Professional Documents

Culture Documents

Nismxxxxa

Nismxxxxa

Uploaded by

vejruiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nismxxxxa

Nismxxxxa

Uploaded by

vejruiCopyright:

Available Formats

Everything you need to prepare & quikly pass the exams Over 8,000 + satisfied students

GET THE MOST IMPORTANT Q & A WITH EXPLANATIONS TO CLEAR THE EXAMS EASILY.

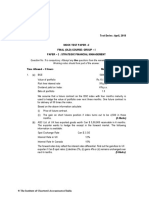

NISM-Series-XXI -A: Portfolio Management (PMS) Mock Test - Demo

Q 1. Identify the TRUE statement with respect to the 'Psychographic Analysis' of investors? A. As per Bailard, Biehl and

Kaiser (BB&K) model, an investor broadly belongs to one of the five types of investor categories B. Due to extraneous

factors, an investor can sometime display behaviours other than his normal type

Only A is true

Only B is true

Both A and B are true

Neither A nor B is true

Q 2. The investment objective of Mr. Sundar is to have a regular income. He approaches a PMS firm for this purpose.

Among the given four choices, which will be the preferred choice of the portfolio manager?

New IPO's

Dividend paying equity shares

Zero coupon bonds

Small and Mid cap equity shares

Q 3. An investor has deposited Rs 50 lakhs with a fund manager. Out of this, only Rs. 35 lakhs was invested and this

earned Rs. 3,40,000. How much return did the investor effectively earn?

9.71%

8.33%

6.8%

5.7%

Q 4. Mr. Suresh wants to invest in long term corporate bonds as they are giving higher returns. However his portfolio

manager is of a strong belief that inflation and interest rates will be on a rise for the next 2-3 years. Which of these

is/are valid arguments to convince Mr. Suresh not to invest in long term corporate bonds?

Due to rising inflation, the profitability of corporates may be negatively affected leading to corporate default

The bond prices and market interest rates are inversely related

Both of the above

None of the above

Q 5. Mr. Mehta's initial contribution is Rs. 2 crores which then rises to Rs. 2 crores 30 lakhs in the first year. Therefore, a

performance fee will be payable on Rs. 30 lakhs. Is this statement True or False?

True

False

Q 6. __________ is the entity which holds the funds and securities of large clients such as banks.

Portfolio Manager

Custodian

Depository

Fund Manager

Q 7. A PMS firm has suddenly found that there is a shortage of working capital funds. From the options given below, which

will be most acceptable?

The PMS firm should borrow for short term from a commercial bank by pledging the securities of the client

The PMS firm should use the common pool of client’s funds in a scheduled commercial bank

The PMS firm should charge the client under PMS fees and reduce the distributions to be made to the client

The PMS firm should borrow from a commercial bank for short term

Q 8. The SEBI Fraudulent and Unfair Trade Practices Regulations prohibit a person to, directly or indirectly _________

securities in a fraudulent manner.

Buy

Sell

Deal

All of the above

Q 9. If there is an uncertainty with respect to the future payment, the investor would require return more than the nominal

required rate of return. The additional component is called ________.

Alpha

Risk free rate of return

Risk premium

Both Alpha and Risk free rate of return

Q Offer for sale (OFS) is method of share sale for ________ .

10.

listed companies

unlisted companies

startups

All of the above

Submit

Passing Guarantee

Clear your exams in first attempt.

Save time & money.

Over 5300 satisfied students.

Testimonials

9th April '24 - Dear Team Pass4Sure, I passed NISM XXI A PMS Distributor exam on 31.....

Anupam Verma - Noida - UP

Feed Back / Query form

Enter Your Name

Enter Email Id

Feedback

Code

2333

SUBMIT

PASS4SURE

Rated 4.7/ 5 based on 8371 Reviews.

Home (/) Login (/register.aspx) About Us (/about_us.aspx) WorkBooks (/workbook/)

How to Enroll at NISM (/pdf/how_to_enroll_at_nism.pdf) FAQ (/faq.aspx) Sitemap (/sitemap.xml)

Contact Us (/contact.aspx)

Terms & Conditions / Privacy Policy (/terms.aspx) Refund Policy (/refund_policy.aspx) NISM Mock Test (/nism-mock-test)

NISM Registration (/nism-registration.aspx) Insurance Mock Test (/insurance-mock-test) Blog (blog/) Show Footer

© 2024 Pass4Sure.in. All rights reserved

We Accept

(http://www.facebook.com/pass4

(http://twitter.com/pass_4

(http://www.linke

You might also like

- SERIES 3 FUTURES LICENSING EXAM REVIEW 2022+ TEST BANKFrom EverandSERIES 3 FUTURES LICENSING EXAM REVIEW 2022+ TEST BANKNo ratings yet

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKNo ratings yet

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Series 6 Exam Study Guide 2022 + Test BankFrom EverandSeries 6 Exam Study Guide 2022 + Test BankNo ratings yet

- 101 Investment Banking Interview Questions & Answers: Ca Monk'SDocument27 pages101 Investment Banking Interview Questions & Answers: Ca Monk'Smanish bhardwajNo ratings yet

- NISM Investment Adviser Level 1 - Series X-A Study Material NotesDocument26 pagesNISM Investment Adviser Level 1 - Series X-A Study Material NotesSRINIVASAN69% (16)

- Series 4 Exam Study Guide 2022 + Test BankFrom EverandSeries 4 Exam Study Guide 2022 + Test BankNo ratings yet

- NISM Securities Operations and Risk Management Practice Test - NISM SORMDocument22 pagesNISM Securities Operations and Risk Management Practice Test - NISM SORMSRINIVASAN100% (4)

- SME Smart ScoreDocument35 pagesSME Smart Scoremevrick_guyNo ratings yet

- Roadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideFrom EverandRoadmap to Cima Gateway Success: Roadmap to help you pass your CIMA Gateway exams - A practical guide: Roadmap to help you pass your CIMA Gateway exams - A practical guideNo ratings yet

- Audit of InvestmentsDocument9 pagesAudit of InvestmentsGirlie SisonNo ratings yet

- 2016 FRM Part I Practice ExamDocument129 pages2016 FRM Part I Practice Examguliguru100% (3)

- NismzxaDocument2 pagesNismzxavejruiNo ratings yet

- NISM-Series-X-A: Investment Adviser (Level 1) Mock Test - DemoDocument6 pagesNISM-Series-X-A: Investment Adviser (Level 1) Mock Test - DemoChriselle D'souzaNo ratings yet

- Nism 5 BDocument2 pagesNism 5 BvejruiNo ratings yet

- Nism Ed Notes Feb 2014Document25 pagesNism Ed Notes Feb 2014bhattpiyush93No ratings yet

- Frequently Asked Questions (Faqs) : What Is The Expertmfd Initiative?Document5 pagesFrequently Asked Questions (Faqs) : What Is The Expertmfd Initiative?JIGNESH SURVENo ratings yet

- WWW - Modelexam.in: Study Notes For Nism - Investment Adviser Level 1 - Series Xa (10A)Document29 pagesWWW - Modelexam.in: Study Notes For Nism - Investment Adviser Level 1 - Series Xa (10A)sharadNo ratings yet

- Requirements For Mutual Funds Distributor RegistrationDocument3 pagesRequirements For Mutual Funds Distributor RegistrationSATISH BHARADWAJNo ratings yet

- NISM Equity Derivatives Study Notes-Feb-2013Document26 pagesNISM Equity Derivatives Study Notes-Feb-2013Priyadarshini Sahoo100% (1)

- NISM Investment Adviser Study MaterialDocument28 pagesNISM Investment Adviser Study MaterialSRINIVASAN100% (1)

- Project ReportDocument37 pagesProject ReportrajrudrapaaNo ratings yet

- NISM Equity Derivatives Study Notes-Feb-2013Document26 pagesNISM Equity Derivatives Study Notes-Feb-2013Jagadeesh VigneshNo ratings yet

- Vishleshan CaseDocument3 pagesVishleshan CaseHarish SatyaNo ratings yet

- Intraday Trading StrategiesDocument5 pagesIntraday Trading Strategiesjadhavcv2015No ratings yet

- Nism Series IIA Register & Transfer AgentsDocument103 pagesNism Series IIA Register & Transfer AgentspratikgildaNo ratings yet

- Pooran 23Document7 pagesPooran 23buddysmbdNo ratings yet

- Comparative Analysis of Various Stock Broking CompaniesDocument38 pagesComparative Analysis of Various Stock Broking CompaniesVihang Varwate60% (5)

- Nism Sorm NotesDocument25 pagesNism Sorm NotesdikpalakNo ratings yet

- WWW - Modelexam.in: Study Notes For Nism - Certified Personal Financial Advisor Exam (Cpfa)Document28 pagesWWW - Modelexam.in: Study Notes For Nism - Certified Personal Financial Advisor Exam (Cpfa)Parthiban SNo ratings yet

- Investor Analysis of Mutualfund in Jhavery PVT Ltd.Document53 pagesInvestor Analysis of Mutualfund in Jhavery PVT Ltd.Chintan PavsiyaNo ratings yet

- WWW - Modelexam.in: Study Notes For NISM Series V - A: Mutual Fund Distributors Exam (Earlier - AMFI Exam)Document26 pagesWWW - Modelexam.in: Study Notes For NISM Series V - A: Mutual Fund Distributors Exam (Earlier - AMFI Exam)Suraj AdhikariNo ratings yet

- Nism 2 ADocument2 pagesNism 2 AvejruiNo ratings yet

- #2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?Document8 pages#2 - What Do You Think This Company Does Right? What Do You Think We Do Wrong?helloNo ratings yet

- SEBI Registered Investment Adviser Application ProcessDocument14 pagesSEBI Registered Investment Adviser Application ProcesskshitijsaxenaNo ratings yet

- CoverDocument6 pagesCoversatyamehtaNo ratings yet

- What Industry Trends You Will Look at When You Are Looking For A Potential Investment?Document7 pagesWhat Industry Trends You Will Look at When You Are Looking For A Potential Investment?helloNo ratings yet

- Equity Research On Paint and FMCG SectorDocument47 pagesEquity Research On Paint and FMCG SectornehagadgeNo ratings yet

- AS Case Study May Jun 2016Document16 pagesAS Case Study May Jun 2016swarna dasNo ratings yet

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Document7 pagesIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloNo ratings yet

- Nism MFD Notes Dec 2014Document26 pagesNism MFD Notes Dec 2014philo21No ratings yet

- Project Report India Infoline.Document20 pagesProject Report India Infoline.avneeshpimr143100% (4)

- Sim Investment & Networking: Committee Member Application 2016Document7 pagesSim Investment & Networking: Committee Member Application 2016Bryan SingNo ratings yet

- Financial Analyst Interview Questions and AnswersDocument18 pagesFinancial Analyst Interview Questions and AnswersfitriafiperNo ratings yet

- Nism 6 AaaDocument2 pagesNism 6 AaavejruiNo ratings yet

- SMC ProjectDocument67 pagesSMC ProjectIlyas AhmedNo ratings yet

- Startup ValuationDocument3 pagesStartup ValuationKewal KrishnaNo ratings yet

- Sai Investment: Portfolio Management Service (PMS)Document5 pagesSai Investment: Portfolio Management Service (PMS)Ajay KharatNo ratings yet

- 1803095-Volatility of Securities Traded in BSE (SENSEX)Document44 pages1803095-Volatility of Securities Traded in BSE (SENSEX)2203029No ratings yet

- NiSM QuestionzssDocument709 pagesNiSM Questionzssatingoyal1No ratings yet

- Pooja 1234Document83 pagesPooja 1234PRIYANo ratings yet

- A Project ReportDocument30 pagesA Project ReportPRANAT GUPTANo ratings yet

- Nism Mutual Fund VaDocument24 pagesNism Mutual Fund VaKanikaa B KaliyaNo ratings yet

- Suresh Rathi Mana Ram JangidDocument56 pagesSuresh Rathi Mana Ram Jangidmanajangid786No ratings yet

- 3P Programme: 3P PROGRAMME Is A Registered Firm in Field of Training, Research, Advisory and ConsultancyDocument6 pages3P Programme: 3P PROGRAMME Is A Registered Firm in Field of Training, Research, Advisory and ConsultancyGauravNo ratings yet

- The Area of Internship and Learning ObjectivesDocument51 pagesThe Area of Internship and Learning ObjectivesNavonil Nag100% (2)

- Tutorial FIN221 Chapter 2 (Q&A) - Part TwoDocument11 pagesTutorial FIN221 Chapter 2 (Q&A) - Part TwojojojoNo ratings yet

- Swaps - Interest Rate and Currency PDFDocument64 pagesSwaps - Interest Rate and Currency PDFKarishma MittalNo ratings yet

- Imperial RulesDocument16 pagesImperial RuleseldictadordelotonnoNo ratings yet

- ECO AssignmentDocument2 pagesECO AssignmentChin-Chin AbejarNo ratings yet

- TB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesDocument24 pagesTB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesMarie Bernadette AranasNo ratings yet

- Asset Classes and Financial Instruments: Bodie, Kane, and Marcus Tenth EditionDocument49 pagesAsset Classes and Financial Instruments: Bodie, Kane, and Marcus Tenth EditionA SNo ratings yet

- Time Value of MoneyDocument1 pageTime Value of MoneyAlelie dela CruzNo ratings yet

- Bonds and DerivativesDocument149 pagesBonds and DerivativesLinh LinhNo ratings yet

- Chapter Two: Financing Decisions / Capital StructureDocument72 pagesChapter Two: Financing Decisions / Capital StructureMikias DegwaleNo ratings yet

- Secret Sauce 2024Document192 pagesSecret Sauce 2024Disha14No ratings yet

- Chapter 12Document52 pagesChapter 12Amylia Amir100% (1)

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- 04 InvestmentsDocument3 pages04 InvestmentsVan TaeNo ratings yet

- BSP Circular 1111Document8 pagesBSP Circular 1111Maya Julieta Catacutan-EstabilloNo ratings yet

- Advanced Bond ConceptsDocument32 pagesAdvanced Bond ConceptsJohn SmithNo ratings yet

- Crack Grade B: Monthly Current AffairsDocument130 pagesCrack Grade B: Monthly Current AffairsRajat ChoureyNo ratings yet

- IfmDocument46 pagesIfmTatjana BabovicNo ratings yet

- Bessie Miller Wealth ManagementDocument12 pagesBessie Miller Wealth ManagementandyNo ratings yet

- Simple InterestDocument19 pagesSimple InterestHJNo ratings yet

- Brooks Financial mgmt14 PPT ch07Document71 pagesBrooks Financial mgmt14 PPT ch07Jake AbatayoNo ratings yet

- UntitledDocument10 pagesUntitledTompelGEDE GTNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- Equity Financing - ExerciseDocument2 pagesEquity Financing - Exerciselovingbooks1No ratings yet

- Solutions To Practice Problem Set #1: Time Value of MoneyDocument18 pagesSolutions To Practice Problem Set #1: Time Value of MoneyraymondNo ratings yet

- Iapm NotesDocument45 pagesIapm NotesBhai ho to dodoNo ratings yet

- ACC 211 SIM Week 6 7Document40 pagesACC 211 SIM Week 6 7Threcia Rota50% (2)

- Engineering Economy Terms 3Document4 pagesEngineering Economy Terms 3kristan7No ratings yet

- Chapter 5 Global Bond InvestmentDocument51 pagesChapter 5 Global Bond InvestmentThư Trần Thị AnhNo ratings yet