Professional Documents

Culture Documents

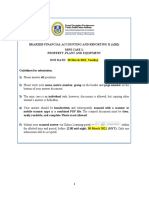

ACCC271 June Test 2017

ACCC271 June Test 2017

Uploaded by

thivarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCC271 June Test 2017

ACCC271 June Test 2017

Uploaded by

thivarCopyright:

Available Formats

QUESTION 3 73 MARKS

PART A 43 MARKS

Tech Steel Trailers Ltd (‘Tech Steel’) was incorporated in June 2008 and commenced with trading

as from 1 July 2008. The financial year-end is 30 June. The company applies International

Financial Reporting Standards (IFRS).

Tech Steel mainly manufactures and sells trailers to South-African residents. The trailer sales were

doing extremely well during the last two years, but the directors still felt that they can perform much

better. During the 2017 financial year the directors also started to buy and sell trailer parts.

Tech Steel rented a premises in the industrial area in Vanderbijlpark until the owner of the

premises sold the property at the end of December 2013. The new owners of the premises allowed

Tech Steel to continue renting on a monthly basis. This made the directors of Tech Steel realise

that it was time to own their own property, the most important reason being that it would then be

their property to do with as they see fit, and that it will also be an investment into the future of the

company. Tech Steel continued with the month to month lease until the date that their own

premises was ready to be occupied.

Tech Steel has been a registered VAT vendor as from 1 September 2009. Tech Steel has various

directors who are responsible for the management of the entity. All directors agreed to apply a

policy to only conduct business with other businesses also registered for VAT, and ensured that

proper documents are kept in order to claim valid input VAT deductions at all times. Assume a VAT

rate of 14%.

Tech Steel adopted various accounting policies pertaining to tangible and intangible assets

and it can be summarised as follows:

Property, plant and equipment

Land is not depreciated. Land is accounted for under the revaluation model in terms of IAS 16

Property, Plant and Equipment at the beginning of a year.

Buildings are depreciated over the expected useful life of the building, taking into account

estimated residual values. Buildings are accounted for under the cost model in terms of IAS 16.

The welding machine and spray-oven will be depreciated over its expected useful life taking

into account estimated residual values. It will be accounted for under the cost model in terms of

IAS 16.

No changes in useful lives or estimated residual values took place during the current financial year

for any asset.

Investment property

All investment property is measured based on the fair value model in terms of

IAS 40 Investment Property.

Intangible assets

All assets classified as intangible assets will be carried on the cost model in terms of

IAS 38 Intangible Assets.

ACCC271 2017 June test 1/43

Land and buildings

Tech Steel was very fortunate to find the most ideal property. The property is close to

Arcellor Mittal, the main supplier of steel for manufacturing the trailers. It is also located in the

industrial area of Vanderbijlpark, being close to the old rented premises and therefore clients would

have no problem finding the new premises.

Over the past years of trading, Tech Steel has accumulated funds for expansion purposes. The

company, therefore, acquired a piece of land on 1 January 2015 at a cost of R942 000 (including

VAT) and the full amount was settled by electronic transfer. Due to cash shortages for erecting the

building, Tech Steel negotiated a specific loan with SAAB bank. The loan amounted to R1 600 000

at an interest rate of 8% per year. The interest would accumulate on an annual basis and be

capitalised to the loan account on the 31 December each year. The loan would have to be repaid

in a once off instalment of which the due date is 1 July 2019. The amount borrowed was paid into

the bank account of Tech Steel on 1 January 2015. Expenditure on the building project can be

summarised as follows:

Amount paid

Date of payment Details to payment

(including VAT)

1 January 2015 Architectural services R228 000

15 June 2015 Sub-contractor for foundation R342 000

20 September 2015 Sub-contractor for erecting the building exclusive R820 800

of the roof

10 January 2016 Sub-contractor for adding the roof R256 500

31 March 2016 Sub-contractor for electrical, painting and plumbing R182 400

The amounts as summarised above, were funded from the loan acquired from SAAB bank and

other cash held in the bank account of Tech Steel. The building was certified as complete and

ready to be used on 1 May 2016. It was estimated by the accountant and financial director that the

building will be depreciated over a useful life of 30 years, and that R550 000 (excluding VAT) will

be deemed to be the estimated residual value.

On 30 June 2017 the useful life of the building remained unchanged but the residual value was

estimated at R500 000 (excluding VAT).

On 1 July 2015, a company called Van Staden Revaluators Ltd (‘Van Staden’) performed a

valuation on the above mentioned land and found the fair value to be R1 820 000 (excluding VAT).

Tech Steel was very impressed with the professional service that Van Staden delivered and,

therefore, decided to employ the company again to perform the revaluation as on 1 July 2016. The

fair value was calculated as R800 000 (excluding VAT) as at 1 July 2016.

VAAL Centre

Tech Steel bought a building called Vaal Centre in central Vanderbijlpark many years ago. The

purpose of the acquisition was to earn rental income and the hope was that the value of the

property would increase over time. On 1 September 2016, Tech Steel decided that due to the fact

that all rental agreements expired on 30 November 2016, that not one of the contracts would be

renewed. As from 1 December 2016, the property was utilised for administration purposes and the

estimated remaining useful life is set at 25 years, having no residual value.

Fair values were determined as follows:

Date Fair values – Net replacement value

(excluding VAT)

30 June 2016 R1 750 000

30 November 2016 R1 790 000

On 30 June 2017, the carrying amount and fair value of the Vaal Centre property did not materially

differ.

ACCC271 2017 June test 2/43

On 1 September 2016, Tech steel paid R7 980 (inclusive of VAT) in order to repair the plumbing of

the building.

The total rent received for the period 1 July 2016 to 30 November 2016 amounted to R96 900

(inclusive of VAT).

Other assets

Details of other assets:

Asset type Cost price Acquisition date Estimated Useful

(including VAT) residual value life

(excluding

VAT )

Rand value Rand value

Spray-oven 1 026 000 1 October 2013 100 000 10 years

Welding machine 364 800 1 July 2015 50 000 4 years

On 1 March 2017, a major part of the spray-oven was removed and had to be replaced as it

caused all paintwork to appear dull and smudged. This major part had not been recorded as a

separate component on date of acquisition of the spray-oven. The accountant and financial director

are both of the opinion that this major part made up at least 60% of the original cost price of the

spray oven and also 60% of the estimated residual value. The old part was sold to the scrap-yard

on 1 March 2017 and a total of R3 477 (including VAT) was received for the part.

On 1 April 2017, the supplier of the major part and Tech Steel negotiated a lease contract in order

to replace the part. The contract stipulated 36 monthly payments of R14 000 payable in arrears,

together with one final balloon payment of R30 000. The fair value of the part amounted to

R505 000 on 1 April 2017. Ownership will not pass over to Tech Steel at the end of the lease term.

The residual value is Rnil for the purposes of IAS 16. This is the first time that Tech Steel

conducted business with a non-vendor. Tech Steel had to pay their lawyer R2 280 (inclusive of

VAT) for legal fees in order to ensure the contract is a legal binding contract. The supplier of the

part estimated that it will be able to sell the part to a third party (even though no contracts or

guarantees as in place to confirm this) for R100 000 (excluding VAT) at the end of the lease term.

The spray-oven continued with normal activities from 1 April 2017 when the part was delivered and

installed.

Tests on possible impairments have been performed in previous financial years for the welding

machine. Tech Steel had to impair welding machine with R7 500 during the financial year ended

30 June 2016. The following amounts were calculated by Van Staden and are stated for your

perusal:

Date Asset type Net replacement Cost to sell Value in use

value (excluding (excluding

(excluding VAT) VAT) VAT)

30 June 2017 Welding Machine R189 000 R2 000 R175 000

ACCC271 2017 June test 3/43

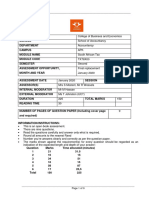

MARKS

REQUIRED:

Subtotal Total

(a) Prepare the land and the buildings column in the property,

plant and equipment note to be disclosed in the financial

statements of Tech Steel for the financial year ended 24

30 June 2017.

The accounting policy note and other qualitative information of

the note are not required.

1

Communication skills – presentation and layout 25

(b) Prepare all journal entries required to account for all the

transactions that involve the spray-oven for the financial year

ended 30 June 2017. (No lease journals are required) 9

Journal narrations are not required. 9

(c) Prepare the profit before tax note to be disclosed in the

financial statements of Tech Steel for the financial year ended

30 June 2017. Only include the related effect of the investment

property and welding machine in the note. 8

Comparative figures and other descriptions as part of the note

are not required.

Communication skills – presentation and layout 1 9

TOTAL MARKS 43

TOTAL: 100

File reference: 8.1.7.2.2

ACCC271 2017 June test 4/43

You might also like

- Anwal Gas-TnDocument35 pagesAnwal Gas-TnMaysam Kh67% (3)

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Document6 pagesQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNo ratings yet

- PPEDocument18 pagesPPECarl Yry BitzNo ratings yet

- MC 1-PPE (Students) - A202Document5 pagesMC 1-PPE (Students) - A202lim qsNo ratings yet

- 288 - Federal Reserve Act RemedyDocument4 pages288 - Federal Reserve Act RemedyDavid E Robinson100% (5)

- 2023 Tutorials Capital Allow & RecoupmtDocument10 pages2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleNo ratings yet

- 2017 FIA324-test 2Document10 pages2017 FIA324-test 2popla poplaNo ratings yet

- Q1 Jun 2017 - PPE, Impairment and Borrowing CostsDocument4 pagesQ1 Jun 2017 - PPE, Impairment and Borrowing Costspopla poplaNo ratings yet

- PPE and ImpairmentDocument3 pagesPPE and ImpairmentSelma IilongaNo ratings yet

- IAS 40 QuestionsDocument3 pagesIAS 40 QuestionsEddie PienaarNo ratings yet

- Test 2 2019Document8 pagesTest 2 2019Koti KatishiNo ratings yet

- Class Practice Question 1 - RevenueDocument2 pagesClass Practice Question 1 - RevenueAmanda KatsioNo ratings yet

- LO5 QuestionDocument2 pagesLO5 QuestionFrederick LekalakalaNo ratings yet

- Tax 200 TUTORIAL QUESTION: Capital Gains Tax (CGT) (60) Week: 22 - 26 August 2016Document2 pagesTax 200 TUTORIAL QUESTION: Capital Gains Tax (CGT) (60) Week: 22 - 26 August 2016Tawanda NgoweNo ratings yet

- Revision Paper - 2023Document12 pagesRevision Paper - 2023chaanNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- Far Icaew Extra QuestionsDocument8 pagesFar Icaew Extra QuestionsK. Manish45No ratings yet

- Exam Pack Tax3701 Pages 14 18Document5 pagesExam Pack Tax3701 Pages 14 18Andile MhlungwaneNo ratings yet

- AUD QuizesDocument9 pagesAUD QuizesDanielNo ratings yet

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Long Term Construction ContractsDocument4 pagesLong Term Construction ContractsAnalynNo ratings yet

- RTP AFR CompiledDocument455 pagesRTP AFR Compiledgopal adhikariNo ratings yet

- FR HandoutDocument67 pagesFR Handoutrolandamuh2023No ratings yet

- Introduction To Financial AccountingDocument2 pagesIntroduction To Financial AccountingNdivho MavhethaNo ratings yet

- IFRS 15 Questions 02042024 122821pmDocument4 pagesIFRS 15 Questions 02042024 122821pmAbdullah ButtNo ratings yet

- PL M17 Far Uk GaapDocument8 pagesPL M17 Far Uk GaapIssa BoyNo ratings yet

- FA3 Block 1 Tut Pack PrintingDocument165 pagesFA3 Block 1 Tut Pack Printingkatelynnewson07No ratings yet

- Fac611s - Financial Accounting 201 - 2nd Opp - July 2019Document6 pagesFac611s - Financial Accounting 201 - 2nd Opp - July 2019Lizaan CloeteNo ratings yet

- Extra Questions For AsDocument35 pagesExtra Questions For AsAmish DebNo ratings yet

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- Sample Problems LBM, Depreciation, Impairment LossDocument10 pagesSample Problems LBM, Depreciation, Impairment LossKenneth M. GonzalesNo ratings yet

- Tutorial QuestionsDocument4 pagesTutorial Questionsemmanuel stanfordNo ratings yet

- Class Practice Question-PPEDocument3 pagesClass Practice Question-PPEAmanda KatsioNo ratings yet

- Su 7 Class Question 1 PrimehyperDocument4 pagesSu 7 Class Question 1 PrimehyperAsive BalisoNo ratings yet

- Financial Accounting 3BDocument5 pagesFinancial Accounting 3BMphoyaBadimo MphoyaBadimoNo ratings yet

- Assignment 1Document8 pagesAssignment 1Ivan SsebugwawoNo ratings yet

- Investment Property Other Non Current Financial Assets and Non Current Assests Held For SaleDocument16 pagesInvestment Property Other Non Current Financial Assets and Non Current Assests Held For SaleRizza Morada50% (2)

- CTAA021 Tutorial 22 February 2024Document4 pagesCTAA021 Tutorial 22 February 2024202200224No ratings yet

- Question Paper Unit f014 01 RB Management Accounting Resource BookletDocument8 pagesQuestion Paper Unit f014 01 RB Management Accounting Resource Bookletjt7qdbvqhvNo ratings yet

- PPE QuestionsDocument10 pagesPPE QuestionsJohn Ibrahim James MohammadNo ratings yet

- Uj 38855+SOURCE1+SOURCE1.1Document9 pagesUj 38855+SOURCE1+SOURCE1.1sacey20.hbNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Ifrs 15 QuestionsDocument2 pagesIfrs 15 QuestionsTata MgpNo ratings yet

- Tutorial 2 IBA AA Sem 2 2019 2020 PDFDocument7 pagesTutorial 2 IBA AA Sem 2 2019 2020 PDFMOHAMAD ASYRAF BIN AZHARNo ratings yet

- Problem 4Document6 pagesProblem 4jhobsNo ratings yet

- Question Bank Disclosure - 2023Document23 pagesQuestion Bank Disclosure - 2023thamsanqamanciNo ratings yet

- FA Dec 2018Document8 pagesFA Dec 2018Shawn LiewNo ratings yet

- Notes - Audit of PpeDocument4 pagesNotes - Audit of PpeLeisleiRagoNo ratings yet

- Tutorial Questions Borrowing Costs - 2019Document7 pagesTutorial Questions Borrowing Costs - 2019Noah MigealNo ratings yet

- tUT3 MFRS15Document4 pagestUT3 MFRS15--bolabolaNo ratings yet

- Tanza EngDocument2 pagesTanza Engisabella.desa04No ratings yet

- Tutorial 2 Capital Allowances - Q&ADocument8 pagesTutorial 2 Capital Allowances - Q&AKamal JabriNo ratings yet

- Kibco Service AnnexDocument9 pagesKibco Service AnnexnigussieabagazNo ratings yet

- May 2021 Path SkillsDocument139 pagesMay 2021 Path Skillsbusolajuliet601No ratings yet

- IAS 2 Inventory Questions-1Document8 pagesIAS 2 Inventory Questions-1lehlohonoloronaldinhoNo ratings yet

- ICAB - IAS 36 - QuestionsDocument3 pagesICAB - IAS 36 - QuestionsMonirul Islam MoniirrNo ratings yet

- FAR-1 Class 6 Practice QuestionDocument2 pagesFAR-1 Class 6 Practice QuestionZain JamilNo ratings yet

- Practice Exercise 1.1Document4 pagesPractice Exercise 1.1leshz zynNo ratings yet

- Fin and Corp Reporting - June11Document6 pagesFin and Corp Reporting - June11SHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- Book Value (Carrying Value) at 2020 25,000 Remaining Life 10 YrsDocument5 pagesBook Value (Carrying Value) at 2020 25,000 Remaining Life 10 YrsMichael PanizaNo ratings yet

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryFrom EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Sundaram Finance VPMDocument4 pagesSundaram Finance VPMsampath18051978No ratings yet

- Swot Analysis of MCBDocument4 pagesSwot Analysis of MCBAbdulMoeedMalik100% (1)

- OpTransactionHistory18 08 2021Document9 pagesOpTransactionHistory18 08 2021Deepak UpadhayayNo ratings yet

- Could This Decade Be The Next 1930Document16 pagesCould This Decade Be The Next 1930Leandro RuschelNo ratings yet

- India Consumer: Wallet Watch - Vol 1/12Document6 pagesIndia Consumer: Wallet Watch - Vol 1/12Rahul GanapathyNo ratings yet

- Ind As 37: Provisions, Contingent Liabilities and Contingent AssetsDocument5 pagesInd As 37: Provisions, Contingent Liabilities and Contingent AssetsDinesh KumarNo ratings yet

- Internet Banking: HSBC Bank Egypt S.A.EDocument2 pagesInternet Banking: HSBC Bank Egypt S.A.Euyên đỗNo ratings yet

- Guide To Non Operative Financial Holding Companies For New Banks in India PDFDocument32 pagesGuide To Non Operative Financial Holding Companies For New Banks in India PDFvishnu pNo ratings yet

- Tanzania International Container Terminal Services LTDDocument1 pageTanzania International Container Terminal Services LTDRimzone Trading Co LtdNo ratings yet

- Armenian Banking Sector Overview For Q1 2019 1559853297Document39 pagesArmenian Banking Sector Overview For Q1 2019 1559853297Anush GrigoryanNo ratings yet

- Assignment Sem III 2021-22Document4 pagesAssignment Sem III 2021-22rtluck9 002No ratings yet

- Difference Between Banks & NBFCDocument8 pagesDifference Between Banks & NBFCSajesh BelmanNo ratings yet

- Why Hayek Was Wrong On Concurrent CurrenciesDocument12 pagesWhy Hayek Was Wrong On Concurrent CurrenciesKrzysiek RembiaszNo ratings yet

- A Report On E-Products of Indian Overseas BankDocument39 pagesA Report On E-Products of Indian Overseas BankThadoi ThangjamNo ratings yet

- About Morgan Stanley Group IncDocument7 pagesAbout Morgan Stanley Group IncjobelcaballeroNo ratings yet

- Banking and Finance Level 6Document463 pagesBanking and Finance Level 6haron murumbaNo ratings yet

- Oracle Receivables - An Overview - Day 1Document69 pagesOracle Receivables - An Overview - Day 1Manoj BhogaleNo ratings yet

- Responsibility Accounting and Transfer Pricing ProblemsDocument20 pagesResponsibility Accounting and Transfer Pricing ProblemsWeniel Dela VictoriaNo ratings yet

- Evaluation of Investment PerformanceDocument19 pagesEvaluation of Investment PerformanceFerdyanWanaSaputraNo ratings yet

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank CH 5Document4 pagesModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank CH 5HarshNo ratings yet

- Adv Acc Sol Manual 2008Document190 pagesAdv Acc Sol Manual 2008Khey Soniga RollanNo ratings yet

- DepreciationDocument4 pagesDepreciationMadhura KhapekarNo ratings yet

- Canadian Entrepreneurship and Small Business Management Canadian 10th Edition Balderson Test Bank 1Document36 pagesCanadian Entrepreneurship and Small Business Management Canadian 10th Edition Balderson Test Bank 1kimberlyhortonfepbyjwzdr100% (30)

- Compensation Survey 2021Document14 pagesCompensation Survey 2021Oussama NasriNo ratings yet

- InteretrustDocument21 pagesInteretrustConstantin WellsNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- Bidding For Hertz Leveraged Buyout (Case Study)Document19 pagesBidding For Hertz Leveraged Buyout (Case Study)Giovi CaltroniNo ratings yet

- What Is A Mutual Fund?Document35 pagesWhat Is A Mutual Fund?Azaan KhanNo ratings yet