Professional Documents

Culture Documents

IFC AnnualReport-2023-EN AtAGlance

IFC AnnualReport-2023-EN AtAGlance

Uploaded by

cemab37297Copyright:

Available Formats

You might also like

- Hkdse English Reading全方位實戰神技精讀 主筆記 Sample 1643026918Document23 pagesHkdse English Reading全方位實戰神技精讀 主筆記 Sample 1643026918SupercellNo ratings yet

- Final Project ReportDocument61 pagesFinal Project ReportAakanksha BharatiNo ratings yet

- 013 Locsin V Mekeni - DigestDocument2 pages013 Locsin V Mekeni - DigestMelgen100% (8)

- Lucerna Part 1Document6 pagesLucerna Part 1api-518665324100% (1)

- IFC AnnualReport 2023 enDocument280 pagesIFC AnnualReport 2023 encemab37297No ratings yet

- 2023 q4 Earnings Results PresentationDocument25 pages2023 q4 Earnings Results PresentationZerohedgeNo ratings yet

- 2022 q3 Earnings Results PresentationDocument21 pages2022 q3 Earnings Results PresentationZerohedgeNo ratings yet

- Broadridge 2022 Annual Report 1 2Document136 pagesBroadridge 2022 Annual Report 1 2Aminul IslamNo ratings yet

- Shareholder Letter Q4 2022Document23 pagesShareholder Letter Q4 2022Mario olivariNo ratings yet

- Access Bank Ar22Document40 pagesAccess Bank Ar22mykecharles7No ratings yet

- Goldman Sachs 2022Document264 pagesGoldman Sachs 2022Ogbu VincentNo ratings yet

- Small Steps Big ShiftsDocument117 pagesSmall Steps Big ShiftsRounak AgarwalNo ratings yet

- Aecom 2020 Annual Report 10kDocument203 pagesAecom 2020 Annual Report 10kSudhir KumarNo ratings yet

- IDFC FIRST Bank Investor Presentation Q3 FY24Document111 pagesIDFC FIRST Bank Investor Presentation Q3 FY24Akash ingaleshwarNo ratings yet

- Ar2022 Complete ReportDocument228 pagesAr2022 Complete Reportcemab37297No ratings yet

- EBL at A GlanceDocument28 pagesEBL at A GlancejubcsxNo ratings yet

- 2021 Annual Report - 27027Document15 pages2021 Annual Report - 27027Rishabh AminNo ratings yet

- Wipro Integrated Annual Report 2020 21Document386 pagesWipro Integrated Annual Report 2020 21Rithesh KNo ratings yet

- 002 Smith Wesson 2022 Annual ReportDocument100 pages002 Smith Wesson 2022 Annual ReportGreicon Wagner Vogelmann BeckerNo ratings yet

- 2023 Annual Report eDocument228 pages2023 Annual Report ecemab37297No ratings yet

- GIG Annual Report - 2021Document70 pagesGIG Annual Report - 2021Jack deFRAUDSTERNo ratings yet

- Annual Report 2022 - 1Document146 pagesAnnual Report 2022 - 1Shady 01No ratings yet

- Bajaj Finance Limited Ar 2022 23Document415 pagesBajaj Finance Limited Ar 2022 23nowdu purnimaNo ratings yet

- Manu 5Document2 pagesManu 5Temp RoryNo ratings yet

- Annual Report 2003 PDFDocument140 pagesAnnual Report 2003 PDFvinskaNo ratings yet

- Bank of America 2019 Annual Report PDFDocument192 pagesBank of America 2019 Annual Report PDFRamsinghNo ratings yet

- Annual Report Imexhs 2022 1Document95 pagesAnnual Report Imexhs 2022 1Eduardo RodriguezNo ratings yet

- Royal Bank of Canada - Earnings Call 2014-12-03 FS000000002184405457Document25 pagesRoyal Bank of Canada - Earnings Call 2014-12-03 FS000000002184405457Nicholi ShiellNo ratings yet

- SBI Life12644 Annual Report FY21Document414 pagesSBI Life12644 Annual Report FY21Sag SagNo ratings yet

- Annual Report 2023 Annual Report 2023Document236 pagesAnnual Report 2023 Annual Report 2023kratosNo ratings yet

- Raghu PPT On SharekhanDocument16 pagesRaghu PPT On SharekhanRAGHU M S0% (1)

- WestRock Sustainability Report 2022 PDFDocument107 pagesWestRock Sustainability Report 2022 PDFMuhammad AwaisNo ratings yet

- 2022 Full Annual ReportDocument234 pages2022 Full Annual ReportJ Pierre RicherNo ratings yet

- 4Q22 BFH Slides - FINALDocument25 pages4Q22 BFH Slides - FINALdon kennedyNo ratings yet

- Bajaj Finance Limited Ar 2022 23Document473 pagesBajaj Finance Limited Ar 2022 23Gaurav SinghNo ratings yet

- 2021 2022 Annual ReportDocument347 pages2021 2022 Annual Reportabhishek.26722No ratings yet

- Annual Message To Shareholders 2009Document16 pagesAnnual Message To Shareholders 2009doffnerNo ratings yet

- 1484106855AnnualReprot2022 23Document454 pages1484106855AnnualReprot2022 23madristasareoneNo ratings yet

- Massy Holdings Annual Report 2023 DigitalDocument210 pagesMassy Holdings Annual Report 2023 DigitalRayad AliNo ratings yet

- 2019 Annual Financial Report - 18feb20 - 2Document88 pages2019 Annual Financial Report - 18feb20 - 2Sơn BadGuyNo ratings yet

- 2021 CIMIC Group Annual Report - 10 February 2022Document278 pages2021 CIMIC Group Annual Report - 10 February 2022AtefNo ratings yet

- 2022 Tronox Annual Report - FinalDocument124 pages2022 Tronox Annual Report - Finaltaufiq_hidayat_1982No ratings yet

- Insurance Premium Finance Quarterly Update 2022 Q2Document11 pagesInsurance Premium Finance Quarterly Update 2022 Q2AgazziNo ratings yet

- Adyen Shareholder Letter FY23 H2Document49 pagesAdyen Shareholder Letter FY23 H2Ashutosh DessaiNo ratings yet

- Intro The Bridge 2023Document21 pagesIntro The Bridge 2023jonathanNo ratings yet

- Annual Report 2023Document346 pagesAnnual Report 2023Hit cinemaNo ratings yet

- Bca Ar 2022 InggrisDocument762 pagesBca Ar 2022 InggrisAhsan MaulanaNo ratings yet

- Nyse Usb 2021Document157 pagesNyse Usb 2021Human GrootNo ratings yet

- Nyse FC 2023Document172 pagesNyse FC 2023Boban CelebicNo ratings yet

- Marriott 2022 Annual ReportDocument81 pagesMarriott 2022 Annual ReportGanpya ThrubeNo ratings yet

- Ncba Integrated Report 2020Document196 pagesNcba Integrated Report 2020JuiNo ratings yet

- Annual Report RBCDocument219 pagesAnnual Report RBC5variaraNo ratings yet

- WP Earnings q3 2018 Final RDocument14 pagesWP Earnings q3 2018 Final RTarek DomiatyNo ratings yet

- InCred Financial Services Limited - AR-2022-23 - C2C - SGA..Document264 pagesInCred Financial Services Limited - AR-2022-23 - C2C - SGA..ArchitGargNo ratings yet

- Oxyzo Annual Report FY 2022 23Document266 pagesOxyzo Annual Report FY 2022 23Kkaran SeethNo ratings yet

- COTY Jun 2018Document10 pagesCOTY Jun 2018Ala BasterNo ratings yet

- Investment Banking - Securities Dealing in The US Industry ReportDocument42 pagesInvestment Banking - Securities Dealing in The US Industry ReportEldar Sedaghatparast SalehNo ratings yet

- iFASTCorp AnnualReport 2020Document216 pagesiFASTCorp AnnualReport 2020Zheng Yuan TanNo ratings yet

- 1 IntroductionDocument23 pages1 IntroductionSucheta SahaNo ratings yet

- A Fintech Platform For Service Businesses and HomeownersDocument23 pagesA Fintech Platform For Service Businesses and HomeownersEly PNo ratings yet

- Kotak Mahindra Bank Limited FY19Document284 pagesKotak Mahindra Bank Limited FY19hyhy 21No ratings yet

- Httpsmarriott - Gcs Web - Comstatic Filesb82978a6 9d28 4e38 9855 Fc4ae2cebe11 2Document81 pagesHttpsmarriott - Gcs Web - Comstatic Filesb82978a6 9d28 4e38 9855 Fc4ae2cebe11 2pablo moraga salvatierraNo ratings yet

- AlRajhiBank AR 2019Document169 pagesAlRajhiBank AR 2019RizkyAufaSNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- J33Document6 pagesJ33Belkisa ŠaćiriNo ratings yet

- Ytg M 0512 PDFDocument128 pagesYtg M 0512 PDFAndres Felipe TapiaNo ratings yet

- 167867-2013-Optima Realty Corp. v. Hertz Phil. ExclusiveDocument8 pages167867-2013-Optima Realty Corp. v. Hertz Phil. ExclusiveYuri NishimiyaNo ratings yet

- Adolescent Health and Development Program - Department of Health WebsiteDocument4 pagesAdolescent Health and Development Program - Department of Health WebsiteJL CalvinNo ratings yet

- AFFLE - Investor Presentation - FY21Document19 pagesAFFLE - Investor Presentation - FY21Abhishek MurarkaNo ratings yet

- SE Lecture 07 - Gantt Chart Feasibility Study Preliminary Investigation 05052021 090543amDocument37 pagesSE Lecture 07 - Gantt Chart Feasibility Study Preliminary Investigation 05052021 090543amMohammad TaimurNo ratings yet

- PANTRANCO Vs PSC - Case DigestDocument1 pagePANTRANCO Vs PSC - Case DigestTrina Donabelle Gojunco100% (2)

- Unisab III Engineering - 2009 06Document293 pagesUnisab III Engineering - 2009 06Marildo CominNo ratings yet

- BSBADM502 - BSBPMG522 Student Assessment V1.1Document10 pagesBSBADM502 - BSBPMG522 Student Assessment V1.1purva0225% (4)

- Labuenavida Business Summary 2023Document24 pagesLabuenavida Business Summary 2023UzoNo ratings yet

- GR 190080Document9 pagesGR 190080Arvi MendezNo ratings yet

- Impact of COVID-19 On People's Livelihoods, Their Health and Our Food SystemsDocument4 pagesImpact of COVID-19 On People's Livelihoods, Their Health and Our Food Systemsjungkook jeonNo ratings yet

- Application For Altering and Adding Charges - Application For ProsecutionDocument2 pagesApplication For Altering and Adding Charges - Application For ProsecutionSandeepani NeglurNo ratings yet

- Ft. CA. t4 Ppe Panel ConectorDocument2 pagesFt. CA. t4 Ppe Panel ConectorSophia Hernández ÁlvaradoNo ratings yet

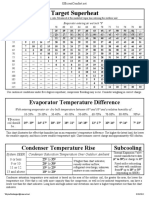

- Charging and TD Chart PlusDocument1 pageCharging and TD Chart PlusFaquruddin AliNo ratings yet

- Soco Assignment 2Document4 pagesSoco Assignment 2Lara LavanyaNo ratings yet

- Cloud Computing: Azmat Ullah Baig. Hamza IdreesDocument26 pagesCloud Computing: Azmat Ullah Baig. Hamza IdreesAzmat Ullah BaigNo ratings yet

- BC OE1 User ManualDocument2 pagesBC OE1 User ManualCarlos DuranNo ratings yet

- Disjuntor SF1 - Dados ElétricosDocument1 pageDisjuntor SF1 - Dados ElétricosotavioalcaldeNo ratings yet

- Continous Humidification Processes: Water-Cooling Tower - Packed TowerDocument30 pagesContinous Humidification Processes: Water-Cooling Tower - Packed Towerdrami94100% (1)

- Hybrid GrandglowDocument5 pagesHybrid Grandglowmohsan bilalNo ratings yet

- Checklist of Organisation Design Principles by Paul KearnsDocument4 pagesChecklist of Organisation Design Principles by Paul KearnsaliNo ratings yet

- Life Below Water: Verlin Andre Africa Simon Marquis Lumbera Rhona Mae Panopio Ais1ADocument14 pagesLife Below Water: Verlin Andre Africa Simon Marquis Lumbera Rhona Mae Panopio Ais1ASimon Marquis LUMBERANo ratings yet

- Intermediate Microeconomics 1st Edition Robert Mochrie 113700844X Solution ManualDocument113 pagesIntermediate Microeconomics 1st Edition Robert Mochrie 113700844X Solution Manualelvin100% (29)

- Basic Electrical, Automation, and Instrumentation.Document4 pagesBasic Electrical, Automation, and Instrumentation.Foaad HawarNo ratings yet

- JDTDocument2 pagesJDTSashikant SharmaNo ratings yet

IFC AnnualReport-2023-EN AtAGlance

IFC AnnualReport-2023-EN AtAGlance

Uploaded by

cemab37297Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFC AnnualReport-2023-EN AtAGlance

IFC AnnualReport-2023-EN AtAGlance

Uploaded by

cemab37297Copyright:

Available Formats

Intact Financial Corporation

Intact at a glance – March 2024

About us

We’re motivated by our purpose

We are here to help people, businesses and society prosper in good times and be resilient in bad times.

We’re driven by our values

Our Values guide our decision-making, keep us grounded, help us outperform and are key to our success.

Integrity Respect Customer- Excellence Generosity

driven

Be honest, Be kind Act with discipline Help others

open and fair Listen to our and drive to

See diversity outperform Protect the

Set high standards as a strength customers environment

Make it easy, Embrace change,

Stand up for Be inclusive and improve every day Make our

what is right collaborate find solutions communities

Deliver second-to- Celebrate success, more resilient

none experiences yet remain humble

We’re guided by our core belief

We are a purpose-driven company based on values and a belief that insurance is about people, not things.

What we do

Intact is the largest provider of Property ①

& Casualty insurance in Canada, a leading

specialty lines insurer with international

expertise and a leader in commercial lines ③

in the U.K. and Ireland.

②

① Largest provider of P&C

insurance in Canada

② Leading Global Specialty

Lines platform

③ U.K. & Ireland leading

commercial lines insurer

We have a global team of more than Our business has grown organically and through

30,000 employees delivering best-in-class acquisitions to over $22 billion of total annual

service through over 350 offices. operating Direct Premiums Written.1

Our P&C segments2 Our lines of business2

13%

28%

20% 46%

67%

26%

Canada U.K.&I U.S. Personal lines Commercial lines Specialty lines

1 See Section 31 — Non-GAAP and other financial measures of the MD&A for more details.

2 Based on 2023 operating DPW on a continuing pro-forma basis. This reflects the impact of the DLG brokered commercial lines acquisition for a full year and excludes U.K. personal

lines DPW, as this is a better indication of our future annual premiums. See Section 31—Non-GAAP and other financial measures of the MD&A for more details.

[4] 2023 Intact Financial Corporation Annual Report

Over the last decade, our total annual operating DLG

Direct Premiums Written1 tripled in size to over ~$36B

$22 billion in 2023. Our strong growth trajectory Market Cap

has been supported by successful acquisitions RSA

while surpassing our financial objectives. As

a result, our market cap has consistently

increased over time and reached a record

high of $36 billion in 2023.

GCNA

$22.4B

DPW

OneBeacon

Innovassur

Canadian

Metro Direct

General

JEVCO

AXA Canada

$4.5B

Market Cap

$4.3B

DPW

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

1 See Section 31 —Non-GAAP and other financial measures of the MD&A for more details.

2023 Intact Financial Corporation Annual Report [5]

What we aim

to achieve

Our objectives

3 out of 4 customers We are a best employer

are our advocates Our customers

Our people are Our employees and leaders

are our

4 out of 5 brokers value

ADVOCATES ENGAGED are representative of the

our specialized expertise communities we serve

3 out of 4 stakeholders Our company

recognize us as leaders in is one of the Exceed industry ROE by 5 pts

building resilient communities

MOST Grow NOIPS 10% yearly over time

Achieve Net Zero by 2050, and halve RESPECTED

our operations emissions by 2030

[6] 2023 Intact Financial Corporation Annual Report

2023 strategic highlights

Our customers are our ADVOCATES 71% 82%

of our personal lines of brokers in Canada,

customers who had the U.S. and the U.K. value

a transaction with us our specialized expertise

are our advocates

Our people are ENGAGED 2023 Kincentric Representing the

Best Employer: communities we serve:

• in Canada for the

8th consecutive year 40%

of Vice President and

• in the U.S. for the

higher positions at IFC

5th consecutive year

are held by women

Progression toward Best

Employer in U.K.&I: 14%

A six-point improvement

of Vice President and higher

this year on the employee

positions in Canada and U.S.

engagement survey

are held by employees who

identify as Black People and

People of Colour1

Our company is one of the 10-year CAGR

57%

MOST RESPECTED 12% of stakeholders in Canada

with a Net Operating Income believe that Intact is a leader

Per Share2 of $11.70 in helping build resilient

communities4

10-year average Return on

Equity2,3 outperformance of

6.8 points

1 Excluding On Side Restoration due to data unavailability.

2 See Section 31 —Non-GAAP and other financial measures of the MD&A for more details.

3 Intact’s ROE corresponds to an adjusted return on equity (AROE), which is more comparable to the industry.

4 Intact’s Resilience Barometer measures our progress on achieving our target of “3 out of 4 stakeholders recognize us as leaders in building resilient communities” through feedback

from key stakeholders. More information on “our company is one of the most respected” objective can be found in the annual Social Impact and ESG Report.

2023 Intact Financial Corporation Annual Report [7]

Our strategic

roadmap

Our strategy

Expand leadership Strengthen leading Build a Specialty

position in Canada position in U.K. & Ireland Lines leader

Leading customer 3 out of 4 customers Leading broker & Expand broker Specialized customer Expand

experience digitally engaged customer experience distribution value proposition distribution

10% Scale in

distribution

Further

consolidation

Optimize

underwriting & claims

Responsive and

agile technology

Profitable &

growing mix

Consolidate

fragmented

NOIPS in Canada for outperformance and operations of verticals market

growth

annually

Outperform industry

over time

combined ratio by 5 pts

Low 90s combined ratio Sub-90s combined ratio

500 bps

Annual ROE

Outperformance*

Transform our competitive advantages & solidify outperformance

Global leader in leveraging data Deep Claims expertise & strong Strong capital & investment

and AI for pricing and risk selection supply chain network management expertise

Invest in our people

Be a best employer Be a destination for top talent & experts Enable our people to thrive

Invest in our community

Leverage our strengths to win on climate Build resilient communities

Based on a weighted-average ROE benchmark of leading P&C insurers in Canada, the U.S. and the U.K.

*

[8] 2023 Intact Financial Corporation Annual Report

Highlights of our

strategic progress

Expand our leadership position in Canada belairdirect, our direct-to-consumer

arm, and BrokerLink, our wholly

owned business, strengthened

our scale in distribution with over

$6.5 billion

of total annual DPW1

Strengthen our leading position in U.K. & Ireland Optimized our footprint to become

one of the largest

commercial lines writers in the U.K. with

the acquisition of Direct Line’s brokered

Commercial Lines operations

Build a Specialty Lines leader Over $6 billion

in DPW1 generated as we expand our

capabilities across our global platform

and progress on pricing sophistication

Transform our competitive advantages 93 new AI models

and solidify outperformance deployed by our Data Lab experts,

guided by an outperformance mindset

and a strong data and AI governance

Invest in our people Almost a quarter

of our employees moved to a new role

and progressed their career, enabling our

people to grow with us, while deepening

the global talent pool

Invest in our community $26.4 million

in funding for climate adaptation since

2010, supporting applied research and

adaptation actions that help build resilient

communities where we operate

1 See Section 31 —Non-GAAP and other financial measures of the MD&A for more details.

2023 Intact Financial Corporation Annual Report [9]

Our strong track

record of financial

performance

[ 10 ] 2023 Intact Financial Corporation Annual Report

Net Operating Income Per Share1 over time

NOIPS

12%

10-year CAGR

15

$11.70

12 This was driven by solid organic growth,

healthy underwriting margins, as well as

9 strong investment and distribution results,

6 altogether bolstered by contributions

from our numerous acquisitions. We

3 remain confident in our ability to grow

NOIPS by 10% annually, over time.

0

2014 2015 2016 2017 2018 2019 2020 2021 20222 20232

ROE1,3 outperformance Average ROE over the past decade

ROE outperformance versus the industry of 14.6% exceeding industry ROE

by a yearly average of 6.8 points.4

15

12 Estimated ROE outperformance in

2023 was impacted by our strategic

9 restructuring and derisking activities

6

during the year. We remain confident

in our ability to deliver 500 bps of ROE

3 outperformance every year, driven by our

underwriting, claims, as well as capital

0

2014 2015 2016 2017 2018 2019 2020 2021 2022 20232 and investment management activities.

Total shareholder return5 10-year Annualized Total

Shareholder Return

IFC TSX 60

300

274% 14% 8%

250 IFC TSX 60

200

150

121% We had 19 consecutive dividend

increases since our IPO, and total

100 shareholder return outpacing the

50 TSX 60 by 600 basis points per

0 year, over the last 10 years.

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

1 See Section 31—Non-GAAP and other financial measures of the MD&A for more details.

2 IFRS 17 basis.

3 Intact’s ROE corresponds to an adjusted return on equity (AROE), which is more comparable to the industry.

4 2023 ROE outperformance is estimated at 260 basis points and includes estimated U.K. industry ROE. Final 2023 outperformance results will be available in Q2-2024.

5 This graph compares the total cumulative return of $100 invested in Common Shares of the Company with the total cumulative return of the S&P/TSX, assuming the reinvestment of dividends.

2023 Intact Financial Corporation Annual Report [ 11 ]

2023 financial highlights

Our performance is driven by our sophisticated pricing, disciplined

underwriting, in-house claims expertise and strong supply chain

network. Despite the unusually challenging operating environment,

we reported solid results, a testament to the resilience of our

operations as well as our ability to deliver strong profitable growth.

We reported solid operating performance in 2023

Underwriting Investment Distribution

$22.4B $1,346M $467M

Operating DPW1 Operating Net

Investment Income1

Distribution Income1

$11.70

BrokerLink closed NOIPS1

94.2% 3.94% 20 acquisitions,

$6.99

representing

Combined Ratio Market-based yield

$375M

1,2

DPW EPS

Our financial position continues to be strong3

22.4% $2.7B

Adjusted Debt-to-Total Total Capital Margin1

Capital Ratio1

Credit Ratings

A+ AA AA- A1

$81.71

BVPS1

A.M. Best DBRS Fitch Moody’s

14.2% 11.7% 8.8%

OROE1 AROE1 ROE1

1 See Section 31 —Non-GAAP and other financial measures of the MD&A for more details.

2 Combined ratio is presented on an undiscounted basis, in line with how we manage our business.

3 As of December 31, 2023.

[ 12 ] 2023 Intact Financial Corporation Annual Report

Shareholder and

corporate information

Toronto Stock Exchange (TSX) listings Transfer agent and registrar

Common Shares Ticker Symbol: IFC Computershare Investor Services Inc.

Series 1 Preferred Shares Ticker Symbol: IFC.PR.A 100 University Avenue, 8th Floor, North Tower

Series 3 Preferred Shares Ticker Symbol: IFC.PR.C Toronto, Ontario M5J 2Y1

Series 5 Preferred Shares Ticker Symbol: IFC.PR.E 1-800-564-6253

Series 6 Preferred Shares Ticker Symbol: IFC.PR.F

Series 7 Preferred Shares Ticker Symbol: IFC.PR.G Dividend reinvestment

Series 9 Preferred Shares Ticker Symbol: IFC.PR.I Shareholders can reinvest their common share dividends of Intact Financial

Series 11 Preferred Shares Ticker Symbol: IFC.PR.K Corporation on a commission-free basis either through their broker under a

Dividend Reinvestment Plan (DRIP) administered on behalf of the Company

Annual meeting of shareholders Earnings conference

by our transfer agent, Computershare Investor Services Inc., or via the

call dates

Date: Wednesday, May 8, 2024 Co-Operative Investing Service operated by Canadian ShareOwner

Q1 —May 8, 2024 Investments Inc. Full details can be obtained by visiting the “Investors”

Time: 1:00 p.m. (Eastern Time) Q2 —July 31, 2024 section of the www.intactfc.com website.

Q3 —November 6, 2024

Place: Virtual-only meeting via

Q4 —February 12, 2025 Eligible dividend designation

live webcast. The webcast will

be available at https://web. For purposes of the enhanced dividend tax credit rules contained in the Income

lumiagm.com/#/452621456. Tax Act (Canada) and any corresponding provincial and territorial tax legislation,

Detailed information on how to all dividends (and deemed dividends) paid by Intact Financial Corporation to

participate in the Meeting is included Canadian residents on our common and preferred shares after December

in our Management Proxy Circular. 31, 2005, are designated as eligible dividends. Unless stated otherwise,

all dividends (and deemed dividends) paid by the Company hereafter are

Common share dividend history designated as eligible dividends for the purposes of such rules.

Record date Payable date Amount Information for shareholders outside of Canada

December 15, 2023 December 29, 2023 $1.10 Dividends paid to residents of countries with which Canada has bilateral tax

treaties are generally subject to the 15% Canadian non-resident withholding tax.

September 15, 2023 September 29, 2023 $1.10

There is no Canadian tax on gains from the sale of shares (assuming ownership

June 15, 2023 June 30, 2023 $1.10 of less than 25%) or debt instruments of the Company owned by non-residents

not carrying on business in Canada. No government in Canada levies estate

March 15, 2023 March 31, 2023 $1.10 taxes or succession duties.

December 15, 2022 December 30, 2022 $1.00

Auditors

September 15, 2022 September 30, 2022 $1.00

Ernst & Young LLP

June 15, 2022 June 30, 2022 $1.00

March 15, 2022 March 31, 2022 $1.00

Investor inquiries Media inquiries

Shubha Khan David Barrett

Common share dividend dates in 2024* Director, Media, Social

Vice President, Investor Relations

1-416-341-1464, ext. 41004 and Owned Channels

Record date Payable date 1-416-227-7905 / 1-514-985-7165

shubha.khan@intact.net

March 15, 2024 March 29, 2024 media@intact.net

June 14, 2024 June 28, 2024

September 13, 2024 September 27, 2024 Data items are not adjusted for stock splits and consolidations. This data

is provided “AS IS”. TSX, its affiliates and their respective service providers,

December 16, 2024 December 31, 2024

suppliers and licensors: (i) make no warranties or representations of any kind,

express, implied or otherwise regarding this data or its accuracy, completeness

or timeliness, (ii) disclaim the implied warranties of merchantability and fitness

Preferred share dividend dates in 2024* for a particular purpose, and (iii) assume no liability in making this data available.

Record date Payable date A glossary of abbreviations can be found in Section 35—Glossary and

definitions of the MD&A. A glossary of definitions of GAAP and non-GAAP

March 15, 2024 March 31, 2024

financial measures, as well as other insurance-related terms used in our

June 14, 2024 June 30, 2024 financial reports, can be obtained by visiting the “Investors” section of the

September 13, 2024 September 30, 2024 www.intactfc.com website.

December 16, 2024 December 31, 2024 Version française

Il existe une version française du présent rapport annuel à la section Investisseurs

* Dividends are not guaranteed and are subject to approval by the Board of Directors. de notre site Web www.intactfc.com/French/accueil/default.aspx.

Les personnes intéressées peuvent obtenir une version imprimée en envoyant

un courriel à ir@intact.net.

2023 Intact Financial Corporation Annual Report [ 277 ]

Why invest

in Intact

Largest provider of P&C Consistently outperforms Track record of strong

insurance in Canada, leader in industry due to disciplined capital generation and annual

commercial lines in the U.K. and underwriting, scale advantage and dividend increases

Ireland, with a leading Global in-house claims expertise

Specialty Lines platform

Proven industry consolidator Financial strength reinforced 2023 Kincentric Best Employer

& integrator by prudent risk management in Canada and the U.S.

You might also like

- Hkdse English Reading全方位實戰神技精讀 主筆記 Sample 1643026918Document23 pagesHkdse English Reading全方位實戰神技精讀 主筆記 Sample 1643026918SupercellNo ratings yet

- Final Project ReportDocument61 pagesFinal Project ReportAakanksha BharatiNo ratings yet

- 013 Locsin V Mekeni - DigestDocument2 pages013 Locsin V Mekeni - DigestMelgen100% (8)

- Lucerna Part 1Document6 pagesLucerna Part 1api-518665324100% (1)

- IFC AnnualReport 2023 enDocument280 pagesIFC AnnualReport 2023 encemab37297No ratings yet

- 2023 q4 Earnings Results PresentationDocument25 pages2023 q4 Earnings Results PresentationZerohedgeNo ratings yet

- 2022 q3 Earnings Results PresentationDocument21 pages2022 q3 Earnings Results PresentationZerohedgeNo ratings yet

- Broadridge 2022 Annual Report 1 2Document136 pagesBroadridge 2022 Annual Report 1 2Aminul IslamNo ratings yet

- Shareholder Letter Q4 2022Document23 pagesShareholder Letter Q4 2022Mario olivariNo ratings yet

- Access Bank Ar22Document40 pagesAccess Bank Ar22mykecharles7No ratings yet

- Goldman Sachs 2022Document264 pagesGoldman Sachs 2022Ogbu VincentNo ratings yet

- Small Steps Big ShiftsDocument117 pagesSmall Steps Big ShiftsRounak AgarwalNo ratings yet

- Aecom 2020 Annual Report 10kDocument203 pagesAecom 2020 Annual Report 10kSudhir KumarNo ratings yet

- IDFC FIRST Bank Investor Presentation Q3 FY24Document111 pagesIDFC FIRST Bank Investor Presentation Q3 FY24Akash ingaleshwarNo ratings yet

- Ar2022 Complete ReportDocument228 pagesAr2022 Complete Reportcemab37297No ratings yet

- EBL at A GlanceDocument28 pagesEBL at A GlancejubcsxNo ratings yet

- 2021 Annual Report - 27027Document15 pages2021 Annual Report - 27027Rishabh AminNo ratings yet

- Wipro Integrated Annual Report 2020 21Document386 pagesWipro Integrated Annual Report 2020 21Rithesh KNo ratings yet

- 002 Smith Wesson 2022 Annual ReportDocument100 pages002 Smith Wesson 2022 Annual ReportGreicon Wagner Vogelmann BeckerNo ratings yet

- 2023 Annual Report eDocument228 pages2023 Annual Report ecemab37297No ratings yet

- GIG Annual Report - 2021Document70 pagesGIG Annual Report - 2021Jack deFRAUDSTERNo ratings yet

- Annual Report 2022 - 1Document146 pagesAnnual Report 2022 - 1Shady 01No ratings yet

- Bajaj Finance Limited Ar 2022 23Document415 pagesBajaj Finance Limited Ar 2022 23nowdu purnimaNo ratings yet

- Manu 5Document2 pagesManu 5Temp RoryNo ratings yet

- Annual Report 2003 PDFDocument140 pagesAnnual Report 2003 PDFvinskaNo ratings yet

- Bank of America 2019 Annual Report PDFDocument192 pagesBank of America 2019 Annual Report PDFRamsinghNo ratings yet

- Annual Report Imexhs 2022 1Document95 pagesAnnual Report Imexhs 2022 1Eduardo RodriguezNo ratings yet

- Royal Bank of Canada - Earnings Call 2014-12-03 FS000000002184405457Document25 pagesRoyal Bank of Canada - Earnings Call 2014-12-03 FS000000002184405457Nicholi ShiellNo ratings yet

- SBI Life12644 Annual Report FY21Document414 pagesSBI Life12644 Annual Report FY21Sag SagNo ratings yet

- Annual Report 2023 Annual Report 2023Document236 pagesAnnual Report 2023 Annual Report 2023kratosNo ratings yet

- Raghu PPT On SharekhanDocument16 pagesRaghu PPT On SharekhanRAGHU M S0% (1)

- WestRock Sustainability Report 2022 PDFDocument107 pagesWestRock Sustainability Report 2022 PDFMuhammad AwaisNo ratings yet

- 2022 Full Annual ReportDocument234 pages2022 Full Annual ReportJ Pierre RicherNo ratings yet

- 4Q22 BFH Slides - FINALDocument25 pages4Q22 BFH Slides - FINALdon kennedyNo ratings yet

- Bajaj Finance Limited Ar 2022 23Document473 pagesBajaj Finance Limited Ar 2022 23Gaurav SinghNo ratings yet

- 2021 2022 Annual ReportDocument347 pages2021 2022 Annual Reportabhishek.26722No ratings yet

- Annual Message To Shareholders 2009Document16 pagesAnnual Message To Shareholders 2009doffnerNo ratings yet

- 1484106855AnnualReprot2022 23Document454 pages1484106855AnnualReprot2022 23madristasareoneNo ratings yet

- Massy Holdings Annual Report 2023 DigitalDocument210 pagesMassy Holdings Annual Report 2023 DigitalRayad AliNo ratings yet

- 2019 Annual Financial Report - 18feb20 - 2Document88 pages2019 Annual Financial Report - 18feb20 - 2Sơn BadGuyNo ratings yet

- 2021 CIMIC Group Annual Report - 10 February 2022Document278 pages2021 CIMIC Group Annual Report - 10 February 2022AtefNo ratings yet

- 2022 Tronox Annual Report - FinalDocument124 pages2022 Tronox Annual Report - Finaltaufiq_hidayat_1982No ratings yet

- Insurance Premium Finance Quarterly Update 2022 Q2Document11 pagesInsurance Premium Finance Quarterly Update 2022 Q2AgazziNo ratings yet

- Adyen Shareholder Letter FY23 H2Document49 pagesAdyen Shareholder Letter FY23 H2Ashutosh DessaiNo ratings yet

- Intro The Bridge 2023Document21 pagesIntro The Bridge 2023jonathanNo ratings yet

- Annual Report 2023Document346 pagesAnnual Report 2023Hit cinemaNo ratings yet

- Bca Ar 2022 InggrisDocument762 pagesBca Ar 2022 InggrisAhsan MaulanaNo ratings yet

- Nyse Usb 2021Document157 pagesNyse Usb 2021Human GrootNo ratings yet

- Nyse FC 2023Document172 pagesNyse FC 2023Boban CelebicNo ratings yet

- Marriott 2022 Annual ReportDocument81 pagesMarriott 2022 Annual ReportGanpya ThrubeNo ratings yet

- Ncba Integrated Report 2020Document196 pagesNcba Integrated Report 2020JuiNo ratings yet

- Annual Report RBCDocument219 pagesAnnual Report RBC5variaraNo ratings yet

- WP Earnings q3 2018 Final RDocument14 pagesWP Earnings q3 2018 Final RTarek DomiatyNo ratings yet

- InCred Financial Services Limited - AR-2022-23 - C2C - SGA..Document264 pagesInCred Financial Services Limited - AR-2022-23 - C2C - SGA..ArchitGargNo ratings yet

- Oxyzo Annual Report FY 2022 23Document266 pagesOxyzo Annual Report FY 2022 23Kkaran SeethNo ratings yet

- COTY Jun 2018Document10 pagesCOTY Jun 2018Ala BasterNo ratings yet

- Investment Banking - Securities Dealing in The US Industry ReportDocument42 pagesInvestment Banking - Securities Dealing in The US Industry ReportEldar Sedaghatparast SalehNo ratings yet

- iFASTCorp AnnualReport 2020Document216 pagesiFASTCorp AnnualReport 2020Zheng Yuan TanNo ratings yet

- 1 IntroductionDocument23 pages1 IntroductionSucheta SahaNo ratings yet

- A Fintech Platform For Service Businesses and HomeownersDocument23 pagesA Fintech Platform For Service Businesses and HomeownersEly PNo ratings yet

- Kotak Mahindra Bank Limited FY19Document284 pagesKotak Mahindra Bank Limited FY19hyhy 21No ratings yet

- Httpsmarriott - Gcs Web - Comstatic Filesb82978a6 9d28 4e38 9855 Fc4ae2cebe11 2Document81 pagesHttpsmarriott - Gcs Web - Comstatic Filesb82978a6 9d28 4e38 9855 Fc4ae2cebe11 2pablo moraga salvatierraNo ratings yet

- AlRajhiBank AR 2019Document169 pagesAlRajhiBank AR 2019RizkyAufaSNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- J33Document6 pagesJ33Belkisa ŠaćiriNo ratings yet

- Ytg M 0512 PDFDocument128 pagesYtg M 0512 PDFAndres Felipe TapiaNo ratings yet

- 167867-2013-Optima Realty Corp. v. Hertz Phil. ExclusiveDocument8 pages167867-2013-Optima Realty Corp. v. Hertz Phil. ExclusiveYuri NishimiyaNo ratings yet

- Adolescent Health and Development Program - Department of Health WebsiteDocument4 pagesAdolescent Health and Development Program - Department of Health WebsiteJL CalvinNo ratings yet

- AFFLE - Investor Presentation - FY21Document19 pagesAFFLE - Investor Presentation - FY21Abhishek MurarkaNo ratings yet

- SE Lecture 07 - Gantt Chart Feasibility Study Preliminary Investigation 05052021 090543amDocument37 pagesSE Lecture 07 - Gantt Chart Feasibility Study Preliminary Investigation 05052021 090543amMohammad TaimurNo ratings yet

- PANTRANCO Vs PSC - Case DigestDocument1 pagePANTRANCO Vs PSC - Case DigestTrina Donabelle Gojunco100% (2)

- Unisab III Engineering - 2009 06Document293 pagesUnisab III Engineering - 2009 06Marildo CominNo ratings yet

- BSBADM502 - BSBPMG522 Student Assessment V1.1Document10 pagesBSBADM502 - BSBPMG522 Student Assessment V1.1purva0225% (4)

- Labuenavida Business Summary 2023Document24 pagesLabuenavida Business Summary 2023UzoNo ratings yet

- GR 190080Document9 pagesGR 190080Arvi MendezNo ratings yet

- Impact of COVID-19 On People's Livelihoods, Their Health and Our Food SystemsDocument4 pagesImpact of COVID-19 On People's Livelihoods, Their Health and Our Food Systemsjungkook jeonNo ratings yet

- Application For Altering and Adding Charges - Application For ProsecutionDocument2 pagesApplication For Altering and Adding Charges - Application For ProsecutionSandeepani NeglurNo ratings yet

- Ft. CA. t4 Ppe Panel ConectorDocument2 pagesFt. CA. t4 Ppe Panel ConectorSophia Hernández ÁlvaradoNo ratings yet

- Charging and TD Chart PlusDocument1 pageCharging and TD Chart PlusFaquruddin AliNo ratings yet

- Soco Assignment 2Document4 pagesSoco Assignment 2Lara LavanyaNo ratings yet

- Cloud Computing: Azmat Ullah Baig. Hamza IdreesDocument26 pagesCloud Computing: Azmat Ullah Baig. Hamza IdreesAzmat Ullah BaigNo ratings yet

- BC OE1 User ManualDocument2 pagesBC OE1 User ManualCarlos DuranNo ratings yet

- Disjuntor SF1 - Dados ElétricosDocument1 pageDisjuntor SF1 - Dados ElétricosotavioalcaldeNo ratings yet

- Continous Humidification Processes: Water-Cooling Tower - Packed TowerDocument30 pagesContinous Humidification Processes: Water-Cooling Tower - Packed Towerdrami94100% (1)

- Hybrid GrandglowDocument5 pagesHybrid Grandglowmohsan bilalNo ratings yet

- Checklist of Organisation Design Principles by Paul KearnsDocument4 pagesChecklist of Organisation Design Principles by Paul KearnsaliNo ratings yet

- Life Below Water: Verlin Andre Africa Simon Marquis Lumbera Rhona Mae Panopio Ais1ADocument14 pagesLife Below Water: Verlin Andre Africa Simon Marquis Lumbera Rhona Mae Panopio Ais1ASimon Marquis LUMBERANo ratings yet

- Intermediate Microeconomics 1st Edition Robert Mochrie 113700844X Solution ManualDocument113 pagesIntermediate Microeconomics 1st Edition Robert Mochrie 113700844X Solution Manualelvin100% (29)

- Basic Electrical, Automation, and Instrumentation.Document4 pagesBasic Electrical, Automation, and Instrumentation.Foaad HawarNo ratings yet

- JDTDocument2 pagesJDTSashikant SharmaNo ratings yet