Professional Documents

Culture Documents

(Tds) .Tds ए .: What is TDS (Tax Deducted at Source) ?

(Tds) .Tds ए .: What is TDS (Tax Deducted at Source) ?

Uploaded by

Neha MahajanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Tds) .Tds ए .: What is TDS (Tax Deducted at Source) ?

(Tds) .Tds ए .: What is TDS (Tax Deducted at Source) ?

Uploaded by

Neha MahajanCopyright:

Available Formats

(TDS)

(TDS) .TDS ए

.

,

(TDS) ऐ

.

ए . ए

.

What is TDS (Tax Deducted at Source)?

Tax Deducted at Source (TDS) is a pre-tax deduction made at source (before

payment) by the payer from the payment made to the payee. It is a mechanism of

collecting tax by using a deduction mechanism rather than through payments

made by the taxpayer. It is deducted at the time of payment, and directly

deposited into the government (Income Tax Department’s) account.

TDS or Tax Deducted at Source is income tax reduced from the money paid at

the time of making specified payments such as rent, commission, professional

fees, salary, interest etc. by the persons making such payments. Usually, the

person receiving income is liable to pay income tax.

Ex. Shine Pvt Ltd makes a payment for office rent of Rs 80,000 per month to

the owner of the property. TDS is required to be deducted at 10%. Shine Pvt

ltd must deduct TDS of Rs 8000 and pay the balance of Rs 72,000 to the

owner of the property.

You might also like

- TDS BROCHURE Final PDFDocument16 pagesTDS BROCHURE Final PDFCA Hiralal ArsiddhaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document2 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ViJaY HaLdErNo ratings yet

- Tds e Book 1 Cover 1 Final 1Document106 pagesTds e Book 1 Cover 1 Final 1abhishek kalbaliaNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

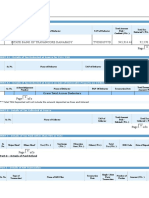

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- T.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneDocument5 pagesT.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneSachin KumarNo ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- %) 4FSJFT: DHS+ D X 1.5Document2 pages%) 4FSJFT: DHS+ D X 1.5Dong NguyenNo ratings yet

- Tax Deducted at Source (T.D.S.) : IND, HUF, EtcDocument1 pageTax Deducted at Source (T.D.S.) : IND, HUF, Etchit2011No ratings yet

- Indian Income Tax Challan Payment of Tds and TcsDocument2 pagesIndian Income Tax Challan Payment of Tds and Tcsmail_sree_nathNo ratings yet

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Synopsis TDSDocument20 pagesSynopsis TDSNand Kishore DubeyNo ratings yet

- 1state Bank of Travancore Danapady TVDS01977D 945,914.44 92,570.00Document2 pages1state Bank of Travancore Danapady TVDS01977D 945,914.44 92,570.00Bhargavaramireddy GadeNo ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- Received With Thanks ' 17,036.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 17,036.00 Through Payment Gateway Over The Internet FromRakesh ShahNo ratings yet

- TDSCalculator 0809Document2 pagesTDSCalculator 0809jeevan_v_mNo ratings yet

- TDS and TCS Credit Received 01atmpk2921p2zi 112022Document1 pageTDS and TCS Credit Received 01atmpk2921p2zi 112022ANIL VERMANo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- TDS and TCS Credit Received 09eygpk5671b1zb 052021Document1 pageTDS and TCS Credit Received 09eygpk5671b1zb 052021lalitkaushik0317No ratings yet

- PPI-851712f Patient Advance Receipt PDFDocument1 pagePPI-851712f Patient Advance Receipt PDFKian GonzagaNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Tds Basics TheoryDocument17 pagesTds Basics TheoryArif ShaikhNo ratings yet

- Adobe Scan Apr 06, 2021Document1 pageAdobe Scan Apr 06, 2021VannurSwamyNo ratings yet

- TRACES Annual Tax StatementDocument1 pageTRACES Annual Tax StatementabhitesplNo ratings yet

- A Guide To Tax Saving Through NPS (National Pension System)Document4 pagesA Guide To Tax Saving Through NPS (National Pension System)alankar2050No ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AFuture ArtistNo ratings yet

- Tds ChallanDocument2 pagesTds Challannilesh vithalaniNo ratings yet

- Sap DocumentsDocument20 pagesSap DocumentsAnil MahapatroNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument9 pagesSummary of Current Charges (RS) : Talk To Us SMSrupanshuNo ratings yet

- TDS CalculatorDocument2 pagesTDS Calculatordasp06100% (1)

- Salary SlipDocument2 pagesSalary Slipranjan988No ratings yet

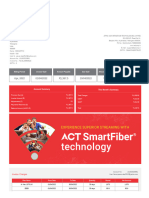

- Inv TG B1 69850616 101002020861 April 2022Document2 pagesInv TG B1 69850616 101002020861 April 2022mohan bNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Advance Tax, Tax Deduction at Source and Introduction to Tax Collection at Source 02 _ Class NotesDocument26 pagesAdvance Tax, Tax Deduction at Source and Introduction to Tax Collection at Source 02 _ Class Noteschhipaashraf4No ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- Public in Motion GMBH Commission PayableDocument3 pagesPublic in Motion GMBH Commission PayableHung PhungNo ratings yet

- Indian Income Tax Challan FOR Payment of Tds and TcsDocument4 pagesIndian Income Tax Challan FOR Payment of Tds and Tcsrahulbhardwaj1986100% (2)

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- Jan Tata Bill RS GandhiDocument9 pagesJan Tata Bill RS Gandhideepak_sharma9323No ratings yet

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- Received With Thanks ' 1,836.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 1,836.00 Through Payment Gateway Over The Internet FromSubramoni RajuNo ratings yet

- This Study Resource Was: Finlatics Research TaskDocument7 pagesThis Study Resource Was: Finlatics Research Taskyogica3537No ratings yet

- Vehicle Bill Aug-17Document1 pageVehicle Bill Aug-17anjum jauherNo ratings yet

- Tax Deducted at SourceDocument9 pagesTax Deducted at SourceAnsHika AroRaNo ratings yet

- T.D.S. / Tcs Tax Challan: DD MM YyDocument1 pageT.D.S. / Tcs Tax Challan: DD MM Yyar8ku9sh0aNo ratings yet

- Act Bill Dec-2021Document2 pagesAct Bill Dec-2021RAJESH BISWASNo ratings yet

- Ias. 11Document15 pagesIas. 11Danyal ChaudharyNo ratings yet

- Ias. 11Document15 pagesIas. 11Danyal ChaudharyNo ratings yet

- TDS CalculatorDocument3 pagesTDS CalculatorFinance SoftSolvers SolutionsNo ratings yet

- BD0164 SalarySlipwithTaxDetailsDocument1 pageBD0164 SalarySlipwithTaxDetailskb5452520No ratings yet

- Income Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeDocument4 pagesIncome Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeKamlesh ChauhanNo ratings yet

- All About TDS Return Forms 24Q 26Q 27Q 27EQ With Due Dates - SAG InfotechDocument9 pagesAll About TDS Return Forms 24Q 26Q 27Q 27EQ With Due Dates - SAG Infotechsukantabera215No ratings yet

- Assignment 3Document2 pagesAssignment 3Neha MahajanNo ratings yet

- Tally Questions PDF AaaDocument41 pagesTally Questions PDF AaaNeha MahajanNo ratings yet

- Assignment 1Document2 pagesAssignment 1Neha MahajanNo ratings yet

- Assinment No 1 NewDocument5 pagesAssinment No 1 NewNeha MahajanNo ratings yet

- Prob No 2Document4 pagesProb No 2Neha MahajanNo ratings yet

- Prob No 1Document3 pagesProb No 1Neha MahajanNo ratings yet