Professional Documents

Culture Documents

Rem9ass2midterm Delicanoj

Rem9ass2midterm Delicanoj

Uploaded by

Mary Sanda SanchezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rem9ass2midterm Delicanoj

Rem9ass2midterm Delicanoj

Uploaded by

Mary Sanda SanchezCopyright:

Available Formats

DELICANO, JUNVE L.

BSREM 1YR SEM2

Assignment #1

Midterm

Title: Procedure for Developing the SMV for Agricultural Lands

Instruction:

Discuss the Procedure for developing the SMV for Agricultural Lands

(SMV) for agricultural lands is a measure used to assess the suitability and

productivity potential of soil for agricultural purposes. It provides valuable

information for landowners, farmers, and agricultural professionals to make informed

decisions about soil management practices and land use planning. The concept of

SMV is particularly important in sustainable land management practices, as it helps

identify areas with different levels of productivity potential and guides the

implementation of targeted soil management strategies to optimize agricultural

productivity while minimizing environmental impact.

Determining the Scheduled Market Value (SMV) for agricultural lands involves a

structured approach to assess the fair market worth of the land, considering various

factors influencing its value. Here's a detailed procedure for developing SMV:

◼ Establish Appraisal Purpose: Define the purpose of the appraisal, whether it's

for taxation, sale, purchase, mortgage, or any other financial transaction. Each

purpose may have different evaluation criteria.

◼ Gather Property Information: Collect comprehensive data about the

agricultural land under evaluation. This includes land size, location, soil type,

topography, accessibility, water availability, infrastructure (such as roads and

utilities), land use history, and any legal restrictions or encumbrances.

◼ Understand Market Trends: Analyze local and regional market trends for

agricultural lands. Consider factors such as supply and demand dynamics, land

prices, rental rates, agricultural productivity, government policies, and economic

conditions affecting the agricultural sector.

◼ Select Appropriate Valuation Method: Choose the most suitable valuation

method based on the characteristics of the agricultural land and the appraisal

purpose. Common valuation methods for agricultural lands include:

✓ Sales Comparison Approach: Compare the subject property with similar

agricultural lands that have been recently sold in the same or similar area.

Adjustments are made for differences in land size, location, soil quality,

improvements, and other relevant factors.

✓ Income Capitalization Approach: Estimate the present value of the expected

income generated by the agricultural land, such as crop yields, livestock

production, or leasing income. This approach typically involves capitalizing

the net operating income using a capitalization rate.

✓ Cost Approach: Determine the value of the land by estimating the cost to

replace or reproduce it, considering factors like land acquisition costs, site

preparation, infrastructure development, and other improvements. Deduct

depreciation for any physical deterioration, functional obsolescence, or

external factors affecting value.

◼ Conduct Property Inspection: Visit the agricultural land to assess its condition

firsthand. Evaluate factors such as soil quality, drainage, topography, vegetation,

land use practices, and any improvements or structures on the land.

◼ Analyze Comparable Sales: Identify and analyze recent sales of comparable

agricultural lands in the vicinity. Consider similarities and differences in terms of

land size, location, soil productivity, accessibility, zoning, and other relevant

factors to derive an indication of the subject property's market value.

◼ Apply Valuation Adjustments: Make appropriate adjustments to the

comparable sales data to account for differences between the subject property and

the comparables. Adjustments may be made for factors such as land size, location,

soil quality, improvements, market conditions, and transaction terms.

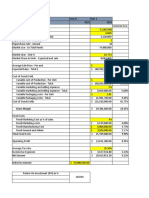

◼ Calculate SMV: Once all necessary data has been gathered and analyzed,

calculate the Scheduled Market Value of the agricultural land using the selected

valuation method. This may involve applying mathematical formulas, regression

analysis, or other quantitative techniques to arrive at a final estimate of value.

◼ Document the Appraisal Report: Prepare a comprehensive appraisal report

documenting the appraisal process, data sources, assumptions made, valuation

methods used, comparable sales analysis, adjustments applied, and the final SMV

determination. Ensure that the report complies with applicable appraisal standards

and regulations.

◼ Review and Quality Assurance: Review the appraisal report for accuracy,

completeness, and consistency. Verify that all relevant data has been properly

considered and that the valuation approach used is appropriate for the appraisal

purpose. Conduct quality assurance checks to minimize errors and ensure the

reliability of the SMV determination.

◼ Finalize SMV Conclusion: Present the finalized Scheduled Market Value

conclusion for the agricultural land, along with any supporting documentation

and analysis. Communicate the findings to relevant stakeholders, such as property

owners, buyers, lenders, tax authorities, or other interested parties.

◼ Update Regularly: Periodically review and update the SMV of agricultural lands

to reflect changes in market conditions, land use patterns, economic factors, or

regulatory requirements. Keeping the valuation up-to-date ensures its relevance

and accuracy over time.

By following this procedure, stakeholders can obtain a reliable estimate of the

Scheduled Market Value for agricultural lands, facilitating informed decision-making

and transactions in the real estate market.

You might also like

- Guidelines On Foreigners Property Ownership in IndonesiaDocument76 pagesGuidelines On Foreigners Property Ownership in IndonesiaRazvan Julian PetrescuNo ratings yet

- Ba Core 1 Module 4 AnswerDocument6 pagesBa Core 1 Module 4 Answerjojie dadorNo ratings yet

- 2 Land Valuation SectionDocument32 pages2 Land Valuation SectionJulie CruzNo ratings yet

- Rem9ass1prefinal DelicanojDocument2 pagesRem9ass1prefinal DelicanojMary Sanda SanchezNo ratings yet

- Mass AppraisalDocument13 pagesMass AppraisalrizaNo ratings yet

- Highest and Best Use Analysis For Agricultural LotDocument3 pagesHighest and Best Use Analysis For Agricultural LotAtnapaz JodNo ratings yet

- Appraisal & Assessment in The Government SectorDocument33 pagesAppraisal & Assessment in The Government SectorRonald MojadoNo ratings yet

- Chapter 4 Land Value Determination and Tax Maps 353172 7Document38 pagesChapter 4 Land Value Determination and Tax Maps 353172 7Andri SuhartoNo ratings yet

- 2015ind Padilla 001 PDFDocument22 pages2015ind Padilla 001 PDFmario j padillaNo ratings yet

- Land Use PlanningDocument23 pagesLand Use Planningkqk07829No ratings yet

- STT171Document34 pagesSTT171Mash SalihNo ratings yet

- Report in Development ValuationDocument17 pagesReport in Development ValuationRhea RepajaNo ratings yet

- Real Estate ValuationDocument12 pagesReal Estate ValuationRahul MalikNo ratings yet

- 5 AppraisalProcess MBC2015 PDFDocument70 pages5 AppraisalProcess MBC2015 PDFRoy John MalaluanNo ratings yet

- h3070 2Document30 pagesh3070 2Paulo IvoNo ratings yet

- Valuation of Real PropertiesDocument7 pagesValuation of Real PropertiesLavanya LakshmiNo ratings yet

- Policy On Valuation & Appointment of ValuersDocument77 pagesPolicy On Valuation & Appointment of ValuersRajwinder SInghNo ratings yet

- Cloud Peak, Big-WPS OfficeDocument12 pagesCloud Peak, Big-WPS OfficeAmanuelNo ratings yet

- SMV AgriDocument4 pagesSMV AgriJestoni AsisNo ratings yet

- Methods of Valuation of A BuildingDocument9 pagesMethods of Valuation of A BuildingNanda Kumar100% (1)

- Farm Planning - 2nd LectureDocument30 pagesFarm Planning - 2nd Lecturepapabilla69No ratings yet

- Understand Appraisal 1109 PDFDocument18 pagesUnderstand Appraisal 1109 PDFwmorreNo ratings yet

- Introduction To Theory & Practice of Fixed Asset Valuation Based On Market ApproachDocument19 pagesIntroduction To Theory & Practice of Fixed Asset Valuation Based On Market ApproachGagan100% (1)

- Residual Land Valuation MethodDocument7 pagesResidual Land Valuation Methodrajeshjadhav89100% (1)

- The Process of Property AppraisalDocument2 pagesThe Process of Property AppraisalDelaNo ratings yet

- Valuation NotesDocument2 pagesValuation NotesveeranjaneyuluNo ratings yet

- F MGT & Account Group WorkDocument15 pagesF MGT & Account Group WorkAmanya GibsonNo ratings yet

- Valuation Testing For Mass AppraisalDocument37 pagesValuation Testing For Mass AppraisalErle Stanley Buyco0% (1)

- Real Estate Valuation - Anri KonomiDocument8 pagesReal Estate Valuation - Anri KonomiAnri KonomiNo ratings yet

- Methods of Valuation: Qs 435 Construction ECONOMICS IIDocument25 pagesMethods of Valuation: Qs 435 Construction ECONOMICS IIGithu RobertNo ratings yet

- Country Evaluation and Selection of International BusinessDocument13 pagesCountry Evaluation and Selection of International BusinessSoumendra Roy100% (2)

- Group No.03 Final Report PDFDocument8 pagesGroup No.03 Final Report PDFAlly DaulathNo ratings yet

- Assignment On QSCM 42 - S.No. 11 - Saifuddin ShyamwalaDocument8 pagesAssignment On QSCM 42 - S.No. 11 - Saifuddin ShyamwalaInfo SaifNo ratings yet

- MAINDocument59 pagesMAINarjunbiju472No ratings yet

- OperationsDocument12 pagesOperationsSiddharth PorwalNo ratings yet

- Man Eco ReviewerDocument12 pagesMan Eco Reviewerlyka PeñaNo ratings yet

- Plant LocationDocument11 pagesPlant Locationnaveencholleti09No ratings yet

- Understand Appraisal 1109 PDFDocument18 pagesUnderstand Appraisal 1109 PDFrubydelacruzNo ratings yet

- Property Valuation LectureDocument45 pagesProperty Valuation LectureTanaka Kashiri100% (1)

- Methods of ValuationDocument19 pagesMethods of ValuationRohit KulkarniNo ratings yet

- Land Value and Purchase: Lesson 3: Appraisal TechniquesDocument8 pagesLand Value and Purchase: Lesson 3: Appraisal TechniquesAgung SugiartoNo ratings yet

- Avaluo Rancho PDFDocument12 pagesAvaluo Rancho PDFFrancisco OrtizNo ratings yet

- Land Use and EvaluationDocument24 pagesLand Use and Evaluationkqk07829No ratings yet

- Unit 5: Rent, Wages, Interest and ProfitDocument52 pagesUnit 5: Rent, Wages, Interest and ProfitAishwarya ChauhanNo ratings yet

- REP AppraisalDocument59 pagesREP Appraisalromi moriNo ratings yet

- Traditional Methods Land ValuationDocument4 pagesTraditional Methods Land ValuationMa Cecile Candida Yabao-RuedaNo ratings yet

- Appraisal Service: Able To Offer A Complete Appraisal Service To Our CustomersDocument8 pagesAppraisal Service: Able To Offer A Complete Appraisal Service To Our CustomersXt3rmin8r100% (1)

- Agroforestry-Economics MAKRAND GUJARDocument41 pagesAgroforestry-Economics MAKRAND GUJARmddy98No ratings yet

- Real Property Valuation MethodsDocument6 pagesReal Property Valuation MethodsMuhammadIqbalMughalNo ratings yet

- Tiger Hotel AppraisalDocument34 pagesTiger Hotel AppraisalThe Columbia Heart Beat100% (1)

- Appraisal Reporting Standards ProceduresDocument18 pagesAppraisal Reporting Standards Proceduresrain06021992No ratings yet

- Comparative Method of Valuation: 5 October 2013Document12 pagesComparative Method of Valuation: 5 October 2013Rajwinder Singh BansalNo ratings yet

- RICS StandardsDocument4 pagesRICS Standardschandrikajadhav067No ratings yet

- Soil Survey and Land Use Planning (SSC 509) Land Potential Assessment (Evaluation)Document22 pagesSoil Survey and Land Use Planning (SSC 509) Land Potential Assessment (Evaluation)Gideon NwekeNo ratings yet

- Lecture - Delphi - Landsuitaility Analysis - 2023Document27 pagesLecture - Delphi - Landsuitaility Analysis - 2023Manas ChuriNo ratings yet

- LGS GCP Course IVB Valuation of Rural Land Revised February 2011Document396 pagesLGS GCP Course IVB Valuation of Rural Land Revised February 2011Osagie AlfredNo ratings yet

- RICS Associate Assessment - Land-Mar 2015-WEBDocument30 pagesRICS Associate Assessment - Land-Mar 2015-WEBStephenSmithNo ratings yet

- Valuation of Properties - 7&8Document72 pagesValuation of Properties - 7&8fouad.mlwbdNo ratings yet

- Multifamily Mastery: A Guide To Strategic Property OptimizationFrom EverandMultifamily Mastery: A Guide To Strategic Property OptimizationNo ratings yet

- Flipping Houses 101: A Beginner's Guide to Real Estate ProfitsFrom EverandFlipping Houses 101: A Beginner's Guide to Real Estate ProfitsNo ratings yet

- Real Estate Investing: Comparative Market Analysis HandbookFrom EverandReal Estate Investing: Comparative Market Analysis HandbookNo ratings yet

- Microfinance in Myanmar Sector AssessmentDocument54 pagesMicrofinance in Myanmar Sector AssessmentTHAN HANNo ratings yet

- India - China Relations: Notes For UPSCDocument5 pagesIndia - China Relations: Notes For UPSCasim khanNo ratings yet

- ECF340-FPD-1 - Course Outline 2020-2 PDFDocument3 pagesECF340-FPD-1 - Course Outline 2020-2 PDFDario KabangaNo ratings yet

- Philippine Planning Process OverviewDocument2 pagesPhilippine Planning Process OverviewcinderellaNo ratings yet

- Rajasthan: Hawa Mahal in Jaipur, RajasthanDocument52 pagesRajasthan: Hawa Mahal in Jaipur, Rajasthangillnirmal111No ratings yet

- SDG4 Profile BangladeshDocument7 pagesSDG4 Profile BangladeshShayekh M ArifNo ratings yet

- Maf5101 Financial Accounting Cat 1Document2 pagesMaf5101 Financial Accounting Cat 1ahimbisibwe lamedNo ratings yet

- AFM NotesDocument4 pagesAFM NotesPhotos Back up 2No ratings yet

- Syllabus 4th SemDocument25 pagesSyllabus 4th SemJaspreet KaurNo ratings yet

- Learning Journey Dates: Year 7 Upto Year 10Document5 pagesLearning Journey Dates: Year 7 Upto Year 10Kogilan A/L Bama DavenNo ratings yet

- Goods and Services Tax - Form GSTR-2B (Quarterly)Document71 pagesGoods and Services Tax - Form GSTR-2B (Quarterly)Param JainNo ratings yet

- Corporate DataDocument201 pagesCorporate DataDinesh YadavNo ratings yet

- Generic Business Plan For Production of Straw PelletsDocument74 pagesGeneric Business Plan For Production of Straw PelletsARIF SAFI'INo ratings yet

- 1664515275102Document72 pages1664515275102FAN OF RGVNo ratings yet

- BM 03N HP2 MarkschemeDocument19 pagesBM 03N HP2 MarkschemeMARIOLA ORTSNo ratings yet

- Tli Dore Buying ProceduresDocument2 pagesTli Dore Buying ProceduressprataNo ratings yet

- Basics of Gold As An Investment ClassDocument6 pagesBasics of Gold As An Investment Classanandyadav_imgNo ratings yet

- Fahad Resume2327Document4 pagesFahad Resume2327Fahad khanNo ratings yet

- Cost Management & Low Rise High Rise PDFDocument36 pagesCost Management & Low Rise High Rise PDFHarleen SehgalNo ratings yet

- Chapter 16Document16 pagesChapter 16soniadhingra1805No ratings yet

- USD TO INR FORECAST 2020, 2021, 2022, 2023, 2024 - Long ForecastDocument7 pagesUSD TO INR FORECAST 2020, 2021, 2022, 2023, 2024 - Long ForecastShanMugamNo ratings yet

- Industry Analysis - Air TransportDocument8 pagesIndustry Analysis - Air Transportzizi018No ratings yet

- Enter P. Full Note 19Document83 pagesEnter P. Full Note 19Hussen MohammedNo ratings yet

- Gross MarginDocument2 pagesGross MarginEDxColdBloodedNo ratings yet

- 01 The Term Structure and Interest Rate DynamicsDocument38 pages01 The Term Structure and Interest Rate DynamicsGastón Saint-HubertNo ratings yet

- Lease and Project Finance Exam 2022 S2Document4 pagesLease and Project Finance Exam 2022 S2bonaventure chipetaNo ratings yet

- Theories ForLQ3Document33 pagesTheories ForLQ3Erica HababagNo ratings yet

- List of Lto Vdap ManufacturerDocument3 pagesList of Lto Vdap ManufacturerRcs CheNo ratings yet