Professional Documents

Culture Documents

BS 420 Practice Test

BS 420 Practice Test

Uploaded by

Prince Daniels Tutor0 ratings0% found this document useful (0 votes)

1 views8 pagesOriginal Title

BS 420 PRACTICE TEST

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views8 pagesBS 420 Practice Test

BS 420 Practice Test

Uploaded by

Prince Daniels TutorCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

BS 420 PRACTICE TEST

PRINCE DANIELS TUTOR

0972286191

PRINCE DANIELS – 2024

QUESTION ONE

On 1 September 20X5 Mapalo Bee Co acquired 70% of Peter Co

for K5,000,000 comprising K1,000,000 cash and 1,500,000 K1

shares.

The statement of financial position of Peter Co at acquisition was

as follows: Z

K'000

Property, plant and equipment 2,700

Inventories 1,600

Trade receivables 600

Cash 400

Trade payables (300)

Income tax payable (200)

4,800

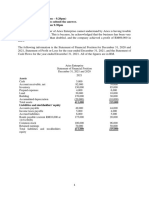

The consolidated statement of financial position of Mapalo Bee Co

as at 31 December 20X5 was as follows:

20X5 20X4

Non-current assets K'000 K'000

Property, plant and equipment 35,500 25,000

Goodwill 1,400 –

36,900 25,000

Current assets

Inventories 16,000 10,000

Trade receivables 9,800 7,500

Cash 2,400 1,500

28,200 19,000

65,100 44,000

PRINCE DANIELS – 2024

Equity attributable to owners of the parent

Share capital 12,300 10,000

Share premium 5,800 2,000

Revaluation surplus 500 –

Retained earnings 32,100 21,900

50,700 33,900

Non-controlling interest 1,600 –

52,300 33,900

Current liabilities

Trade payables 7,600 6,100

Income tax payable 5,200 4,000

12,800 10,100

65,100 44,000

The consolidated income statement of Mapalo Bee Co for the year ended

31 December 20X5 was as follows:

20X5

K'000

Profit before tax 16,500

Income tax expense (5,200)

Profit for the year 11,300

Other comprehensive income

Revaluation surplus 500

Total comprehensive income for the year 11,800

Profit attributable to:

Owners of the parent 11,100

Non-controlling interest 200

PRINCE DANIELS – 2024

11,300

Total comprehensive income for the year attributable to

Parent 11,450

Non-controlling interest 200 + (500 × 30%) 350

11,800

Notes:

1. Depreciation charged for the year was K5,800,000. The group made

no disposals of property, plant and equipment.

2. Dividends paid by Mapalo Bee Co amounted to K900,000.

3. It is the group's policy to value the non-controlling interest at its

proportionate share of the fair value of the subsidiary's identifiable net

assets.

Required

Prepare the consolidated statement of cash flows of Mapalo Bee Co for

the year ended 31 December 20X5. No notes are required.

…………………………………………………………………………………..

QUESTION TWO

On 1 January 20X0 Taonga Ltd acquired 90% of the ordinary shares of a French subsidiary

Lauren SA. At that date the balance on the retained earnings of Lauren SA was €10,000. The non-

controlling interest in Lauren was measured using proportionate method. No shares have been

issued by Lauren since acquisition. The summarised statements of comprehensive income and

statements of financial position of Taonga Ltd and Lauren SA at 31 December 20X2 were as

follows:

Statements of comprehensive income for the year ended 31 December 20X2

Taonga Ltd Lauren SA

£000 €000

Sales 317,200 200,000

Cost of sales 170,000 100,000

Gross profit 147,200 100,000

Dividend received from Lauren SA 1,800 NIL

Administration 30,000 30,000

Other expenses 15,000 7,000

PRINCE DANIELS – 2024

Interest paid 6,000 3,000

Total expenses 51,000 40,000

Profit before taxation 98,000 60,000

Taxation 21,000 15,000

Profit after taxation 77,000 45,000

Dividend paid 20,000 10,000

Statement of financial position as at 31 December 20X2

£000 €000

Non-current assets 94,950 150,000

Investment in Lauren SA 41,050

Current assets:

Inventories 60,000 12,000

Trade receivables 59,600 40,000

Lauren SA 2,400

Cash 11,000 11,000

Total assets 269,000 213,000

Current liabilities:

Trade payables 45,000 18,000

Taonga Ltd 12,000

Taxation 21,000 15,000

Non- current liabilities

Debentures 40,000 10,000

Equity

Share capital 80,000 60,000

Share premium 6,000 20,000

Revaluation reserve 10,000 12,000

Retained earnings 67,000 66,000

269,000 213,000

The following information is also available:

(i) The revaluation reserve in Lauren SA arose from the revaluation of non-current assets on

1/1/20X2.

(ii) No impairment of goodwill has occurred since acquisition.

(iii) Exchange rates were as follows:

PRINCE DANIELS – 2024

At 1 January 20X0 £1 = €2

Average for the year ending 31 December 20X2 £1 = €4

At 31 December 20X1/1 January 20X2 £1 = €3

At 31 December 20X2 £1 = €5

Required:

Assuming that the functional currency of Lauren SA is the euro, prepare the consolidated accounts

for the Taonga group at 31 December 20X2.

…………………………………………………………………………………………………………….

PRINCE DANIELS – 2024

QUESTION THREE

The following are the financial statements of the parent company Njivwa plc, a subsidiary

company Wendy and an associate company Natasha.

Statements of financial position as at 31 December 20X3

Njivwa Wendy Natasha

ASSETS £ £ £

Non-current assets

Property, plant and equipment at cost 320,000 180,000 100,000

Depreciation 200,000 70,000 21,000

120,000 110,000 79,000

Investment in Wendy 140,000

Investment in Natasha 40,000

Current assets

Inventories 120,000 60,000 36,000

Trade receivables 130,000 70,000 36,000

Current account – Wendy 15,000

Current account – Natasha 3,000

Bank 24,000 7,000 6,000

Total current assets 292,000 137,000 78,000

Total assets 592,000 247,000 157,000

EQUITY AND LIABILITIES

£1 shares 250,000 60,000 50,000

General reserve 30,000 20,000 12,000

Retained earnings 150,000 120,000 50,000

430,000 200,000 112,000

Current liabilities

Trade payables 132,000 25,000 34,000

Taxation payable 30,000 7,000 8,000

Current account – Njivwa 15,000 3,000

Total equity and liabilities 592,000 247,000 157,000

Statement of comprehensive income for the year ended 31 December 20X3

PRINCE DANIELS – 2024

£ £ £

Sales 300,000 160,000 100,000

Cost of sales 90,000 80,000 40,000

Gross profit 210,000 80,000 60,000

Expenses 95,000 50,000 40,000

Dividends paid (shown in equity) 40,000 10,000 8,000

Dividends received from Wendy and Natasha 11,000 NIL 10,000

Profit before tax 126,000 30,000 30,000

Income tax expense 30,000 7,000 8,000

Profit for the period 96,000 23,000 22,000

Dividend paid (shown in equity) 40,000 10,000 8,000

Notes

(a) Njivwa acquired 90% of the shares in Wendy on 1 January 20X1 when the balance on the

retained earnings of Wendy was £60,000 and the balance on the general reserve of Wendy

was £16,000. Njivwa also acquired 25% of the shares in Natasha on 1 January 20X2 when

the balance on Natasha’s accumulated retained profits was £30,000 and the general reserve

£8,000

(b) During the year Njivwa sold Wendy goods for £16,000, which included a mark-up of one-third.

80% of these goods were still in inventory at the end of the year.

Required:

(a) Prepare a consolidated statement of comprehensive income, including the associated

company Natasha’s results, for the year ended 31 December 20X3.

(b) Prepare a consolidated statement of financial position as at 31 December 20X3. The group

policy is to measure non-controlling interests using the proportionate method.

…………………………………………………………………………………………………………….

PRINCE DANIELS – 2024

You might also like

- CITN Study Pack - Financial and Tax AnalysisDocument282 pagesCITN Study Pack - Financial and Tax AnalysisOguntimehin Adebisola75% (4)

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Solution Manual For Understanding Financial Accounting Canadian Edition Christopher D Burnley Robert e Hoskin Maureen R Fizzell Donald C CherryDocument37 pagesSolution Manual For Understanding Financial Accounting Canadian Edition Christopher D Burnley Robert e Hoskin Maureen R Fizzell Donald C Cherrymeilbyouxb95% (22)

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- Final Project - FA Assignment Financial Analysis of VoltasDocument26 pagesFinal Project - FA Assignment Financial Analysis of VoltasHarvey100% (2)

- BS 420 - Cash FlowDocument4 pagesBS 420 - Cash FlowPrince Daniels TutorNo ratings yet

- BS 420 - 16TH MayDocument5 pagesBS 420 - 16TH MayPrince Daniels TutorNo ratings yet

- BS 420 Exam QuestionsDocument17 pagesBS 420 Exam QuestionsPrince Daniels TutorNo ratings yet

- BS 420 - 13TH MayDocument5 pagesBS 420 - 13TH MayPrince Daniels TutorNo ratings yet

- Foreign Exchange Question With SolutionsDocument3 pagesForeign Exchange Question With SolutionsPrince Daniels TutorNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- Acc140 PresentationDocument8 pagesAcc140 PresentationnyararaitatendaNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Latihan Intercompany Profit Transactions-Plant Assets WS 2Document5 pagesLatihan Intercompany Profit Transactions-Plant Assets WS 2Raihan SalehNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- Akuntansi Keuangan Lanjutan 1Document14 pagesAkuntansi Keuangan Lanjutan 1darwas darwasNo ratings yet

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 9Document10 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 9YOHANNES WIBOWONo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Tutorial 4 - Consolidated Statement of Cash FlowsDocument6 pagesTutorial 4 - Consolidated Statement of Cash FlowsFatinNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- E - CAsh Flow Question Meath With Solution and WorkingsDocument5 pagesE - CAsh Flow Question Meath With Solution and Workingschalah DeriNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Big Company LimitedDocument6 pagesBig Company LimitedFariha MaharinNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- BS 420 Test One 2024Document5 pagesBS 420 Test One 2024Prince Daniels TutorNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Assignment 7 - RosalDocument4 pagesAssignment 7 - RosalGinie Lyn RosalNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Cashflow Solutions Q2Document7 pagesCashflow Solutions Q2calliemozartNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- Adelaide - TaggedDocument2 pagesAdelaide - TaggedudhaymiscworkNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- AaaaaDocument2 pagesAaaaaMondays AndNo ratings yet

- PART A: Prepare A Company's Financial Reports Tika Company LTD A Wholesaler CompanyDocument2 pagesPART A: Prepare A Company's Financial Reports Tika Company LTD A Wholesaler CompanyMakeleta VaenukuNo ratings yet

- ACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Document1 pageACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Tenghour LyNo ratings yet

- DFNDFNDFNDFNDFDocument6 pagesDFNDFNDFNDFNDFMohammad Ibnu LapaolaNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Acc117 - Assessment - Project 2 (Q)Document5 pagesAcc117 - Assessment - Project 2 (Q)SHARIFAH NOORAZREEN WAN JAMURINo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- ST - 21-Fin 1a - N-Fin Man. (Midterm Quiz 2)Document3 pagesST - 21-Fin 1a - N-Fin Man. (Midterm Quiz 2)irish romanNo ratings yet

- Equity Method VS Cost MethodDocument14 pagesEquity Method VS Cost MethodMerliza JusayanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sessions 8 - 9 - BS - SentDocument11 pagesSessions 8 - 9 - BS - SentAjay DesaleNo ratings yet

- Internship Report Final)Document51 pagesInternship Report Final)Maryam Ghaffar100% (1)

- Projport For Bhog PurDocument26 pagesProjport For Bhog Purpj singhNo ratings yet

- T 8Document3 pagesT 8Hamayoon AhmedNo ratings yet

- Sol. Man. - Chapter 11 - Partnership FormationDocument12 pagesSol. Man. - Chapter 11 - Partnership FormationpehikNo ratings yet

- Quiz FARDocument5 pagesQuiz FARGlen JavellanaNo ratings yet

- Warren22e12 FinalDocument52 pagesWarren22e12 FinalNiken PurwantyNo ratings yet

- AFAR Set BDocument11 pagesAFAR Set BRence Gonzales0% (2)

- CPAR - AFAR - Final PB - Batch89Document18 pagesCPAR - AFAR - Final PB - Batch89MellaniNo ratings yet

- ADRIANO, Glecy C. CAÑADA, Lyka Joyce MDocument14 pagesADRIANO, Glecy C. CAÑADA, Lyka Joyce MADRIANO, Glecy C.No ratings yet

- Coc Model Level Iv ChoiceDocument22 pagesCoc Model Level Iv ChoiceBeka Asra100% (3)

- Ratio Reviewer 2Document15 pagesRatio Reviewer 2Edgar Lay60% (5)

- Pre-Bankruptcy Financial Performance of Firms: Do Size and Industry Matter?Document6 pagesPre-Bankruptcy Financial Performance of Firms: Do Size and Industry Matter?Livia PredaNo ratings yet

- INSEAD-ValueCreation2 0Document29 pagesINSEAD-ValueCreation2 0Henri GolionoNo ratings yet

- Financial Ratio Analysis, TATA STEELDocument13 pagesFinancial Ratio Analysis, TATA STEELabhijitsamanta183% (12)

- Golden Harvest Agro Industries Limited: A Brief Financial AnalysisDocument31 pagesGolden Harvest Agro Industries Limited: A Brief Financial AnalysisAsif Abdullah KhanNo ratings yet

- 681 Questions + Answers: Cfa ExamDocument256 pages681 Questions + Answers: Cfa ExamAbdullah MantawyNo ratings yet

- Jubasan Inopacan Leyte CY 2020-2022Document47 pagesJubasan Inopacan Leyte CY 2020-2022Ken BocsNo ratings yet

- Seminar On IFRS September 29 2010 Sirc of Icwai S.A.Murali PrasadDocument12 pagesSeminar On IFRS September 29 2010 Sirc of Icwai S.A.Murali PrasadsamservNo ratings yet

- Inv536 Group AssignmentDocument27 pagesInv536 Group AssignmentSHAHRUL IZZUDDIN AHMAD FAUZINo ratings yet

- Leverage Buyout Project2Document22 pagesLeverage Buyout Project2arnab_b87No ratings yet

- MODULE 5 Part 2.Document5 pagesMODULE 5 Part 2.Charissa Jamis ChingwaNo ratings yet

- Dev Financial Analysis-2Document8 pagesDev Financial Analysis-2Adam BelmekkiNo ratings yet

- Bus.-Finance LAS 5-6 QTR 2Document18 pagesBus.-Finance LAS 5-6 QTR 2lun zagaNo ratings yet

- Contents of The PFS: I. Project SummaryDocument7 pagesContents of The PFS: I. Project SummaryMykel King NobleNo ratings yet

- Key Quiz 2 2022 2023Document4 pagesKey Quiz 2 2022 2023Leslie Mae Vargas ZafeNo ratings yet

- AE 22 Activity 8Document2 pagesAE 22 Activity 8Venus PalmencoNo ratings yet