Professional Documents

Culture Documents

Infographic Quick Start To CPO Futures

Infographic Quick Start To CPO Futures

Uploaded by

Salwani Asyikin ZakaryaCopyright:

Available Formats

You might also like

- END-OF-DAY SWING STRATEGY - The Prop TraderDocument8 pagesEND-OF-DAY SWING STRATEGY - The Prop Traderyoussner327No ratings yet

- Day Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingFrom EverandDay Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingRating: 5 out of 5 stars5/5 (9)

- Draw On Liquidity: Visual Guide by HansonDocument20 pagesDraw On Liquidity: Visual Guide by HansonNabeel Sarwar100% (4)

- Lotus MMXM Trading Model 1.2Document13 pagesLotus MMXM Trading Model 1.2MUDDASSIR RAJA100% (1)

- It JaganDocument108 pagesIt JaganSaiSudheerreddy AnnareddyNo ratings yet

- Lotusxbt Trading ModelDocument8 pagesLotusxbt Trading ModelNassim Alami MessaoudiNo ratings yet

- Introduction To Price Action Manipulation TrainingDocument13 pagesIntroduction To Price Action Manipulation TrainingCyberWizard100% (1)

- Tfrs 15: Ready For The ChallengesDocument19 pagesTfrs 15: Ready For The ChallengesSudharaka PereraNo ratings yet

- Drain The Banks!! TherumpledoneDocument11 pagesDrain The Banks!! TherumpledoneLuis VicenteNo ratings yet

- How to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingFrom EverandHow to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingNo ratings yet

- Products Services FCPO EnglishDocument16 pagesProducts Services FCPO EnglishKhairul AdhaNo ratings yet

- Lotus XBT ICT ModelDocument19 pagesLotus XBT ICT ModelDaniel PerezNo ratings yet

- Lotk Trading: Lotktrading 1Document22 pagesLotk Trading: Lotktrading 1jorge perez100% (1)

- Broker Report ViewDocument3 pagesBroker Report ViewCrestore Jillian CapiñaNo ratings yet

- Fcpo Product Brochure English LatestDocument9 pagesFcpo Product Brochure English LatestPritib KumarNo ratings yet

- Safemoon: Static Rewards LP Acquisition Manual BurnDocument7 pagesSafemoon: Static Rewards LP Acquisition Manual BurnBÙI NGUYÊN LUẬN - VIOLYMPIC TOÁNNo ratings yet

- FP Markets CopyTrade Url2pdf - 65301bccc2e7fDocument6 pagesFP Markets CopyTrade Url2pdf - 65301bccc2e7fharissonrafandradeNo ratings yet

- PPO IndicatorDocument6 pagesPPO Indicatorcoinslots00No ratings yet

- White Paper of Kim Mempin Trading in CryptocurrencyDocument20 pagesWhite Paper of Kim Mempin Trading in Cryptocurrencyfor Sale100% (1)

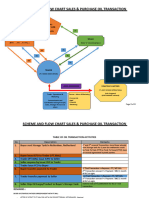

- FINAL - REVISED. Scheme and Flow Chart OIL TransactionDocument4 pagesFINAL - REVISED. Scheme and Flow Chart OIL TransactionPebb PondNo ratings yet

- EBook - YouTube HandbookDocument29 pagesEBook - YouTube Handbookditiromandewo14No ratings yet

- Three Drive Price Action - CMF - ToBeaTraderDocument194 pagesThree Drive Price Action - CMF - ToBeaTraderNabinChhetri100% (2)

- (TTI) ReadyAimFreeze Pro - Indicator by TintinTrading - TradingViewDocument4 pages(TTI) ReadyAimFreeze Pro - Indicator by TintinTrading - TradingViewTran NghiemlsNo ratings yet

- Stock Market SimulationDocument4 pagesStock Market SimulationROBERTO BRYAN CASTRONo ratings yet

- Scalping Trading StrategiesDocument2 pagesScalping Trading Strategieszooor0% (1)

- Research Report On LKP SecDocument9 pagesResearch Report On LKP SecVipin PatilNo ratings yet

- FX Model - KelvinFXDocument9 pagesFX Model - KelvinFXThar RharNo ratings yet

- Basics of TradingDocument6 pagesBasics of Tradingfor SaleNo ratings yet

- 5-What Is A Spread in Forex TradingDocument16 pages5-What Is A Spread in Forex TradingjmwallohNo ratings yet

- FX Product GuideDocument99 pagesFX Product GuideVikram SuranaNo ratings yet

- Trade Mechanics and Market FlowDocument12 pagesTrade Mechanics and Market FlowCyberWizardNo ratings yet

- Lotusxbt Trading Model 1.1Document9 pagesLotusxbt Trading Model 1.1edi abdulm100% (1)

- Livre Blanc LIMOCOIN Version en AnglaisDocument41 pagesLivre Blanc LIMOCOIN Version en Anglaisaditya111No ratings yet

- 3-What Is A Pip in ForexDocument12 pages3-What Is A Pip in ForexjmwallohNo ratings yet

- Five Minutes To Fame in The E-Mini - Futures MagazineDocument4 pagesFive Minutes To Fame in The E-Mini - Futures MagazineRisantoNo ratings yet

- Data Analysis Low IncomeDocument30 pagesData Analysis Low IncomeAdora AdoraNo ratings yet

- Educational InventoryDocument31 pagesEducational InventoryMohammad RahatNo ratings yet

- SCALPING - PIVOT STRATEGY - The Prop TraderDocument7 pagesSCALPING - PIVOT STRATEGY - The Prop Traderyoussner327No ratings yet

- Minutes To Financial Freedom Course Guide 2022 PDFDocument28 pagesMinutes To Financial Freedom Course Guide 2022 PDFAnas TubailNo ratings yet

- Semana 1 Uap 2018-1sfDocument24 pagesSemana 1 Uap 2018-1sfKatherine Atencio CabezasNo ratings yet

- Screening For Swing Trading Set Ups (TC2000 Scanner)Document9 pagesScreening For Swing Trading Set Ups (TC2000 Scanner)Gas TeoNo ratings yet

- Bracket Orders & Trailing Stoploss (SL) Z-Connect by ZerodhaDocument167 pagesBracket Orders & Trailing Stoploss (SL) Z-Connect by Zerodhacsakhare82No ratings yet

- Panda Chain Whitepaper: Static Rewards, LP Acquisition, Manual BurnDocument3 pagesPanda Chain Whitepaper: Static Rewards, LP Acquisition, Manual BurnKevin TanuNo ratings yet

- Forward Contract and HedgingDocument78 pagesForward Contract and HedgingAnvesha Tyagi100% (1)

- October 6, 15, 22 and 29 at 3:00-5:30pm PDTDocument21 pagesOctober 6, 15, 22 and 29 at 3:00-5:30pm PDTDuy DangNo ratings yet

- A Guide To Futures Trading at PMEX Updated 1Document20 pagesA Guide To Futures Trading at PMEX Updated 1emehtab8No ratings yet

- Compression Price Action - To Be A TraderDocument227 pagesCompression Price Action - To Be A TraderNabinChhetri100% (1)

- How To Leverage Market Contango and Backwardation - Futures MagazineDocument2 pagesHow To Leverage Market Contango and Backwardation - Futures Magazinethirusays29No ratings yet

- Corporate Highlights - 18/5/2010Document2 pagesCorporate Highlights - 18/5/2010Rhb InvestNo ratings yet

- December 17 at 3:00-5:30pm PST: Session 14Document38 pagesDecember 17 at 3:00-5:30pm PST: Session 14Lê Duy ThanhNo ratings yet

- Total Return Futures On Cac 40 PresentationDocument17 pagesTotal Return Futures On Cac 40 Presentationouattara dabilaNo ratings yet

- Economics For Managers: Market/ Monopoly Power Consumers' Surplus, Producers' Surplus and Deadweight LossDocument42 pagesEconomics For Managers: Market/ Monopoly Power Consumers' Surplus, Producers' Surplus and Deadweight LossRomit BanerjeeNo ratings yet

- Trigger 9 - New Franchise OfferingDocument18 pagesTrigger 9 - New Franchise OfferingALBERTNo ratings yet

- Sapp Balancing Market: Traders and Controllers Training - Day 1Document69 pagesSapp Balancing Market: Traders and Controllers Training - Day 1Addie Hatisari DandaNo ratings yet

- 0709Venter67No4final PDFDocument12 pages0709Venter67No4final PDFremo213No ratings yet

- Klou TobeatraderDocument106 pagesKlou TobeatraderNabinChhetriNo ratings yet

- Quick Guide For Learning BTMM M15 StrategyDocument21 pagesQuick Guide For Learning BTMM M15 StrategyflorentNo ratings yet

- Attractive Yield With The Longest Growth Runway: Megaworld REITDocument12 pagesAttractive Yield With The Longest Growth Runway: Megaworld REITJoulo YabutNo ratings yet

- ME - Paper 3 - Part B1 - Data FileDocument12 pagesME - Paper 3 - Part B1 - Data Filemmontagne1No ratings yet

- Ca Q&aDocument129 pagesCa Q&aRavi TejaNo ratings yet

- CapstoneDocument16 pagesCapstoneKaithlyn LandichoNo ratings yet

- Chithoor Thaneerpandhampatty Waiting Shed 1.50lakhsDocument70 pagesChithoor Thaneerpandhampatty Waiting Shed 1.50lakhsrkpragadeeshNo ratings yet

- Arts 9 - Q4 - Mod4 - ChoreographyMovementAndGesturesFromWesternClassicalPlaysOperas - v4Document15 pagesArts 9 - Q4 - Mod4 - ChoreographyMovementAndGesturesFromWesternClassicalPlaysOperas - v4Nikko PatunganNo ratings yet

- Simatic ManagerDocument19 pagesSimatic ManagerNabilBouabana100% (2)

- PandasDocument1,349 pagesPandasMichael GemminkNo ratings yet

- Customer Service AssignmentDocument2 pagesCustomer Service AssignmentJoe Kau Zi YaoNo ratings yet

- Priyanshu Raj 20EE10055 Exp 5 Part 2Document17 pagesPriyanshu Raj 20EE10055 Exp 5 Part 2Priyanshu rajNo ratings yet

- Mini-Lesson 3 Ethical and Legal Mini-LessonDocument2 pagesMini-Lesson 3 Ethical and Legal Mini-Lessonapi-674346530No ratings yet

- B23 PDFDocument3 pagesB23 PDFHector SilvaNo ratings yet

- Selected Bibliography: Fundraising: Last Update: March 2009Document4 pagesSelected Bibliography: Fundraising: Last Update: March 2009Jorge Alberto Birrueta RubioNo ratings yet

- Lab 3Document23 pagesLab 3RAMESH KUMARNo ratings yet

- The Handmaid's Tale ContextDocument2 pagesThe Handmaid's Tale ContextBeheshtaNo ratings yet

- Get All Employee Details From The Employee TableDocument23 pagesGet All Employee Details From The Employee TableSachin KumarNo ratings yet

- Tank BlanketingDocument27 pagesTank Blanketingkhali54100% (1)

- Hippias Major PlatonDocument4 pagesHippias Major PlatonLaura LapoviţăNo ratings yet

- KTM ContentsDocument4 pagesKTM Contentstahaqureshi123No ratings yet

- I 0610026377Document15 pagesI 0610026377Arif KurniawanNo ratings yet

- Complete PersepolisDocument7 pagesComplete Persepolisapi-301951533No ratings yet

- Post Graduate Dip DermatologyDocument2 pagesPost Graduate Dip DermatologyNooh DinNo ratings yet

- Artificial Retina: Presented byDocument6 pagesArtificial Retina: Presented bySai KrishnaNo ratings yet

- SEMIKRON DataSheet SKiiP 36NAB126V1 25230120Document4 pagesSEMIKRON DataSheet SKiiP 36NAB126V1 25230120Merter TolunNo ratings yet

- Pathway To English Peminatan 3 Bab 3Document9 pagesPathway To English Peminatan 3 Bab 3Agung PrasetyoNo ratings yet

- Monica Ward ThesisDocument7 pagesMonica Ward Thesiscandacedaiglelafayette100% (2)

- Media and Information Literacy - G11Document62 pagesMedia and Information Literacy - G11Jerfel MAAMONo ratings yet

- Some Oral Chief Mate QuestionsDocument6 pagesSome Oral Chief Mate QuestionsKapil KhandelwalNo ratings yet

- Shuqaiq Steam Power Plant: OwnerDocument441 pagesShuqaiq Steam Power Plant: OwnerAaqib Mujtaba100% (1)

- Hardness Test: Materials Science and TestingDocument6 pagesHardness Test: Materials Science and TestingCharlyn FloresNo ratings yet

- Eta Line 150-250Document32 pagesEta Line 150-250tafseerahmadNo ratings yet

Infographic Quick Start To CPO Futures

Infographic Quick Start To CPO Futures

Uploaded by

Salwani Asyikin ZakaryaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Infographic Quick Start To CPO Futures

Infographic Quick Start To CPO Futures

Uploaded by

Salwani Asyikin ZakaryaCopyright:

Available Formats

Quick Start

To CPO Futures

5 Steps To

Glossary:

CPO = Crude Palm Oil

FCPO = Crude Palm Oil Futures

Start Trading FCPO

MPOB = Malaysian Palm Oil Board

MPOC = Malaysia Palm Oil Council

TICK = Minimum Movement in Points

*Note: (to be boxed up at the side for readers to refer at the beginning)

(a) What is the basic “LONG” or “SHORT”

strategy?

STEP 1

Example:

Bullish View Note: For FCPO 1 tick = MYR 25

Know the If you expect an upward FCPO price movement, the strategy is

to Buy First and Sell Later.

Trading Action: Trade

Strategies Buy or “Long”

Buy 1 FCPO contract @

Summary:

Number Number

for FCPO

of x of x Price

2400 and contracts ticks per tick

Sell or “Short” 1 x 50 x MYR 25

1 FCPO contract @ 2450

= 50 ticks = MYR 1,250 (gross profit)

Action: Trade

Sell or “Short” Summary:

1 FCPO contract @

Bearish View

Number Number

of of Price

x x

2500 and contracts ticks per tick

If you expect a downward FCPO

Buy or “Long” 1 x 20 x MYR 25 price movement, the strategy is to Sell First

1 FCPO contract @ 2480

= 20 ticks = MYR 500 (gross profit) and Buy Later.

(b) Trading Range

On average, the daily trading range for CPO since January – July 2020 is approximately between 50 to 70 points. Prior to

trading, it is prudent to be kept abreast on the latest news and developments together with fundamental and technical anal-

ysis knowledge. Having a trading view and using technical analysis to identify past market patterns may help in your

trading decisions.

Get latest technical and daily research reports from

Kenanga Research at:

https://bit.ly/36id9yl

Once you are ready to trade, just access and trade

FCPO via KDF TradeActiveTM

Source: Bloomberg

Kenanga Futures Sdn Bhd 199501024398 (353603-X), Level 6, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia.

(603) 2172 3888 futuresmarketing@kenanga.com.my www.kenangafutures.com.my

STEP 2

Watch out for the comments and insights from edible oil speakers and market

traders in these key global events listed below. Industry traders follow these

events for overall industry and market outlook updates.

Key CPO Palm and Lauric Oils Price Outlook Conference (POC)

related

Organiser: Bursa Malaysia

Malaysia

events in China International Oils and Oilseeds Conference (CIOC)

Organiser: Dalian Commodity Exchange

major

China

Globoil India

markets

Organiser: Tefla’s

India

Indonesian Palm Oil Conference and Price Outlook (IPOC)

Organiser: Gabungan Pengusaha Kelapa Sawit Indonesia (GAPKI)

Indonesia

In general, the importing and exporting countries are as follows:

Top Importing Countries 1 (‘mil tonnes) Top Exporting Countries 2 (‘mil tonnes)

India 4.41 Indonesia 28.75

China 2.49 Malaysia 16.73

Pakistan 1.09 Guatemala 0.81

Netherlands 0.88 Colombia 0.78 Sources:

1 = Malaysian Palm Oil Board

(Figures from year 2019)

Turkey 0.71 Papua New Guinea 0.57 2 = Indexmundi

(Estimate for year 2020)

Efficient

Has the highest yield per hectare planted among world’s top edible oils.

STEP 3

Versatile

Widest applications for both edible and non-edible segments.

Sustainable

Demand for vegetable oil for biodiesel production.

Healthy

Factors

Has the highest nutritional benefits among vegetable oils.

Source: Frost & Sullivan Research

that

To know more on factors affecting demand and supply, please refer to: support

CPO price

Product Factsheet: https://bit.ly/32nG7ck

MPOB: the government agency responsible for the promotion and

development of the palm oil industry in Malaysia. Market traders refer to

MPOB to update on the daily, weekly and monthly prices of CPO. For retail trends and

investors please refer: https://bit.ly/3j8NIlX for the latest updates on CPO

price movements. long term

MPOC: the government agency set up to promote the market

expansion of Malaysian palm oil and its products. Traders often look

prospects

to MPOC for event updates. For retail investors please refer:

http://mpoc.org.my/market-highlights or

visit https://www.facebook.com/MPOCHQ for market updates.

Kenanga Futures Sdn Bhd 199501024398 (353603-X), Level 6, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia.

(603) 2172 3888 futuresmarketing@kenanga.com.my www.kenangafutures.com.my

STEP 4 Have a Trading Plan and identify

the best entry and exit strategies

Plan

& Understand the physical market

and factors that can move prices

Learn

Know where to access and trade

the FCPO contract through

Kenanga Futures website where

you can access Daily Research,

Market Report and Educational links

For information on the features of FCPO,

please visit this link:

https://bit.ly/2QiSz7B

Contact us to learn more on

how you can trade FCPO with Kenanga Futures: STEP 5

Telephone: +603 2172 3888 Contact Us

Customer Services Hotline: 1300 13 3010

Website: www.kenangafutures.com.my

Disclaimer:

This document has been prepared solely for the use of the recipient. No part of this publication may be reproduced, stored in a retrieval system,

or transmitted in any form or by any means without the prior written permission from Kenanga Futures Sdn Bhd. Although care has been taken

to ensure the accuracy of the information contained herein, Kenanga Futures Sdn Bhd does not warrant or represent expressly or impliedly as

to the accuracy or completeness of the information. This information does not constitute financial or trading advice; neither does it make any

recommendation regarding product(s) mentioned herein. Kenanga Futures Sdn Bhd does not accept any liability for any trading and financial

decisions of the reader or third party on the basis of this information. All applicable laws, rules, and regulations, from local and foreign authori-

ties, must be adhered to when accessing and trading on the respective markets.

Kenanga Futures Sdn Bhd 199501024398 (353603-X), Level 6, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia.

(603) 2172 3888 futuresmarketing@kenanga.com.my www.kenangafutures.com.my

You might also like

- END-OF-DAY SWING STRATEGY - The Prop TraderDocument8 pagesEND-OF-DAY SWING STRATEGY - The Prop Traderyoussner327No ratings yet

- Day Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingFrom EverandDay Trading Bitcoin & Ethereum : Advanced Strategies To Day Trade For A LivingRating: 5 out of 5 stars5/5 (9)

- Draw On Liquidity: Visual Guide by HansonDocument20 pagesDraw On Liquidity: Visual Guide by HansonNabeel Sarwar100% (4)

- Lotus MMXM Trading Model 1.2Document13 pagesLotus MMXM Trading Model 1.2MUDDASSIR RAJA100% (1)

- It JaganDocument108 pagesIt JaganSaiSudheerreddy AnnareddyNo ratings yet

- Lotusxbt Trading ModelDocument8 pagesLotusxbt Trading ModelNassim Alami MessaoudiNo ratings yet

- Introduction To Price Action Manipulation TrainingDocument13 pagesIntroduction To Price Action Manipulation TrainingCyberWizard100% (1)

- Tfrs 15: Ready For The ChallengesDocument19 pagesTfrs 15: Ready For The ChallengesSudharaka PereraNo ratings yet

- Drain The Banks!! TherumpledoneDocument11 pagesDrain The Banks!! TherumpledoneLuis VicenteNo ratings yet

- How to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingFrom EverandHow to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingNo ratings yet

- Products Services FCPO EnglishDocument16 pagesProducts Services FCPO EnglishKhairul AdhaNo ratings yet

- Lotus XBT ICT ModelDocument19 pagesLotus XBT ICT ModelDaniel PerezNo ratings yet

- Lotk Trading: Lotktrading 1Document22 pagesLotk Trading: Lotktrading 1jorge perez100% (1)

- Broker Report ViewDocument3 pagesBroker Report ViewCrestore Jillian CapiñaNo ratings yet

- Fcpo Product Brochure English LatestDocument9 pagesFcpo Product Brochure English LatestPritib KumarNo ratings yet

- Safemoon: Static Rewards LP Acquisition Manual BurnDocument7 pagesSafemoon: Static Rewards LP Acquisition Manual BurnBÙI NGUYÊN LUẬN - VIOLYMPIC TOÁNNo ratings yet

- FP Markets CopyTrade Url2pdf - 65301bccc2e7fDocument6 pagesFP Markets CopyTrade Url2pdf - 65301bccc2e7fharissonrafandradeNo ratings yet

- PPO IndicatorDocument6 pagesPPO Indicatorcoinslots00No ratings yet

- White Paper of Kim Mempin Trading in CryptocurrencyDocument20 pagesWhite Paper of Kim Mempin Trading in Cryptocurrencyfor Sale100% (1)

- FINAL - REVISED. Scheme and Flow Chart OIL TransactionDocument4 pagesFINAL - REVISED. Scheme and Flow Chart OIL TransactionPebb PondNo ratings yet

- EBook - YouTube HandbookDocument29 pagesEBook - YouTube Handbookditiromandewo14No ratings yet

- Three Drive Price Action - CMF - ToBeaTraderDocument194 pagesThree Drive Price Action - CMF - ToBeaTraderNabinChhetri100% (2)

- (TTI) ReadyAimFreeze Pro - Indicator by TintinTrading - TradingViewDocument4 pages(TTI) ReadyAimFreeze Pro - Indicator by TintinTrading - TradingViewTran NghiemlsNo ratings yet

- Stock Market SimulationDocument4 pagesStock Market SimulationROBERTO BRYAN CASTRONo ratings yet

- Scalping Trading StrategiesDocument2 pagesScalping Trading Strategieszooor0% (1)

- Research Report On LKP SecDocument9 pagesResearch Report On LKP SecVipin PatilNo ratings yet

- FX Model - KelvinFXDocument9 pagesFX Model - KelvinFXThar RharNo ratings yet

- Basics of TradingDocument6 pagesBasics of Tradingfor SaleNo ratings yet

- 5-What Is A Spread in Forex TradingDocument16 pages5-What Is A Spread in Forex TradingjmwallohNo ratings yet

- FX Product GuideDocument99 pagesFX Product GuideVikram SuranaNo ratings yet

- Trade Mechanics and Market FlowDocument12 pagesTrade Mechanics and Market FlowCyberWizardNo ratings yet

- Lotusxbt Trading Model 1.1Document9 pagesLotusxbt Trading Model 1.1edi abdulm100% (1)

- Livre Blanc LIMOCOIN Version en AnglaisDocument41 pagesLivre Blanc LIMOCOIN Version en Anglaisaditya111No ratings yet

- 3-What Is A Pip in ForexDocument12 pages3-What Is A Pip in ForexjmwallohNo ratings yet

- Five Minutes To Fame in The E-Mini - Futures MagazineDocument4 pagesFive Minutes To Fame in The E-Mini - Futures MagazineRisantoNo ratings yet

- Data Analysis Low IncomeDocument30 pagesData Analysis Low IncomeAdora AdoraNo ratings yet

- Educational InventoryDocument31 pagesEducational InventoryMohammad RahatNo ratings yet

- SCALPING - PIVOT STRATEGY - The Prop TraderDocument7 pagesSCALPING - PIVOT STRATEGY - The Prop Traderyoussner327No ratings yet

- Minutes To Financial Freedom Course Guide 2022 PDFDocument28 pagesMinutes To Financial Freedom Course Guide 2022 PDFAnas TubailNo ratings yet

- Semana 1 Uap 2018-1sfDocument24 pagesSemana 1 Uap 2018-1sfKatherine Atencio CabezasNo ratings yet

- Screening For Swing Trading Set Ups (TC2000 Scanner)Document9 pagesScreening For Swing Trading Set Ups (TC2000 Scanner)Gas TeoNo ratings yet

- Bracket Orders & Trailing Stoploss (SL) Z-Connect by ZerodhaDocument167 pagesBracket Orders & Trailing Stoploss (SL) Z-Connect by Zerodhacsakhare82No ratings yet

- Panda Chain Whitepaper: Static Rewards, LP Acquisition, Manual BurnDocument3 pagesPanda Chain Whitepaper: Static Rewards, LP Acquisition, Manual BurnKevin TanuNo ratings yet

- Forward Contract and HedgingDocument78 pagesForward Contract and HedgingAnvesha Tyagi100% (1)

- October 6, 15, 22 and 29 at 3:00-5:30pm PDTDocument21 pagesOctober 6, 15, 22 and 29 at 3:00-5:30pm PDTDuy DangNo ratings yet

- A Guide To Futures Trading at PMEX Updated 1Document20 pagesA Guide To Futures Trading at PMEX Updated 1emehtab8No ratings yet

- Compression Price Action - To Be A TraderDocument227 pagesCompression Price Action - To Be A TraderNabinChhetri100% (1)

- How To Leverage Market Contango and Backwardation - Futures MagazineDocument2 pagesHow To Leverage Market Contango and Backwardation - Futures Magazinethirusays29No ratings yet

- Corporate Highlights - 18/5/2010Document2 pagesCorporate Highlights - 18/5/2010Rhb InvestNo ratings yet

- December 17 at 3:00-5:30pm PST: Session 14Document38 pagesDecember 17 at 3:00-5:30pm PST: Session 14Lê Duy ThanhNo ratings yet

- Total Return Futures On Cac 40 PresentationDocument17 pagesTotal Return Futures On Cac 40 Presentationouattara dabilaNo ratings yet

- Economics For Managers: Market/ Monopoly Power Consumers' Surplus, Producers' Surplus and Deadweight LossDocument42 pagesEconomics For Managers: Market/ Monopoly Power Consumers' Surplus, Producers' Surplus and Deadweight LossRomit BanerjeeNo ratings yet

- Trigger 9 - New Franchise OfferingDocument18 pagesTrigger 9 - New Franchise OfferingALBERTNo ratings yet

- Sapp Balancing Market: Traders and Controllers Training - Day 1Document69 pagesSapp Balancing Market: Traders and Controllers Training - Day 1Addie Hatisari DandaNo ratings yet

- 0709Venter67No4final PDFDocument12 pages0709Venter67No4final PDFremo213No ratings yet

- Klou TobeatraderDocument106 pagesKlou TobeatraderNabinChhetriNo ratings yet

- Quick Guide For Learning BTMM M15 StrategyDocument21 pagesQuick Guide For Learning BTMM M15 StrategyflorentNo ratings yet

- Attractive Yield With The Longest Growth Runway: Megaworld REITDocument12 pagesAttractive Yield With The Longest Growth Runway: Megaworld REITJoulo YabutNo ratings yet

- ME - Paper 3 - Part B1 - Data FileDocument12 pagesME - Paper 3 - Part B1 - Data Filemmontagne1No ratings yet

- Ca Q&aDocument129 pagesCa Q&aRavi TejaNo ratings yet

- CapstoneDocument16 pagesCapstoneKaithlyn LandichoNo ratings yet

- Chithoor Thaneerpandhampatty Waiting Shed 1.50lakhsDocument70 pagesChithoor Thaneerpandhampatty Waiting Shed 1.50lakhsrkpragadeeshNo ratings yet

- Arts 9 - Q4 - Mod4 - ChoreographyMovementAndGesturesFromWesternClassicalPlaysOperas - v4Document15 pagesArts 9 - Q4 - Mod4 - ChoreographyMovementAndGesturesFromWesternClassicalPlaysOperas - v4Nikko PatunganNo ratings yet

- Simatic ManagerDocument19 pagesSimatic ManagerNabilBouabana100% (2)

- PandasDocument1,349 pagesPandasMichael GemminkNo ratings yet

- Customer Service AssignmentDocument2 pagesCustomer Service AssignmentJoe Kau Zi YaoNo ratings yet

- Priyanshu Raj 20EE10055 Exp 5 Part 2Document17 pagesPriyanshu Raj 20EE10055 Exp 5 Part 2Priyanshu rajNo ratings yet

- Mini-Lesson 3 Ethical and Legal Mini-LessonDocument2 pagesMini-Lesson 3 Ethical and Legal Mini-Lessonapi-674346530No ratings yet

- B23 PDFDocument3 pagesB23 PDFHector SilvaNo ratings yet

- Selected Bibliography: Fundraising: Last Update: March 2009Document4 pagesSelected Bibliography: Fundraising: Last Update: March 2009Jorge Alberto Birrueta RubioNo ratings yet

- Lab 3Document23 pagesLab 3RAMESH KUMARNo ratings yet

- The Handmaid's Tale ContextDocument2 pagesThe Handmaid's Tale ContextBeheshtaNo ratings yet

- Get All Employee Details From The Employee TableDocument23 pagesGet All Employee Details From The Employee TableSachin KumarNo ratings yet

- Tank BlanketingDocument27 pagesTank Blanketingkhali54100% (1)

- Hippias Major PlatonDocument4 pagesHippias Major PlatonLaura LapoviţăNo ratings yet

- KTM ContentsDocument4 pagesKTM Contentstahaqureshi123No ratings yet

- I 0610026377Document15 pagesI 0610026377Arif KurniawanNo ratings yet

- Complete PersepolisDocument7 pagesComplete Persepolisapi-301951533No ratings yet

- Post Graduate Dip DermatologyDocument2 pagesPost Graduate Dip DermatologyNooh DinNo ratings yet

- Artificial Retina: Presented byDocument6 pagesArtificial Retina: Presented bySai KrishnaNo ratings yet

- SEMIKRON DataSheet SKiiP 36NAB126V1 25230120Document4 pagesSEMIKRON DataSheet SKiiP 36NAB126V1 25230120Merter TolunNo ratings yet

- Pathway To English Peminatan 3 Bab 3Document9 pagesPathway To English Peminatan 3 Bab 3Agung PrasetyoNo ratings yet

- Monica Ward ThesisDocument7 pagesMonica Ward Thesiscandacedaiglelafayette100% (2)

- Media and Information Literacy - G11Document62 pagesMedia and Information Literacy - G11Jerfel MAAMONo ratings yet

- Some Oral Chief Mate QuestionsDocument6 pagesSome Oral Chief Mate QuestionsKapil KhandelwalNo ratings yet

- Shuqaiq Steam Power Plant: OwnerDocument441 pagesShuqaiq Steam Power Plant: OwnerAaqib Mujtaba100% (1)

- Hardness Test: Materials Science and TestingDocument6 pagesHardness Test: Materials Science and TestingCharlyn FloresNo ratings yet

- Eta Line 150-250Document32 pagesEta Line 150-250tafseerahmadNo ratings yet