Professional Documents

Culture Documents

Alhabib Woman Islamic Asaan Savings Account

Alhabib Woman Islamic Asaan Savings Account

Uploaded by

professional.ca728Copyright:

Available Formats

You might also like

- Mt103 Home Energy 280221Document2 pagesMt103 Home Energy 280221ismail saltan100% (2)

- Bins Dump ListDocument36 pagesBins Dump ListEsteban Camilo Ortiz Zambrano0% (1)

- Base N PV Model Documentation V 502Document66 pagesBase N PV Model Documentation V 502Cinecan BooksNo ratings yet

- Payment Information Account Summary: March 9 20Document3 pagesPayment Information Account Summary: March 9 20Mark Williams100% (2)

- Aviz de Refuz La PlataDocument1 pageAviz de Refuz La PlataMihail LiahNo ratings yet

- Key Fact Sheet For Islamic Digital AccountDocument7 pagesKey Fact Sheet For Islamic Digital Accountwaqas wattooNo ratings yet

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocument3 pagesKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamNo ratings yet

- Mahana MunafaDocument2 pagesMahana Munafaalimurtaza6582No ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- KFS HBL Conventional Current Account - July 2023Document6 pagesKFS HBL Conventional Current Account - July 2023M. MUNEEB UR REHMANNo ratings yet

- BOP Asaan Current AccountDocument2 pagesBOP Asaan Current AccountAhmad CssNo ratings yet

- Key Fact Statement For Deposit Products: Account Types & Salient FeaturesDocument3 pagesKey Fact Statement For Deposit Products: Account Types & Salient FeaturesHassan AhmadNo ratings yet

- KFS HBL Conventional Current Account-07-Nov-2022Document6 pagesKFS HBL Conventional Current Account-07-Nov-2022Faique MemonNo ratings yet

- KFS HBL Conventional Saving Account 28-12-2023Document6 pagesKFS HBL Conventional Saving Account 28-12-2023Awais PanhwarNo ratings yet

- Woman Savings Account KFSDocument2 pagesWoman Savings Account KFSQ Trade DistributorsNo ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- Product Features and Applicable ChargesDocument4 pagesProduct Features and Applicable ChargesDesignNo ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July To DecemberDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July To DecemberAftab AhmedNo ratings yet

- BOP NAAZ (Current Account)Document2 pagesBOP NAAZ (Current Account)umerbashir743No ratings yet

- KFS HBL Islamic Basic Banking Account - Jul 19Document1 pageKFS HBL Islamic Basic Banking Account - Jul 19M-Waseem AnsariNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- KFS LCY Saving Accounts Individuals and Entities 01Document3 pagesKFS LCY Saving Accounts Individuals and Entities 01Mysterious PerformerNo ratings yet

- Annexure BDocument3 pagesAnnexure BMayapur CommunicationNo ratings yet

- SOB Indus PartnerDocument2 pagesSOB Indus Partnerrajprince26460No ratings yet

- Corporate Tariff and Charges: HSBC UaeDocument23 pagesCorporate Tariff and Charges: HSBC UaeqweeeNo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- KFS HBL Al-Irtifa Account - Jul 19Document1 pageKFS HBL Al-Irtifa Account - Jul 19M-Waseem AnsariNo ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- Income Distribution - Month Ended June 30, 2019Document1 pageIncome Distribution - Month Ended June 30, 2019Prince KhalilNo ratings yet

- KFS MdaDocument2 pagesKFS MdaMohsinNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Business - Account Services: Minimum Average Credit BalanceDocument6 pagesBusiness - Account Services: Minimum Average Credit BalanceSameer NooraniNo ratings yet

- Priority Banking Soc Con Nov 2019Document1 pagePriority Banking Soc Con Nov 2019sundarkspNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Tariff List: Category Tariff Products Category TariffDocument1 pageTariff List: Category Tariff Products Category TariffsrajkrishnaNo ratings yet

- Service Charges: An Easy Guide To Banking FeesDocument24 pagesService Charges: An Easy Guide To Banking FeesolimNo ratings yet

- Mercantile Bank Consolidated Pricing Guide - 11march2022Document5 pagesMercantile Bank Consolidated Pricing Guide - 11march2022sipho5mlnNo ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Personal Banking TariffDocument14 pagesPersonal Banking TariffMohamed SeifNo ratings yet

- MyMoBiz Account Pricing Guide 2023Document6 pagesMyMoBiz Account Pricing Guide 2023gadlampumeNo ratings yet

- HSBC Qatar - Personal Banking TariffDocument16 pagesHSBC Qatar - Personal Banking TariffjoeNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July 2019 PDFDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July 2019 PDFBaD cHaUhDrYNo ratings yet

- Current AccountsDocument3 pagesCurrent Accountssyllahassane01No ratings yet

- Minimum Disclosure of Bank Fees and Charges 2021Document1 pageMinimum Disclosure of Bank Fees and Charges 2021Bahati RaphaelNo ratings yet

- Regular Salary AccountDocument3 pagesRegular Salary AccountPrashant KumarNo ratings yet

- Premier TariffDocument13 pagesPremier TariffMohamed SeifNo ratings yet

- AL Habib Mahana Munafa Key FactDocument2 pagesAL Habib Mahana Munafa Key FactAmir Mehmood AbbasiNo ratings yet

- ADC (Alternate Delivery Channel) : Bank AL Habib LimitedDocument9 pagesADC (Alternate Delivery Channel) : Bank AL Habib LimitedZainab RiazNo ratings yet

- KFS HBL Conventional Current AccountDocument6 pagesKFS HBL Conventional Current AccountMillat AfridiNo ratings yet

- CDRD Revised Tariff Guide 2020Document11 pagesCDRD Revised Tariff Guide 2020Atlas Microfinance LtdNo ratings yet

- Cash Transaction Charges For Savings Account HoldersDocument6 pagesCash Transaction Charges For Savings Account HoldersMaheshkumar AmulaNo ratings yet

- Updated MD TARRIFS A2 Amendments March 24thDocument1 pageUpdated MD TARRIFS A2 Amendments March 24thjustas kombaNo ratings yet

- Product-Features-and-Applicable - Charges-AL Habib-RDADocument4 pagesProduct-Features-and-Applicable - Charges-AL Habib-RDAmaroof mNo ratings yet

- YCADocument3 pagesYCAmuneebghouri13No ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- HSBC Qatar - Premier TariffDocument16 pagesHSBC Qatar - Premier TariffjoeNo ratings yet

- Deposit Accounts & Services For Individuals: Deposits GuideDocument23 pagesDeposit Accounts & Services For Individuals: Deposits GuideshubhraNo ratings yet

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- عسکری بینکDocument39 pagesعسکری بینکNain TechnicalNo ratings yet

- Schedule of Charges For Retail Customers (Effective From 1 JULY 2016)Document3 pagesSchedule of Charges For Retail Customers (Effective From 1 JULY 2016)atulNo ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Built-In Functions - Python 3.11.2 DocumentationDocument26 pagesBuilt-In Functions - Python 3.11.2 Documentationprofessional.ca728No ratings yet

- 9-Market VarDocument4 pages9-Market Varprofessional.ca728No ratings yet

- @PO Taken ATP Standard Costing N Variance Analysis - Pgs.40Document40 pages@PO Taken ATP Standard Costing N Variance Analysis - Pgs.40professional.ca728No ratings yet

- EducationTrainingScheme 05sep18Document79 pagesEducationTrainingScheme 05sep18professional.ca728No ratings yet

- ImportantDecisions285 CouncilMeetingDocument3 pagesImportantDecisions285 CouncilMeetingprofessional.ca728No ratings yet

- Ifrs 2019 - Practice StatementsDocument58 pagesIfrs 2019 - Practice Statementsprofessional.ca728No ratings yet

- UntitledDocument3 pagesUntitledprofessional.ca728No ratings yet

- Volume XXVI of Selected OpinionsDocument70 pagesVolume XXVI of Selected Opinionsprofessional.ca728No ratings yet

- Fresh Health Declaration Form (NEW) - 004Document2 pagesFresh Health Declaration Form (NEW) - 004professional.ca728No ratings yet

- Handout - IsAE 3402Document9 pagesHandout - IsAE 3402professional.ca728No ratings yet

- Orca Share Media1578971459500Document2 pagesOrca Share Media1578971459500Tin TinNo ratings yet

- New Customer-Protection Measures On Cards For Electronic PaymentsDocument8 pagesNew Customer-Protection Measures On Cards For Electronic PaymentsAvula Shravan YadavNo ratings yet

- Ferrel L. Agard,: DebtorDocument20 pagesFerrel L. Agard,: DebtorJfresearch06100% (1)

- Role of Banks in The Development of Indian Economy: Prof. Jagdeep KumariDocument4 pagesRole of Banks in The Development of Indian Economy: Prof. Jagdeep KumariJOEL JOHNNo ratings yet

- International Finance - Monetary SystemsDocument44 pagesInternational Finance - Monetary Systemsassem mohamedNo ratings yet

- HDFC Apr To As On DateDocument10 pagesHDFC Apr To As On DatePDRK BABIUNo ratings yet

- Import FinancingDocument11 pagesImport FinancingDheeraj rawatNo ratings yet

- English MortgageDocument2 pagesEnglish MortgageManali Jain100% (1)

- CHP 11 Discussion Questions HandwriteDocument2 pagesCHP 11 Discussion Questions HandwriteAnatasyaOktavianiHandriatiTataNo ratings yet

- SExam2 PDFDocument4 pagesSExam2 PDFdicheyaNo ratings yet

- Mishkin CH 15Document21 pagesMishkin CH 15YenNo ratings yet

- Account Statement 011121 241122Document57 pagesAccount Statement 011121 241122Sandeep KumarNo ratings yet

- A Reflection On The Global Capital MarketDocument1 pageA Reflection On The Global Capital MarketJaycel BayronNo ratings yet

- How Can Financial Innovations Lead To Financial CrisisDocument4 pagesHow Can Financial Innovations Lead To Financial CrisisAdeel Khan50% (2)

- Chapter 1,2,3Document35 pagesChapter 1,2,3bj_raj064No ratings yet

- 97530200000452Document75 pages97530200000452bagore nileshNo ratings yet

- Digital Payments JUNE 2022Document10 pagesDigital Payments JUNE 2022Rajni KumariNo ratings yet

- Intermediate Accounting 1 - Cash Straight ProblemsDocument3 pagesIntermediate Accounting 1 - Cash Straight ProblemsCzarhiena SantiagoNo ratings yet

- Cash Reserve RatioDocument6 pagesCash Reserve RatioAmitesh RoyNo ratings yet

- CI QuestioDocument46 pagesCI QuestioRajendra KumarNo ratings yet

- Investment Banking - Lecture-1 (08 09 2014)Document26 pagesInvestment Banking - Lecture-1 (08 09 2014)alibettaniNo ratings yet

- Revised Chapter 4Document21 pagesRevised Chapter 4kellydaNo ratings yet

- MBAD511 Term PaperDocument3 pagesMBAD511 Term PaperelizabethNo ratings yet

- Icici Bank ScamDocument2 pagesIcici Bank ScamriyaNo ratings yet

- IndyMac OneWest Why They Do Not Do Loan ModificationsDocument9 pagesIndyMac OneWest Why They Do Not Do Loan Modificationstraderash1020No ratings yet

Alhabib Woman Islamic Asaan Savings Account

Alhabib Woman Islamic Asaan Savings Account

Uploaded by

professional.ca728Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alhabib Woman Islamic Asaan Savings Account

Alhabib Woman Islamic Asaan Savings Account

Uploaded by

professional.ca728Copyright:

Available Formats

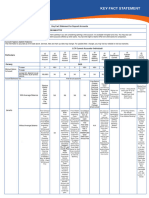

Key Fact Statement (KFS) for Deposit Accounts

BANK AL HABIB LTD Date

__________ branch IMPORTANT: Read this document carefully if you are considering opening a new account. It is available in English and Urdu. You may also use

this document to compare different accounts offered by other banks. You have the right to receive KFS from other banks for comparison.

Account Types & Salient Features: AL Habib Woman Islamic Asaan Savings Account

This information is accurate as of the date above. Services, fees and profit rates may change on Monthly basis. For updated fees/charges, you may visit our website at

www.bankalhabib.com or visit our branches.

Bank AL Habib Woman Islamic Asaan Saving Account is a complete banking solution catering the financial needs of Woman.All you need is your CNIC to start banking with us

and enjoy a host of value-added services.

• Free PayPak Debit Card (Issuance Only)* • Free Internet and Mobile Banking • Deposit are accepted on the basis of Mudarabah

• Free e-statements • Banker's Cheques / Pay Orders Facility • Free Intercity Online Transactions

• Free Life Takaful** • SMS Alert Facility • Free First Cheque Book (10 Leaves)

• Monthly profit payout • Profit calculated on monthly average balance

• Total Debits per Month: Rs. 1,000,000/- • Total Credit Balance Limit: Rs. 1,000,000/-

* Bank AL Habib PayPak card is free (issuance/annual/renewal) debit card being offered on maintaining monthly average balance of Rs. 25,000/-, however you may opt for a Visa

and UnionPay card. Terms & conditions apply.

**Free Life Takaful Coverage for customer with following eligibility criteria:

• New Accounts Eligible after 30 Days of Opening of Account • Claims Payable on the basis of 90 Days of average Balance in Customer Account

• Maximum Payable on the Natural Death / Permanent Disability PKR 2 Million • Maximum Payable on the Accidental Death PKR 4 Million

• In Case of Joint Account, Any One of the Account-holders will be covered • Age Limit- 18 to 60 Years

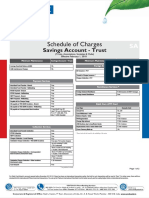

Note: Islamic Banking

Particulars

AL Habib Woman Islamic Asaan Savings Account

Currency PKR

Minimum Balance for To open 0

Account To keep 0

Account Maintenance Fee 0

Is Profit Paid on account

Yes

Subject to the applicable tax rate

Indicative Profit Rate. (%) Expected 15.75%

Profit Payment Frequency Monthly

Monthly Avg Bal: PKR 1,000

Provide example:

Monthly Profit: PKR.13.125

Total Debit

PKR 1,000,000/- Monthly

Balance Limit

Total Credit

PKR 1,000,000/-

Balance Limit

Free Life Takaful Yes

Service Charges

IMPORTANT: This is a list of the main service charges for this account. It does not include all charges. You can find a full list at our branches, on our website at

www.bankalhabib.com. Please note that all bank charges are exclusive of applicable taxes.

Islamic Banking

Services Modes

AL Habib Woman Islamic Asaan Savings Account

Intercity 0

Intra-city 0

Cash Transaction

Own ATM withdrawal 0

Other Bank ATM PKR 23.44

ADC/Digital -

SMS Alerts Monthly

Clearing

(without FED) PKR 120 / month

For other transactions

Visa Silver PKR1,700

Visa Gold PKR 2,500

Debit Cards

Visa Platinum PKR 5,200

(Issuance & Annual charges)

UnionPay PKR 1,600

Paypak 0 (Issuance Only)

Issuance 0 – First Cheque book (10 leaves only)

Cheque Book Stop payment PKR 600 per instruction

Cheque Book

Loose cheque PKR 50/cheque

Islamic Banking

Services Modes

AL Habib Woman Islamic Asaan Savings Account

Rs. 350/PO (No charges for making Banker's Cheque / DD/ any other related instrument for payment of fee/dues in favor

Remittance (Local) Banker Cheque / Pay Order

of educational institutions, HEC/Board etc.)

USD 18 plus bank charges. Additional 0.5% or minimum $3 will be applicable, if the differential amount that is to be

Foreign Demand Draft

Remittance remitted is not maintained with the Bank for minimum period of 15 days.

Foreign stop payment of FDD/FTT US$ 6 plus drawee bank charges at actual

Wire Transfer -

Annual 0

Half Yearly 0

Statement of Statement of A/c upto 6 Months PKR 35

Account Duplicate

Statement of A/c Above 6 months Additional PKR 35 per 6 months

E-Statements (Monthly) 0

Free IBFT - Upto Rs. 25,000/- per month / per account. For additional amount above Rs. 25,000/- per month / per

ADC/Digital Channels

Fund Transfer account, 0.1% of the transaction amount or Rs. 200, whichever is lower will be charge

Others 0

Internet Banking subscription 0

Digital Banking

Mobile Banking subscription 0

Normal 0

Clearing Intercity PKR 300

Same Day PKR 500 Flat

Closure of Account Customer request 0

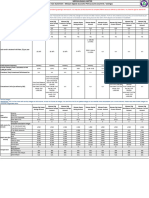

You Must Know

Requirements to open an account: To open the account you will need to satisfy some identification requirements

Unclaimed Deposits: In terms of Section 31 of Banking

as per regulatory instructions and banks' internal policies. These may include providing documents and information

Companies Ordinance, 1962 all deposits which have not been

to verify your identity. Such information may be required on a periodic basis. Please ask us for more details.

operated during the period of last ten years, except deposits in

the name of a minor or a Government or a court of law, are

Cheque Bounce: Dishonoring of cheques is subject to a criminal trial in Pakistan under Pakistan Penal Code,

1860. Accordingly, you should be writing cheques with utmost prudence. surrendered to State Bank of Pakistan (SBP) by the relevant

Safe Custody: You are requested to do not share any personal information such as: Birth, mother’s maiden name,

banks, after meeting the conditions as per provisions of law. The

surrendered deposits can be claimed through the respective

Internet/Mobile Banking user ID & passwords, One Time Passwords, TPIN, Debit/Credit card number, PIN and

banks. For further information, please contact your relationship

CVV. In case you receive such email, please do not respond. Instead, we would appreciate it if you report these

emails/SMS at info@bankalhabib.com branch.

Closing this account: In order to close your account, kindly

Record updating: Always keep profiles/records updated with the bank to avoid missing any significant

communication. You can visit your relationship branch to update your information. visit your Relationship Branch

How can you get assistance or make a complaint?

What happens if you do not use this account for a long period? If your account remains inoperative for 12

months, it will be treated as dormant. You have to reactivate your account. Bank AL Habib Limited,

Customer Services Division (CSD),

Plot # 28-C, Lane 3, Bukhari Commercial,

2nd, 3rd & 4th Floor, Khayaban-e-Bukhari Branch,

Phase VI, DHA Karachi.

(021) 35171784-89

(021) 35243591

Helpline: (021) 111-014-014

Email: feedback@bankalhabib.com/info@bankalhabib.com

Website: www.bankalhabib.com

I ACKNOWLEDGE RECEIVING AND UNDERSTAND THIS KEY FACT STATEMENT

Customer Name: Date:

Product Chosen:

Mandate of account: Single/Joint/Either or Survivor

Address

Contact No.: Mobile No. Email Address

Customer Signature Signature Verified

Customer Signature

(Secondary-Incase of Joint Signature Verified

Account)

You might also like

- Mt103 Home Energy 280221Document2 pagesMt103 Home Energy 280221ismail saltan100% (2)

- Bins Dump ListDocument36 pagesBins Dump ListEsteban Camilo Ortiz Zambrano0% (1)

- Base N PV Model Documentation V 502Document66 pagesBase N PV Model Documentation V 502Cinecan BooksNo ratings yet

- Payment Information Account Summary: March 9 20Document3 pagesPayment Information Account Summary: March 9 20Mark Williams100% (2)

- Aviz de Refuz La PlataDocument1 pageAviz de Refuz La PlataMihail LiahNo ratings yet

- Key Fact Sheet For Islamic Digital AccountDocument7 pagesKey Fact Sheet For Islamic Digital Accountwaqas wattooNo ratings yet

- Key Facts Sheet Asaan Digital Account (Ada) Islamic CurrentDocument3 pagesKey Facts Sheet Asaan Digital Account (Ada) Islamic CurrentAmira AslamNo ratings yet

- Mahana MunafaDocument2 pagesMahana Munafaalimurtaza6582No ratings yet

- MCB Young Key Fact SheetDocument3 pagesMCB Young Key Fact SheetFahad MagsiNo ratings yet

- KFS HBL Conventional Current Account - July 2023Document6 pagesKFS HBL Conventional Current Account - July 2023M. MUNEEB UR REHMANNo ratings yet

- BOP Asaan Current AccountDocument2 pagesBOP Asaan Current AccountAhmad CssNo ratings yet

- Key Fact Statement For Deposit Products: Account Types & Salient FeaturesDocument3 pagesKey Fact Statement For Deposit Products: Account Types & Salient FeaturesHassan AhmadNo ratings yet

- KFS HBL Conventional Current Account-07-Nov-2022Document6 pagesKFS HBL Conventional Current Account-07-Nov-2022Faique MemonNo ratings yet

- KFS HBL Conventional Saving Account 28-12-2023Document6 pagesKFS HBL Conventional Saving Account 28-12-2023Awais PanhwarNo ratings yet

- Woman Savings Account KFSDocument2 pagesWoman Savings Account KFSQ Trade DistributorsNo ratings yet

- 141121120000AMIOP Key Fact Current Accounts ConvDocument5 pages141121120000AMIOP Key Fact Current Accounts Convdesignify101No ratings yet

- Product Features and Applicable ChargesDocument4 pagesProduct Features and Applicable ChargesDesignNo ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July To DecemberDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July To DecemberAftab AhmedNo ratings yet

- BOP NAAZ (Current Account)Document2 pagesBOP NAAZ (Current Account)umerbashir743No ratings yet

- KFS HBL Islamic Basic Banking Account - Jul 19Document1 pageKFS HBL Islamic Basic Banking Account - Jul 19M-Waseem AnsariNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- KFS LCY Saving Accounts Individuals and Entities 01Document3 pagesKFS LCY Saving Accounts Individuals and Entities 01Mysterious PerformerNo ratings yet

- Annexure BDocument3 pagesAnnexure BMayapur CommunicationNo ratings yet

- SOB Indus PartnerDocument2 pagesSOB Indus Partnerrajprince26460No ratings yet

- Corporate Tariff and Charges: HSBC UaeDocument23 pagesCorporate Tariff and Charges: HSBC UaeqweeeNo ratings yet

- Key Fact Statement For Deposit Accounts: UBL Freelance Digital AccountDocument1 pageKey Fact Statement For Deposit Accounts: UBL Freelance Digital AccountZainabNo ratings yet

- KFS HBL Al-Irtifa Account - Jul 19Document1 pageKFS HBL Al-Irtifa Account - Jul 19M-Waseem AnsariNo ratings yet

- Deposit Accounts GCo Key Fact Statement EnglishDocument5 pagesDeposit Accounts GCo Key Fact Statement EnglishAyaan AhmedNo ratings yet

- Income Distribution - Month Ended June 30, 2019Document1 pageIncome Distribution - Month Ended June 30, 2019Prince KhalilNo ratings yet

- KFS MdaDocument2 pagesKFS MdaMohsinNo ratings yet

- IDFC Startup NewBusinessCA SOCDocument2 pagesIDFC Startup NewBusinessCA SOCdhruvsaidavaNo ratings yet

- Business - Account Services: Minimum Average Credit BalanceDocument6 pagesBusiness - Account Services: Minimum Average Credit BalanceSameer NooraniNo ratings yet

- Priority Banking Soc Con Nov 2019Document1 pagePriority Banking Soc Con Nov 2019sundarkspNo ratings yet

- Indus Business Account SOC 30.07.2020Document1 pageIndus Business Account SOC 30.07.2020Rameshchandra SolankiNo ratings yet

- Tariff List: Category Tariff Products Category TariffDocument1 pageTariff List: Category Tariff Products Category TariffsrajkrishnaNo ratings yet

- Service Charges: An Easy Guide To Banking FeesDocument24 pagesService Charges: An Easy Guide To Banking FeesolimNo ratings yet

- Mercantile Bank Consolidated Pricing Guide - 11march2022Document5 pagesMercantile Bank Consolidated Pricing Guide - 11march2022sipho5mlnNo ratings yet

- Service Charges - BoB - As On 6.11.17Document63 pagesService Charges - BoB - As On 6.11.17Praneta pandeyNo ratings yet

- Personal Banking TariffDocument14 pagesPersonal Banking TariffMohamed SeifNo ratings yet

- MyMoBiz Account Pricing Guide 2023Document6 pagesMyMoBiz Account Pricing Guide 2023gadlampumeNo ratings yet

- HSBC Qatar - Personal Banking TariffDocument16 pagesHSBC Qatar - Personal Banking TariffjoeNo ratings yet

- Key Fact Sheet (HBL FreedomAccount) - July 2019 PDFDocument1 pageKey Fact Sheet (HBL FreedomAccount) - July 2019 PDFBaD cHaUhDrYNo ratings yet

- Current AccountsDocument3 pagesCurrent Accountssyllahassane01No ratings yet

- Minimum Disclosure of Bank Fees and Charges 2021Document1 pageMinimum Disclosure of Bank Fees and Charges 2021Bahati RaphaelNo ratings yet

- Regular Salary AccountDocument3 pagesRegular Salary AccountPrashant KumarNo ratings yet

- Premier TariffDocument13 pagesPremier TariffMohamed SeifNo ratings yet

- AL Habib Mahana Munafa Key FactDocument2 pagesAL Habib Mahana Munafa Key FactAmir Mehmood AbbasiNo ratings yet

- ADC (Alternate Delivery Channel) : Bank AL Habib LimitedDocument9 pagesADC (Alternate Delivery Channel) : Bank AL Habib LimitedZainab RiazNo ratings yet

- KFS HBL Conventional Current AccountDocument6 pagesKFS HBL Conventional Current AccountMillat AfridiNo ratings yet

- CDRD Revised Tariff Guide 2020Document11 pagesCDRD Revised Tariff Guide 2020Atlas Microfinance LtdNo ratings yet

- Cash Transaction Charges For Savings Account HoldersDocument6 pagesCash Transaction Charges For Savings Account HoldersMaheshkumar AmulaNo ratings yet

- Updated MD TARRIFS A2 Amendments March 24thDocument1 pageUpdated MD TARRIFS A2 Amendments March 24thjustas kombaNo ratings yet

- Product-Features-and-Applicable - Charges-AL Habib-RDADocument4 pagesProduct-Features-and-Applicable - Charges-AL Habib-RDAmaroof mNo ratings yet

- YCADocument3 pagesYCAmuneebghouri13No ratings yet

- Service Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Document3 pagesService Charges and Fees of Current Account Business Privilege (CAPBG) 01102020Mukunda MukundaNo ratings yet

- HSBC Qatar - Premier TariffDocument16 pagesHSBC Qatar - Premier TariffjoeNo ratings yet

- Deposit Accounts & Services For Individuals: Deposits GuideDocument23 pagesDeposit Accounts & Services For Individuals: Deposits GuideshubhraNo ratings yet

- Au Digital Savings Account - 31 - MarchDocument5 pagesAu Digital Savings Account - 31 - MarchZach KingNo ratings yet

- Indus Freedom February2017Document1 pageIndus Freedom February2017HeartKiller LaxmanNo ratings yet

- عسکری بینکDocument39 pagesعسکری بینکNain TechnicalNo ratings yet

- Schedule of Charges For Retail Customers (Effective From 1 JULY 2016)Document3 pagesSchedule of Charges For Retail Customers (Effective From 1 JULY 2016)atulNo ratings yet

- KFS HBL Islamic Saving Account Bilingual June22Document4 pagesKFS HBL Islamic Saving Account Bilingual June22Tatheer ZeeshanNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Built-In Functions - Python 3.11.2 DocumentationDocument26 pagesBuilt-In Functions - Python 3.11.2 Documentationprofessional.ca728No ratings yet

- 9-Market VarDocument4 pages9-Market Varprofessional.ca728No ratings yet

- @PO Taken ATP Standard Costing N Variance Analysis - Pgs.40Document40 pages@PO Taken ATP Standard Costing N Variance Analysis - Pgs.40professional.ca728No ratings yet

- EducationTrainingScheme 05sep18Document79 pagesEducationTrainingScheme 05sep18professional.ca728No ratings yet

- ImportantDecisions285 CouncilMeetingDocument3 pagesImportantDecisions285 CouncilMeetingprofessional.ca728No ratings yet

- Ifrs 2019 - Practice StatementsDocument58 pagesIfrs 2019 - Practice Statementsprofessional.ca728No ratings yet

- UntitledDocument3 pagesUntitledprofessional.ca728No ratings yet

- Volume XXVI of Selected OpinionsDocument70 pagesVolume XXVI of Selected Opinionsprofessional.ca728No ratings yet

- Fresh Health Declaration Form (NEW) - 004Document2 pagesFresh Health Declaration Form (NEW) - 004professional.ca728No ratings yet

- Handout - IsAE 3402Document9 pagesHandout - IsAE 3402professional.ca728No ratings yet

- Orca Share Media1578971459500Document2 pagesOrca Share Media1578971459500Tin TinNo ratings yet

- New Customer-Protection Measures On Cards For Electronic PaymentsDocument8 pagesNew Customer-Protection Measures On Cards For Electronic PaymentsAvula Shravan YadavNo ratings yet

- Ferrel L. Agard,: DebtorDocument20 pagesFerrel L. Agard,: DebtorJfresearch06100% (1)

- Role of Banks in The Development of Indian Economy: Prof. Jagdeep KumariDocument4 pagesRole of Banks in The Development of Indian Economy: Prof. Jagdeep KumariJOEL JOHNNo ratings yet

- International Finance - Monetary SystemsDocument44 pagesInternational Finance - Monetary Systemsassem mohamedNo ratings yet

- HDFC Apr To As On DateDocument10 pagesHDFC Apr To As On DatePDRK BABIUNo ratings yet

- Import FinancingDocument11 pagesImport FinancingDheeraj rawatNo ratings yet

- English MortgageDocument2 pagesEnglish MortgageManali Jain100% (1)

- CHP 11 Discussion Questions HandwriteDocument2 pagesCHP 11 Discussion Questions HandwriteAnatasyaOktavianiHandriatiTataNo ratings yet

- SExam2 PDFDocument4 pagesSExam2 PDFdicheyaNo ratings yet

- Mishkin CH 15Document21 pagesMishkin CH 15YenNo ratings yet

- Account Statement 011121 241122Document57 pagesAccount Statement 011121 241122Sandeep KumarNo ratings yet

- A Reflection On The Global Capital MarketDocument1 pageA Reflection On The Global Capital MarketJaycel BayronNo ratings yet

- How Can Financial Innovations Lead To Financial CrisisDocument4 pagesHow Can Financial Innovations Lead To Financial CrisisAdeel Khan50% (2)

- Chapter 1,2,3Document35 pagesChapter 1,2,3bj_raj064No ratings yet

- 97530200000452Document75 pages97530200000452bagore nileshNo ratings yet

- Digital Payments JUNE 2022Document10 pagesDigital Payments JUNE 2022Rajni KumariNo ratings yet

- Intermediate Accounting 1 - Cash Straight ProblemsDocument3 pagesIntermediate Accounting 1 - Cash Straight ProblemsCzarhiena SantiagoNo ratings yet

- Cash Reserve RatioDocument6 pagesCash Reserve RatioAmitesh RoyNo ratings yet

- CI QuestioDocument46 pagesCI QuestioRajendra KumarNo ratings yet

- Investment Banking - Lecture-1 (08 09 2014)Document26 pagesInvestment Banking - Lecture-1 (08 09 2014)alibettaniNo ratings yet

- Revised Chapter 4Document21 pagesRevised Chapter 4kellydaNo ratings yet

- MBAD511 Term PaperDocument3 pagesMBAD511 Term PaperelizabethNo ratings yet

- Icici Bank ScamDocument2 pagesIcici Bank ScamriyaNo ratings yet

- IndyMac OneWest Why They Do Not Do Loan ModificationsDocument9 pagesIndyMac OneWest Why They Do Not Do Loan Modificationstraderash1020No ratings yet