Professional Documents

Culture Documents

GST Full Length QP

GST Full Length QP

Uploaded by

Jyoti ManwaniCopyright:

Available Formats

You might also like

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- GST PRACTICE SET - 6th EDITION - SET JDocument6 pagesGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINo ratings yet

- Income Taxation - Part 3 PartnershipDocument35 pagesIncome Taxation - Part 3 PartnershipJenny Malabrigo, MBANo ratings yet

- TaxReturn PDFDocument24 pagesTaxReturn PDFga83% (6)

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- GST Post Q 20 May PDF - 29979560Document4 pagesGST Post Q 20 May PDF - 29979560priya02sharma22No ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- Mock Test Cma June 19Document6 pagesMock Test Cma June 19amit jangraNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- 25-7-21 611 nf-8175 GST QueDocument4 pages25-7-21 611 nf-8175 GST QueJignesh NagarNo ratings yet

- Wa0000Document4 pagesWa0000priya02sharma22No ratings yet

- GST - Ch. 6, 8 - 13 - NS - Dec. 23Document2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23Madhav TailorNo ratings yet

- Case ScenarioDocument11 pagesCase Scenariopujitha vegesnaNo ratings yet

- IDT 2 New Question PaperDocument13 pagesIDT 2 New Question PaperSagar Deep MsdNo ratings yet

- Audit Ca Inter QuestionDocument5 pagesAudit Ca Inter QuestionVishal Kumar 5504No ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadNo ratings yet

- Income Tax Question Note 1Document6 pagesIncome Tax Question Note 1Vishal Kumar 5504No ratings yet

- MCQs of ch8 ITCDocument20 pagesMCQs of ch8 ITCAman AgarwalNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Multiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaDocument7 pagesMultiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaVIHARI DNo ratings yet

- Indirect Taxation Finals Question PaperDocument3 pagesIndirect Taxation Finals Question PaperShubham NamdevNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- Ca FinalDocument11 pagesCa FinalHadia HNo ratings yet

- Paper 4 IDT - Pdfpaper 4 IDTDocument7 pagesPaper 4 IDT - Pdfpaper 4 IDTharsh agarwalNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Document7 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7india1965No ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Inu 2216 Idt - Question PaperDocument5 pagesInu 2216 Idt - Question PaperVinil JainNo ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- 1idt PDFDocument19 pages1idt PDFShantanuNo ratings yet

- Paper11 3Document34 pagesPaper11 3mhatrenimisha03No ratings yet

- Ii Shree Ganeshaya Namah IiDocument2 pagesIi Shree Ganeshaya Namah IiAman RayNo ratings yet

- P18 PDFDocument14 pagesP18 PDFsiva ramanNo ratings yet

- Charge of GSTDocument4 pagesCharge of GSTpujitha vegesnaNo ratings yet

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- Indirect Tax Prelim-II - Question PaperDocument7 pagesIndirect Tax Prelim-II - Question Paperhitendrapatil6778No ratings yet

- Payment of Tax @icmaifamilyDocument9 pagesPayment of Tax @icmaifamilypriyababu4701No ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- MCQ OF CHAPTER 12 A & B - Payment of TaxDocument11 pagesMCQ OF CHAPTER 12 A & B - Payment of TaxAman AgarwalNo ratings yet

- MCQ OF CHAPTER 14 To CHAPTER 17Document8 pagesMCQ OF CHAPTER 14 To CHAPTER 17Aman AgarwalNo ratings yet

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- Most Expected Top 50 GST Questions For CA Inter November 2023 ExamsDocument45 pagesMost Expected Top 50 GST Questions For CA Inter November 2023 ExamsmukhiapurvaNo ratings yet

- Sample IDTDocument34 pagesSample IDTsaraNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- Most Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1Document236 pagesMost Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1148salwa HussainNo ratings yet

- Suggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate ExaminationDocument13 pagesSuggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate Examinationseenu pNo ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument19 pagesST ST: © The Institute of Chartered Accountants of IndiaÑïkêţ BäûðhåNo ratings yet

- GST & Charge of GST PaperDocument3 pagesGST & Charge of GST PaperDevendra AryaNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- Paper11 Set1 MTP Dec 23Document9 pagesPaper11 Set1 MTP Dec 23avani.patel.smollanNo ratings yet

- Mighty 50Document34 pagesMighty 50venkatesansanthiya969No ratings yet

- MTP 2 Ques IdtDocument14 pagesMTP 2 Ques IdtAmra NaazNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Amazon Invoice UpdatedDocument1 pageAmazon Invoice UpdatedJaideep SinghNo ratings yet

- Ankit Rawat JioFiber December 2023 BillDocument2 pagesAnkit Rawat JioFiber December 2023 BillAnkit RawatNo ratings yet

- Capital Budgeting CaseDocument2 pagesCapital Budgeting CaseEkta AgarwalNo ratings yet

- AEC 215 Prelim LessonsDocument54 pagesAEC 215 Prelim LessonsJohn Ferdie Madulid100% (1)

- TW2A12823900009RPOSDocument3 pagesTW2A12823900009RPOSarun poojariNo ratings yet

- SalesBill VI 139 DigitallySignedDocument1 pageSalesBill VI 139 DigitallySignedKundariya MayurNo ratings yet

- HST NotesDocument4 pagesHST NotesDrippy SnowflakeNo ratings yet

- II-c. Cir Vs S.C. JohnsonDocument2 pagesII-c. Cir Vs S.C. JohnsonPia SottoNo ratings yet

- Bir Update Form (1905)Document1 pageBir Update Form (1905)Francis Nico PeñaNo ratings yet

- Samrat PDFDocument2 pagesSamrat PDFCHIRAYU PHARMACEUTICALSNo ratings yet

- Dealings On PropertiesDocument8 pagesDealings On PropertiesEllah MaeNo ratings yet

- Computation of Total Income For ItrDocument2 pagesComputation of Total Income For Itravisinghoo7No ratings yet

- US Internal Revenue Service: I1040aDocument80 pagesUS Internal Revenue Service: I1040aIRS100% (1)

- One Ohio Now - Top Ten LoopholesDocument1 pageOne Ohio Now - Top Ten LoopholesoneohionowNo ratings yet

- Deductions From Gross Income Part 2 Illustrative ProblemsDocument2 pagesDeductions From Gross Income Part 2 Illustrative ProblemsJohn Rich GamasNo ratings yet

- 4515512273482Document1 page4515512273482VermaNo ratings yet

- Shiawassee County Ballot Proposals Nov. 2020Document3 pagesShiawassee County Ballot Proposals Nov. 2020WILX Krystle HollemanNo ratings yet

- Cir Vs Hawaiian Phil Co - DigestDocument2 pagesCir Vs Hawaiian Phil Co - DigestRona Rosos100% (1)

- Salary Income Tax Calculation in EthiopiaDocument4 pagesSalary Income Tax Calculation in EthiopiaMulatu Teshome90% (42)

- Accomplishment Report (Summer Job)Document2 pagesAccomplishment Report (Summer Job)aileendavadellomosNo ratings yet

- Final ProjectDocument5 pagesFinal ProjectAkshayNo ratings yet

- GST Invoice, Download GST Tax InvoiceDocument2 pagesGST Invoice, Download GST Tax Invoiceanujt thakurNo ratings yet

- Vat Declaration FormDocument5 pagesVat Declaration FormYohannes AssefaNo ratings yet

- Registering For A Tax ReturnDocument2 pagesRegistering For A Tax ReturnCodrin EneaNo ratings yet

- BRD InvoicesDocument29 pagesBRD InvoicesJTOCCN ORAINo ratings yet

- Majeed SB - COMPUTATION and WEALTH STATEMENT 2022Document5 pagesMajeed SB - COMPUTATION and WEALTH STATEMENT 2022Muhammad SherazNo ratings yet

- Corporate Taxation For Managers 5.12.23Document2 pagesCorporate Taxation For Managers 5.12.23Vani BalajiNo ratings yet

GST Full Length QP

GST Full Length QP

Uploaded by

Jyoti ManwaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Full Length QP

GST Full Length QP

Uploaded by

Jyoti ManwaniCopyright:

Available Formats

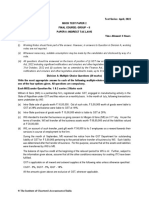

MINDSPARK ACADEMY CLASSES FOR CA, CS, CMA

GST Full length

SUGGESTED ANSWER SHEET

Marks: 50

Part A: MCQ (Marks- 15)

1. What are different types of supplies covered under the scope of Supply?

(a) Supplies made with consideration

(b) Supplies made without consideration

(c) Both of the above

(d) None of the above

2. Can a registered person opting for composition scheme collect GST on his outward

supplies?

(a) Yes, in all cases

(b) Yes, only on such goods as may be notified by the Central Government.

(c) Yes, only on such services as may be notified by the Central Government.

(d) No

3. Which of the following Activities or transactions shall not be treated as a supply of

goods?

(a) Title in goods under an agreement that property shall pass at a future date

(b) undivided share in goods without transfer of title in them

(c) Goods forming part of business assets are transferred/disposed off by/under

direction of person carrying on business so as no longer to form part of those assets,

whether or not for consideration

(d) Supply of goods by an unincorporated association or body of person to a member

4. Sarthak Constructor has constructed individual residential units for agreed

consideration of 1.2crore per unit . 90 lakh per unit were received before issuance

of completion certificate by the competent authority and balance after completion.

What type of supply involved in the given transaction?

a. supply of goods

b. Supply of services

C. Neither supply of goods nor supply of service

d. either supply of goods or supply of services

5. In case of Goods Transport Agency (GTA) services, tax is to be paid under forward

charge if:

CA GALIB MIRZA (7709873587)

MINDSPARK ACADEMY CLASSES FOR CA, CS, CMA

(a) GST is payable @ 12%

(b) GST is payable @ 5% and a factory registered under the Factories Act, 1948 is the

recipient of GTA service.

(c) An unregistered individual end customer is the recipient of GTA service.

(d) A registered casual taxable person is the recipient of GTA service.

For question 6 to 10 refer (2 marks each)

Based on the above answer the following questions:

6.

CA GALIB MIRZA (7709873587)

MINDSPARK ACADEMY CLASSES FOR CA, CS, CMA

7.

8.

9.

10.

CA GALIB MIRZA (7709873587)

MINDSPARK ACADEMY CLASSES FOR CA, CS, CMA

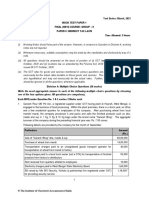

PART B: DESCRIPTIVE QUESTIONS

MARKS: 35

Ques 2. Answer the following: (Any 3) 15 Marks

1. State with brief reason, whether following suppliers of taxable goods are required

to register under the CST Law:

(I) Mr. Raghav is engaged in wholesale cum retail trading of medicines in the State

of Assam. His aggregate tumover during the financial year is Rs. 9,00,000 which

consists of Rs. 8,00,000 as Intra-State supply and Rs. 1,00,000 as Inter state supply.

(II) Mr S.N Gupta of Rajasthan is engaged in trading of taxable goods on his own

account and also acting as an agent of Mr. Rishi of Delhi. His turnover in the financial

year 2017-18 is of Rs. 12 lakhs on his own account and Rs. 9 lakhs onbehalf of

principal. Both turnovers are Intra-State supply. 5 Marks

2. Royal Fashions, a registered supplier of designer outfits in Delhi, decides to exhibit

its products in a Fashion Show being organised at Hotel Park Royal, Delhi on 4th

January. For the occasion, it gets the service by way of makeover of its models from

Aura Beauty Services Ltd., Ashok Vihar, on 4th January, for which a consideration

of` 5,00,000 (excluding GST) has been charged. Aura Beauty Services Ltd. issued a

duly signed tax invoice on 10 th February showing the lumpsum amount of `

5,90,000inclusive of CGST and SGST @ 9% each for the services provided. Answer

the followingquestions:

(i) Examine whether the tax invoice has been issued within the time limit prescribed

under law.

(ii) Tax consultant of Royal Fashions objected to the invoice raised suggesting that the

amount of tax charged in respect of the taxable supply should be shown separately in

the invoice raised by Aura Beauty Services Ltd. However, Aura Beauty Services Ltd.

contended that there is no mandatory requirement of showing tax component

separately in the invoice. You are required to examine the validity of the objection

raised by tax consultant of Royal Fashions. (5 MARKS)

3. M/s Software Limited reduced the amount of Rs. 2,00,000 from the output tax

liabilityin contravention of provisions of section 42(10) of the CGST Act, 2017 (ie.

Under or excess claim of ITC) in the month of December 2017, which is ineligible

credit. A showcause notice was issued by the Tax Department to pay tax along with

interest. M/s Software Limited paid the tax and interest on 31 st March, 2018.

Calculate interest liability (Ignore penalty) (5M)

for a period of 101 days and interest liability will be Rs. 13.282 (approx.).]

CA GALIB MIRZA (7709873587)

MINDSPARK ACADEMY CLASSES FOR CA, CS, CMA

Q 4. (5M)

(A) State whether the provisions pertaining to tax collected at source under

section 52 of CGST Act, will be applicable, if Fitan Ltd. sells watch on its own

through its ownwebsite?

(B) State whether the provisions pertaining to tax collected at source under section

52 of CGST Act, will be applicable, if ABC limited who is dealer of Royul brand sells

watches through Slipkart, an electronic commerce operator?

Ques 3. Answer the following: (any 4) (20 Marks)

1. XYZ & Co., a firm of Chartered Accountants, issued invoice for servicesrendered

to Mr. A on 7th September. Determine the time of supply in the following independent cases:

(1) The provision of service was completed on 1st August and payment was received

on 28th September.

(2) The provision of service was completed on 14th August and payment was received

on 28th September.

(3) Mr. A made the payment on 3rd August. However, provision of service was

remaining to be completed at that time.

(4) Mr. A made the payment on 15th September. However, provision ofservice was

remaining to be completed at that time. (5m)

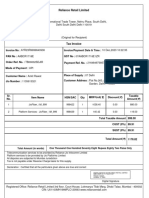

2. Following are the particulars, relating to one of the machine sold by SQM ltd. To

ACDLtd. In the month of February 2020 at list price of Rs. 9.50.000 (exclusive

of taxes and discount) further, following additional amounts have been charged

from ACD Ltd: (5m)

S. No. Particulars Amount (Rs)

(i) Municipal taxes chargeable on the machine 45.000

(ii) Outward freight charges (Contract 65.000

was to deliver machine at ACD

Ltd.’s factory i.e. F.O.R. contract)

Additional information:

1. SQM Ltd. Normally gives an interest-free credit period of 30 days for

payment,after that it charges interest @1% p.m. or part thereof on list price.

2. ACD Ltd. Paid for the supply after 45 days, but SQM Ltd. Waived the

interestpayable.

CA GALIB MIRZA (7709873587)

MINDSPARK ACADEMY CLASSES FOR CA, CS, CMA

3. SQM Ltd. Received Rs. 50.000 as subsidy, from one non-government

organisation (NGO) on sale of such machine. This subsidy was not linked to the

price of machine andalso not considered in list prise of Rs. 9.50.000.

4. ACD Ltd. deducted discount of Rs. 15,000 at the time of final payment, which

wasnot as per agreement.

5. SQM Ltd. collected Rs. 9,500 as TCS (tax collected at source) under the

provisionsof the Income Tax Act, 1961.

Compute the value of taxable supply as per the provision of GST laws, considering

that the price is the sole consideration for the supply and both parties are

unrelated to eachother.

Note: Correct legal provision should form part of your answer. (5 M)

3. CANWIN Ltd., a registered supplier, is engaged in the manufacture of Tanks. The

company provides the following information pertaining to GST paid on the purchases

made/input services availed by it during the month of January 2018:

Particulars GST Paid (Rs.)

(i) Purchase of Machinery where debit note is issued 1.15.000

(ii) Input purchased was directly delivered to Mr. Joe, a 80.000

job worker and a registered supplier

(iii) Computers purchased (Depreciation was claimed on 50.000

the said GST portion under the Income-Tax Act,

1961)

(iv) Works Contract services availed for construction of 4.25.000

Staff quarters within the company premises

Determine the amount of ITC available to M/s. CANWIN Ltd. For the

month ofJanuary 2018 by giving brief explanations for treatment of various items.

Subject to the information given above, all the conditions necessary for availing

the ITC have beenfulfilled. (5 M)

4. Janku Ltd. A registered person is engaged in the business of spices. It provides

following details for GST paid during October, 2018.

S. No Particulars GST Paid(Rs.)

1. Raw spices purchase-Raw spices used for 50.000

furtherance of business

-Raw spices used for personal use of Directors 20.000

CA GALIB MIRZA (7709873587)

MINDSPARK ACADEMY CLASSES FOR CA, CS, CMA

2. Electric machinery purchased to be used in the 25.000

manufacturing process.

3. Motor vehicle used for transportation of the 55.000

employee

4. Payment made for material and to contractor for 1.25.000

construction of staff quarter.

Determine the amount of ITC available to Jamku Ltd. For the month October,

2018with all related workings and explanation.

All the conditions necessary for availing the ITC have been fulfilled.

[5 Marks]

CA GALIB MIRZA (7709873587)

You might also like

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- GST PRACTICE SET - 6th EDITION - SET JDocument6 pagesGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINo ratings yet

- Income Taxation - Part 3 PartnershipDocument35 pagesIncome Taxation - Part 3 PartnershipJenny Malabrigo, MBANo ratings yet

- TaxReturn PDFDocument24 pagesTaxReturn PDFga83% (6)

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- GST Post Q 20 May PDF - 29979560Document4 pagesGST Post Q 20 May PDF - 29979560priya02sharma22No ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- Mock Test Cma June 19Document6 pagesMock Test Cma June 19amit jangraNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- 25-7-21 611 nf-8175 GST QueDocument4 pages25-7-21 611 nf-8175 GST QueJignesh NagarNo ratings yet

- Wa0000Document4 pagesWa0000priya02sharma22No ratings yet

- GST - Ch. 6, 8 - 13 - NS - Dec. 23Document2 pagesGST - Ch. 6, 8 - 13 - NS - Dec. 23Madhav TailorNo ratings yet

- Case ScenarioDocument11 pagesCase Scenariopujitha vegesnaNo ratings yet

- IDT 2 New Question PaperDocument13 pagesIDT 2 New Question PaperSagar Deep MsdNo ratings yet

- Audit Ca Inter QuestionDocument5 pagesAudit Ca Inter QuestionVishal Kumar 5504No ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadNo ratings yet

- Income Tax Question Note 1Document6 pagesIncome Tax Question Note 1Vishal Kumar 5504No ratings yet

- MCQs of ch8 ITCDocument20 pagesMCQs of ch8 ITCAman AgarwalNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Multiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaDocument7 pagesMultiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaVIHARI DNo ratings yet

- Indirect Taxation Finals Question PaperDocument3 pagesIndirect Taxation Finals Question PaperShubham NamdevNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- Ca FinalDocument11 pagesCa FinalHadia HNo ratings yet

- Paper 4 IDT - Pdfpaper 4 IDTDocument7 pagesPaper 4 IDT - Pdfpaper 4 IDTharsh agarwalNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Document7 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7india1965No ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Inu 2216 Idt - Question PaperDocument5 pagesInu 2216 Idt - Question PaperVinil JainNo ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- 1idt PDFDocument19 pages1idt PDFShantanuNo ratings yet

- Paper11 3Document34 pagesPaper11 3mhatrenimisha03No ratings yet

- Ii Shree Ganeshaya Namah IiDocument2 pagesIi Shree Ganeshaya Namah IiAman RayNo ratings yet

- P18 PDFDocument14 pagesP18 PDFsiva ramanNo ratings yet

- Charge of GSTDocument4 pagesCharge of GSTpujitha vegesnaNo ratings yet

- MTP 2 Idt 2019Document10 pagesMTP 2 Idt 2019kartikNo ratings yet

- Indirect Tax Prelim-II - Question PaperDocument7 pagesIndirect Tax Prelim-II - Question Paperhitendrapatil6778No ratings yet

- Payment of Tax @icmaifamilyDocument9 pagesPayment of Tax @icmaifamilypriyababu4701No ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- MCQ OF CHAPTER 12 A & B - Payment of TaxDocument11 pagesMCQ OF CHAPTER 12 A & B - Payment of TaxAman AgarwalNo ratings yet

- MCQ OF CHAPTER 14 To CHAPTER 17Document8 pagesMCQ OF CHAPTER 14 To CHAPTER 17Aman AgarwalNo ratings yet

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- Most Expected Top 50 GST Questions For CA Inter November 2023 ExamsDocument45 pagesMost Expected Top 50 GST Questions For CA Inter November 2023 ExamsmukhiapurvaNo ratings yet

- Sample IDTDocument34 pagesSample IDTsaraNo ratings yet

- Question-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamDocument4 pagesQuestion-1 I) : SKANS School of Accountancy Principles of Taxation Mid Term ExamMuhammad ArslanNo ratings yet

- Most Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1Document236 pagesMost Expected MCQs DT & IDT by VG Sir Assure Your 60+ Marks 1148salwa HussainNo ratings yet

- Suggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate ExaminationDocument13 pagesSuggested Answer - Syl12 - June 2016 - Paper - 11 Intermediate Examinationseenu pNo ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument19 pagesST ST: © The Institute of Chartered Accountants of IndiaÑïkêţ BäûðhåNo ratings yet

- GST & Charge of GST PaperDocument3 pagesGST & Charge of GST PaperDevendra AryaNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- Mock Test Cma Dec 19-1Document13 pagesMock Test Cma Dec 19-1amit jangraNo ratings yet

- Paper11 Set1 MTP Dec 23Document9 pagesPaper11 Set1 MTP Dec 23avani.patel.smollanNo ratings yet

- Mighty 50Document34 pagesMighty 50venkatesansanthiya969No ratings yet

- MTP 2 Ques IdtDocument14 pagesMTP 2 Ques IdtAmra NaazNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Amazon Invoice UpdatedDocument1 pageAmazon Invoice UpdatedJaideep SinghNo ratings yet

- Ankit Rawat JioFiber December 2023 BillDocument2 pagesAnkit Rawat JioFiber December 2023 BillAnkit RawatNo ratings yet

- Capital Budgeting CaseDocument2 pagesCapital Budgeting CaseEkta AgarwalNo ratings yet

- AEC 215 Prelim LessonsDocument54 pagesAEC 215 Prelim LessonsJohn Ferdie Madulid100% (1)

- TW2A12823900009RPOSDocument3 pagesTW2A12823900009RPOSarun poojariNo ratings yet

- SalesBill VI 139 DigitallySignedDocument1 pageSalesBill VI 139 DigitallySignedKundariya MayurNo ratings yet

- HST NotesDocument4 pagesHST NotesDrippy SnowflakeNo ratings yet

- II-c. Cir Vs S.C. JohnsonDocument2 pagesII-c. Cir Vs S.C. JohnsonPia SottoNo ratings yet

- Bir Update Form (1905)Document1 pageBir Update Form (1905)Francis Nico PeñaNo ratings yet

- Samrat PDFDocument2 pagesSamrat PDFCHIRAYU PHARMACEUTICALSNo ratings yet

- Dealings On PropertiesDocument8 pagesDealings On PropertiesEllah MaeNo ratings yet

- Computation of Total Income For ItrDocument2 pagesComputation of Total Income For Itravisinghoo7No ratings yet

- US Internal Revenue Service: I1040aDocument80 pagesUS Internal Revenue Service: I1040aIRS100% (1)

- One Ohio Now - Top Ten LoopholesDocument1 pageOne Ohio Now - Top Ten LoopholesoneohionowNo ratings yet

- Deductions From Gross Income Part 2 Illustrative ProblemsDocument2 pagesDeductions From Gross Income Part 2 Illustrative ProblemsJohn Rich GamasNo ratings yet

- 4515512273482Document1 page4515512273482VermaNo ratings yet

- Shiawassee County Ballot Proposals Nov. 2020Document3 pagesShiawassee County Ballot Proposals Nov. 2020WILX Krystle HollemanNo ratings yet

- Cir Vs Hawaiian Phil Co - DigestDocument2 pagesCir Vs Hawaiian Phil Co - DigestRona Rosos100% (1)

- Salary Income Tax Calculation in EthiopiaDocument4 pagesSalary Income Tax Calculation in EthiopiaMulatu Teshome90% (42)

- Accomplishment Report (Summer Job)Document2 pagesAccomplishment Report (Summer Job)aileendavadellomosNo ratings yet

- Final ProjectDocument5 pagesFinal ProjectAkshayNo ratings yet

- GST Invoice, Download GST Tax InvoiceDocument2 pagesGST Invoice, Download GST Tax Invoiceanujt thakurNo ratings yet

- Vat Declaration FormDocument5 pagesVat Declaration FormYohannes AssefaNo ratings yet

- Registering For A Tax ReturnDocument2 pagesRegistering For A Tax ReturnCodrin EneaNo ratings yet

- BRD InvoicesDocument29 pagesBRD InvoicesJTOCCN ORAINo ratings yet

- Majeed SB - COMPUTATION and WEALTH STATEMENT 2022Document5 pagesMajeed SB - COMPUTATION and WEALTH STATEMENT 2022Muhammad SherazNo ratings yet

- Corporate Taxation For Managers 5.12.23Document2 pagesCorporate Taxation For Managers 5.12.23Vani BalajiNo ratings yet