Professional Documents

Culture Documents

Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings Deductions

Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings Deductions

Uploaded by

Sivi BabuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings Deductions

Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings Deductions

Uploaded by

Sivi BabuCopyright:

Available Formats

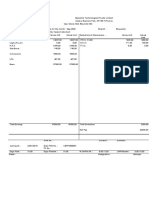

GHODAWAT ENTERPRISES PVT. LTD.

(Star Air)

Plot 13-A-P2, KIADB Hi-Tech Defence and Aerospace Park, (IT Sector),

Bengaluru North, Karnataka - 562 149. T: +91 80 3542 9000 F: +91 80

35429149 E: info@starair.in

Pay Slip for the month of April 2024

All amounts are in INR

Emp Code : SA1656 Total Days : 30.00 Location : HINDON-UTTAR PRADESH

Emp Name : KRISHNA A r r e a r D a y ( s ): 0 . 0 0 IFSC Code :

Department : COMMERCIAL/SECURITY Bank A/c No. : CHEQUE

Designation : TRAINEE SECURITY AGENT Cost Center : GHODAWAT ENTERPRISES PVT. LTD. (Star

Grade : L1 Air)

Gender : F PAN : PANNOTAVBL

DOB : 21 Sep 1998 PF No. :

DOJ : 30 Jan 2024 PF UAN. : 101612560565

Payable Days: 29.00 ESI No. :

LWP : 1.00 Unit : HINDON

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

BASIC 3750.00 3625.00 0.00 3625.00 PF 435.00

HRA 1875.00 1813.00 0.00 1813.00 ESI 101.00

Flexible Allowances 7343.00 7098.00 0.00 7098.00

Children Edu Allow 200.00 193.00 0.00 193.00

Washing Allowance 113.00 109.00 0.00 109.00

Hostel Allowance 600.00 580.00 0.00 580.00

GROSS EARNINGS 13881.00 13418.00 0.00 13418.00 GROSS DEDUCTIONS 536.00

Net Pay : 12882.00 (TWELVE THOUSAND EIGHT HUNDRED EIGHTY TWO ONLY)

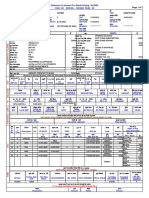

Income Tax Worksheet for the Period April 2024 - March 2025 (Proposed Investments)

*You have opted tax option without investment

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation

BASIC 44875.00 0.00 44875.00 Investments u/s 80C Rent Paid 0.00

HRA 22438.00 0.00 22438.00 From

Flexible Allowances 87871.00 0.00 87871.00 To

Children Edu Allow 2393.00 0.00 0.00 1. Actual HRA 0.00

Washing Allowance 1352.00 0.00 1352.00 2. 40% or 50% of Basic 0.00

Hostel Allowance 7180.00 0.00 7180.00 3. Rent - 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 0.00

Gross 166109.00 0.00 163716.00 Total Ded Under Chapter VI-A 0.00

Tax Working TDS Deducted Monthly

Standard Deduction 50000.00 Month Amount

Previous Employer Taxable Income 0.00 April-2024 0.00

Previous Employer Professional Tax 0 Tax Deducted on Perq. 0.00

Professional Tax 0 Total 0.00

Under Chapter VI-A 0.00

Any Other Income 0.00

Taxable Income 113720.00

Total Tax 0.00

Tax Rebate u/s 87a 0.00

Surcharge 0.00

Tax Due 0.00

Health and Education Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax per month 0.00

Tax on Non-Recurring Earnings 0.00 Total Any Other Income

Tax Deduction for this month 0.00

LWP Count: 1 . 0 0

LOPR (+ve) Count: 0 . 0 0

LOPR (-ve) Count: 0 . 0 0

Disclaimer: This is a system generated payslip, does not require any signature.

You might also like

- Equity Cis - Company ProfileDocument10 pagesEquity Cis - Company Profile김영찬No ratings yet

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash Lamani100% (1)

- English Allied Traders PLC Has A Wide Range of ManufacturingDocument2 pagesEnglish Allied Traders PLC Has A Wide Range of ManufacturingAmit Pandey0% (1)

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsVivek ViviNo ratings yet

- SalarySlipwithTaxDetails 2021 JuneDocument1 pageSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- H Theory of Money SupplyDocument3 pagesH Theory of Money SupplyShofi R Krishna100% (17)

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- Compass India Food Services Private LimitedDocument1 pageCompass India Food Services Private LimitedBoopathi ChinnaduraiNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Timezone Entertainment Private Limited: Earnings DeductionsDocument1 pageTimezone Entertainment Private Limited: Earnings Deductionsa97438195No ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Payslip Sep 2023Document1 pagePayslip Sep 2023atozinstitute96No ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsayanbhargav3No ratings yet

- Compass India Food Services Private LimitedDocument1 pageCompass India Food Services Private LimitedBoopathi ChinnaduraiNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- SalarySlip MarchDocument2 pagesSalarySlip Marchseenasrinivas113No ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- Employee DataDocument1 pageEmployee DataDinesh RNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- SettlementReportDocument1 pageSettlementReportPraneeth Sasanka TadepalliNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsmbdeepu8No ratings yet

- Compass India Food Services Private LimitedDocument1 pageCompass India Food Services Private LimitedBoopathi ChinnaduraiNo ratings yet

- SalarySlipwithTaxDetails (1) (1) (1) (2) (1)Document1 pageSalarySlipwithTaxDetails (1) (1) (1) (2) (1)dipak923434No ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- Health & Glow Private LimitedDocument1 pageHealth & Glow Private LimitedVishal BawaneNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- SalarySlipwithTaxDetails (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1)Document1 pageSalarySlipwithTaxDetails (1) (1) (1) (1) (1) (1) (1) (1) (1) (1) (1)dipak923434No ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- Employee DataDocument1 pageEmployee Datanathsri321No ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- April Salary PDFDocument1 pageApril Salary PDFomkassNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsvineethpowerstarNo ratings yet

- June Salry PDFDocument1 pageJune Salry PDFomkassNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsvineethpowerstarNo ratings yet

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- April Payment SleepDocument1 pageApril Payment Sleepizajahamed1No ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- BD0164 SalarySlipwithTaxDetailsDocument1 pageBD0164 SalarySlipwithTaxDetailskb5452520No ratings yet

- Jagan Mohan Absli Payslip AprilDocument1 pageJagan Mohan Absli Payslip AprilSurya GodasuNo ratings yet

- Health & Glow Private Limited: Earnings DeductionsDocument1 pageHealth & Glow Private Limited: Earnings DeductionsVishal BawaneNo ratings yet

- E010072 Payslip 01-JanDocument1 pageE010072 Payslip 01-JanhariprasadhpNo ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- SalarySlipwithTaxDetails 5Document1 pageSalarySlipwithTaxDetails 5Kiran NoraNo ratings yet

- Downloading May 2024-2025Document1 pageDownloading May 2024-2025aakash Kumar aryaNo ratings yet

- Tasleem MayDocument2 pagesTasleem MayManthan ShahNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2From EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No ratings yet

- Bcas & C NaDocument11 pagesBcas & C NaSivi BabuNo ratings yet

- CC For AepDocument10 pagesCC For AepSivi BabuNo ratings yet

- Payslip 1667991635Document1 pagePayslip 1667991635Sivi BabuNo ratings yet

- ViewpayslipDocument6 pagesViewpayslipSivi BabuNo ratings yet

- Becc 103 em 2023 24 KPDocument17 pagesBecc 103 em 2023 24 KPGourav SealNo ratings yet

- SC Group Sanctions Policy Statement: Crimea & SevastopolDocument2 pagesSC Group Sanctions Policy Statement: Crimea & SevastopolPatrickLnanduNo ratings yet

- Reviewer For Managerial EconomicsDocument7 pagesReviewer For Managerial EconomicsEdrhene Iahne RoldanNo ratings yet

- Nature of Macro EconomicsDocument15 pagesNature of Macro EconomicsSantosh ChhetriNo ratings yet

- Extras de Cont / Account StatementDocument3 pagesExtras de Cont / Account Statementbogdan.ch23No ratings yet

- Import Duty CalculatorDocument6 pagesImport Duty Calculatorshivam_dubey4004No ratings yet

- MPS 1941669 1202490 16026890L 04 2023Document2 pagesMPS 1941669 1202490 16026890L 04 2023Ajay AhlawatNo ratings yet

- Vinal RITESH JAIN Affidavit of Evidence FinalDocument29 pagesVinal RITESH JAIN Affidavit of Evidence FinalSailee RaneNo ratings yet

- A New Group of Left-Wing Presidents Takes Over in Latin America - The EconomistDocument5 pagesA New Group of Left-Wing Presidents Takes Over in Latin America - The EconomistFrancisco CanoNo ratings yet

- Case Study 1 Unit 1 (2305843009213717812)Document5 pagesCase Study 1 Unit 1 (2305843009213717812)312SYEcommerceRABLEEN KaurNo ratings yet

- January - September 2023Document16 pagesJanuary - September 2023Valentin DrăghiciNo ratings yet

- Ingles Basico - 2023Document11 pagesIngles Basico - 2023mctsiamasNo ratings yet

- Agriculture Vision 2020Document10 pagesAgriculture Vision 20202113713 PRIYANKANo ratings yet

- Fixedline and Broadband ServicesDocument5 pagesFixedline and Broadband ServicesKumar MNo ratings yet

- August 16, 2019 Strathmore TimesDocument19 pagesAugust 16, 2019 Strathmore TimesStrathmore TimesNo ratings yet

- Extended Metropolitan RegionDocument7 pagesExtended Metropolitan RegionGabriela UlloaNo ratings yet

- Module 4 - Decisions Under UncertaintyDocument19 pagesModule 4 - Decisions Under UncertaintyRussell Lito LingadNo ratings yet

- The Government Game Student WorksheetDocument3 pagesThe Government Game Student WorksheetAnuj Singh BhadoriyaNo ratings yet

- 01 Indian Economy at Independence - @ksDocument10 pages01 Indian Economy at Independence - @ksFavas KNo ratings yet

- USMEX 2021 June Lo Res - PDF Versión 1Document36 pagesUSMEX 2021 June Lo Res - PDF Versión 1Jesus roberto Cruz andradeNo ratings yet

- Cabin 1800 X 900 With CompositeDocument1 pageCabin 1800 X 900 With CompositeHemanth LNo ratings yet

- Week 11 PDFDocument3 pagesWeek 11 PDFyogeshgharpureNo ratings yet

- Nowicki 7e Ch3-7c238730Document26 pagesNowicki 7e Ch3-7c238730Uki NaeroraNo ratings yet

- Introduction To Ind AsDocument24 pagesIntroduction To Ind AsRicha AgarwalNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- Minimum Acceptable Rate of ReturnDocument17 pagesMinimum Acceptable Rate of ReturnRalph Galvez100% (1)

- PUNTUACIÓN QUE SE OTORGARÁ A ESTE EJERCICIO: (Véanse Las Distintas Partes Del Examen)Document3 pagesPUNTUACIÓN QUE SE OTORGARÁ A ESTE EJERCICIO: (Véanse Las Distintas Partes Del Examen)Victor Hugo GonzálezNo ratings yet