Professional Documents

Culture Documents

FIRM1

FIRM1

Uploaded by

janm45.niazisolutionsCopyright:

Available Formats

You might also like

- Corp Regulations-Full Short NotesDocument35 pagesCorp Regulations-Full Short NotesIt's me78% (9)

- Walmart Inc PDFDocument1 pageWalmart Inc PDFWaqar AhmedNo ratings yet

- Apple - Report PDFDocument1 pageApple - Report PDFUwie AndrianaNo ratings yet

- Bby AaDocument1 pageBby AalondonmorganNo ratings yet

- Tri VLDocument1 pageTri VLJ Pierre RicherNo ratings yet

- AppleDocument1 pageAppleavinwiriandari61198No ratings yet

- Harley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 pageHarley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDBrent UptonNo ratings yet

- Spiva Us Year End 2021Document39 pagesSpiva Us Year End 2021Hyenuk ChuNo ratings yet

- IntelDocument1 pageIntelavinwiriandari61198No ratings yet

- SF No 28 Kadhampadi ModelDocument1 pageSF No 28 Kadhampadi ModelmanojNo ratings yet

- SF No 28 Kadhampadi ModelDocument1 pageSF No 28 Kadhampadi ModelmanojNo ratings yet

- Laporan BulananDocument7 pagesLaporan Bulananmuhammad syaifuddin ihsanNo ratings yet

- 6754 DatasheetDocument1 page6754 DatasheetSuryakanth KattimaniNo ratings yet

- (24-03-22) - ASML Holding N.V. ASML Value Line ReportDocument1 page(24-03-22) - ASML Holding N.V. ASML Value Line ReportSalman D.No ratings yet

- VFD HarmonicsDocument1 pageVFD HarmonicstwinvbooksNo ratings yet

- 1437960464extreme Rainfall JuneDocument7 pages1437960464extreme Rainfall JuneSuyogya DahalNo ratings yet

- 1-4 Barrel Culvert4Document1 page1-4 Barrel Culvert4Delahan AbatyoughNo ratings yet

- Briefs About Season 2022-23 As of 12022023 - LSMDocument5 pagesBriefs About Season 2022-23 As of 12022023 - LSMWaqasNo ratings yet

- Link Net Company Presentation - Investor UpdateDocument47 pagesLink Net Company Presentation - Investor UpdateumarhidayatNo ratings yet

- Tamplarie GalgauDocument1 pageTamplarie GalgauOana VaidaNo ratings yet

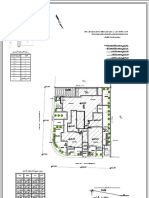

- Gwapo FloorplanDocument1 pageGwapo FloorplanJayLord Mico PacisNo ratings yet

- Plan de Travail Cotes DéfinitivesDocument1 pagePlan de Travail Cotes DéfinitivesSergey YusupovNo ratings yet

- No 04 97Document1 pageNo 04 97widibae jokotholeNo ratings yet

- 1a. Pagina, PresentationDocument1 page1a. Pagina, PresentationJose A. Bravo B.No ratings yet

- PipaDocument1 pagePipaIman KadarismanNo ratings yet

- SRMPCDocument3 pagesSRMPCBHANUKRISHNA VISAKOTANo ratings yet

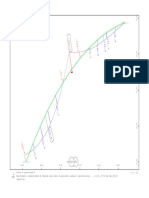

- Intervalos Musicales Puros Relación de FrecuenciasDocument1 pageIntervalos Musicales Puros Relación de FrecuenciasFelipe RodríguezNo ratings yet

- Nextera Library Validation and Cluster Density OptimizationDocument2 pagesNextera Library Validation and Cluster Density OptimizationhellowinstonNo ratings yet

- شركة ديلارDocument10 pagesشركة ديلارKhaled AwwadNo ratings yet

- L & T Catalogue 14Document4 pagesL & T Catalogue 14amulya00428No ratings yet

- ROTRON Regenerative Blowers EN523 CP523 3.0HPDocument2 pagesROTRON Regenerative Blowers EN523 CP523 3.0HPKHANNNNo ratings yet

- Fund Report - Pure Stock Fund - Aug 2021Document3 pagesFund Report - Pure Stock Fund - Aug 2021faleela IsmailNo ratings yet

- Bby 2008Document1 pageBby 2008londonmorganNo ratings yet

- VFD Calculators For Fan & Pump ApplicationsDocument16 pagesVFD Calculators For Fan & Pump ApplicationsAFRI-N-HARINo ratings yet

- Historico PIB MexicoDocument1 pageHistorico PIB MexicoJUAN SINMIEDONo ratings yet

- European Union Labour Force Survey-Annual Results 2008: Population and Social Conditions 33/2009Document8 pagesEuropean Union Labour Force Survey-Annual Results 2008: Population and Social Conditions 33/2009ekonimija86No ratings yet

- VDS MasterplanDocument1 pageVDS MasterplanSamudrala SreepranaviNo ratings yet

- Monitor de SequiaDocument7 pagesMonitor de Sequiass.sefi.infraestructuraNo ratings yet

- Intervalos Musicales Puros en Escala Loraritmica de Base 2Document1 pageIntervalos Musicales Puros en Escala Loraritmica de Base 2Felipe RodríguezNo ratings yet

- Jacket PatternDocument1 pageJacket Patternwidibae jokotholeNo ratings yet

- Fold Table All PartsDocument1 pageFold Table All PartsivanNo ratings yet

- Jalladianpettai 149 FMB 1Document1 pageJalladianpettai 149 FMB 1JaganCivilNo ratings yet

- Druga Fazamy PDFDocument1 pageDruga Fazamy PDFpaki12No ratings yet

- Transito de AvenidasDocument15 pagesTransito de AvenidasROBNo ratings yet

- S 8000 Rolled or Machined CylindersDocument4 pagesS 8000 Rolled or Machined CylindersRicardo Paz SoldanNo ratings yet

- Dhi1 Ups Health - Report - PRTG Network Monitor (Adrtpprtg1)Document21 pagesDhi1 Ups Health - Report - PRTG Network Monitor (Adrtpprtg1)Arie SutopoNo ratings yet

- TRANSITO DE AVENIDAS - Con Obra de TomaDocument15 pagesTRANSITO DE AVENIDAS - Con Obra de TomaROBNo ratings yet

- 104 Alpha Lavel OptiLobe Performance Curves - ImperialDocument1 page104 Alpha Lavel OptiLobe Performance Curves - Imperialwjb124No ratings yet

- HDM 128GS24: Dimensional DrawingDocument2 pagesHDM 128GS24: Dimensional DrawingMitchell DanielsNo ratings yet

- Second Floor Plan: Proposed Two (2) - Storey Commercial Building With RoofdeckDocument1 pageSecond Floor Plan: Proposed Two (2) - Storey Commercial Building With Roofdeckdante mortelNo ratings yet

- 2020-03 - MED - C - Pumps For VentilatorsAspiratorsO2ConcentratorsDocument37 pages2020-03 - MED - C - Pumps For VentilatorsAspiratorsO2Concentratorspuri ghibahNo ratings yet

- Book 2Document1 pageBook 2Abu TalhaNo ratings yet

- Feb 2022Document20 pagesFeb 2022Ritesh OjhaNo ratings yet

- ASD Fan CalculatorsDocument14 pagesASD Fan CalculatorsuguraydemirNo ratings yet

- 0A-0081-01 Cid - Idm Base: Title: Size Dwg. No. Weight: G SCALE: 1:6Document1 page0A-0081-01 Cid - Idm Base: Title: Size Dwg. No. Weight: G SCALE: 1:66toNo ratings yet

- Opzv Series: Tubular Gel BatteryDocument4 pagesOpzv Series: Tubular Gel BatteryAhmed ZeharaNo ratings yet

- Z ZZZZZZZZDocument1 pageZ ZZZZZZZZabene abebeNo ratings yet

- Lead Screw Phi 18Document1 pageLead Screw Phi 18bhageshlNo ratings yet

- Traffic Rep0218Document20 pagesTraffic Rep0218gogana93No ratings yet

- Commercial Aspirin IR SpectrumDocument1 pageCommercial Aspirin IR SpectrumJoshua C. CastilloNo ratings yet

- CMA FormulaDocument4 pagesCMA FormulaKanniha SuryavanshiNo ratings yet

- Osian'sDocument12 pagesOsian'sDiksha SharmaNo ratings yet

- CZBS - Playing A Different GameDocument5 pagesCZBS - Playing A Different GameWillNo ratings yet

- Investment Strategies Research PaperDocument7 pagesInvestment Strategies Research Papergw1sj1yb100% (1)

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Accounting Grade 12 Trial 2021 P1 and MemoDocument32 pagesAccounting Grade 12 Trial 2021 P1 and Memotsholofelokgomane29No ratings yet

- Unclaimed Peerless InsuranceDocument8 pagesUnclaimed Peerless InsurancejeevanreddyvkNo ratings yet

- Chapter 2 Separate and Consolidated FS - Date of AcquisitionDocument21 pagesChapter 2 Separate and Consolidated FS - Date of AcquisitioneiaNo ratings yet

- WSP CFPAM - Corporate Finance & StrategyDocument66 pagesWSP CFPAM - Corporate Finance & Strategyaakashpatel19No ratings yet

- (Ebook PDF) Using Financial Accounting Information: The Alternative To Debits and Credits 10th Edition Gary A. Porter - Ebook PDF All ChapterDocument69 pages(Ebook PDF) Using Financial Accounting Information: The Alternative To Debits and Credits 10th Edition Gary A. Porter - Ebook PDF All Chapterursinagammie100% (10)

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Valuation of GoodwillDocument4 pagesValuation of Goodwillvansh gandhiNo ratings yet

- AccountingDocument2 pagesAccountingwindell arth MercadoNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Cash Flows of A Project: Learning ObjectivesDocument51 pagesCash Flows of A Project: Learning Objectiveshuy anh leNo ratings yet

- S.4 BAFS - Quiz 4Document5 pagesS.4 BAFS - Quiz 4MINGYU WENGNo ratings yet

- Practical Financial Management 7Th Edition Lasher Test Bank Full Chapter PDFDocument67 pagesPractical Financial Management 7Th Edition Lasher Test Bank Full Chapter PDFAdrianLynchpdci100% (11)

- Spotify Technology S.A.: United States Securities and Exchange CommissionDocument48 pagesSpotify Technology S.A.: United States Securities and Exchange CommissionSunday AyomideNo ratings yet

- Final Exam FF01 2019 With Solutions TroegeDocument10 pagesFinal Exam FF01 2019 With Solutions TroegeRosadea AbbracciaventoNo ratings yet

- College Accounting A Career Approach 12th Edition Scott Solutions ManualDocument97 pagesCollege Accounting A Career Approach 12th Edition Scott Solutions Manualrobertnelsonxrofbtjpmi100% (13)

- INVESTMENTSDocument7 pagesINVESTMENTSJhon Eljun Yuto EnopiaNo ratings yet

- Advanced Valuation Concepts and Methods - BLK - 1Document72 pagesAdvanced Valuation Concepts and Methods - BLK - 1Kim GeminoNo ratings yet

- Government Grants (Millan, 2022)Document5 pagesGovernment Grants (Millan, 2022)didit.canonNo ratings yet

- Finance Q1W2 ModuleDocument10 pagesFinance Q1W2 Modulemara ellyn lacsonNo ratings yet

- Unit 1 NotesDocument26 pagesUnit 1 NotesSarath kumar CNo ratings yet

- Chapter 6 Business Section 4 - 6Document34 pagesChapter 6 Business Section 4 - 6kparsons938512No ratings yet

- Accounting Equation and Debit and Credit Rules PDFDocument5 pagesAccounting Equation and Debit and Credit Rules PDFوجد ميانNo ratings yet

- Capital Structure Theory1Document9 pagesCapital Structure Theory1Kamba RumbidzaiNo ratings yet

- Module 6 Cost of Capital and Capital Investment Decisions PDFDocument14 pagesModule 6 Cost of Capital and Capital Investment Decisions PDFDaisy ContinenteNo ratings yet

FIRM1

FIRM1

Uploaded by

janm45.niazisolutionsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIRM1

FIRM1

Uploaded by

janm45.niazisolutionsCopyright:

Available Formats

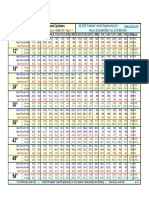

AGILENT TECH.

NYSE-A RECENT

PRICE 139.59 P/ERATIO 24.8(Trailing:

Median: 24.0) P/E RATIO 1.43 YLD 0.7%

26.0 RELATIVE DIV’D VALUE

LINE

TIMELINESS 3 Raised 10/13/23 High:

Low:

57.9

40.2

61.2

38.1

43.6

33.1

48.6

34.2

70.9

45.7

75.1

60.4

85.7

62.0

120.2

61.1

179.6

112.5

160.3

112.5

159.6

96.8

151.6

126.7

Target Price Range

2027 2028 2029

SAFETY 2 Raised 11/15/19 LEGENDS

20.0 x ″Cash Flow″ p sh 320

TECHNICAL 2 Raised 4/19/24 . . . . Relative Price Strength

Options: Yes

BETA .95 (1.00 = Market) Shaded area indicates recession 200

18-Month Target Price Range 160

Low-High Midpoint (% to Mid) 120

100

$95-$166 $131 (-5%) 80

2027-29 PROJECTIONS 60

Ann’l Total

Price Gain Return 40

High 225 (+60%) 13%

Low 165 (+20%) 5%

% TOT. RETURN 3/24

Institutional Decisions THIS VL ARITH.*

2Q2023 3Q2023 4Q2023 STOCK INDEX 18

Percent 30 1 yr. 5.9 16.9

to Buy 373 398 475 shares 20

to Sell 479 431 421 3 yr. 16.7 16.2

traded 10

Hld’s(000) 254106 258201 263472 5 yr. 87.6 71.5

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 © VALUE LINE PUB. LLC 27-29

16.50 12.95 15.29 19.06 19.82 20.37 20.84 12.18 12.99 13.89 15.45 16.71 17.45 20.91 23.19 23.39 23.60 25.65 Sales per sh A 32.60

2.55 .38 2.32 3.65 4.20 3.29 3.63 2.06 2.31 2.68 3.18 3.57 3.75 4.83 5.73 5.96 6.05 6.60 ‘‘Cash Flow’’ per sh 8.55

1.87 d.09 1.77 2.85 3.27 2.10 3.04 1.74 1.98 2.36 2.79 3.11 3.28 4.34 5.22 5.44 5.50 6.05 Earnings per sh A B 7.85

-- -- -- -- .30 .46 .53 .40 .46 .53 .60 .66 .72 .78 .84 .90 .94 1.00 Div’ds Decl’d per sh C 1.26

.44 .37 .34 .54 .56 .59 .61 .30 .43 .55 .56 .50 .39 .62 .99 1.02 1.35 1.25 Cap’l Spending per sh 1.40

7.31 7.24 9.07 12.42 14.98 15.87 15.82 12.57 13.12 15.00 14.36 15.37 15.92 17.83 17.97 20.01 22.10 24.65 Book Value per sh D 34.80

350.00 346.00 356.00 347.00 346.00 333.00 335.00 331.46 323.46 322.00 318.00 309.00 306.00 302.21 295.26 292.12 285.75 279.55 Common Shs Outst’g E 262.15

17.7 -- 17.5 14.7 12.1 21.0 18.5 22.8 21.4 23.5 24.1 23.4 26.5 31.6 25.7 24.3 Bold figures are Avg Ann’l P/E Ratio 25.0

1.07 -- 1.11 .92 .77 1.18 .97 1.15 1.12 1.18 1.30 1.25 1.36 1.71 1.48 1.41 Value Line Relative P/E Ratio 1.40

estimates

-- -- -- -- .8% 1.0% .9% 1.0% 1.1% 1.0% .9% .9% .8% .6% .6% .7% Avg Ann’l Div’d Yield .6%

CAPITAL STRUCTURE as of 1/31/24 6981.0 4038.0 4202.0 4472.0 4914.0 5163.0 5339.0 6319.0 6848.0 6833.0 6750 7170 Sales ($mill) A 8550

Total Debt $2555 mill. Due in 5 Yrs $900 mill. 21.7% 21.5% 23.1% 23.9% 24.3% 25.6% 25.0% 27.8% 29.5% 29.4% 29.5% 29.5% Operating Margin 30.0%

LT Debt $2555 mill. LT Interest $84 mill. 187.0 97.0 94.0 95.0 105.0 113.0 124.0 127.0 126.0 132.0 135 140 Depreciation ($mill) 150

(Tot. Interest covered 20.6x)

(32% of Cap’l) 1029.0 586.0 653.0 768.0 907.0 989.0 1023.0 1332.0 1565.0 1609.0 1590 1710 Net Profit ($mill) 2095

Leases, Uncapitalized Annual rentals $51 mill. 15.5% 19.6% 18.8% 18.0% 18.0% 16.8% 15.2% 14.2% 14.0% 13.8% 14.0% 14.0% Income Tax Rate 14.0%

14.7% 14.5% 15.5% 17.2% 18.5% 19.2% 19.2% 21.1% 22.9% 23.5% 23.6% 23.8% Net Profit Margin 24.5%

Pension Assets-10/23 $1.15 bill. Oblig. $1.03 bill. 3798.0 2710.0 2690.0 2906.0 2677.0 1109.0 1948.0 2091.0 1917.0 2583.0 2550 2690 Working Cap’l ($mill) 3100

2762.0 1655.0 1912.0 1801.0 1799.0 1791.0 2284.0 2729.0 2733.0 2735.0 2700 2700 Long-Term Debt ($mill) 2600

Pfd Stock None

Common Stock 293,055,284 shs. 5298.0 4167.0 4243.0 4831.0 4567.0 4748.0 4873.0 5389.0 5305.0 5845.0 6315 6890 Shr. Equity ($mill) D 9120

as of 2/27/24 13.5% 10.6% 11.2% 12.2% 14.8% 15.7% 14.8% 16.9% 20.0% 19.3% 18.5% 18.5% Return on Total Cap’l 18.5%

19.4% 14.1% 15.4% 15.9% 19.9% 20.8% 21.0% 24.7% 29.5% 27.5% 25.0% 25.0% Return on Shr. Equity 23.0%

MARKET CAP: $40.9 billion (Large Cap) 16.1% 10.9% 11.9% 12.4% 15.7% 16.5% 16.4% 20.3% 24.8% 23.0% 21.0% 20.5% Retained to Com Eq 19.5%

CURRENT POSITION 2022 2023 1/31/24 17% 23% 23% 22% 21% 21% 22% 18% 16% 16% 17% 17% All Div’ds to Net Prof 16%

($MILL.)

Cash Assets 1053 1590 1748 BUSINESS: Agilent Technologies, Inc. is a leading supplier of revenue), CrossLab (23%) and Diagnostics and Genomics (21%).

Receivables 1405 1291 1295 laboratory-workflow instruments, software, and services to the life R&D: 7.0% of 2023 sales. Had about 18,100 employees, as of

Inventory (FIFO) 1038 1031 1033 sciences, diagnostics, and applied chemical markets. Products in- 10/23. Offs./dirs. own less than 1% of common stock; BlackRock,

Other 282 274 262

Current Assets 3778 4186 4338 clude liquid and gas chromatography systems, mass spec- 10.9% (2/24 proxy). Chairman: James Cullen. CEO: Padraig

Accts Payable 580 418 488 trometers, and atomic absorption instruments. Has three reportable McDonnell. Inc.: DE. Addr.: 5301 Stevens Creek Blvd., Santa Clara,

Debt Due 36 -- -- segments: Life Sciences and Applied Markets (56% of fiscal ’23 CA 95051. Tele.: 877-424-4536. Internet: www.agilent.com.

Other 1245 1185 1129

Current Liab. 1861 1603 1617 Agilent Technologies has got a new to weigh on the bottom line, given that

CEO. Indeed, on February 21st, the lab country’s weak economy and pullbacks in

ANNUAL RATES Past Past Est’d ’21-’23 equipment maker announced that Mike spending by regional pharmaceutical com-

of change (per sh) 10 Yrs. 5 Yrs. to ’27-’29

Sales 1.5% 10.0% 6.5% McMullen was retiring after more than panies.

‘‘Cash Flow’’ 4.0% 15.0% 7.5% nine years on the job and that Padraig We remain generally positive about

Earnings 6.0% 16.0% 8.0% McDonnell, who most recently headed the Agilent’s long-term prospects. To wit,

Dividends 12.5% 9.5% 7.0%

Book Value 2.5% 5.5% 11.0% Silicon Valley-based company’s CrossLab we have share profits reaching $7.85 by

Group, would replace him effective May 2027–2029, up an average of roughly 8%

Fiscal QUARTERLY SALES ($ mill.) A Full

Year Fiscal 1st. The transition should be fairly smooth annually over the next few years. Un-

Ends Jan.31 Apr. 30 Jul. 31 Oct. 31 Year as Mr. McDonnell has worked at Agilent derpinning our favorable stance is, in part,

2021 1548 1525 1586 1660 6319 in various capacities for roughly 26 years. an expectation that business in China will

2022 1674 1607 1718 1849 6848 Furthermore, Mr. McMullen will serve as snap back, as the country, for example,

2023 1756 1717 1672 1688 6833 an advisor to the company until October. makes good on pledges to extend

2024 1658 1585 1715 1792 6750

2025 1760 1685 1820 1905 7170 During his nearly decade-long tenure, Mr. healthcare to the masses and to improve

Fiscal Full

McMullen had a pretty good run. Notably, food, water, and air quality. The company

EARNINGS PER SHARE AB

Year Fiscal over that time frame, Agilent’s revenues should also benefit from a push to remove

Ends Jan.31 Apr.30 Jul.31 Oct.31 Year have increased nearly 70% while its harmful (PFAS) ‘‘forever’’ chemicals from

2021 1.06 .97 1.10 1.21 4.34 shares have more than tripled in price America’s potable water systems.

2022 1.21 1.13 1.34 1.53 5.22 (+231%), easily outpacing the benchmark At the recent quotation, shares of

2023 1.37 1.27 1.43 1.38 5.44

2024 1.29 1.19 1.45 1.57 5.50 S&P 500’s 144% gain over the same Agilent Technologies should yield

2025 1.42 1.31 1.60 1.72 6.05 stretch. decent risk-adjusted returns for con-

The company is soon likely to post its servative, buy-and-hold investors. The

Cal- QUARTERLY DIVIDENDS PAID C

Full third-straight down quarter. At $1.19 a financial flexibility provided by the compa-

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

share, our earnings target for the April in- ny’s strong free cash flow is, in part, the

2020 .18 .18 .18 .18 .72 terim represents a 6% year-over-year basis of our bullish long-term stance. A

2021 .194 .194 .194 .194 .776 decline. What’s more, it would be the bounce back in China would help nicely, as

2022 .21 .21 .21 .21 .84

2023 .225 .225 .225 .225 .90 lowest quarterly tally for Agilent in two well.

2024 .236 .236 years. As we see it, China likely continued Nils C. Van Liew May 10, 2024

(A) Fiscal years end October 31st. Excludes Quarterly EPS may not sum to total due to ber. (D) Incl. intang. In ’23: $4,435 mill., Company’s Financial Strength B++

Electronic Measurement starting in fiscal 2015. rounding. Next earnings report due in late May. $15.18/sh. (E) In millions. Stock’s Price Stability 90

(B) Dil. earnings. Adjusted after 2013. Ex- (C) Initiated quarterly dividend on 4/25/12. Divi- Price Growth Persistence 85

cludes n/r gain/(loss): ’13, (78¢); ’14, ($1.55). dend is paid late January, April, July, and Octo- Earnings Predictability 100

© 2024 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part To subscribe call 1-800-VALUELINE

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

You might also like

- Corp Regulations-Full Short NotesDocument35 pagesCorp Regulations-Full Short NotesIt's me78% (9)

- Walmart Inc PDFDocument1 pageWalmart Inc PDFWaqar AhmedNo ratings yet

- Apple - Report PDFDocument1 pageApple - Report PDFUwie AndrianaNo ratings yet

- Bby AaDocument1 pageBby AalondonmorganNo ratings yet

- Tri VLDocument1 pageTri VLJ Pierre RicherNo ratings yet

- AppleDocument1 pageAppleavinwiriandari61198No ratings yet

- Harley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 pageHarley-Davidson: 29.4 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDBrent UptonNo ratings yet

- Spiva Us Year End 2021Document39 pagesSpiva Us Year End 2021Hyenuk ChuNo ratings yet

- IntelDocument1 pageIntelavinwiriandari61198No ratings yet

- SF No 28 Kadhampadi ModelDocument1 pageSF No 28 Kadhampadi ModelmanojNo ratings yet

- SF No 28 Kadhampadi ModelDocument1 pageSF No 28 Kadhampadi ModelmanojNo ratings yet

- Laporan BulananDocument7 pagesLaporan Bulananmuhammad syaifuddin ihsanNo ratings yet

- 6754 DatasheetDocument1 page6754 DatasheetSuryakanth KattimaniNo ratings yet

- (24-03-22) - ASML Holding N.V. ASML Value Line ReportDocument1 page(24-03-22) - ASML Holding N.V. ASML Value Line ReportSalman D.No ratings yet

- VFD HarmonicsDocument1 pageVFD HarmonicstwinvbooksNo ratings yet

- 1437960464extreme Rainfall JuneDocument7 pages1437960464extreme Rainfall JuneSuyogya DahalNo ratings yet

- 1-4 Barrel Culvert4Document1 page1-4 Barrel Culvert4Delahan AbatyoughNo ratings yet

- Briefs About Season 2022-23 As of 12022023 - LSMDocument5 pagesBriefs About Season 2022-23 As of 12022023 - LSMWaqasNo ratings yet

- Link Net Company Presentation - Investor UpdateDocument47 pagesLink Net Company Presentation - Investor UpdateumarhidayatNo ratings yet

- Tamplarie GalgauDocument1 pageTamplarie GalgauOana VaidaNo ratings yet

- Gwapo FloorplanDocument1 pageGwapo FloorplanJayLord Mico PacisNo ratings yet

- Plan de Travail Cotes DéfinitivesDocument1 pagePlan de Travail Cotes DéfinitivesSergey YusupovNo ratings yet

- No 04 97Document1 pageNo 04 97widibae jokotholeNo ratings yet

- 1a. Pagina, PresentationDocument1 page1a. Pagina, PresentationJose A. Bravo B.No ratings yet

- PipaDocument1 pagePipaIman KadarismanNo ratings yet

- SRMPCDocument3 pagesSRMPCBHANUKRISHNA VISAKOTANo ratings yet

- Intervalos Musicales Puros Relación de FrecuenciasDocument1 pageIntervalos Musicales Puros Relación de FrecuenciasFelipe RodríguezNo ratings yet

- Nextera Library Validation and Cluster Density OptimizationDocument2 pagesNextera Library Validation and Cluster Density OptimizationhellowinstonNo ratings yet

- شركة ديلارDocument10 pagesشركة ديلارKhaled AwwadNo ratings yet

- L & T Catalogue 14Document4 pagesL & T Catalogue 14amulya00428No ratings yet

- ROTRON Regenerative Blowers EN523 CP523 3.0HPDocument2 pagesROTRON Regenerative Blowers EN523 CP523 3.0HPKHANNNNo ratings yet

- Fund Report - Pure Stock Fund - Aug 2021Document3 pagesFund Report - Pure Stock Fund - Aug 2021faleela IsmailNo ratings yet

- Bby 2008Document1 pageBby 2008londonmorganNo ratings yet

- VFD Calculators For Fan & Pump ApplicationsDocument16 pagesVFD Calculators For Fan & Pump ApplicationsAFRI-N-HARINo ratings yet

- Historico PIB MexicoDocument1 pageHistorico PIB MexicoJUAN SINMIEDONo ratings yet

- European Union Labour Force Survey-Annual Results 2008: Population and Social Conditions 33/2009Document8 pagesEuropean Union Labour Force Survey-Annual Results 2008: Population and Social Conditions 33/2009ekonimija86No ratings yet

- VDS MasterplanDocument1 pageVDS MasterplanSamudrala SreepranaviNo ratings yet

- Monitor de SequiaDocument7 pagesMonitor de Sequiass.sefi.infraestructuraNo ratings yet

- Intervalos Musicales Puros en Escala Loraritmica de Base 2Document1 pageIntervalos Musicales Puros en Escala Loraritmica de Base 2Felipe RodríguezNo ratings yet

- Jacket PatternDocument1 pageJacket Patternwidibae jokotholeNo ratings yet

- Fold Table All PartsDocument1 pageFold Table All PartsivanNo ratings yet

- Jalladianpettai 149 FMB 1Document1 pageJalladianpettai 149 FMB 1JaganCivilNo ratings yet

- Druga Fazamy PDFDocument1 pageDruga Fazamy PDFpaki12No ratings yet

- Transito de AvenidasDocument15 pagesTransito de AvenidasROBNo ratings yet

- S 8000 Rolled or Machined CylindersDocument4 pagesS 8000 Rolled or Machined CylindersRicardo Paz SoldanNo ratings yet

- Dhi1 Ups Health - Report - PRTG Network Monitor (Adrtpprtg1)Document21 pagesDhi1 Ups Health - Report - PRTG Network Monitor (Adrtpprtg1)Arie SutopoNo ratings yet

- TRANSITO DE AVENIDAS - Con Obra de TomaDocument15 pagesTRANSITO DE AVENIDAS - Con Obra de TomaROBNo ratings yet

- 104 Alpha Lavel OptiLobe Performance Curves - ImperialDocument1 page104 Alpha Lavel OptiLobe Performance Curves - Imperialwjb124No ratings yet

- HDM 128GS24: Dimensional DrawingDocument2 pagesHDM 128GS24: Dimensional DrawingMitchell DanielsNo ratings yet

- Second Floor Plan: Proposed Two (2) - Storey Commercial Building With RoofdeckDocument1 pageSecond Floor Plan: Proposed Two (2) - Storey Commercial Building With Roofdeckdante mortelNo ratings yet

- 2020-03 - MED - C - Pumps For VentilatorsAspiratorsO2ConcentratorsDocument37 pages2020-03 - MED - C - Pumps For VentilatorsAspiratorsO2Concentratorspuri ghibahNo ratings yet

- Book 2Document1 pageBook 2Abu TalhaNo ratings yet

- Feb 2022Document20 pagesFeb 2022Ritesh OjhaNo ratings yet

- ASD Fan CalculatorsDocument14 pagesASD Fan CalculatorsuguraydemirNo ratings yet

- 0A-0081-01 Cid - Idm Base: Title: Size Dwg. No. Weight: G SCALE: 1:6Document1 page0A-0081-01 Cid - Idm Base: Title: Size Dwg. No. Weight: G SCALE: 1:66toNo ratings yet

- Opzv Series: Tubular Gel BatteryDocument4 pagesOpzv Series: Tubular Gel BatteryAhmed ZeharaNo ratings yet

- Z ZZZZZZZZDocument1 pageZ ZZZZZZZZabene abebeNo ratings yet

- Lead Screw Phi 18Document1 pageLead Screw Phi 18bhageshlNo ratings yet

- Traffic Rep0218Document20 pagesTraffic Rep0218gogana93No ratings yet

- Commercial Aspirin IR SpectrumDocument1 pageCommercial Aspirin IR SpectrumJoshua C. CastilloNo ratings yet

- CMA FormulaDocument4 pagesCMA FormulaKanniha SuryavanshiNo ratings yet

- Osian'sDocument12 pagesOsian'sDiksha SharmaNo ratings yet

- CZBS - Playing A Different GameDocument5 pagesCZBS - Playing A Different GameWillNo ratings yet

- Investment Strategies Research PaperDocument7 pagesInvestment Strategies Research Papergw1sj1yb100% (1)

- ADRO FY22 Press ReleaseDocument7 pagesADRO FY22 Press ReleaseChuslul BadarNo ratings yet

- Accounting Grade 12 Trial 2021 P1 and MemoDocument32 pagesAccounting Grade 12 Trial 2021 P1 and Memotsholofelokgomane29No ratings yet

- Unclaimed Peerless InsuranceDocument8 pagesUnclaimed Peerless InsurancejeevanreddyvkNo ratings yet

- Chapter 2 Separate and Consolidated FS - Date of AcquisitionDocument21 pagesChapter 2 Separate and Consolidated FS - Date of AcquisitioneiaNo ratings yet

- WSP CFPAM - Corporate Finance & StrategyDocument66 pagesWSP CFPAM - Corporate Finance & Strategyaakashpatel19No ratings yet

- (Ebook PDF) Using Financial Accounting Information: The Alternative To Debits and Credits 10th Edition Gary A. Porter - Ebook PDF All ChapterDocument69 pages(Ebook PDF) Using Financial Accounting Information: The Alternative To Debits and Credits 10th Edition Gary A. Porter - Ebook PDF All Chapterursinagammie100% (10)

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Valuation of GoodwillDocument4 pagesValuation of Goodwillvansh gandhiNo ratings yet

- AccountingDocument2 pagesAccountingwindell arth MercadoNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Cash Flows of A Project: Learning ObjectivesDocument51 pagesCash Flows of A Project: Learning Objectiveshuy anh leNo ratings yet

- S.4 BAFS - Quiz 4Document5 pagesS.4 BAFS - Quiz 4MINGYU WENGNo ratings yet

- Practical Financial Management 7Th Edition Lasher Test Bank Full Chapter PDFDocument67 pagesPractical Financial Management 7Th Edition Lasher Test Bank Full Chapter PDFAdrianLynchpdci100% (11)

- Spotify Technology S.A.: United States Securities and Exchange CommissionDocument48 pagesSpotify Technology S.A.: United States Securities and Exchange CommissionSunday AyomideNo ratings yet

- Final Exam FF01 2019 With Solutions TroegeDocument10 pagesFinal Exam FF01 2019 With Solutions TroegeRosadea AbbracciaventoNo ratings yet

- College Accounting A Career Approach 12th Edition Scott Solutions ManualDocument97 pagesCollege Accounting A Career Approach 12th Edition Scott Solutions Manualrobertnelsonxrofbtjpmi100% (13)

- INVESTMENTSDocument7 pagesINVESTMENTSJhon Eljun Yuto EnopiaNo ratings yet

- Advanced Valuation Concepts and Methods - BLK - 1Document72 pagesAdvanced Valuation Concepts and Methods - BLK - 1Kim GeminoNo ratings yet

- Government Grants (Millan, 2022)Document5 pagesGovernment Grants (Millan, 2022)didit.canonNo ratings yet

- Finance Q1W2 ModuleDocument10 pagesFinance Q1W2 Modulemara ellyn lacsonNo ratings yet

- Unit 1 NotesDocument26 pagesUnit 1 NotesSarath kumar CNo ratings yet

- Chapter 6 Business Section 4 - 6Document34 pagesChapter 6 Business Section 4 - 6kparsons938512No ratings yet

- Accounting Equation and Debit and Credit Rules PDFDocument5 pagesAccounting Equation and Debit and Credit Rules PDFوجد ميانNo ratings yet

- Capital Structure Theory1Document9 pagesCapital Structure Theory1Kamba RumbidzaiNo ratings yet

- Module 6 Cost of Capital and Capital Investment Decisions PDFDocument14 pagesModule 6 Cost of Capital and Capital Investment Decisions PDFDaisy ContinenteNo ratings yet