Professional Documents

Culture Documents

1603Q p.1 FRINGE BENEFITS TAX. VIA PHIL

1603Q p.1 FRINGE BENEFITS TAX. VIA PHIL

Uploaded by

Leocadia GalnayonCopyright:

Available Formats

You might also like

- April 2022Document2 pagesApril 2022abul hasan nayemNo ratings yet

- Final Citibike Locations For Prospect Heights, Crown Heights and Prospect-Lefferts GardensDocument1 pageFinal Citibike Locations For Prospect Heights, Crown Heights and Prospect-Lefferts GardensDNAinfoNewYork0% (1)

- AMM Steel Producers Map 2018 PDFDocument1 pageAMM Steel Producers Map 2018 PDFspencerNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsArgielJedTabalBorrasNo ratings yet

- Tampines Ave 6 (North Bound) Tampines Ave 6 (North Bound) : Key PlanDocument1 pageTampines Ave 6 (North Bound) Tampines Ave 6 (North Bound) : Key PlanReshanth SelvaratnamNo ratings yet

- HALL_9Document1 pageHALL_9n.dangariaNo ratings yet

- Workbook Answer Key - OPDDocument64 pagesWorkbook Answer Key - OPDRoberta YoungNo ratings yet

- Hotel SDP For DrawingDocument1 pageHotel SDP For DrawingJohn Zedrick MacaisaNo ratings yet

- Off-Base Concrete Batch PlantDocument4 pagesOff-Base Concrete Batch PlantNadir Khattak Jr.No ratings yet

- Puerta: Gal. 882 NW - Nv. 4280 Veta Ursula 3Document1 pagePuerta: Gal. 882 NW - Nv. 4280 Veta Ursula 3RodrigoTejadaGallegosNo ratings yet

- DM C F G B CDocument11 pagesDM C F G B CGerard bouchardNo ratings yet

- 1.Detail Marking & TreeDocument1 page1.Detail Marking & TreeSumalata SalianNo ratings yet

- FM - 2 - PC - 21006 - 0-Feeder A Tna004 Hub Salemba To Tna004j010 Rbb0001481Document1 pageFM - 2 - PC - 21006 - 0-Feeder A Tna004 Hub Salemba To Tna004j010 Rbb0001481denurrantoNo ratings yet

- Jaime A Restrepo: Sanitary Level 1 - Residential BuildingDocument1 pageJaime A Restrepo: Sanitary Level 1 - Residential BuildingSrijon BrahmacharyNo ratings yet

- Eehc SC MP 0300102Document1 pageEehc SC MP 0300102ahmedsmman1976No ratings yet

- RE-NEET-EXAM_PAPER_WITH_ANSWERS-23-06-24[1]Document25 pagesRE-NEET-EXAM_PAPER_WITH_ANSWERS-23-06-24[1]babuvtwebNo ratings yet

- P-12 POI P-11: Ubicación GeneralDocument1 pageP-12 POI P-11: Ubicación GeneraledulinlinNo ratings yet

- MV1 ModelDocument1 pageMV1 ModelSohail YounisNo ratings yet

- Western Adventure LoopDocument4 pagesWestern Adventure Loopanon_275937008No ratings yet

- Eehc SC MP 0300101Document1 pageEehc SC MP 0300101ahmedsmman1976No ratings yet

- 19lg0119 Plan Part16Document6 pages19lg0119 Plan Part16jenurbano02No ratings yet

- 360o of Omnichannel Commerce: CustomerDocument1 page360o of Omnichannel Commerce: CustomerLiliaNo ratings yet

- 2.costaneras - Templetes - Canal - Techo 2 y 3Document1 page2.costaneras - Templetes - Canal - Techo 2 y 3Luis Fernando GarciaNo ratings yet

- AIA CA 2019 CBC Requirements: Residential Mandatory MeasuresDocument2 pagesAIA CA 2019 CBC Requirements: Residential Mandatory MeasuresMika SihiteNo ratings yet

- SÑ 02 PDFDocument1 pageSÑ 02 PDFC.O. INGENIERIA Y CONSTRUCCIONNo ratings yet

- 3401 PV MapDocument1 page3401 PV MaprasmushoygaardNo ratings yet

- Estadio Alcantarillado GeneralDocument1 pageEstadio Alcantarillado GeneralRubén Flores VillanuevaNo ratings yet

- A Song For You PianoDocument3 pagesA Song For You PianoBoatman Bill100% (1)

- 11.3 Plano TopografiaDocument1 page11.3 Plano TopografiaLuis HuamaniNo ratings yet

- Ingreso: Ss. Hh. DiscapacitadosDocument1 pageIngreso: Ss. Hh. DiscapacitadosIsaacNo ratings yet

- Virginia: Pineville MiddlesboroDocument1 pageVirginia: Pineville MiddlesboroArrigo CerroniNo ratings yet

- STP Ph1 JWWF PP 01 3201Document1 pageSTP Ph1 JWWF PP 01 3201Faisal MumtazNo ratings yet

- 501 e Walnut 5.25.2022Document1 page501 e Walnut 5.25.2022sokil_danNo ratings yet

- Lote 17: Circunvalacion NorteDocument1 pageLote 17: Circunvalacion NorteStefano IannuzzelliNo ratings yet

- 3Document1 page3Sanal SamsonNo ratings yet

- Alcantarill 9+350Document1 pageAlcantarill 9+350melcvmfotosNo ratings yet

- Ya Rayah-8ni-Partitura e PartiDocument9 pagesYa Rayah-8ni-Partitura e Parti3nzos1x0% (1)

- 3rd - Ashenafi Argaw Residence 2007 St-Layout1Document1 page3rd - Ashenafi Argaw Residence 2007 St-Layout1Jaspergroup 15No ratings yet

- Planta 3Document1 pagePlanta 3Giomara LazoNo ratings yet

- Ku Plumbing Progress Set-6162023Document19 pagesKu Plumbing Progress Set-6162023Chainlink EngineeringNo ratings yet

- NoyadadDocument44 pagesNoyadadAlejandro QuintanillaNo ratings yet

- p45-Dwg-civ-20-Pile Load Test Location-Sh 1 of 2Document1 pagep45-Dwg-civ-20-Pile Load Test Location-Sh 1 of 2Maan JiiNo ratings yet

- Imcu 10 Beds Nicu 16 Beds Picu 6 Beds: Typical Noggin FixingDocument1 pageImcu 10 Beds Nicu 16 Beds Picu 6 Beds: Typical Noggin Fixingmanikandan4strlNo ratings yet

- PDF HighlightedDocument9 pagesPDF Highlightedmartinaandrei.powerupNo ratings yet

- Locality Plan: Subject SiteDocument7 pagesLocality Plan: Subject SiteRavinesh SinghNo ratings yet

- Chittoor Div Map Dwg-ModelDocument1 pageChittoor Div Map Dwg-ModelExecutive EngineerNo ratings yet

- Dokumen - Tips Geography For CsecDocument4 pagesDokumen - Tips Geography For Csecjesse vixNo ratings yet

- Ball Ground Zoning Map 071514Document1 pageBall Ground Zoning Map 071514John loydNo ratings yet

- Assignment 1 CoverDocument1 pageAssignment 1 CoverAnonymous WEJ2b9Gm7No ratings yet

- Alcantarill 8+451.54Document1 pageAlcantarill 8+451.54melcvmfotosNo ratings yet

- Shilparamam Hyderabad Revised1 Model 1 PDFDocument1 pageShilparamam Hyderabad Revised1 Model 1 PDFPratima MaheshNo ratings yet

- Happy Birthday To You PDFDocument1 pageHappy Birthday To You PDFPham Minh Quyen100% (1)

- Irrigation Water Tank V:200 m3: Foundation OutlineDocument1 pageIrrigation Water Tank V:200 m3: Foundation OutlineZrar IsqeliNo ratings yet

- مخطط الموقع العام ;كابلات طبرجل-ModelDocument1 pageمخطط الموقع العام ;كابلات طبرجل-ModelIbrahim AliNo ratings yet

- Alcantarill 9+140.53Document1 pageAlcantarill 9+140.53melcvmfotosNo ratings yet

- 06 07 Mar 24 01 Cluster San Agustin RasantesDocument1 page06 07 Mar 24 01 Cluster San Agustin RasantesandreNo ratings yet

- OT3073-20 L3 LAB Condenseur R3Document1 pageOT3073-20 L3 LAB Condenseur R3becemNo ratings yet

- SG3120B SFNW P2P DiagramDocument3 pagesSG3120B SFNW P2P Diagramprint press (printpress.eg)No ratings yet

- Here's To You PDFDocument4 pagesHere's To You PDFmondosonoroNo ratings yet

- PRE2 SegundaDocument1 pagePRE2 Segundadaniel cruzNo ratings yet

- Tax ReturnDocument15 pagesTax ReturnCristóbal Rodas100% (1)

- Income Tax Payment Challan: PSID #: 172247415Document1 pageIncome Tax Payment Challan: PSID #: 172247415fast fbrNo ratings yet

- Employee'S Provident Fund Organisation: Electronic Challan Cum Return (Ecr)Document1 pageEmployee'S Provident Fund Organisation: Electronic Challan Cum Return (Ecr)Vora ParvejNo ratings yet

- TechnocraftDocument1 pageTechnocraftMilan KanriNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1Angel RosalesNo ratings yet

- 3jgo Manpower Provider, Inc. Tisado, Joylit Cadiente: Payroll Period: Jun 10 2019-Jun 24 2019 Emp. NameDocument1 page3jgo Manpower Provider, Inc. Tisado, Joylit Cadiente: Payroll Period: Jun 10 2019-Jun 24 2019 Emp. NameJoylit Garcia CadienteNo ratings yet

- TAX-1601 (Additions To Tax)Document4 pagesTAX-1601 (Additions To Tax)lyndon delfinNo ratings yet

- Get LetterDocument1 pageGet LetterMACPRAISE HOLDINGSNo ratings yet

- Tax Invoice: Gift From: Gift To: Customer CommentsDocument1 pageTax Invoice: Gift From: Gift To: Customer CommentsCA Shrikant VaranasiNo ratings yet

- Module 6 - Donor's TaxationDocument14 pagesModule 6 - Donor's TaxationLex Dela CruzNo ratings yet

- GST Assignment1.1lDocument3 pagesGST Assignment1.1lHamza AliNo ratings yet

- Form P.T 10 Form P.T 10 Form P.T 10: Mrumair AkramDocument1 pageForm P.T 10 Form P.T 10 Form P.T 10: Mrumair AkramZubair AkramNo ratings yet

- Social Security Contribution LevyDocument5 pagesSocial Security Contribution LevyNews CutterNo ratings yet

- In Voice 15333451944702861966Document2 pagesIn Voice 15333451944702861966Jinu SajiNo ratings yet

- PMT-3 PDFDocument2 pagesPMT-3 PDFHemant KumarNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- PayrollDocument9 pagesPayrollKen MabalotNo ratings yet

- Maternity and Paternity LeaveDocument4 pagesMaternity and Paternity LeavePerry YapNo ratings yet

- Dream Valley 11Document13 pagesDream Valley 11prachi_sipi1830No ratings yet

- Rutansh Itr 2022-23Document1 pageRutansh Itr 2022-23NDN CANo ratings yet

- 2016 Itr1 PR7 PDFDocument5 pages2016 Itr1 PR7 PDFVyankatesh KurriNo ratings yet

- Concept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Document2 pagesConcept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Ranjan BaradurNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDrsex DrsexNo ratings yet

- Assignment 1Document4 pagesAssignment 111dylan97No ratings yet

- BIR - Remittance of CWT (Form 1606) Should Be in The Name of The Buyer - JUAN PATAG REAL ESTATEDocument2 pagesBIR - Remittance of CWT (Form 1606) Should Be in The Name of The Buyer - JUAN PATAG REAL ESTATERoy RitagaNo ratings yet

- Villanueva V City of IloiloDocument1 pageVillanueva V City of IloiloEllaine Virayo100% (1)

- Adobe Scan 09 Jan 2024Document1 pageAdobe Scan 09 Jan 2024swapna vijayNo ratings yet

- Jeevan Umang-945: Special-FeatureDocument4 pagesJeevan Umang-945: Special-FeatureManjunathNo ratings yet

1603Q p.1 FRINGE BENEFITS TAX. VIA PHIL

1603Q p.1 FRINGE BENEFITS TAX. VIA PHIL

Uploaded by

Leocadia GalnayonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1603Q p.1 FRINGE BENEFITS TAX. VIA PHIL

1603Q p.1 FRINGE BENEFITS TAX. VIA PHIL

Uploaded by

Leocadia GalnayonCopyright:

Available Formats

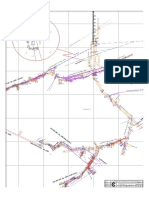

BIR Form No.

1603Qv2018 Page 1 of 1

BIR Form No. Quarterly Remittance Return

1603Q of Final Income Taxes Withheld on Fringe Benefits

January 2018 (ENCS) Paid to Employees Other Than Rank and File

Page 1 Enter all required information in CAPITAL LETTERS using BLACK ink. Mark all applicable boxes with

an "X". Two copies MUST be filed with the BIR and one held by the Tax Filer.

1 For the Year 2 Quarter 3 Amended Return? 4 Any Taxes Withheld? 5 No. of Sheet/s Attached

2018

1st

2nd

3rd

4th Yes

No

Yes

No

0

PART I - BACKGROUND INFORMATION

6 Taxpayer Identification Number (TIN) 009 / 249 / 799 / 000 7 RDO Code 051

8 Withholding Agent's Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

VIA PHILIPPINES TRAVEL CORPORATION

Registered Address (Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form

9 No. 1905)

UNIT 405-407 FIVE ECOM CENTER BUILDING, BLK 18, PACIFIC DRIVE, MALL OF%2

0ASIA (MOA), BARANGAY 76, PASAY CITY, NCR, FOURTH DISTRICT PHILIPPINES 9A Zip Code 1300

10 Contact Number 0285559444 11 Category of Withholding Agent Private

Government

12 Email Address rochelle011200@gmail.com

13 Are there payees availing of tax relief under

Special Law or International Tax Treaty? Yes

No

13A If yes, specify

PART II - COMPUTATION OF TAX

14 Total Taxes Withheld (From Part IV-Schedule 1) 14 398,114.52

15 Less: Tax Remitted in Return Previously Filed, if this is an amended return 15 0.00

16 Other Remittances Made (specify) 16 0.00

17 Total Remittances Made (Sum of Items 15 and 16) 17 0.00

18 Tax Still Due/(Over-remittance) (Item 14 Less Item 17) 18 398,114.52

Add: Penalties 19 Surcharge 19 0.00

20 Interest 20 0.00

21 Compromise 21 0.00

22 Total Penalties (Sum of Items 19 to 21) 22 0.00

23 TOTAL AMOUNT STILL DUE (Sum of Items 18 and 22) 23 398,114.52

I/We declare under the penalties of perjury that this remittance return, and all its attachments, have been made in good faith, verified by me/us, and to the best of my/our

knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Further, I give my consent to the processing of my information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If

Authorized Representative, attach authorization letter)

For Individual: For Non-Individual:

Signature over Printed Name of Taxpayer/Authorized Representative/Tax Agent Signature over Printed Name of President/Vice President/

(Indicate Title/Designation and TIN) Authorized Officer or Representative/Tax Agent (Indicate Title/Designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney's Roll No. (If applicable) (MM/DD/YYYY) (MM/DD/YYYY)

PART III - DETAILS OF PAYMENT

Particulars Drawee Bank/Agency Number Date (MM/DD/YYYY) Amount

24 Cash/Bank Debit Memo

25 Check

26 Tax Debit Memo

27 Others (specify below)

Stamp of Receiving Office/AAB and Date of Receipt (RO's Signature/Bank

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

Teller's Initial)

file://C:\Users\PC\AppData\Local\Temp\{ACA73A24-12E9-4142-92EC-41DEA5BCC37... 10/8/2021

You might also like

- April 2022Document2 pagesApril 2022abul hasan nayemNo ratings yet

- Final Citibike Locations For Prospect Heights, Crown Heights and Prospect-Lefferts GardensDocument1 pageFinal Citibike Locations For Prospect Heights, Crown Heights and Prospect-Lefferts GardensDNAinfoNewYork0% (1)

- AMM Steel Producers Map 2018 PDFDocument1 pageAMM Steel Producers Map 2018 PDFspencerNo ratings yet

- Editable IRS Form 8879 For 2017-2018Document2 pagesEditable IRS Form 8879 For 2017-2018PDFstockNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsArgielJedTabalBorrasNo ratings yet

- Tampines Ave 6 (North Bound) Tampines Ave 6 (North Bound) : Key PlanDocument1 pageTampines Ave 6 (North Bound) Tampines Ave 6 (North Bound) : Key PlanReshanth SelvaratnamNo ratings yet

- HALL_9Document1 pageHALL_9n.dangariaNo ratings yet

- Workbook Answer Key - OPDDocument64 pagesWorkbook Answer Key - OPDRoberta YoungNo ratings yet

- Hotel SDP For DrawingDocument1 pageHotel SDP For DrawingJohn Zedrick MacaisaNo ratings yet

- Off-Base Concrete Batch PlantDocument4 pagesOff-Base Concrete Batch PlantNadir Khattak Jr.No ratings yet

- Puerta: Gal. 882 NW - Nv. 4280 Veta Ursula 3Document1 pagePuerta: Gal. 882 NW - Nv. 4280 Veta Ursula 3RodrigoTejadaGallegosNo ratings yet

- DM C F G B CDocument11 pagesDM C F G B CGerard bouchardNo ratings yet

- 1.Detail Marking & TreeDocument1 page1.Detail Marking & TreeSumalata SalianNo ratings yet

- FM - 2 - PC - 21006 - 0-Feeder A Tna004 Hub Salemba To Tna004j010 Rbb0001481Document1 pageFM - 2 - PC - 21006 - 0-Feeder A Tna004 Hub Salemba To Tna004j010 Rbb0001481denurrantoNo ratings yet

- Jaime A Restrepo: Sanitary Level 1 - Residential BuildingDocument1 pageJaime A Restrepo: Sanitary Level 1 - Residential BuildingSrijon BrahmacharyNo ratings yet

- Eehc SC MP 0300102Document1 pageEehc SC MP 0300102ahmedsmman1976No ratings yet

- RE-NEET-EXAM_PAPER_WITH_ANSWERS-23-06-24[1]Document25 pagesRE-NEET-EXAM_PAPER_WITH_ANSWERS-23-06-24[1]babuvtwebNo ratings yet

- P-12 POI P-11: Ubicación GeneralDocument1 pageP-12 POI P-11: Ubicación GeneraledulinlinNo ratings yet

- MV1 ModelDocument1 pageMV1 ModelSohail YounisNo ratings yet

- Western Adventure LoopDocument4 pagesWestern Adventure Loopanon_275937008No ratings yet

- Eehc SC MP 0300101Document1 pageEehc SC MP 0300101ahmedsmman1976No ratings yet

- 19lg0119 Plan Part16Document6 pages19lg0119 Plan Part16jenurbano02No ratings yet

- 360o of Omnichannel Commerce: CustomerDocument1 page360o of Omnichannel Commerce: CustomerLiliaNo ratings yet

- 2.costaneras - Templetes - Canal - Techo 2 y 3Document1 page2.costaneras - Templetes - Canal - Techo 2 y 3Luis Fernando GarciaNo ratings yet

- AIA CA 2019 CBC Requirements: Residential Mandatory MeasuresDocument2 pagesAIA CA 2019 CBC Requirements: Residential Mandatory MeasuresMika SihiteNo ratings yet

- SÑ 02 PDFDocument1 pageSÑ 02 PDFC.O. INGENIERIA Y CONSTRUCCIONNo ratings yet

- 3401 PV MapDocument1 page3401 PV MaprasmushoygaardNo ratings yet

- Estadio Alcantarillado GeneralDocument1 pageEstadio Alcantarillado GeneralRubén Flores VillanuevaNo ratings yet

- A Song For You PianoDocument3 pagesA Song For You PianoBoatman Bill100% (1)

- 11.3 Plano TopografiaDocument1 page11.3 Plano TopografiaLuis HuamaniNo ratings yet

- Ingreso: Ss. Hh. DiscapacitadosDocument1 pageIngreso: Ss. Hh. DiscapacitadosIsaacNo ratings yet

- Virginia: Pineville MiddlesboroDocument1 pageVirginia: Pineville MiddlesboroArrigo CerroniNo ratings yet

- STP Ph1 JWWF PP 01 3201Document1 pageSTP Ph1 JWWF PP 01 3201Faisal MumtazNo ratings yet

- 501 e Walnut 5.25.2022Document1 page501 e Walnut 5.25.2022sokil_danNo ratings yet

- Lote 17: Circunvalacion NorteDocument1 pageLote 17: Circunvalacion NorteStefano IannuzzelliNo ratings yet

- 3Document1 page3Sanal SamsonNo ratings yet

- Alcantarill 9+350Document1 pageAlcantarill 9+350melcvmfotosNo ratings yet

- Ya Rayah-8ni-Partitura e PartiDocument9 pagesYa Rayah-8ni-Partitura e Parti3nzos1x0% (1)

- 3rd - Ashenafi Argaw Residence 2007 St-Layout1Document1 page3rd - Ashenafi Argaw Residence 2007 St-Layout1Jaspergroup 15No ratings yet

- Planta 3Document1 pagePlanta 3Giomara LazoNo ratings yet

- Ku Plumbing Progress Set-6162023Document19 pagesKu Plumbing Progress Set-6162023Chainlink EngineeringNo ratings yet

- NoyadadDocument44 pagesNoyadadAlejandro QuintanillaNo ratings yet

- p45-Dwg-civ-20-Pile Load Test Location-Sh 1 of 2Document1 pagep45-Dwg-civ-20-Pile Load Test Location-Sh 1 of 2Maan JiiNo ratings yet

- Imcu 10 Beds Nicu 16 Beds Picu 6 Beds: Typical Noggin FixingDocument1 pageImcu 10 Beds Nicu 16 Beds Picu 6 Beds: Typical Noggin Fixingmanikandan4strlNo ratings yet

- PDF HighlightedDocument9 pagesPDF Highlightedmartinaandrei.powerupNo ratings yet

- Locality Plan: Subject SiteDocument7 pagesLocality Plan: Subject SiteRavinesh SinghNo ratings yet

- Chittoor Div Map Dwg-ModelDocument1 pageChittoor Div Map Dwg-ModelExecutive EngineerNo ratings yet

- Dokumen - Tips Geography For CsecDocument4 pagesDokumen - Tips Geography For Csecjesse vixNo ratings yet

- Ball Ground Zoning Map 071514Document1 pageBall Ground Zoning Map 071514John loydNo ratings yet

- Assignment 1 CoverDocument1 pageAssignment 1 CoverAnonymous WEJ2b9Gm7No ratings yet

- Alcantarill 8+451.54Document1 pageAlcantarill 8+451.54melcvmfotosNo ratings yet

- Shilparamam Hyderabad Revised1 Model 1 PDFDocument1 pageShilparamam Hyderabad Revised1 Model 1 PDFPratima MaheshNo ratings yet

- Happy Birthday To You PDFDocument1 pageHappy Birthday To You PDFPham Minh Quyen100% (1)

- Irrigation Water Tank V:200 m3: Foundation OutlineDocument1 pageIrrigation Water Tank V:200 m3: Foundation OutlineZrar IsqeliNo ratings yet

- مخطط الموقع العام ;كابلات طبرجل-ModelDocument1 pageمخطط الموقع العام ;كابلات طبرجل-ModelIbrahim AliNo ratings yet

- Alcantarill 9+140.53Document1 pageAlcantarill 9+140.53melcvmfotosNo ratings yet

- 06 07 Mar 24 01 Cluster San Agustin RasantesDocument1 page06 07 Mar 24 01 Cluster San Agustin RasantesandreNo ratings yet

- OT3073-20 L3 LAB Condenseur R3Document1 pageOT3073-20 L3 LAB Condenseur R3becemNo ratings yet

- SG3120B SFNW P2P DiagramDocument3 pagesSG3120B SFNW P2P Diagramprint press (printpress.eg)No ratings yet

- Here's To You PDFDocument4 pagesHere's To You PDFmondosonoroNo ratings yet

- PRE2 SegundaDocument1 pagePRE2 Segundadaniel cruzNo ratings yet

- Tax ReturnDocument15 pagesTax ReturnCristóbal Rodas100% (1)

- Income Tax Payment Challan: PSID #: 172247415Document1 pageIncome Tax Payment Challan: PSID #: 172247415fast fbrNo ratings yet

- Employee'S Provident Fund Organisation: Electronic Challan Cum Return (Ecr)Document1 pageEmployee'S Provident Fund Organisation: Electronic Challan Cum Return (Ecr)Vora ParvejNo ratings yet

- TechnocraftDocument1 pageTechnocraftMilan KanriNo ratings yet

- COMEX1 TAX REVIEW Canvas-1Document18 pagesCOMEX1 TAX REVIEW Canvas-1Angel RosalesNo ratings yet

- 3jgo Manpower Provider, Inc. Tisado, Joylit Cadiente: Payroll Period: Jun 10 2019-Jun 24 2019 Emp. NameDocument1 page3jgo Manpower Provider, Inc. Tisado, Joylit Cadiente: Payroll Period: Jun 10 2019-Jun 24 2019 Emp. NameJoylit Garcia CadienteNo ratings yet

- TAX-1601 (Additions To Tax)Document4 pagesTAX-1601 (Additions To Tax)lyndon delfinNo ratings yet

- Get LetterDocument1 pageGet LetterMACPRAISE HOLDINGSNo ratings yet

- Tax Invoice: Gift From: Gift To: Customer CommentsDocument1 pageTax Invoice: Gift From: Gift To: Customer CommentsCA Shrikant VaranasiNo ratings yet

- Module 6 - Donor's TaxationDocument14 pagesModule 6 - Donor's TaxationLex Dela CruzNo ratings yet

- GST Assignment1.1lDocument3 pagesGST Assignment1.1lHamza AliNo ratings yet

- Form P.T 10 Form P.T 10 Form P.T 10: Mrumair AkramDocument1 pageForm P.T 10 Form P.T 10 Form P.T 10: Mrumair AkramZubair AkramNo ratings yet

- Social Security Contribution LevyDocument5 pagesSocial Security Contribution LevyNews CutterNo ratings yet

- In Voice 15333451944702861966Document2 pagesIn Voice 15333451944702861966Jinu SajiNo ratings yet

- PMT-3 PDFDocument2 pagesPMT-3 PDFHemant KumarNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- PayrollDocument9 pagesPayrollKen MabalotNo ratings yet

- Maternity and Paternity LeaveDocument4 pagesMaternity and Paternity LeavePerry YapNo ratings yet

- Dream Valley 11Document13 pagesDream Valley 11prachi_sipi1830No ratings yet

- Rutansh Itr 2022-23Document1 pageRutansh Itr 2022-23NDN CANo ratings yet

- 2016 Itr1 PR7 PDFDocument5 pages2016 Itr1 PR7 PDFVyankatesh KurriNo ratings yet

- Concept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Document2 pagesConcept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Ranjan BaradurNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDrsex DrsexNo ratings yet

- Assignment 1Document4 pagesAssignment 111dylan97No ratings yet

- BIR - Remittance of CWT (Form 1606) Should Be in The Name of The Buyer - JUAN PATAG REAL ESTATEDocument2 pagesBIR - Remittance of CWT (Form 1606) Should Be in The Name of The Buyer - JUAN PATAG REAL ESTATERoy RitagaNo ratings yet

- Villanueva V City of IloiloDocument1 pageVillanueva V City of IloiloEllaine Virayo100% (1)

- Adobe Scan 09 Jan 2024Document1 pageAdobe Scan 09 Jan 2024swapna vijayNo ratings yet

- Jeevan Umang-945: Special-FeatureDocument4 pagesJeevan Umang-945: Special-FeatureManjunathNo ratings yet

![RE-NEET-EXAM_PAPER_WITH_ANSWERS-23-06-24[1]](https://imgv2-2-f.scribdassets.com/img/document/747760565/149x198/10ebd11f7b/1720062581?v=1)