Professional Documents

Culture Documents

Salary Tax Calculator, Nepal

Salary Tax Calculator, Nepal

Uploaded by

Rajiv Sah0 ratings0% found this document useful (0 votes)

4 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageSalary Tax Calculator, Nepal

Salary Tax Calculator, Nepal

Uploaded by

Rajiv SahCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

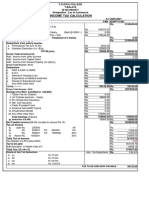

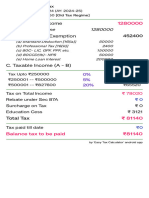

Total Income (TI): Rs.

1176000

Sum of SSF, EPF Rs. 25000

and CIT

(SSF+EPF+CIT):

Insurance: Rs. 0

Total Deduction Rs. 25000

(TD):

Net Assessable (TI- Rs. 1151000

TD):

Assesible Income Rate Tax Liability

(Rs.) (%) (Rs.)

500,000 1.00 5,000

200,000 10.00 20,000

300,000 20.00 60,000

151,000 30.00 45,300

Rs.1,151,000 Rs.130,300

Rs.

Net Tax Liability (Monthly):

10,858.333

Net Tax Liability (Yearly): Rs. 130,300

* This is rough estimation.

https://salarytaxnepal.com/ 14/04/2024, 14 23

Page 1 of 1

:

You might also like

- India AUG 2018Document1 pageIndia AUG 2018vsharsha100% (1)

- For Holders: Automated Income Tax CalculationDocument16 pagesFor Holders: Automated Income Tax Calculationmaruf048No ratings yet

- Salary Tax CalculatorDocument1 pageSalary Tax Calculatormilan subediNo ratings yet

- Double TaxationDocument10 pagesDouble TaxationMintuNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- UCC E-Filling SolutionDocument5 pagesUCC E-Filling SolutionSibam BanikNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 16-Jul-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 16-Jul-2019)KomalaNo ratings yet

- Taxation Class Test 2Document5 pagesTaxation Class Test 2ap.quatrroNo ratings yet

- Tax Calculator AY 2021-22Document1 pageTax Calculator AY 2021-22mehedi hasanNo ratings yet

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Tutorial 9 - PIT1-Summer 2023-Sample AnswerDocument4 pagesTutorial 9 - PIT1-Summer 2023-Sample Answerkien tran100% (1)

- Income Tax Seatwork - Answers Ver 2 PartialDocument3 pagesIncome Tax Seatwork - Answers Ver 2 PartialgillianNo ratings yet

- As 22Document1 pageAs 22Sajish RaiNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- Month Net Taxable Income Tax Slabs Tax RateDocument2 pagesMonth Net Taxable Income Tax Slabs Tax RateBhargav ChintalapatiNo ratings yet

- 6CATS - INDIA INCOME CALCULATOR - EMPLOYED - USD150phDocument1 page6CATS - INDIA INCOME CALCULATOR - EMPLOYED - USD150phMichael BonettNo ratings yet

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- TX-UK Worked ExamplesDocument5 pagesTX-UK Worked ExamplesRich KishNo ratings yet

- UnknownDocument1 pageUnknownSagar RaghavendraNo ratings yet

- April 2023 - UnlockedDocument2 pagesApril 2023 - Unlockedajinkya jagtapNo ratings yet

- Part 4Document7 pagesPart 4Kushagra BurmanNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorRohit KumarNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- 2017 Sec 4E5N Prelim Paper 2 - AnsDocument7 pages2017 Sec 4E5N Prelim Paper 2 - AnsDamien SeowNo ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- P 13-6 Profitability RatioDocument1 pageP 13-6 Profitability RatioAhmed Magdy MohamedNo ratings yet

- Tutorial 9 PIT1 Summer 2023 Sample AnswerDocument6 pagesTutorial 9 PIT1 Summer 2023 Sample Answernewgen2173No ratings yet

- Particulars Amount Exemption Net AmountDocument29 pagesParticulars Amount Exemption Net AmountDead Beat's RandomNo ratings yet

- Model Solution: Solution To The Question No. 1Document9 pagesModel Solution: Solution To The Question No. 1HossainNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountvsharshaNo ratings yet

- Calculo Rta 5ta 2020Document12 pagesCalculo Rta 5ta 2020CARLOS DANIEL ARELLANO SOLANONo ratings yet

- Chapter 12 - Computation of Total Income and Tax Payable - NotesDocument54 pagesChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- New Tax Certi PDFDocument1 pageNew Tax Certi PDFAli Azhar KhanNo ratings yet

- How To Calculate Total IncomeDocument16 pagesHow To Calculate Total IncomeAshish ChatrathNo ratings yet

- Easy TaxDocument1 pageEasy TaxSiva GaneshNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument15 pages© The Institute of Chartered Accountants of IndiaAnkitaNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- Oofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyDocument8 pagesOofits: Qualifying (27 885) U/S 8octo Donation Rounded Off U/S 288A of Tax of DR For AyKushagra BurmanNo ratings yet

- GST MDLDocument98 pagesGST MDLIndhuja MNo ratings yet

- UnknownDocument2 pagesUnknownSudip MondalNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountSuresh ChandraNo ratings yet

- NitishDocument1 pageNitishkaushikdutta176No ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- 2017 BGSS 4E5N Prelim P2 AnsDocument6 pages2017 BGSS 4E5N Prelim P2 AnsDamien SeowNo ratings yet

- Paystub 202402Document1 pagePaystub 202402asafintax.consultingNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- BUSN AssigmentDocument4 pagesBUSN AssigmentMalik Khurram AwanNo ratings yet