa | Professor Quinto 9 / 20

Variable Costing: Example

Units produced FMOH

Units in FMOH allocated

Inventory, to Inventory, $0 ,

3,000 , 15% 0%

Units in FMOH allocated to

COGS, COGS, $2,800,000 ,

17,000 , 85% 100%

ACCT 4200 | University of Iowa | Professor Quinto 10 / 20

Reconciling Absorption and Variable Costing

Reconciliation

Net income under Variable Costing

Add: FMOH costs in Ending Inventory*

Less: FMOH costs in Beginning Inventory

Net income under Absorption Costing

Timing difference

*FMOH costs in Ending Inventory

Units in ending inventory

FMOH per unit

FMOH costs in Ending Inventory

ACCT 4200 | University of Iowa | Professor Quinto 11 / 20

Reconciling Absorption and Variable Costing

If Inventory … Then Why?

Increases AC net income > VC net income Under AC, we put some current-period FMOH into

(production > sales) inventory. Conversely, under VC, we expense all

current-period FMOH. Therefore, AC has less FMOH

expensed in the income statement than VC.

No change AC net income = VC net income There is no change in the amount of FMOH in

(production = sales) inventory. Therefore, the amount of FMOH expensed

in the income statement is the same under AC and VC.

Decreases AC net income < VC net income Under AC, we expense FMOH from prior periods when

(production < sales) the inventory is sold. Therefore, under AC, we expense

all current-period FMOH as well as some prior-period

FMOH. Conversely, under VC, we only expense

current-period FMOH. Consequently, AC has more

FMOH expensed in the income statement than VC.

Note: These relations may not hold 100% of the time in a multi-product company

ACCT 4200 | University of Iowa | Professor Quinto 12 / 20

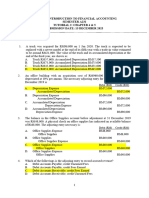

Absorption & Variable Costing: Practice

Year 1 Year 2

Bhattacharya Inc. manufactures lighting fixtures for

Beginning inventory (units) 0

sale in big-box stores such as Walmart and Home

Depot. The tabulated data pertain to its operations Units produced 2,000 1,700

in the most recent two years. Units sold 1,800

Required: Prepare an income statement for Ending inventory (units) 0

Bhattacharya Inc. using the following methods:

1) Absorption Costing Per unit

2) Variable Costing Selling price $120

Then, reconcile the two net incomes. Variable manufacturing costs $40

Hint: Assume that … Variable SG&A $30

• Overhead is allocated based on number of units FMOH $42,500

• All overhead is fixed Fixed SG&A $35,000

• The overhead rate is computed annually

ACCT 4200 | University of Iowa | Professor Quinto 13 / 20

Absorption & Variable Costing: Practice

Income Statement: Absorption Costing Year 1 Year 2

Year 1 Year 2

Beginning inventory (units) 0

Sales

Units produced 2,000 1,700

Less: Cost of goods sold

Gross margin Units sold 1,800

Less: SG&A expenses Ending inventory (units) 0

Net income (loss)

Per unit

SG&A expenses

Selling price $120

Cost of goods sold Year 1 Year 2

Variable manufacturing costs $40

Year 1 Year 2 Variable SG&A

Variable SG&A $30

Variable

manufacturing Fixed SG&A FMOH $42,500

SG&A expenses Fixed SG&A $35,000

FMOH

Cost of goods sold

ACCT 4200 | University of Iowa | Professor Quinto 14 / 20

Absorption & Variable Costing: Practice

Income Statement: Variable Costing Year 1 Year 2

Year 1 Year 2

Beginning inventory (units) 0

Sales

Units produced 2,000 1,700

Less: Variable costs

Contribution margin Units sold 1,800

Less: Fixed costs Ending inventory (units) 0

Net income (loss)

Per unit

Variable costs

Selling price $120

Year 1 Year 2

Fixed costs Variable manufacturing costs $40

Variable

manufacturing Year 1 Year 2 Variable SG&A $30

Fixed MOH FMOH $42,500

Variable SG&A

Fixed SG&A Fixed SG&A $35,000

Variable costs Fixed costs

ACCT 4200 | University of Iowa | Professor Quinto 15 / 20

Absorption & Variable Costing: Practice

Reconciliation Year 1 Year 2

Net income under Variable Costing

Add: FMOH costs in Ending Inventory*

Less: FMOH costs in Beginning Inventory

Net income under Absorption Costing

*FMOH costs in Ending Inventory Year 1 Year 2

Units in ending inventory

FMOH per unit

FMOH costs in ending inventory

ACCT 4200 | University of Iowa | Professor Quinto 16 / 20

The Effect of Absorption Costing on Incentives

➢ Both sales and production affect net income

➢ The manager can increase income in the current period by

increasing production

o More overhead is assigned to inventory instead of being reported as expenses

in the current period

o But the effect is temporary—overhead in inventory is expensed when the

inventory is sold

⇒ Absorption costing may contribute to managerial myopia,

where long-term value is sacrificed to meet short-term goals

ACCT 4200 | University of Iowa | Professor Quinto 17 / 20

The Effect of Absorption Costing on Incentives

➢ “Earnings slightly less than zero

occur much less frequently than

would be expected given the

smoothness of the remainder of

the distribution,” Burgstahler

and Dichev (1997)

o Suggests that managers engage in

earnings management to meet

earnings targets

ACCT 4200 | University of Iowa | Professor Quinto 18 / 20

The Effect of Absorption Costing on

Incentives

➢ How can we control the incentive to over-produce?

o Complicated issue because it’s difficult to discern whether inventory is being

built up because:

1. The manager is acting opportunistically, i.e., over-producing to boost current-period profits

2. The manager is acting in the interests of the company, i.e., producing the correct amount

of inventory to meet future demand

o Some ideas:

ACCT 4200 | University of Iowa | Professor Quinto 19 / 20

Before Our Next Class …

➢ Read Chapter 4

➢ Print notes on ICON

ACCT 4200 | University of Iowa | Professor Quinto 20 / 20

You might also like

- Section 1 - 5Document18 pagesSection 1 - 5Shiela78% (9)

- Lecture 3 Costing and Costing TechniquesDocument43 pagesLecture 3 Costing and Costing TechniquesehsanNo ratings yet

- A Levels Accounting Notes PDFDocument207 pagesA Levels Accounting Notes PDFLeanne Teh100% (4)

- CH 06 SMDocument94 pagesCH 06 SMapi-234680678No ratings yet

- Homework Assignment DoneDocument6 pagesHomework Assignment DoneKezia N. ApriliaNo ratings yet

- Level 3 Costing & MA Text Update June 2021pdfDocument125 pagesLevel 3 Costing & MA Text Update June 2021pdfAmi KayNo ratings yet

- Bookkeeping 101Document4 pagesBookkeeping 101bjaykc_46100% (1)

- Marginal Costing & Absorption CostingDocument56 pagesMarginal Costing & Absorption CostingHoàng Phương ThảoNo ratings yet

- Qualifying Exam Reviewer Basic Accounting StudentDocument10 pagesQualifying Exam Reviewer Basic Accounting StudentAngelica Postre100% (1)

- Session Objectives:: Methods of Costing?Document15 pagesSession Objectives:: Methods of Costing?Sachin YadavNo ratings yet

- Absorption (Full Costing) Variable (Direct Costing)Document4 pagesAbsorption (Full Costing) Variable (Direct Costing)Leo Sandy Ambe CuisNo ratings yet

- Variable CostingDocument10 pagesVariable Costingrodell pabloNo ratings yet

- Absorption and Variable CostingDocument3 pagesAbsorption and Variable CostingDhona Mae FidelNo ratings yet

- D - Absorption and Variable CostingDocument5 pagesD - Absorption and Variable Costingian dizonNo ratings yet

- 006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecDocument25 pages006 Camist Ch04 Amndd Hs PP 79-102 Branded BW RP SecMd Salahuddin HowladerNo ratings yet

- IWB Chapter 5 - Marginal and Absorption CostingDocument28 pagesIWB Chapter 5 - Marginal and Absorption Costingjulioruiz891No ratings yet

- Absorption and Variable CostingDocument1 pageAbsorption and Variable Costingqrrzyz7whgNo ratings yet

- 3MA 03 Absortion and Variable CostingDocument3 pages3MA 03 Absortion and Variable CostingAbigail Regondola BonitaNo ratings yet

- SIM - Variable and Absorption Costing - 0Document5 pagesSIM - Variable and Absorption Costing - 0lilienesieraNo ratings yet

- Contribution Approach 2Document16 pagesContribution Approach 2kualler80% (5)

- Absorption and Variable CostingDocument5 pagesAbsorption and Variable CostingKIM RAGANo ratings yet

- Topic 7 - Absorption & Marginal CostingDocument8 pagesTopic 7 - Absorption & Marginal CostingMuhammad Alif100% (5)

- Chapter 7Document12 pagesChapter 7Camille GarciaNo ratings yet

- BFD Class NotesDocument20 pagesBFD Class NotesAnas KhanNo ratings yet

- Absorption and Variable Costing ReviewDocument13 pagesAbsorption and Variable Costing ReviewRodelLabor100% (1)

- Mas-03: Absorption & Variable CostingDocument4 pagesMas-03: Absorption & Variable CostingClint AbenojaNo ratings yet

- 04 Variable and Absorption CostingDocument8 pages04 Variable and Absorption CostingJunZon VelascoNo ratings yet

- Absorption Vs VariableDocument10 pagesAbsorption Vs VariableRonie Macasabuang CardosaNo ratings yet

- Presentation - Chapter3 & 9Document49 pagesPresentation - Chapter3 & 9rajeshaisdu009No ratings yet

- Absorption Variable Costing1Document3 pagesAbsorption Variable Costing1Jasmine LimNo ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- (Cpar2017) Mas-8205 (Product Costing) PDFDocument12 pages(Cpar2017) Mas-8205 (Product Costing) PDFSusan Esteban Espartero50% (2)

- Module 4 Absorption and Variable Costing NotesDocument3 pagesModule 4 Absorption and Variable Costing NotesMadielyn Santarin Miranda100% (3)

- MAS 04 Absorption CostingDocument6 pagesMAS 04 Absorption CostingJoelyn Grace MontajesNo ratings yet

- BBA211 Vol5 Marginal&AbsortptionCostingDocument15 pagesBBA211 Vol5 Marginal&AbsortptionCostingAnisha SarahNo ratings yet

- Absorption Costing GclassDocument4 pagesAbsorption Costing GclassDoromal, Jerome A.No ratings yet

- Mas 9404 Product CostingDocument11 pagesMas 9404 Product CostingEpfie SanchesNo ratings yet

- Management Accounting Absorption and Variable Costing Absorption CostingDocument10 pagesManagement Accounting Absorption and Variable Costing Absorption CostingnaddieNo ratings yet

- A Level Accounting NotesDocument16 pagesA Level Accounting NotesChaiwatTippuwananNo ratings yet

- Notes and Summary in Product Costing With QuizzerDocument12 pagesNotes and Summary in Product Costing With QuizzerCykee Hanna Quizo LumongsodNo ratings yet

- F2-08 Absorption and Marginal CostingDocument16 pagesF2-08 Absorption and Marginal CostingJaved ImranNo ratings yet

- Information For Decision MakingDocument33 pagesInformation For Decision Makingwambualucas74No ratings yet

- Chapter 4 - Marginal CostingDocument14 pagesChapter 4 - Marginal Costingphithuhang2909No ratings yet

- Overview of Absorption and Variable CostingDocument5 pagesOverview of Absorption and Variable CostingJarrelaine SerranoNo ratings yet

- 07 Module 03 AVC PDFDocument12 pages07 Module 03 AVC PDFMarriah Izzabelle Suarez RamadaNo ratings yet

- 3 Absorption Vs Variable CostingDocument16 pages3 Absorption Vs Variable CostingXyril MañagoNo ratings yet

- MI Synopsis PDFDocument54 pagesMI Synopsis PDFTaufik AhmmedNo ratings yet

- Module 5-Variable and Absorption CostingDocument13 pagesModule 5-Variable and Absorption CostingAna ValenovaNo ratings yet

- Chapter 7Document4 pagesChapter 7Mixx MineNo ratings yet

- General Discussion Absorption Costing Variable Costing: FixedDocument4 pagesGeneral Discussion Absorption Costing Variable Costing: FixedHassan KhanNo ratings yet

- Costman Variable CostingDocument2 pagesCostman Variable CostingJeremi BernardoNo ratings yet

- MAS Product Costing Part IDocument2 pagesMAS Product Costing Part IMary Dale Joie BocalaNo ratings yet

- Variable & Absorption Costing LectureDocument11 pagesVariable & Absorption Costing LectureElisha Dhowry PascualNo ratings yet

- Ias 2Document47 pagesIas 2waqas ahmadNo ratings yet

- Variable and Absorption CostingDocument21 pagesVariable and Absorption Costingbrabz rayNo ratings yet

- Variable Costing CRDocument21 pagesVariable Costing CRMary Rose GonzalesNo ratings yet

- Management Accounting NotesDocument212 pagesManagement Accounting NotesFrank Chinguwo100% (1)

- Absorption Costing Vs Variable CostingDocument20 pagesAbsorption Costing Vs Variable CostingMa. Alene MagdaraogNo ratings yet

- SCM Unit 4 Variable and Absorption CostingDocument9 pagesSCM Unit 4 Variable and Absorption CostingMargie Garcia LausaNo ratings yet

- Exercise 2Document3 pagesExercise 2Kathy LaiNo ratings yet

- MS103 SendingDocument3 pagesMS103 SendingEthel Joy Tolentino GamboaNo ratings yet

- MS Absorption-and-Variable-CostingDocument2 pagesMS Absorption-and-Variable-Costingkalloni.zoeNo ratings yet

- Cost Two IIDocument65 pagesCost Two IIAbdi Mucee TubeNo ratings yet

- Lecture-9.1 Variable & Absorption Costing PDFDocument24 pagesLecture-9.1 Variable & Absorption Costing PDFNazmul-Hassan Sumon100% (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Chapter Five: Audit Planning and Types of Audit TestsDocument42 pagesChapter Five: Audit Planning and Types of Audit TestsJade BelenNo ratings yet

- B Com (Hons) Semester System Course Outline PDFDocument98 pagesB Com (Hons) Semester System Course Outline PDFSanwal Faheem Afsar KhanNo ratings yet

- Ias 16 Property Plant EquipmentDocument4 pagesIas 16 Property Plant Equipmentfaisal_zuhri100% (1)

- Accounts InternalDocument6 pagesAccounts Internalaarav balujaNo ratings yet

- Chapter 1 AuditDocument13 pagesChapter 1 AuditMisshtaC100% (1)

- Company Name Most Recent Fiscal Year Date of Coverage AnalystDocument79 pagesCompany Name Most Recent Fiscal Year Date of Coverage AnalystPassmore DubeNo ratings yet

- Manufacturing Accounts FormatDocument7 pagesManufacturing Accounts Formatlaguda babajide100% (10)

- Ceo or Coo or CfoDocument2 pagesCeo or Coo or Cfoapi-121403662No ratings yet

- Types of Financial Statements: Statement of Profit or Loss (Income Statement)Document4 pagesTypes of Financial Statements: Statement of Profit or Loss (Income Statement)LouiseNo ratings yet

- Ibs Gemas 1 30/09/21Document10 pagesIbs Gemas 1 30/09/21HEMA A/P K.RAMU MoeNo ratings yet

- Application of F-Score in Predicting Fraud Errors PDFDocument21 pagesApplication of F-Score in Predicting Fraud Errors PDFBinh Dang ThaiNo ratings yet

- Group19 Mercury AthleticDocument11 pagesGroup19 Mercury AthleticpmcsicNo ratings yet

- CH - 0 - Audit - BasicsDocument21 pagesCH - 0 - Audit - BasicsEkansh AgarwalNo ratings yet

- X120 Cslides 19Document19 pagesX120 Cslides 19Jowelyn Cabilleda AriasNo ratings yet

- Chap 4 CVPDocument60 pagesChap 4 CVPManju SreeNo ratings yet

- Framework For Business Analysis and Valuation Using Financial StatementsDocument9 pagesFramework For Business Analysis and Valuation Using Financial StatementsDikaGustianaNo ratings yet

- Index of SEC Memo CircularsDocument7 pagesIndex of SEC Memo Circulars武當No ratings yet

- Cost Acconting IV Sem BBA Full BookDocument180 pagesCost Acconting IV Sem BBA Full Bookprachee goyalNo ratings yet

- Course Structure - BfiaDocument2 pagesCourse Structure - BfiaAmity-elearningNo ratings yet

- Kelompok 8 - Tugas Audit SimulationDocument68 pagesKelompok 8 - Tugas Audit SimulationDhimas Satria WirakusumaNo ratings yet

- Unitech Annual Report 2010 11Document114 pagesUnitech Annual Report 2010 11Akash SinghNo ratings yet

- Bkaf1023: Introduction To Financial Accounting Semester A231 Tutorial 2: Chapter 4 & 5 Submission Date: 15 December 2023Document12 pagesBkaf1023: Introduction To Financial Accounting Semester A231 Tutorial 2: Chapter 4 & 5 Submission Date: 15 December 2023chenwei gohNo ratings yet

- Ias 23Document6 pagesIas 23faridaNo ratings yet

- TufDocument14 pagesTufHoàng VũNo ratings yet