Professional Documents

Culture Documents

Terminal Sample 1 Solved

Terminal Sample 1 Solved

Uploaded by

Jan Mohammad BalochOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Terminal Sample 1 Solved

Terminal Sample 1 Solved

Uploaded by

Jan Mohammad BalochCopyright:

Available Formats

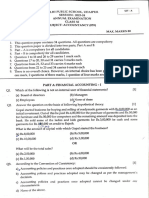

COMSATS Institute of Information Technology Abbottabad

Department of Management Sciences

Terminal Section A

Class: Date:

Subject: Accounting Instructor: Zaheer A. Swati

Time Allowed: 30 Minutes Max Marks: 30

Registration # Signature

SECTION-A

(Time allowed: 30 Minutes) (Marks = 30)

A. Write appropriate choice in Answer Sheet (A) (Marks 30 * 1 = 30)

1. Marketable Securities, Account Receivables and Inventory are listed as

(a) Current Asset (b) Current Liabilities (c) Long Term Asset (d) Long term liabilities

2. Which of the followings are books of prime entry?

(a) Sales day book and trial balance (b) Petty cash book and accounts receivable ledger

(c) Petty cash book and General Journal (d) Cash book and assets register

3. Which of the following would not be regarded as an asset?

(a) A piece of equipment owned by a business (b) A building that has been used by the business

(c) An inventory of goods that have yet to be sold (d) A sum of money owed to the business

4. The adjusting entry to record unpaid salaries is

(a) Salary Expense (Dr) & Cash (Cr) (b) Salary Payable (Dr) & Salary Payable (Cr)

(c) Salary Expense (Dr) & Salary Payable (Cr) (d) Salary Payable (Dr) & Cash (Cr)

5. Unearned revenue of Rs. 2,000 now earned. The entry is?

(a) Unearned revenue to revenue (b) Cash to revenue

(c) Revenue to Unearned revenue (d) None of above

6. At the end of the current accounting period, Johnson Company failed to record utilities consumed during the period. Johnson

will be billed for the utilities during the next accounting period. As a result, current period assets, liabilities, equity, and

income, respectively, are

(a) Overstated, overstated, correct, correct (b) Correct, understated, overstated, overstated

(c) Overstated, understated, overstated, overstated (d) Overstated, understated, correct, correct

7. Adjusting entries at the end of an accounting period would not be required for which of the following

(a) Multi period costs that must be split among two or more accounting periods

(b) Multi period revenues that must be split among two or more accounting periods

(c) Expenses that have been incurred in a given period but not yet recorded in the accounts

(d) Revenue that has been earned and recorded in the accounting records

8. At the end of the fiscal year, Accounts Receivable has a balance of Rs. 100,000 and Allowance for Doubtful Accounts has a

balance of Rs. 7,000. The expected net realizable value of the accounts receivable is:

(a) Rs. 100,000 (b) Rs. 93,000 (c) Rs. 107,000 (d) Rs. 7,000

www.accountancyKnowledge.com Terminal Solution

1

9. If the equipment account has a balance of Rs. 22,500 and its accumulated depreciation account has a balance of Rs. 14,000,

the book value of the equipment is

(a) Rs. 36,500 (b) Rs. 22,500 (c) Rs. 14,000 (d) Rs. 8,500

10. Bank reconciliation is not a

(a) Ledger account (b) Memorandum statement

(c) Reconcile records (d) Procedure to prove cash book balance

11. The check which is deposited into bank but not cleared at the end of a particular year is called

(a) Omitted check (b) Unpresented check (c) Uncredited check (d) Dishonored check

12. An amount of Rs. 1000 is debited twice in the bank statement. When overdraft as per the cash book is the starting point.

(a) Rs. 1,000 will be deducted (b) Rs. 1,000 will be added

(c) Rs. 2,000 will be deducted (d) Rs. 2,000 will be added

13. Accrued expenses are also called

(a) Accrued liabilities (b) Expenses already incurred but not yet paid

(c) Both a & b (d) None

14. External Users of Financial Accounting Information include all of the following except

(a) Line Manager (b) Labor Union (c) Investors (d) General Public

15. An overstatement of closing inventory in one period results in:

(a) No effect on net income (b) An overstatement of net income

(c) An understatement of net income (d) An overstatement of the closing inventory of the next period

16. Which one of the following is an example of current Liability?

(a) Bank overdraft (b) Fixtures (c) Shares (d) Long term Bank Loan

17. Which account would be listed on a post-closing trial balance,

(a) A revenue account (b) The Amortization account

(c) The Discount allowed account (d) None of Above

18. Ahmed gives a cash discount of 40 to a customer. The discount is credited in Ahmed’s book. The effect of recording the

discount in this way is that profit will be

(a) Correct (b) Overstated by 80 (c) Understated by 80 (d) Understated by 40

19. A business received cash of Rs. 3,000 in advance for the service that will be provided later. At the end of the period Rs. 1,100

is still unearned. The adjusting entry for the situation well be

(a) Debit ‘Unearned Revenue’ and Credit ‘Revenue’ for Rs. 1,900

(b) Debit ‘Unearned Revenue’ and Credit ‘Revenue’ for Rs. 1,100

(c) Debit ‘Revenue’ and Credit ‘Unearned Revenue’ for Rs. 1,100

(d) Debit ‘Revenue’ and Credit ‘Unearned Revenue’ for Rs. 1,900

20. The first item listed under current liabilities is usually?

(a) Notes payable (b) Accounts payable (c) Salaries payable (d) Taxes payable

21. An overstatement of closing inventory in one period results in?

(a) No effect on net income (b) An overstatement of net income

(c) An understatement of net income (d) An overstatement of the closing inventory of the next period

www.accountancyKnowledge.com Terminal Solution

2

22. Which one of the following is an example of current Liability?

(a) Bank overdraft (b) Fixtures (c) Shares (d) Long term Bank Loan

23. At the end of the fiscal year, Accounts Receivable has a balance of $100,000 and Allowance for Doubtful Accounts has a

balance of $7,000. The expected net realizable value of the accounts receivable is:

(a) $ 100,000 (b) $ 93,000 (c) $ 107,000 (d) $ 7,000

24. The transactions of the following must be kept separate from the personal activities of the owners for accounting purposes?

(a) Proprietorship (b) Partnership (c) Corporation (d) Both a and b above

25. The payment of cash to supplier will?

(a) Reduce cash balance and reduce current liabilities (b) Increase receivables and reduce cash balance

(c) Reduce account payable and increase purchases (d) Increase payable and reduce cash balance

26. The effect of a credit entry on the payables account is to?

(a) Decrease the account balance (b) Decrease & increase the account balance

(c) Decrease or increase the account balance (d) Increase the account balance

27. Which of the following would not be regarded as an asset?

(a) A piece of equipment owned by a business (b) A building that has been used by the business

(c) An inventory of goods that have yet to be sold (d) A sum of money owed to the business

28. Which one of the following is not true for Profit & Loss Account?

(a) It shows whether a business has made a profit or loss over a financial year

(b) It shows the financial position of a business for the period

(c) It shows revenues and expenses for the period

(d) It is used to calculate surplus/deficit for a particular period

29. Which of the following is/are not shown in balance sheet?

(a) Fixed assets (b) Current liabilities (c) Profit sharing ratio (d) Long term assets

30. Specific business entity separate from personnel affair of the owner is?

(a) Objectivity principle (b) Stable currency principle

(c) Entity principle (d) Matching principle

Best of Luck

www.accountancyKnowledge.com Terminal Solution

3

COMSATS Institute of Information Technology Abbottabad

Department of Management Sciences

Terminal Section B & C

Class: Date:

Subject: Accounting Instructor: Zaheer A. Swati

Total Time Allowed: 150 Minutes Max Marks: 70

Registration # Signature

SECTION-B

(Attempt all four questions, all questions carry equal marks 10 * 4 = 40)

Q1. From the following particulars write up the Cash Book for Muhammad Huzaifa Umar Trading Co. for the month of

June 2016 (Time should use 25 minutes).

2016

June 1 Favourable Cash Balance Rs. 18,000; Bank balance Overdraft Rs. 37,000

4 Paid Wages Rs. 200 by cash and Rent by check Rs. 1,000

6 Total sales of worth Rs. 10,000 in which 3,000 apply to credit customers Mr. Ali

9 Owner further investment Rs. 13,000, of which Rs. 10,000 was banked and the balance was retained

11 Received a check from Mr. Kazmi and deposited into the bank of worth Rs. 16,000

14 Withdrew from bank for office purpose Rs. 4,000 and for owner domestic use Rs. 2,000

18 Received check from Mr. Hamid of Rs. 22,000 and was not deposited in same date

21 Dated 6th June, 2010 Mr. Ali sent 3,000 check which was deposited in same date

23 Mr. Kazmi check of Dated 11th, June, 2010 was dishonoured and return by bank

28 Mr. Hamid check received on 18th June, 2010 were deposited into bank

30 Discount Received Rs. 300 and Discount allowed Rs. 200

Muhammad Huzaifa Umar TRADING CO.

Cash Book

For the month ended June, 2016

Receipts Payments

Date Description Ref Cash Bank Dis Date Description Ref Cash Bank Dis

2016 2016

June 1 Balance b/d 18,000 Oct 1 Balance b/d 37,000

6 Sales 7,000 4 Wages 200

9 Owner Equity 3,000 10,000 4 Rent 1,000

11 Mr. Kamal 16,000 14 Cash (c) 4,000

14 Bank (c) 4,000 14 Drawing 2,000

18 Mr. Hamid 22,000 23 Dishonoured 16,000

21 Mr. Ali 3,000 28 Bank (c) 22,000

28 Cash (c) 22,000 30 Discount 300

30 Discount 200

Balance c/d 9,000 Balance c/d 31.800

54,000 50,000 200 54,000 50,000 300

July 1 Balance b/d 31.800 July 1 Balance b/d 9,000

www.accountancyKnowledge.com 4 Terminal Solution

Q2. Make corrected Trial Balance after anticipating hidden errors for Amina Ghalib Khan Ltd. Financial year for this

company is July 1st, 2016 to June 30th, 2017 (Time should used 25 minutes).

Amina Ghalib Khan Ltd.

Trial Balance

As on 30th June, 2017

Amount (Rs.)

S. No Heads of Accounts Dr Cr

1 Purchases 35,000

2 Factory Overhead (Applied) 1,000

3 Octri and Taxes 100

4 Rebate received 500

5 Trade Mark 55,000

6 Sales 80,000

7 Share Capital 50,000

8 Return Outward 1,600

9 Bills Owed 6,500

10 Carriage Outward 3,700

11 Inventory (1.07.2016) 10,500

12 Motor Van 25,000

13 Claims Receivables 1,500

14 Sundry Debtors 9,000

15 Return Inward 2,000

16 Leasehold Premises 3,000

17 Discount on Sales 2,000

18 Petty Cash 800

19 Stock 30-06-2017 33,300

20 Sundry Creditors 10,000

21 Suspense Account 19,700

Total Rs. 175,100 Rs. 175,100

Errors in Trial Balance:

(i) Machinery bought Rs. 3,000 posted to as Trade Mark account

(ii) Credit sales of worth Rs. 1,200 was omitted to record in the book of original entry

(iii) Repairs to Motor Van Rs. 1,500 have been debited to Motor Van account

(iv) Unearned Sales of Rs. 15,000 was incorrectly credited to Sales Account

Following accounts are used for correction and adjusting the transactions.

Sales; Unearned Sales, Motor Van; Sundry Debtors; Motor Van Expense; Machinery; Trade Mark

www.accountancyKnowledge.com 5 Terminal Solution

Amina Ghalib Khan Ltd.

Trial Balance

As on 30th June, 2017

Amount (Rs.)

S. No Heads of Accounts Dr Cr

1 Purchases (35,00 – 3,000) 35,000

2 Factory Overhead (Applied) 1,000

3 Octri and Taxes 100

4 Rebate received 500

5 Trade Mark (55,00 – 3,000) 52,000

6 Sales (80,000 + 1,200-15,000) 66,200

7 Share Capital 50,000

8 Return Outward 1,600

9 Bills Owed 6,500

10 Carriage Outward 3,700

11 Inventory (1.07.2016) 10,500

12 Motor Van (25,000 -1,500) 23,500

13 Claims Receivables 1,500

14 Sundry debtors (9,000 + 1,200) 10,200

15 Return Inward 2,000

16 Leasehold Premises 3,000

17 Discount on Sales 2,000

18 Petty Cash 800

19 Sundry Creditors 10,000

20 Motor Van Repairs 1,500

21 Machinery 3,000

22 Unearned Sales 15,000

Total Rs. 149,800 Rs. 149,800

Q3. Following Data related to Shahrukh Shakeel Manufacturing at the end of June, 2017 (Time should used 25 minutes).

Cost incurred during the period

Cost of Goods Manufactured ………………105,000 Carriage in ……………………………………… 3,000

Carriage Outward …………………………. 3,000 Direct Labour………………………………….. 16,000

Direct Material Used ………………………. 78,000 Cost of Goods Sold …………………….……… 110,000

www.accountancyKnowledge.com 6 Terminal Solution

INVENTORIES

Ending Beginning

Direct Material ………………………………………………….. 9,000 ……………………………………... 19,000

Work in Process …………………………………………………. ? ……….…………………………….. 7,400

Finished Goods ………………………………………………….. 12,000 ……………………….…………….. ?

Net Sales of Rs. 400,000, Marketing Expense 2%, Administration Expense 1 % of Net Sales and Other Expense 7,000

and Other Income is 25,000; Factory overhead is applied 60% of direct labour cost and 15,000 units were completed

during year.

Requirements:

(a) Cost of Goods Sold (b) Per Unit Cost (c) Net Profit/Loss

Shahrukh Shakeel Manufacturing

Cost of Goods Sold Statement

For the Ended June, 2017

Opening Inventory 19,000

Net Purchases (Calculated) 65,000

Carriage in 3,000

Material Available for use 87,000

Closing Inventory (9,000)

Direct Material used 78,000

Direct Labor 16,000

Prime Cost 94,000

Factory Overhead Cost Applied (16,000 * 0.60) 9,600

Total Factory Cost 103,600

Opening Work in Process 7,400

Cost of Goods to be Manufactured 111,000

Closing Work in Process (Calculated) (6,000)

Cost of Goods Manufactured 105,000

Opening Finished Goods (Calculated) 17,000

Cost of Goods to be Sold 122,000

Closing Finished Goods (12,000)

Cost of Goods Sold 110,000

Per unit Cost of goods manufactured = 105,000 / 15,000 = 7 Per Unit

Gross Profit = 400,000 - 110,000 = Rs. 290,000

Net Profit = 290,000 – (3,000 + 8,000 + 4,000 +7,000) + 25,000 = Rs. 293,000

www.accountancyKnowledge.com 7 Terminal Solution

Q4. From the following particulars of Hassan Rehman Ltd. find out the errors in cash book and bank statement by

missing method and than prepare Bank Reconciliation Statement as on 30-06-2017 (Time should used 25 Minutes).

i. The bank overdrawn as per company cash book on June 30th, 2010 was Rs. 16,000.

ii. The bank statement debited Rs. 750 for insurance premium paid on June 20, on company’s standing order, but it

was recorded by company as Rs. 570.

iii. Credit side of the cash book over cast Rs. 1,000.

iv. A checks deposited by bank of worth Rs. 45,000 but Rs. 8,000 check was not collected by bank.

v. Check issued of Rs. 20,000, but cashed prior to 30.06.2010 amounting to Rs. 17,500.

vi. Bank received dividend on behalf of company and recorded correctly but recorded twice in the cash book of Rs.

3,500.

vii. A check of Rs. 5,000 issued to vendor was dishonoured due to some technical errors of accountant.

viii. A check for Rs. 1,200 was issued by the company for purchase of stationery and was paid by the bank but not

recorded in company’s book.

ix. Bill Receivable collected by the bank directly on the behalf of company Rs. 8,000.

x. Check recorded for collection but not sent to the bank Rs. 12,000.

Hassan Rehman Ltd.

Bank Reconciliation Statement

As on June 30th, 2017

i. Balance As per Cash Book (Cr) 16,000

Add:

ii. Under Recorded 180

vi. Recorded Twice 3,500

viii. Unrecorded 1,200

iv. Uncollected 8,000

x. Not sent 12,000 24,880

40,880

Less:

iii. Over cast 1,000

vii. Dishonoured 5,000

ix. Direct Collection 8,000

v. Uncashed 2,500 (16,500)

Balance As Bank Statement (Dr) 24,380

Cash Book Bank Statement

iii. Over cast 1,000 ii. Under recorded 180 v. Uncashed 2,500 iv. Uncollected 8,000

vii. dishonoured 5,000 vi. Recorded Twice 3,500 x. Not send 12,000

ix. Direct Collection 8,000 viii. Unrecorded 1,200

www.accountancyKnowledge.com 8 Terminal Solution

SECTION-C

(Attempt any two questions, all questions carry equal marks 15 * 2 = 30)

Q1. Hashim Khan & Company purchased a factory machine of Rs. 51,000 on January 1, 2005. The machine is expected

to have a salvage value of Rs. 6,000 at the end of its 5 year useful life. During the useful life, the machine is expected to

be used for 5,000 hours. The machine was used as under

Years Hours used

2005 1,200

2006 800

2007 1,150

2008 850

2009 1,000

Required: Prepare Schedule of Depreciation on the basis of following methods (Time should used 25 minutes).

(a) Straight Line Method

(b) Units of Output Method

(c) Double Declining Balance Method

(d) Sum of Year Digit Method

Solution (a)

Cost Re sidualValue

Straight Line Method = YearsOfUsefulLife

51, 0006, 000

Straight Line Method = 5

= Rs. 9,000

Schedule of Depreciation

Years Cost Annual Depreciation Accumulated Depreciation Book Value

2005 51,000 9,000 9,000 42,000

2006 51,000 9,000 18,000 33,000

2007 51,000 9,000 27,000 24,000

2008 51,000 9,000 36,000 15,000

2009 51,000 9,000 45,000 6,000

Solution (b)

Cost Re sidualValue

Unit of Output Method = EstimatedUnitsOfOutput

51, 0006 , 000

Unit of Output Method = 5, 000

= Rs. 9 per hour

www.accountancyKnowledge.com 9 Terminal Solution

Schedule of Depreciation

Annual Accumulated Book

Years Cost Hours used Rate per hr

Depreciation Depreciation Value

2005 51,000 1,200 9.0 10,800 10,800 40,200

2006 51,000 800 9.0 7,200 18,000 33,000

2007 51,000 1,150 9.0 10,350 28,350 22,650

2008 51,000 850 9.0 7,650 36,000 15,000

2009 51,000 1,000 9.0 9,000 45,000 6,000

Solution (c)

Double Declining Rate= 1 * 2

5

Rate of Depreciation =40%

Schedule of Depreciation

Rate of Annual Accumulated

Years Cost Book Value

Depreciation Depreciation Depreciation

2005 51,000 40% 20,400 20,400 30,600

2006 51,000 40% 12,240 32,640 18,360

2007 51,000 40% 7,344 39,984 11,016

2008 51,000 40% 4,406.4 44,390.4 6,609.6

2009 51,000 40% 609.6 45,000 6,000

Solution (d)

SYD=1+2+3+4+ 5= 15

51,000-6,000= 45,000

Schedule of Depreciation

Rate of Annual Accumulated

Years Cost Book Value

Depreciation Depreciation Depreciation

2005 51,000 5/15 15,000 15,000 36,000

2006 51,000 4/15 12,000 27,000 24,000

2007 51,000 3/15 9,000 36,000 15,000

2008 51,000 2/15 6,000 42,000 9,000

2009 51,000 1/15 3,000 45,000 6,000

www.accountancyKnowledge.com 10 Terminal Solution

Q2. The following Trial Balance of Saba Nisar & Co. on December 31st, 2016, Prepare Financial Statement in horizontal

style

Particular Dr Cr Particular Dr Cr

Owner’s Equity 4,000 Note Payable 560

Account Payable 5,200 Note Receivable 720

Plant and Machinery 5,000 Return Inward 930

Office Furniture & Fittings 260 Provision for Bad Debts 250

Opening Inventory 4,800 Drawing 700

Motor Van 1,200 Return Outward 550

Account Receivables 4,570 Rent 600

Cash in Hand 40 Factory Lighting and Lighting 80

Cash at Bank 650 Insurance 630

Wages 15,000 General Expenses 100

Salaries 1,400 Bad Debts 250

Purchases 21,350 Discount 650 370

Sales 48,000 Total Rs. 58,930 Rs. 58,930

The following adjustments are to be made:

(i) Stock at the end of year Rs. 5,200 and Three months factor lighting and heating is due, but not paid Rs. 30

(ii) 5 percent depreciation to be written-off on furniture and write-off further bad debts Rs. 70

(iii) The provision for bad debts to be Rs. 300 and provision for discount on debtor @ 2 % to be made

(iv) During the year machinery was purchased for Rs. 2,000, but was debited to Purchase account

Saba Nisar & Co.

Trading and Profit & Loss Account

For the Year ended 31st, December 2016

Expenses Debit Revenue Credit

Sales

Opening Inventory 4,800 48,000

Purchases Return Inward

21,350 (930) 47,070

Returns Outward

(550) Closing Stock 5,200

Machinery Purchase

(2,000) 18,800

Wages 15,000

Gross Profit c/d 13,670

Total 52,270 Total 52,270

Salaries 1,400 Gross Profit b/d 13,670

Rent 600 Discount 370

Factory Lighting & Heating 80

Outstanding 30 110

Insurance 630

General Expenses 100

Bad Debts 250

Additional 70 320

Discount 650

www.accountancyKnowledge.com 11 Terminal Solution

Depreciation Exp. _Furniture 13

Provision for Bad Debts:

New 300

Old (250) 50

Provision for Discount on Debtor

(4,200@2%) 84

Net Profit c/f to B/S 10,083

Total Rs. 14,040 Total Rs. 14,040

Saba Nisar & Co.

Balance Sheet

As on 31st, December 2016

Equities Amount Assets Amount

Fixed and Long Term:

Owner’s Equity: Plant and Machinery 5,000

Capital 4,000 Additional 2,000 7,000

Drawing (700) Office Furniture & Fitting 260

Profit b/f 10,083 13,383 Depreciation 13 247

Motor Van 1,200

Current Liabilities: Current Assets:

Note Payable 560 Cash in Hand 40

Account Payable 5,200 Cash at Bank 650

Outstanding Factor Lighting &

Heating 30 Note Receivable 720

Account Receivable 4,570

Further B/D (70)

Provision for B/D (300)

Provision for Dis. on Debtor (84) 4,116

Closing Stock 5,200

Total Rs. 19,173 Total Rs. 19,173

Q3. Prepare Store Ledger Card (SLC) from the following information (Time should used 25 Minutes)..

2017

March 1 Beginning Inventory …………. 180 Pieces @ Rs. 30 …………………… Rs. 5,400

9 Sales ………………………….. 60 Pieces @ Rs. 45 …………………… Rs. 2,700

12 Purchases ……………..……… 50 Pieces @ Rs. 28 …………………… Rs. 1,400

18 Sale…………………………… 140 Pieces @ Rs. 60 …………………… Rs. 8,400

23 Purchases …………..…………. 80 Pieces @ Rs. 26 …………………… Rs. 2,080

24 Purchase ……………………….. 90 Pieces @ Rs. 20 ……………………. Rs. 1,800

30 Sales …………………………… 180 Pieces @ Rs. 65 …………………… Rs. 11,700

Required

Use Comparative Cost Sheet in order to determine the Cost of Sales, cost of Closing Stock, Sales and Gross profit / loss

under each of the following method by using perpetual inventory system.

a. Cost are assigned on the basis of FIFO

b. Cost are assigned on the basis of Weighted Average

www.accountancyKnowledge.com 12 Terminal Solution

Store Ledger Card (SLC) FIFO

Purchases Sales Balances

Date Description Units @ Amount Units @ Amount Units @ Amount

March 1 Balance b / f 180 30 5,400

9 Sales 60 30 1,800 120 30 3,600

12 Purchases 50 28 1,400 120 30 3,600

50 28 1,400

18 Sales 120 30 3,600

20 28 560 30 28 840

23 Purchases 80 26 2,080 30 28 840

80 26 2,080

24 Purchases 90 20 1,800 30 28 840

80 26 2,080

90 20 1,800

30 Sales 30 28 840

80 26 2,080

70 20 1,400 20 20 400

Total 220 5,280 380 10,280 20 400

www.accountanyKnowledg.com 13 Terminal Solution

Store Ledger Card (SLC) Average

Purchases Sales Balances

Date Description Units @ Amount Units @ Amount Units @ Amount

March 1 Balance b / f 180 30 5,400

9 Sales 60 30 1,800 120 30 3,600

12 Purchases 50 28 1,400 170 29.41 5,000

18 Sales 140 29.41 4117.4 30 29.41 882.6

23 Purchases 80 26 2,080 110 26.93 2,962.6

24 Purchases 90 20 1,800 200 23.81 4,762.6

30 Sales 180 23.81 4,285.8 20 23.81 476.2

Total 220 5,280 380 10,203.2 20 23.81 476.2

Comparative Cost Sheet

Methods Balance Purchases Closing Stock CGS Sales Gross Profit

FIFO 5,400 5,280 (400) 10,080 22,800 12,520

Average 5,400 5,280 (476.2) 10,203.8 22,800 12,596.2

www.accountanyKnowledg.com 14 Terminal Solution

You might also like

- Nism XV - Research Analyst Exam - Last Day Test 1Document54 pagesNism XV - Research Analyst Exam - Last Day Test 1roja22% (9)

- Case 5 Chrysler ExamDocument6 pagesCase 5 Chrysler ExamFami FamzNo ratings yet

- When Goods Are Purchased:: Journal Entries in A Perpetual Inventory SystemDocument27 pagesWhen Goods Are Purchased:: Journal Entries in A Perpetual Inventory SystemFami FamzNo ratings yet

- Evaluation of Spin Off of Indian CompaniesDocument33 pagesEvaluation of Spin Off of Indian Companiesparthsarthi_705No ratings yet

- Terminal Sample 1 UnsolvedDocument9 pagesTerminal Sample 1 UnsolvedFami FamzNo ratings yet

- Sessional 2 Paper Sample 1Document3 pagesSessional 2 Paper Sample 1Fami FamzNo ratings yet

- Sessional 2 Paper Sample 3Document3 pagesSessional 2 Paper Sample 3Fami FamzNo ratings yet

- Accountancy Model Paper-2-1Document9 pagesAccountancy Model Paper-2-1Hashim SethNo ratings yet

- Terminal Sample 2 UnsolvedDocument7 pagesTerminal Sample 2 UnsolvedFami FamzNo ratings yet

- Terminal Sample 2 SolvedDocument11 pagesTerminal Sample 2 SolvedFami FamzNo ratings yet

- Sample Paper: H.O.: 6, Vidya Sagar Lane, Behind Apex Mall, Indrapuri, Lal Kothi. Tonk Road, JaipurDocument11 pagesSample Paper: H.O.: 6, Vidya Sagar Lane, Behind Apex Mall, Indrapuri, Lal Kothi. Tonk Road, JaipurTanisha GuptaNo ratings yet

- Adjusting Entries MCQsDocument3 pagesAdjusting Entries MCQsNoshair Ali100% (1)

- Sessional 2 Paper Sample 2Document3 pagesSessional 2 Paper Sample 2Fami FamzNo ratings yet

- ElugabaechariDocument12 pagesElugabaecharihitaNo ratings yet

- XI-Accountancy Term-1 (2021-2022)Document9 pagesXI-Accountancy Term-1 (2021-2022)Arpita JalanNo ratings yet

- 21936mtp Cptvolu1 Part4Document404 pages21936mtp Cptvolu1 Part4Arun KCNo ratings yet

- 21935mtp Cptvolu1 Part3 PDFDocument224 pages21935mtp Cptvolu1 Part3 PDFArun KCNo ratings yet

- FInal Exam (Accounts)Document5 pagesFInal Exam (Accounts)mitaliNo ratings yet

- Sessional 2 Solved Sample 3Document4 pagesSessional 2 Solved Sample 3Fami FamzNo ratings yet

- Journal, Ledger, Trail Balance and Finnancial Statement MCQsDocument5 pagesJournal, Ledger, Trail Balance and Finnancial Statement MCQsNoshair Ali100% (6)

- 12th ACCOUNTS One MarksDocument3 pages12th ACCOUNTS One Markssujithrasuji773No ratings yet

- Revision II (Ratio Analysis)Document6 pagesRevision II (Ratio Analysis)Allwin GanaduraiNo ratings yet

- Ac Test 80 M (1) - Watermark - WatermarkDocument5 pagesAc Test 80 M (1) - Watermark - Watermarkanikeshyadav0700No ratings yet

- 11 Accountancy Practice PaperDocument9 pages11 Accountancy Practice PaperPlayer dude65No ratings yet

- Gat Subject Management Sciences Accounting Mcqs1 50Document5 pagesGat Subject Management Sciences Accounting Mcqs1 50Muhammad NajeebNo ratings yet

- Sample QP For Grade 11 ACC Model Examination 2024Document9 pagesSample QP For Grade 11 ACC Model Examination 2024Suhaim SahebNo ratings yet

- Last Assignment of PRC-04 August 2022Document63 pagesLast Assignment of PRC-04 August 2022ali khanNo ratings yet

- PAPER 2 RevisedDocument36 pagesPAPER 2 RevisedMâyúř PäťîĺNo ratings yet

- Financial AccountingDocument7 pagesFinancial Accountingmiraclechibueze093No ratings yet

- PAPER 2 RevisedDocument36 pagesPAPER 2 RevisedV veeranNo ratings yet

- 21934mtp Cptvolu1 Part2Document194 pages21934mtp Cptvolu1 Part2arshNo ratings yet

- +1 Acc Model Hly QN (EM) 2022Document4 pages+1 Acc Model Hly QN (EM) 2022BABA AssociatesNo ratings yet

- CPT Question Paper December 2016 With Answer Key PDFDocument28 pagesCPT Question Paper December 2016 With Answer Key PDFSarthak LakhaniNo ratings yet

- Management Scince McqsDocument5 pagesManagement Scince McqsMuhammad NajeebNo ratings yet

- Delhi Public School, VijayawadaDocument5 pagesDelhi Public School, VijayawadaDubai SheikhNo ratings yet

- CH 3Document12 pagesCH 3landmarkconstructionpakistanNo ratings yet

- 11th Accountancy EM Half Yearly Exam 2023 Question Paper Virudhunagar District English Medium PDF DownloadDocument4 pages11th Accountancy EM Half Yearly Exam 2023 Question Paper Virudhunagar District English Medium PDF DownloadDr.ManogaranNo ratings yet

- Sample QP 1 Jan2020Document19 pagesSample QP 1 Jan2020M Rafeeq100% (1)

- Acc MockDocument10 pagesAcc MockCoc DonoNo ratings yet

- Prudence Final ExamDocument5 pagesPrudence Final ExamBhumi NavtiaNo ratings yet

- Namma Kalvi 11th Accountancy Model Questin Paper EM 221452Document8 pagesNamma Kalvi 11th Accountancy Model Questin Paper EM 221452sharonjamesappuNo ratings yet

- All MCQs of Finnancial AccountingDocument13 pagesAll MCQs of Finnancial AccountingNoshair Ali100% (2)

- Sub. Code 205415/ 205515/ 205615/ 205715/ 205815Document10 pagesSub. Code 205415/ 205515/ 205615/ 205715/ 205815qaqc marineryNo ratings yet

- Namma Kalvi 11th Accountancy 1 Mark Questions Reduced Syllabus em 219820Document9 pagesNamma Kalvi 11th Accountancy 1 Mark Questions Reduced Syllabus em 219820mageshwari mohanNo ratings yet

- Last Assignment of PRC-04 December 2022Document94 pagesLast Assignment of PRC-04 December 2022mudassar saeedNo ratings yet

- TERM 1 11 ACCSDocument10 pagesTERM 1 11 ACCSfebaanu20No ratings yet

- Accountancy XIDocument8 pagesAccountancy XIGurmehar Kaur100% (1)

- 11th Accountancy EM First Revision Exam 2024 Question Paper Thenkasi District English Medium PDF DownloadDocument6 pages11th Accountancy EM First Revision Exam 2024 Question Paper Thenkasi District English Medium PDF DownloadKanishka S IX-ENo ratings yet

- Disclaimer: Vidya Sagar InstituteDocument38 pagesDisclaimer: Vidya Sagar InstituteAkashdeep MukherjeeNo ratings yet

- Doe Paper 2Document6 pagesDoe Paper 2prince bhatiaNo ratings yet

- 11 Accountancy First Term Set BDocument6 pages11 Accountancy First Term Set Bmcsworkshop777No ratings yet

- I Term - Acts - XI - Set - A+MSDocument10 pagesI Term - Acts - XI - Set - A+MSBhavya AggarwalNo ratings yet

- AccountancyDocument8 pagesAccountancyvanitasharmap0124No ratings yet

- ACC2010 Sample Final ExamDocument19 pagesACC2010 Sample Final ExamHarjot SinghNo ratings yet

- AFMDocument34 pagesAFMPhanikumar KaturiNo ratings yet

- Hours) : - (L) : (Part-lI)Document11 pagesHours) : - (L) : (Part-lI)Sadhik LaluwaleNo ratings yet

- ABM 2 Exam 2 v1 2023 StudentDocument10 pagesABM 2 Exam 2 v1 2023 StudentdwacindyfjNo ratings yet

- Mock Full Book 02 BookDocument3 pagesMock Full Book 02 Bookgoharmahmood203No ratings yet

- financial accounting ss1Document6 pagesfinancial accounting ss1sulaimonomowunmiyusratNo ratings yet

- Accountancy Class 11 PaperDocument14 pagesAccountancy Class 11 Paperjimoochaudhary0% (1)

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Haridas OngallurNo ratings yet

- Sa110 Notes 2016Document6 pagesSa110 Notes 2016coolmanzNo ratings yet

- RATIO ANALYSIS MCQsDocument9 pagesRATIO ANALYSIS MCQsAS GamingNo ratings yet

- Sample/practice Exam 13 November 2015, Questions Sample/practice Exam 13 November 2015, QuestionsDocument19 pagesSample/practice Exam 13 November 2015, Questions Sample/practice Exam 13 November 2015, QuestionsFami FamzNo ratings yet

- Registration No: Q1. Multiple Choice Questions (Marks 10)Document4 pagesRegistration No: Q1. Multiple Choice Questions (Marks 10)Fami FamzNo ratings yet

- Plant Asset QuizDocument3 pagesPlant Asset QuizFami Famz100% (1)

- Quiz 2 3 Sample 3 PaperDocument6 pagesQuiz 2 3 Sample 3 PaperFami FamzNo ratings yet

- Quiz 1 Sample 7 SolvedDocument6 pagesQuiz 1 Sample 7 SolvedFami FamzNo ratings yet

- Accounting 1 MGT: Registration No - SignatureDocument6 pagesAccounting 1 MGT: Registration No - SignatureFami FamzNo ratings yet

- Quiz 1 Sample 3 SolutionDocument6 pagesQuiz 1 Sample 3 SolutionFami FamzNo ratings yet

- Quiz 1 Sample 4 SolvedDocument4 pagesQuiz 1 Sample 4 SolvedFami FamzNo ratings yet

- Terminal Sample 2 SolvedDocument11 pagesTerminal Sample 2 SolvedFami FamzNo ratings yet

- Sessional 2 Paper Sample 3Document3 pagesSessional 2 Paper Sample 3Fami FamzNo ratings yet

- Terminal Sample 1 UnsolvedDocument9 pagesTerminal Sample 1 UnsolvedFami FamzNo ratings yet

- Sessional 2 Paper Sample 1Document3 pagesSessional 2 Paper Sample 1Fami FamzNo ratings yet

- Test 1 September 2017, Answers Test 1 September 2017, AnswersDocument7 pagesTest 1 September 2017, Answers Test 1 September 2017, AnswersFami FamzNo ratings yet

- Sessional 1 Unsolved Sample 1Document4 pagesSessional 1 Unsolved Sample 1Fami FamzNo ratings yet

- Sessional 2 Solved Sample 3Document4 pagesSessional 2 Solved Sample 3Fami FamzNo ratings yet

- Sessional 2 Paper Sample 2Document3 pagesSessional 2 Paper Sample 2Fami FamzNo ratings yet

- Prepare: Cash and Signs A Note For The BalanceDocument1 pagePrepare: Cash and Signs A Note For The BalanceFami FamzNo ratings yet

- Terminal Sample 2 UnsolvedDocument7 pagesTerminal Sample 2 UnsolvedFami FamzNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Test Bank 1Document70 pagesFinancial Statement Analysis 11th Edition Subramanyam Test Bank 1shaina100% (43)

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Price-Book Value Ratio: DefinitionDocument25 pagesPrice-Book Value Ratio: DefinitionRajvachan ManiNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- Fundamental AnalysisDocument52 pagesFundamental Analysisrahairi100% (8)

- REVIEWDocument7 pagesREVIEWGinn100% (1)

- Economic Value Added A Study On Selected Indian BanksDocument71 pagesEconomic Value Added A Study On Selected Indian BanksSubhash BajajNo ratings yet

- Dip IFR 2020 June QuestionDocument11 pagesDip IFR 2020 June Questionluckyjulie567100% (2)

- Ise 307Document56 pagesIse 307Hussain Ali Al-HarthiNo ratings yet

- Acquisition and Disposition of Property, Plant, and EquipmentDocument26 pagesAcquisition and Disposition of Property, Plant, and Equipmentgfnns299nhNo ratings yet

- Ppe Cpale Reviewer Ppe Ap 11234Document3 pagesPpe Cpale Reviewer Ppe Ap 11234Sharon CarilloNo ratings yet

- Quizzer 1 - Pas 8 and Cash/accrual, Single EntryDocument10 pagesQuizzer 1 - Pas 8 and Cash/accrual, Single Entryjaleummein100% (1)

- Receivables Mock QuizDocument5 pagesReceivables Mock QuizChester CariitNo ratings yet

- ch09 Plant AssetsDocument102 pagesch09 Plant Assetsyoshe laura100% (2)

- Damodaran - Financial Services ValuationDocument7 pagesDamodaran - Financial Services ValuationBogdan TudoseNo ratings yet

- Afar Notes by DR Ferrer Summary Bs AccountancyDocument22 pagesAfar Notes by DR Ferrer Summary Bs AccountancyAnne Echavez Pasco100% (2)

- Pertemuan 6 Analisis Investasi Antar Perusahaan (Intercompany Investment Analysis)Document23 pagesPertemuan 6 Analisis Investasi Antar Perusahaan (Intercompany Investment Analysis)putri pertiwiNo ratings yet

- D&L Industries Investor Deck 9M14Document24 pagesD&L Industries Investor Deck 9M14Giang NguyenNo ratings yet

- Corporate Governance Investor Protection and Performance in EmerDocument40 pagesCorporate Governance Investor Protection and Performance in EmerThương PhạmNo ratings yet

- 10000000294Document215 pages10000000294Chapter 11 DocketsNo ratings yet

- Company Analysis - Overview: Affine SADocument8 pagesCompany Analysis - Overview: Affine SAQ.M.S Advisors LLCNo ratings yet

- ACCOUNTING P2 QP GR12 P2 JUNE 2023 - EnglishDocument13 pagesACCOUNTING P2 QP GR12 P2 JUNE 2023 - EnglishmulisanembaheNo ratings yet

- 5th Account Gobind Kumar Jha 9874411552Document69 pages5th Account Gobind Kumar Jha 9874411552binay chaudharyNo ratings yet

- Investment Property ProblemsDocument3 pagesInvestment Property ProblemsAbigail TalusanNo ratings yet

- Full Download Advanced Accounting 13th Edition Beams Solutions ManualDocument36 pagesFull Download Advanced Accounting 13th Edition Beams Solutions Manualjacksongubmor100% (39)

- Unique Consultancy and Training Center Solution Mannual 2023Document25 pagesUnique Consultancy and Training Center Solution Mannual 2023Firdows SuleymanNo ratings yet

- TB - Chapter02 Financial Statements, Cash Flows and Taxes PDFDocument67 pagesTB - Chapter02 Financial Statements, Cash Flows and Taxes PDFJennifer RasonabeNo ratings yet

- Accounting Textbook Solutions - 44Document19 pagesAccounting Textbook Solutions - 44acc-expertNo ratings yet