Professional Documents

Culture Documents

Additional Solution

Additional Solution

Uploaded by

freaann03Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Solution

Additional Solution

Uploaded by

freaann03Copyright:

Available Formats

EXERCISE 6

1

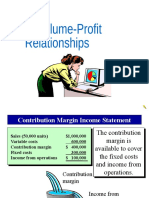

Sales ₱600,000

Variable Expenses 420,000

Contibution Margin ₱180,000

Fixed Expenses 150,000

Operating Income ₱30,000

Selling Price ₱40

Variable Cost ₱28

Fixed Cost

BEP (units) =

(Selling Price/unit - Variable Cost / unit)

BEP (units) = ₱150,000

₱40 - ₱28

BEP (units) = ₱150,000

₱12

BEP (units) = 12,500 units

Fixed Cost

BEP (pesos) =

1- (Variable Expenses / Sales)

BEP (pesos) = ₱150,000

1- (₱420,000 / ₱600,000)

BEP (pesos) = ₱150,000

1- (0.7)

BEP (pesos) = ₱150,000

0.3

BEP (pesos) = ₱500,000

BEP (pesos) = BEP (units) x selling price/unit

BEP (pesos) = 12,500 units x ₱40/unit

BEP (pesos) = ₱500,000

EXERCISE 7

1

Per Unit

Selling Price ₱75.00

Variable Expenses 45.00

Contribution Margin 30.00

Current Monthly Sales:

Sales ₱75 x 3,000 units = ₱225,000

Variable Expenses ₱225,000 x 60% = ₱135,000

Contribution Margin ₱225,000 x 40% = ₱90,000

Fixed Expenses (given) = ₱75,000

Sales with Additional Advertising Budget:

Sales ₱225,000 + ₱15,000 = ₱240,000

Variable Expenses ₱240,000 x 60% = ₱144,000

Contribution Margin ₱240,000 x 40% = ₱96,000

Fixed Expenses ₱75,000 + ₱8,000 = ₱ 83,000

2

Sales with an Increased Variable Cost

Sales 3,000 x 115% = 3,450 units x ₱75/unit= ₱258

Variable Expenses ₱258,750 x 64% = ₱165,600

Contribution Margin ₱258,750 x 36% = ₱258,750 x 64 = ₱93,150

Fixed Expenses ₱75,000

New Ratio of Variable Expenses over sales

[₱75/( ₱45+ ₱3)]100 = 64%

New Ratio of Contribution Margin over sales

100% - 64% = 36%

Percent of Sales:

100%

60%

40%

000 units = ₱225,000

x 60% = ₱135,000

x 40% = ₱90,000

+ ₱15,000 = ₱240,000

x 60% = ₱144,000

x 40% = ₱96,000

+ ₱8,000 = ₱ 83,000

15% = 3,450 units x ₱75/unit= ₱258,750

x 64% = ₱165,600

x 36% = ₱258,750 x 64 = ₱93,150

EXERCISE 8

You might also like

- Tutorial ContDocument25 pagesTutorial ContJJ Rivera75% (4)

- Chapter 4 Cost Volume Profit AnalysisDocument12 pagesChapter 4 Cost Volume Profit AnalysisItzi Estrella100% (3)

- Lesson 1-4 Cost - Volume-Profit AnalysisDocument13 pagesLesson 1-4 Cost - Volume-Profit AnalysisClaire BarbaNo ratings yet

- Tugas CH 7 - Amelia Zulaikha PDocument3 pagesTugas CH 7 - Amelia Zulaikha Pamelia zulaikha100% (1)

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Chap 12Document13 pagesChap 12freaann03No ratings yet

- CVP ExercisesDocument10 pagesCVP ExercisesDaiane AlcaideNo ratings yet

- Roxas Seatwork-4Document14 pagesRoxas Seatwork-4Ronna Mae RedublaNo ratings yet

- 4 Lecture - CVP AnalysisDocument34 pages4 Lecture - CVP AnalysisDorothy Enid AguaNo ratings yet

- CVP AnalysisDocument2 pagesCVP AnalysisRikki Mae TeofistoNo ratings yet

- Chapter # 8 Exercise & Problems - AnswersDocument8 pagesChapter # 8 Exercise & Problems - AnswersZia UddinNo ratings yet

- Requirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)Document4 pagesRequirement 1 Total Per Unit: Banitog, Brigitte C. BSA 211 Exercise 1 (Contribution Format Income Statement)MyunimintNo ratings yet

- Chapter 12 Ap 12Document3 pagesChapter 12 Ap 12freaann03No ratings yet

- SCM Chap 3 Probs 1-3Document4 pagesSCM Chap 3 Probs 1-3aj dumpNo ratings yet

- Unit 8 MC CVP Analysis Solutions 3Document32 pagesUnit 8 MC CVP Analysis Solutions 3Ankit AgarwalNo ratings yet

- Biaya Variabe Harga Jual $ 7 $ 20Document6 pagesBiaya Variabe Harga Jual $ 7 $ 20Shelley TaniaNo ratings yet

- Chapter 13 ExcelDocument42 pagesChapter 13 ExcelMd Al Alif Hossain 2121155630No ratings yet

- Practical Problems & Solutions Class Work Upto IL.10Document20 pagesPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodNo ratings yet

- PRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2CDocument2 pagesPRACTICE PROBLEMS in CVP ANALYSIS - Boter - Jesseca - BSA-2ClalalalaNo ratings yet

- Break Even Analysis and Managerial Decision MakingDocument12 pagesBreak Even Analysis and Managerial Decision MakingkunalNo ratings yet

- Lab CH 7Document4 pagesLab CH 7bella100% (1)

- Break-Even Analysis (Single Product)Document1 pageBreak-Even Analysis (Single Product)Rikki Mae TeofistoNo ratings yet

- Nguyễn Khánh Hiền - additional exerciseDocument8 pagesNguyễn Khánh Hiền - additional exerciseANH NGUYEN THI THUYNo ratings yet

- CHAPTER 12 Exercise 345Document6 pagesCHAPTER 12 Exercise 345freaann03No ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAzumi RaeNo ratings yet

- PT IbnuDocument1 pagePT IbnuEVI MARIA SIBUEANo ratings yet

- Chapter 12 Exercise 11Document7 pagesChapter 12 Exercise 11freaann03No ratings yet

- Stratma 3.2Document2 pagesStratma 3.2Patrick AlvinNo ratings yet

- Contribution Margin: Enter The Appropriate Amount in The Shaded Cells in Columns C and EDocument16 pagesContribution Margin: Enter The Appropriate Amount in The Shaded Cells in Columns C and EJames BagsicNo ratings yet

- Ass 1 CVPDocument21 pagesAss 1 CVPJorniNo ratings yet

- Answers To Final Exam Revision Practice QDocument5 pagesAnswers To Final Exam Revision Practice QMinSu YangNo ratings yet

- BA 115 2nd Module Exercise Analysis 1Document14 pagesBA 115 2nd Module Exercise Analysis 1Koi CallejaNo ratings yet

- Jawaban Jawaban Soal 1: Asst. Bagus, Elvira, & YogiDocument4 pagesJawaban Jawaban Soal 1: Asst. Bagus, Elvira, & YogiRavanellyNo ratings yet

- Solution Post-Test4Document5 pagesSolution Post-Test4Shienell PincaNo ratings yet

- Case Analysis - Tip-Top Toy Comp.Document12 pagesCase Analysis - Tip-Top Toy Comp.Charlene Esparcia100% (1)

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet

- Kelompok 1 - CVP Analysis - Akmen (A4)Document20 pagesKelompok 1 - CVP Analysis - Akmen (A4)Yuliana RiskaNo ratings yet

- Break Even Analysis and Managerial Decision Making: Barnali ChakladerDocument12 pagesBreak Even Analysis and Managerial Decision Making: Barnali ChakladerAshwin DalelaNo ratings yet

- Ch17 - Guan CM - AISEDocument40 pagesCh17 - Guan CM - AISEIassa MarcelinaNo ratings yet

- SME2001-Midterm 2 Practice Problem & Solution, Multi-Prod CVP Target Profit, Point of Indifference, V (3.4) - RBDocument10 pagesSME2001-Midterm 2 Practice Problem & Solution, Multi-Prod CVP Target Profit, Point of Indifference, V (3.4) - RBSwapan Kumar SahaNo ratings yet

- APMATH FormulasDocument89 pagesAPMATH FormulasLariza PadrinaoNo ratings yet

- CVP AnalysisDocument40 pagesCVP AnalysisFatima's WorldNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseKhiks ObiasNo ratings yet

- BMC Limited: Calculation of Fixed Elements of Each Component CostsDocument6 pagesBMC Limited: Calculation of Fixed Elements of Each Component CostsHumphrey OsaigbeNo ratings yet

- Pertemuan 10Document7 pagesPertemuan 10jennifer christieNo ratings yet

- 3 Nov Cost-Volume - Profit Analysis - QusetionsDocument44 pages3 Nov Cost-Volume - Profit Analysis - QusetionsAbhinavNo ratings yet

- Managerial Accounting Class Exercise1Document3 pagesManagerial Accounting Class Exercise1risvana rahimNo ratings yet

- Queens CollegeDocument8 pagesQueens CollegeKALKIDAN KASSAHUNNo ratings yet

- Tugas Akuntansi ManajemenDocument3 pagesTugas Akuntansi ManajemenThera MonicaNo ratings yet

- CVP Analysis in One ProductDocument6 pagesCVP Analysis in One ProductShaira GampongNo ratings yet

- Solution Post-Test3Document6 pagesSolution Post-Test3Shienell PincaNo ratings yet

- Assgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Document10 pagesAssgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Agung Rizal DewantoroNo ratings yet

- Summary CH 3Document2 pagesSummary CH 3JOSHNo ratings yet

- Accounting 202 Chapter 7 NotesDocument15 pagesAccounting 202 Chapter 7 NotesnitinNo ratings yet

- Managerial Accounting-Solutions To Ch05Document4 pagesManagerial Accounting-Solutions To Ch05Mohammed HassanNo ratings yet

- Break Even PointDocument20 pagesBreak Even PointVannoj AbhinavNo ratings yet

- CVP ExerciseDocument7 pagesCVP ExerciseKhiks ObiasNo ratings yet

- CVP Analysis: PG D M2 0 21-23 RelevantreadingsDocument21 pagesCVP Analysis: PG D M2 0 21-23 RelevantreadingsAthi SivaNo ratings yet

- Cost Accounting Exercise-11Document5 pagesCost Accounting Exercise-11Ki xxiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 12 Exercise 11Document7 pagesChapter 12 Exercise 11freaann03No ratings yet

- Chapter 12 Exercise 1 21Document5 pagesChapter 12 Exercise 1 21freaann03No ratings yet

- Chapter 14 Exercises 34Document7 pagesChapter 14 Exercises 34freaann03No ratings yet

- Chapter 14 Problem 12Document6 pagesChapter 14 Problem 12freaann03No ratings yet

- Chapter 14 Exercise 12Document7 pagesChapter 14 Exercise 12freaann03No ratings yet

- Art MovementsDocument26 pagesArt Movementsfreaann03No ratings yet

- Ets 1-2 LRCDocument44 pagesEts 1-2 LRChieutn3No ratings yet

- Page 40 - List of Codes Not Eligible For Section 44ADDocument49 pagesPage 40 - List of Codes Not Eligible For Section 44ADca.sharatbrNo ratings yet

- MGT80002 Business Strategy Topic 4 Designing StrategyDocument17 pagesMGT80002 Business Strategy Topic 4 Designing StrategyWizky OnNo ratings yet

- Cir V Benguet DigestDocument1 pageCir V Benguet DigestAgnes GamboaNo ratings yet

- Integrated Report 2021 - AjinomotoDocument107 pagesIntegrated Report 2021 - AjinomotoyulianaNo ratings yet

- Chapter 6 Construction AdministrationDocument66 pagesChapter 6 Construction AdministrationVũ Thị Hà TrangNo ratings yet

- Financial and Managerial Accounting 7th Edition Wild Test BankDocument35 pagesFinancial and Managerial Accounting 7th Edition Wild Test Bankmatildaamelinda25o3100% (31)

- Marginal Costing Problems OnlyDocument6 pagesMarginal Costing Problems OnlyBharat ThackerNo ratings yet

- Kelompok 9 - Tugas Translasi Higiene IndustriDocument5 pagesKelompok 9 - Tugas Translasi Higiene IndustriEvellyn PangaribuanNo ratings yet

- Competitor Analysis of ColgateDocument4 pagesCompetitor Analysis of ColgateJiawei Lee100% (3)

- Example Business Profit and Economic ProfitDocument2 pagesExample Business Profit and Economic Profitmaria isabellaNo ratings yet

- Machining & Manufacturing Cost Estimation, Quotes, and Rates PDFDocument21 pagesMachining & Manufacturing Cost Estimation, Quotes, and Rates PDFkali50No ratings yet

- Molty Foam PakistanDocument8 pagesMolty Foam Pakistankiranbakhtawar10No ratings yet

- Araling Panlipunan: Self-Learning ModuleDocument22 pagesAraling Panlipunan: Self-Learning ModuleKerth Galagpat75% (4)

- Lower of Cost and Net Realizable ValueDocument3 pagesLower of Cost and Net Realizable ValueMae Loto100% (1)

- HSE Form No.8 Warning Notice - 1Document8 pagesHSE Form No.8 Warning Notice - 1Myungki OhNo ratings yet

- Material 1 (Writing Good Upwork Proposals)Document3 pagesMaterial 1 (Writing Good Upwork Proposals)OvercomerNo ratings yet

- Jefferies-Global Secondary Market Review-January 2023Document10 pagesJefferies-Global Secondary Market Review-January 2023Chuan JiNo ratings yet

- Pepper VA Survival GuideDocument17 pagesPepper VA Survival GuidemfaglaNo ratings yet

- Implementation Process of Apple IncDocument7 pagesImplementation Process of Apple Incsardar hussainNo ratings yet

- 6.daily Delivery ReportDocument3 pages6.daily Delivery ReportSridhar KodaliNo ratings yet

- Merger AND It'S TypesDocument14 pagesMerger AND It'S TypesSachinGoelNo ratings yet

- Ficha Técnica FilmTec BW30XFR 400 34Document3 pagesFicha Técnica FilmTec BW30XFR 400 34Daniel HernándezNo ratings yet

- CHP 1 Entrepreneurial Opportunities Class 12Document4 pagesCHP 1 Entrepreneurial Opportunities Class 12Madhan VeluNo ratings yet

- Crafting & Executing Strategy Chapter 1 SummaryDocument33 pagesCrafting & Executing Strategy Chapter 1 SummaryTruc Tran100% (4)

- Cost Accounting: University of CalicutDocument208 pagesCost Accounting: University of CalicutSilsilath ShamzudinNo ratings yet

- Shera - End User Price List FY23Document1 pageShera - End User Price List FY23Anggita Arief FebriandiaNo ratings yet

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- The Beacon Group Welcomes Ganesh Peruvemba As Director in The Industrial Technology PracticeDocument2 pagesThe Beacon Group Welcomes Ganesh Peruvemba As Director in The Industrial Technology PracticePR.comNo ratings yet

- The Siaya County Water and Sanitation Bill 2018Document29 pagesThe Siaya County Water and Sanitation Bill 2018Dennis MwangiNo ratings yet