Professional Documents

Culture Documents

Beneficiary Share JDKDK

Beneficiary Share JDKDK

Uploaded by

Devraj Dash0 ratings0% found this document useful (0 votes)

4 views3 pagesBenkkdjjkdkkd idokdkoodkjo sioeke

Original Title

beneficiary share jdkdk

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBenkkdjjkdkkd idokdkoodkjo sioeke

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views3 pagesBeneficiary Share JDKDK

Beneficiary Share JDKDK

Uploaded by

Devraj DashBenkkdjjkdkkd idokdkoodkjo sioeke

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

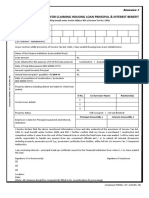

DECLARATION AS TO BENEFICIAL OWNERSHIP

loan amounting to Rs.136217

hereby declare that the deduction in respect of interest on housing

amount Rs. 253783 for the financial year 2021-22

is not claimed by any

and repayment of principal

share in the

other person and I am the 100 % beneficial owner(Please indicate the proportionate

beneficial ownership amongst the Co-owner of the property)

e ( Is04)

Employee Signature

DebrmibaVand 0

Signature of the Co-Owner

Employee Name: Devraj Dash

Date:4th Jan 2022

Employee No: H161845

FORM NO. 12C

See rule 26B]

Form for sending particulars of income under section 192(2B) for

the year ending 31st March, 2022

1.Name and address of the employee Devraj Dash

2.Permanent Account Number AWJPD8433F

3.Residential status India

4.Particulars of income under any head of income other than "salaries"

(Not being a loss under any such head other than the loss under the

head "Income from house property") received in the financial year

Income from house property

(in case of loss, enclose computation thereof as per annexure to form 12C) Rs.(136217)

(ii) Profits and gains of business or profession Rs.

(i) Capital gains Rs

(v) Income from other sources Rs.

a) Interest Rs.

b) Other incomes (specify) Rs.

Rs. TOTAL Rs.(136217)

of sub-items (i) to (iv) of item 4

5. Aggregate

[enclose certificate(s) issued under

section 203]

6. Tax deducted at source

Bangalore e v r

Place

y Jan-202 2 Signature of the employee

Date

Verification the best of my knowledge and

belief.

Dash do hereby declare that what is stated above is true to

I, Devraj , 2022.

Verified today, the un _day of an

e D

Place Bangaloe

Signature of the employee

Date U J a n 2022

Annexure to Form 12C

Details of Loss form House Property: use appropriate column in case employee owns more than one house then other column

can be used.

PARTICULARS PROPERTY 1 PROPERTY 2 PROPERTY 3

SELF-OCCUPIED (LET-OUT) (LET-OUM

| Name of the borrower Devraj Dash

Property situated at with full address including Flat No AG02 Sekhar

District and State. Bellevue, balagere road

Bangalore 560087

Details of Co-borrowers sharein the Property. Debamitra Panda

Whether the Co-borrower is claiming deduction for No

Principal repayment and Interest, if so provide the

details of each Co-borrower's%of claim.

Date of Takingloan 16/08/2016

Date of completion of construction of house | NA

Date of occupancy of house 14/11/2017

Interest payable during the construction period

(1)EMI Interest for 2021-22 136217

253783

(2)EMI Principal for 2021-22

(3) Figures to match with bank's

certificate)

Total interest for 2021-22 136217

If loan is taken before 1st April 1999-30,000/-

Ifloanistaken after 1st April 1999-1,50,000

NA

B-DETAILS REQUIRED WHEN HOUSE IS GIVEN

ON RENT& LOAN IS TAKEN FOR SAME (See Note)

Name of the borrOwer

Property situated at with full address including

District and State.

| Details of Co-borrowers share in the Property._

for

Whether the Co-borrower is claiming deduction

if provide the

Principal repayment and Interest,

so

details of each Co-borrower's % of claim.

Annual Rent received

Less Municipal taxes actually paid like water, Fire,

Cess, Sewage tax

Net Annual Value(NAV)

Less:1. Standard Deduction (30% of NAV)

2. Interest on Borrowed Capital

(Noceiling of 30,000/1,50,000/-.

Taxable Property Income

Note:- Details required when house is rented

(1) Name of the borrower Pe De

(2)Date of taking loan

(3)Annual Rent earned

41ss Municipal taxes paid Employee Signature

99Annual value

You might also like

- Self-Declaration For Claiming Housing Loan Principal & Interest BenefitDocument1 pageSelf-Declaration For Claiming Housing Loan Principal & Interest Benefitinkedin linkedinNo ratings yet

- Self-Declaration For Claiming Housing Loan Principal & Interest Benefit 1Document1 pageSelf-Declaration For Claiming Housing Loan Principal & Interest Benefit 1NAGARAJ M O100% (6)

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- C5 Pact MOU Published Fully Signed 11.9.18Document23 pagesC5 Pact MOU Published Fully Signed 11.9.18Amir AnsariNo ratings yet

- Space Age Furniture Company Case StudyDocument11 pagesSpace Age Furniture Company Case StudySimonNo ratings yet

- INCOME TAX MASTER FILEDocument28 pagesINCOME TAX MASTER FILEDIVYA RANINo ratings yet

- Form12 Sunpetro E87776 Desh Deepak 2023 2024Document1 pageForm12 Sunpetro E87776 Desh Deepak 2023 2024Desh DeepakNo ratings yet

- Form 12BBDocument6 pagesForm 12BBmoin.m.baigNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- 12BB Per Circular 2023-2024Document8 pages12BB Per Circular 2023-2024amer.ms2711No ratings yet

- Housing Loan DeclarationDocument1 pageHousing Loan DeclarationHema GarikapatiNo ratings yet

- Broadband ReiumbursementDocument2 pagesBroadband ReiumbursementAkshay SoniNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- Indian Contract Act Day 1 2 Unit 1Document61 pagesIndian Contract Act Day 1 2 Unit 1Deepak YadavNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- 10033-Abhishek Gautam-2020 1610262699Document2 pages10033-Abhishek Gautam-2020 1610262699Yogendra MishraNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Housing Loan Self DeclarationDocument1 pageHousing Loan Self DeclarationSreenivasa RaoNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument4 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Yearly Rent Receipt For The FY 2022-'23Document1 pageYearly Rent Receipt For The FY 2022-'23Naveen Kumar GadeNo ratings yet

- 1.income Tax Declaration FY 2022-23Document49 pages1.income Tax Declaration FY 2022-23vasant ugaleNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- Annexure III&IIIA-Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA-Form12C&ComputationSheetBhooma Shayan100% (1)

- Declaration For Housing LoanDocument2 pagesDeclaration For Housing LoanjaberyemeniNo ratings yet

- Annexure III&IIIA Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA Form12C&ComputationSheetkalpNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportKabir's World dinoloverNo ratings yet

- DocScanner Feb 3, 2024 19-20Document1 pageDocScanner Feb 3, 2024 19-20Ronak PatelNo ratings yet

- Housing Loan DeclarationDocument1 pageHousing Loan Declarationappsectesting3100% (1)

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Six Digit As Given On Pay SlipDocument4 pagesSix Digit As Given On Pay SlipShahzad DurraniNo ratings yet

- 2022 04 25 15 00 40 TDS Declaration Form For F Y 2022 23Document2 pages2022 04 25 15 00 40 TDS Declaration Form For F Y 2022 23Mayank RanaNo ratings yet

- Form-12BB Format - FY 2023-24Document2 pagesForm-12BB Format - FY 2023-24Sreedhar BodalapalleNo ratings yet

- Annexures (If Applicable)Document7 pagesAnnexures (If Applicable)Santosh TandaleNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- Hba Form11Document3 pagesHba Form11Kamaraj PandianNo ratings yet

- MacroeconomistDocument28 pagesMacroeconomistRaufi MatinNo ratings yet

- Form PDF 927814290281220Document8 pagesForm PDF 927814290281220Project EngineerNo ratings yet

- Key Fact Sheet: DelhiDocument3 pagesKey Fact Sheet: Delhisales.kayteeautoNo ratings yet

- Form 8-200312 - 5 - 03-2012Document6 pagesForm 8-200312 - 5 - 03-2012Bhaskar Siva KumarNo ratings yet

- It Form 12BBDocument4 pagesIt Form 12BBBunty JeeNo ratings yet

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- Test Unit 1 Day I Nature of ContractDocument8 pagesTest Unit 1 Day I Nature of ContractDeepak YadavNo ratings yet

- Annexure SDDocument2 pagesAnnexure SDSAHIL DESAINo ratings yet

- Leases - Practice QuestionsDocument18 pagesLeases - Practice Questionsosama saleemNo ratings yet

- Form PDF 437810230020820Document7 pagesForm PDF 437810230020820Saurya KumarNo ratings yet

- MSME Application Up To Rs.2.00 CRDocument9 pagesMSME Application Up To Rs.2.00 CRsayanNo ratings yet

- Annexure IV Future Investment DeclarationDocument2 pagesAnnexure IV Future Investment DeclarationBhooma Shayan100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document8 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961heenaNo ratings yet

- Return Form - 692429350311221Document6 pagesReturn Form - 692429350311221Santhosh KumarNo ratings yet

- Form12BB FY2122Document3 pagesForm12BB FY2122Anurag pradhanNo ratings yet

- House Rent Allowance (HRA)Document4 pagesHouse Rent Allowance (HRA)jayaprakash.annaladeviNo ratings yet

- Statement of Account - 15!45!10Document3 pagesStatement of Account - 15!45!10Raghav SharmaNo ratings yet

- Form No. Chg-1: English Hindi Form LanguageDocument7 pagesForm No. Chg-1: English Hindi Form LanguageKunal ObhraiNo ratings yet

- Form PDF 108927770310819Document6 pagesForm PDF 108927770310819cchascashcNo ratings yet

- 2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Document2 pages2023 04 25 17 32 23 TDS Declaration Form For FY 2023 24Mayank Rana0% (1)

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

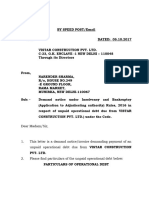

- Demand NoticeDocument5 pagesDemand Noticeg95jyt8hg2No ratings yet

- Royal Traders DRC-03 Dated 12.12.2023 (100800)Document2 pagesRoyal Traders DRC-03 Dated 12.12.2023 (100800)vikenveerNo ratings yet

- My Billionaire Mom 501-600Document605 pagesMy Billionaire Mom 501-600Ayodele DinaNo ratings yet

- Mark Blaug - Economic Theory in Retrospect-Cambridge University Press (1985)Document773 pagesMark Blaug - Economic Theory in Retrospect-Cambridge University Press (1985)Rodolfo Tomás CallesNo ratings yet

- Itinerary AllDocument9 pagesItinerary AllprafullkcNo ratings yet

- July 25, 2022Document77 pagesJuly 25, 2022Debasish DashNo ratings yet

- Impact of Brand Image On Consumers Buying Behaviour A Case Study of Waitrose.Document52 pagesImpact of Brand Image On Consumers Buying Behaviour A Case Study of Waitrose.Vikinguddin Ahmed82% (17)

- Legal Aspects of BusinessDocument14 pagesLegal Aspects of BusinessMEGHANA DIGHENo ratings yet

- 4.1.data Analysis & Findings: Print Vs Digital Media Print in IndiaDocument16 pages4.1.data Analysis & Findings: Print Vs Digital Media Print in IndiaSidNo ratings yet

- MIS Assigment NEWDocument7 pagesMIS Assigment NEWEphrem Belay0% (1)

- GST's Effect On Start-Ups: TOPSIS Approach On Compliances, Cost and Tax FactorsDocument9 pagesGST's Effect On Start-Ups: TOPSIS Approach On Compliances, Cost and Tax FactorsarunNo ratings yet

- Is The U.S. Market in A Bubble?Document2 pagesIs The U.S. Market in A Bubble?Leslie LammersNo ratings yet

- CAPE Financial Accounting Internal Assessment: NAME OF CANDIDATE: Sashane GordonDocument23 pagesCAPE Financial Accounting Internal Assessment: NAME OF CANDIDATE: Sashane GordonSashane Gordon100% (1)

- The Consumer in The European UnionDocument12 pagesThe Consumer in The European UnionLagnajit Ayaskant SahooNo ratings yet

- Sarkozy Sentenced To 3 Years' Jail Over Corruption Pact With JudgeDocument18 pagesSarkozy Sentenced To 3 Years' Jail Over Corruption Pact With JudgeGrafo Bogdanov Novi SadNo ratings yet

- CV Experienced Candidates Sample-3Document2 pagesCV Experienced Candidates Sample-3Rahul RoyNo ratings yet

- Mini Project ReportDocument20 pagesMini Project ReportBhumika MittapelliNo ratings yet

- Profiles: Prospects For Coal and Clean Coal Technologies in IndonesiaDocument2 pagesProfiles: Prospects For Coal and Clean Coal Technologies in IndonesiayansenbarusNo ratings yet

- Kumar Saurabh Singh: Professional ExperienceDocument3 pagesKumar Saurabh Singh: Professional ExperienceSaurabh RaghuvanshiNo ratings yet

- On January 1 2012 Travers Company Acquired 90 Percent ofDocument1 pageOn January 1 2012 Travers Company Acquired 90 Percent ofAmit PandeyNo ratings yet

- IC Kickoff Presentation 11167 - PowerPointDocument11 pagesIC Kickoff Presentation 11167 - PowerPointLOGAN_70No ratings yet

- 002 HSE Manual Rev A - 29.9.2.2017Document234 pages002 HSE Manual Rev A - 29.9.2.2017umesh kumarNo ratings yet

- Pabahay Bonanza: Philippine National Bank As of September 30, 2009Document80 pagesPabahay Bonanza: Philippine National Bank As of September 30, 2009ramonlucas700No ratings yet

- List of VN Establishments To Korea 6.2016Document119 pagesList of VN Establishments To Korea 6.2016Thảo Pallet NhựaNo ratings yet

- IGCSE Business 3 TestDocument2 pagesIGCSE Business 3 TestAda heeseungNo ratings yet

- Usha Martin Limited: Unravelling The Vertical Integration StrategyDocument14 pagesUsha Martin Limited: Unravelling The Vertical Integration Strategykavyashreenitin100% (1)

- C5Document31 pagesC5kouider100% (1)

- LPT - PPT Program LineDocument12 pagesLPT - PPT Program LineaaaelsayesNo ratings yet

- M. Ramalakshmi Reddi v. CIT (1998) 232 ITR 281Document8 pagesM. Ramalakshmi Reddi v. CIT (1998) 232 ITR 281Sahal ShajahanNo ratings yet

- E-Payslip Admin. - 1561198Document2 pagesE-Payslip Admin. - 1561198xkr5f7wyt2No ratings yet