Professional Documents

Culture Documents

Analysis of Business Transactions

Analysis of Business Transactions

Uploaded by

haarrisali70 ratings0% found this document useful (0 votes)

4 views5 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views5 pagesAnalysis of Business Transactions

Analysis of Business Transactions

Uploaded by

haarrisali7Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

Q.1. Mr.

Waldo started a business “Waldo Printing Services” by investing

cash $30,000. Following transactions pertains to December 2023.

a) Purchased printing press on account $10,000

b) Purchased printing supplies on cash $5,000

c) Completed printing work for a client and collected cash $4,000

d) Salaries paid to workers $1,400

e) Billed client $5000 for printing services rendered on account.

f) Purchased a computer for $2,000, cash paid $500 and singed a note for

the balance amount

g) Received electricity bill for the month $1,500

h) Mr. Waldo withdrew cash from business for his personal needs $1,000

i) Cash collected from a customer to whom services rendered on account in

transaction e

j) Printing supplies on hand $2400

Analysis of Business Transactions

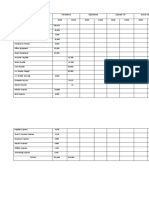

Title of Classification Type of Normal Increase Effect

account account balance or

Decrease

Cash Asset Real Dr. Increase Dr.

Capital Owner’s equity Personal Cr. Increase Cr.

A Printing Press Asset Real Dr. Increase Dr.

A/c Payable Liability Personal Cr. Increase Cr.

B P. Supplies Asset Real Dr. Increase Dr.

Cash Asset Real Dr. Decrease Cr.

C Cash Asset Real Dr. Increase Dr.

Service Rev Income Nominal Cr. Increase Cr.

D Sal. Exp Expense Nominal Dr. Increase Dr.

Cash Asset Real Cr. Decrease Cr.

E A/c Receivable Asset Personal Dr. Increase Dr.

Service Rev Income Nominal Cr. Increase Cr.

F Computer Asset Real Dr. Increase Dr.

Cash Asset Real Dr. Decrease Cr.

Notes Payable Liability Personal Cr Increase Cr.

G Elec. Exp Expense Nominal Dr. Increase Dr.

A/c Payable Liability Personal Cr. Decrease Cr.

h Drawings Own Withdrawl Nominal Dr. Increase Dr.

Cash Asset Real Dr. Decrease Cr.

I Cash Asset Real Dr. Increase Dr.

A/c Receivable Asset Personal Dr. Decrease Cr.

j Supplies Exp Expense Nominal Dr. Increase Dr.

P. Supplies Asset Real Dr. Decrease Cr.

Waldo Printing Services

General Journal

For the month of December 2023

Date Description Post Dr. Cr.

Ref

Cash 30000

Capital 30000

A Printing Press 10000

Account Payable 10000

B Printing Supplies 5000

Cash 5000

C Cash 4000

Service Revenue 4000

D Salary Expense 1400

Cash 1400

E Account receivables 5000

Service Revenue 5000

F Computer 2000

Cash 500

Notes Payable 1500

G Elec. Expense 1500

Account Payable 1500

H Drawings 1000

Cash 1000

I Cash 5000

Account Receivables 5000

J Supplies Expense 2600

Printing Supplies 2600

Cash Account

Capital 30000 Printing Supplies 5000

Service Revenue 4000 Salary Expense

1400

Accounts Receivable 5000 Computer 500

Drawings

1000

Balance

31100

39000 39000

Cash Account

Description P/R Debit Credi Balance

t

Capital 30000 30000 Dr.

Printing supplies 5000 25000 Dr.

Service revenues 4000 29000 Dr.

Salary expense 1400 27600 Dr.

Computer 500 27100 Dr.

Drawings 1000 26100 Dr.

Accounts receivable 5000 31100 Dr.

Normal Balance Debit Normal Balance Credit

Assets Liabilities

Expenses/Losses Capital/ Owner’s equity/

Stockholders equity

Drawings Revenues/Sales/Gains

Waldo Printing Services

Trial Balance

For the month of December 2023

A/C No Title of Account Dr. Cr.

Cash 31100

Capital 30000

Printing Press 10000

Printing Supplies 2400

Account payable 11500

Notes Payable 1500

Service revenue 9000

Salary Expense 1400

Computer 2000

Elec. Expense 1500

Drawings 1000

Supplies Expense 2600

Total 52000 52000

Waldo Printing Services

Trial Balance

For the month of December 2023

A/C No Title of Account Dr. Cr.

101 Cash 31100

102 Printing Supplies 2400

103 Printing Press 10000

104 Computer 2000

201 Account payable 11500

202 Notes Payable 1500

301 Capital 30000

302 Drawings 1000

401 Service revenue 9000

501 Salary Expense 1400

502 Elec. Expense

503 Supplies Expense 2600

Total 52000 52000

Errors that cause imbalance of

Trial Balance

Transposition error

Slide error

Fail to post one aspect of a business

transaction

Debit posted as credit or credit

posted as debit

Errors that don’t cause imbalance

of Trial Balance

Double transposition error

Double slide error

Fail to record a business transaction

Fail to post both aspects of a

business transactions

Debit posted as credit and credit

posted as debit

You might also like

- J&L RailroadDocument15 pagesJ&L RailroadLily Hellings50% (2)

- JAIBB - AFS Solutions (Collected) PDFDocument78 pagesJAIBB - AFS Solutions (Collected) PDFZinia Zerin92% (13)

- WorksheetDocument13 pagesWorksheetAlyanne Patrice Medrana100% (1)

- Philippine Association of Certified Tax TechniciansDocument3 pagesPhilippine Association of Certified Tax Techniciansucc second yearNo ratings yet

- 7.1 Completing The Cycle SampleDocument4 pages7.1 Completing The Cycle SampleKena Montes Dela PeñaNo ratings yet

- Week 3 AssignmentDocument7 pagesWeek 3 AssignmentWilson ChipetaNo ratings yet

- Basic Accounting Answer KeyDocument12 pagesBasic Accounting Answer KeyJASTINENo ratings yet

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- Acc Quiz1 Nguyễn Hữu Nghĩa Hs180944 Mkt1831Document4 pagesAcc Quiz1 Nguyễn Hữu Nghĩa Hs180944 Mkt1831nn27102004No ratings yet

- Excek Rough WorkDocument10 pagesExcek Rough WorkAnshu KhemkaNo ratings yet

- Accounting For Manager - Accounting Exam SolutionDocument9 pagesAccounting For Manager - Accounting Exam SolutionDinar HassanNo ratings yet

- Class Work Journal EntryDocument16 pagesClass Work Journal EntryRishabh ChawlaNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Accounting Excel SheetDocument29 pagesAccounting Excel SheetsumbulNo ratings yet

- Maria Hernandes and AssociatesDocument5 pagesMaria Hernandes and AssociatesRAGHU MALLEGOWDANo ratings yet

- Maria Case - 19 AugDocument12 pagesMaria Case - 19 AugKartikey BharadwajNo ratings yet

- Vogue Co. JournalDocument8 pagesVogue Co. JournalParvathaneni KarishmaNo ratings yet

- Ganzon Accounting FirmDocument41 pagesGanzon Accounting FirmTeng Deguzman GanzonNo ratings yet

- ABC Trial Balance As at 31 December 2016Document2 pagesABC Trial Balance As at 31 December 2016alinuurNo ratings yet

- Accounting Edexcel FINALDocument6 pagesAccounting Edexcel FINALClifford PeraltaNo ratings yet

- AaaaDocument5 pagesAaaaminh trungNo ratings yet

- Unit 3 Worksheet: AnswerDocument23 pagesUnit 3 Worksheet: AnswerMingxNo ratings yet

- E34Document9 pagesE34Nguyen Nguyen KhoiNo ratings yet

- The Need For AdjustmentDocument5 pagesThe Need For AdjustmentAnna CharlotteNo ratings yet

- Ae 112 Prelim - SolutionsDocument8 pagesAe 112 Prelim - SolutionsRica Ann RoxasNo ratings yet

- Chapter 1 - Recording Business TransactionDocument14 pagesChapter 1 - Recording Business TransactionThủy NguyễnNo ratings yet

- BachDocument9 pagesBachlenguyenvietbach2004No ratings yet

- Chữa đề NLKT thầy Cường và đề EBBADocument12 pagesChữa đề NLKT thầy Cường và đề EBBATiêu Vân GiangNo ratings yet

- Use Perpetual Inventory System For P6.3Document15 pagesUse Perpetual Inventory System For P6.3Giang LinhNo ratings yet

- 144 - Muskan Lath - Assignment01Document13 pages144 - Muskan Lath - Assignment01PRALHAD DASNo ratings yet

- FA With AdjustmentsDocument14 pagesFA With AdjustmentsHarshini AkilandanNo ratings yet

- Question Sheet - Non Profit OrganisationDocument7 pagesQuestion Sheet - Non Profit OrganisationShivangi JhawarNo ratings yet

- Pa SS1+2 HWDocument10 pagesPa SS1+2 HWHà Anh ĐỗNo ratings yet

- Vogue Co. Ledger - TB - FsDocument8 pagesVogue Co. Ledger - TB - FsNavneet SharmaNo ratings yet

- Name Assignment: Submitted To Department: Zarwah Butt AccountingDocument12 pagesName Assignment: Submitted To Department: Zarwah Butt AccountingZarwah ButtNo ratings yet

- Chapter 1 - Mr Hiếu ExcerisesDocument8 pagesChapter 1 - Mr Hiếu Excerises31231020411No ratings yet

- Work Sheet 1 PDFDocument9 pagesWork Sheet 1 PDFProtik SarkarNo ratings yet

- Prelim TTHDocument20 pagesPrelim TTHNoverben BachillerNo ratings yet

- ACCOUNTANCY English Medium Answer Key - Tamil Nadu HSC 11th Public Exam March 2019 by M.SubramanianDocument11 pagesACCOUNTANCY English Medium Answer Key - Tamil Nadu HSC 11th Public Exam March 2019 by M.Subramanians.arjun934562No ratings yet

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisUtkarshNo ratings yet

- RNS 3.6Document5 pagesRNS 3.6RAGHU MALLEGOWDANo ratings yet

- Luyen Tap Chuong 2 - and SOLUTION - Daily TransactionDocument8 pagesLuyen Tap Chuong 2 - and SOLUTION - Daily TransactionPham Huu KhiemNo ratings yet

- Luyen Tap Chuong 2 - and SOLUTION - Daily TransactionDocument8 pagesLuyen Tap Chuong 2 - and SOLUTION - Daily TransactionPham Huu KhiemNo ratings yet

- Webex 1 HomeworkDocument20 pagesWebex 1 HomeworkRuchin ShahNo ratings yet

- How To Prepare A Trial BalanceDocument3 pagesHow To Prepare A Trial Balancecloudgrim5No ratings yet

- Anthony Chapter 4Document15 pagesAnthony Chapter 4RAGHUMALLEGOWDANo ratings yet

- AccountsDocument2 pagesAccountsMinjin lesner ManalansanNo ratings yet

- Final Account Numerical ProblemDocument56 pagesFinal Account Numerical ProblemPrasad BhanageNo ratings yet

- Iyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeDocument9 pagesIyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeJudy Silvestre BẹnóngNo ratings yet

- MB2001-FA-2025-Week4B-Accounting For Receivables-Practice ExercisesDocument31 pagesMB2001-FA-2025-Week4B-Accounting For Receivables-Practice Exercisesjonathan christiandriNo ratings yet

- Del Mundo TradingDocument1 pageDel Mundo TradingAriel PalayNo ratings yet

- Accounting Case StudyDocument6 pagesAccounting Case StudyHaneen JosephNo ratings yet

- Accounting CycleDocument26 pagesAccounting CycleOmerhayat MianNo ratings yet

- Ae 112 Prelim Assessment 1Document7 pagesAe 112 Prelim Assessment 1Chelssy ParadoNo ratings yet

- Accounting Cycle SimulationDocument15 pagesAccounting Cycle SimulationMc Clent CervantesNo ratings yet

- Case - FRADocument12 pagesCase - FRARAGHU MALLEGOWDANo ratings yet

- Class Activity, Adjustments & WORK SHEETDocument18 pagesClass Activity, Adjustments & WORK SHEETkhanNo ratings yet

- Accountin Rules - Session 1 SJDocument5 pagesAccountin Rules - Session 1 SJKrishna ChaitanyaNo ratings yet

- Journal Entry For Atkin AgencyDocument4 pagesJournal Entry For Atkin AgencySamarth LahotiNo ratings yet

- Financial AccountingDocument28 pagesFinancial AccountingMy Duyen NguyenNo ratings yet

- SamuelDocument12 pagesSamuelEhtisham Ul HaqNo ratings yet

- Week 3 AssignmentDocument6 pagesWeek 3 AssignmentWilson ChipetaNo ratings yet

- PICPA NO - Corporate Income TaxDocument80 pagesPICPA NO - Corporate Income TaxMerlyn M. Casibang Jr.No ratings yet

- BAF3102 Financial Management IIDocument107 pagesBAF3102 Financial Management IIYves GaelNo ratings yet

- Business Plan of A Three-Star Hotel in The City of Lisbon "Lisbon Journey Hotel"Document193 pagesBusiness Plan of A Three-Star Hotel in The City of Lisbon "Lisbon Journey Hotel"Abayneh MeleseNo ratings yet

- Module 1 Intro To Cost AcctgDocument28 pagesModule 1 Intro To Cost AcctgKei TsukishimaNo ratings yet

- Keppel Eaas Pte. Ltd. - Audited Financial Statement FY31.12.2022Document29 pagesKeppel Eaas Pte. Ltd. - Audited Financial Statement FY31.12.2022Genevieve TayNo ratings yet

- Compensation IncomeDocument21 pagesCompensation IncomeRyDNo ratings yet

- Financial IntelligenceDocument153 pagesFinancial Intelligenceklose fNo ratings yet

- Filed BIR Form No. 1601C - March 2022Document1 pageFiled BIR Form No. 1601C - March 2022Kyle ParisNo ratings yet

- Tax ReturnDocument16 pagesTax ReturnDutchavelli5th100% (1)

- QUESTION One (Multiple Choice) : Insurance Company OperationsDocument14 pagesQUESTION One (Multiple Choice) : Insurance Company Operationsmamush fikaduNo ratings yet

- Resume Sunaina+GoyalDocument2 pagesResume Sunaina+GoyalThe Cultural CommitteeNo ratings yet

- Answers 11Document6 pagesAnswers 11Nguyễn Ngọc ÁnhNo ratings yet

- Revenue: Profit and Loss Statement Notes and DescriptionsDocument1 pageRevenue: Profit and Loss Statement Notes and DescriptionsNahom AsamenewNo ratings yet

- Relax Pharma QuestionDocument3 pagesRelax Pharma QuestionTushar Ballabh0% (1)

- Auditing True and FalseDocument4 pagesAuditing True and FalseGhalib HussainNo ratings yet

- By - Product Problem Solving - AsifDocument4 pagesBy - Product Problem Solving - AsifJafa AbnNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Bida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Document27 pagesBida-Tech Company Statement of Financial Position: (See Notes To Financial Statements)Trisha Mae Mendoza MacalinoNo ratings yet

- Effects of IFRS 9 Implementation by CPA Anthony MutheeDocument31 pagesEffects of IFRS 9 Implementation by CPA Anthony MutheeSaida KHEMIRINo ratings yet

- 澳亚 CPA 21S1 FR week2 M2&3Document89 pages澳亚 CPA 21S1 FR week2 M2&3Sijia TaoNo ratings yet

- Draft FS Tax Purpose 01.03.2018Document25 pagesDraft FS Tax Purpose 01.03.2018Engineering EntertainmentNo ratings yet

- Session 3Document20 pagesSession 3Talha JavedNo ratings yet

- Montly Fund Fact SheetDocument2 pagesMontly Fund Fact SheetAaron FooNo ratings yet

- Microsoft Financial Data - FY19Q1Document26 pagesMicrosoft Financial Data - FY19Q1trisanka banikNo ratings yet

- Goodwill Valuation: PreprintDocument19 pagesGoodwill Valuation: PreprintAdedara Oluwasola EbenezerNo ratings yet

- Review 105 - Day 22 TOADocument6 pagesReview 105 - Day 22 TOAAbriel BumatayNo ratings yet

- Options I UploadDocument3 pagesOptions I UploadManav DhimanNo ratings yet