Professional Documents

Culture Documents

Cost Job Order Exercises Anskey

Cost Job Order Exercises Anskey

Uploaded by

Lizbeth Gangano WalacCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Job Order Exercises Anskey

Cost Job Order Exercises Anskey

Uploaded by

Lizbeth Gangano WalacCopyright:

Available Formats

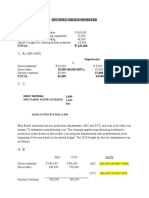

3-2 MULTIPLE CHOICE 3.

4 Multiple Choice

1. C 1. B

2. B 2. B

3. A 3. A

4. D Direct materials

5. C (P142,500 x 80%) P114,000.00

Direct labor 84,000.00

6. B

Factory overhead

7. B

(P20,400+160,500) 180,900.00

8. A Total manufacturing cost P378,900.00

9. D Completed percentage X 65%

10. D Finished goods P246,286.00

Percentage of sold X 85%

Cost of goods sold P209,342.25

4. C

Sales (Job 101) P62,250

Less: Cost

3-3 MULTIPLE CHOICE Materials

(P4,500 + 9,000) P13,500

1. C

Direct labor 21,000

2. C

Applied FO

3. A (5,400 x P3.50) 18,900 P53,400

4. A Gross profit P 8,850

5. B

6. D 5. C

Predetermined FOH rate: Work in process at the end (Job 103)

=P1,080,000/900,000= P1.2 per DLH Direct materials

(P10,500 + 4,800) P15,300

Applied FOH=P1.20 x 975,000= P1,170,000 Direct labor 12,000

Less: Actual FOH P1,140 000 Applied factory overhead

Over-applied FO P 30,000 (2,850 x P3.50) 9,975

Total cost of Job 103 P37,275

7. A

6. B

Applied FOH P116,250

Applied factory overhead

Actual FOH P111,000 (4,500+5,400+2,850)xP3.50) P44,625

Over-applied FOH P 5,250 Actual factory overhead

Allocation to Finished Goods *Indirect materials P3,450

[30,000 / (86,250 + 30,000)] x 5,250 *Indirect labor 5,550

=P1,354.84 or P1,355 *Other FOH 29,100

*Depreciation 8,100 P46,200

8. B Under-applied FOH P 1,575

Prime cost =P600+3,200+450+750=P2,100

FOH applied = P3,600 -2, 100 =P1,500 7. B

Predetermine FOH rate Materials issued P489,000

= 1,500 /(1,200) = 125% Add: WIP — ending 127,500

Total P616,500

Less: WIP — beginning 112,500

9. B

Raw materials purchased P504,000

WIP Balance (job 90)

= 18,000 +60,000 +45,000+40,500-150,000 8. C

=P13,500 Total manufacturing cost = direct materials +

direct labor + applied factory overhead

Direct materials =13,500-3,375-(3,375/90%) P1,029,000=P489,000+X+0.60X

=P6,375 1.60X= P1,029,000-P489,000

X=P540,000/1.60

X=P337,500

10. D

Direct Materials P37,500 9. B

Direct labor Work in process — beg. P 120,000

Dept.A P12,000 Add: Total manufacturing cost 1,029,000

Dept.B P18,000 P30,000 Total goods in process 1,149,000

Factory Overhead Less: WIP — ending 45,000

Dept.A Cost of goods manufactured 1,104,000

(P12,000x900/300) P36,000

Dept.B 10. A

(P18,000x600/1200) P9,000 P45,000 Finished goods — beg P135,000

Job 101 Cost P112,500 Add: CGM 1,104,000

Goods available for sale 1,239,000

Less: Finished goods — end 165,000

Cost of goods sold 1,074,000

You might also like

- Don Hall - PyrapointDocument243 pagesDon Hall - Pyrapointcabaleiromedieval100% (4)

- Maintenance KitsDocument6 pagesMaintenance Kitssebastian BugueñoNo ratings yet

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Cost Job Order Exercises AnskeyDocument1 pageCost Job Order Exercises AnskeyLizbeth Gangano WalacNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument13 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AMaica GarciaNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument12 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AHardin LavistreNo ratings yet

- Ansay, Allyson Charissa T. - BSA 2 - Job Order CostingDocument9 pagesAnsay, Allyson Charissa T. - BSA 2 - Job Order Costingカイ みゆきNo ratings yet

- (Mas) Week1 Solutions ManualDocument17 pages(Mas) Week1 Solutions ManualBeef Testosterone100% (1)

- MAS Assessment Exam Answer Key SolutionDocument7 pagesMAS Assessment Exam Answer Key SolutionJonalyn JavierNo ratings yet

- Multiple Choice Questions TheoreticalDocument13 pagesMultiple Choice Questions TheoreticalAiraNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Problem 8 COSTDocument2 pagesProblem 8 COSTJoresol AlorroNo ratings yet

- Cost Chapter 14Document15 pagesCost Chapter 14Marica ShaneNo ratings yet

- Mas Test Bank SolutionDocument13 pagesMas Test Bank SolutionMark Jonah BachaoNo ratings yet

- 4 - Sample Problems - Standard Costing and Variance AnalysisDocument8 pages4 - Sample Problems - Standard Costing and Variance AnalysisJustin AciertoNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionGem Alcos NicdaoNo ratings yet

- Mas Test Bank SolutionDocument14 pagesMas Test Bank SolutionLyzaNo ratings yet

- Chapter 5 Factory Overhead Accounting ExercisesDocument10 pagesChapter 5 Factory Overhead Accounting ExercisesxicoyiNo ratings yet

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsPremium AccountsNo ratings yet

- RCA Sol Sample Exam PDFDocument5 pagesRCA Sol Sample Exam PDFdiane camansagNo ratings yet

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- Mas Solutions To Problems Solutions 2018Document14 pagesMas Solutions To Problems Solutions 2018Jahanna Martorillas0% (1)

- Mas Solutions To Problems Solutions 2018 PDFDocument13 pagesMas Solutions To Problems Solutions 2018 PDFMIKKONo ratings yet

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDale MartinNo ratings yet

- Costco1 - Assign 5Document7 pagesCostco1 - Assign 5Deryl GalveNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Chapter 6 Activity Based CostingDocument20 pagesChapter 6 Activity Based CostingSVPSNo ratings yet

- Cost Chapter 15Document13 pagesCost Chapter 15Marica Shane100% (3)

- Chapter 4Document3 pagesChapter 4?????100% (1)

- StratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyDocument5 pagesStratCostMgmt 4 - Mock Test For Quiz 1 Answer KeyFoshAtokNo ratings yet

- Mock Boards Answers AfarDocument5 pagesMock Boards Answers AfarKenneth DiabordoNo ratings yet

- 2022 CA Chapter 13Document5 pages2022 CA Chapter 13Athena Ashley Gepte AquinoNo ratings yet

- Chapter 15Document21 pagesChapter 15randyNo ratings yet

- 12 Task Performance 1Document3 pages12 Task Performance 1Razel AntiniolosNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- MAS Answer Key SolutionDocument6 pagesMAS Answer Key SolutionJonalyn JavierNo ratings yet

- Relevant Costing ActivityDocument3 pagesRelevant Costing ActivityRosario BacaniNo ratings yet

- Gapas, Daniel John L. (Etivity 10)Document4 pagesGapas, Daniel John L. (Etivity 10)Daniel John GapasNo ratings yet

- Cost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Document7 pagesCost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Saarah KylueNo ratings yet

- Chapter 4 Job Order Costing and Cost Allocation v2021Document7 pagesChapter 4 Job Order Costing and Cost Allocation v2021Dalia ElarabyNo ratings yet

- Studocu 12137811-1Document31 pagesStudocu 12137811-1kristinejoy pacalNo ratings yet

- Sales Price: (400 Units X P26.50) : PROBLEM 14-3Document2 pagesSales Price: (400 Units X P26.50) : PROBLEM 14-3Gileah Ymalay ZuasolaNo ratings yet

- Module 4.2 Activity-Based Costing ProblemsDocument5 pagesModule 4.2 Activity-Based Costing ProblemsDanica Ramos100% (1)

- Answers To Multiple Choice - Theoretical: Charged To Specific JobDocument11 pagesAnswers To Multiple Choice - Theoretical: Charged To Specific JobJennifer Marie AlmueteNo ratings yet

- MAS1Document48 pagesMAS1ryan angelica allanicNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

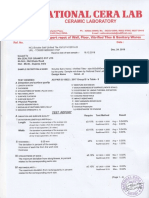

- 12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Document3 pages12 - National Cera Lab Test Report - 600x1200 MM - 24.12.2019Shaikh MohammedHanifSultanNo ratings yet

- Central Place TheoryDocument10 pagesCentral Place Theoryतरुण पन्तNo ratings yet

- WSG7 Dec02Document77 pagesWSG7 Dec02adelNo ratings yet

- Quiz - Chapter 4 - Partnership Liquidation - 2021 EditionDocument7 pagesQuiz - Chapter 4 - Partnership Liquidation - 2021 EditionYam SondayNo ratings yet

- Stone-Geary Utility Function - выводDocument3 pagesStone-Geary Utility Function - выводМаксим НовакNo ratings yet

- PETRONAS Licensing and Registration General Guidelines (English Version - As at 1 June 2017)Document41 pagesPETRONAS Licensing and Registration General Guidelines (English Version - As at 1 June 2017)Adilah AzamiNo ratings yet

- ThoughtWorks SampleDocument4 pagesThoughtWorks SampleAbhijit ChakrabortyNo ratings yet

- ABC MemoDocument4 pagesABC MemoPriyanshi PatelNo ratings yet

- Raft Slab LayoutDocument1 pageRaft Slab LayoutDINESH M.NNo ratings yet

- g76 Capstan GripDocument4 pagesg76 Capstan GripAlexandreinspetorNo ratings yet

- Oleh:: Jutawan Dua LogamDocument42 pagesOleh:: Jutawan Dua LogamMustaffa Bin HashimNo ratings yet

- Micro Economics Consumer EquilibriumDocument34 pagesMicro Economics Consumer EquilibriumSurajNo ratings yet

- BRM Final Gavish AroraDocument4 pagesBRM Final Gavish AroraAryanSinghNo ratings yet

- Brief Intro of IsraelDocument28 pagesBrief Intro of Israel王郁妘No ratings yet

- The Impact of Trade Liberalization On EmploymentDocument12 pagesThe Impact of Trade Liberalization On EmploymentRobinson BhandariNo ratings yet

- Family Leadership Succession and Firm Performance: The Moderating Effect of Tacit Idiosyncratic Firm KnowledgeDocument9 pagesFamily Leadership Succession and Firm Performance: The Moderating Effect of Tacit Idiosyncratic Firm KnowledgeJorge Ivan Villada LizarazoNo ratings yet

- Epressing Resul So That, Such ThatDocument2 pagesEpressing Resul So That, Such Thatسدن آرماNo ratings yet

- Quality Checklist For Site Works: 17 Wet-Area Waterproofing TaskDocument1 pageQuality Checklist For Site Works: 17 Wet-Area Waterproofing Taskadnan-651358No ratings yet

- Liquidity Grab With Support & Resistance IndicatorDocument6 pagesLiquidity Grab With Support & Resistance Indicatorst augusNo ratings yet

- 1e0001 - Steel - Heat Treated Cold Finished BarDocument3 pages1e0001 - Steel - Heat Treated Cold Finished BarPuneet EnterprisesNo ratings yet

- Nitrogen N-5050 FillingDocument2 pagesNitrogen N-5050 FillingApriyan Tri KusumaNo ratings yet

- BS 6004-12Document34 pagesBS 6004-12jamilNo ratings yet

- RESUMEN - Stanford Graduate School of BusinesDocument3 pagesRESUMEN - Stanford Graduate School of Businesclaudiarojas2309No ratings yet

- Economic Theories of The Firm - Past, Present, and Future PDFDocument16 pagesEconomic Theories of The Firm - Past, Present, and Future PDFJeremiahOmwoyoNo ratings yet

- Chapter-The Age of Industrialisation: Multiple Choice QuestionDocument6 pagesChapter-The Age of Industrialisation: Multiple Choice QuestionAbhilash GSNo ratings yet

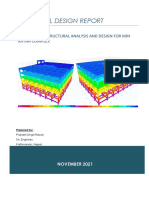

- Commercial Building Structural Design ReportDocument76 pagesCommercial Building Structural Design ReportPrakash Singh RawalNo ratings yet

- ISPDataDocument495 pagesISPDataSabitra RudraNo ratings yet

- Time Series Using Stata (Oscar Torres-Reyna Version) : December 2007Document32 pagesTime Series Using Stata (Oscar Torres-Reyna Version) : December 2007Humayun KabirNo ratings yet