Professional Documents

Culture Documents

Cash Management

Cash Management

Uploaded by

f4farhansiddiqui17Copyright:

Available Formats

You might also like

- Data ReportDocument92 pagesData Reportarun.s201186100% (1)

- M5 e Text BookDocument534 pagesM5 e Text BookMalvin TanNo ratings yet

- Master Budget With SolutionsDocument12 pagesMaster Budget With SolutionsDea Andal100% (4)

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- Cash Budget . Feb 2020: Q 1 Calgon ProductsDocument11 pagesCash Budget . Feb 2020: Q 1 Calgon Products신두No ratings yet

- Cash Budget McqsDocument5 pagesCash Budget McqsWarsa Ul Zaman100% (1)

- M5 Management of Cash Pract. ProbDocument5 pagesM5 Management of Cash Pract. ProbAmruta PeriNo ratings yet

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementdhruvNo ratings yet

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- Exercises Budgeting ACCT2105 3s2010Document7 pagesExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- Cash Management-ProblemsDocument2 pagesCash Management-ProblemsNagma ParmarNo ratings yet

- Budgeting - ExamplesDocument2 pagesBudgeting - Examplessunil.ctNo ratings yet

- Cash Management QuestionsDocument5 pagesCash Management QuestionsManasi Jamsandekar100% (1)

- Question On Budget A LevelDocument3 pagesQuestion On Budget A LevelMUSTHARI KHANNo ratings yet

- Lecture 11Document26 pagesLecture 11Riaz Baloch Notezai100% (1)

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Two The 20%. The: Vinze and of As TinDocument4 pagesTwo The 20%. The: Vinze and of As TinPRAYAGRAJ MITRA MANDAL GROUPNo ratings yet

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- FALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERDocument7 pagesFALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERAkankshaNo ratings yet

- Budgeting - 1Document3 pagesBudgeting - 1Muhammad MansoorNo ratings yet

- Budget Questions Hac1Document5 pagesBudget Questions Hac1odedeyi aishat0% (1)

- Cash Budget Test 3Document2 pagesCash Budget Test 3Prince TshepoNo ratings yet

- kALBARYONISHERLY 1Document8 pageskALBARYONISHERLY 1De MarcusNo ratings yet

- Question BankDocument8 pagesQuestion Bankitzzmuskan4No ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Cost Accounting - Cash BudgetDocument4 pagesCost Accounting - Cash BudgetRealGenius (Carl)No ratings yet

- Preparation of Cash BudgetDocument3 pagesPreparation of Cash BudgetFaye RoceroNo ratings yet

- Master Budgeting ProblemsDocument4 pagesMaster Budgeting ProblemsKRook NitsNo ratings yet

- Chapter 5 Management of Cash and Chapter - 6 Ratio AnalysisDocument21 pagesChapter 5 Management of Cash and Chapter - 6 Ratio AnalysisAbhishek TiwariNo ratings yet

- Months Sales Material Wages Overheads: Estimated Sale and CostDocument1 pageMonths Sales Material Wages Overheads: Estimated Sale and CostGarimaNo ratings yet

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- Lecture Notes On Treasury Management and Control PDFDocument11 pagesLecture Notes On Treasury Management and Control PDFSanchit Yadav0% (1)

- Answer The Following Questions Very CarefullyDocument2 pagesAnswer The Following Questions Very CarefullyMaham ImtiazNo ratings yet

- Lecture # 44Document3 pagesLecture # 44bwcs1122No ratings yet

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- Additional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyDocument2 pagesAdditional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyNsscollege RajakumariNo ratings yet

- Semi-Finals-2nd Sem-22-23-BudgetingDocument1 pageSemi-Finals-2nd Sem-22-23-BudgetingMae Polison ManteNo ratings yet

- 2 AssingmentDocument3 pages2 AssingmentABM MOZAHIDNo ratings yet

- Cash Budgets 2Document2 pagesCash Budgets 2Prince TshepoNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- 2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Document4 pages2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Mohammad ShahidNo ratings yet

- Cash BudgetDocument15 pagesCash Budgetkunarapu gopi krishnaNo ratings yet

- Cash BudgetDocument15 pagesCash Budgetpriyanshu kumari0% (1)

- 5Document11 pages5Youssef MohammedNo ratings yet

- Master BudgetDocument36 pagesMaster BudgetRafols AnnabelleNo ratings yet

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Q1Document2 pagesQ1Haris HasanNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetAbdulkarim Hamisi KufakunogaNo ratings yet

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- ICAB Knowledge Level Accounting May-Jun 2016Document2 pagesICAB Knowledge Level Accounting May-Jun 2016Bizness Zenius HantNo ratings yet

- Quiz Audit of ReceivablesDocument4 pagesQuiz Audit of ReceivableswesNo ratings yet

- Budgeting NumericalsDocument6 pagesBudgeting NumericalsAll in ONENo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Acct Statement - XX5710 - 18092021 (4) DeshDocument14 pagesAcct Statement - XX5710 - 18092021 (4) DeshRahul SahaniNo ratings yet

- Boat 115 BillDocument1 pageBoat 115 BillVINEET TIWARINo ratings yet

- 23 Mutual Fund OperationsDocument49 pages23 Mutual Fund OperationsPaula Ella BatasNo ratings yet

- Property Rights - Eco 3206Document7 pagesProperty Rights - Eco 3206gilbert kalemaNo ratings yet

- Value-Added Tax (VAT) Is A Form of Sales TaxDocument6 pagesValue-Added Tax (VAT) Is A Form of Sales TaxFeiya LiuNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- Customer No.: 21379988 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument8 pagesCustomer No.: 21379988 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressSushant PandeyNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH08 PPTDocument36 pagesRoss Fundamentals of Corporate Finance 13e CH08 PPTJessica LiNo ratings yet

- 2.1 - Optimal Risk PortfoliosDocument25 pages2.1 - Optimal Risk PortfoliosMuhammad MuhaiminNo ratings yet

- Catawba Industrial Company-Case QuestionsDocument1 pageCatawba Industrial Company-Case QuestionsSumit Kulkarni0% (3)

- Writing Practice Set 1 (Integrated) : Passage, Lecture, and QuestionDocument2 pagesWriting Practice Set 1 (Integrated) : Passage, Lecture, and QuestionAngie AlettoNo ratings yet

- ClothingDocument2 pagesClothingFHKNo ratings yet

- A PROJECT REPORT ON RISK ANALYSIS AND RISK MANAGEMENT IN INVESTING IN INSAURANCE POLICES EditedDocument47 pagesA PROJECT REPORT ON RISK ANALYSIS AND RISK MANAGEMENT IN INVESTING IN INSAURANCE POLICES EditedSumit PandeyNo ratings yet

- Product (GDP) of Many Small Countries,"adding,"this TimeDocument5 pagesProduct (GDP) of Many Small Countries,"adding,"this Timenadya umairaNo ratings yet

- Assignment No. 1 Title: Submit A Profile Summary of A Successful EntrepreneurDocument3 pagesAssignment No. 1 Title: Submit A Profile Summary of A Successful EntrepreneurPranav MhatreNo ratings yet

- Tybaf Sem6 Fm-Iii Apr19Document6 pagesTybaf Sem6 Fm-Iii Apr19rizwan hasmiNo ratings yet

- Sample Self Introduction EssayDocument7 pagesSample Self Introduction Essayafibybflnwowtr100% (2)

- IUG Class: Master 2 Aac COURSE: Advanced Management Control-Assignment 1 Time 2Hrs Instructions: Anszer All QuestionsDocument2 pagesIUG Class: Master 2 Aac COURSE: Advanced Management Control-Assignment 1 Time 2Hrs Instructions: Anszer All Questionskwei melvisNo ratings yet

- This Study Resource Was: 1. Damon Is The Lessee in Connection With A Type A Lease. Under The New ASU, Damon WouldDocument4 pagesThis Study Resource Was: 1. Damon Is The Lessee in Connection With A Type A Lease. Under The New ASU, Damon WouldDaniella Mae ElipNo ratings yet

- Odi MejiDocument1 pageOdi MejigopuremagicNo ratings yet

- Chilton Flagship Strategies - Presentation - February 2012Document25 pagesChilton Flagship Strategies - Presentation - February 2012ChapersonNo ratings yet

- 9 Steps To Overcome Competition in Retail BusinessDocument3 pages9 Steps To Overcome Competition in Retail BusinessMarina IvanNo ratings yet

- Review For MidtermI Solution 1092Document120 pagesReview For MidtermI Solution 1092C14041159王莫堯No ratings yet

- Carrefour CSRDocument3 pagesCarrefour CSRTapochekNo ratings yet

- A Project Report On IpoDocument36 pagesA Project Report On IpoOm AherNo ratings yet

- 160+ GD Topics For Bank Exams 2022 (With Answers)Document6 pages160+ GD Topics For Bank Exams 2022 (With Answers)udayNo ratings yet

- PAGINA 47 Proceedings Iniic Conference 1 2020Document60 pagesPAGINA 47 Proceedings Iniic Conference 1 2020Leandro TorricelliNo ratings yet

- Cambridge International AS & A Level: Economics 9708/32Document12 pagesCambridge International AS & A Level: Economics 9708/32ayan sajjadNo ratings yet

Cash Management

Cash Management

Uploaded by

f4farhansiddiqui17Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Management

Cash Management

Uploaded by

f4farhansiddiqui17Copyright:

Available Formats

CASH MANAGEMENT CA SUNIL KESWANI 1

Cash Management

Question - 1

Reference - Page No. -

A firm maintains a separate account for cash disbursement. Total disbursement are `1,05,000

per month or `12,60,000 per year. Administrative and transaction cost of transferring cash to

disbursement account is `20 per transfer. Marketable securities yield is 8% per annum.

Determine the optimum cash balance according to William J. Baumol Model.

Question - 2

Reference - Page No. -

The following information is available in respect of SK Ltd:

(i) On an average, debtors are collected after 45 days; inventories

have an average holding period of 75 days and creditor’s payment

period on an average is 30 days.

(ii) The firm spends a total of `120 lakhs annually at a constant rate.

(iii) It can earn 20 per cent on investments.

From the above information, you are required to calculate:

(a) The cash cycle and cash turnover

(b) Minimum amounts of cash to be obtained to meet payments as they become due,

(c) Savings by reducing the average inventory holding period by 30 days.

Question - 3

Reference - Page No. -

Prepare monthly cash budget of 6 months beginning from April 2021, on the basis of following

information:

(a) Estimated monthly sales are as follows:

Jan `1,00,000 June `80,000

Feb 1,20,000 July 1,00,000

March 1,40,000 Aug 80,000

April 80,000 Sept 60,000

May 60,000 Oct 1,00,000

(b) Wages and salaries are estimated to be payable as follows:

April `9,000 July `10,000

May 8,000 Aug 9,000

June 10,000 Sept 9,000

(c) Cash sales are 75% less than the credit sales. 75% of credit sales are collected within one

month and the balance in two months. There are no bad debt losses.

CODE – CASUNIL CONTACT - 9953735388

CASH MANAGEMENT CA SUNIL KESWANI 2

(d) Purchases amount to 80% of sales and are made and paid for in the

month preceding the sale.

(e) The firm has 10% Debentures of `1,20,000. Interest on these has to be

paid quarterly in Jan. April and so on.

(f) The firm is to be make an advance payment of tax of `5,000 in July

2021

(g) The firm had a cash balance of `20,000 on April, 1 2021, which is the

minimum desired level of cash balance. Any cash surplus/deficit above/below this level is

made up by temporary investment/liquidation of temporary investments or Temporary

borrowings at the end of each month (interest on these to be ignored).

Question - 4

Reference - Page No. -

A garment trader is preparing cash forecast for first three months of calendar year 2021. His

estimated sales for the forecasted periods are as below:

January (` ‘000) February (` ‘000) March (` ‘000)

Total Sales 600 600 800

(i) The trader sells directly to public against cash payments and to other entities on credit.

Credit sales are expected to be four times the value of direct sales to public. He expects

15% customers to pay in the month in which credit sales are made, 25% to pay in the

next month and 58% to pay in the next to next month. The outstanding balance is

expected to be written off.

(ii) Purchase of goods are made in the month prior to sales and it amounts to 90% of sales

and made on credit. Payments of these occur in the month after the purchase. No

inventories of goods are held.

(iii) Cash balance as on 1st January, 2021 is `50,000

(iv) Actual sales for the last two months of calendar year 2020 are as below:

November (` ‘000) December (` ‘000)

Total Sales 640 880

You are required to prepare a monthly cash budget for the three months from January to March,

2021.

Question - 5

Reference - Page No. -

The following information relates to SK ltd., a publishing company:

The selling price of a book is `15, and sales are made on credit through a book club and

invoiced on the last day of the month. Variable costs of production per book are materials (`5),

labour (`4) and overhead (`2).

The sales manager has forecasted the following volumes:

CODE – CASUNIL CONTACT - 9953735388

CASH MANAGEMENT CA SUNIL KESWANI 3

Month No. of books

November 1,000

December 1,000

January 1,000

February 1,250

March 1,500

April 2,000

May 1,900

June 2,200

July 2,200

August 2,300

Customers are expected to pay as follows:

One month after the sale 40%

Two months after the sale 60%

The company produces the books two months before they are sold and the creditors for

materials are paid two months after production.

Variable overheads are paid in the month following production and are expected to increase by

25% in April; 75% of wages are paid in the month of production and 25% in the following

month. A wage increase of 12.5% will take place on 1st March.

The company is going through a restructuring and will sell one of its freehold properties in

May for `25,000, but it is also planning to buy a new printing press in May for `10,000.

Depreciation is currently `1,000 per month, and will rise to `1,500 after the purchase of the

new machine.

The company’s corporation tax (of `10,000) is due for payment in march. The company

presently has a cash balance at bank on 31 December 2020, of `1,500.

You are required to prepare a cash budget for the six months from January to June 2021.

Question - 6

Reference - Page No. -

You are required to prepare a cash budget based on the given information. The cash balance in

hand on 1 January 2021 is `72,500. Assume that 50 per cent of total sales are cash sales. Assets

are to be acquired in the months of February and April. Therefore, provisions should be made

for the payment of `8,000 and `25,000 for the same. An application has been made to the

bank for the grant of a loan of `30,000 and it is hoped that the loan amount will be received in

the month of May.

CODE – CASUNIL CONTACT - 9953735388

CASH MANAGEMENT CA SUNIL KESWANI 4

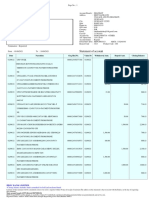

Months Sales (`) Materials Salaries & Production Office and

Purchases (`) Wages (`) Over Heads Selling Over

(` ) Heads (`)

January 72,000 25,000 10,000 6,000 5,500

February 97,000 31,000 12,100 6,300 6,700

March 86,000 25,500 10,600 6,000 7,500

April 88,600 30,600 25,000 6,500 8,900

May 1,02,500 37,000 22,000 8,000 11,000

June 1,08,700 38,800 23,000 8,200 11,500

It is anticipated that a dividend of `35,000 will be paid in June. Debtors are allowed one

month’s credit. Creditors for materials purchased and overheads grant one month’s credit. Sales

commission at 3 per cent on sales is paid to the sales man each month.

Question - 7

Reference - Page No. -

From the following information relating to a departmental store, you are required to prepare

for the three months ending 31st March, 2021:

(a) Month-wise cash budget on receipts and payments basis; and

(b) Statement of Sources and uses of funds for the three months period.

It is anticipated that the working capital & other account balances at 1st January, 2021 will be

as follows:

`in 000’s

Cash in hand and at bank 1,090

Short term investments 600

Debtors 5,140

Stock 2,600

Trade creditors 4,220

Other creditors 400

Dividend payable 970

Tax due 640

Plant 1,600

Budgeted Profit Statement `in 000’s

January February March

Sales 4,200 3,600 3,400

Cost of sales 3,270 2,810 2,660

Gross profit 930 790 740

Administrative, selling and distribution 630 540 510

expenses

Net Profit before tax 300 250 230

CODE – CASUNIL CONTACT - 9953735388

CASH MANAGEMENT CA SUNIL KESWANI 5

Budgeted balances at the end of each month `in 000’s

January February March

Short term investments 1,400 - 400

Debtors 5,200 5,000 4,7000

Stock 2,400 2,200 2,000

Trade creditors 4,000 3,900 3,800

Other creditors 400 400 400

Dividend payable 970 - -

Tax due 640 640 640

Plant (depreciation ignored) 1,600 3,200 3,100

Depreciation amount of `1,20,000 is included in the budgeted expenditure for each month.

Question - 8

Reference - Page No. -

You are given below the Profit & Loss Accounts for two years for a company:

Profit & Loss Account

Particulars Year 1(`) Year 2(`) Particulars Year 1(`) Year 2(`)

To Opening Stock 40,00,000 50,00,000 By Sales 4,00,00,000 5,00,00,000

To Raw Materials 1,50,00,000 2,00,00,000 By Closing 50,00,000 75,00,000

Stock

To Stores 50,00,000 60,00,000 By Misc. 5,00,000 5,00,000

Income

To Manufacturing 50,00,000 80,00,000

Exp.

To Other 50,00,000 50,00,000

Expenses

To Depreciation 50,00,000 50,00,000

To Net Profit 65,00,000 90,00,000

4,55,00,000 5,80,00,000 4,55,00,000 5,80,00,000

Sales are expected to be `6,00,00,000 in year 3. Other expenses will

increase by `25,00,000 besides other charges. Only raw materials are in

stock. Assume sales and purchases are in cash terms and the closing stock

is expected to go up by the same amount as between year 1 and 2. You may

assume that no dividend is being paid. The Company can use 75% of the

cash generated to service a loan. Compute how much cash from operations

will be available in year 3 for the purpose? Ignore income tax.

Question - 9

Reference - Page No. -

SK Ltd is a manufacturing company producing and selling a range of cleaning products to

wholesale customers. It has three suppliers and two customers. SK Ltd relies on its cleared

funds forecast to manage its cash. You are an accounting technician for the company and have

CODE – CASUNIL CONTACT - 9953735388

CASH MANAGEMENT CA SUNIL KESWANI 6

been asked to prepare a cleared funds forecast for the period Friday 9 July to Tuesday 13 July

2021 inclusive. You have been provided with the following information:

(1) Receipts from customers

Credit Terms Payment 9 July 2021 sales 9 June 2021

Method sales

P Ltd. 1 Calendar month BACS `3,00,000 `2,60,000

M Ltd. None Cheque `3,60,000 `3,10,000

(a) Receipt of money by BACS (Bankers’ Automated clearing Services) is instantaneous.

(b) M Ltd.’s cheque will be paid into SK ltd.’s bank account on the same day as the sale is

made and will clear on the third day following this (excluding day of payment)

(2) Payment to Suppliers

Supplier Credit Payment 9 July 2021 9 June 2021 9 May 2021

Name terms Method Purchases Purchases Purchases

R Ltd. 1 calendar Standing `1,30,000 `1,10,000 `90,000

month order

J Ltd. 2 calendar Cheque `1,70,000 `1,60,000 `1,50,000

month

K Ltd. None Cheque `1,90,000 `1,80,000 `1,70,000

(a) SK Ltd has set up a standing order for `90,000 a month to pay for supplies from R Ltd.

This will leave SK’s bank account on 9 July. Every few months, an adjustment is made to

reflect the actual cost of supplies purchased (you do not need to make this adjustment).

(b) SK Ltd will send out, by post, cheques to J Ltd and K Ltd on 9 July. The amounts will

leave its bank account on the second day following this (excluding the day of posting).

(3) Wages and salaries

June 2021 July 2021

Weekly wages `24,000 `26,000

Monthly salaries `1,12,000 `1,18,000

(a) Factory workers are paid cash wages (weekly). They will be paid one week’s wages, on

13 July, for the last week’s work done in June (i.e. they work a week in hand).

(b) All the office workers are paid salaries (monthly) by BACS. Salaries for June will be paid

on 9 July.

(4) Other miscellaneous payments

(a) Every Friday morning, the petty cashier withdraws `400 from the

company bank account for the petty cash. The money leaves SK’s bank

account straight away.

(b) The room cleaner is paid `60 from petty cash every Sunday morning.

(c) Office stationery will be ordered by telephone on Saturday 10 July to

the value of `600. This is paid for by company debit card. Such

payments are generally seen to leave the company account on the next working day.

CODE – CASUNIL CONTACT - 9953735388

CASH MANAGEMENT CA SUNIL KESWANI 7

(d) Five new software will be ordered over the Internet on 12 July at a total cost of `13,000.

A cheque will be sent out on the same day. The amount will leave SK Ltd.’s bank account

on the second day following this (excluding the day of posting).

(5) Other information

The balance on SK’s bank account will be `4,00,000 on 9 July 2021. This represents both the

book balance and the cleared funds.

Prepare a cleared funds forecast for the period Friday 9th July to Tuesday 13th July 2021

inclusive using the information provided. Show clearly the uncleared funds float each day.

Question - 10

Reference - Page No. -

Based on the following information prepare a cash budget for SK Ltd:

1st Qtr (`) 2nd Qtr (`) 3rd Qtr (`) 4th Qtr

(` )

Opening cash balance 10,000 — — —

Collections from customers 1,25,000 1,50,000 1,60,000 2,21,000

Payments:

Purchase of materials 20,000 35,000 35,000 54,200

Other expenses 25,000 20,000 20,000 17,000

Salary and wages 90,000 95,000 95,000 1,09,200

Income tax 5,000 — — —

Purchase of machinery — — — 20,000

The company desired to maintain a cash balance of `15,000 at the end

of each quarter. Cash can be borrowed or repaid in multiples of `500 at

an interest of 10% per annum. Management does not want to borrow cash

more than what is necessary and wants to repay as early as possible. In

any event, loans cannot be extended beyond four quarters. Interest is

computed and paid when the principal is repaid. Assume that borrowings

take place at the beginning and repayments are made at the end of the

quarters.

Question - 11

Reference - Page No. -

Consider the balance sheet of SK ltd. as on 31 March, 2022. The company has received a large

order and anticipates the need to go to its bank to increase its borrowings. As a result, it has to

forecast its cash requirements for April, May and June, 2022. Typically the company collects

20 percent of this sales in the month of sale, 70 percent in the subsequent month, and 10 percent

in the second month after the sale. All sales are credit sales.

CODE – CASUNIL CONTACT - 9953735388

CASH MANAGEMENT CA SUNIL KESWANI 8

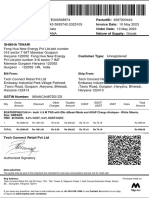

Equity & liabilities Amount Assets Amount

(` in ‘000) (` in ‘000)

Equity share capital 100 Net fixed assets 1,836

Retained earnings 1,439 Inventories 545

Long-term borrowings 450 Accounts receivables 530

Accounts payables 360 Cash and bank 50

Loan from banks 400

Other liabilities 212

2,961 2,961

Purchase of raw materials are made in the month prior to the sale and amounts to 60 percent of

sales. Payments for these purchases occur in the month after the purchase. Labour costs,

including overtime, are expected to be 1,50,000 in April, `2,00,000 in May and `1,60,000 in

June. Selling, administrative, taxes and other cash expenses are expected to be `1,00,000 per

month for April through June. Actual sales in February and March and projected sales for April

through July are as follows (in thousands):

Month ` Month ` Month `

February 500 March 600 April 650

May 600 June 1,000 July 750

On the basis of this information:

(a) Prepare a cash budget and determine the amount of additional bank borrowings necessary

to maintain a cash balance of `50,000 at all times for the months of April, May, and June.

(b) Prepare a pro forma balance sheet as on 30th June 2022.

CODE – CASUNIL CONTACT - 9953735388

You might also like

- Data ReportDocument92 pagesData Reportarun.s201186100% (1)

- M5 e Text BookDocument534 pagesM5 e Text BookMalvin TanNo ratings yet

- Master Budget With SolutionsDocument12 pagesMaster Budget With SolutionsDea Andal100% (4)

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- Cash Budget . Feb 2020: Q 1 Calgon ProductsDocument11 pagesCash Budget . Feb 2020: Q 1 Calgon Products신두No ratings yet

- Cash Budget McqsDocument5 pagesCash Budget McqsWarsa Ul Zaman100% (1)

- M5 Management of Cash Pract. ProbDocument5 pagesM5 Management of Cash Pract. ProbAmruta PeriNo ratings yet

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementdhruvNo ratings yet

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Document7 pagesBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNo ratings yet

- Exercises Budgeting ACCT2105 3s2010Document7 pagesExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- Cash Management-ProblemsDocument2 pagesCash Management-ProblemsNagma ParmarNo ratings yet

- Budgeting - ExamplesDocument2 pagesBudgeting - Examplessunil.ctNo ratings yet

- Cash Management QuestionsDocument5 pagesCash Management QuestionsManasi Jamsandekar100% (1)

- Question On Budget A LevelDocument3 pagesQuestion On Budget A LevelMUSTHARI KHANNo ratings yet

- Lecture 11Document26 pagesLecture 11Riaz Baloch Notezai100% (1)

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Two The 20%. The: Vinze and of As TinDocument4 pagesTwo The 20%. The: Vinze and of As TinPRAYAGRAJ MITRA MANDAL GROUPNo ratings yet

- Cash Management: ProblemsDocument4 pagesCash Management: ProblemsPoojitha ReddyNo ratings yet

- Cash Budget Sums Mcom Sem 4Document14 pagesCash Budget Sums Mcom Sem 4Prachi BhosaleNo ratings yet

- FALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERDocument7 pagesFALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERAkankshaNo ratings yet

- Budgeting - 1Document3 pagesBudgeting - 1Muhammad MansoorNo ratings yet

- Budget Questions Hac1Document5 pagesBudget Questions Hac1odedeyi aishat0% (1)

- Cash Budget Test 3Document2 pagesCash Budget Test 3Prince TshepoNo ratings yet

- kALBARYONISHERLY 1Document8 pageskALBARYONISHERLY 1De MarcusNo ratings yet

- Question BankDocument8 pagesQuestion Bankitzzmuskan4No ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Cost Accounting - Cash BudgetDocument4 pagesCost Accounting - Cash BudgetRealGenius (Carl)No ratings yet

- Preparation of Cash BudgetDocument3 pagesPreparation of Cash BudgetFaye RoceroNo ratings yet

- Master Budgeting ProblemsDocument4 pagesMaster Budgeting ProblemsKRook NitsNo ratings yet

- Chapter 5 Management of Cash and Chapter - 6 Ratio AnalysisDocument21 pagesChapter 5 Management of Cash and Chapter - 6 Ratio AnalysisAbhishek TiwariNo ratings yet

- Months Sales Material Wages Overheads: Estimated Sale and CostDocument1 pageMonths Sales Material Wages Overheads: Estimated Sale and CostGarimaNo ratings yet

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- Lecture Notes On Treasury Management and Control PDFDocument11 pagesLecture Notes On Treasury Management and Control PDFSanchit Yadav0% (1)

- Answer The Following Questions Very CarefullyDocument2 pagesAnswer The Following Questions Very CarefullyMaham ImtiazNo ratings yet

- Lecture # 44Document3 pagesLecture # 44bwcs1122No ratings yet

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- Additional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyDocument2 pagesAdditional Information:: From The Following Information Prepare A Cash Budget For The Months of June and JulyNsscollege RajakumariNo ratings yet

- Semi-Finals-2nd Sem-22-23-BudgetingDocument1 pageSemi-Finals-2nd Sem-22-23-BudgetingMae Polison ManteNo ratings yet

- 2 AssingmentDocument3 pages2 AssingmentABM MOZAHIDNo ratings yet

- Cash Budgets 2Document2 pagesCash Budgets 2Prince TshepoNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- 2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Document4 pages2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Mohammad ShahidNo ratings yet

- Cash BudgetDocument15 pagesCash Budgetkunarapu gopi krishnaNo ratings yet

- Cash BudgetDocument15 pagesCash Budgetpriyanshu kumari0% (1)

- 5Document11 pages5Youssef MohammedNo ratings yet

- Master BudgetDocument36 pagesMaster BudgetRafols AnnabelleNo ratings yet

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Q1Document2 pagesQ1Haris HasanNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetAbdulkarim Hamisi KufakunogaNo ratings yet

- Assignment IIDocument4 pagesAssignment IIAfifa TonniNo ratings yet

- ICAB Knowledge Level Accounting May-Jun 2016Document2 pagesICAB Knowledge Level Accounting May-Jun 2016Bizness Zenius HantNo ratings yet

- Quiz Audit of ReceivablesDocument4 pagesQuiz Audit of ReceivableswesNo ratings yet

- Budgeting NumericalsDocument6 pagesBudgeting NumericalsAll in ONENo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Acct Statement - XX5710 - 18092021 (4) DeshDocument14 pagesAcct Statement - XX5710 - 18092021 (4) DeshRahul SahaniNo ratings yet

- Boat 115 BillDocument1 pageBoat 115 BillVINEET TIWARINo ratings yet

- 23 Mutual Fund OperationsDocument49 pages23 Mutual Fund OperationsPaula Ella BatasNo ratings yet

- Property Rights - Eco 3206Document7 pagesProperty Rights - Eco 3206gilbert kalemaNo ratings yet

- Value-Added Tax (VAT) Is A Form of Sales TaxDocument6 pagesValue-Added Tax (VAT) Is A Form of Sales TaxFeiya LiuNo ratings yet

- Chapter 2: Current Liabilities, Provisions, and ContingenciesDocument14 pagesChapter 2: Current Liabilities, Provisions, and ContingenciesGirma NegashNo ratings yet

- Customer No.: 21379988 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument8 pagesCustomer No.: 21379988 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressSushant PandeyNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH08 PPTDocument36 pagesRoss Fundamentals of Corporate Finance 13e CH08 PPTJessica LiNo ratings yet

- 2.1 - Optimal Risk PortfoliosDocument25 pages2.1 - Optimal Risk PortfoliosMuhammad MuhaiminNo ratings yet

- Catawba Industrial Company-Case QuestionsDocument1 pageCatawba Industrial Company-Case QuestionsSumit Kulkarni0% (3)

- Writing Practice Set 1 (Integrated) : Passage, Lecture, and QuestionDocument2 pagesWriting Practice Set 1 (Integrated) : Passage, Lecture, and QuestionAngie AlettoNo ratings yet

- ClothingDocument2 pagesClothingFHKNo ratings yet

- A PROJECT REPORT ON RISK ANALYSIS AND RISK MANAGEMENT IN INVESTING IN INSAURANCE POLICES EditedDocument47 pagesA PROJECT REPORT ON RISK ANALYSIS AND RISK MANAGEMENT IN INVESTING IN INSAURANCE POLICES EditedSumit PandeyNo ratings yet

- Product (GDP) of Many Small Countries,"adding,"this TimeDocument5 pagesProduct (GDP) of Many Small Countries,"adding,"this Timenadya umairaNo ratings yet

- Assignment No. 1 Title: Submit A Profile Summary of A Successful EntrepreneurDocument3 pagesAssignment No. 1 Title: Submit A Profile Summary of A Successful EntrepreneurPranav MhatreNo ratings yet

- Tybaf Sem6 Fm-Iii Apr19Document6 pagesTybaf Sem6 Fm-Iii Apr19rizwan hasmiNo ratings yet

- Sample Self Introduction EssayDocument7 pagesSample Self Introduction Essayafibybflnwowtr100% (2)

- IUG Class: Master 2 Aac COURSE: Advanced Management Control-Assignment 1 Time 2Hrs Instructions: Anszer All QuestionsDocument2 pagesIUG Class: Master 2 Aac COURSE: Advanced Management Control-Assignment 1 Time 2Hrs Instructions: Anszer All Questionskwei melvisNo ratings yet

- This Study Resource Was: 1. Damon Is The Lessee in Connection With A Type A Lease. Under The New ASU, Damon WouldDocument4 pagesThis Study Resource Was: 1. Damon Is The Lessee in Connection With A Type A Lease. Under The New ASU, Damon WouldDaniella Mae ElipNo ratings yet

- Odi MejiDocument1 pageOdi MejigopuremagicNo ratings yet

- Chilton Flagship Strategies - Presentation - February 2012Document25 pagesChilton Flagship Strategies - Presentation - February 2012ChapersonNo ratings yet

- 9 Steps To Overcome Competition in Retail BusinessDocument3 pages9 Steps To Overcome Competition in Retail BusinessMarina IvanNo ratings yet

- Review For MidtermI Solution 1092Document120 pagesReview For MidtermI Solution 1092C14041159王莫堯No ratings yet

- Carrefour CSRDocument3 pagesCarrefour CSRTapochekNo ratings yet

- A Project Report On IpoDocument36 pagesA Project Report On IpoOm AherNo ratings yet

- 160+ GD Topics For Bank Exams 2022 (With Answers)Document6 pages160+ GD Topics For Bank Exams 2022 (With Answers)udayNo ratings yet

- PAGINA 47 Proceedings Iniic Conference 1 2020Document60 pagesPAGINA 47 Proceedings Iniic Conference 1 2020Leandro TorricelliNo ratings yet

- Cambridge International AS & A Level: Economics 9708/32Document12 pagesCambridge International AS & A Level: Economics 9708/32ayan sajjadNo ratings yet