Professional Documents

Culture Documents

FIN - Chap 6 - Discount Cash Flows and Valuation

FIN - Chap 6 - Discount Cash Flows and Valuation

Uploaded by

duyennthds170525Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN - Chap 6 - Discount Cash Flows and Valuation

FIN - Chap 6 - Discount Cash Flows and Valuation

Uploaded by

duyennthds170525Copyright:

Available Formats

a series of equally-spaced & level cash flows - over a

Annuity finite number of period

a series of equally-spaced & level of cash flows -

Perpetuity continue forever

cash flows - end of a period

Ordinary Annuity

mortgage payments, interest payments to

bondholders

cash flow - begin of a period

Annuity Due

leases, car insurance

amount needed to produce the annuity

current fair value or market price of annuity

amount of a loan - can be repaid with the annuity

Present Value (OD)

how borrowed funds are calculated over the life of a

loan

Ordinary Due Loan Amortization

less interest, more principle, paid off with the last

payment

Future Value

Present Value period less than in an ordinary annuity

Annuities Due value always higher than ordinary

Future Value period more than in an ordinary annuity

Chap 6: Discount Cash

Flows and Valuation

most important perpetuities - securities markets

today - stock issues

promises - pay investors a fixed dividend forever -

Perpetuities unless retirement date

PV = CF/i

Cash Flows That Grow at a Constant Rate

Growing Annuities

Growing Annuity

Growing

Perpetuity

require banks - disclose to consumers - annual

percentage rate - loan

APR

using simple interest

effective annual interest rate - take compounding

over the course of a year into acc

Effective Annual Interest Rate

APR

EAR

Lending Act - borrowers - be told actual cost

Consumer Protect Acts and Interest Rate Saving Act - actual return - be disclosed

Disclosure

Credit Card Act - limit credit card fee and interest

rate increase

You might also like

- Bold-Bolder-Boldest-V5 3 6 9 0 - 2Document171 pagesBold-Bolder-Boldest-V5 3 6 9 0 - 2Snow67% (3)

- Randy Perkins InformationDocument108 pagesRandy Perkins InformationStephen White100% (1)

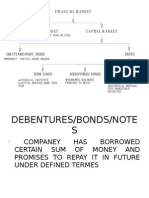

- 015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Document3 pages015 - Quick-Notes - Financial Liabilities From Borrowings Part 2Zatsumono YamamotoNo ratings yet

- Capital Budgeting Data CollectionDocument20 pagesCapital Budgeting Data CollectionalanNo ratings yet

- AP Review LiabDocument10 pagesAP Review LiabTuya DayomNo ratings yet

- Finance Exam 2 Cheat Sheet: by ViaDocument2 pagesFinance Exam 2 Cheat Sheet: by ViaKimondo KingNo ratings yet

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- Module 3 - Cost of CapitalDocument59 pagesModule 3 - Cost of CapitalPrateek JainNo ratings yet

- Fixed Income Level 1 Mindmaps 1Document16 pagesFixed Income Level 1 Mindmaps 1TrevorNo ratings yet

- Lesson 5 - Notes and Loans ReceivableDocument5 pagesLesson 5 - Notes and Loans ReceivableKatrina MarzanNo ratings yet

- Bonds Payable ReviewerDocument4 pagesBonds Payable ReviewerHazel TanongNo ratings yet

- Banking Awareness EbookDocument13 pagesBanking Awareness EbookPavan HebbarNo ratings yet

- FIN - Chap 8Document1 pageFIN - Chap 8duyennthds170525No ratings yet

- Financial Mathematics FormulasDocument5 pagesFinancial Mathematics FormulasKhoaNamNguyenNo ratings yet

- Concept of Bonds and StocksDocument3 pagesConcept of Bonds and StocksSeok Jin KimNo ratings yet

- MM Financial Market and Products V1Document23 pagesMM Financial Market and Products V1Imran MobinNo ratings yet

- Ia Notes-PayableDocument2 pagesIa Notes-PayableJhunnie LoriaNo ratings yet

- Interest Bearing: Chapter 5 - Notes ReceivableDocument4 pagesInterest Bearing: Chapter 5 - Notes ReceivableEUNICE NATASHA CABARABAN LIMNo ratings yet

- Short-Term Financing ReviewerDocument3 pagesShort-Term Financing ReviewerSeleenaNo ratings yet

- ResearchDocument3 pagesResearchrmurmatam0583pamNo ratings yet

- Chapter 4 (Money Market)Document29 pagesChapter 4 (Money Market)janellemoralestNo ratings yet

- Long-Term Financing: Debts: Financial Management Part IIDocument11 pagesLong-Term Financing: Debts: Financial Management Part IIKisha QuirozNo ratings yet

- Lecture 2 - Understanding Interest RatesDocument11 pagesLecture 2 - Understanding Interest RatesDung Thùy100% (1)

- Chapter-4: Sources and Uses of Funds, Performance Evaluation and Bank FailureDocument16 pagesChapter-4: Sources and Uses of Funds, Performance Evaluation and Bank FailureEEL KfWBMZ2.1No ratings yet

- Notes PayableDocument2 pagesNotes Payablereymonastrera07No ratings yet

- Unit14-P1-Recovery of Retail LoansDocument6 pagesUnit14-P1-Recovery of Retail LoansRishi KayasthNo ratings yet

- The Meaning of Interest Rates: ContentDocument11 pagesThe Meaning of Interest Rates: ContentQuang NguyenNo ratings yet

- Notes Receivable (Chapter 6)Document19 pagesNotes Receivable (Chapter 6)chingNo ratings yet

- The Time Value of MoneyDocument2 pagesThe Time Value of Moneypier AcostaNo ratings yet

- 2024 L1 FixedIncomeDocument93 pages2024 L1 FixedIncomehamna wahabNo ratings yet

- 5 - Business Finance MRM (Bond Par Value Basic Theory)Document28 pages5 - Business Finance MRM (Bond Par Value Basic Theory)faizy24No ratings yet

- Law On Partnership ReviewerDocument2 pagesLaw On Partnership ReviewerEMZy ChannelNo ratings yet

- Accounting and The Time Value of Money Accounting and The Time Value of MoneyDocument54 pagesAccounting and The Time Value of Money Accounting and The Time Value of MoneyRony RahmanNo ratings yet

- Quiz Preparation Notes JTDocument2 pagesQuiz Preparation Notes JTxhayyyzNo ratings yet

- Bond ValuationDocument31 pagesBond ValuationVeena DixitNo ratings yet

- Definitions Highlighted C5andC7Document3 pagesDefinitions Highlighted C5andC7Jerleen FelismeniaNo ratings yet

- Bonds PayableDocument13 pagesBonds PayablekyramaeNo ratings yet

- 8.sources of Short-Term FinancingDocument26 pages8.sources of Short-Term FinancingJohann BonillaNo ratings yet

- Finmar Finals RevDocument6 pagesFinmar Finals RevMae Marie De DiosNo ratings yet

- Bond Valuation 17.11.22-SecA-v3-1Document114 pagesBond Valuation 17.11.22-SecA-v3-1Micky VirusNo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- Chapter 7-9 Reviewer Semi FinalsDocument10 pagesChapter 7-9 Reviewer Semi FinalsAngel FuentesNo ratings yet

- Characteristics Characteristics: Cost of DebtDocument4 pagesCharacteristics Characteristics: Cost of DebtMegha Agarwal ParikhNo ratings yet

- Cost+of+Capital +Ajay+Kulkarni+Document38 pagesCost+of+Capital +Ajay+Kulkarni+jangitisindhu2002No ratings yet

- MidtermsDocument108 pagesMidtermsdumpyforhimNo ratings yet

- Session. 3. Bank ProfitabilityDocument14 pagesSession. 3. Bank ProfitabilityArbazuddin shaikNo ratings yet

- Reviewer in Business FinanceDocument3 pagesReviewer in Business FinancebaekhyunNo ratings yet

- Security Analysis and Portfolio Management: Valuation of BondsDocument28 pagesSecurity Analysis and Portfolio Management: Valuation of BondsFranklin ArnoldNo ratings yet

- Short Term FinancingDocument15 pagesShort Term FinancingJoshua Cabinas100% (1)

- Financial ManagementDocument6 pagesFinancial ManagementMark Joseph E VisdaNo ratings yet

- Concept Map (Garcia, Plata, Villamin) PDFDocument6 pagesConcept Map (Garcia, Plata, Villamin) PDFMinji OhNo ratings yet

- 34 34 Sources of FinanceDocument23 pages34 34 Sources of FinanceShri DongareNo ratings yet

- Valuation of Bonds and Shares: What Is A Bond?Document5 pagesValuation of Bonds and Shares: What Is A Bond?Sajib IslamNo ratings yet

- Valuing Bonds Cheat Sheet: by ViaDocument4 pagesValuing Bonds Cheat Sheet: by ViaTushar JainNo ratings yet

- Reading 1 - Time Value of MoneyDocument34 pagesReading 1 - Time Value of MoneyAllen AravindanNo ratings yet

- Alm and Liquidity RiskDocument42 pagesAlm and Liquidity Riskyogeshhooda85No ratings yet

- FIN 102 Banking and Financial InstitutionsDocument10 pagesFIN 102 Banking and Financial Institutionsron aviNo ratings yet

- FM DebentureDocument11 pagesFM DebentureGOVINDARAJ MNo ratings yet

- Fin Man CH 7Document4 pagesFin Man CH 7AdamNo ratings yet

- Short-Term FinancingDocument15 pagesShort-Term FinancingyukiNo ratings yet

- Genmath 6Document6 pagesGenmath 6JOYCE ENGARANNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- FDRM Unit I Session 2,3 & 4Document18 pagesFDRM Unit I Session 2,3 & 4N ArunsankarNo ratings yet

- BiotechDocument10 pagesBiotechavico510No ratings yet

- Dsonic An20210527a1 1Document25 pagesDsonic An20210527a1 1EllaMay DelazernaNo ratings yet

- SecuritisationDocument45 pagesSecuritisationSaravanan SnrNo ratings yet

- Prof. Kavita PareekDocument27 pagesProf. Kavita Pareekbackupsanthosh21 dataNo ratings yet

- Risk & Return Analysis-2020Document23 pagesRisk & Return Analysis-2020Puneet Shukla100% (1)

- UBS Recruiting GuideDocument97 pagesUBS Recruiting GuideShawn Pantophlet100% (1)

- Enhanced a-EnrichGold-i (With 20pay30)Document46 pagesEnhanced a-EnrichGold-i (With 20pay30)wan marzukiNo ratings yet

- Hungary Takeover GuideDocument14 pagesHungary Takeover GuidefelixloNo ratings yet

- Us Aers A Roadmap To The Issuers Accounting For Convertible DebtDocument260 pagesUs Aers A Roadmap To The Issuers Accounting For Convertible DebtMANUEL JESUS MOJICA MATEUSNo ratings yet

- Advanced Accounting Baker Test Bank - Chap002Document36 pagesAdvanced Accounting Baker Test Bank - Chap002donkazotey60% (5)

- ICE Brent Crude Futures: Contract SpecificationsDocument3 pagesICE Brent Crude Futures: Contract SpecificationseltowerNo ratings yet

- Presentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Document20 pagesPresentation On " ": Devi Ahilya Vishwavidyalaya, Indore (A State Govt. Statutory University of M.P.)Buddhapratap RathoreNo ratings yet

- Chapter 1 Cash and Cash EquivalentsDocument29 pagesChapter 1 Cash and Cash EquivalentsENCARNACION Princess MarieNo ratings yet

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- India Report - The Herald of A New Chapter - Student Accommodation in India PDFDocument19 pagesIndia Report - The Herald of A New Chapter - Student Accommodation in India PDFsam662223No ratings yet

- BFI Topic 1 2 3Document17 pagesBFI Topic 1 2 3Arnold LuayonNo ratings yet

- International Constitution of Association of Lions ClubsDocument51 pagesInternational Constitution of Association of Lions ClubsDavid Benjamin MwinganizaNo ratings yet

- JLL Real Estate As A Global Asset ClassDocument9 pagesJLL Real Estate As A Global Asset Classashraf187100% (1)

- BFIN300 - Chapter 5 - Time Value of MoneyDocument15 pagesBFIN300 - Chapter 5 - Time Value of MoneyMhmdNo ratings yet

- 07.ind As 102Document35 pages07.ind As 102Pranjul AgrawalNo ratings yet

- JPM The J P Morgan View 2022-05-09 4086002Document57 pagesJPM The J P Morgan View 2022-05-09 4086002Kurt ZhangNo ratings yet

- PE Expansion PhaseDocument2 pagesPE Expansion PhaseVikram SenNo ratings yet

- 01 - 2016 - JAN Technical Analysis of Stocks & CommoditiesDocument66 pages01 - 2016 - JAN Technical Analysis of Stocks & CommoditiesGiang Nguyễn100% (1)

- Diba Das ID 111-11-2021 AV3823 PDFDocument79 pagesDiba Das ID 111-11-2021 AV3823 PDFprincedhakaNo ratings yet

- Chapter 18Document35 pagesChapter 18Joey Zahary GintingNo ratings yet